What About Cobra Plans

COBRA plans are a unique in a way that is essential to be aware of. When your employer insurance ends, you trigger an SEP that allows you to enroll in Medicare with no penalties. This isnt true for COBRA plans: you will have to pay late penalties if you don’t enroll in Medicare when you have a COBRA plan.

Basically, COBRA plans dont qualify as employer group plans in Medicares eyes. If you have a COBRA plan when you become eligible, you should enroll in Medicare as soon as possible so you dont face late fees.

If your employer coverage ends after your IEP, then you still have 8 months to get covered by Medicare. During this time, you may be covered by a COBRA plan, but it will cease immediately when you start your Medicare coverage. In this situation, its still best to enroll in Medicare ASAP.

When Would I Enroll If I Delay Or Only Take Part A

If you are able to delay enrolling in either all or part of Medicare, you will have a Special Enrollment Period of eight months that begins when the employer coverage is lost or when your spouse retires. During this time, youll be able to enroll in Medicare Parts A & B. You can also enroll in a Part D prescription drug plan. And, after you enroll in Part B, youll be able to enroll in a Medicare supplement insurance plan or a Medicare Advantage plan.

When Am I Eligible For Medicare

In general, most people become eligible for Medicare when they turn 65. However, people younger than 65 with End-Stage Renal Disease or Lou Gehrigs Disease are also eligible for Medicare. These, of course, are special scenarios.

For most people, Medicare Part A will be free in retirement. Wondering if youre included in this group? If you worked at least 40 quarters in the United States, and paid Medicare taxes while employed, you should receive Part A at no monthly cost.

If you didnt work or pay Medicare taxes, you may still be eligible for coverage if your spouse did. You and your family worked many years to ensure that your health is covered in retirement, so see this as an added benefit.

While Part A is part of Medicare, it doesnt ensure complete coverage. If youre also wanting outpatient coverage, youll need Medicare Part B as well. If you want Part B, youll have to pay a monthly premium which will depend on the official start date of your Part B, and your income level.

Finally, if youre wanting Part D and a Medicare Supplement policy , you will also pay a monthly premium for this added coverage.

Also Check: Is Shingles Shot Covered Under Medicare

How Does Medicare Work With My Employee Insurance

If youve decided that you want to enroll in Medicare while still working, its important to know how Medicare works with your current employee insurance. If you have Medicare and employer-sponsored insurance together, each type of coverage is considered a payer. In regard to paying out a claim, the primary payer will pay what it owes on your bills first. The primary payer might be Medicare or your companys insurance. It will be important to check with your insurance to determine if they will pay first or not. After this step, the secondary payer pays up to its coverage limits on the remainder of the bill.

Its important to remember that this does not necessarily mean that the secondary payer will cover all of your remaining costs. You must understand your Medicare coverage as well as your employer-sponsored coverage to understand the coverage limits, as well as your own financial responsibilities to your medical expenses.

Do I Have To Sign Up For Medicare If I’m 65 Or Older And Still Working

If you’re age 65 or older, eligible for Medicare, and have insurance through your current job or your spouses current job, you need to make some important Medicare enrollment decisions.

If you don’t enroll on time, you may have to pay a penalty. Before you make any changes, it’s good to understand how your current coverage works with Medicare about four to five months before you become eligible for Medicare.

Ask your benefits manager or human resource department how your employer health insurance works with Medicare, and confirm this information with the Social Security Administration and Medicare .

When you retire or if you lose your employer coverage, you will get a Special Enrollment Period to sign up for Medicare. Be sure to review the rules carefully, so you don’t miss deadlines.

Note: If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Medicare Part A to avoid an IRS tax penalty. As well, before you enroll in Medicare while still working, check with your employer to see if their employer group health plan coverage for prescription drugs is creditable coverage. If it is not creditable, you could face paying Medicare Part D penalties later on.

Also Check: What Is The Best And Cheapest Medicare Supplement Insurance

How Does Medicare Work With My Job

Keep in mind that:

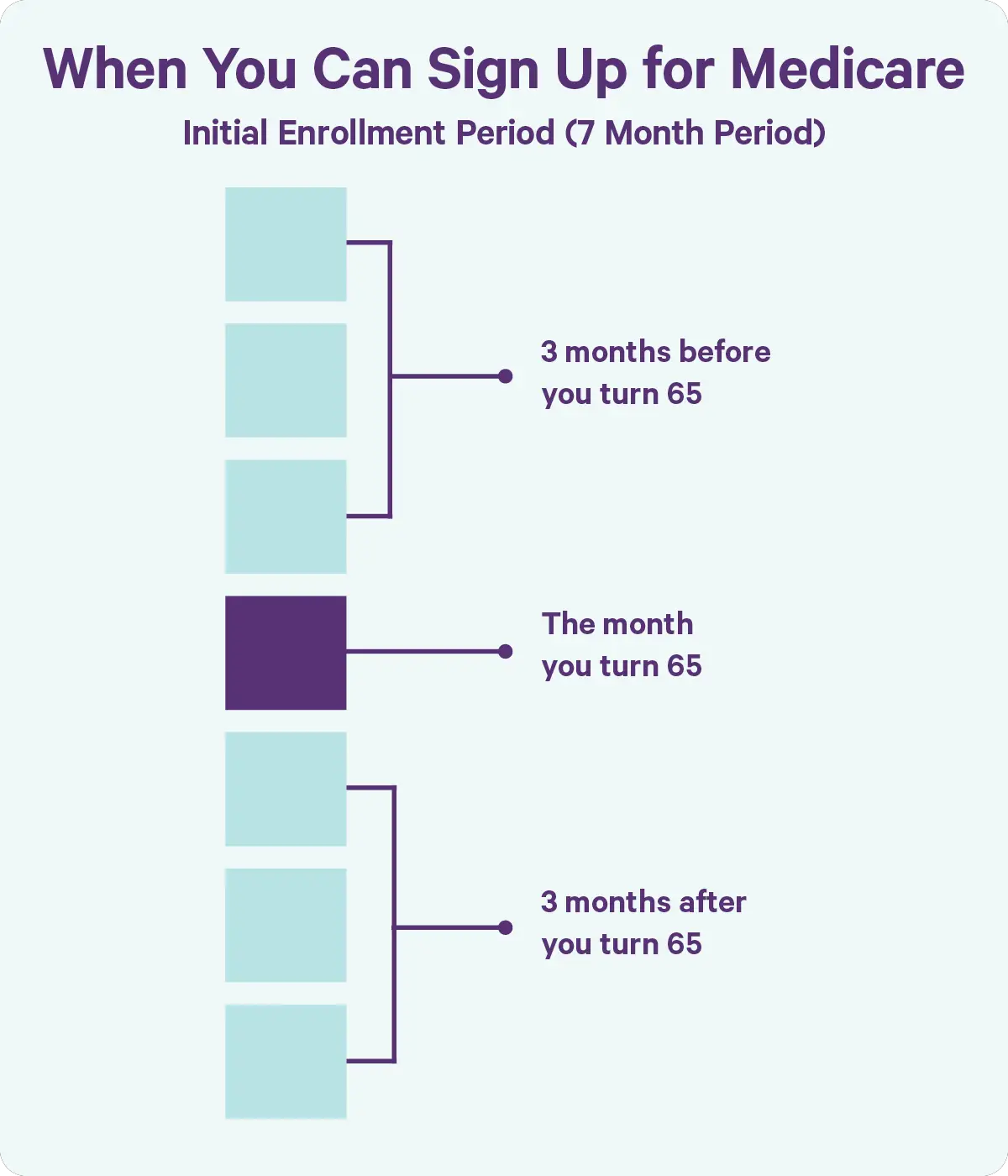

- Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security .

- If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Part A to avoid a tax penalty.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Must I Enroll In Medicare At Age 65

What Are The Drawbacks Of Getting Medicare While Still Working

While Medicare Part A is free, Medicare Part B which covers doctor visits and outpatient medical supplies requires you to pay a monthly premium . If you keep your existing insurance, you could end up paying premiums for two policies, which could get expensive.

Also, having two insurance policies can be confusing and possibly lead to billing complications. You and your doctor would have to keep track of which plan is primary and which is secondary.

Finally, if you have a high-deductible health plan through your employer, you may no longer be eligible to contribute to a health savings account once you enroll in Medicare.

Do You Need Medicare Part B If You Are Still Working

You should take advantage of Medicare Part B while you are still working.

Medicare Part B typically covers the followings:

- Preventative services

- Clinical research

- Some outpatient prescription medications

If you are still working and have job-based insurance, you want to contact your insurance company once turning 65, to confirm their Medicare stipulations. Your insurance company may require you to apply for Medicare Part B. If this is a stipulation of your current insurance, and you do not apply for Medicare Part B, your current insurance costs may increase or your policy may be terminated.

Don’t Miss: What Is A Medicare Set Aside In Personal Injury

And Still Working: Should You Enroll In Medicare

Dear Carrie,

I’m planning to continue to work past age 65, and wondering if I should stick with my employer’s health insurance or move over to Medicare. How do I decide?

A Reader

Dear Reader,

This is becoming a common question as more and more people decide to work past age 65. In fact, according to the Bureau of Labor Statistics, in 2020, 26.6 percent of people aged 65-74 remained in the workforceand those numbers are projected to continue to grow. This can be seen as a positive since it means we’re redefining aging. At the same time, though, adequate health insurance remains essential.

So it’s an important questionand the answer largely depends on the size of your employer, as well as the cost and coverage of your current plan as compared to Medicare. You’ll need to familiarize yourself with the pertinent Medicare regulations and deadlines to ensure the most seamless transitionwhether that happens at age 65 or later.

Also realize that once you file for Social Security, you’re automatically enrolled in Medicare Parts A and B when you turn 65. However, you have the option to opt out of Part B, which you may want to do if you are covered by an employer plan.

If you haven’t filed for Social Security, you can choose to enroll in just Medicare Part A or both Parts A and B . Alternatively, you can postpone enrolling until you stop working. Let’s take a look at some Medicare basics as well as some of the factors that can help you decide.

Theres A Push For Change

If the rules governing the transition to Medicare sound complicated, rest assured that experts agree. Moving into Medicare from other kinds of health insurance can be so complicated that it should be a required chapter in Retirement 101, Mr. Moeller said.

The only government warning about the risks associated with late enrollment comes in the form of a very brief notice near the end of the annual Social Security Administration statement of benefits.

The Medicare Rights Center and other advocacy groups have proposed legislation that would require the federal government to notify people approaching eligibility about enrollment rules, and how Medicare works with other types of insurance. The legislation the Beneficiary Enrollment Notification and Eligibility Simplification Act, also would eliminate coverage gaps now experienced by enrollees during the Initial Enrollment Period and General Enrollment Period. The legislation was introduced in Congress last year, and will be reintroduced this year.

In the meantime, Mr. Baker proposes a simple rule of thumb to help people approaching Medicare eligibility to avoid costly errors.

If you are eligible for Medicare, you should really consider it to be your default, primary coverage. If you are going to decline Medicare, think very carefully and take the time to really understand all the rules.

Also Check: How To Change Mailing Address For Medicare

Who Is Ehealth Medicare

If you qualify for Medicare and are ready to look at plans, eHealth Medicare, an independent insurance broker and partner of Investopedia, has licensed insurance agents at < 833-970-1257 TTY 711> who can help connect you with Medicare Advantage, Medicare Supplement Insurance, and Prescription Drug Part D plans.

Do You Pay More For Medicare If You Are Still Working

You’ll typically pay an extra 10% for each year you could have signed up for Part B, but didn’t. We’ll add this penalty to your monthly Part B premium. If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance.

Recommended Reading: How To Get The Most Out Of Medicare

How Does Enrolling In Medicare Affect My Hsa Plan

If you have a health plan through your employer and it includes a health savings account , signing up for Medicare Part B, or being enrolled in Medicare Part A, will change things. You can stay on your employer plan, but you cant add money to your HSA once you enroll in Medicare.

If youre considering this option, its a good idea to check with a financial adviser. They know the ins and outs of how Medicare will affect your HSA and your taxes, and can help you figure out your best option.

Medicare simplified: your step-by-step guide

If youre about to join Medicare, this guide answers some of the most frequently asked questions.

What Are Cases When Medicare Automatically Starts

Medicare will automatically start when you turn 65 if youve received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday.

Youll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks. According to the Social Security Administration, more than 30% of seniors claim Social Security benefits early.1 For those seniors, Medicare Part A and Part B will automatically start when they reach the age of 65.

When do You Get Your Medicare Card?

You can expect to receive your Medicare card in the mail three months before your birthday. Your Medicare card will come with a complete enrollment package that includes basic information about your coverage. Your card wont be usable until you turn 65, even though youll receive the card before that time.

What Are Your Costs?

Keep in mind that youll still have to pay the usual costs of Medicare, even though youre automatically enrolled. Once your Medicare is active, the cost of your Part B premium will be deducted from your Social Security or RRB benefits.

What If You Already Enrolled in Medicare?

What about Medicare Supplement ?

What If I Switch to Medicare Advantage?

And if you want to switch to Medicare Advantage , youll have a one-time Initial Enrollment Period for Medicare Advantage that begins 3 months before the month you turn 65 and lasts for 7 months.

What I Have Part A?

Read Also: Is Dental Care Included In Medicare

If You Work At A Large Company

The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance . At that point, you’d be subject to various deadlines to sign up or else face late-enrollment penalties.

While everyone’s situation is different, there’s a good chance your current insurance through work is a more cost-effective option, said Danielle Roberts, co-founder of insurance firm Boomer Benefits in Fort Worth, Texas.

This may be due to lower premiums and other cost-sharing aspects such as copays or co-insurance, or lower costs for prescriptions under the group plan.

“We often find that their insurance is already quite good and it doesn’t make sense to leave it,” Roberts said.

We often find that their insurance is already quite good and it doesn’t make sense to leave it.Danielle Robertsco-founder of Boomer Benefits

Again, however, if Part A is free, you can sign up as long as it wouldn’t interfere with your plans to contribute to a health savings account.

There are, of course, instances where Medicare might be the better option.

“If you’re going to, say, therapy every week and it’s a $40 co-pay, it might be cheaper to go on Medicare and get a supplement with it,” Gavino said.

On the other hand, if you take a specialty drug that is covered by your group plan, it might be wise to continue with it if that drug would be more expensive under Medicare.

Signing Up After Leaving A Job

But signing up late also means that your premiums for Medicare Part B, which covers doctor visits and outpatient services, most likely will cost you more.

If you plan to continue working past 65, however, and want to keep your company health plan or stay on your spouses group plan, in most cases, but not all, you can delay signing up for Medicare until you or your spouse stop working without a penalty.

You have an eight-month special enrollment window after you or your spouse leave the job. But be forewarned, even if you have COBRA coverage to extend your employers healthcare coverage after you stop working, this is not considered credible coverage in the eyes of Medicare, and you still must sign up within that eight-month window after the end of employment or face late penalties.

As soon as you know youre going to retire, sign up for Parts A & B of Medicare in order to avoid any gaps in coverage, said Tricia Sandiego, senior adviser for AARPs Caregiving and Health Team.

But if youre zeroing in on that 65th birthday and plan to continue working, its important to remember that you have options.

You can keep your company health plan or stay on your spouses group plan. Thats up to you but only if you work for what Medicare considers a large company one with at least 20 employees. Those employers must offer older employees the same healthcare benefits that they offer younger workers.

Read Also: Do You Have To Work To Get Medicare

Signing Up For Medicare Part A At 65 If Youre Still Working

If you’re still working at age 65 and not claiming Social Security benefits, the government will not automatically enroll you in Medicare Part A, which covers hospital stays.

If you work for a company with 20 or more employees and you’re enrolled in your employer’s health insurance plan, you do not have to enroll in Part A. If your employer covers the bulk of your premiums, you have a low deductible, and you’re not eligible for premium-free Part A, it might make sense to continue relying solely on your workplace coverage.

If you’re eligible for premium-free Part Amost people are because they’ve paid Medicare taxes throughout their working yearsyou might as well enroll since you’ve earned it. As secondary health insurance, Part A may cover hospital expenses your employer’s plan does not.

If you work for a company with fewer than 20 employees, you should enroll in Part A as soon as you’re eligible. Medicare will become your primary payer.

If you’re covered by a Health Insurance Marketplace plan or COBRA, you should sign up for Medicare Part A during your initial enrollment period, which starts three months before you turn 65, includes your birthday month, and ends three months after you turn 65.

Although Medicare Part A pays for inpatient hospital stays and nursing care, there’s an annual deductible, which is $1,484 for 2021 and $1,556 for 2022. Many people don’t pay a monthly premium for Part A, and there are no coinsurance costs for hospital stays of 60 days or less.