When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

But You Don’t Have To Sign Up For Medicare

Just because you’re turning 65 this year doesn’t mean you’re giving up your job. And if you plan to keep working, you may continue to have access to a group health insurance policy through your employer.

If you’re happy with that coverage and want to keep it, you can delay your Medicare enrollment and avoid a late signup penalty. But if you’re not happy with that group plan, know that you’re allowed to work and get health coverage through Medicare at the same time.

Furthermore, if you’re keeping your group health coverage through your job, you may want to sign up for Medicare Part A regardless. Though you’ll pay a premium for Parts B and D, Part A is generally free for enrollees. Signing up could give you access to secondary insurance that may pick up the tab for hospital care your primary insurance doesn’t cover.

That said, once you enroll in Medicare, you won’t be eligible to contribute to a health savings account. And so if you’re currently taking advantage of that option, you may want to forgo that free Part A coverage if you’re keeping your group plan through work.

How To Enroll In Medicare Beyond The Initial Enrollment Period

Things to know about the Medicare General Enrollment Period:

- You might be charged a penalty fee for failing to enroll during your Initial Enrollment Period.

- If you did not enroll during the IEP when you were first eligible, you may enroll during the General Enrollment Period.

- The General Enrollment Period for Original Medicare occurs each year from January 1 through March 31.

Things to know about the Medicare Special Enrollment Period :

- When you turn 65, you may choose to forgo Medicare Part B when you become eligible. You will be able to enroll in Medicare when your group coverage ends.

- Your eight-month SEP for Medicare Part B begins either the month that your employment ends or immediately when your group health coverage ends.

- If you enroll in Medicare during an SEP, you do not have to pay a late-enrollment penalty.

Other Medicare enrollment options:

Read Also: Does Medicare Cover Whooping Cough Vaccine

Review Options Available In Your County

Different health plans are available based on the county where you live. If you already have Medicaid, youve been in touch with a county worker who helps you with your plan. As you approach your 65th birthday, your county worker will provide you with a list of options so you can choose the right plan for your needs.

Your options at age 65 include plans called Minnesota Senior Care Plus or Minnesota Senior Health Options .

- Determine if you are dual eligible for Medicare and Medicaid. If you are, a plan that combines the services of both programs may be a good choice for you. You dont need to worry about coordinating coverage between both programs and can have it all in one.

- Understand whats covered in each plan type

- Compare MSHO vs. MSC+ plans to decide which plan is best for you

Medicare Before You Retire Maybe

Before you do anything about enrolling in Medicare, you need to talk with your employer benefits manager. You need to understand if your employer insurance qualifies as creditable coverage that could allow you to delay Medicare as well as find out how Medicare and your employer coverage may work together. In some cases your employer coverage will enable you to put off Medicare enrollment, and in other cases you may be required to take full Medicare benefits at age 65 even if you continue working. Quickly discover your options here.

Don’t Miss: How To Apply For Medicare Through Spouse

Turning 65 What You Need To Know About Signing Up For Medicare

The first of the 78 million baby boomers turned 65 on January 1, 2011, and some 10,000 boomers a day will reportedly reach that milestone between now and 2030. If you are about to turn 65, then it is time to think about Medicare. You become eligible for Medicare at age 65, and delaying your enrollment can result in penalties, so it is important to act right away.

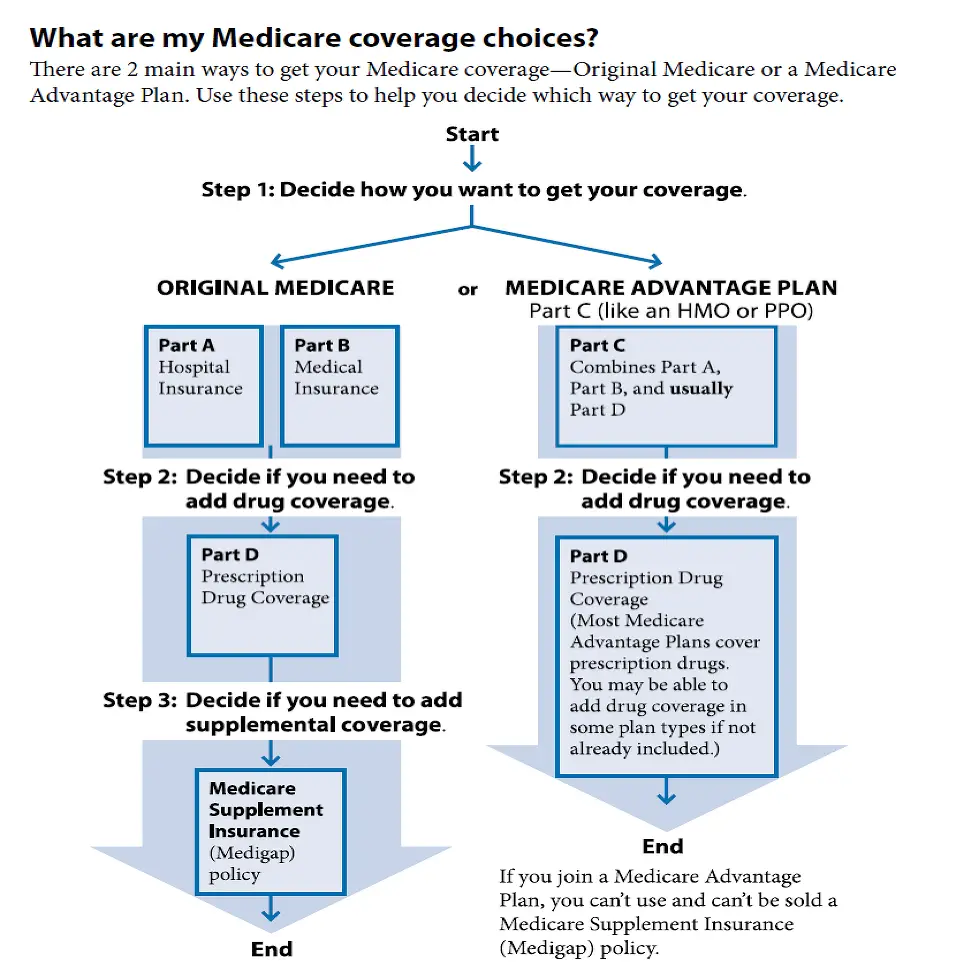

There are a number of different options to consider when signing up for Medicare. Medicare consists of four major programs: Part A covers hospital stays, Part B covers physician fees, Part C permits Medicare beneficiaries to receive their medical care from among a number of delivery options, and Part D covers prescription medications. In addition, Medigap policies offer additional coverage to individuals enrolled in Parts A and B.

Local Elder Law Attorneys in Your City

City, State

Medicare enrollment begins three months before your 65th birthday and continues for 7 months. If you are currently receiving Social Security benefits, you don’t need to do anything. You will be automatically enrolled in Medicare Parts A and B effective the month you turn 65. If you do not receive Social Security benefits, then you will need to sign up for Medicare by calling the Social Security Administration at 800-772-1213 or online at . It is best to do it as early as possible so your coverage begins as soon as you turn 65.

For Workers At Small Businesses

If you have health insurance through a small company , you should sign up for Medicare at age 65 regardless of whether you stay on the employer plan. If you do choose to remain on it, Medicare is your primary insurance.

However, it may be more cost-effective in this situation to drop the employer coverage and pick up Medigap and a Part D plan or, alternatively, an Advantage Plan instead of keeping the work plan as secondary insurance.

Often, workers at small companies pay more in premiums than employees at larger firms.

The average premium for single coverage through employer-sponsored health insurance is $7,470, according to the Kaiser Family Foundation. However, employees contribute an average of $1,243 or about 17% with their company covering the remainder.

At small firms, the employee’s share might be far higher. For example, 28% are in a plan that requires them to contribute more than half of the premium for family coverage, compared with 4% of covered workers at large firms.

Recommended Reading: Can You Change Your Medicare Supplement Insurance Anytime

If You Are Under 65 With A Disability:

Once youve enrolled in Medicare

Call ERS to provide us with the information located on your Medicare ID card. ERS will confirm your enrollment in Medicare Parts A and B and start the process to enroll you in the HealthSelectSM Medicare Advantage Plan, preferred provider organization administered by UnitedHealthcare.

Retirees and/or dependents with end-stage renal disease are eligible to enroll in HealthSelect MA PPO only after their 30-month coordination period with Medicare has ended.

Important: Until ERS receives your Medicare information, we cannot begin the process to enroll you in HealthSelect MA PPO. Plan ahead: The process can take 30 to 60 days before your HealthSelect MA PPO coverage begins. During this time, you will be enrolled in HealthSelectSM Secondary. If you need to access medical benefits while enrolled in HealthSelect Secondary, you will be charged a $200 deductible. HealthSelect MA PPO is a Medicare Part C plan that combines Medicare Parts A and B with your state health insurance. It provides additional group benefits you may not receive with Medicare alone and covers most or all of your medical expenses.

If you dont provide your Medicare information to ERS

When You Turn 65

Over the recent holidays we had a big birthday celebration for my mom, who turned 65.

A milestone birthday, for sure! All her kids and grandkids were there to celebrate with her. We sang over a huge cake with 65 blazing candles and all cheered when she blew them out, with a little help from the grandkids.

It was a sweet night full of memories and acknowledgement of the incredible life she has lived and the blessing that has been to all of us.

Many of you are approaching the same milestone in your own life. In addition to looking back and remembering all the joys and triumphs of so many years, you may also be looking forward to the future, and wondering how to prepare for whats coming next. One of the things that is probably on your radar is Medicare. And you may have a few questions.

In this article we will answer all your questions about how Medicare works when you turn 65. We will give you a thorough understanding of the program, established and administered by the United States federal government to provide health insurance for people over 65.

We will specifically address any questions that may have arisen as you have thought about signing up for Medicare.

These will include: Is Medicare free at age 65? Do you have to go on Medicare when you turn 65? How do you sign up for Medicare when you turn 65? Does Medicare start the month you turn 65? Are you penalized if you dont sign up for Medicare at 65?

WHAT IS MEDICARE?

IS MEDICARE FREE AT AGE 65?

part A

Recommended Reading: Will Medicare Pay For An Upwalker

If The Employer Has 20 Or More Employees

As long as you have group health insurance from an employer for which you or your spouse actively works after you turn 65, you can delay enrolling in Medicare until the employment ends or the coverage stops , without incurring any late penalties if you enroll later. When the employer-tied coverage ends, youre entitled to a special enrollment period of up to eight months to sign up for Medicare.

Note that “active employment” is the key phrase here. You cant delay Medicare enrollment without penalty if your employer-sponsored coverage comes from retiree benefits or COBRA by definition, these do not count as active employment.

Nor does it count if you work beyond 65 but rely on retiree benefits from a former employer. You must be actively working for the employer that currently provides your health insurance in order to delay Medicare enrollment and qualify for a special enrollment period later on.

The law requires a large employer one with at least 20 employees to offer you the same benefits that it offers to younger employees . It is entirely your choice whether to:

- accept the employer health plan and delay Medicare enrollment

- have the employer coverage and Medicare at the same time

Can You Get Social Security And Not Sign Up For Medicare

Yes, many people receive Social Security without signing up for Medicare.

Most people arent eligible for Medicare until they turn 65. As you can start collecting Social Security retirement benefits at 62, individuals may have Social Security without Medicare for several years.

Most people enroll in Part B once they turn 65, but you may decide to delay enrolling in Part B if you or your spouse has health insurance through an employer. Be sure to learn more about how Medicare enrollment works in your specific case, though. If you delay enrollment in Medicare Part B when youre first eligible and you dont have other creditable coverage, you could face late enrollment penalties for the rest of the time that you have Part B once you sign up.

As most people dont pay a premium for Part A, theres no reason to cancel the coverage, even if you dont think you need it. You are free to decline other Medicare plans, such as Parts B and D, though again you should make sure you wont cause yourself to go without coverage or have to pay late enrollment penalties in the future.

Also Check: Where To Compare Medicare Part D Plans

Do You Have To Sign Up For Medicare If You Are Still Working

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because theyre still working, theyre likely covered under their employers health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Being covered under your employer-provided health insurance plan has no bearing on your Medicare eligibility. Medicare works in conjunction with several other types of health insurance including health insurance provided by employers or unions and wont prevent you from enrolling.

However, if you are not collecting Social Security retirement benefits at least four months before you turn 65, you will not be automatically enrolled in Medicare when you turn 65. In this case, you will have to manually sign up for Medicare when youre ready to enroll.

Many people choose to delay their Social Security retirement benefits until a later age when they can collect the full amount. If you choose to delay your retirement benefits, you must still sign up for Medicare manually once youre eligible in order to avoid any late enrollment penalties .

Some people who are still working sign up for Medicare anyway, because Medicare can work as extra insurance along with an employer group health insurance plan. Some people may decide that Medicare is more affordable than their employers insurance, so they may continue working but disenroll from their group plan and enroll in Medicare instead.

End Stage Renal Disease

You can qualify for early Medicare coverage if you:

- have received a diagnosis of ESRD from a medical professional

- are on dialysis or have had a kidney transplant

- are able to receive SSDI, Railroad Retirement benefits, or qualify for Medicare

You must wait 3 months after starting regular dialysis or receiving a kidney transplant to qualify for Medicare coverage.

Your Medicare coverage will begin the first day of the fourth month of your dialysis treatment. You can get coverage as soon as your first month of treatment if you complete a Medicare-approved training program to do your own at-home dialysis treatment.

Providing coverage to those with medical disabilities and some chronic health conditions has even increased access to healthcare and reduced the number of deaths. An estimated 500,000 people with Medicare have ESRD, according to a 2017 article. The researcher determined that the ESRD Medicare program prevents up to 540 deaths from ESRD each year.

Recommended Reading: Which Medicare Plans Cover Silver Sneakers

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Sorting Out Your Options

All of this can lead to confusion about which sign-up options are best for you. Most people sign up for A, B, and D, with many adding Medigap coverage as well. Others choose Medicare Advantage instead of A, B, and D. If you choose a Medicare Advantage plan and want prescription drug coverage, make sure it is provided by your MA plan. If not, you may need to add Part D coverage to your plan.

Because Medicare normally pays first , chances are that any available retiree policy will require you to have, at minimum, Medicare Part A and Part B. Check out costs and coverage before signing up for Medicare.

If you decide to go back to work after retirement and are eligible for group health plan coverage, it will likely work differently with Medicare. Check with the human resources department of your new employer to avoid overlaps or lapses in coverage. If you have retiree health insurance from a former employer, find out what happens if you cancel that coverage but want it back at a later date.

Costs for Medigap coverage depend on the type of policy you have and where you live they can range from $50 per month to several hundred dollars. Learning about drug pricing tiers and Part D can help you decide on an optimal plan.

Recommended Reading: How Do I Choose Medicare Part D Plan

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |