How Do I Find Medicare Coverage That Works For My Needs

There are two types of private Medicare plans you might consider, depending on your eligibility, plan availability and your specific needs:

- Medicare Supplement Insurance

- Medicare Advantage

Medicare Advantage plans and Medicare Supplement Insurance plans are very different. You cannot be enrolled in a Medicare Advantage plan and a Medicare Supplement Insurance plan at the same time.

- Medicare Supplement plans can pay for some of the out-of-pocket costs that Original Medicare doesnt cover. These costs can include certain Medicare deductibles and copayments such as the 20% coinsurance that Medicare Part B typically requires you to pay for approved doctors services and other outpatient care. If you have a Medigap plan, you may want to consider also enrolling in a Medicare prescription drug plan also.

- Medicare Advantage plans are an alternative to Original Medicare. They replace your Original Medicare coverage completely. They include all the benefits of Original Medicare, and most Medicare Advantage plans also include prescription drug coverage.Some Medicare Advantage plans may include benefits that Original Medicare doesnt cover, such as hearing coverage, dental coverage, and vision coverage.

Beginning in 2019, Medicare Advantage plans were allowed to start providing expanded services such as in-home care aides, home-delivered meals, transportation to medical appointments and fitness memberships.

How To Choose A Medicare Plan

As you enter your elderly years, Medicare can loom over your healthcare decision making. When can you get it? And once you can acquire it, how do you choose a Medicare plan thats best for you? There are lots of questions that come with choosing a Medicare plan, but first, lets get into the most basic question: what exactly is Medicare?

Medicares Part D Benefit Is Complex But Simple Shopping Strategies Can Potentially Save Enrollees Thousands Of Dollars Each Year

Medicare enrollees have from October 15 through December 7 to shop around for a new Part D plan for the following year.

As a Medicare beneficiary, you have a multitude of choices to make. From my experience dealing with frustrated Medicare enrollees, I can tell you that selecting the right prescription drug plan is one of the most important. If you make the right choices, they can save you huge sums of of money and headache, while ensuring you have access to the medications you need.

My family is a perfect example: When I sat down with a great uncle a few years ago to take a look at his Part D coverage, it was very quickly obvious that he was overpaying about $2,000 too much for coverage for prescription drugs he needed. Even with my immediate family, my father had the right drugs covered but was paying too much by hundreds of dollars each year.

My family members are just two examples out of the millions of Americans more than 46 million as of late 2019 who are enrolled in Part D coverage, including those with stand-alone Part D plans and those with Part D coverage integrated with a Medicare Advantage plan about three-quarters of all Medicare beneficiaries have Part D coverage.

Read Also: How To Apply For Medicare Without Claiming Social Security

Selecting A Medigap Plan: Recent Changes Limit Choices

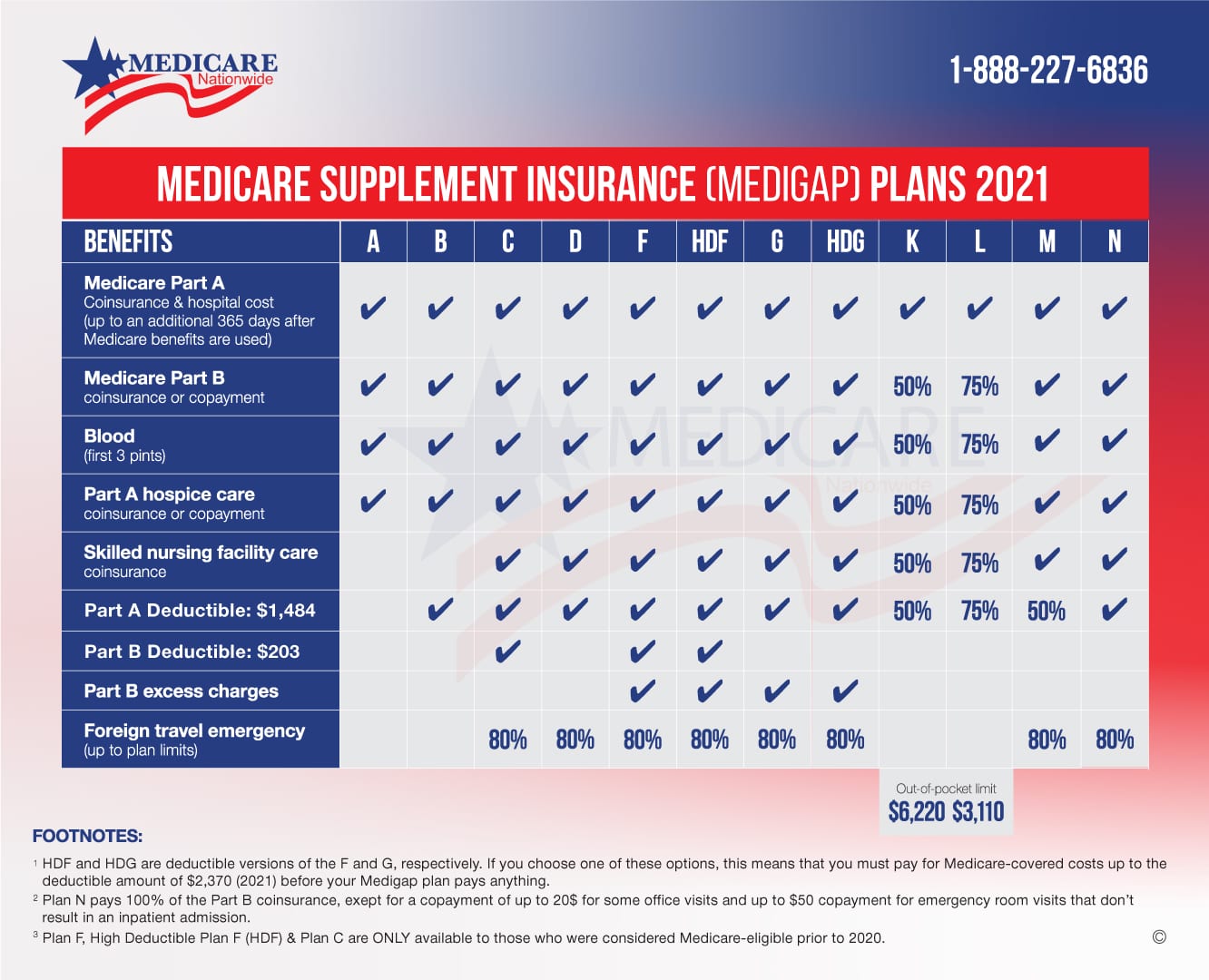

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

Find Medicare Part D Prescription Drug Plans Available In Your Area

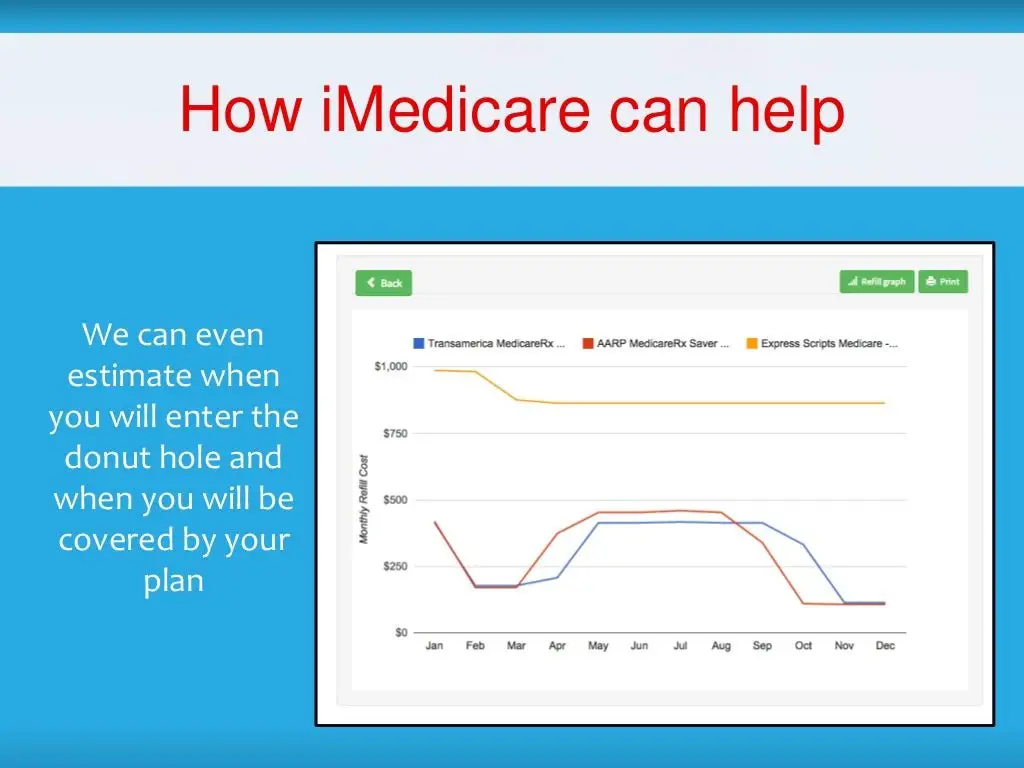

After youve listed out your medications, you can beginlooking for the Medicare Part D plans that are available in your area. Using anonline tool that displays Part D plans from multiple carriers may make thisstep easier. A thorough tool should allow you to filter your options by whats offeredin your zip code, and to enter your prescription information and pharmacypreferences in order to estimate your costs for each plan.

Recommended Reading: What Does My Medicare Cover

What Do Medicare Part D Plans Cover

Medicare drug plans from any insurer must meet the same standards as Medicare. This means that they all have to cover certain categories of drugs laid out by Medicare, but they can pick and choose which exact drugs to cover. If your exact brand of the drug isnt covered, a similar option will be.

Most insurance providers cover both generic and name-brand drugs, and theyll list exactly which drugs they cover in something called a formulary. Its important to note that the cost of each drug can vary from plan to plan, because of co-pays, tiered pricing, and more.

How To Buy Your Part D Plan

Medicare Part D plans cover outpatient prescription drugs. Choose from a standalone plan or drug coverage included in a Medicare health plan. Which ones right for you?

When I shop online, sometimes the company will suggest an item that pairs well with what Im buying. If Im buying a slow cooker, they might suggest a cookbook to go with it. I like that! I have the option to buy the slow cooker alone, or buy the items together.

You can apply that same approach to buying a Medicare Part D plan. Buy it alone, or buy it with your health coverage.

First, its important to know that Original Medicare includes Part A and Part B . But it doesnt include coverage for most outpatient prescription drugs, like the medicines you take every day or for short periods of time. A Part D prescription drug plan would help pay for these types of medicines.

Two ways to get a Part D plan

You can buy a Part D prescription drug plan from a private insurance company that has a contract with Medicare.

Heres what you need to do to get Part D:

- Enroll in Medicare Part A or Part B, or both

- Live in a county where the plan is offered

And here are the ways you can get coverage.

Don’t Miss: Does Aetna Medicare Advantage Have Silver Sneakers

Do I Need Medicare Part D If I Don’t Take Any Drugs

If you are healthy and donât take prescription medicines, you might be asking yourself if having a Medicare Part D Drug Plan is necessary.

Part D plans cover prescription drugs, so it may not seem like an obvious choice. However, not enrolling in a Part D plan may cost you more money in the long run, either through late enrollment penalties or through unexpected and expensive prescription costs.

How Much Does A Medicare Advantage Plan Cost

The cost of a Medicare Advantage plan may also vary by zip code, the services covered, and the type of care model it uses .

In 2022, the average monthly premium for a Medicare Advantage plan is $62.66 per month. But many Medicare Advantage beneficiaries pay no premium for their Medicare Advantage plan.

How can a Medicare Advantage plan offer a $0 premium? you may ask.

The answer is that Medicare Advantage plan carriers are paid by the Federal government to take on Medicare beneficiaries. Many plan carriers have been able to realize some operational efficiencies by doing things such as restricting the use of high-cost providers.

Recommended Reading: Do Husband And Wife Pay Separate Medicare Premiums

Do I Need Medicare Part D If I Dont Take Any Drugs

Need? No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D. But that doesnât mean you should skip getting a drug plan.

Drug plans offer coverage for prescriptions. We strongly recommend enrolling in a Part D plan even if you donât feel you need it right now, because it will likely save you money in the future and give you coverage in case you need it.

The Center for Disease Control reports that over 85% of adults over the age of 60 take at least one prescription per month. Even if you donât now, statistics show that you will more than likely need a prescription at some point in the future.

If you find yourself asking if you need Part D coverage, we have a previous blog post that addresses common concerns people have. Our post âDo I Really Need a Medicare Part D Drug Planâ covers the basics of what a Part D plan is, what it covers, and why you may want one even if youâre healthy.

How Much Do Medicare Part D Plans Cost

Medicare Part D Plans are offered by private insurance companies approved by Medicare, which means that each company sets its own cost structure. There are three elements to consider in comparing plan costs: The monthly premium, the yearly deductible, and the coinsurance or copayment structure.

Unless you get your prescription drug coverage through a Medicare Advantage plan, youll generally pay a separate monthly premium to your insurance company for Medicare Part D.

Your plan may also have an annual deductible, although many plans do not. A deductible is the amount you pay out of pocket before the plan begins to pay. The deductible varies by plan, but cannot exceed the limit set by Medicare each year. Youll also have cost-sharing with your coverage. Some plans use a copayment system, where you pay a flat fee for each prescription. Other plans use coinsurance, which is a percentage of the actual cost of the prescription. Many plans use a tiered copayment or coinsurance system, where you pay a lower amount for less expensive generic prescription drugs and a higher amount for costly brand-name prescription drugs.

Recommended Reading: What Does Medicare Part A And B Not Cover

To Sum Up What I Think The Positives To Medicare Advantage Plan Are:

1) Low to $0 dollar monthly premiums and some can reduce the Part B premium you pay the government.

2) Medicare Advantage covers everything Original Medicare covers. In addition, plans can cover things that Original Medicare doesnt cover like, some dental, vision hearing needs. Transportation to doctor visits, some cover gym memberships, over-the-counter pharmacy benefits, and more. To give an example of how far these benefits can go. I represent a plan that actually will pay up to a certain amount to have your pet boarded. In case of a hospital or skilled nursing stay.

3) Most have Part D prescription coverage included.

How Do I Get A Medicare Book

If you want to learn more I suggest a couple of Medicare publications. 1st is the Medicare and you Handbook Medicare puts out every year. And also Medicares official guide called Understanding Medicare Advantage Plans. Depending on where you are reading this there will be a link somewhere to download your own copies if you dont already have them. This went longer than I wanted, thank you for reading all the way through, but I feel what I covered is very important to help you to decide if Medicare Advantage is right for you.

You May Like: Who Offers Medicare Supplemental Insurance

How To Find The Best Medicare Part D Plan For The Coverage

Different Medicare Part D prescription drug plans may cover different prescription drugs. However, Medicare Part D prescription drug plans must cover all or substantially all prescription drugs that are:

- Immunosuppressant to prevent organ transplant rejection

- Antidepressants

- Antiretrovirals

- Antineoplastics

Medicare Part D mandates the coverage of these classes of prescription drugs to protect the vulnerable populations that take them. To know if your prescription drug is covered by your plan, ask for the plans formulary. A formulary is a list of covered prescription medications. If you have a plan that doesnt cover a prescription drug you need, you can appeal for that medication to be covered.

Other Points To Keep In Mind:

Medicare Advantage plans have maximum out-of-pocket limits that cant exceed $6,700 in 2019, and that limit will continue to apply in 2020. But prescription costs dont count towards the out-of-pocket cap, since it only applies to services that are covered under Medicare Parts A and B.

Part D prescription drug plans vary considerably from one plan to another, but they fall into two basic categories: Basic and Enhanced. As implied by the names, Enhanced plans will provide more benefits, but also tend to have higher monthly premiums. A broker and/or the plan finder tool will help you pinpoint the best plan for your needs, but its helpful to keep the distinction between Basic and Enhanced plans in mind when comparing options.

Also Check: Does Medicare Cover Oral Surgery Biopsy

Check The Plan Ratings

Every October, Medicare releases ratings on Part D plans, called the Medicare Star Rating System. Plans receive an overall rating , as well as ratings on four subcategories. These are:

- Customer service

- Member experience

- Member satisfaction, including complaints, issues experienced receiving service, and how many members choose to leave the plan

- Pricing and safety

If you have trouble deciding between two plans, a look at each plans’ ratings helps tip the scales in favor of one or the other.

Review Plan Details And Make Your Selection

Now that you have an idea about which Medicare Part DPrescription Drug Plans may be the most cost-effective, there are a few finalfactors to help you narrow your options down. When youre reading over the plandetails, pay special attention to the following:

- Star ratings: Ratings are given out of 5stars for each plan. Several variables are taken into account when calculatingthis, including member satisfaction and management of chronic conditions.

- Prior authorization: Some Part D plansmay require you to receive preapproval or step therapy before theyll covercertain medications.

- Pharmacies: The plan may have a preferrednetwork for pharmacies, including mail-order options. Staying in this network couldsave you money on your prescription.

Recommended Reading: Can You Have Kaiser And Medicare

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

You May Like: Does Everyone Go On Medicare At 65

Can I Add Drop And Change Coverage

Yes, and no.

You cant add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

Lets go through each situation and see if you can drop or add it, if there will be any penalties, and when you can do it.

Can I add Part A later?

No, this is what you start with. If you dont qualify for Part A but do later down the road, you can add it then.

Can I drop Part A later?

Yes, but you shouldnt especially because there are no monthly premiums.

Can I add Part B later?

Yes, but there is a 10 percent late enrollment fee for every 12 months you dont have Part B after you initially enroll.

Can I drop Part B later?

Yes. This may occur when a spouse or loved one finds a job that covers all the costs that Part B covers. There is no penalty to do this.

Can I change from a Medicare Original plan to a Medicare Advantage Plan after and vice versa?

Yes, you can add the Advantage Plan later, but you can only do so in the open enrollment period from October 15 to December 7. You can switch to the Original Medicare plan in the same time.

Can I change from one Medicare Advantage Plan to another?

Yes, during the aforementioned open enrollment period mentioned in the last section.

Can I disenroll from my Advantage Plan?

Yes, there is a period from January 1 to February 14 when you can disenroll.

MORE ADVICE