Where Are You In Your Medicare Journey

1 Original Medicare coverage is required in order to purchase a Medicare Supplement plan.

2These programs are NOT insurance and do not provide reimbursement for financial losses. Some restrictions may apply. Programs and services may be added or discontinued at any time. Customers are required to pay the entire discounted charge for any discounted products or services available through these programs. The Healthy Rewards program is provided by Cigna Health and Life Insurance Company. Programs are provided through third party vendors who are solely responsible for their products and services. Program availability may vary by location, and are not available where prohibited by law.

4 Medicare Supplement plans may be subject to medical underwriting, and coverage may be denied.

Notice for persons eligible for Medicare because of disability:

In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin.

Tennessee Medicare Supplement Policy Forms

Plan A: CNHIC-MS-AA-A-TN Plan F: CNHIC-MS-AA-F-TN Plan G: CNHIC-MS-AA-G-TN Plan N: CNHIC-MS-AA-N-TN

- Customer Plan Links

Managed Care Vs Medicare Supplements

Managed-care plans and Medicare Supplement plans are not the same. This misconception is common. Both provide additional benefits to Original Medicare. However, they serve two totally different purposes. Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan.

MA plans decide on rate amounts, making prices different from plan to plan. Processing payments are done through the private plan, not Medicare.

Medicare Supplement plans or Medigap policies also cover some gaps that Medicare doesnt. However, Supplement insurance works in combination with Original Medicare.

Medigap can help cover expenses such as deductibles, co-payments, and co-insurances. Medicare covers its part of the approved medical charges then Medigap pays its part of the bill. Beneficiaries are responsible to pay the remaining balance.

Having Medicaid Or A Medicare Savings Program

Medicare covers many services, but it doesnt cover long-term care benefits and can leave its enrollees with large cost-sharing expenses. Medicaid pays for some services that Medicare doesnt cover for enrollees whose incomes and assets make them eligible. If you have Medicaid or a Medicare Savings Program a program where Medicaid pays for Medicare premiums and cost-sharing then your enrollment options are different than if you only had Medicare.

Some Medicare Advantage plans specialize in covering low-income Medicare beneficiaries. These are known as Dual Eligible Special Needs Plans , and are available in every state. If you have Medicare and Medicaid, you should have few out-of-pocket expenses if you see providers enrolled in both programs regardless of whether you enroll in a D-SNP. Receiving coverage through a D-SNP requires you to see only providers who participate with the D-SNP insurer.

Some D-SNPs offer additional services, such as home care, dental or vision benefits. D-SNPs can also help coordinate all of the health services you receive. But low-income Medicare beneficiaries are better off with Original Medicare paired with regular Medicaid as secondary coverage if their providers accept those programs, but not D-SNP plans. In many states, the fee-for-service Medicaid benefit also covers dental or vision care.

Here is more information about programs available to Medicare beneficiaries with limited incomes and assets.

Also Check: Do I Have To Use Medicare When I Turn 65

What Is Original Medicare

En español | Original Medicare, also known as traditional Medicare, works on a fee-for-service basis. This means that you can go to any doctor or hospital that accepts Medicare, anywhere in the United States, and Medicare will pay its share of the bill for any Medicare-covered service it covers. You pay the rest, unless you have additional insurance that covers those costs. Original Medicare provides many health care services and supplies, but it doesnt pay all your expenses.

When you first sign up for Medicare Part A and Part B, Social Security automatically enrolls you in original Medicare. If you prefer to receive your care from a private Medicare Advantage plan, such as an HMO or PPO, instead of the original program, you must actively enroll in a plan thats offered in your area. If you prefer to stay in original Medicare, you can get prescription drug coverage by joining a private Part D drug plan for an additional premium and you can also choose to buy private supplemental insurance to cover some of your out-of-pocket costs in the original program.

Read Also: When Is The Next Medicare Open Enrollment

What Is A Medicare Advantage Plan

Enrollment in Medicare Advantage plans has doubled over the last 20 years, with 39% of Medicare enrollees enrolled in Medicare Advantage during 2020, according to the Kaiser Family Foundation. But what is a Medicare Advantage plan? If traditional Medicare doesnât meet your needs, an Advantage plan could be an excellent alternative.

You May Like: Does Medicare Cover Life Line Screening

How Does Original Medicare Work

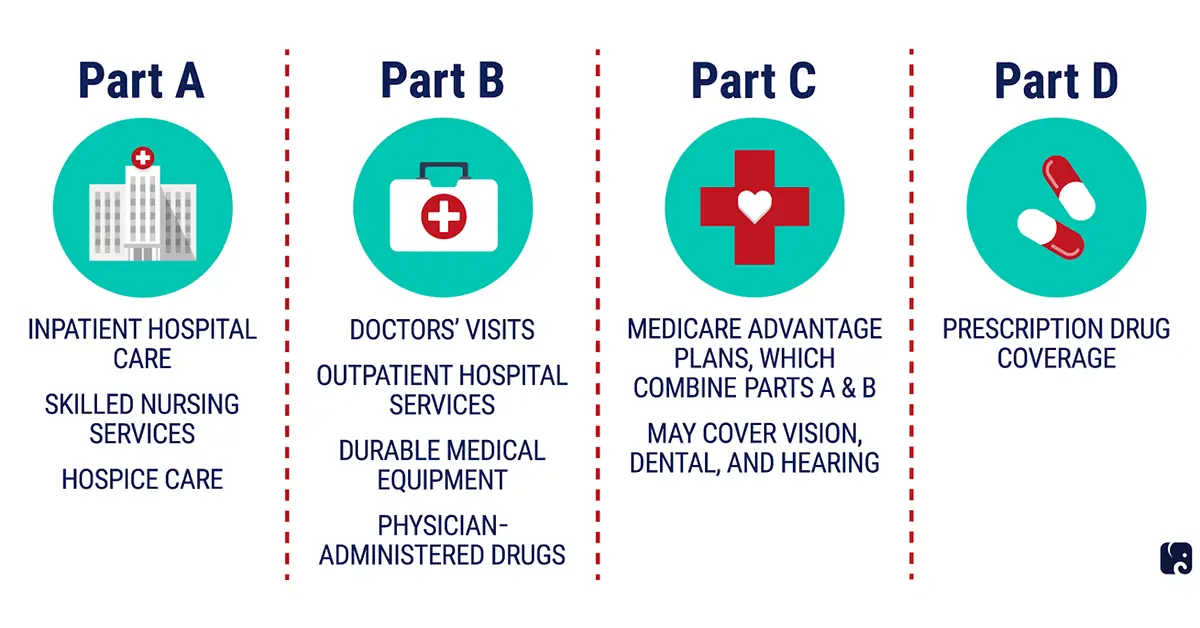

Original Medicare is a government-funded medical insurance option for people age 65 and older. Many older Americans use Medicare as their primary insurance since it covers:

- Inpatient hospital services. These benefits include coverage for hospital visits, hospice care, and limited skilled nursing facility care and at-home health care.

- Outpatient medical services . These benefits include coverage for preventive, diagnostic, and treatment services for health conditions.

Original Medicare generally doesnt cover prescription drugs, dental, vision or hearing services, or additional healthcare needs.

However, for people who have enrolled in original Medicare, there are add-ons such as Medicare Part D prescription drug coverage and Medicare supplement plans that can offer additional coverage.

If Your Income Is High Or Very Low Or Youre Feeling Lucky You Might Be Able To Rely On Traditional Medicare Heres Why Most People Dont

Only 19% of Original Medicare beneficiaries have no supplemental coverage .

- Supplemental coverage can help prevent major expenses.

If youre approaching Medicare eligibility, youve probably heard about the various private-coverage options that are available to replace or supplement Medicare. These plans are popular, but are they necessary?

If you shun private coverage, can you get by on Original Medicare without purchasing supplemental coverage or using a Medicare Advantage plan?

The answer is: It depends.

Don’t Miss: Do I Have To Apply For Medicare At Age 65

Improve Medicare For All Beneficiaries

Medicare is extremely popular, but it needs attention to ensure all beneficiaries receive comprehensive coverage and equitable treatment. The Medicare program that Americans know and cherish has been allowed to wither. Traditional Medicare, preferred by most beneficiaries, has not been improved in years, yet private Medicare Advantage plans have been repeatedly bolstered. Its time to build a better Medicare for all those who rely on it now, and will in the future.

The Alternatives To Original Medicare

Medicare Part C, also known as Medicare Advantage, is a private insurance alternative to traditional Medicare that often includes additional benefits, such as vision, dental or drug coverage.

Medicare Advantage plans do have annual out-of-pocket limits, typically $6,700 if you stick within your plans network of medical providers.

When youre enrolled in Medicare Advantage, youre still responsible for paying your Part B premiums. There might be an additional monthly premium amount for Part C, though not always.

Part D is the way to add prescription drug coverage to original Medicare. Part D drug plans are offered by private insurance companies and cost an average of $32.74 per month in 2020, though prices vary by location.

Seniors will usually benefit most from choosing a Part C Medicare Advantage plan or going with original Medicare plus Part D prescription coverage and yet another option: Medicare supplement insurance.

Supplement plans also known as Medigap pay the steep out-of-pocket costs from original Medicare and might even cover medical expenses when you travel outside the U.S. But Medigap doesnt provide coverage for vision, dental or hearing care, or prescriptions.

As with Parts C and D, Medigap plans are sold by private insurance companies, and different insurers can charge vastly different premiums for very similar plans. So it really pays to shop around and find the best price.

Don’t Miss: What Is Medicare Advantage Otc Card

Original Medicare Vs Medicare Advantage Vs Medicare Supplement

by Christian Worstell | Published April 22, 2021 | Reviewed by John Krahnert

Original Medicare is Part A and Part B .

But beneficiaries also have other Medicare coverage options, including Medicare Advantage plans and Medicare Supplement Insurance plans .

Learn more about how these options compare to find out which one might be right for your needs.

Read Also: Why Sign Up For Medicare At 65

Differences Between Original Medicare Vs Medicare Advantage

Original Medicare is made up of Medicare Part A and Medicare Part B. When you have Original Medicare, the federal government administers your benefits. Medicare Part A covers hospital benefits and Medicare Part B is your medical coverage. Beneficiaries pay into Original Medicare throughout their working career in the form of Medicare taxes.

On the other hand, with Medicare Advantage, private insurance companies manage benefits. Medicare pays the carrier to administer your benefits under Medicare Part C .

Get A Free Quote

Find the most affordable Medicare Plan in your area

These private insurance companies must follow the guidelines the federal government sets. However, the companies can set their own prices, deductibles, and additional benefits.

Recommended Reading: Is Smart Vest Covered By Medicare

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

Cons Of Original Medicare

When you enroll in Original Medicare, you are responsible for the Medicare Part B premium, Medicare Part A and Part B deductibles, and Medicare Part A and Part B coinsurances. With these costs, there is no out-of-pocket maximum for Original Medicare.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Alongside the out-of-pocket costs, another con is that Original Medicare does not provide additional benefits. These include dental, vision, hearing, and drug coverage. If you require this coverage, you will have to seek additional policies.

Recommended Reading: Who Can Get Medicare Insurance

Medicare Advantage Plans May Cost You Less

If you enroll in a Medicare Advantage plan, you continue to pay your Medicare Part B premium and you may pay an additional premium. The insurer determines the Medicare Advantage planâs premium, which can vary from one Medicare Advantage plan to another. Some Medicare Advantage plans may have premiums as low as $0.

Your cost sharing may also be less under Medicare Advantage. For, example, if you visit a primary care physician under Medicare Advantage, you may pay a copayment of $10. However, if you visit a primary care physician under Original Medicare, you may have a coinsurance of 20%, which could be more than $10.

Also, a Medicare Advantage plan limits your maximum out-of-pocket expense. Once you have spent that maximum, you pay nothing for covered medical services for the remainder of the year. Original Medicare does not provide a maximum out-of-pocket cap, so your potential expenses are limitless.

Often a Medicare Advantage plan can be less expensive than comparable coverage you would receive if you stayed with Original Medicare. To get all the benefits of Medicare Advantage with Original Medicare, you would also need to enroll in a stand-alone Medicare Part D Prescription Drug Plan as well as a Medicare Supplement plan.

What Are The Two Main Medicare Coverage Options

Traditional Medicare

- Traditional Medicare covers Part A and Part B .

- Individuals also have the option to add Part D coverage for prescription drugs alongside their Part A and B coverage if they choose.

- Under Traditional Medicare, there is no annual limit on out-of-pocket costs. To help with the cost of coverage, individuals in traditional Medicare can buy Medicare Supplemental Insurance , which is extra insurance available from a private company. Medicare beneficiaries with limited income and resources may qualify for supplemental coverage under Medicaid.

Medicare Advantage , also referred to as Part C

- As a coverage alternative to traditional Medicare, beneficiaries have the option to enroll in Medicare Advantage.

- MA plans are run by private health insurers that follow the rules set by the Medicare program and are then paid by Medicare to provide services.

- Unlike traditional Medicare, MA plans usually include Part D as part of a bundle with Part A and Part B.

- Under MA, annual out-of-pocket costs are limited. Once an enrollee reaches the MA plans limit, the plan pays 100 percent of the cost of covered services for the remainder of the year.

You May Like: What Is The Average Medicare Supplement Premium

Online Access To Your Plan

myCigna.com gives you 1-stop access to your coverage, claims, ID cards, providers, and more. Log in to manage your plan or sign up for online access today.

Accidental injury, critical illness, and hospital care.

Controlling costs, improving employee health, and personalized service are just a few of the ways we can help your organization thrive.

Use Cigna for Brokers to access everything you need to manage your business and complete enrollments.

Read Also: Does Medicare Cover Disposable Briefs

Which Is Better Traditional Medicare Or Medicare Advantage

Go to main Voices page »

Retiring as a single female at 70 to a life plan community , I aimed to simplify and avoid unexpected costs. I chose Medicare plus Medigap for the reasons Rick Moberg and Andrew Forsythe listed. For my Medigap Plan G , the premium is the same every month . I set it to autopay from my bank account. My Plan G has an annual deductible set by Medicare , and beyond that I incur $0 out-of-pocket costs. For example, in 2022 I had a total hip replacement and knew all the associated costs would be completely covered. The bills up to the Plan G deductible went to my CCRC, and all bills after that went directly to Medicare and Medigap simplicity and security.

Edits: The Plan G premium is about $130/mo in 2022. And of course theres the Part B monthly premium set by Medicare, taken out of my Social Security benefit.

The goal I have above all in retirement is flexibility and resilience. We should have a strong enough balance sheet when I stop working to afford traditional Medicare + medigap with a high-deductible gap plan. For many of the reasons Rick Moberg mentioned, this should be optimal for us.

I think the lower upfront premium costs and expanded benefits of Medicare Advantage plans are great as long as you never get seriously sick or injured. Inasmuch as thats unlikely as we age, I like traditional Medicare with a Medicare Supplement plan for the following reasons:

Don’t Miss: How Much Does Medicare Pay For Dental

Which Is Better: Medicare Advantage Or Medigap

The question of whether Medicare Advantage or Medigap is better is one of the most common questions Cicchelli gets but, unfortunately, comes with no easy answer, he says. The reason is that the decision is subjective and depends on your individual needs.

It can be a real gamble when choosing whether to go Advantage or Medigap, he says. A persons overall health profile can give clues, but none of us knows what will happen one day to the next. Every appointment often comes down to weighing pros and cons between the different types and levels of coverage, he says.

An advantage of MA Plans is the monthly premiums can be quite low, Boden says. However, you could have a deductible and out-of-pocket maximums as high as $7,550 depending on the plan.

On the other hand, Medigap plans have higher monthly premiums, but he says the only cost for services is usually just a small copay. You can also generally choose your own doctor regardless of where they work as long as they take Medicare insurance, which means you have medical insurance coverage all over the country.

But with Medigap you need to get separate prescription drug coverage, whereas with Medicare Advantage, drug coverage is usually bundled with the plan, he says. This can be a benefit or drawback, depending on your situation.

Regardless of which coverage you choose, you can generally find small, ancillary plans to increase coverage in weaker areas, Cicchelli says.

Drug Coverage In Medigap Vs Medicare Advantage Ppo

If you are on a Medicare Advantage PPO, you cannot purchase a stand-alone drug plan. What that means is that if the PPO that works best for your medical needs for you doesnt have the drug coverage youd like, you are out of luck.

If the plan you want doesnt offer prescription coverage, you are out of luck.

Even if you dont take any medications, youll need either a drug plan or creditable coverage to avoid future penalties. With a Medicare Supplement plan, you can purchase the drug plan that saves you the most money. But it will be at an added expense. Heres how to find the prescription drug plan that saves you the most money.

Part B Medications in Medicare Advantage PPO vs Medicare Supplement

Medicare Advantage PPOs handle Part B medications differently than original Medicare and a Medicare Supplement Plan.

For example, if you are diabetic and use a pump, Medicare and Plan F covers your insulin at 100%. With Medicare Advantage PPOs, you could have a co-pay ranging up to 20 50% of the cost of the drug.

The same thing applies to chemotherapy drugs and other doctor provided shots such as Lupron. The Medicare Advantage PPO could require you to pay a co-insurance amount where-as with a Medigap Plan you could have a smaller amount to pay.

Durable Medical Equipment in Medicare Supplement vs Medicare Advantage PPO

Medical Conditions in Medigap vs Medicare Advantage PPO

The good news about Medicare Advantage PPOs is that they MUST accept you into their plan as long as you:

Read Also: When Are You Required To Sign Up For Medicare