What Is The Difference Between Medicare And Medicaid

PayingForSeniorCare is committed to providing information, resources, and services free ofcharge to consumers that help seniors and their families make better decisions about senior living and care.

We may receive business-to-business compensation from senior care partnerships and/or website advertising. This compensation doesnt dictate our research and editorial content, nor how we manage our consumerreviews program. PayingForSeniorCare independently researches the products and services that oureditorial team suggests for readers. Advertising and partnerships can impact how and where products,services, and providers are shown on our website, including the order in which they appear, but theydont determine which services or products get assessed by our team, nor which consumer reviews getpublished or declined.

PayingForSeniorCare.com awards some companies with badges and awards based on our editorial judgment. We dont receive compensationfor these badges/awards: a service provider or product owner may not purchase the award designation orbadge.

Learn moreabout our mission and how we are able to provide content and services to consumers free of charge.

Medicare Vs Medicaid Compare Benefits

In the context of long term care for the elderly, Medicares benefits are very limited. Medicare does not pay for personal care . Medicare will pay for a very limited number of days of skilled nursing . Medicare will also pay for some home health care, provided it is medical in nature. Starting in 2019, some Medicare Advantage plans started offering long term care benefits. These services and supports are plan specific. But they may include:

- Adult day care

Effective Date Of Coverage

Once an individual is determined eligible for Medicaid, coverage is effective either on the date of application or the first day of the month of application. Benefits also may be covered retroactively for up to three months prior to the month of application, if the individual would have been eligible during that period had he or she applied. Coverage generally stops at the end of the month in which a person no longer meets the requirements for eligibility.

Read Also: Do Husband And Wife Pay Separate Medicare Premiums

Medicaid Eligibility And Costs

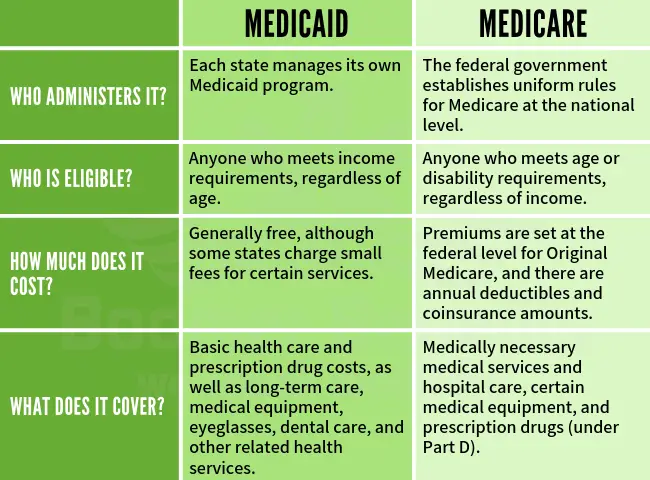

The federal and state partnership results in different Medicaid programs for each state. Through the Affordable Care Act , signed into law in 2010, President Barack Obama attempted to expand healthcare coverage to more Americans. As a result, all legal residents and citizens of the United States with incomes 138% below the poverty line qualify for coverage in Medicaid participating states.

While the ACA has worked to expand both federal funding and eligibility for Medicaid, the U.S. Supreme Court ruled that states are not required to participate in the expansion to continue receiving already established levels of Medicaid funding. As a result, many states have chosen not to expand funding levels and eligibility requirements.

Those covered by Medicaid pay nothing for covered services. Unlike Medicare, which is available to nearly every American of 65 years and over, Medicaid has strict eligibility requirements that vary by state.

However, because the program is designed to help the poor, many states have stringent requirements, including income restrictions. For a state-by-state breakdown of eligibility requirements, visit Medicaid.gov and BenefitsCheckUp.org.

Medicare Services & Fees

Eligible recipients of Medicare have a choice. They may enroll into either Original Medicare or into a private health plan known as Medicare Advantage . All plans cover the same basic Medicare-covered health services, but there are differences in premiums, deductibles, coinsurance and provider networks. People should carefully consider their own situations before choosing. If their needs change, people may also change plans during the Open Enrollment period each year.

People enrolling in Original Medicare should also consider enrolling in a stand-alone Prescription Drug Plan , also known as Part D, to cover their outpatient prescription drugs. Most Medicare Advantage Plans already cover prescription drugs.

Below is more detail on coverage provided by Medicare parts A, B, C and D:

Original Medicare members can also enroll in Medicare Supplement Insurance, also called Medigap, which fills in the gaps not covered by Original Medicare. Medigap is offered by private, approved insurance companies. These plans pay for costs such as coinsurance, copayments and deductibles.

In Connecticut, a Medigap cannot be used as a stand-alone plan, and is designed to be used in combination with Parts A and B. These plans do not provide prescription drug benefits. The state offers up to 10 standardized policy options, each labeled with a letter. All plans of the same letter offer the same benefits, no matter which insurance company offers the plan.

Read Also: What Is The Average Cost Of Medicare Part B

What Is Medicare Dual Eligible And How Do I Qualify

Most Americans understand that when they turn 65, Medicare will become their main health insurance plan. However, many Americans are less familiar with another health care program, Medicaid, and what it means if they are eligible for both Medicare and Medicaid. If you are dual eligible, Medicaid may pay for your Medicare out-of-pocket costs and certain medical services that arent covered by Medicare.

What Are The Disadvantages Of Medicaid

Disadvantages of Medicaid

- Lower reimbursements and reduced revenue. Every medical practice needs to make a profit to stay in business, but medical practices that have a large Medicaid patient base tend to be less profitable.

- Administrative overhead.

- Medicaid can help get new practices established.

Recommended Reading: Does Medicare Part B Pay For Hearing Aids

How Much Does Medicare Cost If You Have Never Worked

If you never worked, then your Part A premium for 2022 will be $499. But if you spent at least 30 to 39 quarters in the workforce and paid Medicare taxes, your premium could be reduced to $274. Medicare Part B, which covers outpatient care, comes with a monthly premium that is not affected by your work history.

Medicare Eligibility At 65 And Older

The year you turn 65, you can apply for Medicare starting three months before your birth month until three months after. You generally have to meet three eligibility requirements to qualify for full Medicare benefits when you turn 65.

The chief requirement is that you must be a U.S. citizen or permanent legal resident who has lived at least five years in the United States.

In addition, you have to meet one of the following other requirements:

- You or your spouse must have worked long enough to also be eligible for Social Security benefits or for railroad retirement benefits. This usually means youve worked for at least 10 years. You must also be eligible for Social Security benefits even if you are not yet receiving them.

- You or your spouse is either a government employee or retiree who did not pay into Social Security but did pay Medicare payroll taxes while working.

Paying Medicare payroll taxes for 10 full years means you wont have to pay premiums for Medicare Part A, which covers hospital care.

You dont need the work credits to qualify for Medicare Part B, which covers doctor visits or outpatient services, or Medicare Part D, which covers prescription drugs. But everyone has to pay premiums for both.

You can still get Medicare if you never worked but it may be more expensive depending on your spouse or total work history.

Prepare for the Medicare Advantage Open Enrollment Period

Read Also: What Is The Coinsurance For Medicare Part B

Original Medicare And Private Medicare Plan Options

Texans have both public and private Medicare plan options. Original Medicare includes Medicare Part A and Medicare Part B . Original Medicare does not cover 100% of costs, and most people have a private health plan such as Medicare Part C, Medicare Part D, or Medicare Supplement.

Medicare Part C , Medicare Part D , and Medicare Supplement are your private health plan options. These are approved by the Centers for Medicare and Medicaid Services .

Learn more about your public and private Medicare plan options in Medicare in Texas.

For Those Who Qualify There Are Multiple Ways To Have Your Medicare Part B Premium Paid

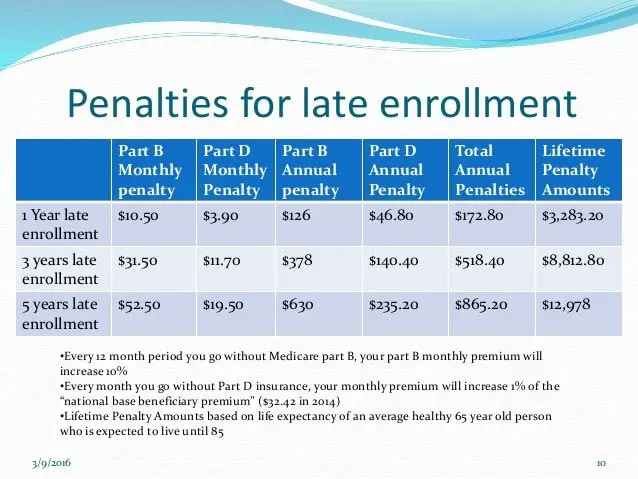

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

These Part B costs can add up quickly, which is why many beneficiaries search for a way to lower or be reimbursed for these expenses. The good news is they have options that can help maximize their savings while on Medicare.

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

Read on to learn about Part B savings options that you may be able to take advantage of.

Recommended Reading: Does Medicare Pay For Maintenance Chiropractic Care

Qualifying Medicaid Beneficiary Only

This is for people who are not eligible to receive full Medicaid benefits. Medicaid will pay the recipients Medicare Part A premiums . It will also pay their Medicare Part B premium for them. Besides, there may be extra help with Medicare insurance deductibles and copayments.

If youre a QMB recipient, you chose the Medicare insurance that you like. Then, Medicaid helps with your deductibles and copayments.

You will want to have good Medicare insurance, like a Medicare Advantage plan, in place if you receive Medicaid benefits. Remember, QMB is a dual-eligible program, not a Medicaid-only program.

Maximum monthly income for those aged 65 and over to qualify for QMB in 2021 is $1,094 for an individual and $1,472 for a couple. For 2021, the maximum asset level is $7,970 for an individual and $11,960 for a couple.

In certain situations like nursing home benefits, people with greater assets may be asked to spend down their assets first before Medicaid kicks in with help.

Qualified Disabled Working Individual Program

The QDWI Program helps pay for the Medicare Part A premium for certain people who meet one of the following criteria:

- Have a disability but are still working

- Lost their premium-free Part A coverage when they returned to work

- Are not receiving medical assistance from their state

- Meet the income and resource limits below

- Income of no more than $4,379 per month for an individual in 2021, or $5,892 for a married couple.

- Resources of $4,000 for an individual in 2021, or $6,000 for a married couple.

The income and resource limits listed above may increase in 2022. If your income and resources are slightly higher, you should still apply.

Read Also: When Am I Available For Medicare

Disclaimer For Requesting A Phone Call Or Email

Your information and the use of this site is governed by our Terms of Service and Privacy Policy.

Medicare65quote.com is not connected with or endorsed by the United States government or the federal Medicare program. For official government information, please visit Medicare.gov . Plans shown on Medicare65quote.com may not represent every plan available in the market. By using Medicare65quote.com you agree to our Terms of Service and Privacy Policy.

Our partner, eHealthInsurance Services, Inc., is a licensed health insurance agency selling plans from a number of insurance companies that offer Medicare Advantage HMO, PPO and PFFS plans and stand-alone prescription drug plans with a Medicare contract. eHealthInsurance Services, Inc. is not affiliated or connected with the federal Medicare program or any government agency. Enrollment in any plan depends on eligibility and other factors. For a complete list of available plans please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare Part A & B Assistance

If you receive or are eligible for Medicare, but youre unable to pay for your premiums, co-pays, or deductibles, you should read more about Medicare Savings Programs in Texas. Four Medicare Savings Programs could help you pay for Medicare Part A and/or Part B deductibles, coinsurance, and copayments.

Don’t Miss: How To Apply For Medicare Insurance

Income Tiers For Dual Eligibility

Each state sets its own income limits for Medicaid eligibility. Thus, the income tiers for dual eligibility will also vary from state to state.

A reasonable benchmark to use for Medicaid eligibility in 2021 is 138% of the federal poverty level. The federal poverty level is a measure of annual income issued every year by the Department of Health and Human Services to determine eligibility for Medicaid and certain other assistance programs.

For 2021, the federal poverty level for the continental 48 states and the District of Columbia is:

- $12,880 for individuals

- $17,420 for a family of 2

- $21,960 for a family of 3

- $26,500 for a family of 4

- $31,040 for a family of 5

- $35,580 for a family of 6

- $40,120 for a family of 7

- $44,660 for a family of 8

Federal poverty levels differ in Alaska and Hawaii.

Most states use an income of no more than 138% of the federal poverty level in order to be eligible for Medicaid. For example, a family of 3 in Arizona would need a household income of no more than $30,304.80 in order to be eligible for Medicaid.

If a member of that family is also eligible for Medicare because of their age or a disability, they would be dual eligible.

Some states have different income tiers for families and individuals. You can explore a complete online list of state income tiers for Medicaid eligibility.

Aged & Disabled Federal Poverty Level Program

If you are aged or disabled and are not eligible for the SSI program, you may be able to get Medi-Cal through the Aged & Disabled Federal Poverty Level program. To qualify, you must:

This Medi-Cal program uses SSI countable income rules as well as a few extra rules you should know. For more information, visit the Medi-Cal section of the Disability Benefits 101 website.

Also Check: Is Root Canal Covered By Medicare

How Is Medicaid Eligibility Determined

Medicaid beneficiaries generally must be residents of the state in which they are receiving Medicaid. They must be either citizens of the United States or certain qualified non-citizens, such as lawful permanent residents. In addition, some eligibility groups are limited by age, or by pregnancy or parenting status.

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

Recommended Reading: Is Medicare Getting A Raise

Whats Considered Income And Assets

What Defines Income?

To be eligible for Medicaid, you must meet income requirements. Texas will count some of your income, but not all of it. Your income includes regular benefit payments from Social Security retirement or disability payment, veterans benefits, you or your spouses pension, salaries or wages, and interest from CDs , bank accounts, or dividends from investments.

Things that are not counted as income include nutritional assistance from programs such as food stamps, housing assistance provided by the federal government, home energy assistance, and potentially some of your earnings from earned work that you perform.

What Assets Count When Applying for Medicaid?

When applying for Medicaid, financial assets counted for include cash, stocks, bonds, investments, savings and checking accounts, and real estate that is not your primary residence.

Many assets are considered exempt and not countable for your eligibility. These items include your personal belongings, household furnishings, one car, irrevocable burial trusts, and your primary place of residence.

What Type Of Coverage Do You Get If You Are Dual Eligible For Medicare And Medicaid

There are two levels of coverage for beneficiaries who are dual eligible:

- Full dual eligibleFull dual eligible refers to those who receive full Medicaid benefits and are also enrolled in Medicare. People who are full dual eligible typically receive Supplemental Security Income benefits, which provide cash assistance for basic food and housing needs. Qualifying as full dual eligible is based on your assets, which include checking and savings accounts, stocks, real estate and vehicles .

- Partial dual eligiblePartial dual eligibility includes those who receive assistance from Medicaid in order to help pay for Medicare costs such as premiums, coinsurance or deductibles. Partial dual eligibles fall into one of four categories of eligibility for Medicare Savings Programs.

A Medicare Savings Program is a federally funded program administered within each state that helps lower income people pay for Medicare premiums, deductibles, copayments and coinsurance.

The four Medicare Savings Programs are outlined below.

Recommended Reading: Does Medicare Cover Out Of Country Medical Expenses

Pathways To Full Medicaid Eligibility Based On Old Age Or Disability

SSI Beneficiaries

States generally must provide Medicaid to people who receive federal Supplemental Security Income benefits.7 To be eligible for SSI, beneficiaries must have low incomes, limited assets, and an impaired ability to work at a substantial gainful level as a result of old age or significant disability. The SSI federal benefit rate is $750 per month for an individual and $1,125 for a couple8 in 2018,9 which is 74 percent of the federal poverty level . The effective SSI income limit is somewhat higher than 74% FPL in four states, due to state supplemental payments and/or additional income disregards: 80% FPL in Idaho, 83% FPL in New York and Wisconsin, and 87% FPL in Missouri . Box 1 provides more information about disregards. SSI beneficiaries also are subject to an asset limit of $2,000 for an individual and $3,000 for a couple.

Optional Pathways

Seniors and people with disabilities up to 100% FPL

Over 40 percent of states elect the option to expand Medicaid to seniors and people with disabilities whose income exceeds the SSI limit but is below the federal poverty level 12 .13 Eighteen of these states set the income limit at 100% FPL, the federal maximum for this pathway. In the other three states electing this option, the eligibility limit is 80% FPL in Arkansas, 81% FPL in Virginia, and 88% FPL in Florida. Twenty of the 21 states electing this option cover both seniors and people with disabilities, while Arkansas only covers seniors.