What Are The Parts Of Medicare And What Do They Cover

Here are some basic facts to get you started learning about Medicare and what it covers.

When I first started my career in the Medicare world, I realized there was a lot of new information I had to learn. I found that breaking it down into bite-sized pieces made it easier to understand. I started by focusing on all the different parts of Medicare. Here are some tips that helped me understand the parts of Medicare and what they cover.

What Are The Limits On Part B

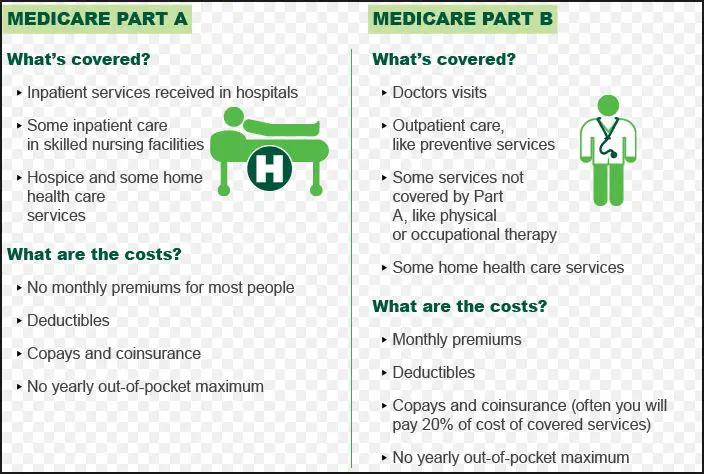

There are no limits to the coverage provided by Part B, but beneficiaries can pay a monthly premium or utilization review fee. It is commonly known as the Part B deductible and is equivalent to 1% of their monthly income. Additionally, beneficiaries must pay 20% of their total Medicare cost for many services . There are also co-pays for certain services .

Medicare Part B Vs Medicare Part C

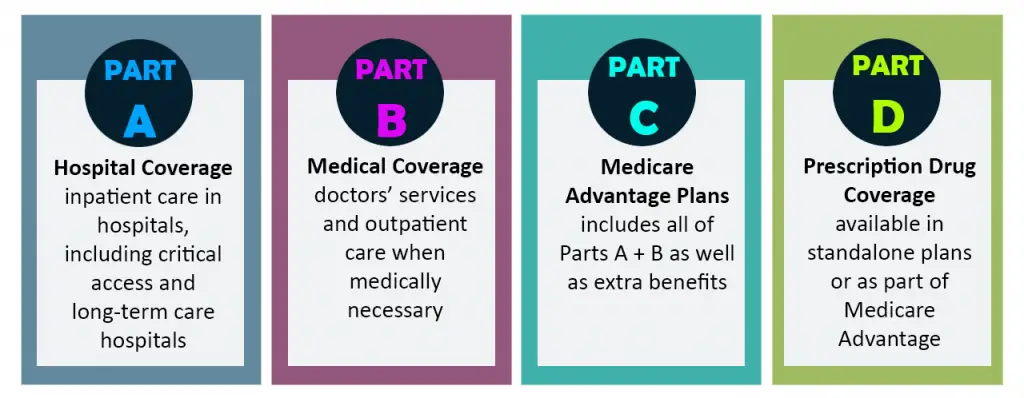

Since Original Medicare do not cover everything, some Medicare recipients opt for Medicare Part C. Also known as Medicare Advantage, these health insurance policies are provided by Medicare-approved private health insurance companies and may cover additional services â like dental or vision care â or help lower out-of-pocket expenses.

However, to get a Medicare Advantage plan, you still need to enroll in Original Medicare and pay your Medicare Part B premium in addition to the Medicare Advantage premium. The exact cost and benefits will depend on the insurer and the plan that you choose. Part C plans often operate like private health insurance plans and may come with their own restrictions on how to use them.

Read more about Medicare Part C.

Recommended Reading: How Old To Get Medicare And Medicaid

Other Medically Necessary Services

There are other items covered by Part B in addition to preventive services. For many of these items, a deductible may apply, and you may pay 20% of the Medicare-approved cost. There is no yearly limit on how much you may have to pay in out-of-pocket costs for health care services.

For this reason, many people also have a Medicare Supplement policy, sometimes called a Medigap policy, to help cover the gaps in coverage. These supplemental policies may be able to provide more complete coverage with the assurance of annual out-of-pocket cost limits.

Here are some other items covered by Part B which may be subject to the deductible and co-pay:

- Ambulance services

Additional services not listed may also be covered.

What Is The Difference For Enrollment In Medicare Part A And Part B

You may be enrolled in Medicare Part A and Part B automatically if:

- Youve been receiving Social Security or Railroad Retirement Board benefits for at least 4 months before you turn 65.

- Youve been receiving disability benefits for 24 months.

If youre still working when you turn 65, you may not be automatically enrolled in Medicare Part A and Part B. You may choose to enroll in Medicare Part A if you can get it premium-free but delay Part B enrollment because you have to pay a premium for it.

You can compare Medicare plans with the click of a button just click Browse Plans on this page.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Also Check: Will Medicare Pay For A Roho Cushion

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a “funding warning” is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 “window”. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

Costs And Funding Challenges

Over the long-term, Medicare faces significant financial challenges because of rising overall health care costs, increasing enrollment as the population ages, and a decreasing ratio of workers to enrollees. Total Medicare spending is projected to increase from $523 billion in 2010 to around $900 billion by 2020. From 2010 to 2030, Medicare enrollment is projected to increase dramatically, from 47 million to 79 million, and the ratio of workers to enrollees is expected to decrease from 3.7 to 2.4. However, the ratio of workers to retirees has declined steadily for decades, and social insurance systems have remained sustainable due to rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office wrote in 2008 that “future growth in spending per beneficiary for Medicare and Medicaidthe federal government’s major health care programswill be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costswhich will be difficult, in part because of the complexity of health policy choicesis ultimately the nation’s central long-term challenge in setting federal fiscal policy.”

Also Check: When Is Open Enrollment For Medicare

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

Are You Looking For Free Insurance Quotes

Secured with SHA-256 Encryption

|

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsburys 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from Seve… |

Recommended Reading: What Benefits Do You Get With Medicare

What Does Part B Cost

With Medicare Part B, you pay a standard monthly premium thats based on your income. In some cases, your monthly premium may be higher if you didnt sign up for Part B when you became eligible.

You may also need to meet an annual deductible before Medicare kicks in and starts paying. Once youve met your deductible, you will pay a 20 percent copay for approved Medicare Part B services.

You can always buy a Medicare Supplement Plan that pays your Part B deductible, as well as other out-of-pocket costs such as copays and coinsurance.

How Do You Sign Up For Medicare Part B

Signing up for Medicare Part B depends on your situation. In some cases, enrollment is automatic, and in others you must apply. If youre already receiving benefits from Social Security or the Railroad Retirement Board for at least four months before you turn 65, youll be automatically enrolled. If thats not the case, you can apply online at ssa.gov/medicare.6

That said, while most people should enroll in Medicare Part A, some people may choose to delay signing up for Part B. This typically depends on the kind of health coverage you have. For instance, if youre working and you still have health coverage through a job, or you have coverage through your spouse whos still working, you may be able to delay coverage without paying a late enrollment penalty.7 There are a lot of nuances find out about those and other situations here.

If you have Lou Gehrigs disease , end-stage renal disease , or youre under 65 and you are receiving Social Security Disability Insurance benefits, find out about enrollment here.

Also Check: How To Choose Best Medicare Part D Plan

What Doesnt Medicare Part B Cover

Medicare Part B doesnt cover every possible medical expense. Heres a partial list of what Part B doesnt generally cover.

- Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B.

- Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services.

- Routine dental care

- Routine vision care

- Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting.

- Hearing aids

- 24-hour home health care

- Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesnt generally cover it.

Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

You May Like: What Is Medicare Ffs Program

Medicare Part B Premiums

Each year, Medicare Part B premiums can go up or down. How does the 2021 Medicare Part B premium stack up? Heres a breakdown:

- Medicare Part B premium 2018: $134

- Medicare Part B premium 2019: $135.50

- Medicare Part B premium 2020: $144.60

- Medicare Part B premium 2021: $148.50

Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each.

If your individual or joint income is above the standard bracket, you may pay an Income-Related Monthly Adjustment Income-Related Monthly Adjustments determine the premium costs for Medicare Part B and Part D based on your income.. Find your IRMAA rate for 2021 below:

Annual income: Individual & Joint

- IRMAA: $0

Annual income: Individual & Joint

- IRMAA: $59.40

Annual income: Individual & Joint

- IRMAA: $148.50

Annual income: Individual & Joint

- IRMAA: $237.60

Annual income: Individual & Joint

- IRMAA: $326.70

Annual income: Individual & Joint

- IRMAA: $356.40

- Part B premium: $504.90

What Parts A And B Don’t Cover

The largest and most important item that traditional Medicare doesn’t cover is long-term care if the only care you need is custodial. If you are diagnosed with a chronic condition that requires ongoing long-term personal care assistance, the kind that requires an assisted-living facility, Medicare will cover none of the cost. However, Medicare will cover the costs for acute-care hospital services, for patients who are transferred from an intensive care or critical care unit. Services covered could include head trauma treatment or respiratory therapy.

Recommended Reading: What Are The Costs Of Medicare Advantage Plans

What Is Not Covered By Original Medicare

Original Medicare doesnt cover everything. If you need certain services that Medicare does not cover, you will have to pay outof-pocket unless you have other insurance to help cover the costs. Even if Medicare covers a service or item, you generally have to pay deductibles, coinsurance, and copayments.

Items and services that Medicare does not cover include, but are not limited to, cosmetic surgery, health care you get while traveling outside of the United States , hearing aids and exams for fitting hearing aids, long-term care, most eyeglasses, routine dental care, dentures, and acupuncture.

Generally, Original Medicare does not cover prescription drugs, also called Part D, although it does cover some drugs in limited cases such as immunosuppressive drugs and oral anti-cancer drugs. Some of these services not covered by Original Medicare may be covered by a Medicare Advantage Plan .

To find out if Medicare covers a service you need, visit medicare.gov and select What Medicare Covers, or call 1-800-MEDICARE . TTY users should call 1-877-486-2048, 24 hours a day/7 days a week.

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

Recommended Reading: How Do You Get Credentialed With Medicare

What Else Should I Consider

Original Medicare is most common and has remained popular over the years. There are, however, other options that you may want to consider. For example:

Medicare Advantage: Also called Medicare Advantage Plan Medicare Advantage is health insurance for Americans aged 65 and older that blends Medicare benefits with private health insurance. This typically includes a bundle of Original Medicare and Medicare Prescription Drug Plan ., this is an alternative to Original Medicare that provides additional benefits like dental, vision and prescription drug coverage. These plans are regulated by Medicare but provided through private insurance companies. Its also important to know that Medicare Advantage also has its own Annual Enrollment Period .

Medigap:Medicare Supplement Insurance Medicare Supplement Insurance is designed to provide coverage that Original Medicare does not. Medigap policies are purchased in addition to Original Medicare and have their own monthly premiums you’ll need to pay. fills the holes in your policy that arent covered by Original Medicare. These are purchased in addition to your Medicare coverage and are offered by private insurance companies.

Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships dont influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

- Medicare Part B is one of the four main parts of Medicare that covers doctors visits, outpatient treatments, and preventative services

- Some of the services that Medicare Part B covers include doctors visits, clinical research, ambulance services, and more

- Costs associated with Medicare Part B include a premium ranging between $170.10 and $578.30 per month, a deductible of $233, and coinsurance of 20% of the Medicare-Approved Amount of services

Medicare includes coverage from four different plans that cover various services. When you enroll in Medicare health insurance, you should understand what each part covers and how much they cost.

You May Like: How Much Is Premium For Medicare