Use Medicaregov To Find Plans

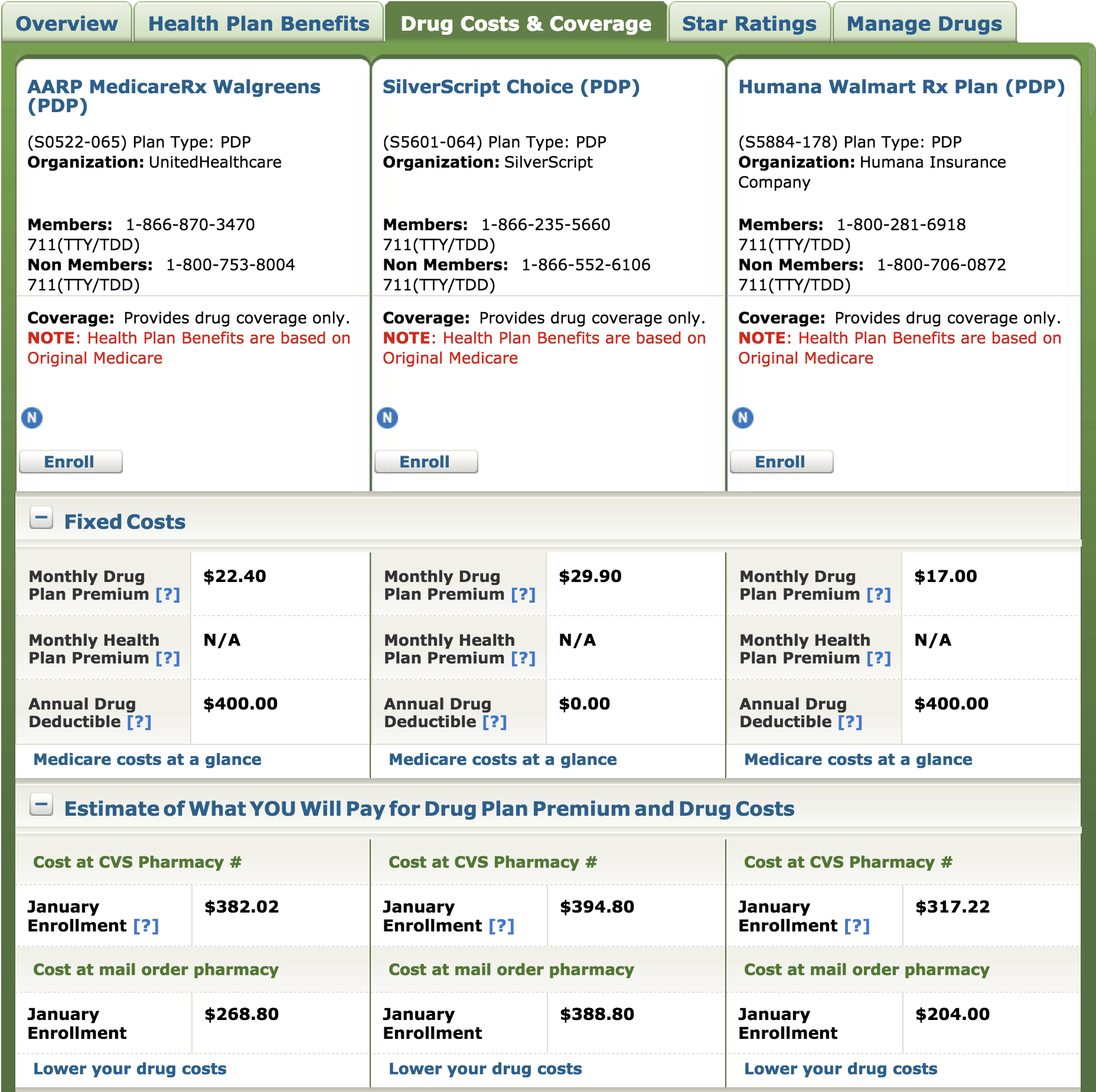

Because plans can change each year and because new plans become available each year, it makes sense to shop for the best Part D coverage for you during each annual Medicare open enrollment period .

The Medicare.gov comparison tool can help. The tool has features that make it clearer and easier to determine if your medicines are covered, what pharmacies are in network near you and what your total out-of-pocket costs will be including copays and deductibles.

These pro tips can help you navigate the comparison tool:

Whether youre searching stand-alone Part D plans or Medicare Advantage plans , the tool allows you to enter each of your medicines. If you have a My Medicare account, the drugs you have already entered will be entered again automatically.

When the list of available plans pops up, it will automatically sort your options in order of lowest to highest total drug costs including premiums. You can search the plans to see if your drugs are covered and at what price.

Note: Just because you enter the drugs you are taking doesnt mean that the plans that appear in the search necessarily cover all of them. You need to dig deeper into the search results to confirm that your medicines are covered in each of the plans in your search.

Note: Read the summary results carefully and note if all costs are included, or if some are coming soon.

Determine If You Qualify For A Special Needs Plan

A Special Needs Plan is a type of Medicare Advantage plan designed for people in specific situations such as those who live in a nursing home, have a medical condition like cancer or have a low income. If you qualify for an SNP, this plan will usually give you the best coverage for your situation.

The three types of Special Needs Plans are:

- Dual Eligible SNP : For those enrolled in both Medicare and Medicaid.

- Institutional SNP : For those living in an institution like a nursing home or those requiring nursing care at home.

- Chronic Condition SNP : For those with chronic conditions such as cancer, diabetes, heart disease, dementia, autoimmune disorders, severe blood disorders, HIV/AIDS, neurological disorders, end-stage liver disease, end-stage renal disease , severe blood disorders, chronic lung disorders, chronic and disabling mental health conditions, stroke or chronic alcohol and other dependence.

An SNP will cover all of the same Medicare services as other plans, but there could be expanded coverage based on the type of plan.

For example, all Medicare Advantage plans cover some level of skilled nursing facility care, but an Institutional SNP will provide better coverage for these services. Similarly, all Medicare Advantage plans will cover treatments for heart disease. But those who meet the criteria for a Chronic Condition SNP could have access to more providers who specialize in the condition and have better coverage for relevant medications.

Compare Medicare Part D Plans 2020

Most insurers release new plans and change-of-coverage notices in the fall for the upcoming plan year. The 2020 plans are generally listed in Part D plan finder tools by October, so you should already have access to the most current information for this year when youre ready to shop.

Its helpful to connect with a professional to narrow down your Part D plan options to find the one that works best for your needs. That way youll know youre getting a complete picture of the Medicare plans in your area before you buy.

Also Check: Is Dexcom G6 Cgm Covered By Medicare

How Does Medicare Prescription Drug Coverage Work

Medicare prescription drug coverage is an optional benefit. Medicare drug coverage is offered to everyone with Medicare. Even if you dont use prescription drugs now, you should consider joining a Medicare drug plan. If you decide not to join a Medicare drug plan when youre first eligible, and you dont have other creditable prescription drug coverage or get Extra Help, youll likely pay a late enrollment penalty if you join a plan later. Generally, youll pay this penalty for as long as you have Medicare prescription drug coverage. To get Medicare prescription drug coverage, you must join a plan approved by Medicare that offers Medicare drug coverage. Each plan can vary in cost and specific drugs covered.

There are two ways to get Medicare prescription drug coverage:

- Medicare Prescription Drug Plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service plans, and Medicare Medical Savings Account plans. You must have Part A and/or Part B to join a Medicare Prescription Drug Plan.

- Medicare Advantage Plans or other Medicare health plans that offer Medicare prescription drug coverage. You get all of your Part A, Part B, and prescription drug coverage , through these plans. Medicare Advantage Plans with prescription drug coverage are sometimes called MA-PDs. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

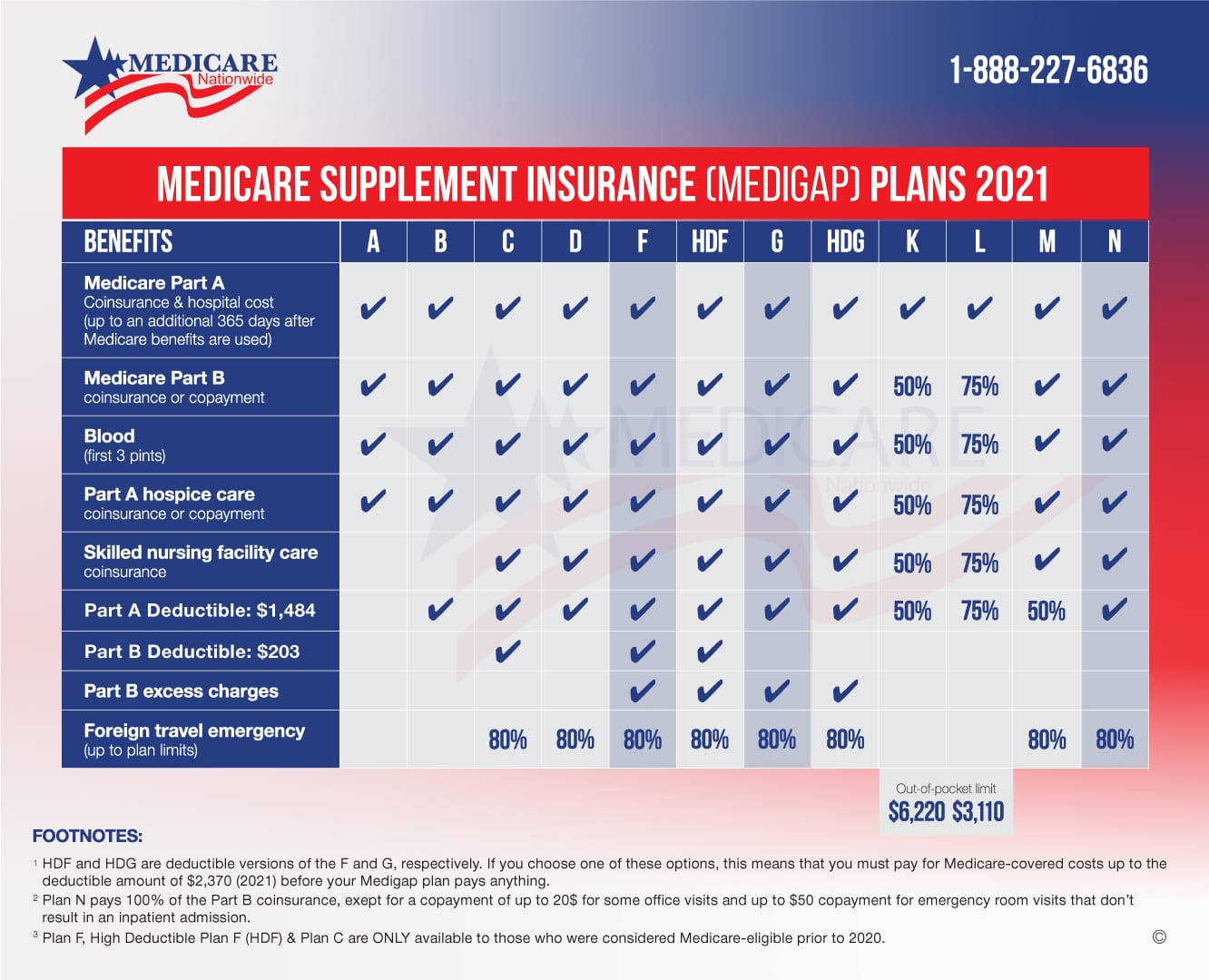

What Are High Deductible Plans F And G

Plan F and Plan G both offer high deductible options, which carry a deductible of $2,490 in 2022.

You must meet this $2,490 plan deductible before your plan coverage kicks in for the rest of the plan year. One tradeoff for the high deductible is a lower monthly premium.

The average premium for a standard Plan F in 2018 was $169.14 per month, while the average premium for high-deductible Plan F was just $57.16 per month.1

Don’t Miss: Do Any Medicare Plans Cover Dental

Standalone Part D Plans Vs Medicare Advantage Plan

You can choose either a standalone Medicare Part D plan, which works alongside your existing Original Medicare coverage, or you can enroll in a Medicare Part C plan that includes Medicare Parts A, B, and D benefits.

Many people prefer bundling their coverage, as they only have one monthly premium to pay. Research the costs involved to decide whether a standalone or Medicare Advantage plan with prescription drug coverage suits you best.

Do I Need A Medicare Drug Plan

Before you look at a Medicare prescription medication plan, take stock of any healthcare insurance you already have or are eligible for because it could affect your decision to get Medicare drug coverage.

Some types of insurance offer very similar prescription medication coverage to Medicare and may be worth keeping instead of enrolling in a Medicare drug plan right away. Examples include:

-

Federal Employee Health Benefits programs

-

Veterans Benefits

-

TRICARE

-

Indian Health Services

These types of insurance plans are considered creditable. You can keep them and avoid paying a penalty if you decide to sign up for a Medicare drug plan in the future. Medicare may charge you a penalty on your monthly premium if you dont enroll when youre first eligible.

Some employer- and union-provided health plans may also be considered creditable. Check with the contact person for your plan.

Also Check: What Income Is Used For Medicare Part B Premiums

How Do I Get Coverage

There are two ways to get prescription drug coverage through Medicare:

-

You can add prescription drug coverage to original Medicare or to special plans such as Medicare Cost Plans, Medicare Private Fee-for-Service Plans, and Medicare Medical Savings Account Plans. If you go this route, you are covered under Part D, also known as a prescription drug plan or PDP.

-

You can get it through a Medicare Advantage Plan or another Medicare plan that offers prescription drug coverage . If you already have a Medicare Advantage Plan but dont have prescription drug coverage, you can switch to a plan that does during open enrollment.

Decide If You Want A Part D Or Medicare Advantage Plan

Medicare Advantage plans provide all of the same benefits as Medicare Part A and Part B, and most Medicare Advantage plans also cover prescription drugs.

Some Medicare Advantage plans may also cover things like routine dental, vision or hearing care, as well as things like transportation to doctors appointments and home meal delivery.

If you want coverage for things like hearing and vision care, you might consider a Medicare Advantage plan. That way you can bundle more of your health care services including your prescription drug coverage under one plan.

You May Like: Do You Have To Apply For Medicare

Look At The Extra Included Benefits

A Medicare Advantage plan bundles coverage across the standard categories of hospital care, medical care and prescription drugs. However, many Medicare Advantage plans also include extras. Options can include:

- Add-on insurance such as dental or vision insurance.

- Add-on benefits such as hearing aid coverage, telemedicine or routine chiropractic adjustments.

- Perks such as gym memberships, discount programs, medical alert systems or SilverSneakers subscriptions.

The value of these add-ons can add up. For example, rather than spending an extra $25 per month on dental insurance, those benefits could be included in your Medicare Advantage plan. That could save you $300 per year because you wouldn’t have to enroll in a separate plan.

These add-ons provide tangible value to the bundle of coverage that you get through Medicare Advantage. However, we recommend that you first narrow down your plan options based on health benefits before weighing the add-ons.

Many insurance marketing materials will push these add-ons. However, the financial benefit from the add-ons is usually much less than the value of having good benefits for medical care and prescription drugs. In other words, make sure the plans you’re considering have good coverage for medical situations like a heart attack or a stroke. Then let perks like an included gym membership tip the scales with their extra value.

Stay Up To Date With Your Current Plan

Each year by early October, your plan will send you an Annual Notice of Change. This is also available on your insurers website. Greeno recommends everyone read this document carefully and check for the following critical information:

Just because your Part D plan covers your medicines now doesnt mean it will next year. Formularies change often. Check the Annual Notice of Change to determine if your insurer is dropping, substituting or restricting any of your prescription drugs.

Check to see if your plan is making any changes in the cost of the drugs it covers. Copays, coinsurance and deductibles can all change. Most plans have tiered copays, charging more for brand-name drugs than generics, for example. Check if any of the medicines you are taking have changed tiers and how that will affect your out-of-pocket costs.

If you have any questions about the Annual Notice of Change, contact your insurer directly.

Recommended Reading: Does Aarp Offer Medicare Supplement Insurance

Is There Coverage For Prescription Drugs Under Medicare

You can enroll in a plan that offers only drug coverage or you can enroll in a Medicare Advantage plan which includes drug coverage, along with other health coverage.There are many plans to choose from. Generally you must stay in the plan you choose for a calendar year . Every year from October 15 to December 7 there is an annual election period when you can change plans, drop coverage or add coverage. The plans can change premiums, co-payments and formularies every year so reviewing plans during the election period is important. The best way to compare plans is to use the Medicare website or SHIIPSMP counselors can also help you compare plans. Click the link below to find a SHIIPSMP Counselor near you.

Do A Thorough Pharmacy Search

Determining which pharmacies in your area are preferred vs. in-network might be the most confusing part of signing up for a Part D plan, says Stephen Schondelmeyer, PharmD, a professor of pharmacoeconomics at the University of Minnesota in Minneapolis.

When we sorted by lowest drug + premium cost using the Medicare plan finder tool, which is the default setting, our spot check found that preferred pharmacies might offer some of the lowest prices on generic meds in particular.

Take, for example, two plans in Denver. For our list of medications, with the Humana Walmart Value Rx plan you would spend $463.56 on the plans premiums plus annual drug costs if you filled your prescriptions at Walmart, a preferred pharmacy. But those same drugs at that same pharmacy would cost $1,182 if you signed up for the Wellcare Value Script plan, which doesnt include Walmart as a preferred pharmacy.

On the other hand, if you did go to one of Wellcare Value Scripts preferred pharmacies, in this case a Safeway, youd pay $670.80. Thats still more expensive than the Humana Walmart plan using a Walmart pharmacy but a lot less than using a nonpreferred pharmacy.

Then look for the pharmacy and Part D plan that have the lowest total amount for both drug and premium cost.

Also Check: Does Aarp Medicare Supplement Insurance Cover Hearing Aids

How Does Iowa Medicare Enrollment Work

If you start receiving your Social Security or Railroad Retirement Board benefits at least four months before you turn 65, youll be enrolled in Medicare automatically. Otherwise, you must fill out an application online or contact your local Social Security office. You can enroll in Medicare during the following periods:

- Initial enrollment: Your Initial Enrollment Period starts three months before your 65th birthday and ends three months after your 65th birthday. If youve never had Medicare, you can enroll during this period. If you started receiving Medicare when you were younger, you can also make changes to your plan.

- General enrollment: Choose this enrollment period if you missed your IEP. The Medicare General Enrollment Period is January 1 to March 31. You can choose Original Medicare, Medicare Advantage, Medigap, or Part D.

- Medicare Advantage open enrollment: You can make changes to your Medicare Part C, also known as Medicare Advantage, from January 1 to March 31.

- Open enrollment: You can join, switch plans, or drop your coverage from October 15 to December 7 each year.

- Special Enrollment Periods : You may qualify for a SEP if you lose your coverage or have changes to your eligibility outside the regular enrollment periods.

What Are The Costs For Medicare Supplement Plans

Medicare Supplement Insurance plan premiums are sold by private insurance companies. This means that plan availability and plan premiums may vary.

The average premium cost for a Medicare Supplement Insurance plan in 2018 was $152 per month.1

The average cost of each type of Medigap plan can vary quite a bit from one plan type to another. Each type of Medigap plan offers a different combination of standardized benefits, which means that plans with fewer benefits may offer lower premiums.

Your age, gender, smoking status, health and the location where you live can all also affect the average cost of Medigap plans near you.

Read Also: How Much Does Medicare Pay Doctors For Visit

Medigap Plan K And Plan L Have Annual Out

Plan K and Plan L each have an annual out-of-pocket spending limit.

Once you reach this limit within a calendar year, the plan will pay 100 percent of the costs for your covered Medicare services for the remainder of the year.

The Plan K out-of-pocket maximum is $6,620 in 2022. The 2022 Plan L out-of-pocket spending limit is $3,310.

Medicare Prescription Drug Plans

Since Original Medicare Parts A and B don’t include prescription drug coverage, a Medicare Prescription Drug plan helps cover the costs of medication. If you only need prescription drug coverage to complete your Original Medicare plan, a UnitedHealthcare Part D plan may be your best option. UnitedHealthcare Part D plans help you save money and give you peace of mind. Each plan includes commonly used generic and brand name prescription drugs, and has slightly different coverage and drug lists.

Recommended Reading: How Do I Replace My Medicare Card Online

Did The Medicare Part D Donut Hole Close In 2020

Technically, the donut hole is closed, but you still pay for prescription drugs if you hit the coverage gap.

There are four stages of Medicare Part D coverage:

- Deductible: You pay 100% of your prescription drug costs until you reach your deductible

- Initial coverage: You pay your coinsurance or copayment amount for prescription drugs until you and your plan have spent $4,020 in 2020

- Coverage gap: Once you fall into the coverage gap, you pay 25% of the cost of the drug, the drug manufacturer pays 70%, and your plan pays 5%. You stay in the coverage gap until your true out-of-pocket costs reach $6,350

- Catastrophic coverage: At this stage, you pay $8.95 or 5% of the drug cost, whichever is higher, for brand-name drugs, and the greater of $3.60 or 5% of the cost for generic drugs.

Before the Affordable Care Act, Medicare beneficiaries paid 100% of the medication costs in the donut hole. Over the past several years, manufacturers have been required to pay an increasing percentage of costs to close the donut hole.

As of 2020, the donut hole for both generic and brand-name drugs has closed.

Stages Of Medicare Part D Coverage2020

| Stage of coverage |

| You Pay |

| Deductible |

| 100% of your drug costs until you spend $435 or your plans deductible, whichever is less |

| Initial Coverage |

| You pay your copayment only for covered medications until you and your plan spend $4,020 on prescription drugs |

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Does Medicare Pay For Orthotics