Costs And Funding Challenges

Over the long-term, Medicare faces significant financial challenges because of rising overall health care costs, increasing enrollment as the population ages, and a decreasing ratio of workers to enrollees. Total Medicare spending is projected to increase from $523 billion in 2010 to around $900 billion by 2020. From 2010 to 2030, Medicare enrollment is projected to increase dramatically, from 47 million to 79 million, and the ratio of workers to enrollees is expected to decrease from 3.7 to 2.4. However, the ratio of workers to retirees has declined steadily for decades, and social insurance systems have remained sustainable due to rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office wrote in 2008 that “future growth in spending per beneficiary for Medicare and Medicaidthe federal government’s major health care programswill be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costswhich will be difficult, in part because of the complexity of health policy choicesis ultimately the nation’s central long-term challenge in setting federal fiscal policy.”

What Are Medicare Part B Excess Charges

You are responsible for paying any remaining difference between the Medicare-approved amount and the amount that your provider charges. This difference in cost is called a Medicare Part B excess charge.

By law, a provider who does not accept Medicare assignment can only charge you up to 15 percent over the Medicare-approved amount.

As you can see from the example above, its important to ask your health care providers if they accept Medicare assignment and how much you can expect to pay before receiving any medical services.

Dont Miss: Does Cigna Have A Medicare Supplement Plan

Medicare Coverage: What Health

So, how much does health care cost when you have a Medicare Advantage plan? To answer that question, heres a quick rundown on how the Medicare Advantage program works.

When you have a Medicare Advantage plan, you still have Medicare but you get your Medicare Part A and Part B benefits through the plan, instead of directly from the government. Private, Medicare-approved insurance companies offer Medicare Advantage plans.

But what about those health-care costs? Since Medicare Advantage plans include Part A and Part B benefits, you know the plans cover them as long as you follow plan rules and Medicare rules. But your cost-sharing portions may vary among plans. There may be an annual deductible, and typically there are copayments or coinsurance amounts as well.

Of course, theres also the plan premium to pay each month. Some plans have premiums as low as $0 per month. You must still pay your Medicare Part B premium every month, along with the plan premium .

Most Medicare Advantage plans include prescription drug coverage, and many plans offer extra benefits. Routine vision and dental services and acupuncture are examples of some of the benefits a Medicare Advantage plan might offer.

Unlike Original Medicare, Medicare Advantage plans have annual out-of-pocket spending limits. So, if your Medicare-approved health-care costs reach a certain amount within a calendar year, your Medicare Advantage plan may cover your approved health-care costs for the rest of the year.

Don’t Miss: How To Sign Up For Medicare Part D

What Original Medicare Doesn’t Cover

Original Medicare doesn’t cover everything. With a few exceptions, Original Medicare doesn’t include coverage for prescription drugs. It also does not cover health care benefits you may have been used to getting with an employer plan such as dental, vision, hearing health care or wellness items like fitness memberships.

Outpatient Care And Laboratory Testing

Medicare medical insurance covers outpatient hospital treatment, such as emergency room or clinic charges, X-rays, injections that are not self-administered, and laboratory work and diagnostic tests. Lab work and tests can be done at the hospital lab or at an independent laboratory facility, as long as that lab is approved by Medicare.

Beware: Medicare pays only a limited amount of outpatient hospital and clinic bills. Unlike most other kinds of services, Medicare places no limits on how much the hospital or clinic can charge for outpatient services over and above what Medicare pays.

Don’t Miss: Does Medicare Part D Cover Sildenafil

The Annual Medicare Wellness Visit

The Annual Medicare Wellness Visit is similar to the Welcome to Medicare Visit except that it does not include a vision exam or an EKG. It is also more stringent on the exam component.

The focus of this visit will be the health risk assessment . Your healthcare provider will gather information to see how well you function in your environment. This will include the evaluation of behavioral and psychosocial risk factors that place you at risk for harm as well as how well you perform activities of daily living. Home safety is key. For example, you may need to consider rubber mats in the bathtub and grab bars in the shower.

Again, you will be screened for depression. During these annual visits, you will also be screened for cognitive impairment and your preventive screening checklist will be updated.

The so-called exam is limited to vital signs and “other routine measurements deemed appropriate based on medical and family history.”

Many people are surprised to learn their healthcare provider is not obligated to listen to their heart or lungs, never mind perform a clinical breast exam or a digital rectal exam to check for cancer, during their Annual Medicare Wellness Visit.

What Telehealth Is Covered By Medicare

Telehealth is a remote clinical service. Doctors must use live, real-time audio, and video connections to interact with patients. Medicare only reimburses telemedicine that takes place via live videoconference. Current telemedicine has coverage through Part B.

Also, the location during the time of service must be in a patients home or an allowable facility. There are no location restrictions for doctors.

Don’t Miss: How Many Days Does Medicare Pay For Nursing Home

Other Costs For Medicare Part A

If you paid Medicare taxes during your working years, you may qualify for premium-free Medicare Part A. To be eligible, youll need to have worked for 40 quarters, or 10 years, and paid Medicare taxes during that time.

If you havent met that benchmark and have to pay monthly premiums, you can expect to pay $458 per month in 2020.

Copays With Medicare Advantage

When it comes to copays, Medicare Advantage is a whole other story. Medicare Advantage, or Part C, refers to a way of receiving your Medicare coverage through a private health insurance company. If you have a Medicare Advantage plan, many of the associated fees will be set by that insurance company, rather than Medicare. Although there are some regulations on these costs, there will be more variety.

This means that some Medicare Advantage plans will have copays, and others wont. The amount of the copay will vary, and some plans may use copays for one type of care while using a coinsurance for others it depends. If you have a Medicare Advantage plan, make sure that you know in advance what the copay is, so you can be prepared when you go see your healthcare provider.

You May Like: Does Medicare Advantage Plan Replace Part B

What Does Medicare Cover For Dementia Patients

Home / FAQs / Medicare Coverage / What Does Medicare Cover for Dementia Patients

Dementia patients with Medicare can expect coverage for medical services such as inpatient care and doctors visits. But, Medicare never covers respite care. If you need in-home caregiver services you can expect to pay for those yourself. Now, there are somethings Medicare will help with such as screenings, psychological services, and care planning. Also, those with Part D will have medication coverage.

Vaccines Covered By Medicare Part B

Medicare Part B covers three important vaccines as part of its preventive care benefits.

Covered vaccines include the following:

- Flu vaccine: Annual vaccine given in one shot before or during flu season, usually November through April

- Pneumonia vaccine: One-time vaccine given in two shots at least one year apart

- Hepatitis B vaccine: One-time vaccine given in two to four shots over one to six months for people who are medium to high risk, including people with diabetes

Part B also covers vaccines you may need if youre exposed to a harmful virus or bacteria by accident. You might need a tetanus shot, for example, if you step on a rusty nail. Or you may need rabies shots if youre bitten by a stray dog.

You May Like: How Do I Qualify For Medicare Low Income Subsidy

Read Also: What Is Gap Coverage For Medicare

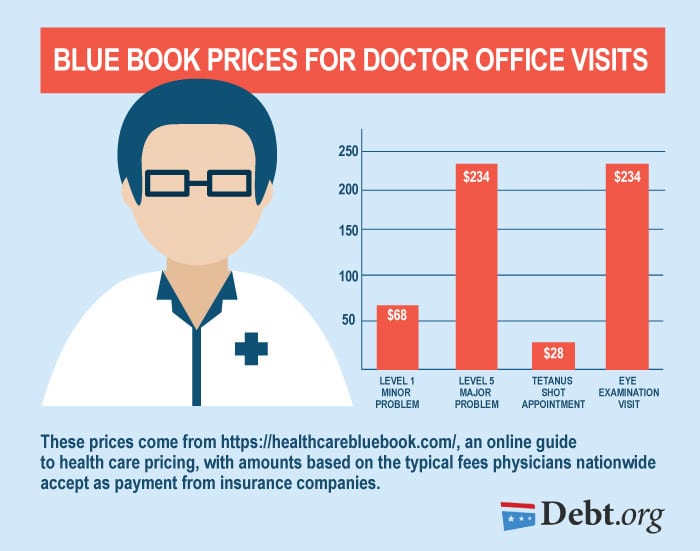

What Affects The Cost Of A Doctor’s Visit

Several factors may affect how much you pay when seeking care at a doctor’s office. Some of these factors include:

- Where you seek care

- If you are going to a specialist

- If you have insurance

- What services you receive at the doctor’s office

- If you will need any prescription medications

- If you get lab tests done and whether those tests are done in-house

- The severity of the condition being treated

Medicare Doesn’t Cover Deductibles And Co

Medicare Part A covers hospital stays, and Part B covers doctors services and outpatient care. But youre responsible for deductibles and co-payments. In 2022, youll have to pay a Part A deductible of $1,556 before coverage kicks in, and youll also have to pay a portion of the cost of long hospital stays — $389 per day for days 61-90 in the hospital and $778 per day after that. Be aware: Over your lifetime, Medicare will only help pay for a total of 60 days beyond the 90-day limit, called lifetime reserve days, and thereafter youll pay the full hospital cost.

Part B typically covers 80% of doctors services, lab tests and x-rays, but youll have to pay 20% of the costs after a $233 deductible in 2022. A medigap policy or Medicare Advantage plan can fill in the gaps if you dont have the supplemental coverage from a retiree health insurance policy. Medigap policies are sold by private insurers and come in 10 standardized versions that pick up where Medicare leaves off. If you buy a medigap policy within six months of signing up for Medicare Part B, then insurers cant reject you or charge more because of preexisting conditions. See Choosing a Medigap Policy at Medicare.gov for more information. Medicare Advantage plans provide both medical and drug coverage through a private insurer, and they may also provide additional coverage, such as vision and dental care. You can switch Medicare Advantage plans every year during open enrollment season.

Recommended Reading: Does Medicare Cover Any Dental Surgery

Expected Costs Of Urgent Care Visits

If you have Original Medicare Part A and B, collectively then 80 percent of the cost for treatment and services received at an urgent care clinic will be covered.

With Part B, you will have to meet a deductible before coverage begins. After the deductible has been met, you pay 20 percent of the Medicare-approved cost.

You will also have to pay a copayment if you receive care in a hospital outpatient setting.

Urgent care visits are also covered through a Medicare Advantage plan since they include everything covered in Original Medicare.

Medicare Advantage plans also include additional benefits and coverage and what is offered in Part A and Part B.

Check with your plan provider to learn about any expanded coverage available related to urgent care trips.

As a result of your urgent care clinic, a doctor or healthcare provider may recommend a prescription drug to help you recover from your injury or illness.

Prescription drug coverage is not available through Original Medicare but is covered by Medicare Part D as an optional benefit through private insurers.

Doctors Who Opt Out Of Medicare

Doctors who opt out of Medicare must stay out of the program for at least two years. They offer what is known as direct billing, and very often they don’t accept any kind of insurance. In this situation, the doctor should ask you to read and sign a document that is really a contract. In signing it, you’re legally agreeing to be responsible for the whole bill, with no reimbursement from Medicare. And because Medicare doesn’t cover treatment from an opted-out doctor, your Medigap insurance won’t cover it either.

Keep in mind, though, that such a contract is with one individual doctor or doctor’s practice. If you go see other doctors who do accept Medicare, their services will be covered in the usual way and a Medigap policy, if you have one, will cover your out-of-pocket costs.

Also Check: Can You Sign Up For Medicare Part A Only

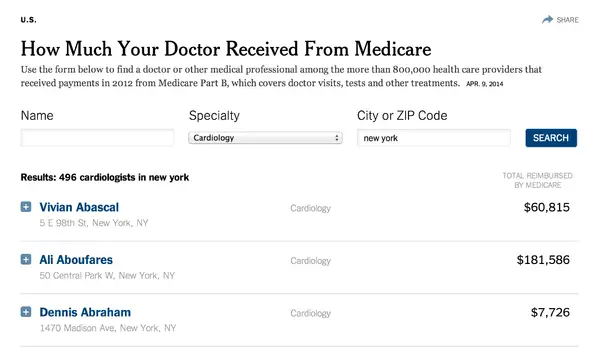

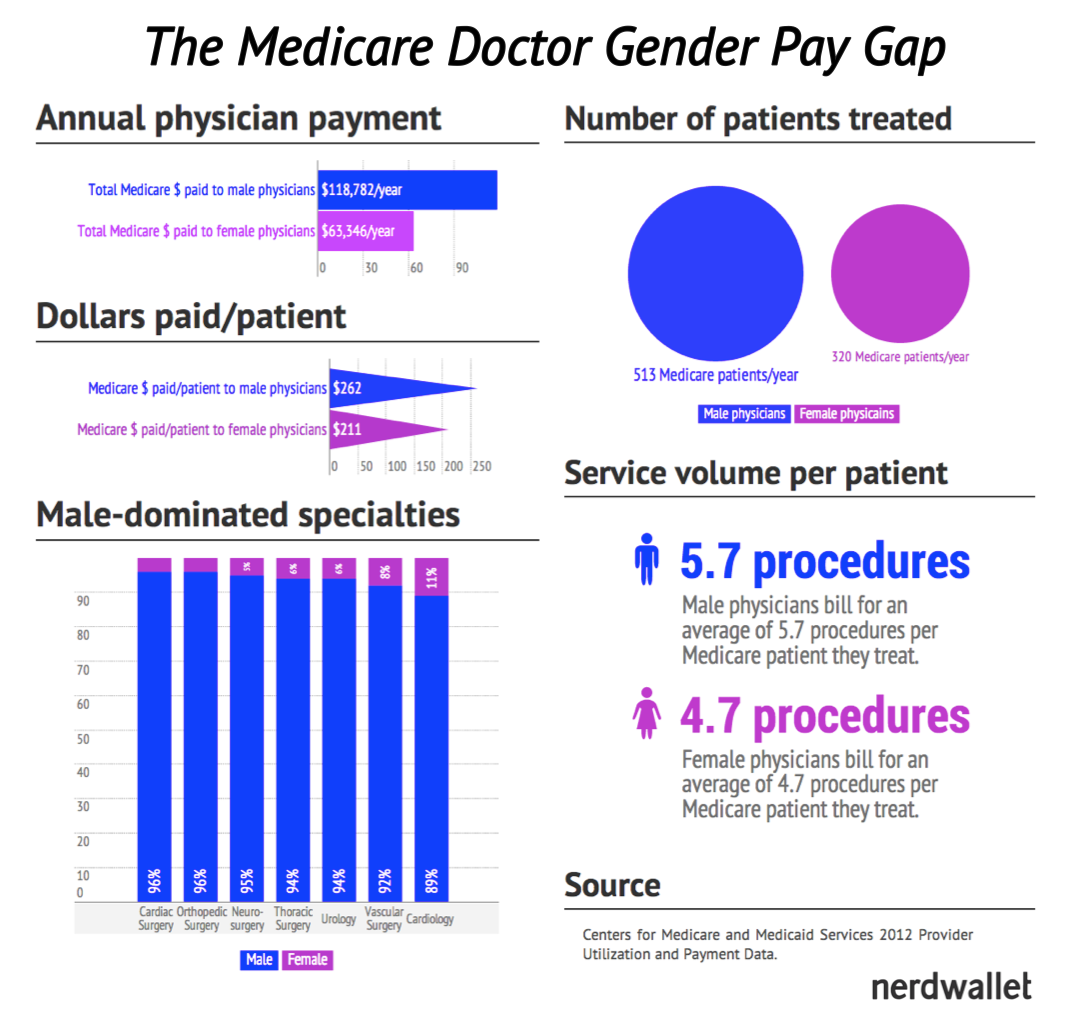

Changing Meaning Of The Physicians Usual Fees

In spite of these findings, the Bureau of Labor Statistics, the American Medical Association and practically all other physician survey groups continue to use the physicians reported usual fee as the measure of price inflation. These list charges, however, obviously do not correspond well with actual payments, causing reflection on exactly what is meant by the term usual fee.

Practically all economic enterprises have established price lists in effect for specified time periods. These appear as stickers on new car windows and on grocery shelves, for example. However, because of discounts, rebates, bad debts, and in-kind exchanges, the price paid by the consumer is a varying fraction of the listed price. Discounts, rebates, and exchanges are all part of a marketing strategy to be used judiciously to maximize sales performance. Where most transactions are affected by these phenomena, the concept of a usual charge loses much of its meaning, as exemplified by the rebate program of the U.S. domestic auto industry.

Although some Medicaid programs maintain Medicare CPR methods, most have switched to either a modified CPR system or a flat fee schedule . In addition, many are slow in updating allowables and/or do not recognize specialty differentials, resulting in further discounting.

Some Doctor Visits May Be Free Of Charge

If you have Medicare Part B, or if youre enrolled in a Medicare Advantage plan, you may get a number of doctor visits and screenings free of charge.

- Welcome to Medicare preventive care visit. During the first 12 months after you enroll in Medicare Part B, Medicare provides full coverage for this preventive care doctor visit. The Welcome to Medicare doctor visit may include:

- A review of your medical history

- A simple vision test

- Measurement of your vital signs

- A written plan outlining what additional screenings, shots and other preventive services you need.

Medicare Part B may cover other doctor visits and preventive screenings. For example, youll get a doctor visit every year to evaluate and help reduce your risk of cardiovascular disease. There is no charge for this visit.

Be aware that if your doctor orders other tests or medical services during your doctor visit, you might need to pay a deductible amount or coinsurance. Medicare might not cover certain tests or services at all. You might want to find out ahead of time whether the services are covered.

Recommended Reading: How Can A Provider Check Medicare Eligibility

Does Medicare Pay For Home Health Care For Dementia Patients

Medicare covers some types of home health services, such as intermittent skilled nursing care as well as physical, occupational, and speech therapy. But, Medicare only covers services that a doctor orders at a certified home health agency.

Medicare wont cover:

- Help with shopping, laundry, or errands

- Round-the-clock care

What Do I Do If My Doctor Does Not Accept Medicare

You can choose to stay and cover the costs out-of-pocket, but this is not an affordable option for most Americans. Instead, you can ask your doctor for a referral to another healthcare provider that does accept Medicare, do your own research, or visit an urgent care facility. Most urgent care offices accept Medicare.

Don’t Miss: How Old Do I Have To Be For Medicare

Quality Of Beneficiary Services

A 2001 study by the Government Accountability Office evaluated the quality of responses given by Medicare contractor customer service representatives to provider questions. The evaluators assembled a list of questions, which they asked during a random sampling of calls to Medicare contractors. The rate of complete, accurate information provided by Medicare customer service representatives was 15%. Since then, steps have been taken to improve the quality of customer service given by Medicare contractors, specifically the 1-800-MEDICARE contractor. As a result, 1-800-MEDICARE customer service representatives have seen an increase in training, quality assurance monitoring has significantly increased, and a customer satisfaction survey is offered to random callers.

The Cost Of A Doctor’s Visit With Insurance

The American Medical Association has published a list of codes used to report medical, surgical, and diagnostic procedures and services. These are the different charges a physician may list when they see a patient and submit for billing. The prices in the table below are the prices that insurance companies process to determine what you are responsible for paying.

Cost of a Doctor’s Visit for Different Specialists By Insurance Type

| Specialty Type |

|---|

**Pediatrics estimate not shown for Medicare due to small sample size.

You May Like: Can I Buy Private Health Insurance Instead Of Medicare

Will A Hospital Treat Me If I Do Not Have Insurance

Under the Emergency Medical Treatment and Active Labor Act, hospitals must provide care to all individuals in an emergency, regardless of insurance status or ability to pay. While you will be treated if experiencing an emergency, you will likely still be responsible for paying your bill after you have recovered.

Doctors’ offices, however, are not covered by this act. Therefore, if you cannot pay and are not experiencing an emergency, you may be denied care at a private doctor’s office.