What Is The Difference Between Assisted Living & Nursing Homes

The main difference between assisted living and a nursing home is the level of care required by its residents. Assisted living facilities usually resemble high-end apartments. Its residents do not typically require constant care and monitoring. On the other hand, a nursing home has more of a hospital feel. Its residents usually require constant care and help with medications or daily activities. Residents of assisted living are much more independent, which nursing home residents are typically unable to care for themselves.

Medicare Part A Deductible

Most Part A costs come from the inpatientInpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facilitySkilled nursing facilities provide in-patient extended care with trained medical professionals to recover from injury or illness and activities of daily living. These facilities provide physical and occupational therapists, speech pathologists and medical professionals assist with medications, tube feedings and wound care. Skilled nursing stays are usually covered under Medicare Part A. will require you to pay the annual deductible.

For the year 2022, the Plan A deductible increased from 2022:

- Medicare Part A deductible 2021: $1,484

- Medicare Part A deductible 2022: $1,556

How Much Is Medicare Part A In 2021

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Recommended Reading: Does Medicare B Cover Prescriptions

Medicare Part B Deductible In 2022

For 2022, your Medicare Part B deductible is $233. Thats a $30 increase over 2021.

Unlike Medicare Part A, there is no benefit period tied to Medicare Part B.

After meeting the deductible, youll usually have to pay 20% of the Medicare-approved costs for most doctor services, outpatient care and durable medical equipment things such as wheelchairs or walkers your doctor may order for you.

What Is The Difference Between Medicare Part A And Medicare Part B

Medicare Part A and Medicare Part B are the two parts of Medicare that make up Original Medicare coverage. For most, Original Medicare is your primary healthcare coverage once you reach age 65 or receive disability income.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Medicare Part A handles inpatient services and benefits, whereas Medicare Part B covers outpatient, doctor, and medical supply benefits.

The two coverages work hand in hand but are not the same in terms of cost and benefits. Often, you will not need to pay a premium for Medicare Part A. However, you will need to pay a monthly premium for Medicare Part B. In terms of out-of-pocket costs, both parts of Medicare require you to pay deductibles, coinsurance, and copayments. However, those costs look very different between the two parts.

Also Check: Can I Sign Up For Medicare Part B Online

B Deductibles In Previous Years

The Part B deductible has generally increased over time, although there have been some years when it stayed the same or even decreased. The increase for 2022 is the largest year-over-year dollar increase in the programs history. Heres an historical summary of Part deductibles over the last several years :

- 2005: $110

Medicare Advantage Part C

What it helps cover:

- Medicare Advantage plans are required by law to provideat minimumthe same coverage, benefits and rights provided by Original Medicare Part A and Part B, with the exception of hospice care.

- Many Medicare Advantage plans also choose to offer prescription drug coverage, as well as coverage for routine dental, vision and hearing benefits.

What it costs:

- Medicare Advantage plans are offered by private insurance companies contracted by the federal government, so they vary in cost, coverage, deductibles and copays.

- Many Medicare Advantage plans offer affordable or $0 premiums plus a variety of coverages and benefits not offered by Original Medicare .

You May Like: How Much Does Medicare Part A And B Cover

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Do I Make My Medicare Payments

If youre on federal retirement benefits, your Medicare Part B premiums get deducted from your Social Security checks. You can elect to get your Medicare Part D premiums deducted from your benefit checks, too. Contact your insurer.

If youre not on federal retirement benefits, youll get a Medicare Premium Bill for any parts of Medicare that youre paying for each month. You can pay this bill via your banks online service or by mailing back a credit card, debit card, check or money order payment.

However, Medicare Easy Pay is probably the simplest way to pay your Medicare Premium Bill. It automatically deducts your payment from a linked bank account around the 20th of each month. Deductibles and copays are generally paid directly to health care providers at the time of service.

Recommended Reading: How Much Copay For Medicare

What Is Original Medicare Part A And B

Friday, January 31, 2014 8:10 AM

Part A and Part B are often referred to as Original Medicare. Original Medicare is one of your health coverage choices as part of the Medicare program managed by the federal government. Unless you choose a Medicare health plan, you will be enrolled in Original Medicare. You can go to any doctor, supplier, hospital, or other facility that is enrolled in Medicare and accepting new Medicare patients. It is fee-for-service coverage, meaning that, generally, there is a cost for each service.

You generally pay a set amount for your health care before Medicare pays its share. Then, Medicare pays its share, and you pay your share for covered services and supplies. You usually pay a monthly premium for Part B.

Recommended Reading: How Can I Get My Medicare Card Number

Detailed Medicare Cost Information For 2022

- Monthly premium:Learn more about Part A costs.

Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

- Late enrollment penalty:

- If you don’t buy it when you’re first eligible, your monthly premium may go up 10%.

Part A costs if you have Original Medicare

Read Also: Does Medicare Offer Dental And Vision

What Do Medicare Part A And Part B Premiums Cover

Medicare has different parts and plans, but the most common is Original Medicare . Parts A and B are available to all Americans 65 years of age and older and individuals under 65 with certain disabilitiesA disability is a restriction or lack of ability to perform an activity in the manner or within the range considered normal for a human being. The Social Security Administration judges disability and whether you qualify for financial assistance based on whether you can work..

Keep in mind, Parts A and B provide different coverage:

Medicare Part A Deductible In 2022

Medicare Part A covers certain hospitalization costs, including inpatient care in a hospital, skilled nursing facility care, hospice and home health care. It does not cover long-term custodial care.

For 2022, the Medicare Part A deductible is $1,556 for each benefit period. If you re-enter the hospital or skilled nursing facility any time after your benefit period ends, you will have to pay the first $1,556 again as a new deductible.

Recommended Reading: Can We Apply For Medicare Online

Can You Change How You Pay For Medicare

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you dont qualify for Social Security benefits, youll get a bill from Medicare that youll need to pay via:

- Your online Medicare account

- Medicare Easy Pay, a tool that lets you automatically transfer monthly payments

- Online bill pay through your bank account

- Check, money order, or credit card payment

If you are having trouble paying your bill, you can contact someone at Medicare for help.

Medicare Advantage and Part D premiums arent automatically deducted from your Social Security benefits, so youll typically receive a bill and pay the insurer directly. If youd prefer to have your premiums for these plans deducted from your benefits check, you can contact your insurer to request this change.

Deductibles For Drug Coverage And Medicare Advantage In 2022

Deductibles for Medicare Part C, also known as Medicare Advantage plans, and Medicare Part D prescription drug coverage varies based on the plan you purchase. Both Medicare Advantage and Part D plans are sold by private insurers that have contracts with the Medicare program.

Medicare Advantage plans may offer coverage that absorb some of your out-of-pocket costs. Though Medicare Advantage deductibles may vary, all plans must set a limit on your maximum out-of-pocket expenses. This is a total spread across your deductibles, coinsurance and copayments.

For 2022, the MOOP for Medicare Advantage plans is $7,550 for in-network care. It can be higher for out-of-network care or services. But once you hit your MOOP for the year, the plan has to cover 100% of all further costs.

Some Medicare Part D prescription drug plans dont have a deductible. Those that do may not have a deductible of more than $480 in 2022.

Don’t Leave Your Health to Chance

Don’t Miss: Where Do I Get Medicare Part B

Some Extra Help With Costs

To protect people from the costs, the government worked with private insurers to come up with a set of plans that are designed to help with some of the costs associated with Original Medicare. By paying a monthly premium for a Medicare Supplement plan, you can get financial help with:

- Paying for your Part A deductible and the share of inpatient care costs not covered by Part A

- Paying for your doctor bills for Part B services

- Paying the costs of hospice care not handled by Original Medicare

These benefits mean that if you have a Medicare Supplement plan, you can:

- Pay a predictable up-front premium for your coverage

- Reduce the amount that you have to pay if you have a long inpatient hospital stay or repeat visits to a specialist.

Recommended Reading: When Does Medicare Coverage Start

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

Recommended Reading: What Is The Age Of Medicare

How Much Is Medicare Part B

You pay a premium each month for Part B. If you get Social Security, Railroad Retirement Board, or Office of Personnel Management benefits, your Part B premium will be automatically deducted from your benefit payment. If you dont get these benefit payments, youll get a bill.

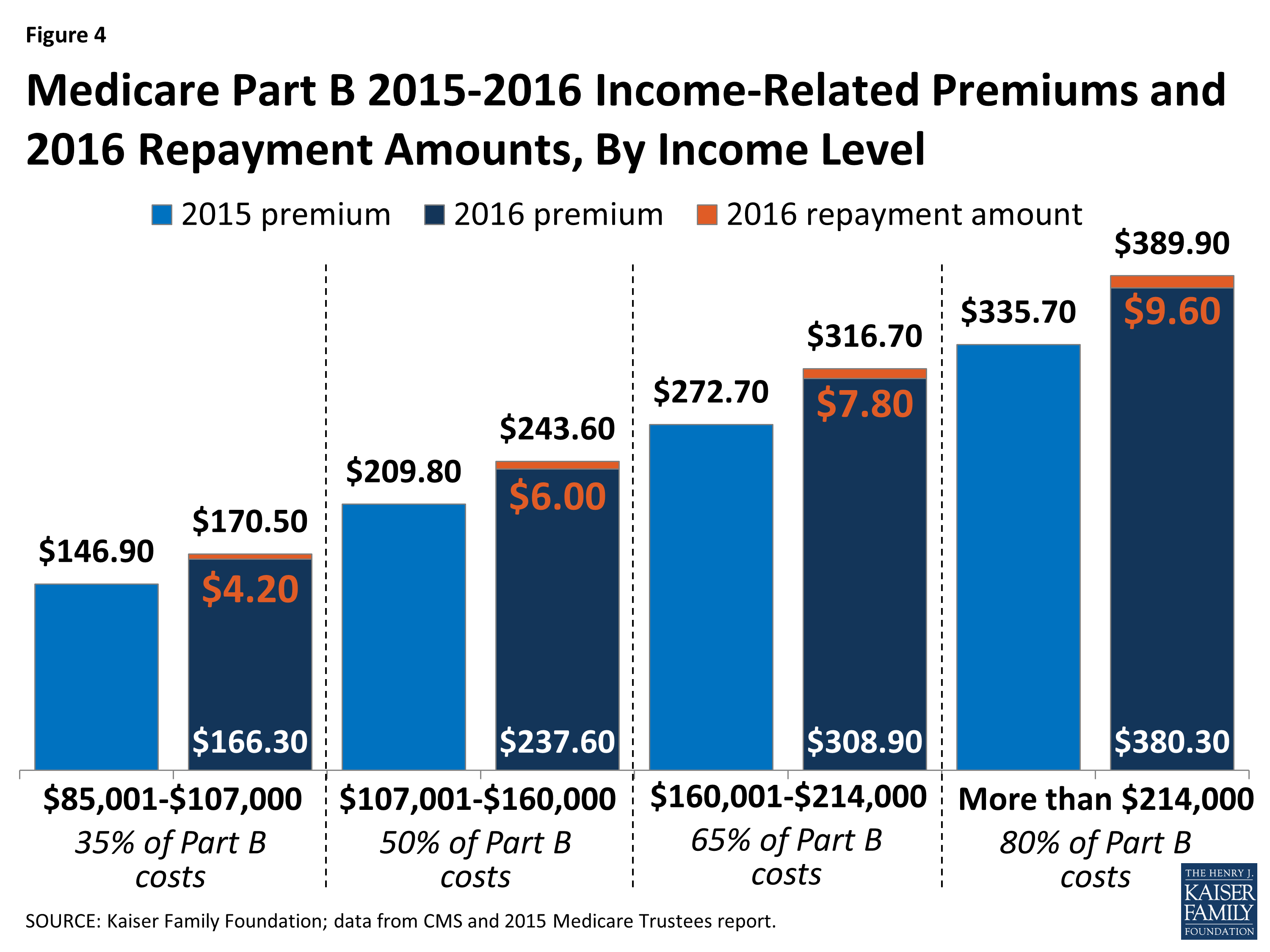

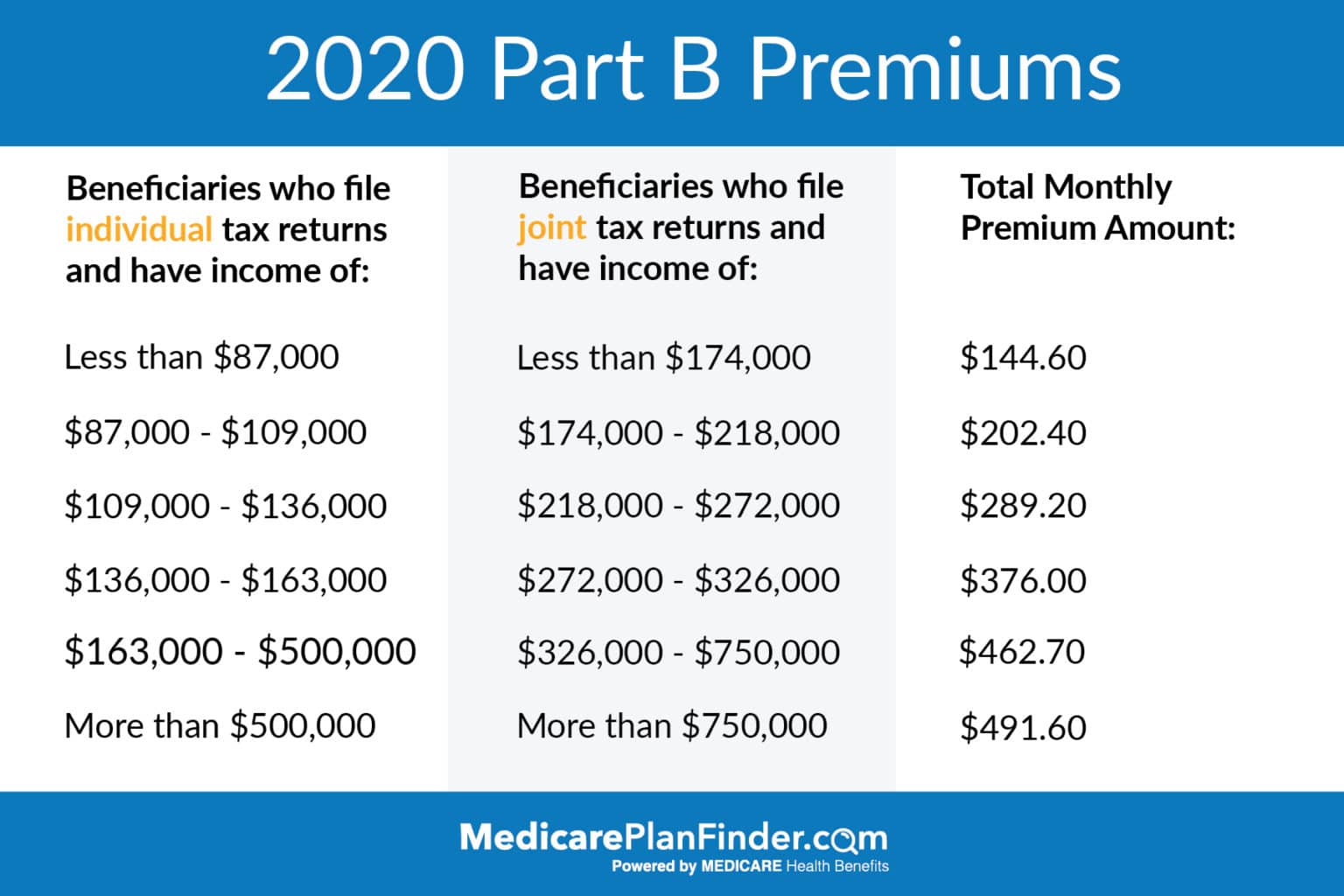

Most people will pay the standard premium amount. However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you may pay an Income Related Monthly Adjustment Amount . IRMAA is an extra charge added to your premium.

The standard Part B premium amount in 2022 is $170.10 . Social Security will tell you the exact amount youll pay for Part B in 2022. Youll pay the standard premium amount if:

- You enroll in Part B for the first time in 2022.

- You dont get Social Security benefits.

- Youre directly billed for your Part B premiums .

- You have Medicare and Medicaid, and Medicaid pays your premiums.

- Your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount. If so, youll pay the standard premium amount and an Income Related Monthly Adjustment Amount . IRMAA is an extra charge added to your premium.

If youre in 1 of these 5 groups, heres what youll pay:

| If your yearly income in 2020 was | In 2022 |

|---|

B Deductible Also Increased For 2021

Medicare B also has a deductible, which increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Also Check: What Information Do I Need To Sign Up For Medicare

Find A Medicare Advantage Plan That Fits Your Income Level

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B ? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Some of these additional benefits such as prescription drug coverage or dental benefits can help you save some costs on your health care, no matter what your income level may be.

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

How Much Does Medicare Part C Cost In 2022

The premium for Medicare Part C â also called Medicare Advantage â depends on your plan and the insurer, since these health plans are provided by private insurance companies.

Deductibles, copays and coinsurance for Medicare Part C vary by plan. However, there is a limit to how much you can spend on out-of-pocket expenses. After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage canât exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

The average out-of-pocket limit for Medicare Advantage enrollees was $5,059 in 2019, according to the Kaiser Family Foundation.

Learn more about Medicare Part C.

Read Also: Are Hearing Aids Covered By Medicare Australia

What Are Cataracts And How Do They Affect Vision

According to the National Eye Institute, a cataract occurs when the lens of your eye becomes cloudy. The lens is the clear part at the front of the eye that helps you to focus on an image. When functioning normally, light enters your eye through the lens and passes to the retina, which then sends signals to your brain that help you process what you see as a clear image. When the lens is clouded by a cataract, light doesnt pass through your eye to your retina as well, and your brain cant process images clearly, resulting in blurry vision.

Cataracts can occur in one or both eyes, but they cannot spread from one eye to the other. Your chances of developing cataracts increase significantly with age.

Some people develop cataracts at a much younger age, such as in their 40s or 50s. However, these cataracts tend to be smaller in size and do not usually affect vision. In general, people dont experience vision problems from cataracts until they reach their 60s.

Medicare Part B And Coinsurance/copayments

You usually pay a 20% coinsurance amount for covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

Read Also: What Is The Medicare Discount Card

Medicare Part A Premiums

Medicare calculates Part A premium costs by how long you or your spouse have paid Medicare taxes.

Here is an explanation of monthly premiums for Plan A in 2022:

If you or your spouse paid Medicare taxes for 10 years or more

$274/mo.

If you or your spouse paid Medicare taxes for more than 7.5 years but less than 10

If you paid Medicare taxes for fewer than 7.5 years