Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Other Times You May Qualify For Guaranteed Issue

There are some special reasons why you might qualify for Guaranteed Issue of a Medigap policy, even after your Open Enrollment Period has expired. They have to do with changes in your life circumstances. You can get Medigap coverage on a Guaranteed Issue basis in these common scenarios:

- You have Medicare Advantage coverage and you move outside of the plans service area

- You dropped Medicare Supplement coverage for your first Medicare Advantage plan, and youve had it for less than 12 months

- You enrolled in Medicare Advantage when you were first eligible, and have been on it for less than 12 months

The last two are known as Trial Rights because they allow you to give Medicare Advantage a try. There are a few other, more obscure, reasons youd qualify for Guaranteed Issue, but these are the most common.

Because of the interplay of these rules, you might want to consider two strategies where it comes to Medigap:

- Enroll in Medicare Supplement when youre first eligible . You can switch to Medicare Advantage at a later date. When you switch, you begin a 12 month period during which you can change your mind and get back into a Medigap plan with Guaranteed Issue rights.

- Enroll in Medicare Advantage when you first start Medicare. If for some reason you dont like it, or you wish youd chosen Medicare Supplement, you can exercise your Trial Right, and switch to Medicare Supplement insurance during the first 12 months of your coverage.

Getting Help With Medicare Costs

You might be able to get help paying for your Medicare coverage if your income and resources are below a specified limit. You could qualify for Medicaid, a government program for low-income individuals.

If your income is too high to qualify for Medicaid, try a Medicare Savings Program , which generally has higher limits for income. As a bonus, if you qualify for an MSP, you automatically qualify for Extra Help, which subsidizes your Part D costs.

Contact your states Medicaid office for more information.

Recommended Reading: How Long Does It Take To Get Medicare B

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Am I Eligible For Medicare Part A

Generally, youre eligible for Medicare Part A if youre 65 years old and have been a legal resident of the U.S. for at least five years. In fact, the government will automatically enroll you in Medicare Part A at no cost when you reach 65 as long as youre already collecting Social Security or Railroad Retirement benefits.

If youre already receiving Social Security or Railroad Retirement benefits, all you need to do is check your mail for your Medicare card, which should automatically arrive in the mail about three months prior to your 65th birthday . The card will arrive with the option to opt-out of Part B , but opting out of Part B is only a good idea if youre still working and have employer-sponsored coverage that provides the same or better coverage, or if your spouse is still working and you have coverage under their plan.

If youre not already receiving Social Security or Railroad Retirement benefits, youll need to enroll in Medicare during a seven-month open enrollment window that includes the three months before the month you turn 65, the month you turn 65, and the three following months. If you enroll before the month you turn 65, your benefits will start the month you turn 65 . If you enroll in the three months after you turn 65, your coverage could have a delayed effective date.

In addition to turning 65, people can become eligible for Medicare due to a disability , or due to end-stage renal disease or amyotrophic lateral sclerosis .

Also Check: What Is The Cheapest Medicare Plan

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the plans denial for a service to be provided.

The Right to Information About All Treatment Options

You have the right to know about all your health care treatment options from your health care provider. Medicare forbids its health plans from making any rules that would stop a doctor from telling you everything you need to know about your health care. If you think your Medicare health plan may have kept a provider from telling you everything you need to know about your health care options, then you have the right to appeal.

How To Get A Medicare Part B Give Back Plan

To get a Part B premium reduction plan, you must be enrolled in Part A and Part B. You must also not be accepting government assistance that pays part of the Part B premium already. But, if you dont qualify for a give-back plan, there are plenty of plan options on the market.

Its important to compare Medicare Advantage & Medigap before enrolling in either option. Many beneficiaries are unaware of the many limitations that come with Advantage plans. A Part B reduction may not be worth the additional cost-sharing.

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Don’t Miss: Is Medicare Accepted In Puerto Rico

Alternative Medicare Assistance Programs

Programs outside of Medicare that can help pay premiums are generally for Medicare Part D plans. Depending on the state you live in, you may be able to get help with paying your Part D premiums through State Pharmaceutical Assistance Programs . These programs provide assistance to adults with disabilities and low-income seniors. States that offer Medicare premium assistance for Part D insurance make their own rules on who can qualify.

Some drug manufacturers also offer help with prescription drug costs, but this is for the cost of medicines instead of the actual premium for your Part D plan. If youre a senior citizen, have limited income, or a disability, you may qualify for discounted or free prescribed medicines through Patient Assistance Programs .

48191-HM-1121

C: Medicare Advantage Plans

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

Recommended Reading: Does Aetna Medicare Advantage Have Silver Sneakers

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

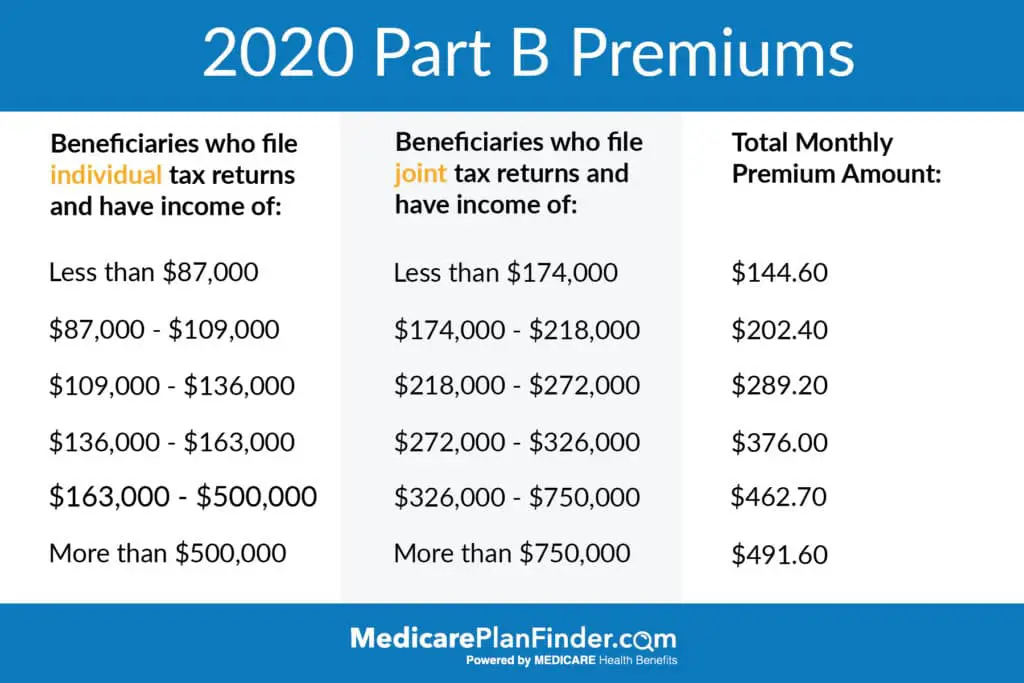

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Delaying Enrollment In Medicare When You’re Eligible For It Could Result In A Penalty That Will Remain In Effect For The Rest Of Your Life

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month.

While Medicare Part A which covers hospital care is free for most enrollees, Part B which covers doctor visits, diagnostics, and preventive care charges participants a premium. Those premiums are a burden for many seniors, but heres how you can pay less for them.

Read Also: When Can You Change Your Medicare Supplement Plan

Do I Qualify For Help With Medicare Premiums

Tips on How to Pay Your Medicare Premiums

- Pay on time to avoid coverage cancellation

- Sign-up for automatic bank payments if your Medicare Part B premiums arent automatically deducted from Social Security

- If you get Medicare Advantage through a private insurance company, contact the company if you think you will miss a paymentcompanies have their own rules on how many payments you can miss before your insurance is cancelled

You may qualify for help with paying your premiums through Medicare Savings Programs if you:

You must contact your state Medicaid office if you think you could qualify for help with paying your Medicare insurance. Even if your income is slightly higher than the limits, you can still be eligible for full or partial premium assistance.

How Do I Qualify For Part D Prescription Drug Medicare Benefits

Anyone enrolled in any part of Original Medicare is eligible to sign up for a Medicare Part D Prescription Drug Plan.

Although enrollment in Part D is entirely voluntary, you must have creditable prescription drug coverage in order to avoid a late enrollment penalty if you decide to enroll after you first become eligible.

In other words, you can delay enrolling in Part D if you have prescription drug coverage through an employer or union health insurance plan. When your other coverage ends, you can enroll in Medicare coverage for prescription drugs without paying a monthly penalty.

Recommended Reading: Which Of The Following Is True Regarding Medicare Supplement Policies

When To Enroll In Medigap

You may only purchase Medicare Supplement Insurance during your open enrollment period. This is a six-month period immediately following your 65th birthday and only after you have enrolled in Medicare Part B.

The enrollment period cannot be changed or repeated. Once the enrollment period ends, you may no longer be able to enroll in a Medigap policy. If you are able, it may cost you more.

Medigap insurers are not allowed to charge you more for a policy if you have pre-existing conditions and cannot ask you about your family medical history.

Costs And Funding Challenges

Over the long-term, Medicare faces significant financial challenges because of rising overall health care costs, increasing enrollment as the population ages, and a decreasing ratio of workers to enrollees. Total Medicare spending is projected to increase from $523 billion in 2010 to around $900 billion by 2020. From 2010 to 2030, Medicare enrollment is projected to increase dramatically, from 47 million to 79 million, and the ratio of workers to enrollees is expected to decrease from 3.7 to 2.4. However, the ratio of workers to retirees has declined steadily for decades, and social insurance systems have remained sustainable due to rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office wrote in 2008 that “future growth in spending per beneficiary for Medicare and Medicaidthe federal government’s major health care programswill be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costswhich will be difficult, in part because of the complexity of health policy choicesis ultimately the nation’s central long-term challenge in setting federal fiscal policy.”

Recommended Reading: What Age Can I Apply For Medicare

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

How Long Can You Stay In A Nursing Home With Medicare

Medicare covers up to 100 days of care in a skilled nursing facility each benefit period. If you need more than 100 days of SNF care in a benefit period, you will need to pay out of pocket. If your care is ending because you are running out of days, the facility is not required to provide written notice.

Read Also: Does Medicare Cover Home Health Care After Surgery

Don’t Miss: Is Rocklatan Covered By Medicare