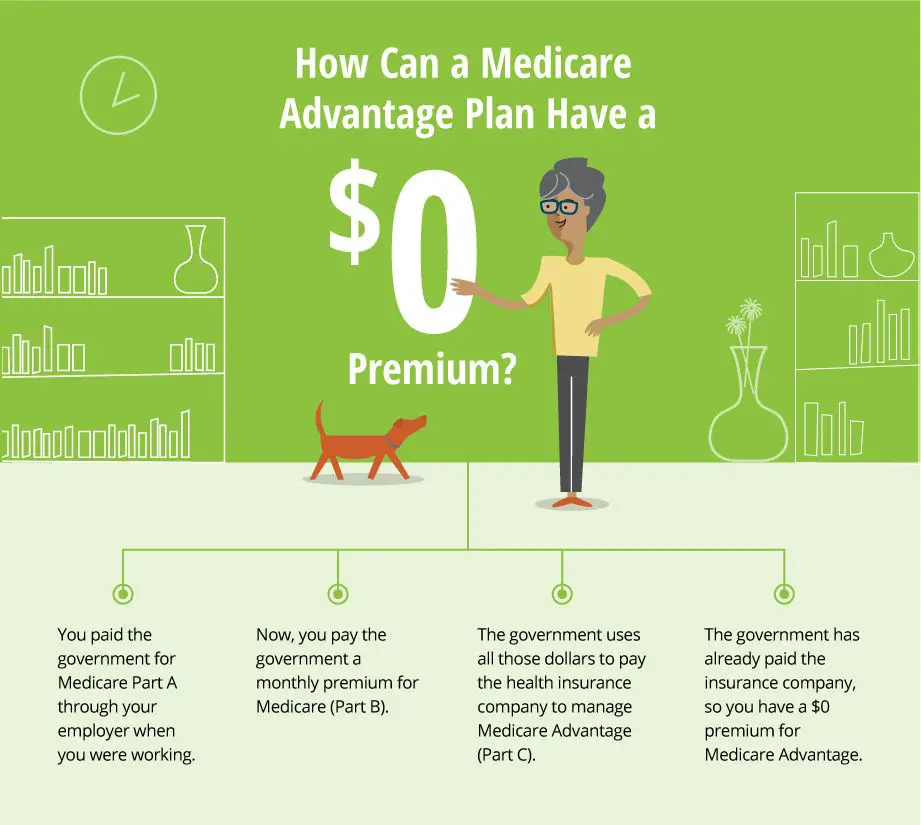

How Some Medicare Advantage Plans Have $0 Premiums

Some Medicare Advantage plans offer $0 premiums because of the way they receive federal funding.

Medicare pays private Medicare Advantage plans through a bidding process.

Plans submit bids based on how much they estimate it will cost to provide each enrollee the same services covered by Medicare Part A and Part B.

These bids are compared to established benchmark amounts set by a formula.

If a plans bid is higher than the benchmark, consumers pick up the difference between the benchmark and the bid by paying a monthly Medicare Advantage premium in addition to the Part B premium.

However, if the bid comes in lower than the benchmark, Medicare and the plan split the difference. This results in a rebate.

In other words, if a Medicare Advantage plan spends less than the flat fee it receives from the federal government, it can pass these savings on to members.

These rebates let insurers offer $0 premium plans. It may also result in additional plan benefits, such as dental, vision, hearing and/or prescription drug coverage.

Even though the monthly Medicare Advantage premium may be waived, insurers have other ways to make up the cost.

An Advantage Health Plan Competes For Participating Physicians And Enrollees

Listen to article

Dr. Dwight Oxley believes that traditional Medicare, which determines physician compensation by government fiat, accords with conservative values because its enrollees have a larger choice of physicians than they do with a Medicare Advantage health plan . The opposite is true. Medicare Advantage plans are more in line with conservative values because they determine physicians remuneration, and enrollees choices, through free-market competition.

An Advantage health plan competes for participating physicians by offering compensation that will attract doctors to fill that plans target network. Then the Advantage plan competes for enrollees in part on the basis of its physician network: One plan may be able to offer enrollees lower premiums because it has offered physicians less compensation . Another health plan can offer enrollees a larger physician network at a higher enrollee premium because it offered physicians higher compensation.

Continue reading your article witha WSJ membership

Disadvantages Of Medicare Advantage Plans

There are several reasons why beneficiaries may feel Medicare Advantage plans are bad. Some policyholders can provide a list of disadvantages, while others might be satisfied with their Medicare Advantage coverage. Based on who you ask, the answer to this question varies.

Overall, many Medicare Advantage policyholders do not like the plans because they thought they were free. Even without a monthly premium, most beneficiaries spend more out-of-pocket on a Medicare Advantage plan than they would on a Medicare Supplement plan.

Common Medicare Advantage plan disadvantages include:

- Coverage does not travel with you

- Small networks of doctorsHigh out-of-pocket maximum

- Plan benefits change annually

- The constant need for referrals and approvals

If you enjoy traveling, prefer going to any doctor or hospital you wish, want to keep out-of-pocket costs low, do not want your benefits to change, and do not want the hassle of getting a referral, a Medicare Advantage plan is probably not for you.

Often, the most significant complaint of all is the small network of doctors and hospitals Medicare Advantage plan beneficiaries can visit. Since not all doctors accept Medicare Advantage plans, it can be challenging to find the right doctor who takes your plan, leading to a delay in care.

Recommended Reading: Who Do You Report Medicare Fraud To

How Does The Medicare Advantage Carrier Get Paid

For each Medicare beneficiary that elects to enroll in a Medicare Advantage plan, Medicare allocates the estimated costs that the beneficiary would cost them over the year. Medicare pays the carrier a monthly fee to take on your risk. Therefore, the Medicare Advantage carrier pays instead of Medicare.

Because they receive their money this way, its in their best interest to keep you healthy with preventative plans and procedures.

You Get What You Pay For

The bottom line: Medicare Advantage plans are not free, even if they have a $0 premium. They are private Medicare health plans that often have lower premiums, but you have to play by the plans rules in exchange for that lower premium. It requires more effort on your part, and you must be an advocate for yourself. Always check at the point of service to ensure you see an in-network provider.

Also, even though the premium might be low, you are responsible for paying plan copays and coinsurance, and sometimes those costs are not cheap. You might have a hospital stay for surgery, and in most cases, you will pay the copay for the hospital AND a separate copay to the surgeon for performing the surgery.

This being said, lets be clear that Medicare Advantage plans are not bad plans. They just work differently than Medicare Supplements, so you, as the consumer, need to understand all the potential exposure for spending. You also need to be diligent about obtaining prior authorizations for certain procedures or checking the network to determine provider participation. If you are okay with extra legwork, these plans can work out just fine for you.

Have further questions about free Medicare Advantage plans? Call our friendly team here for more insight into these plans and help determining which plan is suitable for you.

Read Also: What Is Medicare Premium Assistance

How Can Some Medicare Advantage Plans Offer Zero Premium

Plans receive federal funding to deliver you Medicare coverage from CMS, which is the government body that operates Medicare. Here is how it works:

- Private insurers estimate the cost of providing Part A and Part B services per person. Then, they submit their plans bid to Medicare.

- Medicare will compare the bid against the benchmark amount, a value based on Medicares average spending per person. Each county has its own benchmark.

- If the plans bid exceeds the benchmark, the enrollee pays for the difference. This amount adds to their standard Part B premium .

But heres the good news if the bid is lower than the benchmark, the plan gets a rebate from Medicare.

This rebate is passed as savings to its members. That is why they can offer $0 premium Medicare Advantageplans. Plus, many MA plans offer extra benefits like dental, vision, hearing, and prescription drug coverage.

Private insurers manage their costs by getting contracts with a network of health providers. They also focus on preventive care and disease management to lower health care costs.

However, its important to remember that, enrolling in these $0 premium Medicare Advantageplans does not mean zero costs. You are still responsible for paying Part B premiums and out-of-pocket costs.

Excuses Exceptions Usually Denied

One Medicare Advantage health plan submitted 57 hardship requests, more than any other insurer, though CMS approved only six. In three cases, the health plans said the records were destroyed in floods. Another cited a warehouse fire, and two said the records couldnt be turned over because a doctor had been convicted for his role in illegally distributing millions of oxycodone pills through his network of pain clinics.

Other Medicare Advantage health plans argued they had no luck retrieving medical records from doctors who had moved, retired, died and in some cases been arrested or lost their licenses for misconduct.

CMS which is part of the federal Department of Health and Human Services found most of the excuses wanting, telling health plans they granted exceptions only in truly extraordinary circumstances. It said it receives about 100 of these requests for each year it audits and approves about 20% of them.

The Medicare Advantage plan issued by Minnesota Blue Cross won its appeal after it relied on Aggeus Healthcare for diagnoses of vascular disease for 11 of its patients who got podiatry care.

Gray, the Chicago podiatrist who owned the Aggeus chain that operated in more than a dozen states, was indicted on federal fraud charges in Missouri in October 2015.

Provided

Don’t Miss: What Is The Most Expensive Medicare Supplement Plan

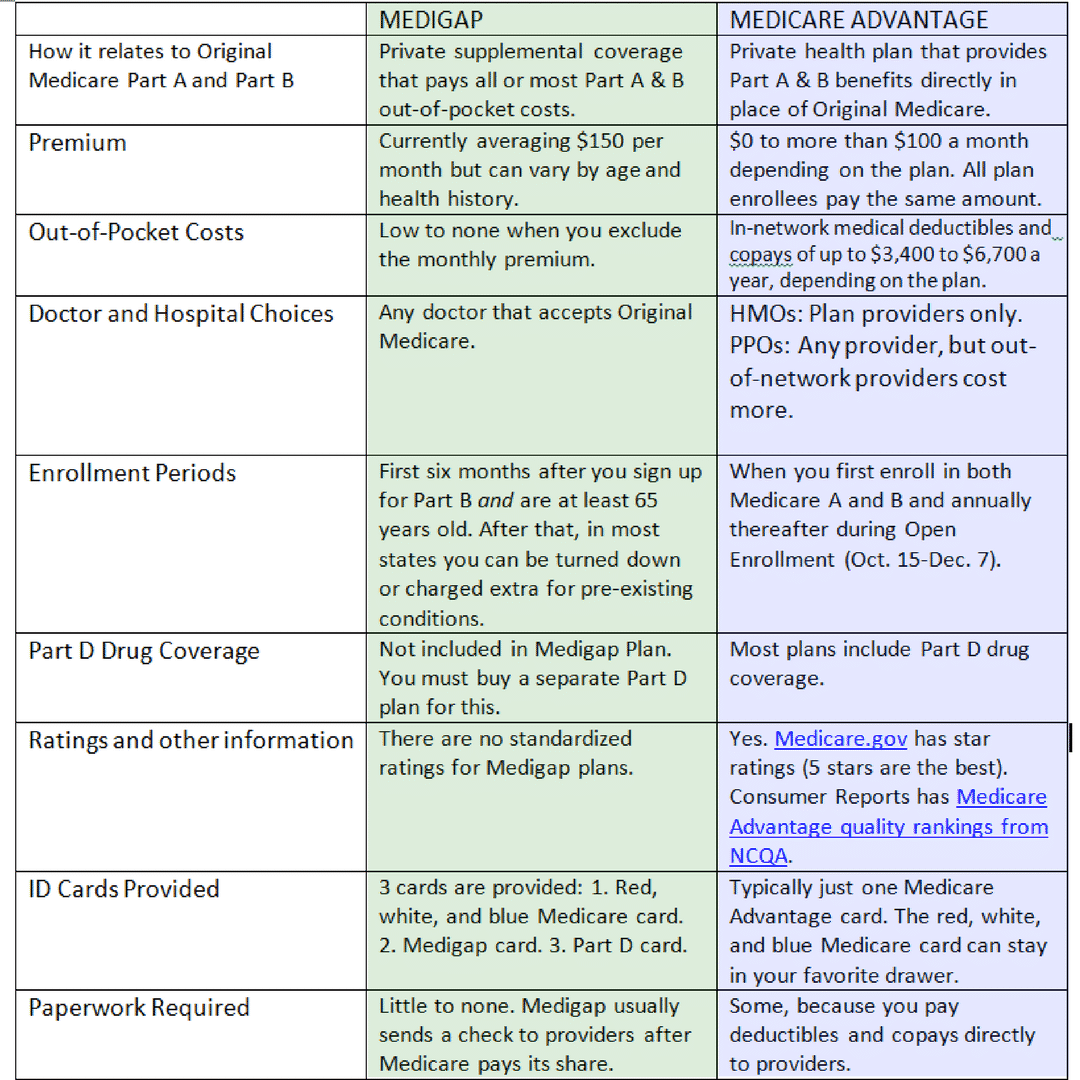

Can Medigap Plans Help Mitigate The Cost

Medigap plans, also known as Medicare Supplement plans, are plans that cover out-of-pocket Medicare costs. These plans don’t directly cover health care services, but just cover other fees like your Part B deductible and coinsurance, depending on which plan you choose.

Medicare Supplement insurance can help keep you from paying high out-of-pocket costs, but it doesn’t apply to Medicare Advantage plans. If you have a zero-premium plan, you will have to fully pay the out-of-pocket costs, with no help from Medigap.

Why Medicare Advantage Plans Are Bad

Home / FAQs / Medicare Advantage / Why Medicare Advantage Plans Are Bad

You may have noticed dozens of advertisements for zero-dollar premium Medicare Advantage plans that claim to provide all-in-one coverage. These Medicare Advantage plans may include prescription drug coverage, care for vision, dental, hearing aids, and maybe even a free membership to the gym. Yet, you may have also heard people complain about or criticize these plans. So, what are the disadvantages of Medicare Advantage? Why are Medicare Advantage plans bad?

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

To be clear, Medicare Advantage plans are not bad in every situation. However, they are certainly not a good fit for everyone. We are here to clarify why these seemingly too-good-to-be-true plans have a less-than-stellar reputation.

Recommended Reading: Is Drug Rehab Covered By Medicare

Medicare Advantage Plans & Pricing

Luis Alvarez / Getty Images

Medicare Advantage plans, also known as Medicare Part C, are an alternate way to receive your Original Medicare benefits. Like Original Medicare, MA plans provide Part A and Part B coverage, but are administered by private health insurance companies instead of the federal government. Some MA plans also include Part D coverage and additional benefits, such as vision, dental, and hearing.

If you choose to enroll in an MA plan, you need to pay the MA plans premium and your Part B premium. However, some MA plans are free and will even pay all or part of your Part B premium for you. You may be wondering how they can afford to do this and if it makes sense to enroll in a free Medicare Advantage plan.

Why Should I Choose Medicare Advantage

A Medicare Advantage plan covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patient’s situation worsens, it might be difficult or expensive to switch plans.

You May Like: What Are Some Medicare Advantage Plans

What Is Medicare Advantage

Medicare Advantage, also known as Medicare Part C, is health insurance provided by private insurance companies and is available to seniors who want more coverage than what is available from Original Medicare.

Although all Medicare Advantage Plans must include the same coverage available in Original Medicare Part A and Part B, Medicare Advantage Plans generally provide much more coverage and various additional benefits that are not available through Original Medicare.

Every Medicare Advantage plan must include the following basic coverages:

- Hospital Coverage , home healthcare expenses, hospice care, and nursing home care.

- Medical Coverage that pays for doctors office expenses for treatment of most medical conditions and preventive care

Generally, all private insurance companies that offer Medicare Advantage plans also provide additional benefits like dental coverage, vision and hearing coverage, prescription drug coverage, and in many cases, a gym membership called Silver Sneakers.

Why Are Some Medicare Advantage Plans Free

Some MA plans charge no premium, and may even pay for part or all of your Part B premium, also called the Medicare Part B premium reduction. The way plans can do this comes down to how much it costs them to provide services and, to a lesser extent, the plans star rating. But its not entirely up to the individual planthe process is highly regulated.

Every year, Medicare Advantage plans determine how much it will cost to provide care for their members. They submit this amount, or bid, to the Centers for Medicare and Medicaid Services , which then reviews the bid against a benchmark. This benchmark is calculated based on average Medicare spending per beneficiary for a specific region or area. If the plans bid falls below the benchmark, the plan is not allowed to charge a premium.

These plans also receive a rebate from the CMS. Its value is determined by how much lower the plans bid is relative to the benchmark and by the star rating that plan hasMA plans with a higher star rating get a bigger rebate. MA plans can then use rebate dollars to further reduce member costs. In addition to providing premium-free MA plans, helping to pay for Part B premiums is one way to reduce member costs.

Another way MA plans can reduce costs, and thereby their bid, is by contracting with in-network providers to provide discounted services to members.

Recommended Reading: How Many Days Does Medicare Cover Skilled Nursing Facility

Can I Get Free Medicare Coverage

If you are low-income, there are Medicare Savings Programs that will help cover some or all of your Medicare costs. These programs range from lowering your drug costs and premiums to paying for your Medicare Part B premium and, at times, covering your portions of co-pays, deductibles, and coinsurance.

How Can A Medicare Advantage Plan Be Free

Free Medicare Advantage plans are Medicare Part C plans that offer a $0 yearly premium. Compared to other Medicare plans, these zero premium Medicare Advantage plans dont charge a yearly amount to be enrolled in the plan. Theres generally no difference in coverage between a free plan and a paid plan. Regardless of cost, most Medicare Part C plans offer parts A and B, prescription drug, and other additional coverage.

So, why do companies offer these zero premium Medicare plans? When a company contracts with Medicare, its given a set amount of money to cover parts A and B insurance. If the company can save money elsewhere, such as by using in-network providers, it may be able to pass those extra savings along to members. This can result in a free monthly premium. These free Medicare Advantage plans are also a great way for companies to advertise attractive savings to potential beneficiaries.

Read Also: Does Medicare Cover Pill Pack

When Is It Worth It To Upgrade To A More Expensive Medicare Advantage Plan

In general, free Medicare Advantage plans with basic benefits are best for those who have typical medical needs and are reasonably healthy.

Itâs a good idea to pay more for a Medicare Advantage plan if the potential health care savings amount you can get from a more expensive plan is more than the extra monthly cost. For example, spending $30 per month would be worth it if it saved you $360 on your annual health care spending.

For those who have higher medical needs, a more expensive plan can often be a net savings because it typically reduces health expenses through lower deductibles, copays and out-of-pocket limits.

You can calculate if it’s worth it to upgrade by comparing the extra cost for a plan against the potential savings you’re likely to get from the extra benefits. Remember to consider all types of coverage including medical care, prescriptions, dental, vision and hearing. With medical care, plans will cover the same essential services, and the difference will be how much you pay for them. But other areas of coverage such as comprehensive dental or hearing aid coverage may only be available with more expensive plans.

The Pros And Cons Of Medicare Advantage

Popular Advantage plans come with some risks. Heres how to weigh your options.

If youre one of the 64 million Americans enrolled in Medicare, you know that a deluge has begun. In your mailbox and on TV youre being inundated with ads for Medicare Advantage plans, star-powered by the likes of William Shatner, all promising great care with low- or zero-cost premiums.

This marketing tsunami is timed to Medicare open enrollment, which runs from Oct. 15 to Dec. 7. Thats when you can switch coverage between Original Medicare and Medicare Advantage, or change your prescription drug plan.

The pitches work: In 2022 nearly half of those eligible for Medicare were enrolled in Advantage plans, up from about a third in 2016, according to the Kaiser Family Foundation. By 2032 about 60 percent of beneficiaries are expected to sign up for these plans.

Its easy to see the appeal: Original Medicare requires piecing together care from whats called Part A, for in-patient hospital and skilled nursing care, and Part B, for doctor services. That typically costs about $165 a month . Plus, many people pay extra for Medigap, to cover copays and other out-of-pocket costs, as well as a Part D plan for drugs.

Advantage plans , on the other hand, provide the benefits of Parts A, B, and often D, usually for about the same amount, with lower copays, so theres no need for Medigap. Some also offer benefits not in Original Medicare, such as fitness classes or some vision and dental care.

Also Check: Does Medicare Pay For Hotel Stay

Can I Enroll In A Medicare Supplement Plan Later If I Enroll In A Medicare Advantage Plan Now

If you enroll in a Medicare Advantage plan now, you may be able to cancel your Medicare Advantage plan and enroll in a Medicare Supplement plan in the future. To do so, you will have to wait until the Annual Enrollment Period or the Medicare Advantage Open Enrollment Period to make changes.

It is important to know that most beneficiaries will only get a Medicare Supplement Open Enrollment Period once in their lifetime. This is your only opportunity to enroll in a Medigap plan without answering health questions.

If you miss this one-time opportunity to enroll, you will have to answer health questions should you wish to enroll in a Medicare Supplement plan in the future. This means the carrier could deny your application due to pre-existing conditions. Thus, the importance of understanding which coverage is best for you and enrolling in that coverage the first time.