When Would My Medicare Coverage Start

If you enroll during the first three months of your IEP, your Medicare coverage begins on the first day of the month you turn 65 or the first day of the previous month if your birthday falls on the first day of a month.

If you sign up for Part B during the fourth month your birthday month coverage begins the first day of the following month.

If you dont enroll in Part B until later, in the fifth, sixth or seventh month of the IEP, coverage will be delayed by two or three months. However, those rules change in 2023, when the coverage will take effect the next month when you enroll after your birthday month.

You can sign up for premium-free Part A any time after your IEP starts. Your coverage will take effect six months retroactively, but no earlier than the month you turn age 65.

The best way to sign up for Medicare during your initial enrollment period is online at the Social Security website.

What Documents Do I Need To Enroll In Medicare

Youll need to prove that youre eligible for Medicare when you first enroll. In some cases, Medicare might already have this information.

If youre already receiving Social Security retirement benefits or Social Security Disability Insurance, you wont need to submit any additional documentation. Social Security and Medicare will already have all the information they need to process your enrollment.

If you dont receive any kind of Social Security benefits, youll need to provide documentation to enroll in Medicare.

You can enroll online, over the phone, or in person at a Social Security office. No matter how you apply, youll need to provide certain information.

Generally, this includes:

Most of this information can be provided simply by filling out the application. Some details, though, will need extra documentation. These documents may include:

You might not need all these documents, but its a good idea to have as many of them ready as you can. Social Security will let you know whats needed.

Any documents you send should be originals. Social Security will accept copies of W-2s, tax documents, and medical records, but everything else needs to be an original document.

Social Security will send the documents back to you after theyre reviewed.

Apply For Financial Assistance To Make Medicare More Affordable

If you have a low income and are concerned about costs, you can also apply to see if youre eligible for financial assistance.

Applications for financial assistance programs are not automatically included when you apply for Medicare coverage. This means that many people are paying more for Medicare coverage than they need to.

Its estimated that about 30% to 45% of those who are eligible for these programs never apply for the benefits.

For programs administered by the state, the income limits and asset requirements vary. So after applying for Medicare, we recommend checking with your state for the exact eligibility requirements that apply to you.

| Program |

|---|

Don’t Miss: Does Medicare Ever Call You On The Phone

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Do You Have To Report Inheritance To Medicaid

medicaidplanner Staff answered 2 years ago. If you inherit money, you are legally obligated to report it to Medicaid. Depending on the amount of the inheritance and your current level of income and assets, an inheritance can cause you to lose your Medicaid coverage. On the other hand, if you inherit money and do not report it,

Don’t Miss: Does Medicare Pay For Ct Scans

When To Enroll In A New Plan

If your plan changes, a special enrollment period will usually be available for 3 months. During this time, you can review your plan options and sign up for a new plan. You can compare Medicare Advantage plans and Medicare Part D plans through a tool on the Medicare website.

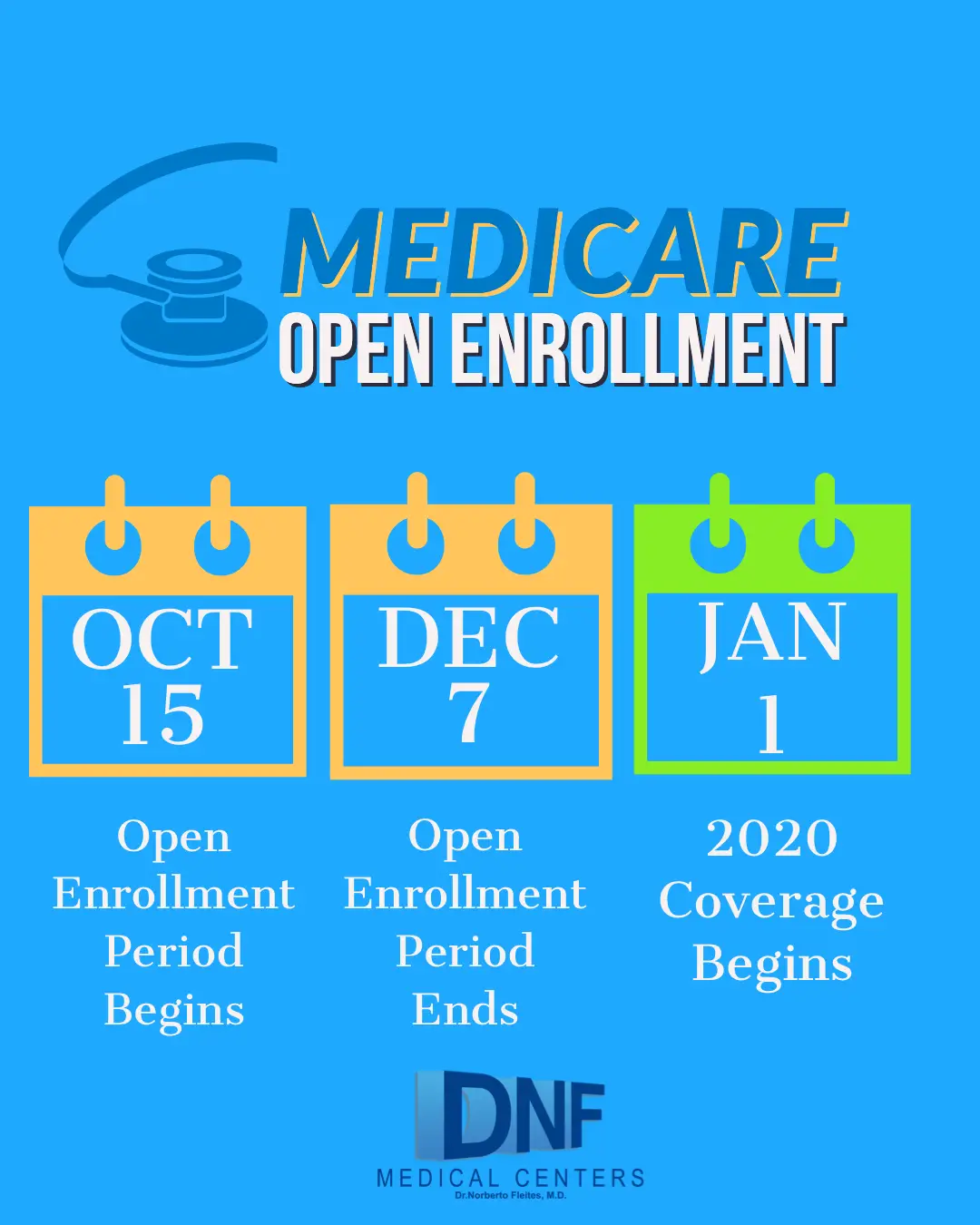

Youll also be able to enroll in a new plan during open enrollment. This takes place each year from If you miss both your special enrollment window and open enrollment, your coverage will continue automatically through original Medicare.

Because your Medicare Advantage plan will no longer be active, you wont be able to enroll in a new Advantage plan during Medicare Advantage open enrollment. This takes place from each year for people with an active Medicare Advantage plan.

You can enroll in a new plan at Medicare.gov or through your new plans provider.

Tips for finding the right plan

- Make a list of your preferred doctors and providers, so you can make sure theyre on the provider list of the plans youre considering.

- Check whether any medications you take regularly are included in a plans formulary, a list of prescription drugs the plan covers.

- Add up the money you spend on medical treatments annually to figure out how much you can afford to spend on a Medicare plan.

- Think about potential health conditions or concerns you may have for the upcoming year.

- Compare plans available in your area here.

How Social Security Benefits Can Affect Medicare Enrollment

If you are receiving Social Security benefits when you turn 65, youll be automatically enrolled in Medicare Parts A and B, even if youre working. Your Medicare card will arrive in the mail about 3 months before your 65thbirthday.

Once youre enrolled in Medicare, a monthly Part B premium will be automatically deducted from your Social Security check. If you dont want Medicare Part B, you need to notify Medicare to opt out. There will be instructions for doing this on the back of your Medicare card.

If youre not receiving Social Security or Railroad Retirement Board benefits, you will need to enroll yourself in Medicare when you become eligible.

You May Like: What Is Extra Help For Medicare

When Do I Have To Apply For Medicare If Im Still Working

Summary:

This depends on your situation. If youâve worked at least 10 years under Medicare-covered employment and paid Medicare taxes during that time, you qualify for premium-free Medicare Part A. You should usually enroll in Part A at age 65 even if youâre still working.

Many people delay enrollment in Medicare Part B if theyâre still working and covered by an employerâs group health plan when they turn 65. But thereâs more to know â keep reading!

in most cases, you should enroll in Medicare Part A when you turn 65, even if youâre still covered by an employerâs group plan . Most people donât have to pay a monthly Part A premium â that includes you if youâve worked at least 10 years while paying Medicare taxes.

Medicare Part B always comes with a monthly premium, so you may similarly choose to delay your Part B enrollment if you or your spouse are still working and have employer-based group coverage.

Remember, if you donât sign up for Medicare when youâre first eligible and donât have other coverage based on current employment, you could have to pay a late-enrollment penalty later when you do enroll. The late-enrollment penalty applies to Medicare Part B .

Medigap Or Supplement Insurance

Original Medicare still leaves significant costs and gaps in your coverage, so you can purchase a supplemental plan to lower your out-of-pocket expenses.

There are a number of different plans to choose from, some that cover virtually all of your expenses. Of course, the cost of your premiums increase as your coverage increases. Theres a good chart on the governments website that compares the features of the different Supplement plans.

Recommended Reading: How Do I Apply For Medicare Part A

Failure To Pay Monthly Premium

A failure to pay your monthly premiums for most plans will lead to a loss of coverage. However, many health insurance plans offered through the marketplace allow their customers a grace period.

This grace period is usually a short time typically 90 days after your original insurance payment due date. A failure to make your payment by the end of the grace period will lead to a termination of your coverage. In that case, you will only be covered until the end of the month for which you made your last payment.

You May Like: Social Security Retirement Benefits Calculator

Missing Key Deadlines Can Mean Paying Extra

If you’re planning to sign up for Medicare as soon as you’re eligible at age 65, you get a seven-month “initial enrollment period” that starts three months before the month of your 65th birthday and ends three months after it.

Meanwhile, if you delayed signing up at age 65 because you continued to work and your employer coverage was acceptable , you get eight months to enroll once your workplace plan ends.

Regardless of the enrollment rules your subject to, missing the deadline to sign up for Part B can result in a life-lasting late-enrollment penalty. For each full year that you should have been enrolled but were not, you’ll pay 10% of the monthly Part B standard premium.

“Many of my high-income earners are shocked at how much Medicare premiums will cost them in retirement.Elizabeth GavinoFounder of Lewin & Gavino

Part D also has a late-enrollment penalty if you miss the deadline. For people signing up during their initial enrollment period at age 65, you get the same seven months for Part D as you do for Part B. However, if you’re beyond that window and your workplace coverage is ending, you get two months to enroll in Part D, whether as a standalone plan or through an Advantage Plan.

The penalty is 1% of the national base premium for each month you didn’t have Part D or creditable coverage and should have.

Recommended Reading: What’s The Difference Between Medicare And Medicaid

What Happens When You Turn 65

When you turn 65, you essentially lose your entitlement to Medicare based on disability and become entitled based on age. In short, you get another chance to enroll, a second Initial Enrollment Period if you will.6

If you decided not to take Part B when you were eligible for disability under 65, when you do turn 65, youll now be automatically enrolled in Part B. Your Medicare card will then be mailed to you about 3 months before your 65th birthday.

You can also decide during this time to enroll in a Medicare Advantage or Part D prescription drug plan. Additionally, once you have Part B, you can enroll in a Medigap plan if you so wish.

Contact Social Security To Sign Up For Medicare

You can either:

Know when to sign up for Part BYou can only sign up for Part B at certain times. If you dont sign up for Part B when you turn 65, you might have to wait to sign up and pay a monthly late enrollment penalty. Find out when you can sign up. How much is the Part B late enrollment penalty?

Read Also: Does Medicare Cover Capsule Endoscopy

When To Apply For Medicare Part A And Part B

The Initial Enrollment Period is usually the first time you can apply for Medicare. There are a few special circumstances that might allow you to enroll earlier . But in general, people apply for Medicare within their seven-month IEP.

Heres what the Initial Enrollment Period looks like:

- Three full months before your 65th birthday month

- The entire month in which you turn 65

- Three full months after your birthday month

If you miss your sign-up window for Medicare Part A and Part B during your Initial Enrollment Period, there is also a General Enrollment Period every year from January 1 to March 31. And if you defer your Part B coverage , there is a Special Enrollment Period.

As a word of caution, if youre signing up for Medicare outside of your IEP, there are some pitfalls that are easily stepped into. You can read more about enrollment periods here.

Read Also: Do Retired Federal Employees Get Medicare

You Move Outside Your Plans Coverage Area

For Medicare Part C and Part D, coverage is typically offered within a specified service area through certain providers. If you move to an area that is not covered by your Part C or Part D plan, you stand to lose your Medicare benefits.

If you need to move to an area that is not covered by your plan, you are eligible to apply for a new plan under the special enrollment period. This allows you to enroll for a Medicare plan in your new area outside of the regular open enrollment period.

For beneficiaries on Original Medicare, you cannot lose your coverage for moving from one area to another since Original Medicare does not have service areas.

You May Like: Lawyers Specializing In Social Security Benefits

Don’t Miss: What Does The Donut Hole Mean In Medicare

Do You Have To Notify Social Security When You Travel Internationally

If you are traveling outside the U.S. for an extended amount of time, its important that you tell Social Security the date you plan to leave and the date you plan to come back, no matter how long you expect your travel to last. Then we can let you know whether your Supplemental Security Income will be affected.

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Don’t Miss: When Can I Change Medicare Advantage Plans

I Am Turning 65 Next Year When Can I Sign Up For Medicare

If you are eligible for Medicare, your initial enrollment period for Part A and Part B begins three months before the month of your 65th birthday and ends three months after it. For example, if your 65th birthday is in June, your enrollment period will extend from March 1 through September 30. If you join during one of the 3 months before you turn 65, coverage will begin the first day of the month you turn 65. If you join during the month you turn 65, your coverage will begin the first day of the month after you turn 65. If you join in the month after you turn 65, coverage will begin 2 months later, and if you join 2 or 3 months after you turn 65, coverage will begin 3 months later. A recent change in law limits these gaps in coverage. Starting in 2023, if you enroll in Medicare during the first 3 months after your turn 65, coverage will begin the first day of the month following the month you enroll.

Once you have Part A and Part B, you are then also eligible to enroll in a Medicare Advantage plan and/or a Part D plan. If you are already receiving Social Security benefits when you turn 65, you will automatically be enrolled in Part A and Part B. If you are not already receiving Social Security benefits and you want to enroll in Medicare, you should contact Social Security.

Reasons You Can Lose Your Medicare Benefits

A few scenarios can cause a beneficiary to lose Medicare benefits. The way you became eligible for Original Medicare plays a major role in how benefits can be taken away. If any of the following apply to you, you could be at risk of losing your Medicare coverage.

- Nonpayment of your monthly premium

- Qualifying disability ends

Also Check: Penn State Health Employee Benefits

Don’t Miss: When Does Medicare Start For Social Security Disability

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

What Is A Medicare Advantage

Offered by private insurance companies, Medicare Advantage plans wrap basic Medicare benefits into one package. They have much lower premiums than Medigap/Supplement plans some actually have no monthly premiums at all. But you are likely to have co-pays and a yearly deductible.

However, many of these plans offer a number of benefits not included in Supplement offerings, including dental and vision coverage, even gym membership.

Don’t Miss: Is Coolief Covered By Medicare

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?