If I Retire At 62 Is That My Medicare Eligibility Age

Most people don’t qualify for Medicare at age 62. Unless you qualify for Medicare based on a disability, you’ll need health insurance until you qualify for Medicare at age 65.

Retirement brings with it many questions, not the least of which is how youll handle health insurance. Medicare is for people age 65 or older or those with qualifying disabilities. If youre retiring at 62 and dont qualify for Medicare with a disability, youre not yet eligible for Medicare.

Read on to get answers to your questions about Medicare at an early age:

- What are the age requirements concerning becoming Medicare eligible?

- Whats the difference between two types of Social Security retirement benefits?

- Can I qualify for Medicare if I dont meet the traditional Medicare age requirement?

- What are insurance options for people that dont qualify for Medicare at age 62?

What Is The Medicare Eligibility Age

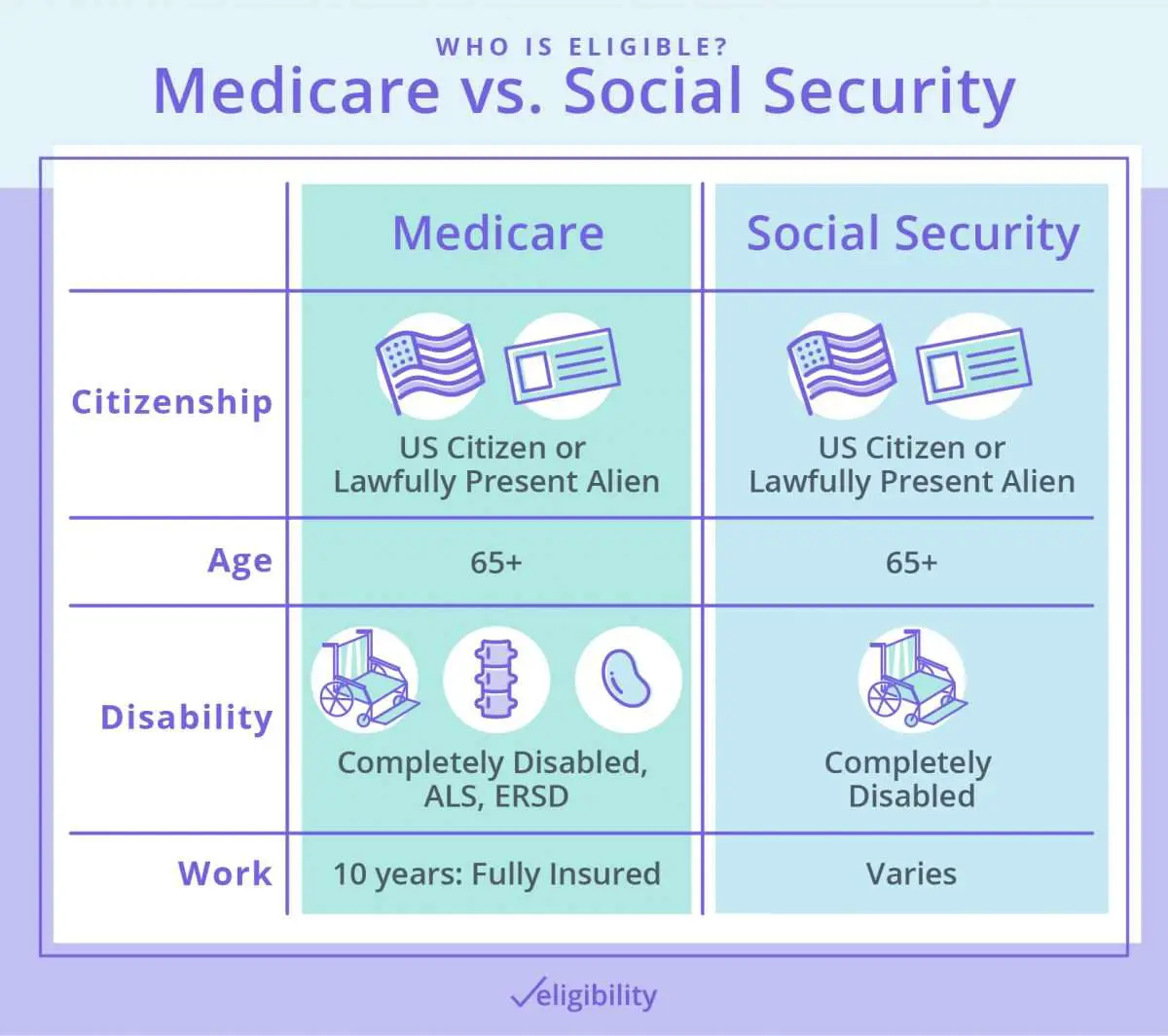

For just about everyone, the Medicare eligibility age is 65. At that point, youll have access to Medicare Part A and are able to purchase Medicare Part B. For some with disabilities or End Stage renal disease, though, eligibility may come at a younger age. Most people are eligible to receive part A without having to pay for it, but there are a few exceptions, which well note in further detail below. For help with healthcare planning and other questions about finances and retirement, consider working with a financial advisor.

Tips For Getting Retirement Ready

- A financial advisor can be a big help in figuring out how medical expenses will affect your retirement. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAssets free financial advisor matching tool matches you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Medical costs arent the only expenses youll need to grapple with in retirement. Think about where youll want to retire to see how cost of living could impact your lifestyle. SmartAssets cost-of-living calculator can help you figure out your costs so youll know how much youll need to save. And our retirement calculator can help you see if youre on track with those savings.

Read Also: Do Medicare Advantage Plans Cover Dentures

How Medicare Works If Your Age 62 Spouse Is Still Working And Youre On Medicare

To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 , he or she could only qualify for Medicare by disability.

Heres an example of when a younger spouse whos not yet on Medicare might help you save money.

- Suppose you reach age 65 and qualify for Medicare, but you havent worked long enough to qualify for premium-free Medicare Part A.

- And suppose your younger spouse has worked at least 10 years while paying Medicare taxes. When your spouse turns 62, youll qualify for premium-free Part A. Your spouse wont qualify for Medicare until they turn 65, but their work record will help you save money by getting Part A with no monthly premium.

NEW TO MEDICARE?

Can I Get Medicare If I Am Still Working

Yes, but whether it makes sense to do so isn’t always straightforward. If you have qualifying coverage through work, you may be able to delay enrolling in Medicare without incurring a late enrollment penalty. If you choose to enroll in Medicare while you’re covered under an employer’s plan, Medicare may become the primary insurer, depending on how large your employer is.

You May Like: Is Revlimid Covered By Medicare

Related Faq For What Age Can A Widow Draw Social Security

Can a widow get Medicare at age 60?

If you are divorced, you must have been married to your ex-spouse for at least 10 years and currently be unmarried. As a widow: You must be at least 60 years old .

Can I retire at 57 and collect Social Security?

You can start your Social Security retirement benefits as early as age 62, but the benefit amount you receive will be less than your full retirement benefit amount.

Can I retire at 58 years old?

A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after normal retirement age may result in larger benefits. With delayed retirement credits, a person can receive his or her largest benefit by retiring at age 70.

Is Social Security based on the last 5 years of work?

Social Security benefits are based on your lifetime earnings. Your actual earnings are adjusted or indexed to account for changes in average wages since the year the earnings were received. Then Social Security calculates your average indexed monthly earnings during the 35 years in which you earned the most.

When can a spouse claim spousal benefits?

You can claim spousal benefits as early as age 62, but you wont receive as much as if you wait until your own full retirement age. For example, if your full retirement age is 67 and you choose to claim spousal benefits at 62, youd receive a benefit thats equal to 32.5% of your spouses full benefit amount.

What Should I Do As I Am Waiting To Reach The Medicare Eligible Age

If you retire at 62, your wait for your Medicare eligible age may only be 3 years. As you wait, you can start researching about Medicare so that you are prepared to make well-informed coverage decisions. For example, you may not know that:

- Original Medicare doesnt generally cover prescription drugs you take at home. You can get coverage for prescription drugs through Medicare Part D, which is offered by private insurance companies contracted with Medicare.

- Original Medicare generally doesnt cover routine dental, hearing aids, or eyeglasses. You may be able to get coverage for these benefits through a Medicare Advantage plan offered by a private insurance company. Medicare Advantage plans must cover everything Original Medicare covers, with the exception of hospice care, which is still covered by Part A.

- Original Medicare has no out-of-pocket maximum. To get help paying for out-of-pocket costs such as copayments, coinsurance, and deductibles, you can get a Medicare Supplement insurance plan, also offered by private insurance companies.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Don’t Miss: Does Medicare Cover Transportation To Physical Therapy

Medicare For People Turning 65

Most people know that when they turn 65 they can start receiving Medicare. In general, you are eligible at 65 if you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if you:

- Receive retirement benefits from Social Security or the Railroad Retirement Board

- Are eligible to receive Social Security or Railroad benefits but you have not yet filed

- Had Medicare-covered government employment

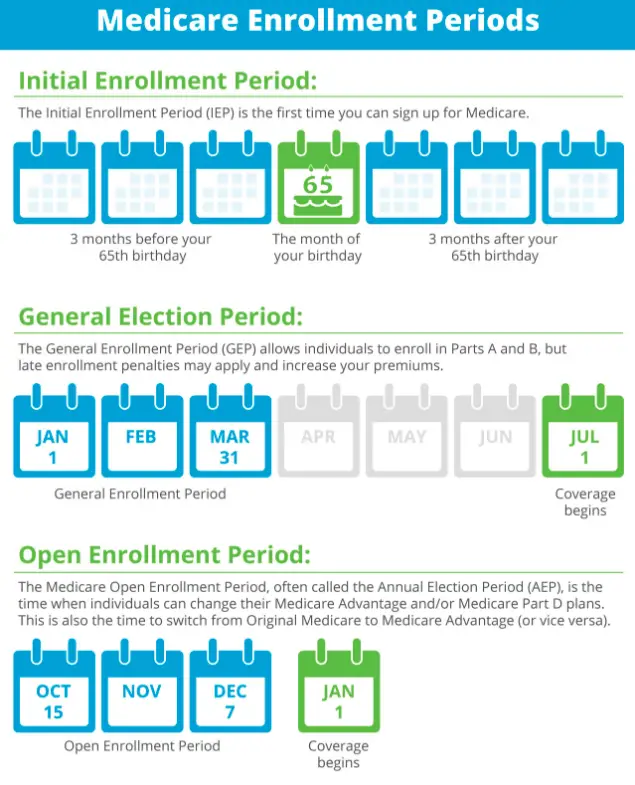

If you qualify for Medicare this way, your Initial Enrollment Period will begin three months before the month you turn 65.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may still be able to buy Part A.

Is Medicare Part A Free At 65

For most people, the answer is yes. You can get premium-free Part A at age 65 if you are already receiving Social Security benefits or Railroad Retirement Board benefits or if youre eligible to receive them but havent filed yet.

You can also receive premium-free Part A if you or your spouse had Medicare-covered government employment. Medicare Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

If you dont qualify for premium-free Part A, you can still buy that same coverage. In 2022, youll pay a premium of either $274 or $499 a month, depending on how long you or your spouse worked and paid Medicare taxes.

The Medicare.gov website provides an easy-to-use tool to help you determine when you might be eligible for Medicare and what you may pay for as a premium.

You May Like: How To Enroll In Medicare Online

How To Apply For Medicare Part A And Part B Before Age 65

Some people are automatically enrolled in Original Medicare. If youve been receiving disability benefits from Social Security or the Railroad Retirement Board for 24 months in a row, you will be automatically enrolled in Original Medicare, Part A and Part B, when you reach the 25th month.

If you have ALS or Lou Gehrigs disease, youre automatically enrolled in Medicare the month you begin receiving your Social Security disability benefits.

Some people will need to sign up for Medicare themselves. If you have end-stage renal disease , and you would like to enroll in Medicare Part A and Part B, you will need to sign up by visiting your local Social Security Office or calling Social Security at 1-800-772-1213 . If you worked for a railroad, please contact the RRB to enroll by calling 1-877-772-5772 , Monday through Friday, 9 AM to 3:30 PM, to speak to an RRB representative.

Taking Medicare But Not Social Security

It is possible to enroll in Medicare coverage but delay taking your Social Security retirement benefits. For many workers, this strategy might be financially advantageous.

For most older people, it is a good idea to enroll in all parts of Medicare coverage they plan to use as soon as they are eligible at age 65. If you delay enrolling, Medicare Part D may become more expensive. If you delay signing up for Part B, you may also experience a gap in your coverage or have to pay a late enrollment penalty.

However, if you can afford to, it is often a smart financial decision to delay receiving Social Security benefits until at least your full retirement age in order to increase the benefit you receive. This may mean that there are several years during which you are enrolled and covered by Medicare but not yet receiving your monthly Social Security benefit.

You May Like: Can You Get Medicare If You Retire At 62

Social Security And Medicare Basics

For most of us, Social Security is the bedrock of retirement income. And Medicare is likely to be your primary source of health coverage. But when can you claim Social Security? And exactly what is Medicare? Understanding how and when to start taking advantage of these programs can help you maximize your benefitsand positively impact your retirement lifestyle.

Though the two programs are separate, Social Security works closely with Medicare to enroll people who are 65 and older, provide information and collect premiums.

Can You Get Medicare At 62 Why You May Be Able To Soon

Ever wondered why you cant get Medicare at 62 but you can get Social Security at 62?

You would think that these two critical systems for retirees would be coordinated to the same age of initial eligibility.

Sadly, thats not how the current rules are written. You cant get Medicare at 62 today, but that could change in the near future if a group of lawmakers gets their way.

Recommended Reading: What Year Did Medicare Start

At What Age Can You Get Medicare

by Christian Worstell | Published April 26, 2021 | Reviewed by John Krahnert

In most cases, the age to get Medicare is age 65 or older. Those who already receive Social Security benefits are typically enrolled in Original Medicare automatically, starting on the first day of the month they turn 65.

Learn more about the age requirement for Medicare and how to get health insurance benefits that meet your needs.

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Read Also: Is Keystone First Medicaid Or Medicare

Medicare Eligibility Requirements For 2020

Not sure if youre eligible for Medicare health insurance? The Social Security Administration enrolls some people automatically. But dont expect that or wait for your Medicare card to show up. Find out if youre eligible now so you can enroll at the right time and avoid any Late Enrollment Penalties .

Theres more than one way to qualify for Medicare, and enrolling in the different parts of Medicare differ as well. Plus, how you qualify may determine how you can receive coverage and what your premiums might be.

If youre looking for more of a crash course in the different parts of Medicare and how the program works as a whole, check out our Ultimate Medicare Guide. Otherwise, read on.

Also Check: What Is Medicare Vs Medicare Advantage

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Read Also: When Is The Earliest You Can Apply For Medicare

What To Do If The Bill Doesnt Pass

To pass Congress, the bill would need full support from all of the Democratic members. Since that seems unlikely, its best to make some plans to find savings for yourself.

If youve got bills piling up these days, health care or otherwise, you may want to consider a lower-interest debt consolidation loan to help get you out of debt easier and sooner.

As for your health-care costs, it will take a little while for you to see the impact of the new subsidies. Make sure youre not overpaying for this crucial coverage by shopping around for the best rate.

And while youre shopping for insurance, why not keep the savings rolling? By looking around for a cheaper policy, you could potentially cut your homeowners insurance bill by $1,000 this year.

Even if the government doesnt pass a change qualifying you for Medicare coverage, with the savings above, you can make your own changes to the status quo, improve your health care coverage and lower your monthly bills.

Donât Miss: Does Medicare Pay For Assisted Living In Ohio

What If You Still Work

There’s a limited period of time during which you can receive SSDI benefits and work, but you can continue to receive Medicare benefits even once disability payments have stopped. This is known as the extended period of Medicare coverage, and it allows you to keep your Medicare coverage for at least 93 months after you have completed your trial work period.

Trial Work Period

There are three timeframes to understand. The first, the trial work period, is a nine-month period during which you can test your ability to work and still receive full SSDI and Medicare benefits. The nine months don’t have to be consecutive, and a qualifying month is one during which you earned at least $1,050 in 2023. The trial period continues until you have worked for nine months within a 60-month long period.

Extended Period of Eligibility

Once those nine months are up, you move into the next time framethe extended period of eligibility. For the next 36 months, you can still receive SSDI in any month you aren’t earning substantial gainful activity income. Plus, you receive a 3-month grace period the first time you earn SGA-level income, during which you’re still paid SSDI benefits. The 2023 monthly SGA amount is $1,470 if you aren’t blind $2,460 if you are. You’ll continue to receive Medicare benefits regardless of income.

Extended Period of Medicare Coverage

Recommended Reading: What Does Medicare Supplemental Insurance Cost