Medicare Part B Enrollment And Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you dont have to enroll in Part B, particularly if youre still working when you reach age 65.

However, if you dont qualify for a Special Enrollment Period , then you may incur penalty charges. These penalty charges are indefinite for as long as you keep Medicare Part B. When should you enroll in Medicare Part B? If youre not automatically enrolled because of the aforementioned conditions, then here are your enrollment options:

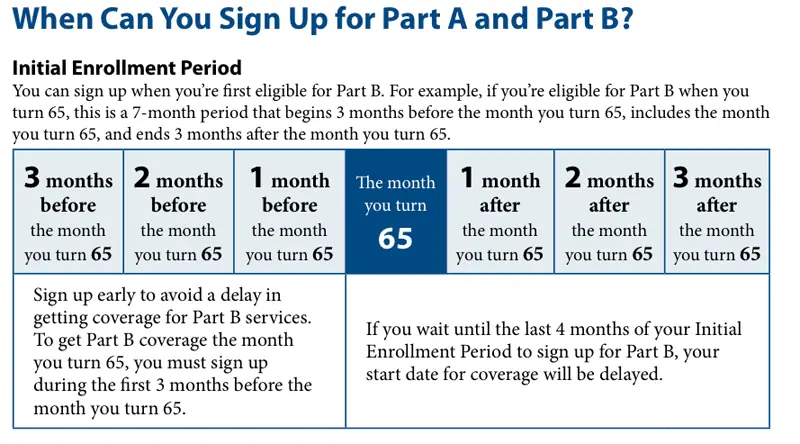

- You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

- If you delay enrollment, then you have to wait until the next general enrollment period begins. For Medicare Part B, you have from January 1 through March 31 to enroll. Coverage doesnt begin until July.

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Sign Up For Part B On Time

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month. If you dont sign up during that seven-month period, you can enroll during Medicares General Enrollment Period each year.

But for each 12-month period you go without Medicare coverage despite being eligible, youll be hit with a penalty that raises your Part B premium cost by 10 percent. Worse yet, that penalty will remain in effect for the rest of your life. The takeaway? If you want to save money, dont be late.

Also Check: Does Medicare Pay For Cpap Machines And Supplies

Is Part B Of Medicare Mandatory

Medicare Part B is optional, and it covers qualified outpatient care, certain preventive care services and durable medical equipment .

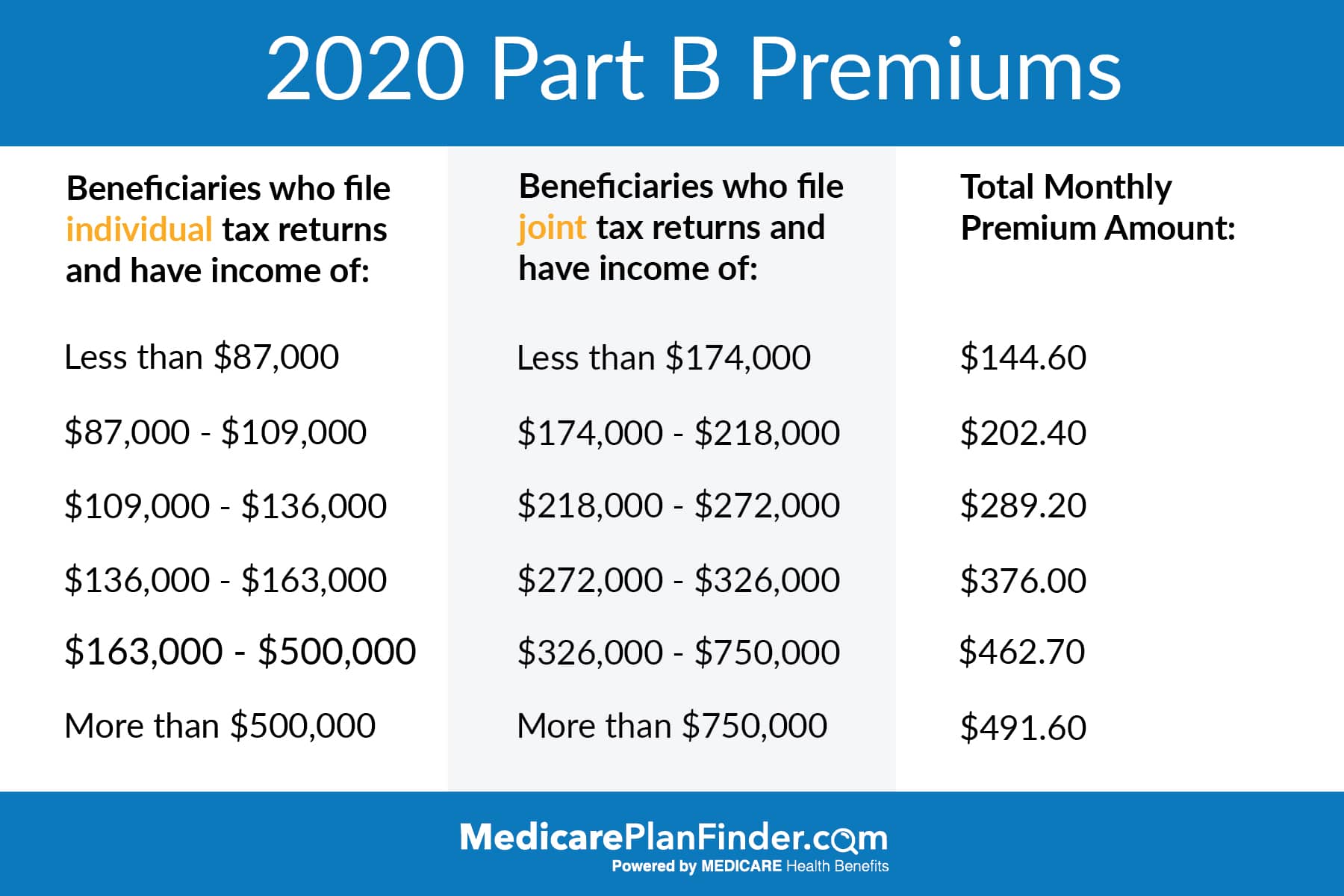

Most beneficiaries pay the standard Part B premium of $170.10 per month in 2022. Some higher income-earners will pay more for their Part B coverage. This higher amount is called the Income-Related Monthly Adjustment Amount, or IRMAA.

Although Part B is optional, it is mandatory to have Medicare Part A and Medicare Part B in order to enroll in a Medicare Advantage plan or a Medicare Supplement Insurance plan.

Medicare Part B Eligibility Requirements

Medicare Part B is a health insurance option that becomes available for people in the United States once they reach age 65. However, there are some special circumstances under which you may qualify to enroll in Medicare Part B before the age of 65.

Below, you will find the eligibility requirements for enrolling in Medicare Part B.

Recommended Reading: How To Qualify For Medicare Disability

Point Of Care Testing

Point of Care Testing has become popular in Pharmacy over the past few years, and with COVID-19 testing this trend has continued to grow. Over the past few years, we have written a few blogs related to POCT, so I will cover some basic information and links to those blogs below. Becoming eligible to bill Medicare Part B for POCT will be a two-part process. First, you will need to obtain your CLIA Certificate of Waiver, and then you will submit your application to get your Medicare billing privileges.

POCT requires Pharmacies to obtain a CLIA Certificate of Waiver by completing the CMS-116 and any State Applications that may exist. The Application are then submitted to your local state agency. It is essential to know that while CMS has no complicated requirements for CLIA Waived Tests, your State may, and you will need to make sure you comply with them.

The next step is to obtain your billing privileges. For this, you will need to complete the CMS-855B or PECOS.

Here are some previous blogs related to POCT:

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Recommended Reading: What Is A Hmo Medicare Plan

Can I Decline Medicare Altogether

Medicare isnt exactly mandatory, but it can be complicated to decline. Late enrollment comes with penalties, and some parts of the program are optional to add, like Medicare parts C and D. Medicare parts A and B are the foundation of Medicare, though, and to decline these comes with consequences.

The Social Security Administration oversees the Medicare program and recommends signing up for Medicare when you are initially eligible, even if you dont plan to retire or use your benefits right away. The exception is when you are still participating in an employer-based health plan, in which case you can sign up for Medicare late, usually without penalty.

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and wont cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits and must repay anything you have already received when you withdraw from the program.

Medicaid Part B Reimbursement Options

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.

You May Like: What Is The Coinsurance For Medicare Part B

The Medicare Part B Premium

Most seniors pay a standard monthly premium for Medicare Part B. In 2022, that standard premium is $170.10 per month. It can be higher depending on your income.

However, that cost might be lower for many people who are receiving Social Security benefits. Part B premiums can be automatically deducted from your Social Security benefit payment. If your Part B premiums are deducted from your Social Security benefit payments, the premium amount may be lower.

I Want To Delay Part B

If you qualify and decide you want to delay enrolling in Medicare Part B, you should not face any late enrollment penalties for Part B. When you lose your employer coverage, you will get an 8-month Special Enrollment Period during which to enroll in Medicare Part B, and Part A if you havent done so already.

Youll also be able to enroll in a Medicare Advantage plan or Part D prescription drug plan in the first two months of this period. Note: if you enroll in Part C or Part D after the first two months of your Special Enrollment Period, you may face late enrollment penalties for Part D. Youll want to also ensure you provide proof of creditable coverage when you enroll in Part D.

You do not need to notify Medicare that you will be delaying Part B unless you are already receiving Social Security or Railroad Retirement Board benefits.

Recommended Reading: Is Obamacare Medicaid Or Medicare

Most Common Mistakes Regarding Part B

The most common mistake we see is from people who confuse Part B and Medigap. Just this week, a reader on our Facebook page commented that she was skipping Part B because she was enrolling in a Medigap plan instead.

She didnt realize that Part B and Medigap are not the same. She cannot purchase Medigap without first enrolling in Part B. I fault our federal government for making this all so confusing.

So just to recap what we covered earlier in this article: Part B is your base outpatient coverage. It pays for 80% of your outpatient services. A Medigap plan is what people with no other coverage buy to pay the other 20%. You need both Parts of Medicare in force before you are eligible to apply for a Medigap plan.

Another common question is: Do I have to apply for Medicare Part B? The answer is yes unless you signed up for Social Security income benefits before you turned 65. These people are automatically enrolled into Medicare.

Ial Medicare Part B Premium Reimbursement

Service retirement and disability benefit recipients who are enrolled in an STRS Ohio medical plan and provide proof of Medicare Part B enrollment may receive partial reimbursement to offset the standard monthly premium charged by Medicare for Part B coverage.

Partial reimbursement of the benefit recipient’s future standard Medicare Part B premium cost will begin after STRS Ohio receives proof of Medicare Part B enrollment. If STRS Ohio receives proof by the 15th of the month, partial reimbursement will begin the first of the following month. If verification is received after the 15th of the month, partial premium reimbursement will begin the first day of the second following month. Partial reimbursement is not applied retroactively based on your Medicare effective date. You will receive reimbursement for future monthly premiums only after you submit proof of Medicare Part B coverage.

If you are eligible to receive a Medicare Part B premium reimbursement through more than one Ohio public retirement system, specific guidelines apply. Its your responsibility to contact STRS Ohio to determine which system is responsible for providing your reimbursement you may not receive more than one Part B premium reimbursement. Please call STRS Ohio for Medicare Part B premium reimbursement guidelines.

Also Check: Which One Is Better Medicare Or Medicaid

Medicare Part B Special Circumstances

Some people dont need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special conditions. And some people choose not to enroll in Medicare Part B, because they dont want to pay for medical coverage they feel they dont need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage. In this section, well discuss a few reasons to hold off on Medicare Part B, as well as how Obamacare affects Medicare Part B coverage.

For starters, people who are still working when they qualify for Medicare may not need to get Part B coverage right away. If you have insurance through your employer, then you most likely already have medical coverage. However, you should still meet with your plan administrator to find out how your current insurance works with Medicare, because some policies change once youre eligible for Medicare. Other special situations include the following:

Once you stop working or lose your work-based coverage, you have an eight-month period to enroll in Medicare Part B. If you dont enroll during this time, you may have to pay the late enrollment penalty every month that you have Part B coverage sometimes indefinitely. Also, you may face a serious coverage gap if you wait to enroll.

Do I Need Medicare Part B

January 2, 2021 By Danielle Kunkle Roberts

Imagine if you had a heart attack and needed open heart surgery. Now imagine that you did not have any coverage for that and would need to pay 100% of the cost of that surgery. Pretty upsetting thought, isnt it?

That could potentially happen if you fail to enroll in Part B, and its astonishing how often it happens. We get calls from at least a dozen people every year who either misunderstood about what they really needed to have. Now they have some significant health issue and are learning they have no way to pay for their care.

So if you are wondering Do I Need Medicare Part B this post will really help you. Lets tackle this question by looking at some common scenarios.

This article has been updated for 2022.

You May Like: How Much Does Medicare Cost Me

Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

The Coverage Under Medicare Part D

The medicare part d refers to outpatient assistance, which is mainly utilized for providing coverage in seeking of medical facilities. According to the medicare part d claims processing, those drugs which are self-administered by the patient such as creams, ointments, pain sprays, liquid remedies, tablets, capsules and other supplements that are used for the treatment of common diseases. These drugs are self-administered by the patient and are eligible under medicare part d claims processing.

Most of the drugs which are covered in part d are also eligible for the billing and claim to process under part b, completely depending upon the usage, administration and the prescribed treatment. However, in both cases, proper documentation is required in order to seek a medical claim for the treatment of various specified diseases.

You May Like: Can You Apply For Medicare At 64

Medicare Part B Enrollment: How Do I Get Medicare Part B

To be eligible for Medicare, you must be a United States citizen or legal permanent resident of at least five continuous years and 65 years or older. You can also be eligible for Medicare before 65 if youve been receiving disability benefits from Social Security or the Railroad Retirement Board for at least two years, or if you have end-stage renal disease or amyotrophic lateral sclerosis .

Like other parts of Medicare, there are rules concerning when youre eligible and when you can sign up for coverage. If youre already receiving retirement benefits before you turn 65, you may be automatically enrolled in Medicare Part A and/or Part B the month that you turn 65. Youre also automatically enrolled in Medicare if youve been receiving Social Security or Railroad Retirement Board disability benefits for at least two years youll be automatically enrolled in the 25th month of disability benefits. Those who qualify for Medicare because of end-stage renal disease must manually sign up for Part B.

You can also sign up for Medicare Part B during the following periods:

You can enroll in Medicare Part B through Social Security in the following ways:

- Online at SSA.gov. If youre not yet ready to apply for retirement benefits, you can apply for Medicare only.

- In-person at a local Social Security office.

Why Could The Premium Change

According to the Washington Post, this is the first time that Medicare has considered a change to its premiums after announcing its annual figures. But this years Part B premium rise the largest dollar amount increase in program history has been an unusual situation.

The dramatic increase was largely in response to the uncertainty surrounding new Alzheimers drug Aduhelm. The drug, which was approved by the Food and Drug Administration this past summer under controversial circumstances, was set to cost $56,000 for a year of treatment. The National Council on Aging also noted that the drug has yet to show clinically significant evidence that it is effective in treating Alzheimers.

Medicare would have been faced with a virtually unprecedented rise in costs if it opted to cover Aduhelm, and that uncertainty was named as a key factor by CMS in its Part B premium rise. But that uncertainty appears to be moving towards a resolution.

Becerras directive was in response to Biogen, the company that makes Aduhlem, dropping its cost to $28,200 according to AARP. On top of that price change, Medicare appears to be closing in on a decision to not offer significant coverage for the drug.

Don’t Miss: How Much Does Medicare Cover For Nursing Home Care

Is Medicare Part A Mandatory

Technically, no Medicare Part A is not mandatory.

If you dont sign up for Medicare Part A, however, you must withdraw from all federal benefits programs. That means you cannot receive Social Security or Railroad Retirement Board benefits. You must also repay any benefits you have already received if you decline Medicare. This is one reason why most people keep their Part A coverage once their eligible.

You will qualify for premium-free Medicare Part A benefits if you worked and paid Medicare taxes for at least 10 full years .

Most beneficiaries qualify for premium-free Part A. Enrolling in Medicare Part A does not kick you off your existing health coverage.

Medicare works with other types of insurance, such as employer coverage, VA insurance and Tricare. If you are still working and have quality health insurance provided by your employer, you can have coordination of benefits to cover your health care costs.

- If your employer has fewer than 20 employees, Medicare will be the primary payer. That means Medicare will pay first for any covered care you receive, and then your employer insurance will pick up the rest of the services covered by that plan.

- If your employer has 20 or more employees, your employer insurance will pay first and Medicare will serve as the secondary payer to pick up any additional covered services.

Some Medicare beneficiaries have to pay a premium for their Part A coverage.