Special Enrollment Periods For Medicare

Medicare special enrollment periods can happen any time during the year due to changes to your personal circumstances.

Examples of Medicare Special Enrollment Qualifying Events

- Moving somewhere outside of the coverage area of your current Medicare Advantage plan

- Phasing out of your employers health insurance plan

- Your current Medicare Advantage provider ending its contract with Medicare

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

When And How To Enroll In Medicare Advantage

First you need to enroll in Medicare Part A and B, which you can do from the three months before you turn 65 to the three months after you turn 65. If you miss your initial enrollment period, you can enroll during the General Enrollment Period that takes place from January 1 to March 31 each year. You can apply for Medicare online, in person or by phone through Social Security.

Once youve enrolled in Original Medicare, you can start comparing MA plans in Texas. You have several opportunities to sign up for a plan:

- Initial Enrollment Period: This is the same period when you can enroll in Original Medicare.

- Medicare Annual Election Period: Change your plan or join Medicare Advantage for the first time each year during Medicare Open Enrollment, which runs October 15 to December 7.

- Medicare Advantage Open Enrollment Period: Already have an MA plan? You can switch plans or change to Original Medicare during this annual period, which runs from January 1 to March 31.

- Special Enrollment Period: You can enroll in a plan or change your plan anytime under certain circumstances, such as:

- Youre moving outside your plans service area.

- Youre getting coverage from a different plan, like a union or employer plan.

- Youre losing your current coverage or becoming ineligible for Medicaid.

- Your plan is no longer going to be offered or is leaving Medicare.

- Youve been diagnosed with a condition that requires an SNP.

Also Check: What Is Medicare Extra Help

How Do I Qualify For Medicare And When Am I Eligible

Qualifying for Medicare is a simple procedure. As a federally funded program, Medicare is available as health insurance for all people 65 or older and those with disabilities or permanent kidney failure. Medicare has four Parts A, B, C and D. Generally, Part A is provided at no cost, while the other benefits are available with premium payments.

Medicare Part D Plans In Texas

A Medicare Part D plan is a stand-alone prescription drug plan for those who get their benefits through Original Medicare, rather than Medicare Advantage. Medicare Part D plan options change each year. For 2022, there are 26 Medicare Part D plans available in Texas, and the same set of plans is available in each of the state’s counties.

The best Medicare Part D plans will provide a balance of good benefits, reasonably strong ratings and affordable rates. And among the providers operating in Texas, two companies stand out.

For 2022, we recommend Humana as the best overall Medicare Part D in Texas for its strong rating of 4.2 out of 5 stars and reasonable average cost of $40 per month. However, the trade-off with Humana is that these higher-rated plans are more expensive than similar coverage from a different provider.

For cheap prescription drug coverage, we recommend Aetna Medicare Part D, which has a lower average cost of $33 per month, but it also has a lower star rating of 3.8 out of 5 stars. Aetna is a great deal for those who are looking for affordable coverage because plans start at just $7 per month. Plus, Aetna also has the best deal on a no-deductible plan. This plan is a great choice for those who expect to have significant or expensive prescription drug needs.

| Company | ||

|---|---|---|

| Blue Cross and Blue Shield of IL, NM, OK, TX | 4.0 | $102 |

Best overall Medicare Part D in Texas

Best cheap Medicare Part D in Texas

Recommended Reading: Does Medigap Cover Medicare Deductible

Helpful Resources For Texas Medicare Beneficiaries And Their Caregivers

Need help with your Medicare application in Texas, or have questions about Medicare eligibility in Texas? These resources provide free assistance and information.

- The Health Information, Counseling, and Advocacy Program , with any questions related to Medicare coverage in Texas. Visit the website or call 1-800-252-9240.The Texas Department of Insurance has a resources page for Texas residents with Medicare coverage.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

About our health insurance quote forms and phone lines

We do not sell insurance products, but this form will connect you with partners of healthinsurance.org who do sell insurance products. You may submit your information through this form, or call to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

With respect to Medicare: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1800 MEDICARE to get information on all of your options.

If you have questions or comments on this service, please contact us.

What Is The Income Limit For Medicaid In Texas

The monthly income limit to be eligible as a Qualified Medicare Beneficiary is $1,153 for individuals and $1,546 for couples for 2022. The QMB program covers Medicare Part A and Part B. To be eligible as a Specified Low-Income Medicare Beneficiary, the monthly income limit is $1,379 for individuals and $1,851 for couples for 2022.

Don’t Miss: How Do I Find My Medicare Number As A Provider

Is Medicare Free In Texas

Medicare Part A is free for about 99% of Texans because of the Medicare taxes paid during working years. In addition, free Medicare Advantage plans are available, which provide bundled coverage that often includes dental, vision and prescription drug benefits. However, all Medicare enrollees must pay for Medicare Part B , with the standard rate for 2022 set at $170.10 per month.

How Does My Child Change Plans

If a different Medicare plan will work better for your young adult, they can switch but only at certain times of the year.

- If they want to sign up for or switch between Medicare Advantage, Prescription Drug, or Supplemental Insurance plans, they can do it during the yearly open enrollment period that runs from October 15 to December 7. Work with the new insurance company to make a plan change or sign up. Call your old insurance company, if necessary, to drop coverage.

- If they want to drop a Medicare Advantage Plan and switch to Original Medicare, they can do this from January 1 to February 14. Call the current insurance plan company or 1-800-MEDICARE to make this switch. While making this switch, they can also add a new Prescription Drug plan or Supplemental Plan at the same time.

You May Like: What Is The Cost Of Medicare Part C For 2020

Should I Enroll In Medicare Part D

No. Medicare-eligible retirees, dependents and survivors who are enrolled in Medicare Parts A and/or B, as well as either HealthSelect MA PPO or HealthSelect Secondary, have prescription drug coverage through HealthSelect Medicare Rx This plan is as good as or better than most private Medicare Part D plans.

Resources

Medicare Resources In Texas

Making the right Medicare decision is important. Texas offers a variety of resources to help support enrollees and inform them about their plan options. In addition, many nonprofit organizations, Area Agencies on Aging , and state and local public health agencies offer programs geared toward helping older residents age in place with a high quality of life. Start with these resources.

Don’t Miss: What Is The Official Medicare Website

How To Apply For Medicaid In Tx

How to Apply for Texas Medicaid. Texas seniors can apply online for Medicaid at Your Texas Benefits or submit a completed paper application, which can be found here. For assistance with the application process or to request a paper application be mailed to you, call Texas Health and Human Services at 1-877-541-7905.

Recommended Reading: Does Medicare Pay For Shower Chairs

Medicare Enrollment In Texas

The number of Medicare beneficiaries in Texas stood at 4,441,418 as of April 2022. Only Florida and California have more residents enrolled in Medicare.

But less than 15% of the Texas population is enrolled in Medicare, compared with about 19% of the United States population enrolled in Medicare. Texas has among the youngest populations in the country, and since most people become eligible for Medicare enrollment when they turn 65, the states lower median age results in a smaller percentage of its residents filing for Medicare benefits.

Although most people become eligible for Medicare coverage enrollment when they turn 65, Medicare also provides coverage for people under age 65. Those who have been receiving disability benefits for 24 months, have ALS, or have end-stage renal disease are eligible for Medicare. Twelve percent of all Medicare beneficiaries in Texas and nationwide were under the age of 65 as of April 2022.

Don’t Miss: How Do I Get A Medicare Explanation Of Benefits

Full Retirement Age By Year

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

An easy way to think about full benefits and retirement age is this,

- Social Security will reduce your payments if you choose to receive your benefit before full retirement age. The percentage of reduced amount is highest at age 62 and decreases until you reach full retirement age.

- If you choose to receive Social Security payments when you reach full retirement, you will get the total amount.

- Suppose you choose not to receive Social Security payments when you reach full retirement and delay your benefit. In that case, you can increase the amount of your payment by earning delayed retirement credits.

If youre not sure when you reach full retirement age, our table provides the years and months you need to know for full retirement.

How Does Medicaid Provide Financial Assistance To Medicare Beneficiaries In Texas

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums and services Medicare doesnt cover such as long-term care.

Our guide to financial assistance for Medicare enrollees in Texas includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

You May Like: How Does Medicare For All Work

What Are The Typical Age Requirements For Medicare Coverage

The typical Medicare age requirement is 65, or younger if you qualify for disability benefits. In addition to meeting the age requirement of 65, you must also be a U.S. citizen or legal permanent resident before you are eligible for Medicare.

Most people who are 65 qualify for premium-free Medicare Part A because they have worked for at least ten years and have paid Medicare taxes. Medicare Part A helps cover hospitalization, skilled nursing facility, home health care, and hospice costs. If you are not eligible for premium-free Part A because you have not worked and paid Medicare taxes, but are a citizen with permanent residency and are 65, you can pay premiums to have Part A coverage. If your spouse has worked long enough to qualify for premium-free Part A, your Part A premiums will be free after your spouse turns 62.

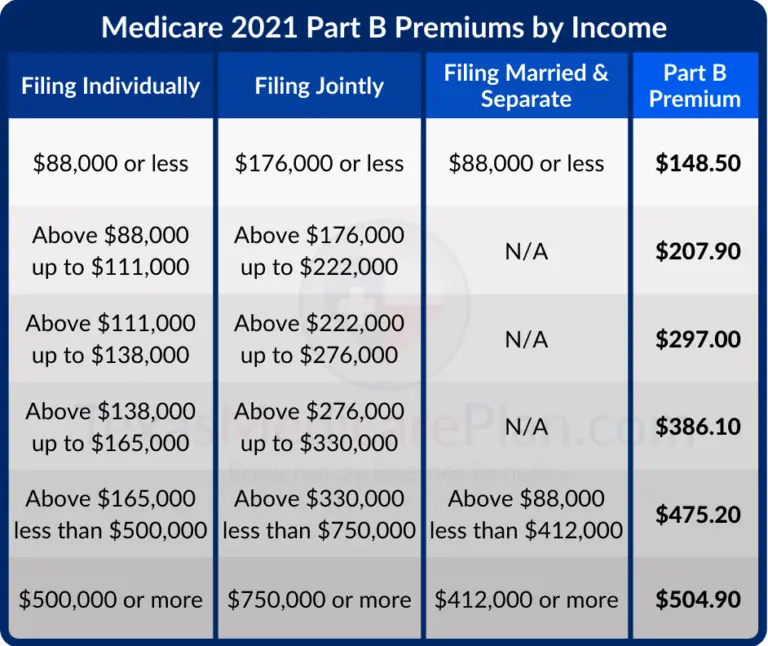

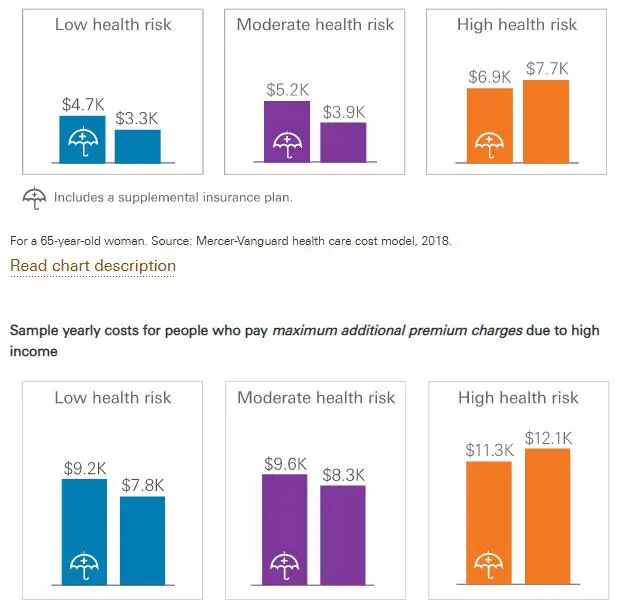

When you meet the requirements for Part A, you also qualify for Medicare Part B which helps cover medical out patient costs such as doctors visits, urgent care, durable medical equipment , some preventive care, and more. If you have Part B, there is a monthly premium you pay, which is $148.50 for 2021, and an annual deductible of $203.

If You Are Turning 65 And Still Working:

If you work for a state agency or higher education institution that participates in the Texas Employees Group Benefits Program

When eligible, you should enroll in free Medicare Part A. While you are working, Medicare Part A hospitalization coverage is secondary to your state health insurance. You can delay your enrollment in Medicare Part B until about 90 days before your retirement date.

Note: If you are not eligible for free Medicare Part A, SSA will send you a letter explaining the reason. Upon retiring, send a copy of this notification directly to your health plan administrator so they know they should be the primary payer on claims submitted for Medicare Part A services. If you are not eligible for free Medicare Part A, you can still enroll in Medicare Part B through the SSA.

Split households

The above also applies if you are actively working and a dependent covered on your state health insurance becomes eligible for Medicare.

Read Also: When Applying For Medicare What Documents Do I Need

Reaching Age 62 Can Affect Your Spouse’s Medicare Premiums

Although reaching age 62 does not qualify you for Medicare, it can carry some significance for your spouse if they receive Medicare benefits.

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they havent yet qualified based on their own work history.

- For example, Gerald is 65 years old, but he doesnt qualify for premium-free Part A because he did not work the minimum number of years required for eligibility. He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

- Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

In the above example, Jessica has not become eligible for Medicare by turning 62. Her husband Gerald, however, is now eligible to receive his Medicare Part A benefits without paying a monthly premium any longer.

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Don’t Miss: What Is The Best Medicare Advantage Plan In Georgia

When Does Medicare Open Enrollment Start

Much confusion is generated concerning the use of the term Open Enrollment in Medicare. Many use it to refer to the Annual Enrollment Period which runs from October 15 through December 7 with coverage beginning January 1. During this period, you can newly enroll, change, or disenroll in Part C Medicare Advantage Plans or Part D prescription drug plans.

The term Open Enrollment is often used to refer to the Medicare Advantage-Open Enrollment which runs from January 1 through March 31 each year with coverage beginning the first of the month after enrollment. This period allows for those already enrolled in Medicare Advantage Plans to change their coverage options or return to Original Medicare.

Open Enrollment is also used to refer to the IEP for Original Medicare. This seven-month period begins three months before you turn 65, includes the month you turn 65 and ends three months after the month in which you turn 65.

During this period, you can enroll in Parts A and B. If you enroll in both parts, you may sign up for an Advantage Plan, Drug Plan, or Supplement Plan offered in your area with no underwriting questions asked. Coverage for these plans will start concurrently with your Part B enrollment.

Getting Help With A Medicare Insurance Plan

Now you have an idea of when your Medicare insurance coverage will be. Now its time to think about supplemental insurance to help cover the cost left over by Original Medicare.

Our licensed insurance agents can help assist with every aspect of Medicare. From teaching you to understand the Medicare hospital insurance to how the Medicare Part B premiums work.

We can help review the insurance companies in your area that offer Medicare Supplement and Medicare Advantage plans and help you find the coverage you need. Simply give us a call or fill out our online request form.

Also Check: Can You Get Medicare Early If You Are Disabled

Medicare Start Dates By Plan

It is always best to enroll in Original Medicare Parts A and B when you are first eligible. If you do not have a Special Enrollment Period , you may encounter penalties and delayed coverage when enrolling later.

If youre eligible for Medicare when you turn 65, you can sign up during your Initial Enrollment Period . This seven-month period begins three months before the month you turn 65, includes the month you turn 65, and ends three months after the month in which you turn 65.

Learn more on Medicare Advantage enrollment periods.