Is It Hard To Qualify For Medicaid

As long as you meet the eligibility rules in your state, it is not hard to qualify for Medicaid. After all, almost 74 million Americans are covered by the program.

Contact your state Medicaid program in order to apply for Medicaid. Applications are generally reviewed and approved within 90 days and typically are reviewed sooner.

Medicaid And Chip Scorecard Links

State per capita expenditures provide information about each states Medicaid program and all the populations they serve. The following estimates provide average annual Medicaid expenditures per enrollee for calendar years 2018 and 2019 by state for five eligibility groups:

The estimates rely on total spending reported by states to the Medicaid Budget and Expenditure System and the number of enrollees and their expenditures reported by states in the Transformed Medicaid Statistical Information System . The calculations exclude all Childrens Health Insurance Program spending and enrollment through both Medicaid CHIP and separate CHIP programs.

The validity of the results presented here is directly related to the accuracy of state-reported data. For this reason, data quality assessments across four domains and an overall assessment of data quality are included to evaluate the usability of each states data to produce the per capita expenditure estimates. The data quality assessments are similar to the approaches used in the 2020 Scorecard, but are now drawn from data quality analyses in the DQ Atlas. The criteria for assigning states a level of overall data quality concern are:

Low overall level of data quality concern: the states data was assessed as low data quality concern across all four domains.

| 2019 |

What Do Medicare And Medicaid Cover

Medicare Part A is hospital insurance and Part B is medical insurance. Medicare Part D is prescription drug coverage, and Part C is an all-in-one coverage option that combines Parts A, B and D, as well as other benefits that may include items like dental, vision, fitness and hearing. Medicare Part A and Part B coverage is standard, but Part C and Part D will vary based in terms of coverage provided depending on the plan, the insurance provider and your location.

Medicaid programs includefederally mandated benefitsand optional benefits. Each state decides what optional benefits to include

Don’t Miss: Does Medicare Cover Erectile Dysfunction Pumps

What Would Medicare For All Cost To Run

Estimated administrative costs as a share of all spending

| friedman | |

|---|---|

| 6% | 5% |

The complexity of the American system means that administrative costs can often be high. Insurance companies spend on negotiations, claims review, marketing and sometimes shareholder returns. One key possible advantage of a Medicare for all system would be to strip away some of those overhead costs.

But estimating possible savings in management and administration is not easy. Medicare currently has a much lower administrative cost share than other forms of insurance, but it also covers sicker people, distorting such comparisons. Certain administrative functions, like fraud detection, can have a substantial return on investment.

The economists all said administrative costs would be lower under Medicare for all, but they differed on how much. Those differences amount to percentage points on top of the differing estimates of medical spending. On this question, there was rough agreement among our estimators that administrative costs would be no higher than 6 percent of medical costs, a number similar to the administrative costs that large employers spend on their health plans. Mr. Blahous said a 6 percent estimate would probably apply to populations currently covered under private insurance, but did not calculate an overall rate.

How Is Medicare Funded

The Centers for Medicare & Medicaid Services is the federal agency that runs the Medicare Program. CMS is a branch of the Department of Health & Human Services .

CMS also monitors

programs offered by each state.

In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

Recommended Reading: What Makes You Eligible For Medicare

How Do Medicare And Medicaid Work Together

Medicare and Medicaid work together to cover medical costs for an individual who qualifies for both programs. First, Medicare pays for Medicare covered services then, Medicaid pays once all Medicare and any other health insurance expenses have been paid. The coverage provided depends on the persons specific health needs.

How Is Medicare Financed

Medicare is funded primarily from general revenues , payroll taxes , and beneficiary premiums .

Figure 7: Sources of Medicare Revenue, 2018

- Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees . Higher-income taxpayers pay a higher payroll tax on earnings .

- Part B is financed through general revenues , beneficiary premiums , and interest and other sources . Beneficiaries with annual incomes over $85,000/individual or $170,000/couple pay a higher, income-related Part B premium reflecting a larger share of total Part B spending, ranging from 35 percent to 85 percent.

- Part D is financed by general revenues , beneficiary premiums , and state payments for beneficiaries dually eligible for Medicare and Medicaid . Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

- The Medicare Advantage program is not separately financed. Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan about half of Medicare Advantage enrollees pay no additional premium.

Also Check: When Can I Start Collecting Medicare Benefits

What Medicaid Helps Pay For

If you have Medicare and qualify for full Medicaid coverage:

- Your state will pay your Medicare Part B monthly premiums.

- Depending on the level of Medicaid you qualify for, your state might pay for:

- Your share of Medicare costs, like deductibles, coinsurance, and copayments.

- Part A premiums, if you have to pay a premium for that coverage.

What Is The Lowest Income To Qualify For Medicaid

There are 13 states that do not grant Medicaid access to individuals based on income alone.

Of those that do, only Wisconsin uses a limit lower than 138%. An individual in Wisconsin can make no more than the federal poverty level in order to qualify for Medicaid.

Texas has the lowest income limit to qualify on a family basis, at 17% of the FPL. A two-parent household with one child in Texas can make no more than $37,332 and qualify for Medicaid.

Recommended Reading: Are Medicare Premiums Based On Income

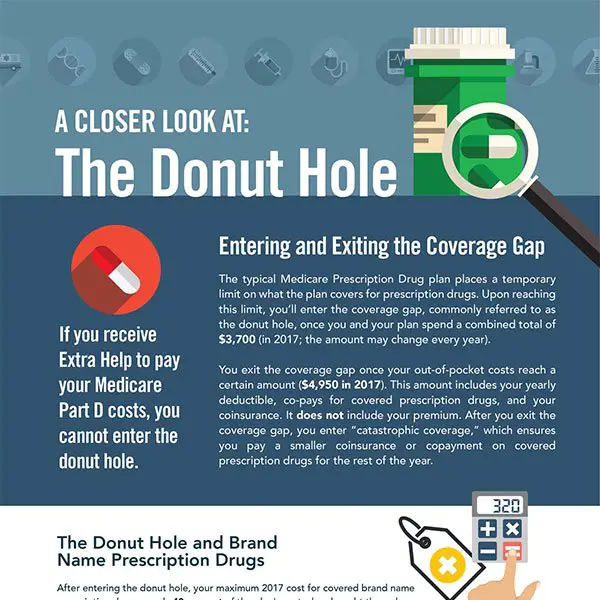

Paying For A Prescription Drug Plan

If you qualify for theQMB, SLMB or QI Medicare Savings Programs, then you also automatically qualify for a program called Extra Help designed to help with paying for your prescription drugs. Prescription drug coverage is provided through Medicare Part D, which is why Extra Help is also known as the Part D Low-Income Subsidy. Part D coverage generally comes with a premium, a deductible and a copayment or coinsurance. Learn more about Medicare Part D here.

But you dont have to be in a Medicare Savings Program to receive help paying for your prescriptions under Extra Help. If your annual income as an individual is up to $1,698 per month or $2,288 as a couple in 2022, you may be eligible. Asset limits in 2022 are up to $15,510 for an individual or $30,950 for a couple.

Depending on which Medicare Part D plan you choose, the program can reduce or eliminate your plans premium and deductible, and also lower the cost you pay for the prescription drugs covered under your plan.

People Who Have Both Medicare & Medicaid

People who have both Medicare and full Medicaid coverage are dually eligible. Medicare pays first when youre a dual eligible and you get Medicare-covered services. Medicaid pays last, after Medicare and any other health insurance you have.

You can still pick how you want to get your Medicare coverage: Original Medicare or Medicare Advantage . Check your Medicare coverage options.

If you choose to join a Medicare Advantage Plan, there are special plans for dual eligibles that make it easier for you to get the services you need, include Medicare coverage , and may also cost less, like:

- Special Needs Plans

- Medicare-Medicaid Plans

- Program of All-Inclusive Care for the Elderly plans can help certain people get care outside of a nursing home

You May Like: Do I Really Need A Medicare Advantage Plan

How Much Does Medicare Part A Cost In 2022

Premiums for Medicare Part A are $0 if youre getting or are eligible for federal retirement benefits. Its also premium-free if youre under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease. If youre eligible for Medicare, but not other federal benefits, youll pay a Part A premium of $274 or $499 each month, depending on how long youve paid Medicare taxes.

The deductible for Medicare Part A is $1,556 per benefit period. A benefit period begins the day youre admitted to a hospital and ends once you havent received in-hospital care for 60 days.

The Medicare Part A coinsurance amount varies, depending on how long youre in the hospital. Coinsurance is typically a percentage of the costs, but Medicare designates the coinsurance as a flat fee.

Heres how much youll pay for inpatient hospital care with Medicare Part A:

-

Days 1-60: $0 per day each benefit period, after paying your deductible.

-

Days 61-90: $389 per day each benefit period.

-

Day 91 and beyond: $778 for each “lifetime reserve day” after benefit period. You get a total of 60 lifetime reserve days until you die.

-

After lifetime reserve days: All costs.

The cost of a stay at a skilled nursing facility is different. This is what a skilled nursing facility costs under Medicare Part A:

-

Days 1-20: $0 per day each benefit period, after paying your deductible.

-

Days 21-100: $194.50 per day each benefit period.

-

Day 101 and beyond: All costs.

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

Also Check: Is Medigold A Medicare Advantage Plan

Example Of A Medicare Tax Bill For A High Earner

The total tax bill for Medicare that could be paid by a high-income taxpayer could look something like this:

Jerry is single and has inherited several pieces of land that produce oil and gas income at the wellhead. He also works as a salesman for a local technology company and earned $225,000 of 1099 income this year. His oil and gas royalties for the year total $50,000, and he also realized capital gains of about $20,000 from the sale of stock.

Key Differences Between Medicare And Medicaid

A key difference between Medicare and Medicaid is that one is mainly based on age, and the other is a welfare program for people of all ages with limited financial means.

Medicare assists people 65 or older. In some cases, people under 65 with certain health concerns may be able to sign up. This only applies to the person who qualifies, but not the person’s entire family. Medicaid is jointly run by the state and federal governments. It is for people whose eligibility is based on income rather than age or disability. It helps people and families who meet income limits get health care.

You can apply for Medicaid at any time. You do not have to wait for an open enrollment period. In most cases, people who qualify for it may be exempt from the individual penalty. There’s more on that below. When you apply for Medicare outside the time to enroll, you may have a penalty.

Read Also: Does Medicare Cover Oxygen At Home

Does Medicare Pay For A Nursing Home

Unfortunately, Original Medicare doesnt cover the cost of a long-term stay at a nursing home, but certain parts of Medicare can pay for medically necessary or essential services at nursing homes. Some of these services include meal preparation, prescription drugs, durable medical equipment, counseling, and other services. Overall, Original Medicare covers short-term visits, but not long-term stays.

Can You Have Both Medicare And Medicaid

Yes, some people can have both Medicare and Medicaid. People who qualify for both Medicare and Medicaid are called dual eligible. If you qualify and choose to enroll in both programs, the two can work together to help cover most of your health care costs. You may also be eligible for a special kind of Medicare Advantage plan called a Dual Special Needs Plan. You canlearn more about being dual eligible and how Medicare coverage can work for you here.

Also Check: Does Medicare Cover Naturopathic Doctors

Medicare Vs Medicaid: Eligibility

Medicare eligibility is mostly based on age, while Medicaid eligibility is mostly based on income.

Medicare: Age-based eligibility for Medicare starts when you turn 65. Medicare also covers certain younger people with disabilities and specific diseases, including end-stage renal disease and amyotrophic lateral sclerosis, also called ALS or Lou Gehrigs disease

Medicaid: Medicaid coverage is based on income. Medicaid is available in every state to those with incomes below the federal poverty level, or FPL. Under the Affordable Care Act, most states have expanded Medicaid eligibility to people with incomes up to 133% of the FPL.

You can enter your information at healthcare.gov/lower-costs to see whether you qualify based on your states rules.

Qualifying for both Medicare and Medicaid is called dual eligibility. A person who qualifies for both programs might be referred to as dual eligible or dually eligible.

Additional Cares Act Funding

On March 27, 2020, former President Donald Trump signed the CARES Acta $2 trillion coronavirus emergency relief packageinto law. A sizable chunk of those funds$100 billionwas earmarked for healthcare providers and suppliers, including those that are Medicare and Medicaid enrolled for expenses related to COVID-19.

Below are some examples of what the additional funding covers:

- A 20% increase in Medicare payments to hospitals for COVID-19 patients.

- A scheduled payment reduction was eliminated for hospitals treating Medicare patients from May 1, 2020, through Dec. 31, 2020.

- An increase in Medicaid funds for states.

You May Like: What Is A Clia Number For Medicare

Nhe By State Of Residence 1991

- In 2020, per capita personal health care spending ranged from $7,522 in Utah to $14,007 in New York. Per capita spending in New York state was 37 percent higher than the national average while spending in Utah was about 26 percent lower.

- Health care spending by region continued to exhibit considerable variation. In 2020, the New England and Mideast regions had the highest levels of total per capita personal health care spending , or 25 and 23 percent higher than the national average. In contrast, the Rocky Mountain and Southwest regions had the lowest levels of total personal health care spending per capita with average spending 17 and 16 percent lower than the national average, respectively.

- Between 2014 and 2020, average growth in per capita personal health care spending was highest in New York at 6.1 percent per year and lowest in Wisconsin at 3.0 percent per year .

- The spread between the highest and the lowest per capita personal health spending across the states has remained relatively stable over 2014-20. Accordingly, the highest per capita spending levels were 90 to 100 percent higher per year than the lowest per capita spending levels during the period.

- Medicare expenditures per beneficiary were highest in Florida and lowest in Vermont in 2020.

- Medicaid expenditures per enrollee were highest in North Dakota and lowest in Georgia in 2020.

For further detail, see health expenditures by state of residence in downloads below.

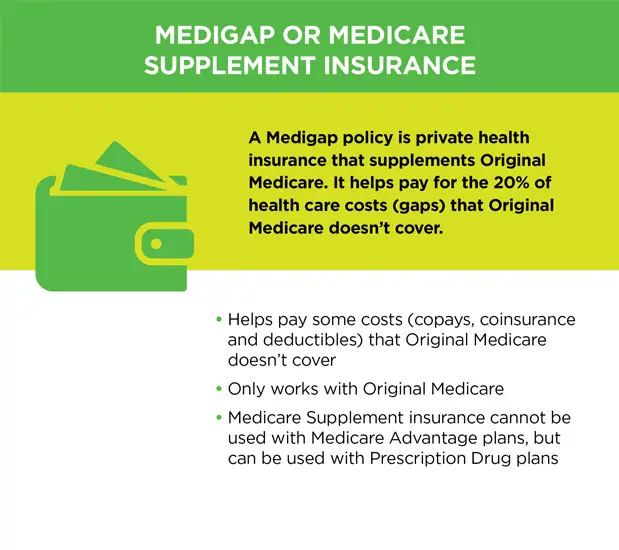

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Also Check: Does Medicare Pay For A Portable Oxygen Concentrator

What Is The Medicaid Income Limit In My State

Most states use a standard of 138% of the federal poverty level as a basis for Medicaid eligibility. But each state is free to set its own limits.

The table below shows the income limit as a percentage of the FPL required for Medicaid eligibility in each state for two-parent households and for individuals adults.

If 0% appears, that means individuals may not qualify for Medicaid in that state based on income alone and must meet other criteria, such as being pregnant or disabled.

Medicaid Income Limit by State|

State |

|

|---|---|

| 52% | 0% |

FPL is used to determine eligibility for Medicaid, certain welfare benefits and other assistance programs. The FPL is computed by the U.S. Census Bureau and can be adjusted every year based on inflation.

Medicaid uses a percentage of the FPL to determine its income limits for eligibility. For example, you may qualify for Medicaid if you earn less than 133% of the federal poverty level. Or you may qualify if you earn less than 150% of the federal poverty level and are disabled. Again, each state sets its own income limits to determine Medicaid eligibility.

Contact your state Medicaid program for more eligibility information, as most states offer different types of Medicaid programs that may each have their own income limits and other qualifying criteria. Even if you make more than the standard limit found below, there may be additional programs for which you still qualify.