What Are Other Options

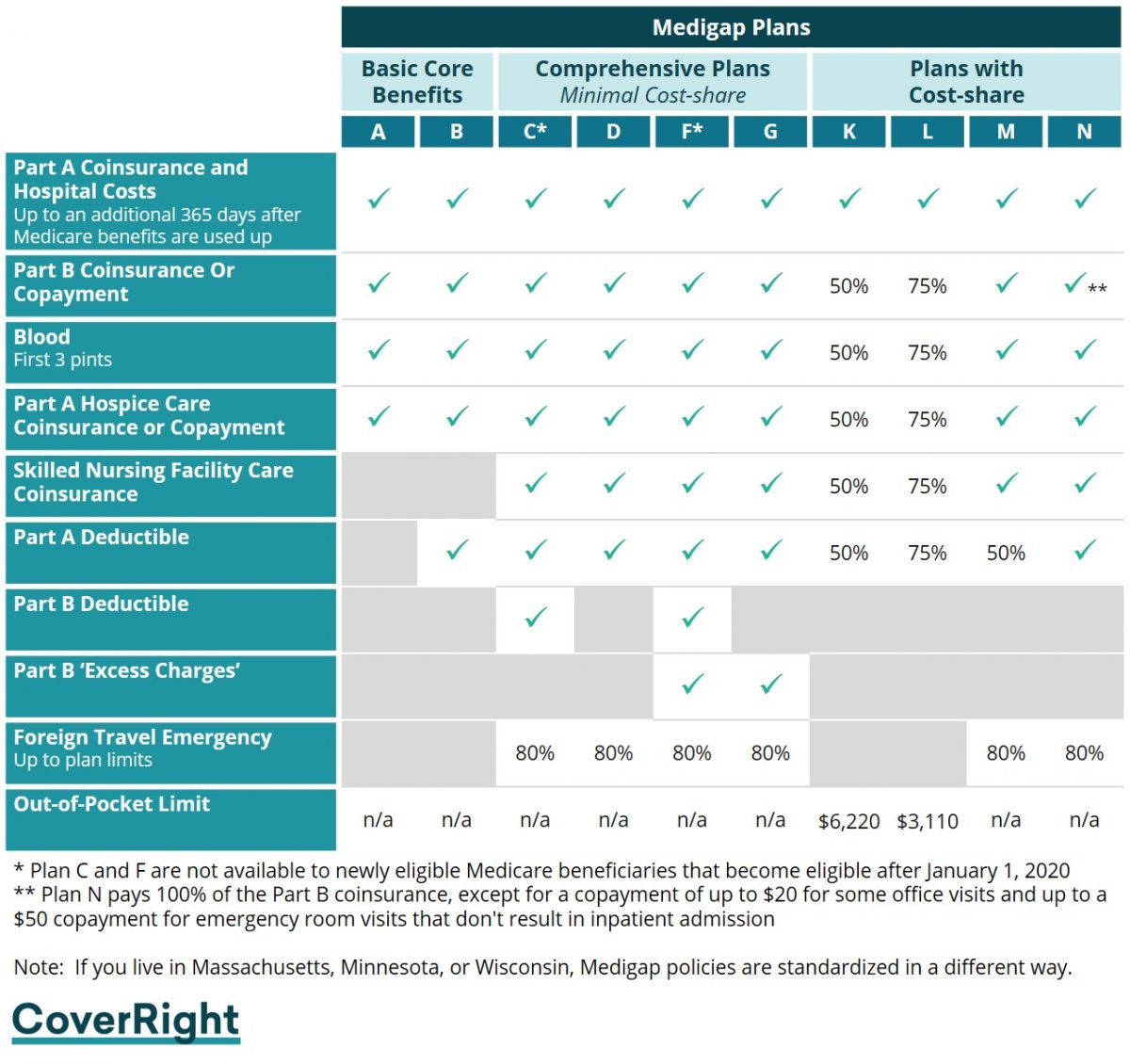

There are nine other plans for beneficiaries to consider, but Plans F, G and N are the most popular.

Plan F has for many years had the highest number of enrollees, covering more than half of policyholders from 2014 to 2017. Plans C, G and N have been popular choices, with G and N gaining popularity for the same time period.8

In 2020, Medigap Plans C and F arent available to those newly eligible for Medicare.9 If youre already a Medicare member, you can still choose Plan F or C.

Plan F and Plan N are often chosen instead of Plan G. Plan F is the most comprehensive Medigap plan since it covers 100% of the gaps in Medicare coverage, so costs more than Plan G or N. This means co-pays for Medicare-covered services and items under Medicare Part A or Part B will be $0 co-pay for those with Plan F. Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

Plan N is the least expensive of these three plans but youll have more out-of-pocket costs with it. With Plan N you are responsible to pay these three items that Plan F covers in full:

- Maximum of $20 for doctor visits and $50 for ER visits

- Part B deductible of $233

If youre more focused on preventive care like doctors visits, and dont expect to have more serious medical needs, then Plan N could save you money.

What You Should Know

|

Plan A includes only the basic core benefits. Plan B includes the basic core benefits and the Medicare Part A deductible. Plan C includes: |

Plan D includes:

- Medically necessary emergency care in a foreign country

Plan F includes:

- 100 percent of Medicare Part B excess charges

- Medically necessary emergency care in a foreign country

High Deductible Plan F includes:

- All Plan F benefits

- While premiums are typically lower under the high deductible option, the insured is required to pay the deductible before the policy will cover your health claims

- The deductible for this plan changes annually

Plan G includes:

- 100 percent of Medicare Part B excess charges

- Medically necessary emergency care in a foreign country

Plan K includes:

- 50 percent of the cost-sharing for Medicare Part A covered hospice expenses

- First three pints of blood

- 50 percent of the Part B co-insurance after meeting the annual deductible

- Payment of the Part A and B deductibles, co-payments, and co-insurance once the annual out-of-pocket spending limit is met

- The deductible for this plan changes annually

Plan L includes:

Plan M includes:

- 50 percent of the Medicare Part A deductible

- Skilled nursing facility care

- Medically necessary emergency care in a foreign country

Plan N includes:

Plans C, F, and F with high deductible may not be offered to individuals newly eligible for Medicare on or after January 1, 2020.

Waiting periods

Important Things To Know About Medicare Supplement Insurance Plans2

- Medicare Supplement insurance plans are not the same as Medicare Advantage plans.

- A Medigap policy only covers 1 person. If you and your spouse both want Medigap coverage, you must buy separate policies.

- Medigap policies do not include prescription drug coverage. If you want prescription drug coverage, you can join a .

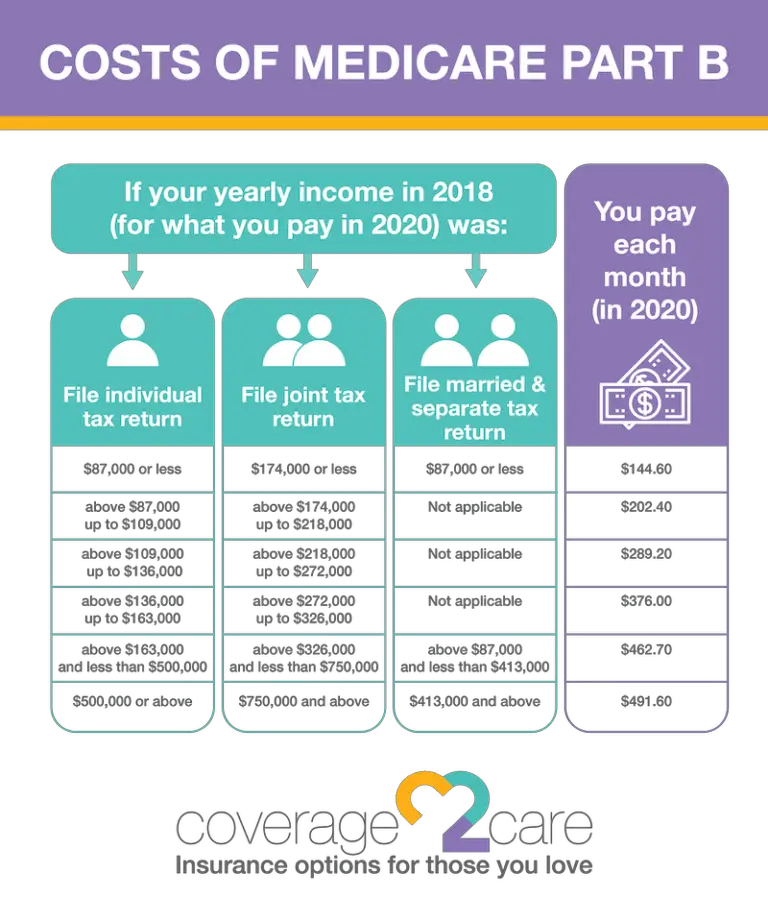

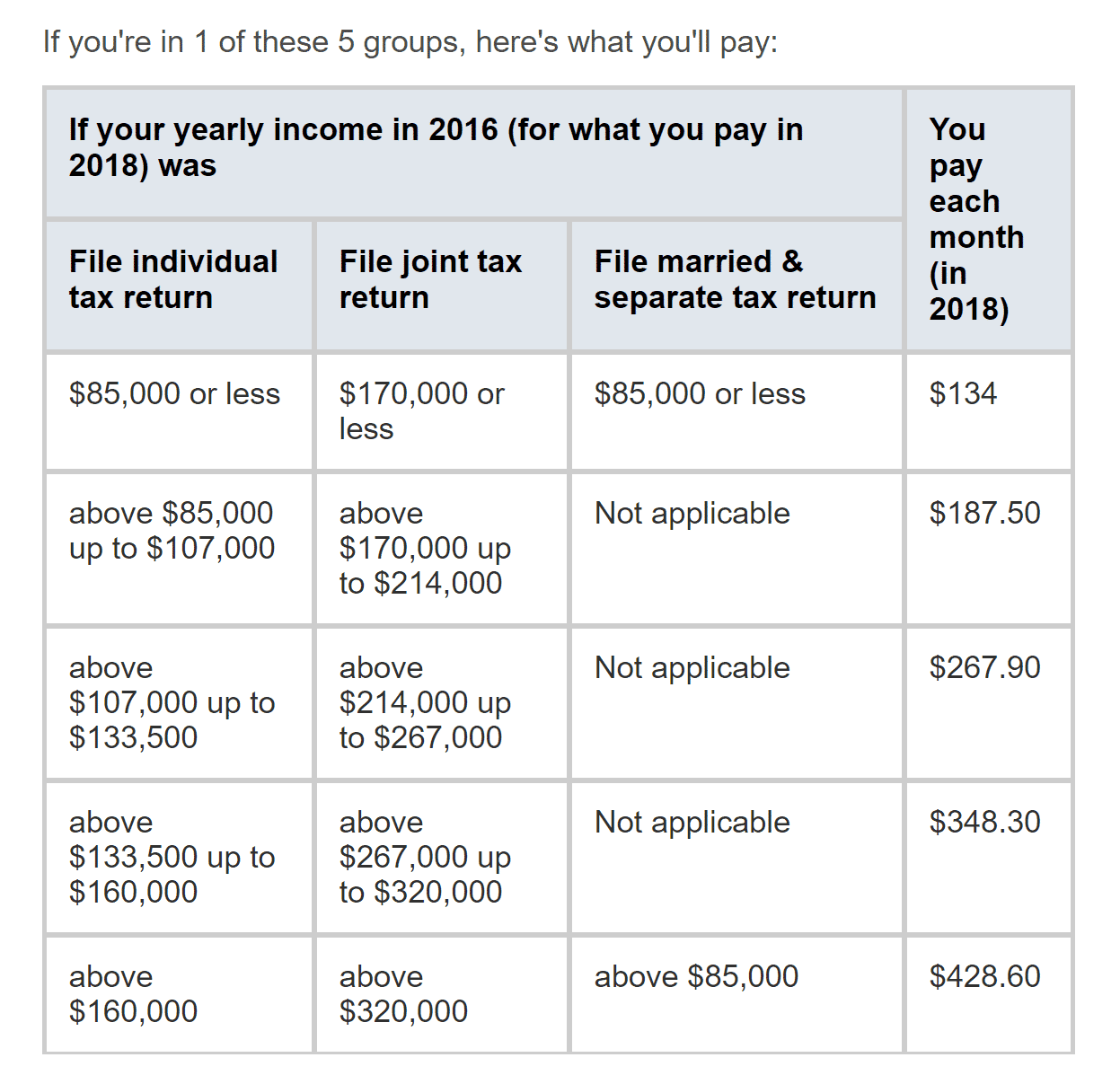

- You will pay a monthly premium when you have a Medicare Supplement plan in addition to the Part B premium to Original Medicare.

- A Medicare Supplement policy is guaranteed renewable even if you have health problems. This means your private insurance company cant cancel your policy as long as you pay the premium and provided accurate information on your application.

- Medigap policies generally dont cover long-term care, vision or dental care, hearing aids, eyeglasses or private-duty nursing.

Recommended Reading: How Much Does Eliquis Cost With Medicare Part D

Does My Medicare Supplement Pay My Part B Deductible

Asked by: Adan Kshlerin

Medicare Supplement insurance plans usually require a monthly premium. Starting January 1, 2020, Medicare Supplement insurance plans can’t cover the Medicare Part B deductible. This eliminates Plan C and Plan F for new beneficiaries. However, if you already have one of these plans, you can keep it.

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesnât have this protection, planning to switch between the systems depending on your health condition is a risky business.

Read Also: How Can I Find Out If I Have Medicare

You May Like: Do Medicare Advantage Plans Include Part B

Medicare Part B Deductible In 2022

For 2022, your Medicare Part B deductible is $233. Thats a $30 increase over 2021.

Unlike Medicare Part A, there is no benefit period tied to Medicare Part B.

After meeting the deductible, youll usually have to pay 20% of the Medicare-approved costs for most doctor services, outpatient care and durable medical equipment things such as wheelchairs or walkers your doctor may order for you.

Does Medigap Cover Original Medicare Deductibles

Medigap insurance, or Medicare Supplements, help to cover out of pocket costs from Medicare Part A and Part B, such as copayments, excess charges, and coinsurance. Some Medicare Supplement plans also cover emergency care costs when you are traveling outside the country.

If youre interested in a Medicare Supplement plan, you may be wondering if your Part A and Part B deductibles will be covered as well. In some cases, they are! However, it will all depend on the plan you have and what you are specifically eligible for.

Also Check: Will Medicare Cover A Lift Chair

When And Where To Buy Medigap Plan G

You can purchase a Medigap Plan G supplement policy through private health insurance companies such as Aetna and UnitedHealthcare. However, not all insurance providers offer Plan G. Therefore, you should research which insurance companies offer a plan that fits your needs and compare quotes so you get your best rate possible.

Starting three months before you turn 65, you have seven months to enroll in Medicare and Plan G, if you choose. You can also sign up for or make changes to your Medicare insurance during open enrollment season, which runs from Oct. 15 to Dec. 7 each year.

Dropping Your Entire Medigap Policy

You may want a completely different Medigap policy . Or, you might decide to switch to a Medicare Advantage Plan that offers prescription drug coverage.

If you decide to drop your entire Medigap policy, you need to be careful about the timing. When you join a new Medicare drug plan, you pay a late enrollment penalty if one of these applies:

- You drop your entire Medigap policy and the drug coverage wasn’t creditable prescription drug coverage

- You go 63 days or more in a row before your new Medicare drug coverage begins

Read Also: Is Medicare Supplement Plan N Good

What Part A Does Not Cover:

- $1,484 deductible when admitted for hospital stay

- Hospital inpatient days 61-90. You pay $371 per day.

- Hospital inpatient days beyond 90 days.* You pay $742 per day.

- Skilled nursing facility stay days 21-100. You pay $185.50 per day.

* You have 60 additional days to use beyond 90 days at the $742 daily rate. These are Lifetime Reserve days you can use across different Benefit Periods . There must be at least 60 days between stays to use Lifetime Reserve days.

These amounts are applied to each benefit period which is when you enter a hospital or skilled nursing facility and ends when you have not received care in those settings for 60 days in a row.

Medicare generally does not pay for Part A and B services or items outside the U.S. and U.S. territories. Medicare may, however, cover inpatient hospital care outside the U.S. under rare circumstances.

Some Medicare Advantage Plans Have Zero Premium True

This is true there are Medicare Advantage plans that do not charge members a monthly fee. However, these plans require members to pay out of pocket a larger percentage of the medical costs they incur. A free plan, for example, could charge you $75.00 to see a specialist, while a plan with a monthly premium could cover that expense without requiring a copay.

Again, be sure to shop carefully and select a Medicare Advantage plan that best fits your healthcare needs and budget. Evaluate the plan to make sure you understand the potential future costs of coverage and what your true cost for healthcare will be.

Read Also: Can A Widow Get Medicare At Age 60

Medicare Supplement Plan N Cost

Lets talk a little bit more about the differences between the two plans, and more specifically what other charges you could incur on Medicare Plan N.

Again, if youre somebody who doesnt go to the doctor very oftenand I have clients who never got to the doctor who loves Plan N because they pay lower premiums all year long.

So they absolutely love it. They know if something happens to them, theyve got outstanding coverage, but their out-of-pocket expenses are going to be minimal, even on a Plan N.

So they love Plan N because they dont go to the doctor very often, but they know they are protected very, very well, God forbid something major happens.

Medicare Select Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

It differs from Medicare Supplement insurance because you are expected to use a network of hospitals associated with the insurance company. In return, you will usually pay lower premiums. Also, in order to enroll in a Medicare SELECT plan, you must live within the service area of a network facility.

Recommended Reading: Do I Have To Have A Medicare Drug Plan

What Carriers Offer Medicare Supplement Plan N

Since Medicare Supplement Plan N is one of the most popular Medigap plans, most large and well-known carriers offer this option. Many lesser-known carriers also offer Medigap Plan N. Ultimately, your choice of companies depends on your location.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

The best carriers that are nationally available who offer Medicare Supplement Plan N include:

- Blue Cross Blue Shield

While this list is not a comprehensive list of carriers offering the plan, the above are some of the highest-rated and most widely available companies.

Is Medigap And Medicare Advantage The Same Thing

Many people compare Medigap vs Medicare Advantage these two policies arent the same thing. The Medigap options give you the freedom to choose doctors, predictable costs, and the ability to travel.

Medicare Advantage plans may have lower premiums, but the out-of-pocket costs can add up quickly. Also, Part C plans require you to stay in the provider network, using doctors only in your service area.

Sure, either plan could be beneficial depending on what you find important, but Medigap generally takes the cake.

Don’t Miss: Does Medicare Offer Dental And Vision Coverage

Am I Eligible For Medigap Plan G

If youre in your Medigap Open Enrollment Period, then you are eligible for Medigap Plan G. Outside of that, the Insurance company could charge more or deny the policy.

In most cases, when you go through underwriting there is no issue with getting you approved.

For those with health issues or concerns about underwriting approval, its best to work with an insurance agent because they can help identify the company most likely to approve your application.

If you qualify for a Special Enrollment Period, you may be entitled to Guaranteed Issue rights, meaning you get to avoid underwriting.

What Are The Types Of Medicare Supplement Plans

There are a wide range of Medicare Supplement plans. The different types of plans are named alphabetically, Plan A through Plan N.

Medicare Supplement plans range from those that offer basic coverage, to those offering a much higher level of coverage. Understanding your health care needs, as well as your financial situation, can help when choosing a Medicare Supplement plan.

Compare Medicare Supplement plans

Don’t Miss: Do Permanent Residents Qualify For Medicare

What Are The Best Medicare Supplement Plans

The best Medicare Supplement plan depends on your situation. Some people will need more coverage than other people.

A Medigap Plan F or Plan G will likely make the most sense if you need comprehensive coverage. But, if a lower premium is more important, alternative plans offer lower monthly costs.

Working with a qualified Medicare advisor is the best way to identify the coverage you need. Call our experts today to see which plan option makes the most sense for you.

You can now complete an online rate form to discover Medigap rates in your area.

Can I Use My Medicare Supplement To Pay My Medicare Part B Premium

Summary:

Medicare Supplement insurance plans donât pay your Medicare Part B monthly premium. However, these plans typically pay at least part of your Medicare Part A and Part B coinsurance or copayments. Some plans pay your Part A deductible, and more.

.Medicare includes Part A and Part B . Most people donât pay a monthly premium for Medicare Part A, but do pay a Medicare Part B premium. If you or your spouse paid Medicare taxes while working for at least 10 years, you generally donât pay a Part A premium.

You May Like: Do Any Medicare Supplement Plans Cover Hearing Aids

Medicare Supplement Plan N Rate Increase History

Among the factors that impact your monthly premium rates, the pricing method that your carrier uses can influence your premium over time. According to csgactuarial.com, premiums for Medigap Plan N increased between 2% and 4% in the last five years. These increases are lower when compared to Medicare Supplement Plan F and Plan G.

As Medigap Plan N benefits are the same from carrier to carrier, it is essential to discuss with your agent the rate increase history for the company you are considering for your plan. Additionally, you should research carrier reviews for Medigap Plan N.

When Is Medicare The Primary Payer

Youâre under 65 and retired, and you have a disability thatâs not end-stage renal disease . You have health insurance through your former employer.

- If youâre still working and your employer has fewer than 100 employees, Medicare will usually pay first. However, Medicare might be the secondary payer if your employer participates in a multi-employer group insurance plan.

In general, if youâre still working and your employer has fewer than 20 employees, Medicare pays first. However, Medicare might be the secondary payer if your employer participates in a multi-employer group insurance plan.

Youâre eligible for Medicare because you have end-stage renal disease and youâre covered by a group plan. After a coordination period of about 30 months, that Medicare generally becomes the primary payer.

Also Check: When Does One Qualify For Medicare

What Is Medicare Supplement Open Enrollment

Medicare supplement enrollment begins within one month when you qualify under Medicare Part B or older. Some people can qualify as being older for disability insurance based on their disability status. This open enrollment period runs six months and allows you to purchase Medicare Supplement plans from any state. When the initial Medicare Supplement open enrollment period ends you can not purchase a Medicare Supplement plan.

Is Medigap Plan G Right For You

If youre comfortable paying a small annual deductible, Plan G offers incredible value. Plan G is a great alternative to Plan Fs full comprehensive coverage, making it a sensible option for people that have serious health issues or those that have high medical bills.

Medigap Plan G is also beneficial for people that worry about serious health issues as they age. just because youre in good health today, doesnt mean something cant happen tomorrow.

Its better to have insurance when you need it. Of course, if a lower premium and more out-of-pocket costs are something that you would prefer, consider looking at Medigap Plan N or the High Deductible Plan G.

Overall, the best Medigap policy for you is the one that provides you with the most value.

Read Also: Can You Work And Get Medicare

Who Is Eligible For Medicare Supplement Insurance

If you are age 65 or older and enrolled in Original Medicare Part B, you may be eligible to apply for Medicare Supplement Insurance. You can apply for a Medicare Supplement plan at any time throughout the calendar year, but during your 6-month open enrollment period, you can buy any policy offered in your state and you are guaranteed coverage even if you have pre-existing health conditions.

- If you are retiring at 65 and applying for Medicare Part B, your open enrollment period lasts for 6 months starting the first day your Part B coverage begins.

- If you are not retiring until later and still getting medical coverage under your employers insurance, then your open enrollment starts when you do retire and sign up for Part B coverage.

Medicare Supplement plans are also available to you if youre younger than age 65 and eligible for Medicare due to disability.

Learn more about Medicare Supplement Enrollment and Eligibility