What Is High Deductible Plan F

The coverage for High Deductible Plan F is nearly the same as Medicare Supplement Plan F, but youre required to satisfy a $2,370 deductible before the plan begins to pay like a normal Plan F. In 2021, you have to pay $2,370 in shared costs before you get the same benefits of regular Plan F. Please note, a High Deductible Plan F also is not available to new Medicare enrollees in 2021.

Can I Buy A Medicare Supplement Insurance Plan At Any Time

You can enroll in a Medigap plan or change Medigap plans at any time of the year. However, you may be subject to medical underwriting as part of the application process.The best time to buy a Medigap plan, however, is during your Medigap Open Enrollment period or during another time when you have a Medigap guaranteed issue right. This can help protect you from potentially paying higher Medicare Supplement Insurance costs due to your health.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What Are The Costs For Medicare Supplement Plans

Medicare Supplement Insurance plan premiums are sold by private insurance companies. This means that plan availability and plan premiums may vary.

The average premium cost for a Medicare Supplement Insurance plan in 2022 is $128.16 per month.1

The average cost of each type of Medigap plan can vary quite a bit from one plan type to another. Each type of Medigap plan offers a different combination of standardized benefits, which means that plans with fewer benefits may offer lower premiums.

Your age, gender, smoking status, health, the location where you live and the timing of when you apply for Medigap can all also affect the average cost of Medigap plans near you.

You May Like: Do You Have To Pay For Part B Medicare

Medicare Supplement Plan Costs

A Medigap plan can help cover the medical and related out-of-pocket expenses that Original Medicare, Part A and Part B, doesnt cover. For example, theres a cost category called Part B excess charges that some Medigap plans cover. This is the amount that a medical provider is legally allowed to charge, in some situations, thats higher than the Medicare-approved amount.

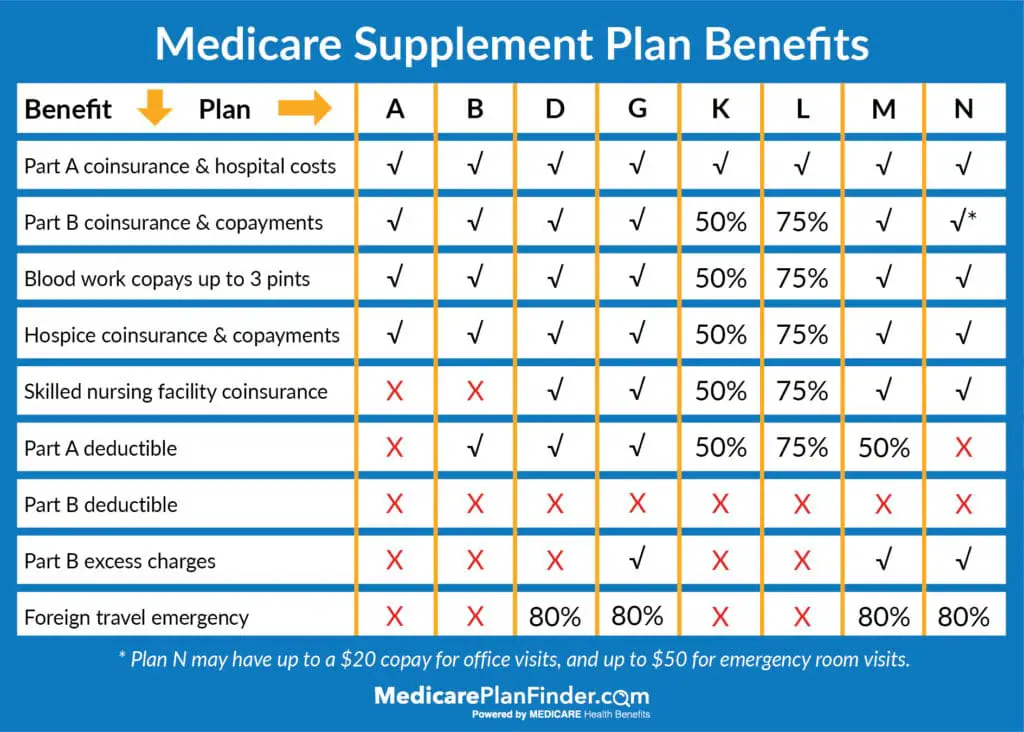

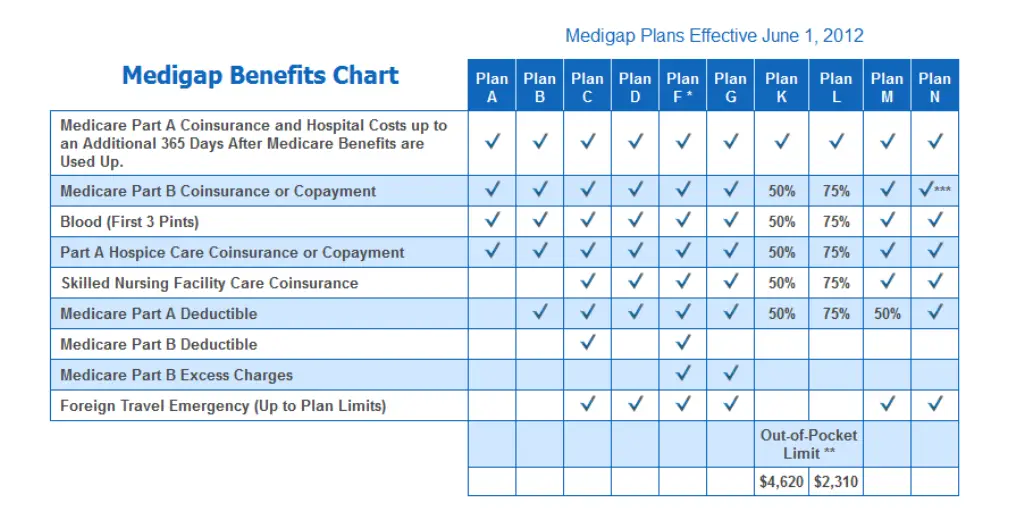

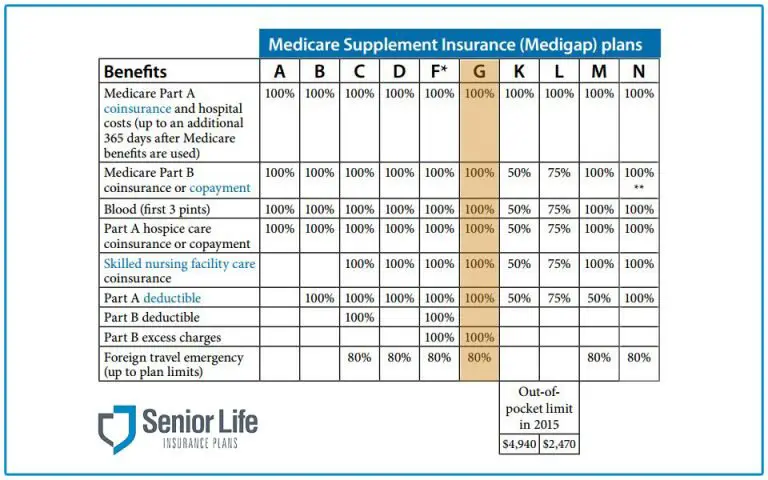

There are 10 different standardized Medigap available in most states. Each plan is designated by a letter , and benefits are standardized across each plan type. This means that coverage is the same for each plan letter no matter which insurance company you buy from. For example, if you buy a Medicare Supplement Plan F in Athens, GA, its benefits will be the same as a Medicare Supplement Plan F in Fargo, ND. Note that Medicare Supplement plans in Massachusetts, Minnesota, and Wisconsin are standardized differently.

It may be well worth taking the time to compare plans before enrolling in a Medigap plan. Since the benefits are exactly the same for plans of the same letter, the main difference is the cost.

Note: Medigap Plan A, Plan B, Plan C, and Plan D are different from Medicare Part A, Part B, Part C, and Part D, despite the similar-sounding names.

Learning the best time to enroll in a Medicare Supplement plan and how insurers price Medigap premiums can help make sure that you get accepted into a Medicare Supplement plan at a price that may work for your budget.

What To Focus On

The governments comparison chart shows 10 health care costs that a Medigap policy could cover. Some come into play more than others, so you should focus most on those big-ticket items. They include:

- Your 20 percent share of the cost of doctor visits

- Your 20 percent share of the cost of lab tests and other outpatient services

- The deductible for each time you are admitted to a hospital

- The coinsurance costs of hospital stays or stays in a skilled nursing facility after being in a hospital

There are other considerations, as well. While other plans cover 100 percent of Part B coinsurance, plans K and L have higher cost-sharing but also an out-of-pocket limit. Once youve paid that amount, they take care of 100 percent of covered services for the rest of the year. In 2022, the limit for Plan K is $6,620, and the limit for Plan L is $3,310. These limits increase each year, based on inflation.

Remember, Medigap does not cover prescription drugs or dental, vision or most other needs that original Medicare doesnt cover.

Don’t Miss: What Is Medical Vs Medicare

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

Medigap Plans That You’ll Never Enroll In

That happens a lot, particularly in states like Texas. Plan B is not much different, having very basic coverage.

These are plans that most people would never enroll in.

Many of these plans you see such as B and D, have less coverage but are almost the same price or sometimes more expensive than Plan N, which has more coverage.

This is exactly why we dont write a lot of people on those plans at all.

If you view the column for both Medicare C and F, youll see that they have a lot more coverage.

Recommended Reading: Does Medicare Cover Lasik Eye Surgery

Medigap Medicare Supplement Insurance

- You can buy Medigap coverage in any state.

- There are gaps in Medigap coverage .

- Medigap plans that cover the Part B deductible can no longer be purchased by newly-eligible enrollees.

- Some Medigap carriers offer discounts.

- The best time to purchase a Medigap policy begins on the first day of the month in which youre at least 65 and have enrolled in Medicare A and B. But several states offer annual guaranteed-issue opportunities to switch plans.

- An insurer cant make you wait for Medigap coverage to start.

Because Original Medicare covers a significant portion of its recipients healthcare expenses, eligibility for Medicare is a welcome milestone. But for all that Medicare covers, its enrollees learn quickly that Original Medicare doesnt pick up the tab for everything.

What Does Medicare Supplement Insurance Cover

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

Read Also: How Long Do You Have To Sign Up For Medicare

What Is The Plan G Deductible In 2021

There are two version of Medigap Plan G: a standard version and a high-deductible version.

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 that must be met before the plan coverage kicks in.

The tradeoff for the high-deductible version of Plan G is that it typically comes at a lower monthly premium than the standard version of the plan.

Also Check: What Is Medicare Insurance Plans

What Is The Average Cost Of Medicare Supplement Insurance Plan F

by Christian Worstell | Published January 26, 2022 | Reviewed by John Krahnert

Medicare Supplement Insurance Plan F offers the most benefits of any of the 10 standardized Medigap plans available in most states.

Some Medicare beneficiaries might assume that Plan F is also the most expensive, but an examination of the average cost of Medigap plans reveals otherwise.

You May Like: When Are You Eligible For Medicare Part B

Medicare Supplement Plans: Coverage Costs And More

As you approach age 65, navigating Medicare and all of its parts and plans may sound daunting, but it can be easier than you think. Original Medicare contains two parts: Part A and Part B. Medicare Part A covers hospital care, skilled nursing facility and hospice fees, and is usually premium-free. Medicare Part B covers medical and preventive services, as well as some medical equipment, for which there is a monthly premium .

In addition to Original Medicare, many people choose to purchase a Medicare Supplement plan to cover services like routine hearing, eye exams and other costs not covered by Parts A and B. Heres what you need to know about Medicare Supplement plans.

Confused About Medicare Supplement Insurance Options?

Find committed, licensed agents who work to understand your coverage needs and find you the best Medicare option.

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

For instance, Plan G is good for people who want very few medical bills and are willing to pay about $190 each month. This can give you peace of mind so that you won’t be surprised by unexpected medical costs. However, if you expect your out-of-pocket medical costs to be less than the plan’s annual cost of about $2,280, then a cheaper Supplement plan may be more cost-effective.

Note that because of a recent legislation change, Plans C and F are not available for new enrollees. Below you can find a chart of the level of coverage and 2022 monthly premium ranges for all of the Medicare Supplement plans. The Medigap plan names are along the top, and on the left are the coverage categories.

| Plan A |

|---|

Read Also: How To Find My Medicare Claim Number

What Is Included In Medicare Supplemental Plan G

Medicare Plan G covers almost everything Original Medicare does not. It doesnt extend the scope of care, just the amount of coverage included. Plan G coverage includes excess charges that are left over from the 80% that Original Medicare does not cover, including Part A and Part B copays and Part As deductible. The other big difference: Plan G does not cover the Part B deductible, which needs to be met. However, that payment does count toward the Plan G deductible as well.

The Plan B deductible for 2020 is $203, so youll have to pay at least this much, but that means you can subtract that amount from your expected Plan G deductible as well.

Read Also: Is Keystone 65 A Medicare Advantage Plan

How Much Does It Cost For Medigap Plan F

The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year.1

Here is how the average estimated premiums of Plan F compare with that of other Medicare Supplement Insurance plans in 2022.

| Plan |

|---|

| $234.20 | $2,810 |

It’s important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

As you compare Medicare Supplement quotes, keep in mind that other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plan premiums could be more expensive for older beneficiaries for a few reasons, such as:

Medigap premiums can increase over time due to inflation and other factors, regardless of the pricing model your insurance company uses.

Don’t Miss: Does Medicare Advantage Cover Chiropractic

Your Medicare Supplement Plan Costs Include:

- Deductible – The amount you pay before Florida Blue begins to pay its share of the cost.

- Copay – A flat dollar amount you pay each time you receive care.

- Coinsurance – A percentage you pay for your care after you meet your deductible.

- Premium – A fixed, monthly amount you pay for your Medicare supplement plan coverage.

Medicare Supplement Vs Medicare Advantage: 6 Facts You Should Know

Knowing the difference between Medicare Supplement and Medicare Advantage is not as hard as it seems. The main issue is that âOriginal Medicareâ provides incomplete health coverage, leaving you exposed to many out-of-pocket expenses. There are two different solutions to this coverage problem: Medicare Supplement and Medicare Advantage. You can have one or the other, but not both. Here are the facts you should know about Medicare Supplement vs. Medicare Advantage, according to the official U.S. government website for Medicare.

Recommended Reading: What Age Can A Woman Get Medicare

What Is Medicare Supplement Plan F Coverage

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What Do Medicare Supplement Plans Cover

Medigap plans will cover the gapsleftover from Original Medicare. Medicare alone has many out-of-pocket costs below is a chart taken from the Medicare and You Guidebook.

Read more about what Original Medicare covers here.

Medicare Supplement plans only cover services that are approved by Medicare. The supplemental is secondary to Medicare. If Medicare doesnt approve your claim, then the Supplement plan will not pay.

Also Check: Does Costco Pharmacy Accept Medicare

Also Check: When Do Medicare Premiums Increase

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.

How Much Does Medicare Plan G Cost

The premium you pay for a Plan G policy may depend on where you live, your gender and depending on when you apply for Plan G your health status. According to MedicareSupplement.com, the average monthly premium for Plan G is $122.78 per month.

Its easy to see how Plan G can quickly save you money, depending on the health care services you need. All those Medicare copays and coinsurance costs for supplies and services can add up quickly.

Dont Miss: Does Kaiser Medicare Cover Dental

Don’t Miss: Does Medicare Offer Home Health Care

Saving On Medigap Costs

To keep your Medigap premium down, you may want to purchase a policy as soon as youre first eligible, during your Medigap Open Enrollment Period. Aside from that, its generally a good idea to shop around and compare prices before getting a Medigap policy.

You can find and compare Medicare Supplement plans in your area by entering your zip code in the form on this page.

When choosing in a Medigap plan, you may want to think carefully about both your present and anticipated future health needs. If you choose to buy a less expensive plan during your Medigap Open Enrollment Period, you may not be able to change to a better plan later on. You may be in good health when you purchase your plan, but your health may decline over time. You may have trouble switching Medigap plans later if your health declines. However, there are a few situations where you can switch Medigap plans with guaranteed issue rights.

Do you have questions about Medigap plans or other Medicare coverage options? Were here to help. You can talk to one of eHealths licensed insurance agents by calling the phone number below.

To learn about Medicare plans you may be eligible for, you can:

- Contact the Medicare plan directly.

- Contact a licensed insurance agency such as Medicare Consumer Guides parent company, eHealth.

- Or enter your zip code where requested on this page to see quote.