How Should I Ensure My Claims Are Also Filed With Medicaid

Many Medicare beneficiaries also qualify for Medicaid due to having limited incomes and resources. Medicaid pays for Medicare co-pays, deductibles and coinsurance for enrollees who see providers that accept both Medicare and Medicaid.

Show your health care provider your Medicare and Medicaid I.D. cards when you check in for your office visit. You should also show the provider your Medicaid managed care plan card .

Read more here about Medicaid benefits for Medicare enrollees.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare ombudsman contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals. In addition to advocacy work, Josh helped implement federal and state health insurance exchanges at the technology firm hCentive. He also has held consulting roles, including as an associate at Sachs Policy Group, where he worked with insurer, hospital and technology clients.

When Do I File A Grievance

It is best to file a grievance as soon as you experience a problem you want to complain about. You must file your grievance no later than 60 days after the event or incident that precipitates the grievance. Most grievances are resolved within 30 days. If we need more information and the delay is in your best interest, or if you ask for more time, we can take up to 14 more days to respond to your grievance. Upon completion of our review, we will notify you by phone or in writing.

How Do I Contact Medicare To File A Complaint About Durable Medical Equipment

If you have a complaint with your Medicare DME, your first step is to contact your DME supplier. The supplier has five days to let you know they have received your complaint, and 14 days to report the results of any investigation into the issue.

You should also contact Medicare at 1-800-MEDICARE and report the issue. TTY users should call 1-877-486-2048. If the supplier doesnt resolve it to your satisfaction, you may be able to file an appeal or take additional action against the supplier.

Don’t Miss: How Does Medicare Work With Other Insurance

Donotpay Helps You Sue Aetna Effortlessly And Win

Suing a big corporation usually includes spending weeks working on the lawsuit and hiring a legal professional to handle all of the legal procedures and documents. Whats more, the process can be pricey, complex, and it might even drag for months.

Luckily, DoNotPay is here for you. With our AI-powered app, fighting for your rights and getting the compensation you deserve will be a piece of cake.

To file a complaint against Aetna hassle-free, all you need to do is:

And thats all there is to it! DoNotPay will generate a demand letter and send it to Aetna on your behalf. This will put some legal pressure on them to resolve your complaint.

If Aetna ignores your complaint or refuses to give you the compensation, we will help you escalate matters and sue them in small claims court.

Need assistance with any other company? Look into our guides to learn how to file Choice Hotels, Disney World, Dell, Microsoft, Nike, DIRECTV, Check n Go, Allegiant Air, and Stevens Ford of Milford complaints.

Medicare Rights Appeals And Complaints

July 15, 2021 / 5 min read / Written by Jason B.

As a Medicare beneficiary, youre protected by certain rights. This article explains these rights, as well as how to file an appeal or complaint.

Your Medicare rights

Medicare guarantees certain rights and protections for everyone. They include, among others:

- Treatment with dignity and respect

- Protection against discrimination

- Confidentiality of personal and health care information

- Access to information that you can understand

- Clear responses to your Medicare questions, in a language you can understand

- Access to doctors and health providers

- Emergency care anytime you need it

- A decision from Medicare about your health-care payment, coverage of services, or prescription drug coverage

Your rights and protections in Original Medicare

If youre enrolled in Original Medicare, Part A and Part B, you have rights and protections in addition to the ones listed above. Under Original Medicare, you have the right to:

- Go to any doctor, specialist, or hospital that participates with Medicare.

- Get information and notices from Medicare indicating why certain services may not be covered.

- Get information about your right to appeal certain Medicare decisions.

- Request an appeal about Medicare payment decisions or health-care coverage.

- Sign up for a Medicare Supplement Plan.

Your rights and protections in Medicare Advantage and other health plans

Your rights and protections in a Medicare plan providing prescription drug coverage

Read Also: Does Medicare Pay For Tdap Vaccine

How Long Do I Have To File A Claim

Original Medicare claims have to be submitted within 12 months of when you received care. Medicare Advantage plans have different time limits for when you have to submit claims, and these time limits are shorter than Original Medicare. Contact your Advantage plan to find out its time limit for submitting claims.

Sick Of Humana Ignoring Your Insurance Complaint Sue Humana In Small Claims Court

If you’ve exhausted all other options and can’t get Humana to resolve your complaint, you can take the company to small claims court. Keep in mind that small claims courts have a limit of up to $5,000 for the value of your claim.

If you are going after Humana for reimbursement for out-of-pocket expenses, you can also file a lawsuit to recoup the amount that was paid out-of-pocket as a result of Medicare Advantage or Part D plan.

To start the legal process against Humana, you must correctly file a claim in the small claims court in your local jurisdiction, based on where you live. You can do this either by completing an online form if one is available or by filing a claim in person with the court’s clerk.

Before the case reaches trial, you are required to send Humana a demand letter notifying the company that you will pursue legal action if they don’t fulfill your request for reimbursement within 30 days.

The demand letter must include:

- Your name and contact information

- The specific service you’re claiming to be entitled to reimburse

- The amount you’re seeking to be reimbursed for the claim

- A specific time period that Humana has to respond

You should also prepare any evidence to support your claim, as well as gather all the correspondence between you and the company regarding the issue in question.

Following a trial, the judge will make a judgment on whether Humana acted in bad faith and whether the fees were reasonable.

Also Check: How Much Does It Cost For Medicare Part C

How To File Your Medicare Complaint

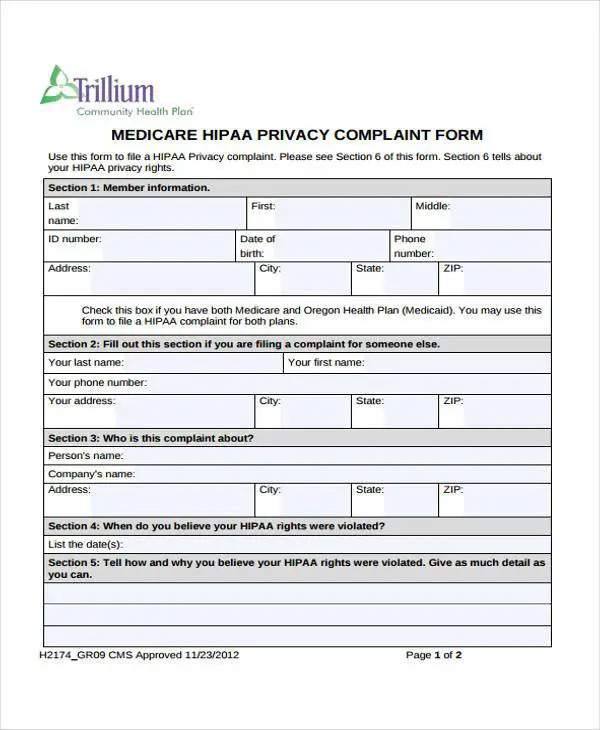

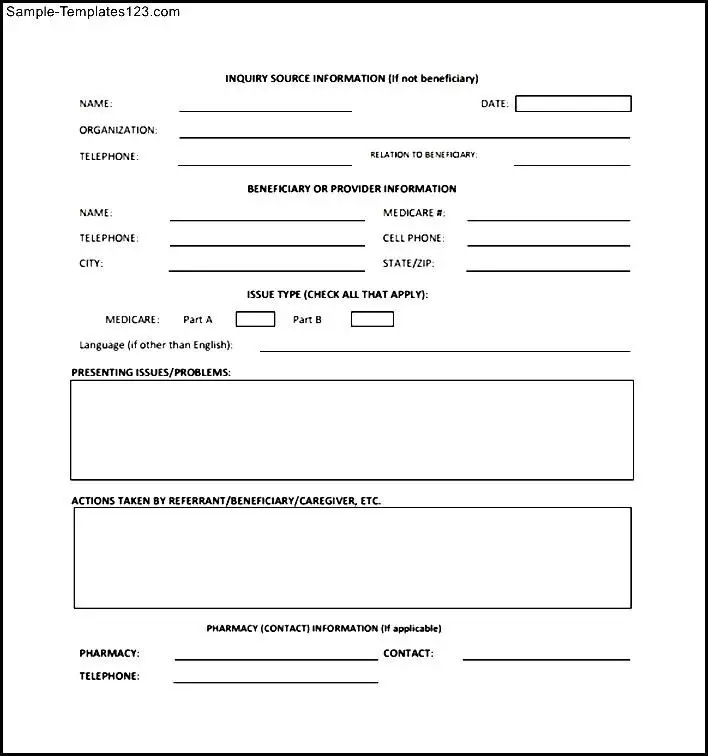

Be sure you have basic information on hand at the time of filing your complaint. Youll need personal info such as your name and address as well as your Medicare card and health plan card. You can use Medicares Blue Button initiative to download all of your pertinent information to a file on your local computer.

In addition to the 1-800 number, theres another way to contact Medicare regarding an appeal or a complaint.

The federal government has contracted with two large regional complaint handlers. You may contact these handlers based on the state in which the service you are complaining about was performed.

- A company called Livanta handles complaints from nine northeastern states and eight Western states, as well as complaints from Puerto Rico and the Virgin Islands.

- A company called KePro handles all the rest of the states and Washington, D.C.

While contact information for these companies is hard to find on Medicares official website, The United Hospital Fund has published a complete list of contact phone numbers by state. You can also begin the process online of filing a complaint through the Medicare complaint form.

Are Claim Filing Requirements Different If I Have Medicare Advantage Or Medigap

If you have Medicare Advantage, providers in the plans network have to bill your insurer for your care. As mentioned above, you may have to submit your own claims if you go out-of-network.

If you decide to file a claim yourself, first contact your insurer for its claims mailing address and any forms to include with your claim. Because Advantage plans have different time limits for filing claims than Original Medicare, be sure to follow your insurers rules to avoid a denial.

Original Medicare will automatically send your claims to most Medigap insurers for secondary payment, but some Medigap insurers require plan holders to manually file claims. If you have to submit your own Medigap claim, youll need to at least send the insurer a Medicare summary notice showing the payment Medicare made, and you may need to provide other documentation, such as an invoice or receipt. You dont have to submit an MSN when filing claims for Medigap services that arent covered by Original Medicare . Contact your Medigap insurer if you have questions about Medigap claims.

Read Also: How To Apply For Medicare Insurance

Care In A Skilled Nursing Facility:

- Send the Bureau of Medi-Cal Fraud & Elder Abuse a copy of your complaint if it involves serious neglect, abuse or Medi-Cal fraud. The BMFEA, a division of the California Attorney Generals office, investigates and prosecutes those who abuse and neglect nursing home residents. There are 3 ways to file your complaint: Call it at 800-722-0432 File your complaint on-line at www.ag.ca.gov/bmfea or Mail a copy of your complaint to the California Department of Justice, Office of the Attorney General, Bureau of Medi-Cal Fraud and Elder Abuse, P.O. Box 944255, Sacramento, CA, 94244-2550.

What Can I File A Medicare Complaint About

Some of the most common reasons for filing a Medicare complaint include:

- Improper, insufficient or unsafe medical care

- Unsatisfactory hospital or doctors office conditions

- Unprofessional conduct or poor customer service from a health care professional

- Receiving an incorrect prescription or dosage level

- Receiving unnecessary or incorrect treatment

- Lack of access to health care providers

- Billing errors

- Quality or use of durable medical equipment

Also Check: Are Hearing Aid Batteries Covered By Medicare

File Humana Insurance Complaints With Medicare

Medicare beneficiaries may include both those who have Humana supplemental insurance and those who have private insurance that covers hospitalization or medical services provided by Humana.

Your complaint will be forwarded to the Medicare Part C Ombudsman or a Regional Ombudsman for further investigation.

If you don’t have access to the Internet, you can also call Medicare’s toll-free number at 1-800-633-4227.

Who May File A Grievance

You or your appointed legal representative may file a grievance. You can name a relative, friend, attorney, doctor, or someone else to act for you. Others may already be authorized under state law to act for you. In order to appoint a legal representative, the proper documentation must be submitted to Cigna Medicare. Examples of appropriate representation documents may include, but are not limited to, a durable power of attorney, a health care proxy, an appointment of guardianship, or other legally recognized forms of appointment. You may also download and complete the appointment of representative form below.

You May Like: Does Costco Pharmacy Accept Medicare

My Part B Premium Is Based On My Old Income

Medicare bases your monthly Part B premium on your income tax return from 2 years ago. That means your 2019 premium is based on your 2017 income.

You pay a higher premium in 2019 if your 2017 income was over $85,000 per year or over $170,000 . This is known as an Income Related Monthly Adjustment Amount and is added to your monthly premium. The IRMAA varies according to your income level. It changes every year.

Of course, most people experience a change in income once they retire. And few want to wait two years for Medicare to catch up to their new income level. Thats why Medicare and Social Security allow you to appeal the IRMAA if your income changes.

To appeal, contact Social Security at 800-772-1213. You can request an appeal within 60 days of receiving your IRMAA notice.

Submit A Complaint Online

The Indiana Department of Insurance handles many types of insurance-related issues, including coverage concerns, claims disputes and premium issues. The Complaint Form can be used to address these and other issues. For a list of other issues and how the Department can help, .

Please Note: If your complaint involves the Healthy Indiana Plan , please do NOT fill out the Indiana Department of Insurance Complaint Form. This Department does NOT handle any complaints involving HIP 2.0 as it is a federally administered plan and the Department has no jurisdiction in the matter even if your HIP 2.0 plan is administered by an insurance company.

To file a complaint regarding HIP 2.0, contact:

FSSA/Communications

Don’t Miss: Does Medicare Cover Dexcom G5

File Humana Insurance Complaints With The Bbb

The Better Business Bureau is an independent organization that has no affiliation with any insurance company or service. The BBB provides assistance in resolving disputes between consumers and their insurers.

To file a complaint with the BBB, complete this online form using the instructions provided on the Bureau’s website.

Do I Need To File Part D Claims

Medicare Part D plans contract with pharmacies where you can fill your prescriptions. Both preferred and non-preferred pharmacies can bill your Part D insurer, although your cost will be lower if you use a preferred pharmacy. If you have to fill medications at a pharmacy outside your plans network because of an emergency, you may be able to receive partial reimbursement by submitting your receipt and supporting documentation to your Part D insurer. Contact your insurer for instructions if you need to file an out-of-network claim.

You may also have to file a Part D claim if you receive medications while hospitalized that arent reimbursed by Medicare or your Medicare Advantage plans payment for your care. Whether you need to submit the claim yourself depends on whether the hospitals pharmacy has a contract with your Part D plan.

Don’t Miss: How Do I Apply For Medicare In Arizona

Aetna Insurance Complaints Being Ignored Start A Small Claims Court Lawsuit

If you’re unhappy with how your insurance claim was handled, you can file a lawsuit against Aetna in small claims court.

You can file the claim with your local small claims court clerk’s office. Some small claims courts also provide online forms for filing claims.

The processes may vary depending on the state and county you live in, so it’s best to consult the court’s website or call the court clerk’s office to ensure you have all the required documents ready.

The court costs are typically $20, although you have to pay more if your claim involves more than $2,500 in damages.

Before the case can reach trial, you have to send Aetna a demand letter, detailing the reason for the lawsuit and giving them an opportunity to settle the matter outside of court by reimbursing you for the damages incurred.

The demand letter must include:

- Your name, address, and contact information

- Amount in damages, including statutory damages or punitive damages if applicable

- Full name and corporate address of the defendant

- A brief explanation of the circumstances that lead to your lawsuit

- The settlement amount you’re seeking from the defendant

Once Aetna has received the demand letter, it will have 20 days to respond. If Aetna fails to respond to your demand within 20 days or refuses to pay the damages you are seeking, you’ll have an opportunity to present your case in front of a judge.

If they rule in your favor, you could be awarded a portion of the damages you’ve incurred.

How To File A Complaint

Most of your encounters with healthcare providers in New Jersey will proceed as they should. Inevitably, however, some will not. This page provides guidance for submitting official complaints.

Hospitals, nursing homes, hospice centers, assisted living facilities, and most other acute and long term care facilities in New Jersey are under the jurisdiction of the Division of Health Facilities Evaluation and Licensing at the Department of Health.

If you are willing to provide your name and contact information, use this online form to file a complaint about the care you received at a licensed health care facility in New Jersey.

If you prefer to remain anonymous, you may still file a complaint by calling the Department of Health Complaint Hotline at 800-792-9770. The hotline is available 24 hours a day.

Alternatively, you may submit a complaint by mail to:

New Jersey Department of HealthDivision of Health Facilities Evaluation and LicensingP.O. Box 367Trenton NJ 08625-0367

If you are a Medicare patient and your complaint concerns a Medicare-affiliated provider, you may additionally file a complaint, or “grievance,” through Medicare.

Charity Care related complaints

To file a complaint about how a hospital processed your application for Charity Care, you must contact the New Jersey Hospital Care Payment Assistance Program. You may call them at 588-5696, email , or write:

New Jersey Department of Health, New Jersey Hospital Care Payment Assistance ProgramPO Box 360

Also Check: Is Pace A Medicare Advantage Plan

Complaints About Health Care

You may want to make a complaint if you are unhappy with the medical care and treatment you, or someone you care for, have received. Complaints about health care may be about the quality or type of care, possible negligence issues, or concerns about how your personal and medical information has been used, shared or disclosed.

It is usually best to try to resolve the problem directly with the doctor, clinic, hospital, or health provider. There are organisation which may be able to help if you cannot resolve the issue.

Find out:

- how to make a complaint about a health practitioner or treatment

- what health services you can complain about, and

- who can help you make a complaint.

How do I make a complaint about my health treatment?

You should first attempt to resolve the issue directly with the health service provider . You can do this in writing or in person. Keep a record of any discussions, letters or emails relating to your problem.

If the complaint cannot be resolved at that level, you can complain to the:

APHRA oversees a wide range of registered health practitioners, including: chiropractors, dentists, doctors, nurses and midwives, optometrists, osteopaths, pharmacists, physiotherapists, podiatrists, psychologists, occupational therapists, and those registered with the Chinese Medicine Board, the Medical Radiation Practice Board and the Aboriginal and Torres Strait Health Practice Board.

What if my complaint is about negligence by the health service?

Get help