What Else Do You Pay For When You Have Medicare Part C

When considering your Medicare expenses, there are two costs to consider in addition to your monthly premium.

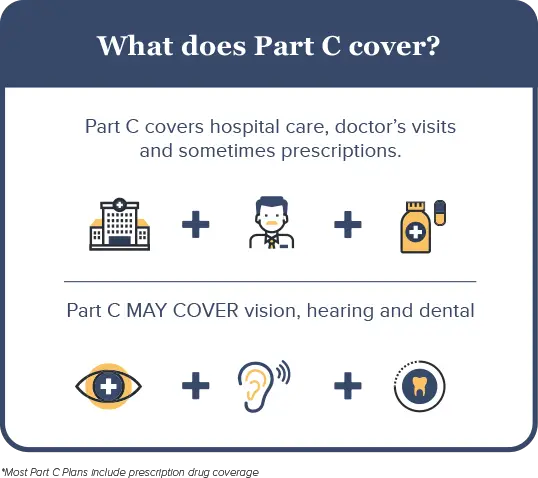

Coverage for dental, vision or hearing varies. These benefits may be included in a Part C plan, which means you’d have no additional cost. You could also have to pay a fee to add this coverage or purchase a stand-alone plan.

A cheaper policy is less likely to include these benefits, and the extra costs can add up. For example, in addition to a $15 Part C plan, you could pay an extra $25 per month for dental coverage and $15 for vision, bringing your total to $55 per month. If you want these coverages, compare the total cost of a cheap policy with add-ons to a more comprehensive policy with a higher price. You may pay less overall by choosing a bundled plan that includes dental and vision coverage.

How Much Does Medicare Advantage Cost

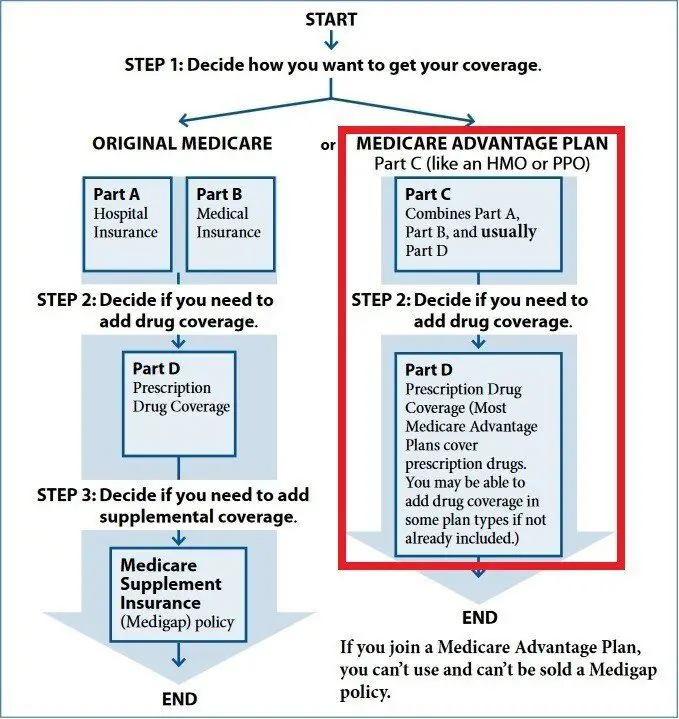

Medicare still costs money even though its funded through the government via taxes. The government sponsors Medicare Part C, and extra services may be included in the plan, which can drive up costs. In general, costs break down as follows:

- In order to enroll in Medicare Advantage, you must have both Part A and Part B, which means that you have to pay a Part B premium. In 2022, the standard Part B premium is $170.10 per month for new beneficiaries. This will drop to $164.90 in 2023.

- The cutoff amount for the standard premium is an income of $97,000 or less per year. If you have a higher income based on tax returns from two years ago, that is you will generally pay a higher premium.

- The deductible is $233 per year in 2022, which increases to $226 in 2023.

- You also pay a 20 percent coinsurance or 20 percent of all medical costs after meeting the deductible for Part B.

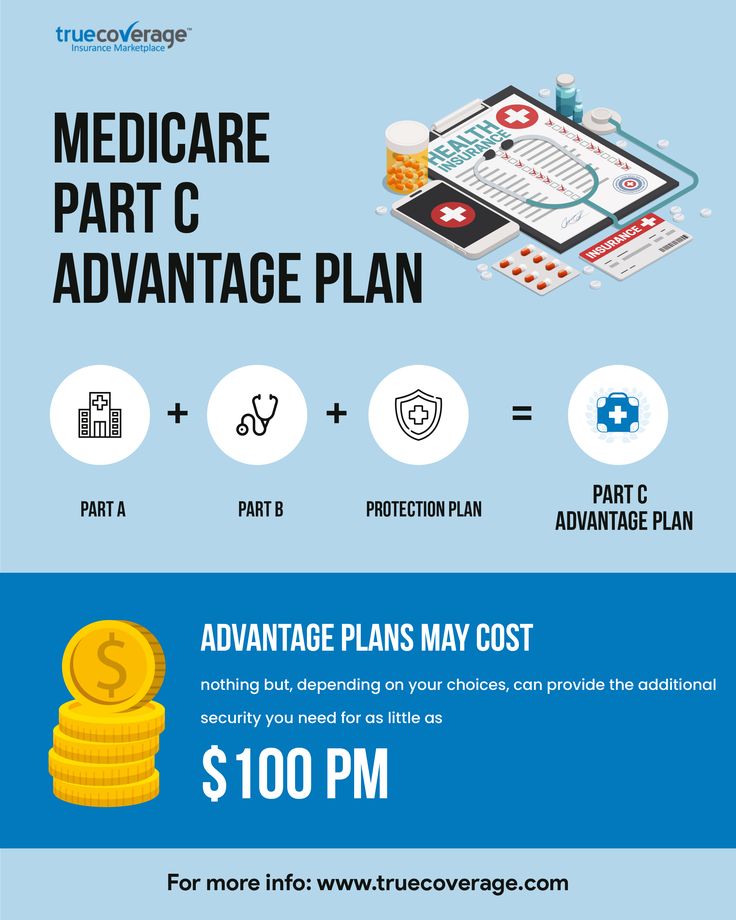

- Medicare Part C has additional costs, which mean that you pay a monthly premium for it as well. These premiums vary but can be as low as $0 per month. Per our analysis of 2023 state data from the Centers for Medicare and Medicaid Services, premiums average to a little over $19 a month next year.

About Half Of All Medicare Advantage Enrollees Would Incur Higher Costs Than Beneficiaries In Traditional Medicare For A 7

Medicare Advantage plans have the flexibility to modify cost sharing for most services, subject to limitations. Total Medicare Advantage cost sharing for Part A and B services cannot exceed cost sharing for those services in traditional Medicare on an actuarially equivalent basis. Further, Medicare Advantage plans may not charge enrollees higher cost sharing than under traditional Medicare for certain specific services, including chemotherapy, skilled nursing facility care, and renal dialysis services.

Medicare Advantage plans also have the flexibility to reduce cost sharing for Part A and B benefits, and may use rebate dollars to do so. According to MedPAC, in 2022, about 43 percent of rebate dollars were used to lower cost sharing for Medicare services.

In the case of inpatient hospital stays, Medicare Advantage plans generally do not impose the Part A deductible, but often charge a daily copayment, beginning on day 1. Plans vary in the number of days they impose a daily copayment for inpatient hospital care, and the amount they charge per day. In contrast, under traditional Medicare, when beneficiaries require an inpatient hospital stay, there is a deductible of $1,556 in 2022 with no copayments until day 60 of an inpatient stay .

Recommended Reading: How Much Are Premiums For Medicare

Medicare Part D Prescription Drug Plans

Medicare Part D prescription drug plans are sold through private insurers and premiums vary from plan to plan. Most Medicare Advantage plans include a Part D plan as well.

If you have a standalone Medicare Part D plan, you can contact the plan administrator to set up automatic deductions from your monthly Social Security check. Not all plans will allow you to set up automatic deductions.

Open Enrollment: Your Time To Join Switch Or Drop A Plan

There is an open enrollment period every year when you can join, switch, or drop a Medicare plan. From October 15 through December 7, 2022, Medicare beneficiaries can review how they receive their Medicare coverage for 2023, says Judith A. Stein, executive director at the Center for Medicare Advocacy in Willimantic, Connecticut.

According to Medicare.gov, you can do any of the following during open enrollment:

- Change from Original Medicare to a Medicare Advantage Plan

- Change from a Medicare Advantage Plan back to Original Medicare

- Switch from one Medicare Advantage Plan to another Medicare Advantage Plan

- Switch from a Medicare Advantage Plan that doesnt offer drug coverage to a Medicare Advantage Plan that offers drug coverage

- Switch from a Medicare Advantage Plan that offers drug coverage to a Medicare Advantage Plan that doesnt offer drug coverage

- Join a Medicare drug plan

- Switch from one Medicare drug plan to another Medicare drug plan

- Drop your Medicare drug coverage completely

Whether you are in Original Medicare with a Part D prescription drug plan, or enrolled in a private Medicare Advantage plan, all beneficiaries should make sure their current plan will meet their needs in the coming year.

Don’t Miss: Which Medicare Plan Is Free

What Is The Medicare Advantage Out

One of the advantages of a Medicare Part C plan is that they are required by law to include an annual out-of-pocket limit. An out-of-pocket limit is the highest amount that you will be required to pay for covered care out of your own pocket over the course of the year. Once that limit is reached, the plan then pays for 100% of covered care for the remainder of the year.

For 2022, the highest out-of-pocket limit allowed by law was $7,550, but the average in-network maximum out-of-pocket spending limit was $4,972.2

Original Medicare does not have an out-of-pocket limit.

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Recommended Reading: Where Is My Medicare Number

Other Types Of Medicare Advantage Plans

If you want more freedom in health care providers or payment options, there are 2 other types of Medicare Advantage plans to consider.

Private Fee-for-Service plans

PFFS plans may or may not have a provider network, but they cover any provider who accepts Medicare. If the plan doesn’t include Part D prescription drug coverage, you can also enroll in a stand-alone Part D plan separately.

Medical Savings Account plans

MSA plans combine a high-deductible health plan with a special savings account. Medicare deposits funds that are withdrawn tax free to pay for qualified health care services. You can see any provider you choose. MSA plans don’t include Part D prescription drug coverage, but you can enroll in a stand-alone Part D plan separately.

Not all plans are available in all areas.

Medicare Advantage : How It Works

Medicare Advantage plans have recently become one of the more popular options among Medicare beneficiaries, accounting for about one third of Medicare coverage in 2019. Over the last ten years, the number of Medicare Advantage beneficiaries has nearly doubled. But what makes Medicare Advantage so appealing and, more importantly, should you take the leap?

You May Like: Who Does Not Qualify For Medicare

The Basics Of Original Medicare

Original Medicare Parts A and B are very specific about what is and isn’t covered. For example, Part A typically pays for inpatient hospital-related care, including surgeries and lab tests. It also covers skilled nursing services, hospice and home care.

Part B focuses more on outpatient care. This can include doctor’s visits, treatments and therapies. Part B also pays for durable medical equipment such as walkers, wheelchairs and rollators.

What Is Covered Under Medicare Part C

Medicare Part C plans have the benefit of being administered by private companies, which means that they can add more services. As a rule, these plans must offer the same coverage as you would receive under Original Medicare. Certain services must be covered, which include the following:

- All benefits of Part B

Most Medicare Advantage plans do not offer hospice care, which is available under Original Medicare. The same goes with prescription drug coverage. While many plans will include this benefit, they do not have to include Part D in any plan. You can still purchase Part D separately if you want prescription drug coverage. Vision, dental and hearing care may be included, but these are considered extras. Premiums may be higher with added services, like wellness programs, nurse helplines and dental care.

When you look at a plans benefits, check for extra services as well as the plans rating. Many higher-rated plans will feature additional benefits along with a higher customer satisfaction rating. Medicare keeps track of Advantage plans and rates them based on different factors, with 5-star plans being the best. The Medicare Plan Finder tool lets you find and compare plans with good scores so that you know what youre buying ahead of time.

Read Also: What Is Medicare Advantage Otc Card

Eligibility For Medicare Part C

Eligibilityfor Medicare Part C plans depends upon the following criteria:

- Geographic area: Medicare advantage plans are typically unavailable or less available in geographic regions with a lower population, such as Alaska and Wyoming. People in larger cities often have the most plans available to them.

- Medical conditions: To qualify for a special needs plan, a person must have the medical condition the plan covers.

Medicares website allows a person to in their area. A person can entertheir zip code and see a listing of available plans.

Why Do I Need Medicare Part C

Medicare Part C is an alternative to traditional Medicare. Some people may choose a Medicare Part C plan for the following reasons:

- They have a medical condition that requires specific services and medications. Medicare Part C offers Special Needs Plans for people with specific conditions, such as congestive heart failure or diabetes. These targeted plans may provide cost savings to a person.

- They need additional services that Medicare does not offer, such as hearing or vision care.

- They receive benefits under a group plan. Some employers and unions offer their retired employees a group plan under Medicare Advantage. These firms may provide additional services at a lower cost to their former employees. An estimated 19% of all Part C enrollees are part of an employer- or union-sponsored group plan, according to the KFF.

People tend to choose Part C over traditional Medicare if they are seeking greater cost savings, expanded coverage, or both.

You May Like: Is Xarelto Covered By Medicare Part D

Are Part C Medicare Costs Going Up Or Down

Unlike many other types of insurance, the cost of Medicare Advantage plans is actually decreasing over time. The $19 average premium in 2022 nearly half the average premium for the same types of plans in 2015.2

A big reason for the low monthly premiums is that many beneficiaries are enrolled in $0 premium Medicare Advantage plans. As mentioned above, 69% of beneficiaries enrolled in Medicare Advantage plans with prescription drug coverage paid no monthly premium for their plan in 2022.2

You can explore the average monthly premium for Medicare plans in every state in 2022, according to MedicareAdvantage.com.

As with most any type of health insurance, the monthly premium isnt the only cost to beneficiaries. Below is a look at the other cost requirements for Medicare Part C plan members.

Types Of Medicare Advantage Plans

HMOs may offer lower premiums than other plans. You must usually stay within your plans network for care and services.

PPOs may allow you to go out-of-network for care. You will usually pay less if you stay within the plans network.

A PFFS plan may or not be network-based and requires non-network providers to accept Medicare reimbursement and the plans terms.

SNPs are designed for people with chronic conditions such as diabetes, and individuals who qualify for both Medicare and Medicaid.

MSAs combines a high-deductible plan with a designated savings account. These plans do not include prescription drug coverage.

These hybrid HMOs let you go outside the network for treatment but may have a higher cost. There can be separate deductibles for in-network and out-of-network costs.

You May Like: What’s The Difference Between Medicare And Medicaid

Medicare Part C Vs Other Plans

Medicare Part C plans and traditional Medicare policies are different. Part C bundles services together, and depending on the plan, may offer more services than traditional Medicare, including dental, vision, and hearing care.

People should check theirindividual plan to see what it covers on top of traditional Medicare. Companiesoffer many different plans.

- If a person uses traditional Medicare, they pay Medicare directly, and Medicare pays out for their services.

- Medicare Part B: A person pays their Medicare Part B premium directly to the government.

- Medicare Part C: People with Part C pay a private insurance company.

- Medicare Part D: Medicare Part D is the traditional portion of Medicare that pays for prescription drug coverage. A person can select from several plans and pay a monthly premium directly to the government.

- Medigap: Medigap insurance can help a person pay for co-payments and deductibles, as well as other out-of-pocket expenses.

Some people prefer thefreedom of choosing their own providers and specialists that can come withtraditional Medicare.

Changes To Medicare Advantage Under Obamacare

In 2014, the Affordable Care Act changed the healthcare system in America and also changed small parts of Medicare. The only real change that most people noticed is that now Medicare and Medicare Advantage plans must include preventive care and cannot reject anyone for pre-existing conditions.

There was also an initial drop in the number of Medicare Advantage plans being offered. An Avalere Health analysis found a 5 percent drop in the availability of Medicare Advantage plans. In addition, the variety of plan types also dropped, with more Medicare Advantage providers offering only HMO policies instead of PPO, PFFS and Special Needs Plans.

For the 2020 enrollment season, Medicare Advantage customers saw an increase in plan options nationwide, with a total of over 5,000 Advantage plans on the market according to state data that we analyzed from the Centers for Medicare and Medicaid Services.

The donut hole, which is a coverage gap in Medicare, has also been eliminated thanks to measures put into place under the Affordable Care Act. Now, once you reach your drug plans initial coverage limit , youll pay 25 percent of the cost of your medications until you reach the catastrophic limit on the other side.

Read Also: What Is The Penalty For Signing Up For Medicare Late

How To Find The Right Medicare Advantage Coverage For You

If youre approaching the age of 65, navigating another qualifying event or reviewing plan options ahead of the Medicare Advantage Open Enrollment period, there are several details to consider when comparing Medicare Advantage plans. To make that process easier, we created the downloadable checklist below.

Medicare Advantage Special Enrollment For 5

You can switch to a 5-star Medicare Advantage plan or other supplemental plan offered by a private health insurance company during a Special Enrollment Period from November 30 to December 8 each year. Many plans are rated just under 5 stars but still offer great benefits and have excellent customer satisfaction.

Plans should also be compared based on their customer satisfaction and reviews. You can read reviews and compare plans based on customer service, pricing, benefits, extra services and ease of use.

Don’t Miss: Can You Get Dental Insurance On Medicare

How Are Inpatient Stays For Mental Health Care Services Handled

Inpatient stays for mental health services are covered by Medicare Part A hospital insurance. Individuals are eligible for up to 190 days of mental health hospitalization in their lifetime. Patients are responsible for covering a deductible when they receive inpatient hospitalization. The deductible varies from one year to another. You also have to pay for your portion of the health professionals bills that accrue during the stay.

The out-of-pocket costs for the deductible for inpatient mental health care is per stay at the psychiatric hospital, not per year. It resets once youve been out of the hospital for at least 60 consecutive days. This means that if youre discharged and readmitted prior to being out for 60 days, you wont have a new deductible to pay for the second hospital stay.

You also have to remember that some inpatient stays have a coinsurance payment. These start on day 61 of being hospitalized during a benefit period. It increases on day 91 to either a lifetime reserve day rate or a full patient responsibility rate. You have 60 lifetime reserve days to use over the course of your life. Once those are exhausted, you pay for the full stay starting at day 91.

Medicare Advantage And Medicare Part D Drug Coverage

Original Medicare beneficiaries who need prescription drug coverage can typically supplement their Part A and Part B benefits with a Medicare Part D Prescription Drug Plan , or they can get their Part A, Part B and prescription drug benefits all in a single Medicare Advantage plan.

Bot of these types of Medicare drug plans will have a listing of covered drugs, called a formulary. Often, drugs are divided into tiers, with those in the top tier costing less than those in lower tiers. Plans may exclude some prescription drugs, such as those for erectile dysfunction, weight management and hair regrowth.

Medicare Advantage Plans are required cover everything Original Medicare cover, and most plans provide more benefits. According to the Kaiser Family Foundation, the vast majority of 2022 Medicare Advantage Plans included prescription drug coverage.

Also Check: What Age Am I Medicare Eligible