Can Medigap Plans Help Mitigate The Cost

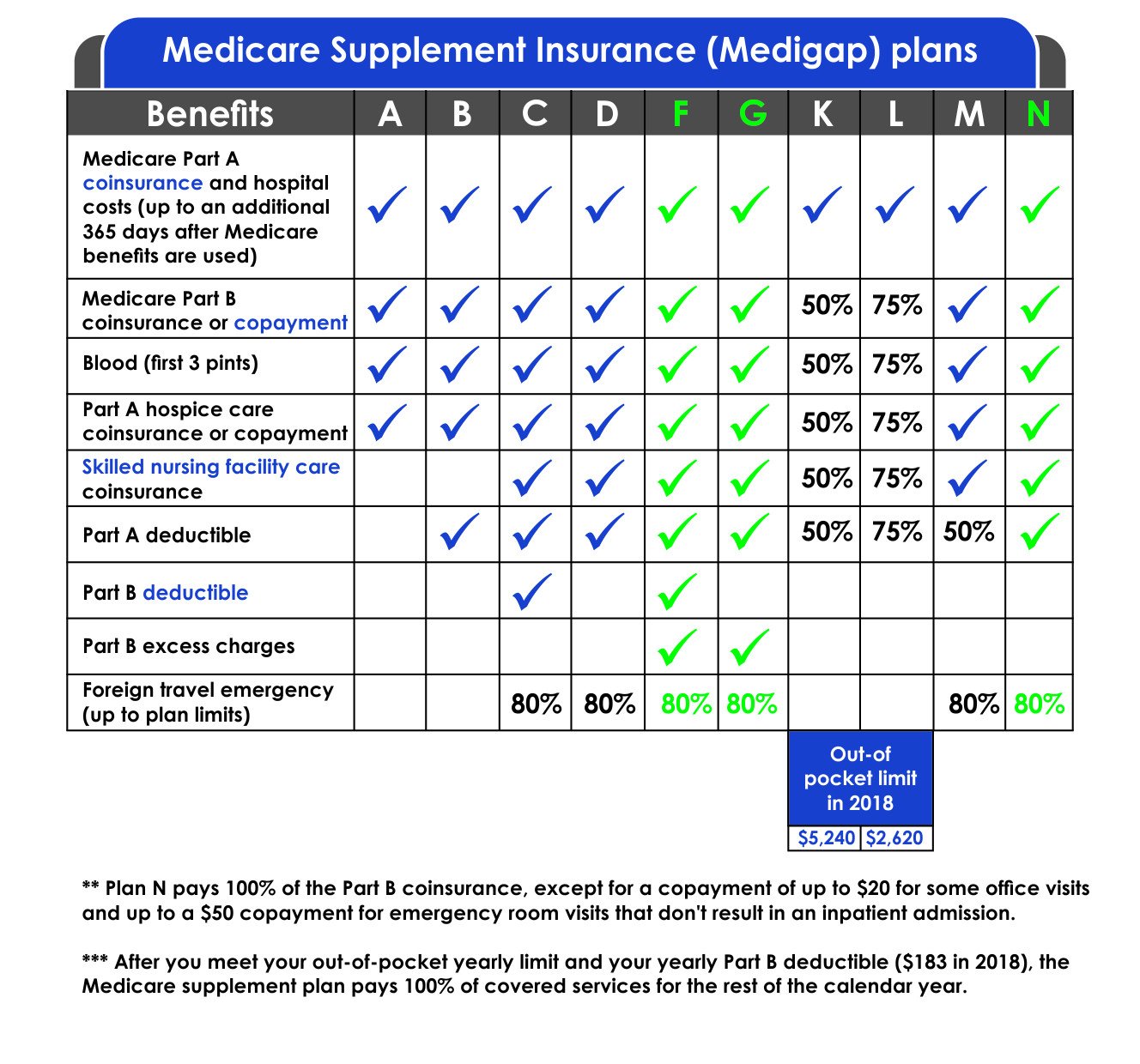

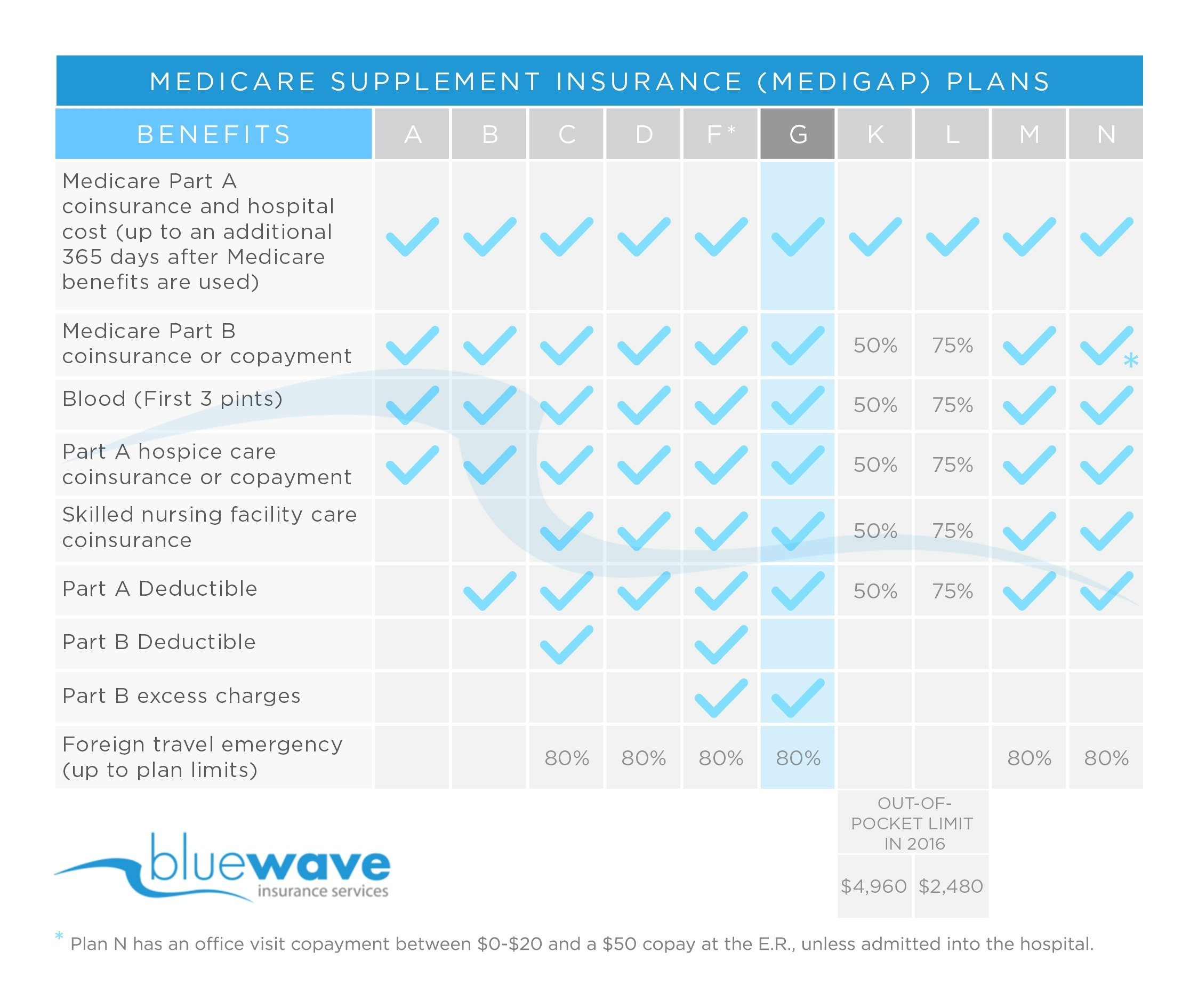

Medigap plans, also known as Medicare Supplement plans, are plans that cover out-of-pocket Medicare costs. These plans don’t directly cover health care services, but just cover other fees like your Part B deductible and coinsurance, depending on which plan you choose.

Medicare Supplement insurance can help keep you from paying high out-of-pocket costs, but it doesn’t apply to Medicare Advantage plans. If you have a zero-premium plan, you will have to fully pay the out-of-pocket costs, with no help from Medigap.

So How Are Some Plans Free

As you can see, Medicare Advantage plans mostly function as private health insurance plans. If youve had private health insurance in the past, you know its far from free. So, how can it be that some Medicare Advantage plans are free?

These free plans are actually just premium-free, meaning that you pay $0 monthly. The trade-off will be higher out-of-pocket costs. This means that although you wont pay any premiums, you may end up paying high cost-sharing percentages or copay fees when you do visit your health care provider. High deductible plans require you to pay a substantial cost out-of-pocket before your Medicare coverage even begins.

For some people, premium-free Part C plans can end up being more expensive than ordinary ones, because the out-of-pocket fees are higher than the premiums would be. The idea behind zero-premium Medicare Advantage plans is that they are worth it if you very rarely visit your doctor. If this is the case for you, you should check these plans out.

However, remember that insurance companies are always out to make money. If they couldnt make money offering premium-free plans, they wouldnt: if it sounds too good to be true, it probably is.

What Is Medicare Part D

Medicare Part D is a supplement to Medicare that covers prescription drugs that older adults take at home. In addition to their monthly premiums, those enrolled in Medicare Part D pay a portion of the cost of most prescription drugs they need.

Copay Limits for Insulin: Copays for insulin for all beneficiaries will be limited to $35 per month. This applies to all insulin covered by a beneficiarys Part D plan or under Medicare Part B.

Coverage for Vaccines: People with Medicare will pay no copays or deductibles for some vaccines covered by their Part D plan, including the shingles vaccine and flu shot. For now, COVID-19 vaccines and boosters remain free with no copay for all Americans.

Higher Barriers to the Coverage Gap and Catastrophic Coverage: Not all Medicare numbers are going down. Medicare beneficiaries will enter the coverage gapwhere they pay out of pocket for medicationsafter their total drug costs reach $4,660 . Once in the coverage gap, beneficiaries have a 75% discount on the cost of brand name and generic drugs.

If Medicare beneficiaries have spent enough money out of pocket while in the coverage gap, they may qualify for something called “catastrophic coverage.” During this period, people pay significantly lower copayments or coinsurance for covered drugs. In 2023, beneficiaries will reach catastrophic coverage after paying $7,400 out of pocket on drugs .

Also Check: Does Medicare Pay For A Nutritionist

Cap On Insulin More Free Vaccines: Changes In 2023 Medicare To Know During Enrollment Period

President Joe Biden signs the Inflation Reduction Act, the Democrats’ landmark climate change and health care bill, in the State Dining Room of the White House in Washington, Aug. 16, 2022. The legislation contains changes in Medicare that will take effect in 2023. The enrollment period for Medicare is open through Dec. 7.AP

CLEVELAND, Ohio Now that the Medicare enrollment period has opened, there are two important things to remember. One, dont take advice from faded-from-fame actors or athletes pitching Medicare hype on TV.

Two, dont assume that last years plan will be a good fit for you in 2023. A cap on the price of insulin, expensive vaccines that will be available for free and decreased premium costs are among the changes coming to Medicare next year.

This time of year, cell phonesare lighting up their texts are lighting up their mailbox is full of paper and every TV station is advertising Medicare Advantage plans. Just try to turn off the noise, said Christina Reeg, director of the Ohio Senior Health Insurance Information Program. The agency is funded by Medicare to provide objective, unbiased information about the federal insurance plan for people 65 and older.

Its very important, during this open enrollment period, that individuals review what they have, and then look closely at whats being offered next year, Reeg said.

More vaccines free in 2023

More vaccines will be free to Medicare recipients next year.

Insulin will be capped at $35

Why Are Some Medicare Advantage Plans Free

- Why are some Medicare Advantage plans free? And are they actually free? Our Medicare plan review gives you the full scoop on $0 premium Medicare Advantage plans and whether one might be a good deal for you.

Youve likely seen advertisements for $0 Medicare Advantage plans and have wondered how they can possibly be free and whether they actually are free.

Its true that many Medicare Advantage plans offer $0 premiums. In fact, nearly 70% of all enrollees in a Medicare Advantage plan with prescription drug coverage paid no premium for their plan in 2022.

So are some Medicare Advantage plans actually free? And if so, how? Read our Medicare plan review to learn more about Medicare Advantage plan costs. You can also compare Medicare Advantage plans online for free, including plans that may feature $0 monthly premiums.

Read Also: Does Everyone Qualify For Medicare

The State With The Best Medicare Advantage Provider

Some insurers only operate in one state, and not all offer Medicare Advantage plans. Depending on where you live, a major national health insurance provider might not be your best option. Local plans can be affordably priced and of a high caliber.

In many states, Sky Cross, Blue Shield, Humana, and United Healthcare receive the top rankings among the national carriers. Aetna Medicare has the highest overall rating in most states.

However, there isnt just one best plan. Your requirements and preferences will determine the best option for you. Consider your budget and the extra services and benefits most important to you.

What Plan Options Are There

More options and flexibility are the main draws of Medicare Advantage for many people. There are many types of plan options available if youre looking for a Part C plan, and youll be familiar with many of these if youve had private insurance in the past.

Most plans will be either an HMO or a PPO plan. Generally speaking, HMO plans translate to a lower premium with a smaller selection to choose from in the plan’s network, while a PPO gives you the freedom to see more doctors, but has a higher price. The specific costs and network sizes can vary, and you should always make sure that your preferred physician is in the plan network that youre looking at.

Read Also: How To Sign Up For Medicare When You Turn 65

What Is The Difference Between Original Medicare And Medicare Advantage

Definitions:

- Premium: The monthly fee you pay to have Medicare or your health plan.

- Deductible: What you must pay before Medicare or your health plan starts paying for your care.

- Copayment/coinsurance: Your share of the cost you pay for each service.

- Part A: Medicare hospital insurance for inpatient care.

- Part B: Medicare medical insurance for outpatient care.

- Part D: Medicare drug coverage.

- Medigap: Supplemental insurance that helps pay your out-of-pocket cost in Original Medicare.

How Does Medicare Work

Medicare Advantage gives you a way to get your Original Medicare coverage through a private, Medicare-approved insurance company instead of directly through the government. Medicare Advantage plans provide all your Medicare Part A and Part B benefits other than hospice care, which Part A still covers. But many Medicare Advantage plans include extra benefits, such as routine dental and vision services. And most Medicare Advantage plans include prescription drug coverage, letting you get all your Medicare benefits through a single plan. You still need to continue paying your Medicare Part B monthly premium, besides any premium the Medicare Advantage plan might charge.If you stay with Original Medicare, be aware that prescription drugs arent covered in most situations. Medicare Part D offers prescription drug coverage through private, Medicare-approved insurance companies. You may want to consider adding a stand-alone Medicare Prescription Drug Plan.If you decide to stay with Original Medicare, another option you may have is to sign up for a Medicare Supplement insurance plan to help pay for Original Medicares out-of-pocket costs. Different Medigap plans pay for different amounts of those costs, such as copayments, coinsurance, and deductibles.Availability and costs of Medicare plan options may vary from one insurance company to another, and from one geographic area to another.

You May Like: Does Medicare Advantage Cover Chiropractic

What Are The Other Parts Of Medicare

In addition to Original Medicare , there are other optional Medicare parts that may help expand your coverage. These parts are:-Medicare Part C, for which you can receive coverage through Medicare Advantage plans-Medicare Part D, or stand-alone Medicare Prescription Drug Coverage-And Medicare Supplement, also called Medigap

Medicare Part A Ambulance Coverage

Generally, Original Medicare is divided into Medicare Part A and Medicare Part B, both of which offer different health insurance coverages. Medicare Part A covers so many services, especially inpatient services.

Usually, the Medicare Part A plans help with drug prescriptions and all other services that are issued when the individual is admittedly in the hospital. However, Medicare Part A does not necessarily cover ambulance services. It can however continue from where Medicare Part B stops once the individual arrives at the hospital.

Don’t Miss: Does Cleveland Clinic Accept Medicare Advantage Plans

What Are Free Medicare Advantage Plans

Maybe youve seen the commercials on TV or advertisements in the mail for free Medicare Advantage plans.

You may be wondering how can Medicare Advantage plans be free?

In short, some private health insurance companies do offer Medicare Advantage plans with a $0 monthly premium but other out-of-pocket Medicare costs still exist.

Medicare Advantage plans are increasingly popular for their one stop shop approach. Many plans offer dental, hearing, vision and Part D prescription drug coverage in addition to standard Medicare coverage.

Instead of juggling coverage from multiple plans, Medicare Advantage offers all benefits within a single plan.

Anyone who is already Medicare beneficiary can qualify for a Medicare Advantage plan.

There are several times throughout the year when you can enroll in a Part C plan, including during the open enrollment period, which lasts from Oct. 15 to Dec. 7 each year.

What Is The Texas Health Information Counseling And Advocacy Program

If you are eligible for Medicare, the Texas’ Health Information, Counseling and Advocacy Program can help you enroll, find information and provide counseling about your options. This partnership between the Texas Health and Human Services system, Texas Legal Services Center and the Area Agencies on Aging trains and oversees certified benefits counselors across the state.

Recommended Reading: How To Apply For Medicare In Michigan Online

Facts About The Medicare Give Back Benefit

If you’re looking to maximize your savings while on Medicare, you may be wondering, what is the Medicare give back benefit? This benefit is not an official Medicare program, but rather a colloquial name for a Medicare Part B premium reduction included in some Medicare Advantage plans. Whether you receive this reduction depends on the conditions of the plan that you choose and a few other factors. Read on for three facts about this benefit.

Extra Measures To Keep You Healthy And Their Costs Down

Carriers will offer disease management and preventative care programs to help their members maintain their health. The healthier you are, the less the healthcare costs are.

Youll usually schedule more appointments, and they closely monitor your health. They focus on keeping you healthy, determining conditions you may be prone to, and trying to prevent them from occurring.

Because their primary focus is keeping you healthy, many have incentives to encourage healthy living. This includes healthy food cards you can use to purchase healthy meals, gym memberships, and other incentives and rewards programs.

In addition, companies usually enter a contract with a network of doctors and hospitals. When your insurance company contracts with a network, you pay less to see doctors and hospitals in the network.

It also means that going out-of-network will cost more if you are covered. You always have coverage in an emergency.

Don’t Miss: Why Have I Not Received My Medicare Card

Medicare Part B Ambulance Coverage

Unlike a Medicare Part A plan, the Medicare Part B plan is mostly known for its outpatient insurance coverage. Also, the Medicare Part B plan covers ambulance services as allowed by Medicare.

As directed by the health insurance company and based on the severity of the condition, Medicare Part B offers ambulance coverage in emergency conditions and some non-emergency ambulance services in some cases.

According to Medicare, a situation is said to be an emergency when a residents life is threatened and theres no safe means of transportation available. In instances like this, the trip cannot be scheduled because the patient might lose his life at any instant.

If the severity of the condition permits the rescheduling of the trip, it is not an emergency. Most times, the Medicare Part B plan covers about 80% of the medically necessary emergency and non-emergency ambulance coverage.

The recipient would have to cover about 20% of the entire cost themselves in form of coinsurance. As of 2022, youd have to spend about $300 as coinsurance for average ambulance coverage.

Sometimes, on the course of the trip to the medical facility, certain precautions are taken in the ambulance to sustain the patient. These precautions which include the administration of certain painkillers, first aid services, resuscitation, and cardiac exercises are also covered by the Medicare Part B plan in expenses.

Medicare Helicopter Ambulance Coverage

The main purpose of any ambulance service is to maintain the safe trip of an individual to the hospital or place of treatment without any health compromise.

Apart from the fact that the individual has to get to the hospital uncompromised, it is a very important goal for the ambulance team to arrive at the hospital on time before the health issue of the patient gets out of hand.

Hence sometimes, road ambulance services are not just enough to save the persons life either due to traffic or other unforeseen circumstances. Either way, with the help of Medicare Ambulance services, an alternative means of transportation can be used to transport patients to the hospital.

Although it is said to be very limited, Medicare offers ambulance coverage through Medicare Part B. However, the service has to be medically necessary and recommended by an expert or health professional.

Hence, Medicare helicopter coverage can be accessed when an individual in a critical situation requires very rapid ambulance transportation that cannot be accessed via a ground ambulance. This could either be because a ground ambulance cannot get to where you are or theres a great distance between where you reside and the hospital or theres traffic .

It can be because of any obstacle that impedes the normal ground ambulance services and function of getting the patient to the health facility on time.

Also Check: When To Sign Up For Medicare Supplemental Insurance

What If I Have A Medicare Advantage Plan

Medicare Advantage plans are private plans you can enroll in instead of original Medicare. They are often area-specific.

Medicare Advantage plans limit your choice of physicians to those who participate in your plan, but may also add some benefits, such as vision care and coverage of rides to the doctor.

“You can reevaluate your choice every year and make sure youre enrolled in the coverage that’s best for you,” , a senior strategic policy advisor for AARP told Verywell, explaining new plans may become available in your area in 2023.

Use Medicares Plan Finder tool to compare Medicare Part D or Medicare Advantage plans. The plan finder compares covered health care services, providers, medications, pharmacies, and drug costs.

According to Stein, Medicare Advantage plans should consider the following questions during the enrollment period:

- Will my doctors, health care providers, hospitals, and healthcare institutions be in my plan next year?

- Will my medications be included in a drug plan, within Medicare Advantage, or in Part D?

“Most people don’t take advantage of open enrollment opportunities as much as perhaps they should, Sung said. “Now is a good time to look at your own coverage priorities and to be aware that there are a lot of different choices out there. Enrollment is a process that can take some time to get through.”

How Much Does Medicare Usually Cost

Most enrollees will get Medicare Part A for free. This will provide coverage for hospitalization, skilled nursing and hospice.

But the other parts of Medicare are not always free. This year, most people will pay $170.10 per month for Medicare Part B, which covers medical care such as doctor’s appointments, lab tests and diagnostics. And there are additional Medicare parts that can be added on top of this to cover prescription drugs, reduce your portion of medical costs, or provide extra benefits. That’s why your total Medicare costs will depend on the combination of Medicare plans you choose and the cost for each type of coverage.

The cheapest option is often to pay for Medicare Part B and enroll in a $0 Medicare Advantage bundle that includes prescription drug benefits and extras like dental coverage. A costlier approach, which can provide a better limit for your medical expenses, is to pay for Part B, Medigap and Part D.

| Type of Medicare coverage | |

|---|---|

| Medigap | $163 |

When enrolling in Medicare, everyone will sign up for Medicare Parts A and B, the two components that are administered by the federal government. The monthly fee for Part B is determined each fall by the Centers for Medicare & Medicaid Services .

These variations in cost are why it’s important to compare plan options when you initially sign up for Medicare and to review your choices annually. This will help you get the best deal based on your available plan options and current medical needs.

You May Like: Does Medicare Pay For Urolift