For Medicare Advantage Enrollees The Average Out

Figure 8: Average Medicare Advantage Plan Out-of-Pocket Limits, Weighted by Plan Enrollment, 2020

In 2020, Medicare Advantage enrollees average out-of-pocket limit for in-network services is $4,925 and $8,828 for out-of-network services . For HMO enrollees, the average out-of-pocket limit is $4,486 these plans do not cover services received from out-of-network providers. For local and regional PPO enrollees, the average out-of-pocket limit for both in-network and out-of-network services are $8,795, and $9,010, respectively. These out-of-pocket limits apply to Part A and B services only, and do not apply to Part D spending.

HMOs generally only cover services provided by in-network providers, whereas PPOs also cover services delivered by out-of-network providers but charge enrollees higher cost-sharing for this care. The size of Medicare Advantage provider networks for physicians and hospitals vary greatly both across counties and across plans in the same county.

Average overall out-of-pocket limits for in-network services has trended down from 2017 with the largest decrease for HMOs . Out-of-network limits for PPOs have also decreased since 2017 .

Most Medicare Advantage Enrollees Are In Plans Operated By Unitedhealthcare Humana Or Bluecross Blueshield Affiliates In 2020

Figure 4: Medicare Advantage Enrollment by Firm or Affiliate, 2020

Medicare Advantage enrollment is highly concentrated among a small number of firms. UnitedHealthcare and Humana together account for 44 percent of all Medicare Advantage enrollees nationwide, and the BCBS affiliates account for another 15 percent of enrollment in 2020. Another four firms account for another 23 percent of enrollment in 2020. For the fourth year in a row, enrollment in UnitedHealthcares plans grew more than any other firm, increasing by more than 500,000 beneficiaries between March 2019 and March 2020. This is also the first year that Humanas increase in plan year enrollment was close to UnitedHealthcares, with an increase of about 494,000 beneficiaries between March 2019 and March 2020. CVS Health purchased Aetna in 2018 and had the third largest growth in Medicare Advantage enrollment in 2020, increasing by about 396,000 beneficiaries between March 2019 and March 2020.

Changes for 2020 due to COVID-19: Medicare Advantage plans have flexibility to waive certain requirements with regard to coverage and cost sharing in cases of disaster or emergency, such as the COVID-19 outbreak. In response to the COVID-19 emergency, most Medicare Advantage insurers have announced that they are voluntarily waiving cost-sharing requirements for COVID-19 treatment.

What Costs Do I Pay With Medicare Part C

Your costs with a Medicare Advantage plan can vary based on things like how often you visit your doctor, if your primary doctor is in-network or out-of-network, and your prescription drug needs. When its time to compare your options, consider these tips:

- Part C does have a provider network. You can contact a GoHealth licensed insurance agent or the plan to find out if your doctor is in-network. Receiving care out-of-network may not be covered thus increasing your cost considerably.

- Deductibles and copays can add up if you anticipate frequent doctor visits or the need for specialty care. It may be helpful to compare your Medicare Advantage plan costs alongside Original Medicare and Medicare Supplement coverage.

- Prescription drugs are usually covered with a Medicare Advantage Plan. Original Medicare requires members to add Part D coverage, which has its own monthly premium. Either way, you should make sure your prescriptions are covered by any Part D plan you choose.

If youre looking for quick plan comparisons and straightforward answers to your Medicare questions, GoHealth can help. A GoHealth licensed insurance agent can compare all the plans available to you side-by-side and find the plan that meets your needs.

What extra benefits and savings do you qualify for?

Read Also: What Does Medicare Part B Cover

Which Specific Costs Will I Have To Pay

As we mentioned, all Medicare Advantage plans will have a premium and a deductible, as well as either a coinsurance, copay or both. However, the cost breakdown can get more complicated when you consider provider networks.

Well get into provider networks in more detail later, but for now, its just important to remember that Part C plans have them. If you go to an out-of-network healthcare provider, then you may have a higher cost-share to pay. This means that you may have to keep track of more cost information and that your monthly costs can vary if you sometimes go to an out-of-network doctor.

Its useful to note here that some Medicare Advantage plans have no premiums at all. While this may sound weird, these plans work because they have very high deductibles and other fees. The idea behind these plans is that they work for people who seldom visit their doctor. However, when they do visit their doctor, the costs are much higher than an ordinary plan. These plans dont work for most people, but they are useful to keep on the table.

Do Medicare Part C Plans Have Deductibles

A deductible is the amount you must pay out of your own pocket toward the costs of covered services and items before your plan coverage kicks in. Plans that include prescription drug coverage may have two separate deductibles: one for medical care costs and one for drug coverage costs.

Some Medicare Advantage plans may include $0 deductibles.

In 2022, the average drug deductible for Medicare Advantage plans is $301.94 per year. Medicare plan drug deductibles can be as high as $480 per year in 2022.

In some states such as Illinois, the drug deductible can be around $400 or higher in 2022. On the other side of the spectrum, Utah’s average Medicare plan drug deductible is $182.18.

Don’t Miss: What Is A Medicare Advantage Medical Savings Account

The Share Of Medicare Beneficiaries In Medicare Advantage Plans By State Ranges From 1% To Over 40%

The share of Medicare beneficiaries in Medicare Advantage plans , varies across the country. More than 40 percent of Medicare beneficiaries are enrolled in Medicare Advantage plans in nineteen states and Puerto Rico. Medicare Advantage enrollment is relatively low in nine states, including two mostly rural states where it is virtually non-existent .

Historically, the majority of Medicare private health plan enrollment in Minnesota has been in cost plans, rather than risk-based Medicare Advantage plans, but as of 2019, most cost plans in Minnesota are no longer offered and have been replaced with risk-based HMOs and PPOs.

Changes for 2020 due to COVID-19: The COVID-19 stimulus package, the Coronavirus Aid, Relief, and Economic Security Act, includes $100 billion in new funds for hospitals and other health care entities. The Centers for Medicare and Medicaid Services has recently made $30 billion of these funds available to health care providers based on their share of total Medicare fee-for-service reimbursements in 2019, resulting in higher payments to hospitals in some states than in others. Hospitals in states with higher shares of Medicare Advantage enrollees may have lower FFS reimbursement overall. As a result, some hospitals and other health care entities may be reimbursed less that they would if the allocation of funds took into account payments received on behalf of Medicare Advantage enrollees.

How Much Does Medigap Cost In 2022

Medigap is a set of plans purchased through private providers that essentially cover costs not otherwise included in your other Medicare coverage. This means that the cost of Medigap plans will vary according to provider and state.

Since the coverage is specific to your age, needs, location, and insurance provider, the price of a Medigap plan in 2022 will vary greatly. Each company determines individual premiums based on these factors. This is why its so important to compare plans and prices when choosing your Medigap provider.

Don’t Miss: Does Medicare Cover Hospital Bills

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

Disadvantages Of Medicare Part C

-

Your list of in-network health care providers will be smaller than with Original Medicare.

-

You may have to get referrals or authorizations for some services, depending on your plan type.

-

Your plan may not cover you if you travel outside your service area.

-

You may not be able to get a Medigap plan if you return to Original Medicare, or it may cost more.

Recommended Reading: Does Medicare Pay For Visiting Nurses

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.

Also Check: Is Dermatology Covered Under Medicare

The Share Of Medicare Beneficiaries In Medicare Advantage Plans Varies Across Counties From Less Than 1% To More Than 70%

Within states, Medicare Advantage penetration varies widely across counties. For example, in Florida, 71 percent of all beneficiaries living in Miami-Dade County are enrolled in Medicare Advantage plans compared to only 14 percent of beneficiaries living in Monroe County .

In 117 counties, accounting for 5 percent of the Medicare population, more than 60% of all Medicare beneficiaries are enrolled in Medicare Advantage plans or cost plans. Many of these counties are centered around large, urban areas, such as Monroe County, NY , which includes Rochester, and Allegheny County, PA , which includes Pittsburgh.

In contrast, in 508 counties, accounting for 3 percent of Medicare beneficiaries, no more than 10 percent of beneficiaries are enrolled in Medicare private plans many of these low penetration counties are in rural parts of the country. Some urban areas, such as Baltimore City and Cook County, IL have low Medicare Advantage enrollment, compared to the national average .

Sign Up As Soon As Possible

You can add Part D coverage to Medicare Parts A and/or B. Like Parts A and B , plans generally come with a deductible. This is the amount you’ll pay before the insurance begins paying a portion of costs. Just like Part B, youll probably pay a late enrollment penalty if you dont sign up for prescription drug coverage when youre first eligible unless one of two conditions applies:

You May Like: How Does Medicare D Work

How Much Does Medicare Part C Cost

Medicare Advantage prices vary greatly by plan, so how much you pay really depends on your individual plan. There are some particular costs you should pay attention to, though. In particular, letâs cover the basics of your monthly premiums, copays, annual deductible, coinsurance, and maximum out-of-pocket limit.

Eliquis Coverage Through Medicare Part D

Medicare Part D is a part of Medicare that covers prescription drugs, and is offered by private insurance companies. Unlike original Medicare, the pricing is only partially set by the government. Medicare Part D will cover your Eliquis prescription, but you may have to pay a deductible, copayment, or coinsurance.

You May Like: Are Dental Implants Covered By Medicare

What Is The Part A Premium

If you or your spouse paid Medicare taxes while working for 40 quarters or more, you are eligible for Premium-free Part A, which means you dont owe any monthly premiums for coverage. If you paid Medicare taxes for 30-39 quarters, youll pay $274 per month in 2022 those whove paid less than 30 quarters in Medicare taxes will pay $499 a month in premiums.1

Medicare Advantage Costs In 2021

Medicare Advantage is private health insurance through which you can get your Medicare Part A and Part B benefits. Medicare Part A continues to pay for hospice benefits when you have a Medicare Advantage plan. Some Medicare Advantage plans include prescription drug coverage and may include other benefits as well. Premiums and deductibles for Medicare Advantage plans may vary, depending on which plan you choose and the extent of your health coverage.

eHealth research* showed that for plans included in the eHealth study:

- The average monthly premium for Medicare Advantage plans decreased from $10 to $6 between 2019 and 2020.

- The average monthly premium for stand-alone Part D prescription drug plans decreased from $23 in 2019 to $20 in 2020.

- Medicare Advantage deductibles in the eHealth study have decreased over time, but deductibles for stand-alone Medicare prescription drug plans have increased over the same period.

Read Also: Do You Need Medicare If You Are Still Working

How Much Does Medicare Part A Cost

Medicare Part A is hospital insurance. Heres how much Medicare Part A costs in 2021.

- Monthly premium: You might be able to save on this Medicare cost if you dont have to pay the Part A premium. Most people dont. If youve worked at least 10 years while paying Medicare taxes, you dont have to pay a Part A premium. If you paid Medicare taxes for 30-39 quarters, your Part A premium is $259 in 2021. If you paid Medicare taxes for less than 30 quarters, your Part A premium is $471 in 2021.

- Deductible: $1,484 in 2021. Note that this cost isnt per year, but per benefit period. A new benefit period starts when you havent had inpatient hospital care or skilled nursing care for at least 60 days in a row, and youre newly admitted as an inpatient.

- Daily coinsurance or copayment: When youre an inpatient in the hospital, or if youre in a skilled nursing facility, Part A may cover some of the costs of your stay.

The first 60 days youre an inpatient, you generally dont pay coinsurance . Days 61 through 90, youll typically pay $371 per day in 2021. From Day 91 on, your coinsurance is $742 per day for each lifetime reserve day. You get a total of 60 lifetime reserve days in your lifetime. When theyre used up, you may have to pay all costs. A Medicare Supplement plan may help pay some of these costs.

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2022 standard premium for Part B is $170.10 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17.01 per month to your Part B premium.

Recommended Reading: Does Medicare A Have A Deductible

More Than 3 Million Medicare Beneficiaries Are Enrolled In Special Needs Plans In 2020

Figure 12: Number of Beneficiaries in Special Needs Plans, 2006-2020

More than three million Medicare beneficiaries are enrolled in Special Needs Plans . SNPs restrict enrollment to specific types of beneficiaries with significant or relatively specialized care needs. The majority of SNP enrollees are in plans for beneficiaries dually eligible for Medicare and Medicaid , Another 11 percent of enrollees are in plans for people with severe chronic or disabling conditions and 3 percent are in plans for beneficiaries requiring a nursing home or institutional level of care .

Enrollment in SNPs increased from 2.9 million beneficiaries in 2019 to 3.3 million beneficiaries in 2020 , accounting for about 14 percent of total Medicare Advantage enrollment in 2020, with some variation across states. In nine states, the District of Columbia, and Puerto Rico, enrollment in SNPs comprises at least one-fifth of Medicare Advantage enrollment . Most C-SNP enrollees are in plans for people with diabetes or cardiovascular disorders in 2020. Enrollment in I-SNPs has been increasing but is still fewer than 100,000 beneficiaries in 2020.

Changes for 2020 due to COVID-19: In response to the public health emergency, CMS will use discretion when enforcing certain oversight and monitoring activities relating to SNPs, including if Medicare Advantage plans do not fully comply with their approved SNP model of care or if plans experience delays in recertifying SNP eligibility.

Topics

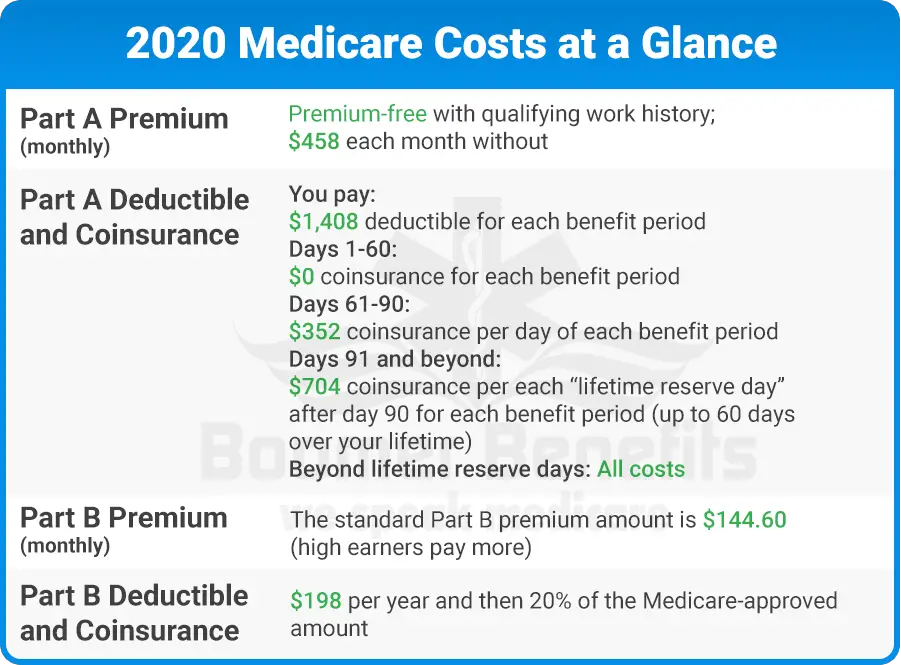

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021 . If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 . If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259 . |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203 . After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Recommended Reading: How Do I Find Out My Medicare Number