What Is Covered Under Medicare A

Medicare Part A is commonly referred to as hospital insurance because its primary function is to help older adults manage the cost of hospital bills. Medicare Part A covers some expenses you incur at what you think of as a traditional hospital, but it also covers similar inpatient services in semi-private rooms at similar facilities, including:

- Acute care hospitals.

- Long-term care hospitals.

- Inpatient care as part of a qualifying clinical research study.

Regardless of the facility used, hospice care is covered by Medicare Part A if you are terminally ill and accept palliative care for comfort instead of treatment for your illness. Some home health care is covered as well.

Short-term care in a skilled nursing facility or nursing home may also be covered by Medicare Part A if its a doctor-approved treatment for a medical condition stemming from an inpatient hospital stay.

As a part of treatment in Medicare-approved facilities, Medicare Part A covers meals, general nursing and drugs that are part of your inpatient treatment as well as surgery and lab tests.

What does Medicare Part A cover and not cover based on your status as a patient? If, for example, you need chemotherapy, Part A will cover it if its administered as a part of an inpatient hospital stay if its done on an outpatient basis, Part A wont cover it .

B: Routine Medical Care

Medicare Part B pays for routine medical care like doctor visits, preventive services, outpatient care, physical therapy and medical equipment.

What you pay.

- A monthly premium

- Deductibles

- Coinsurance

- Costs for care outside the United States

Parts A and B can cover other services and items not mentioned here. You can investigate the full details at Medicare.gov.

What Are Medicare Supplement Plan Basic Benefits

Basic benefits for each lettered Medicare Supplement plans are set by the government. If you buy Medicare Supplement Plan G from one company, it will have essentially the same basic benefits as Plan G offered by another insurance company.

All Medicare Supplement plans may pay 100% of your daily hospital coinsurance under Medicare Part A, and include an additional 365 days of coverage after Medicare coverage runs out. All plans generally pay between 50% and 100% of your Medicare Part B coinsurance and copayments, your Part A skilled nursing home coinsurance, and your Part A hospice coinsurance. They all may cover your first three pints of blood.

Also Check: Will Medicare Pay For My Nebulizer

How Do I Sign Up For Medicare Part A

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board . You can sign up in a few different ways:

- Online: Visit the Social Security website to apply for Medicare Part A and/or Part B.

- : Call Social Security at 1-800-772-1213 . Representatives are available Monday through Friday, from 7AM to 7PM.

- In-person: Visit your local Social Security office to apply.

- If you worked for a railroad, contact the RRB to apply at 1-877-772-5772. . You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative.

You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so. If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

If you dont sign up during your Initial Enrollment Period, you may be able to sign up during the General Enrollment Period that takes place every year from January 1 to March 31 your coverage would start on July 1.

Additional Health Insurance Options

Original Medicare doesnt cover everything. If you decide to stay with Original Medicare , you can purchase a Medicare Supplement plan to help cover Original Medicares out-of-pocket costs, such as coinsurance, copayments, and deductibles. Original Medicare doesnt include prescription drug coverage, so you also might want to add a stand-alone Medicare Prescription Drug Plan.

Medicaid is another possible option to help cover health-care costs for those eligible for the program.

Don’t Miss: Does Medicare Advantage Pay For Hearing Aids

What Are The Alternatives To Medicare For All

Not everyone believes in the viability and success of a single-payer healthcare system like Medicare for All. Joe Bidens alternative to Medicare for All includes an expansion of the Affordable Care Act that was enacted under President Obama in 2010. These changes would not impact Medicare beneficiaries in the same way that Medicare for All would.

The Patient Protection and Affordable Care Act or simply the Affordable Care Act , often referred to as Obamacare, was designed to create affordable healthcare options for more Americans.

As an alternative to Medicare for All, the changes according to Joe Biden, to the ACA would include:

- more health insurance choices for all Americans

- lower premiums and extended coverage

- expanded coverage to include those with lower incomes

- increased affordable options for enrollees

- changes in billing practices and medical costs

- reduced drug costs and improved generic options

- expanded reproductive and mental health services

Accordingto a recentreview of the current literature, there are also two additional federal and20 state proposals for a single-payer healthcare system here in the UnitedStates.

What Parts A And B Don’t Cover

The largest and most important item that traditional Medicare doesn’t cover is long-term care if the only care you need is custodial. If you are diagnosed with a chronic condition that requires ongoing long-term personal care assistance, the kind that requires an assisted-living facility, Medicare will cover none of the cost. However, Medicare will cover the costs for acute-care hospital services, for patients who are transferred from an intensive care or critical care unit. Services covered could include head trauma treatment or respiratory therapy.

Read Also: Does Medicare Pay For Dtap Shots

Do You Need Medicare Part A For Hospital Coverage

If you, like most people, dont have to pay a monthly premium for Part A, there is no downside to enrolling when you become eligible at age 65. You dont have to pay a premium if you have paid Medicare taxes for at least 10 years.

If you face an inpatient hospital stay and have Part A, you will still be responsible for some costs. Those costs, however, are significantly reduced.

Making An Informed Decision

If youre new to Medicare, you may want to determine which type of Medicare insurance plan will fit your health-care and financial needs. If youre still employed or have coverage such as veterans benefits, check with your plan administrator to see how this insurance works with Medicare. Its also important to decide if you need prescription drug coverage. Once your Medicare benefits kick in, dont forget to schedule your complimentary Welcome to Medicare physical exam with a doctor, and be sure to ask about any preventive services he or she might recommend.

As you can see, there are various Medicare insurance options available. To get help finding a plan or comparing plans in your area, you can enter your zip code where indicated on this page or feel free to contact one of eHealths licensed insurance agents at the phone number shown below.

Statistical data from the Centers for Medicare & Medicaid Services, On its 50th anniversary, more than 55 million Americans covered by Medicare as of July 28, 2015 and 2016 MA Part D Landscape State-by-State Fact Sheet as of September 21, 2015.

You May Like: How To Sign Up For Aetna Medicare Advantage

Medicare Part A B C And D: What You Need To Know

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

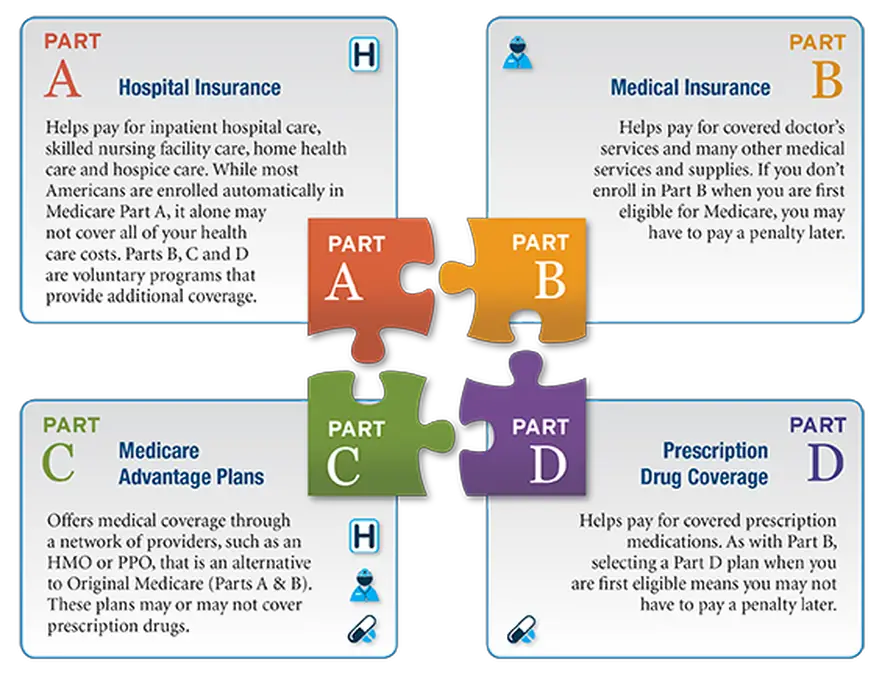

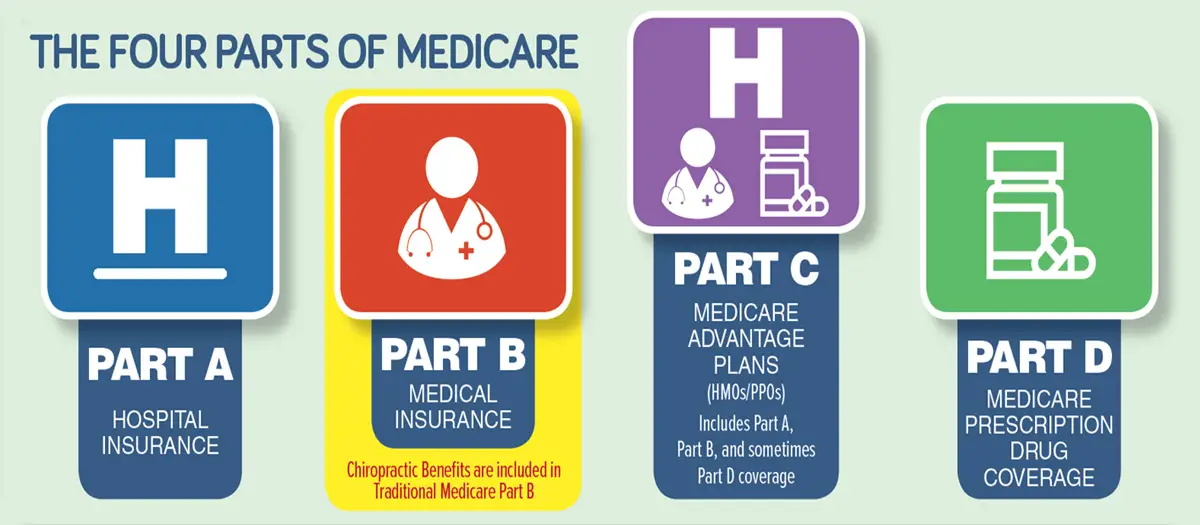

Medicare Parts A, B, C, and D are the four distinct types of coverage available to eligible individuals. Each Medicare part covers different healthcare-related costs. While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services , Medicare Part C and Medicare Part D are managed by private insurance companies.

Medicare is similar to the health insurance coverage youve probably had with an employer or an individual policy. It can cover doctor visits, inpatient and outpatient hospital care, prescription drugs, and lab tests. Depending on the plan you choose, your Medicare plan can also cover dental and vision, if you like.

Heres a brief overview of each of the parts of Medicare.

Medicare Part B: Doctors And Tests

Medicare Part B covers a long list of medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatment.

You’re not required to enroll in Part B if you have “” from another source, such as an employer or spouse’s employer. If you don’t enroll and you don’t have creditable coverage from another source, you may have to pay a penalty if you enroll later.

You pay a monthly premium for Part B. In 2021, the cost is $148.50, up from $144.60 in 2020. If you’re on Social Security, this may be deducted from your monthly payment.

The annual deductible for Part B is $198 in 2020 and rises to $203 in 2021. Once you meet the deductible, you pay 20% of the Medicare-approved cost of the service, provided your healthcare provider accepts Medicare assignment. But beware: There is no cap on your 20% out-of-pocket expense.

For example, if your medical bills for a certain year were $100,000, you could be responsible for up to $20,000 of those charges, plus the charges incurred under Part A and D umbrellas. There is no lifetime maximum.

Kathryn B. Hauer, MBA, CFP®, EA, a financial advisor with Wilson David Investment Advisors in Aiken, S.C., and author of Financial Advice for Blue Collar America, explains:

Recommended Reading: Does Medicare Part D Cover Shingrix

A Quartet Of Medicare Enrollment Periods

There are several enrollment periods, in addition to the seven-month initial enrollment period. If you missed signing up for Part B during that initial enrollment period and you aren’t working , you can sign up for Part B during the general enrollment period that runs from Jan. 1 to March 31. Coverage will begin on July 1. But you will have to pay a 10% penalty for life for each 12-month period you delay in signing up for Part B. Those who are covered by a current employer’s plan, though, can sign up later without penalty during a special enrollment period, which lasts for eight months after you lose that employer coverage. If you miss your special enrollment period, you will need to wait until the general enrollment period to sign up.

Open enrollment runs from Oct. 15 to Dec. 7 every year during which you can change Part D plans or Medicare Advantage plans for the following year, or switch between Medicare Advantage and original Medicare. Advantage enrollees also can switch to a new Advantage plan or original Medicare between Jan. 1 and March 31. And if a Medicare Advantage plan or Part D plan available in your area has a five-star quality rating, you can switch to that plan outside of the open enrollment period.

Enrollment Period For Medicare Part D

Like Medicare Part C, you are eligible to enroll in Medicare Part D during the seven-month period around your 65th birthdaybeginning three months before the month of your 65th birthday, including the month of your birthday, and up to three months after the end of your birthday month. You must enroll directly through an insurance company.

You May Like: Do I Need To Sign Up For Medicare Part B

What Is Medicare Supplement

Medicare Supplement is not an official lettered Part of Medicare, but if you have Original Medicare you may want it. With Medicare Part A and Part B, you may be left with significant out-of-pocket costs including copayments, coinsurance, and deductibles. Original Medicare also has no out-of-pocket maximum, or cap on how much you might spend. Medicare Supplement Insurance plans may cover a portion of these out-of-pocket costs.

Enrollment Period For Medicare Part A

Youre eligible to enroll in Medicare Part A during your Initial Enrollment Period , which is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes your birth month, and lasts up to three months after your birthday month.

When you apply for Social Security benefits, youre automatically enrolled in Medicare Part A.

Also Check: Can I Get Medicare At Age 62

Is Medicaid Part Of Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare. Heres how Medicaid works for people who are age 65 and older: Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article Can I get help paying my Medicare costs?

WANT TO KEEP LEARNING HOW MEDICARE WORKS?

Do You Need More Than Part A For Hospital Coverage

While Part A covers a significant portion of a typical hospital bill and usually provides coverage for U.S. citizens age 65 and older without a monthly premium, your bill could still be costly without other coverage.

Part B of Original Medicare helps cover the medical portion of hospital bills. Part B usually does require a monthly premium.

Enrolling in Part A and B of Original Medicare opens the options for you to add a Medigap supplemental plan to help with Part A deductibles and coinsurance.

Those with Part A and B can switch to a Medicare Advantage plan from a private insurance company that replaces Original Medicare and provides the same coverage as Parts A and B while offering additional coverage.

Also Check: Does Medicare Cover Cosmetic Surgery

C: Medicare Advantage Plans

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

Costs And Funding Challenges

Over the long-term, Medicare faces significant financial challenges because of rising overall health care costs, increasing enrollment as the population ages, and a decreasing ratio of workers to enrollees. Total Medicare spending is projected to increase from $523 billion in 2010 to around $900 billion by 2020. From 2010 to 2030, Medicare enrollment is projected to increase dramatically, from 47 million to 79 million, and the ratio of workers to enrollees is expected to decrease from 3.7 to 2.4. However, the ratio of workers to retirees has declined steadily for decades, and social insurance systems have remained sustainable due to rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office wrote in 2008 that “future growth in spending per beneficiary for Medicare and Medicaidthe federal government’s major health care programswill be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costswhich will be difficult, in part because of the complexity of health policy choicesis ultimately the nation’s central long-term challenge in setting federal fiscal policy.”

Recommended Reading: Do I Qualify For Medicare If I Am Disabled

When Do I Sign Up For Medicare Part A

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.

Automatic enrollment in Medicare Part A

If youre currently receiving retirement benefits from Social Security or the Railroad Retirement Board , youre automatically enrolled in both Medicare Part A and Part B starting the first day of the month you turn age 65. If your birthday happens to fall on the first day of the month, then youll be automatically enrolled in Medicare on the first day of the month before your birthday. You should get your Medicare card in the mail three months before your 65th birthday.

Most people dont pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years while working. If you havent worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouses work history.

If you are under age 65 and disabled, you automatically get Part A and Part B after you have received disability benefits from Social Security or certain disability benefits from the Railroad Retirement Board for 24 months. You will receive your Medicare card in the mail three months before the 25th month of disability. If you have ALS , you automatically get Part A the first month that your disability benefits begin.

Manual enrollment in Medicare Part A

- Go to Medicare.gov.