Will I Get Medicare At 62 If I Retire Then

If you retire before the age of 65, you may be able to continue to get medical insurance coverage through your employer, or you can purchase coverage from a private insurance company until you turn 65. While waiting for Medicare enrollment eligibility, you may contact your State Health Insurance Assistance Program to discuss your options.

Here are some ways you may be eligible for Medicare at age 62:

- You may qualify for Medicare due to a disability if you have been receiving SSDI checks for more than 24 months.

- You have been diagnosed with End-Stage Renal Disease .

- You are getting dialysis treatments or have had a kidney transplant.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

How Do I Get Medicare In Florida

You can get Medicare in Florida by reaching out to the Social Security office during your Initial Medicare Enrollment Period, which occurs from three months before you turn 65, includes the month you turn 65, and lasts until three months afterward. If you miss this window, you can also enroll during the General Enrollment Period from January 1 to March 31.

You can apply for Medicare Advantage or a Medicare Part D plan when you first get Medicare, or during the annual Medicare Open Enrollment Period from October 15 to December 7.3

Are you ready to start shopping for a Medicare Advantage, Medicare Supplement, or Medicare Part D Plan? Let the HealthMarkets FitScore rank plans for you, using your responses to a few quick questions.

Failing To Plan Around Non

Under Florida law, Medicaid estate recovery does not apply to your personal residence if it qualifies as homestead property. However, that does not stop Medicaid from recovering against second homes or rental properties you own. After you pass away, Medicaid will seek reimbursement against any non-homestead real estate. Fortunately, there are also planning tools available to those who own multiple pieces of real estate. In many cases, these tools may prevent Medicaid from seizing the real estate after you pass away. The most common of these tools is recording a Florida lady bird deed .

Read Also: What Age Do You Register For Medicare

Am I Eligible For This Program

The Medicare buy-in program uses the same financial resource limits as the Supplemental Security Income program, but with different qualification amounts for income.

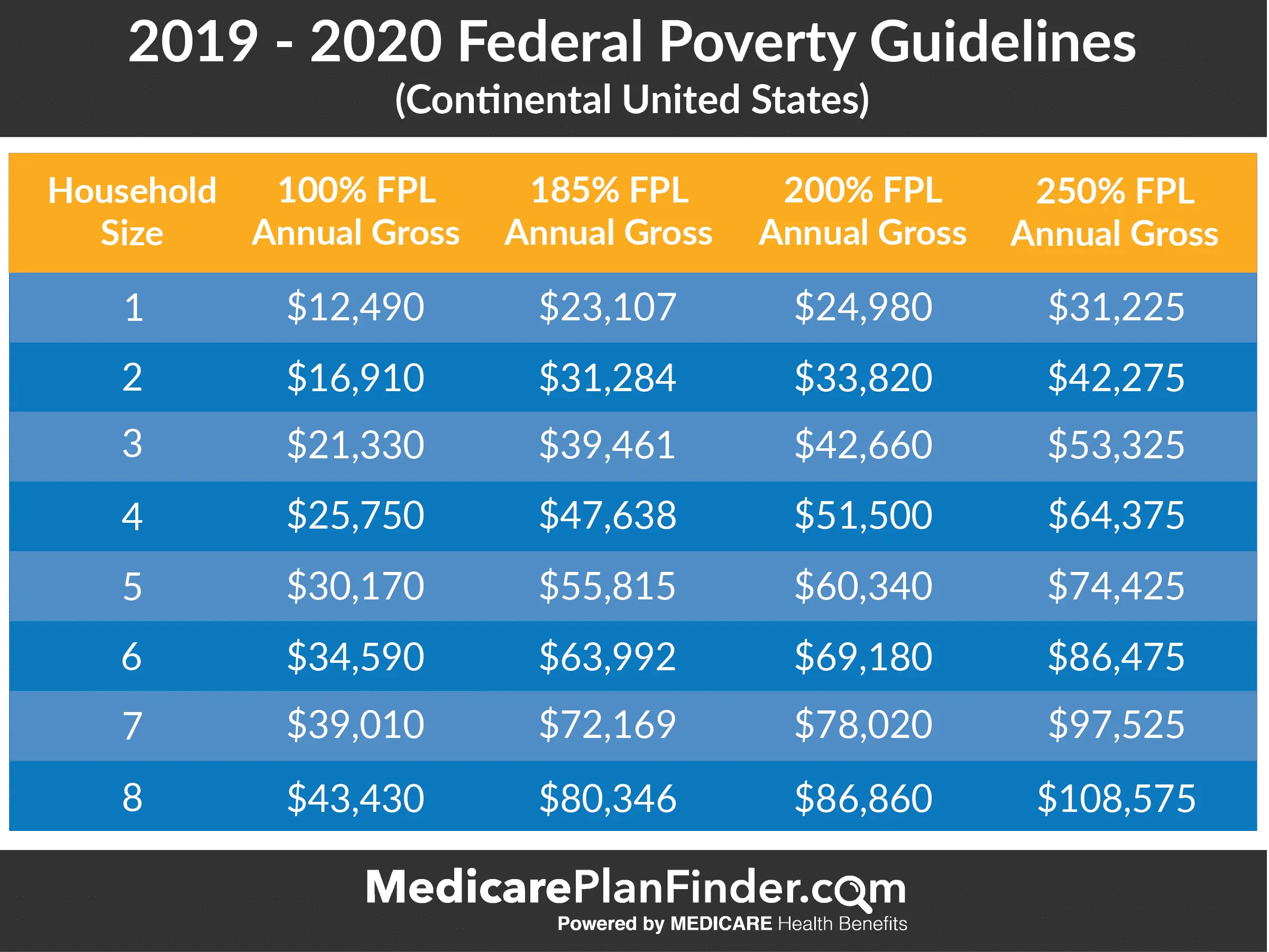

Eligibility and application rules vary by state. To qualify, individuals and couples must meet income and resource needs based on the federal poverty level and state guidelines for the MSPs.

If youre eligible for SSI, you qualify for Medicaid. You can apply for an MSP if you dont currently have Medicare parts A or B. You can also apply if you have Part A and need help with Part B premiums.

Once you qualify, youll be enrolled in parts A, B, and sometimes D. You may receive help with all or some premiums based on your need.

To find out whether youre eligible for an MSP or other Social Security benefits, you can use the Social Security Administrations benefit eligibility screening tool.

Checking your eligibility status

To find out whether youre eligible for the buy-in program, you can:

- birth certificate

- proof of address

Once you apply and meet the requirements, states can automatically enroll you in the Part B buy-in program to help cover your premium.

If you enroll in Medicaid, SSI, or an MSP, you also automatically qualify for Extra Help. This is a program that helps you pay your Part D premium.

Part D is prescription drug coverage offered by Medicare. Extra Help removes the enrollment penalty for Part D if you didnt apply when you were first eligible. However, youll still need to choose a Part D plan.

Medicare Eligibility If You Are Under 65

People younger than 65 may qualify for Medicare if they have certain costly medical conditions or disabilities.

If you are under 65, you qualify for full Medicare benefits if:

- You have been receiving Social Security disability benefits for at least 24 months. These do not need to be consecutive months.

- You have end-stage renal disease requiring dialysis or a kidney transplant. You qualify if you or your spouse has paid Social Security taxes for a specified period of time based on your age.

- You have amyotrophic lateral sclerosis, also known as Lou Gehrigs disease. You qualify for Medicare immediately upon diagnosis.

- You receive a disability pension from the Railroad Retirement Board and meet certain other criteria.

You May Like: How Can I Get My Medicare Card Number

When To Sign Up For Medicare In Florida

Medicare Annual Election Period is October 15 to December 7 each year. Beneficiaries who are already enrolled in Medicare should review their healthcare needs for the upcoming year and determine if changes to their current coverage are necessary. The Medicare Plan Finder allows users to compare pricing between Original Medicare, Medicare plans with prescription drug coverage, Medicare Advantage plans, and Medicare Supplement Insurance policies.

How Do I Apply For Medicaid In Florida

Medicaid eligibility is determined by the Department of Children and Families in Florida. You can apply for Medicaid ABD or an MSP using this website. The DCF website also lists local partners who can help you file a Medicaid application.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare technical assistance contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare and Medicaid claims and appeals. In addition to advocacy work, Josh helped implement federal and state health insurance exchanges at the technology firm hCentive. He also has held consulting roles, including at Sachs Policy Group, where he worked with clients on Medicare and Medicaid issues.

You May Like: Should I Enroll In Medicare If I Have Employer Insurance

Does Florida Help With My Medicare Premiums

A Medicare Savings Program can help Florida Medicare beneficiaries who struggle to afford the cost of Medicare coverage. The MSPs help some Floridians pay for Medicare Part B premiums, Medicare Part A and B cost-sharing, and in some cases Part A premiums.

- Qualified Medicare Beneficiary : QMB pays for Part A and B cost sharing and Part B premiums. If a Medicare beneficiary owes Part A premiums, QMB pays for them, too. The income limit for QMB is $1,064 a month for individuals and $1,437 a month for couples.

- Specified Low-income Medicare Beneficiary : SLMB pays for Part B premiums for those with income below $1,276 a month if single or $1,723 a month if married.

- Qualifying Individuals : QI pays for Part B premiums for beneficiaries with income under $1,436 a month for individuals less than $1,940 a month for married couples.

- Qualified Disabled Working Individuals : QDWI pays for Part A premiums for certain enrollees who have incomes below $2,024 a month if they live by themselves or $2,744 a month if they live with one other person.

MSP asset limits: Florida uses the federal asset limit $7,860 if single and $11,800 if married for QMB, SLMB and QI. The asset limit for QDWI is $5,000 if single and $6,000 if living with others.

Difference Between Qmb And Medicaid Waiver Program In Florida

Medicaid Waiver is for those Floridians who need help paying for home-health care or ALF bills. For those already enrolled in a Medicaid Waiver program in Florida, they will receive all the same benefits as those who only have QMB. In other words, QMB is really for those Medicare recipients who don’t yet need help with their activities of daily living but who are in need of assistance paying for health care and prescription medications.

In addition, QMB does not have a waitlist, while the Medicaid Waiver / Home and Community Based Medicaid has a waitlist that last for months and months. We often assist our Medicaid clients, who need assistance with their activities of daily living, with strategies to qualify and apply to both programs. The primary benefit to applying for both QMB and Medicaid Waiver benefits in Florida is to start receiving QMB benefits now while waiting to come off the Medicaid Waiver waitlist.

Recommended Reading: Who Is Entitled To Medicare Benefits

Eligibility For Medicare Part C

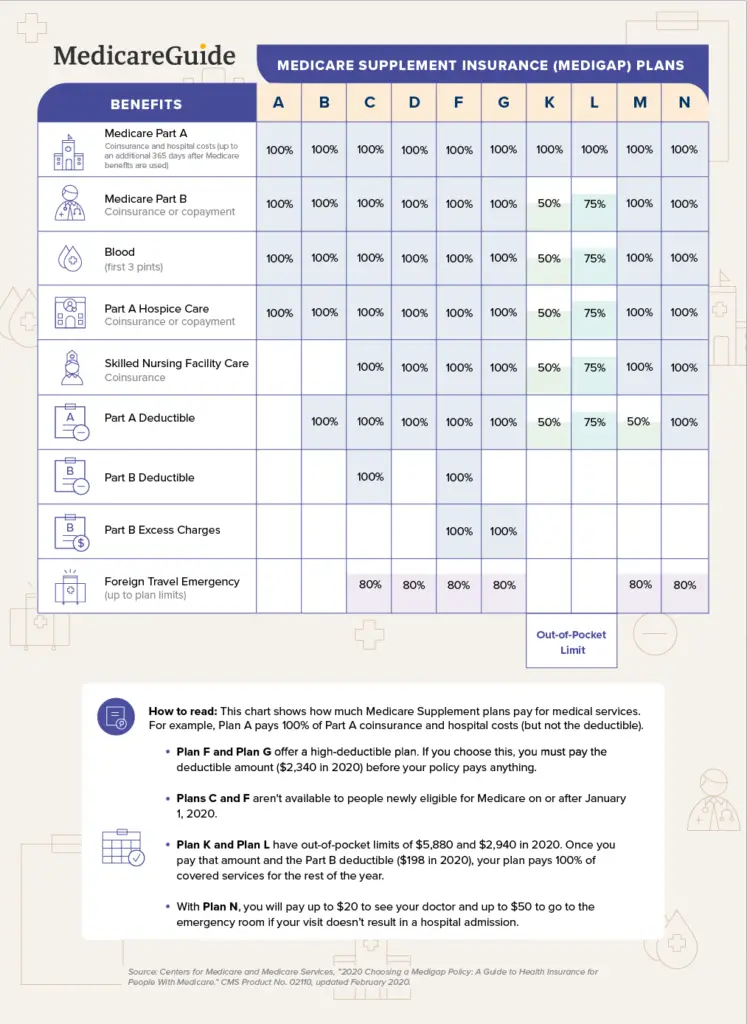

Medicare Part C is another name for the Medicare Advantage program which is issued by private insurance companies instead of Original Medicare. You can get them from an agent, broker, or the company directly. Usually, these plans have smaller networks than Medicare, but some of them include built-in Part D coverage.

To be eligible for Part C, you must first be enrolled in both Medicare Parts A and B. You must also live in the plans service area.

Many people think that if they enroll in a Medicare Advantage plan, they can drop their Part B and escape paying Part B premiums. This is NOT the case. You must have both A and B to even be eligible to enroll in either a Medicare Advantage plan or Medigap plan. You must continue to be enrolled in Parts A and B during the entire time that you are enrolled in a Medicare Advantage plan.

Florida Medicaid Program Eligibility

Medicaid is a program for medical assistance that gives low-income individuals and families access to health care that they wouldnt otherwise have. Medicaid also assists people with disabilities and the elderly with the costs of expenses like care in nursing facilities and other long-term medical bills.

The agency responsible for Medicaid in Florida is the Agency for Health Care Administration, also known as simply the Agency. The Agency has successfully completed implementing the SMMC program. Under this program, most of the recipients of Medicaid are enrolled into one of a variety of health plans. These health plans are accredited nationally and selected by a competitive procurement process.

Read Also: Is Inogen One Covered By Medicare

Local Resources For Medicare In Florida

Medicare Savings Programs in Florida: For residents whose income falls below a certain limit, there are various programs that can assist with paying for out-of-pocket Medicare costs, like your premiums or deductibles. Programs are also available to provide special help for low-income beneficiaries who need help paying for prescription medication costs.

Florida Serving Health Insurance Needs of Elders: Most states have a program called SHIP that helps beneficiaries to understand their Medicare rights/protections. In Florida, this program is called SHINE . Its run by a network of volunteers and funded by a grant from the Centers for Medicare and Medicaid Services .

Failing To Take Required Minimum Distributions From Qualified Retirement Accounts Such As Ira’s 401k’s Or Sep’s

Qualified retirement accounts receive preferential treatment by the IRS and are generally sheltered from your creditors. Similarly, in many cases these accounts are not a countable asset for purposes of determining whether you satisfy the Medicaid asset test. Nevertheless, under Florida law specific steps must be taken in order to prevent these accounts from disqualifying you from receiving Medicaid. The most critical step is to take regular distributions if you are eligible to take them. However, remember that the distributions are counted as income, which may push you over the income limit discussed above. If this is the case, you may need to create a qualified income trust or miller trust to receive any excess income.

An often overlooked aspect of this rule is that each and every qualified retirement account you own must make its own regular distributions. Any account not making such distributions will be considered a countable asset. Once again, if you are looking only at the IRS rules governing this accounts, you are going to miss this issue. Always remember that Medicaid has its own unique rules.

Recommended Reading: How Much Is Premium For Medicare

Can I Have Both At The Same Time

If you qualify for both Medicare and Medicaid, you can have them both simultaneously. When you have both it means that you are unlikely to have any out-of-pocket medical expenses. Around 20 percent of Medicare beneficiaries are also eligible for Medicaid. They are called dual-eligibleDual-eligible beneficiaries are those who receive both Medicare and Medicaid benefits. It includes beneficiaries enrolled in Medicare Part A and/or Part B while receiving full Medicaid and/or financial assistance through a Medicare Savings Program….. You would need to apply for each one separately to determine if you can qualify for both.

Dual-eligibles are categorized based on whether they receive full or partial Medicaid benefits. Full benefit dual-eligibles receive comprehensive Medicaid coverage, while partial benefit dual-eligibles receive help with their Medicare premiums and cost-sharing through one of four Medicare Savings Programs.

Failing To Disclose Assets Or Income Sources To The Department Of Children And Families

In order to apply for Medicaid in Florida, you are required to sign a financial release. This enables Medicaid to access copies of your tax returns, write to financial institutions where you hold accounts and investigate your bank accounts, brokerage accounts and other assets. Failing to disclose assets to Medicaid is a serious crime. These disclosure requirements continue after you file your Medicaid application. You are required to report changes in assets or income to the Department of Children and Families within 10 days of any change in circumstances.

You May Like: How Do You Get Credentialed With Medicare

Medicaid Eligibility And Costs

The federal and state partnership results in different Medicaid programs for each state. Through the Affordable Care Act , signed into law in 2010, President Barack Obama attempted to expand healthcare coverage to more Americans. As a result, all legal residents and citizens of the United States with incomes 138% below the poverty line qualify for coverage in Medicaid participating states.

While the ACA has worked to expand both federal funding and eligibility for Medicaid, the U.S. Supreme Court ruled that states are not required to participate in the expansion to continue receiving already established levels of Medicaid funding. As a result, many states have chosen not to expand funding levels and eligibility requirements.

Those covered by Medicaid pay nothing for covered services. Unlike Medicare, which is available to nearly every American of 65 years and over, Medicaid has strict eligibility requirements that vary by state.

However, because the program is designed to help the poor, many states have stringent requirements, including income restrictions. For a state-by-state breakdown of eligibility requirements, visit Medicaid.gov and BenefitsCheckUp.org.

Can I Be Enrolled In Medicare And Medicaid At The Same Time

Q: Can I be enrolled in Medicare and Medicaid at the same time?

A: In many cases, yes. Some Americans qualify for both Medicare and Medicaid, and when this happens, it usually means they dont have any out-of-pocket healthcare costs.

Beneficiaries with Medicare and Medicaid are known as dual eligibles and account for about 20 percent of Medicare beneficiaries . Dual eligibles are categorized based on whether they receive partial or full Medicaid benefits.

Full-benefit dual eligibles have comprehensive Medicaid coverage, while partial benefit dual eligibles receive help with Medicares premiums and cost sharing through a Medicare Savings Program .

The federal government oversees Medicare eligibility meaning it is the same in each state. But states set their own eligibility rules for Medicaid and the MSPs and income limits for these programs vary widely.

Recommended Reading: Does Medicare Pay Anything On Dental

What Florida Medicare Plans Are Available

With a large senior population in the state, Medicare in Florida is a commonly used program to secure health care services. The program, while beneficial, can also be complex. Therefore, it’s helpful to know the various components of it are and the ins and outs of enrollment and eligibility.

Medicare consists of several different parts, each of which speaks to a different aspect of healthcare.

Part A:Medicare Part A is the element that covers hospitalization as well as inpatient care in a skilled nursing facility. It may also cover care in a stand-alone surgical center or hospice. It is free to those who qualify for Medicare coverage due to paying into the Social Security system and available for purchase for those that do not who are of retirement age.

Part B: This portion of the program functions a lot like traditional medical insurance in that there is a monthly premium . It covers in-office physician visits and other elements of preventative care. Those ineligible for automatic free Medicare Part A benefit may purchase Part B, but they must also purchase Part A.

Part C: Medicare Part C is commonly referenced as the Medicare Advantage plan. This plan is administered by privatized entities that work with Medicare to provide the benefits of both Parts A and B and may sometimes even include prescription drug benefits and other coverage.

Part D:Part D is the stand-alone prescription drug benefit. It also requires a monthly premium for those eligible .

Qualified Medicare Beneficiary And Medicaid For The Aged Or Disabled

These programs are for our clients who are interested in home care or ALF care, and are on a waitlist or those who are in need of assistance paying for medical bills and prescriptions.

QMB and MEDS-AD are programs that have different income/asset requirements than the programs described above have no waitlist and will pay for Medicare premiums, co-pays, deductibles, etc. We often apply for QMB in conjunction with long-term care waiver benefits, so our clients can receive some financial assistance while waiting for home-care or ALF benefits to begin.

This summary is just a brief overview of what would be discussed during a consultation. The bulk of the consultation will discuss legal and ethical methods of qualifying you or your loved one for one or more of these Medicaid long-term care programs in a way that does not trigger the five-year lookback period so you can obtain the services needed with as little delay as possible.

Certainly, many people attempt to apply for Medicaids ICP or home and community-based waiver program on their own.

Below are some of the most common mistakes I see being made:

Recommended Reading: Do You Need Referrals For Medicare