It Can Be Difficult To Determine What Medicare Advantage Plan Is Actually Best For Your Needs

When shopping around for Medicare Advantage plans, it can be tough to find accurate side-by-side comparisons. Plans come in all shapes and sizes, and it can be confusing trying to figure out which available plans fit your individual needs. While you know you will at least be receiving the basics already afforded to you by Medicare Parts A and B, the similarities end there. Two different plans may both offer zero-dollar premiums, but annual out-of-pocket expenses or co-pays may be significantly different. Many Medicare Advantage plans offer extra features that original Medicare plans do not, such as chiropractic, dental, vision or continuing care facility coverage, and these benefits will also vary from plan to plan.

And just because you have found a plan that fits your needs now doesnt mean that the plan will be the same next year. Contracts can end, and plans will change accordingly. Choosing Medicare Advantage means youll need to be even more diligent about your coverage from year to year, although any insurance plan should be reviewed each year to see if its still working for you.

As always, we highly suggest that you seek advice from a licensed Medicare insurance professional, and take measures to ensure that he or she is in fact licensed and working with a reputable agency.

Wellcare Medicare Part D Plans Reviews And Ratings

Wellcares Medicare Part D and Medicare Advantage plans are rated by the Centers for Medicare and Medicaid Services . Other ratings and ranking entities provide insight into Wellcares parent company, Centene, or Wellcares health plans as a whole. See how Wellcare stacks up against other health insurance providers.

How Much Do Blue Cross Medicare Advantage Plans Cost

The Medicare Advantage marketplace is an increasingly competitive one. If you live in a metropolitan county, there may be dozens of plans to choose from.

The following are some examples of Blue Cross Medicare Advantage plans in various locations with their monthly premiums and other costs. These plans do not include the cost of your monthly Part B premium.

| City/plan |

|---|

Recommended Reading: Can I Sign Up For Medicare Part B Online

Are There Different Types Of Medicare Advantage Plans

Many people like the flexibility that Medicare Advantage plans provide. Unlike Original Medicare, which is the same for everyone, there are several different Medicare Advantage options you may be eligible for. Some of the popular ones include:

- Health Maintenance Organizations . These plans usually have the lowest premiums and out-of-pocket costs, however, you may be required to get all your health care from providers in the plans network. Many HMOs include coverage for prescription drugs and other routine health benefits.

- Special Needs Plans are a type of HMO that limits enrollment to people with certain conditions, or who live in a nursing facility, or are eligible for both Medicare and Medicaid.

- Preferred Provider Organizations *. PPOs let you see any provider who accepts your plan, but your costs are much lower if you use in-network providers. You can often find plans that include Part D prescription drug coverage.

- Private Fee-for-Service plans . With PFFS plans, you can get health care from any provider who accepts the terms of your plan. However, doctors are not required to accept your plan even if they participate in the Medicare program. Youll need to ask each time you get care, even if youve used the provider in the past.

Not every type of plan may be available where you live, and plan benefits and premiums vary. Keep these questions in mind when you evaluate the Medicare Advantage plans youre eligible for:

Is Medicare Advantage Cheaper Than Medicare

Both Medicare Advantage and Medicare can have out-of-pocket costs. With Medicare, Part A coverage is typically premium-free for most people. Medicare Part B coverage has both a premium and a deductible. For 2021, the standard Part B premium is $148.50. What you pay for Medicare Part B premiums can depend on your income and tax filing status.

The standard Medicare Part B deductible is $203 for 2021. For Medicare Part B services, you typically pay 20% of the Medicare-approved amount after meeting the deductible. If youre also enrolled in Medicare Part D with Original Medicare, youll pay a separate premium for that.

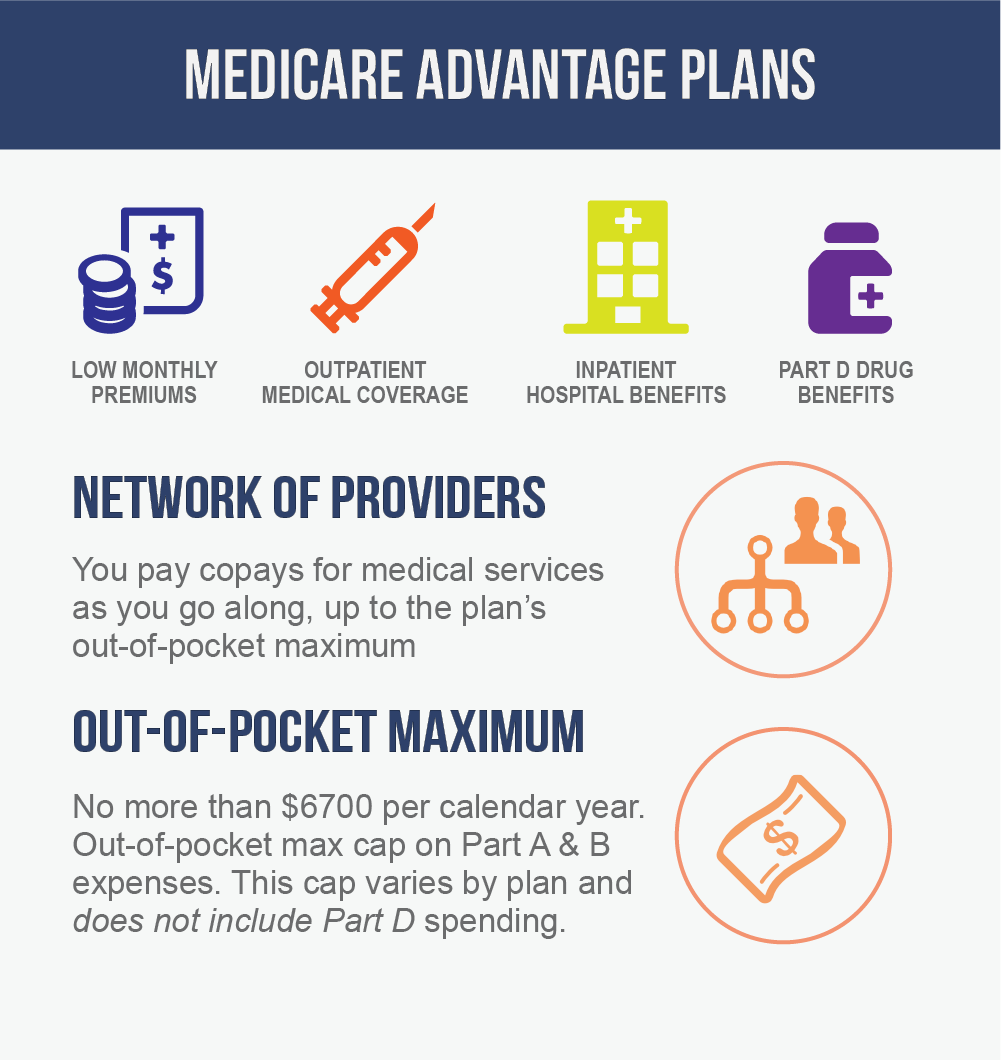

With Medicare Advantage plans, the amount you pay for premiums or deductibles can depend on the plan. Some Medicare Advantage plans have a $0 premium, for instance. If the plan does charge a premium, youd pay this in addition to the regular Medicare Part B premium. But you may not be paying extra for Part D prescription drug coverage if thats included in the plan.

Medicare Advantage plans may require copayments or coinsurance. There may be a yearly limit, however, on what youre required to pay out of pocket. You wont need to purchase Medigap insurance either, which is designed to supplement some of the costs that Original Medicare doesnt cover.

So which is cheaper, Medicare Advantage vs. Medicare?

Read Also: Is Stem Cell Treatment Covered By Medicare

What Do Wellcare Medicare Part D Plans Cover

All Medicare Part D plans are regulated by CMS and must cover a wide range of prescription drugs that people with Medicare take. Each plan has its own formulary and separates drugs into tiers that correspond to costs. Lower tiers include generic, lower-cost medications, and higher tiers include higher-cost, brand name, or specialty drugs.

As with most Medicare Part D plans, Wellcares plans include a coverage gap that begins when you and your plan have spent a certain amount on prescription drugs and ends when youve spent $7,050 and enter the catastrophic coverage period. You then will pay a small coinsurance percentage or copay amount for drugs you need until the end of the year.

When you are in the coverage gap, you will pay up to 25% of drug costs.

Your share of costs for each prescription drug may change depending on which pharmacy you choose, the tier of the drug, and when you enter each coverage phase. You must meet your annual deductible before your plan pays. Wellcares Part D plans include:

- Discounts for preferred retail pharmacies and three-month prescriptions.

- Options for one-month and three-month mail-order prescriptions

- Allowance for those who get Extra Help to use any pharmacy

- Senior Savings Program for select insulins to keep your costs below $35/month

Medicare Vs Medicare Advantage: The Basics

If you have original Medicare, the goverment directly pays for your Medicare benefits. In contrast, with Medicare Advantage plans, you receive your benefits from private medical insurance companies that Medicare has approved. There are several types of Medicare Advantage Plans:

The Official U.S. Government Site for Medicare online states that you must live in the service area of you prospective plan and also have Medicare Part A and Part B in order to join a Medicare Advantage Plan.

Both Medicare and Medicare Advantage are also legally required to cover certain basic health services, though the costs you pay and the specific services that are covered vary.

Medicare Advantage began in 1995, though similar programs were available as early as the 1970s. The key distinction between the two programs is that Medicare is government health insurance, while Medicare Advantage is private health insurance that the government helps fund.

Read Also: When Can I Start Collecting Medicare Benefits

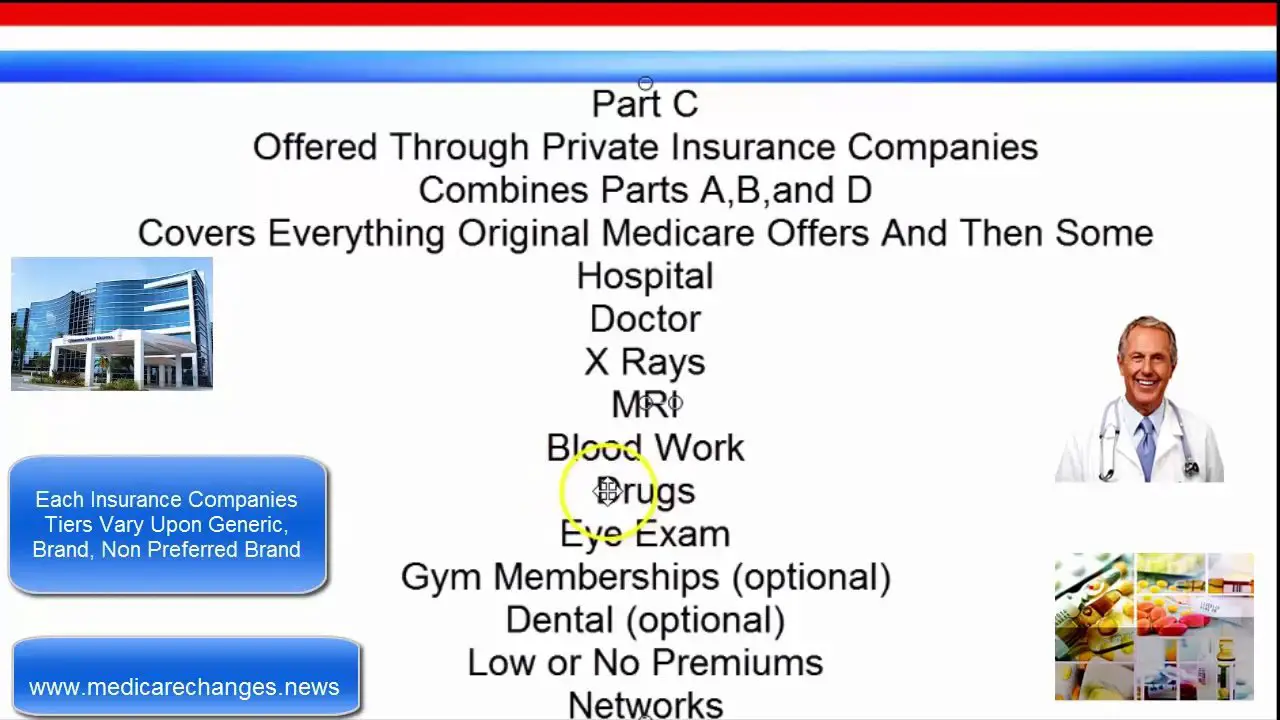

What Are Medicare Advantage Plans

A Medicare Advantage Plan is another way to get your Medicare coverage. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, youll still have Medicare but youll get most of your Medicare Part A and Medicare Part B coverage from the Medicare Advantage Plan, not Original Medicare. Most plans include Medicare prescription drug coverage . In most cases, youll need to use health care providers who participate in the plans network. However, many plans offer out-of-network coverage, but sometimes at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because youll need it if you ever switch back to Original Medicare.

Medicare Advantage Plans cover almost all Medicare Part A and Part B benefits

In all types of Medicare Advantage Plans, youre always covered for emergency and urgent care. Medicare Advantage Plans must cover almost all of the medically necessary services that Original Medicare covers. However, if youre in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies.

Plans can offer extra benefits

Medicare Advantage Plans must follow Medicare’s rules

Restricted Networks Also Known As Skinny Networks

When you have a Medicare Advantage plan, the only doctors or facilities that you can visit are ones that are in your network, unless you want to pay substantially higher charges for going out of network. This means that depending on which network your chosen insurance agency is a part of, you may not get to keep your current doctor. It also means that if you need to see a specialist, you will need a referral from your primary care physician. Those enrolled in traditional Medicare plans do not have these restrictions and can see any doctor they like with no restrictions, including specialists.

Some members of Medicare Advantage plans also have reported that finding emergency care within their network can be difficult. When you are in a medical emergency you dont want to have to worry about what facility will be covered by your insurance companys network of providers. While most health plans will waive added charges in a true emergency, its tough to make a gamble like that when you need care and dont know where to turn.

If you find a plan that includes a network with doctors you trust in a local group, this isnt a concern. However, it is possible for contracts to end and insurance companies to drop networks. This can be frustrating, to say the least, for those with Medicare Advantage plans.

Also Check: Can Permanent Residents Get Medicare

Wellcare Medicare Part D Coverage Reviews

Fact checked Reviewed by: Leron Moore, Medicare consultant –

Is Wellcare Medicare Part D a good fit for you?

Wellcare offers Medicare Part D prescription drug coverage through standalone plans for people with Original Medicare Part A and/or B. Prescription drug coverage is also included in many of Wellcares Medicare Advantage Plans.

| A.M. Best financial strength rating: Not Rated | BBB rating: A- | NCQA rating: 2.5 to 3.5 stars | Consumer Affairs rating: 3 stars | J.D. Power ranking: 9th out of 10 |

Wellcare Healthplans Inc. was initially founded in 1985 and began offering Medicare Part D prescription drug plans in 2006. Wellcare was acquired by Centene Corporation in January 2020 and is Centenes largest provider of government-sponsored health care programs.

Based on Medicare ratings, plans vary in quality across the nation, but you can find Centers for Medicare and Medicaid Services rating information for each plan by searching on Medicare.gov.

Wellcares preferred pharmacies are CVS and Caremark, so your costs are lowest if you use one of these pharmacies and choose generic drugs. Compare Wellcares Prescription Drug Plans available in your area on Wellcares website.

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

Read Also: What Does Medicare Supplement Plan N Cover

D Prescription Drug Coverage

Medicare Part D is prescription drug coverage. You can obtain coverage for your medications either through a Medicare Advantage plan that offers drug coverage , or through a standalone Prescription Drug Plan that can be used with Original Medicare or a Medicare Advantage plan that doesnt offer drug coverage.

PDPs are also sold by private insurers, and there may be a number of plans available where you live.

The Fine Print Of Medicare Advantage Plans

Medicare Advantage plans, usually bundled with prescription drug coverage, typically require you to use health care providers in their network. The policies limit your annual out-of-pocket costs for covered services.

“They think ‘zero premium’ means it’s free, which it’s not.”

“People need to go beyond the commercials” to understand the fine print of Medicare Advantage plans, Omdahl said. “There are indeed zero-premium Advantage plans and many of the plans do not have any deductibles. But the zero co-pay is misleading. Zero co-pay is for your primary doctor depending on where you live, co-pays may apply in other situations.”

In addition, noted Omdahl, “start digging into the evidence of coverage and you will see that Medicare Advantage is pay-as-you go: fifty dollars to see a specialist, four hundred dollars a day for five or six days of hospitalization. So you are writing checks, and that’s what people don’t realize. They think ‘zero premium’ means it’s free, which it’s not.”

Savage said that due to the Medicare program’s rules, Medicare Advantage enrollees could wind up paying out of pocket as much as $7,500 a year more than $11,000 a year if you use out-of-network health care providers.

“These plans work best if you don’t get sick,” she said. “Once you need to see a lot of specialists, then you start paying.”

Omdahl said that before signing up for a Medicare Advantage plan, understand that anytime you want care other than an emergency, the plan has to approve it.

Don’t Miss: Does Aspen Dental Accept Medicare

Complete Coverage For Parts A And B

When seniors join a Medicare Advantage plan, they remain part of the Medicare system. They are simply choosing to get their coverage through a Medicare-approved, private plan. Medicare pays flat fees to insurance companies that offer Medicare Advantage, so Medicare gets to set standards of minimum coverage. In order for plans to qualify for Medicares approval and funding, they have to offer complete coverage that lines up with what Medicare typically covers under Parts A and B. Complete doesnt mean that all healthcare is 100% covered it means that the coverage will be comparable to or better than what is offered through Original Medicare.

Below we have included a quick overview of items and services that are typically covered by Parts A and B . Weve also included some resources for further reading that provides an even greater level of detail.

Part B Coverage OverviewPart B focuses on two broad categories of need: preventative and medically necessary items and services. These categories include things like primary and specialist doctor visits, screenings and treatments for illnesses, mental healthcare , clinical trial participation, ambulance use, a very limited list of prescription drugs , and Durable Medical Equipment . More information on how Original Medicare defines all of these categories of care can be found on the official Medicare website.

Things To Know About Medicare Advantage Plans

Also Check: Is Everyone Eligible For Medicare

Coverage Benefits With Medicare Advantage

One of the biggest perks to enrolling in a Medicare Advantage plan is the list of additional services that might be covered depending on plan type, among them prescription drug coverage, dental, vision, assisted living and nursing home care. Traditional Medicare plans do not cover these benefits, so any costs accrued would be paid for out of pocket.

Prescription drug coverage is available to regular Medicare enrollees but at an additional cost in the form of Medicare Part D. Not all Medicare Advantage plans cover prescription drugs, but those plans are by far the minority, with over 82 percent of Medicare Advantage plans offering this coverage. Whether this is an advantage will depend on your personal situation, as in what drugs you carry prescriptions for.

Most Advantage plans also cover extra services like vision, dental, assisted living and nursing home care. Traditional Medicare plans do not cover these services, which can make it especially hard for some to pay for assisted living and nursing home services as most of these facilities are only able to accept a certain percentage of residents with Medicare coverage.