If Your Income Has Gone Down

If your income has gone down and the change makes a difference in the income level we consider, contact us to explain that you have new information. We may make a new decision about your income-related monthly adjustment amount for the following reasons:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

How Much Does Original Medicare Part A Cost

What it helps cover:

- Home healthcare

What it costs:

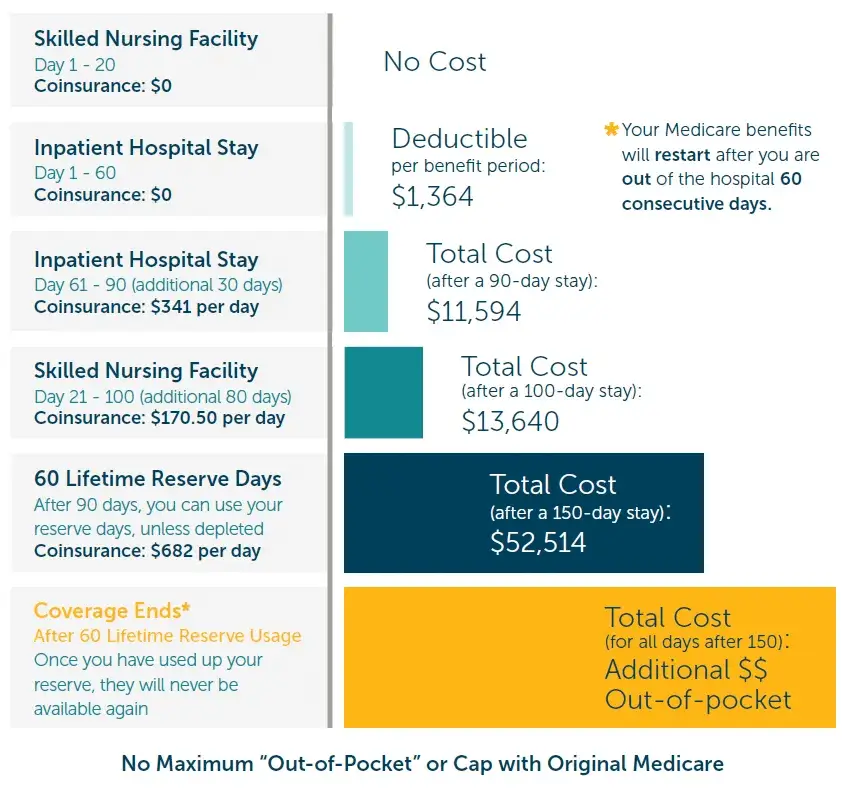

Most people generally don’t pay a monthly premium for because they paid Medicare taxes while they were working. However, there are costs you may have to cover.

Other Part A costs for 2022:

- An annual deductible of $1,556 for in-patient hospital stays.

- $389 per day coinsurance payment for in-patient hospital stays for days 61 to 90.

- After day 91 there is a $778 daily coinsurance payment for each lifetime reserve day used.

- After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

How Do I Pay For Medicare

In some cases, you may not be eligible for premium insurance. You will pay an extra fee in Part B, which is optional. Social Security benefits are automatically deposited into the accounts of the taxpayer who receives benefits from their employer. Medicare pays you directly if you do not collect Social Security. If your plan requires supplemental premiums for part C or part D, please contact us. In some instances, Social Security can be repaid for the premiums a person has paid out of his or her paycheck, although this is not automatic. If no benefits are paid, Medicare pays the payment for the Part D portion and Part C.

Read Also: How Can I Get My Medicare Card Number

Can You Change How You Pay For Medicare

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you dont qualify for Social Security benefits, youll get a bill from Medicare that youll need to pay via:

- Your online Medicare account

- Medicare Easy Pay, a tool that lets you automatically transfer monthly payments

- Online bill pay through your bank account

- Check, money order, or credit card payment

If you are having trouble paying your bill, you can contact someone at Medicare for help.

Medicare Advantage and Part D premiums arent automatically deducted from your Social Security benefits, so youll typically receive a bill and pay the insurer directly. If youd prefer to have your premiums for these plans deducted from your benefits check, you can contact your insurer to request this change.

What Is The Lowest Social Security Payment

Imagine that an individual who attained full retirement age at 67 had enough years of coverage to qualify for the full minimum Social Security benefit of $897. If they filed at 62, there would be a 30% reduction to benefits. This means that for 2020, the minimum Social Security benefit at 62 is $628.

Don’t Miss: Is Imvexxy Covered By Medicare

What Percentage Of Medicare Part B Premiums Are Based On Income

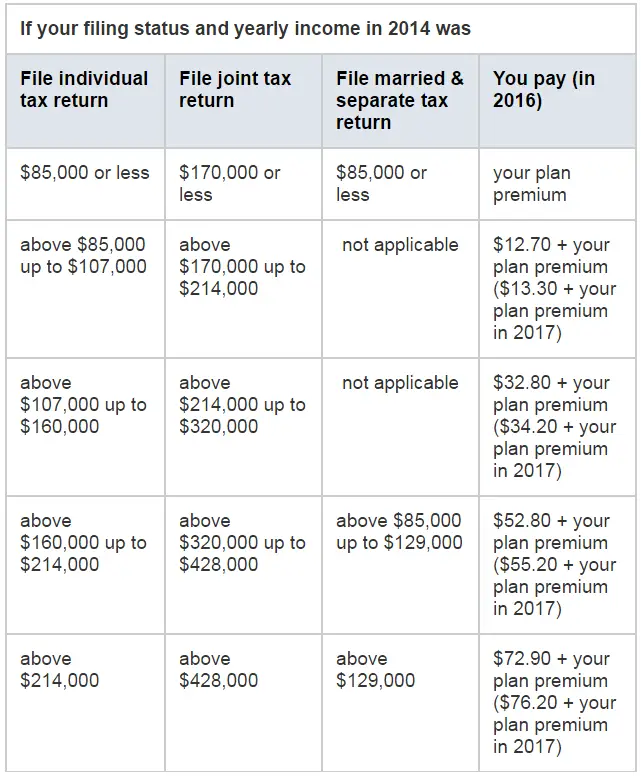

Since 2007, a beneficiarys Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table: Beneficiaries who file.

Medicare Taxes: The Basics

Like Social Security benefits, Medicares Hospital Insurance program is funded largely by employment taxes. If you work under the table you wont pay into these systems. Thats why payroll tax withholding, although it takes a chunk out of your take-home pay, is actually providing you with something in return for those lost dollars in your paychecks.

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though its still below the Social Security tax rate. The current Social Security tax is 12.4% with employees and employers each paying 6.2%.

Today, the Medicare tax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.

Don’t Miss: How To Get A Medicare Number As A Provider

Medicare Part C And Part D

Medicare Part C and Medicare Part D plans are sold by private companies that contract with Medicare.

Medicare Advantage plans cover everything that Medicare parts A and B do and often include coverage for extra services. Medicare Part D plans cover prescription drugs.

Part C and Part D plans are optional. If you do want either part, youll also have multiple options at various price points. You can shop for Part C and Part D plans in your area on the Medicare website.

Some plans will have an additional premium but others will be premium-free.

You can have your Part C or Part D plan premiums deducted from Social Security. Youll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.

This means your first payment could end up being very large since itll cover multiple months at once. Your plan will walk you through the details and let you know how long it will take.

Your premiums will be deducted once per month after everything is set up.

So Much For That Generous Social Security Raise

In 2022, seniors on Social Security are in line for a 5.9% cost-of-living adjustment , their largest in decades. All told, the average benefit will rise from $1,565 a month to $1,657 a month, representing a $92 increase.

But now, about one-third of that raise will be wiped out by the higher cost of Medicare Part B. And while its easy to argue that seniors will still come out ahead financially, lets also remember that the whole reason Social Security benefits are rising so much in 2022 is that inflation has driven the cost of living up substantially. And so while Medicare Part B hikes wont take seniorsentire Social Security raise, the remainder of that increase will no doubt be eaten up by higher gas, grocery, and utility costs.

For years, Medicare premiums costs have risen at a much faster rate than Social Security COLAs, leaving seniors struggling to keep up. In addition to higher monthly premiums, seniors on Medicare will face an annual Part B deductible of $233 in 2022. Thats a $30 increase from 2021, and while it may not seem like a huge jump on its own, combined with premium increases, it certainly leaves many beneficiaries in a tough spot.

Read Also: Will Medicare Pay For Diapers

How Much Does Ssdi Take Out For Medicare And What Are The Benefits

By David KrugDavid Krug is the CEO & President of Bankovia. He’s a lifelong expat who has lived in the Philippines, Mexico, Thailand, and Colombia. When he’s not reading about cryptocurrencies, he’s researching the latest personal finance software.3 minute read

Ready to get the latest from Bankovia? Sign up for our newsletter.

If youre receiving Social Security Disability Insurance , youre automatically enrolled in Medicare Part A and Part B after 24 months. Part A is free, but Part B comes with a monthly premium. Most people receiving SSDI will have the premium deducted from their benefit check. The standard Part B premium in 2020 is $1460.

Medicare Part A Premiums

Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as youre eligible for Social Security or Railroad Retirement Board benefits.

You can also get premium-free Part A coverage even if youre not ready to receive Social Security retirement benefits yet. So, if youre 65 years old and not ready to retire, you can still take advantage of Medicare coverage.

Part A does have a yearly deductible. In 2022, the deductible is $1,556. Youll need to spend this amount before your Part A coverage takes over.

Recommended Reading: How To Replace My Lost Medicare Card

Medicare And Medicaid Costs

Medicare is administered by the Centers for Medicare & Medicaid Services , a component of the Department of Health and Human Services. CMS works alongside the Department of Labor and the U.S. Treasury to enact insurance reform. The Social Security Administration determines eligibility and coverage levels.

Medicaid, on the other hand, is administered at the state level. Although all states participate in the program, they aren’t required to do so. The Affordable Care Act increased the cost to taxpayersparticularly those in the top tax bracketsby extending medical coverage to more Americans.

According to the most recent data available from the CMS, national healthcare expenditure grew 9.7% to $4.1 trillion in 2020. That’s $12,530 per person. This figure accounted for 19.7% of gross domestic product that year. If we look at each program individually, Medicare spending grew 3.5% to $829.5 billion in 2020, which is 20% of total NHE, while Medicaid spending grew 9.2% to $671.2 billion in 2020, which is 16% of total NHE.

What Is Medicare Tax Definitions Rates And Calculations

Find Cheap Medicare Plans in Your Area

Medicare tax is deducted automatically from your paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total tax amount is split between employers and employees, each paying 1.45% of the employee’s income. High-income earners pay a slightly higher percentage and those who are self-employed pay the tax with their quarterly filings.

Recommended Reading: How To Enroll In Original Medicare

How Did Price Hikes Affect People In 2019

Price hikes predominantly affected people in the top three income brackets. In 2019, not only did the premium rates increase across all income brackets but the brackets changed again. Instead of five income brackets, there were six. The change in brackets affected those at the highest income level only.

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $170.10 a month for Part B premiums in 2022. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2022 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2022 is $233.

Read Also: What Is The Best Medicare Advantage Plans In South Carolina

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

How Much Is Deducted From Social Security Each Month For Medicare

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

You May Like: How Old Do You Need To Be To Receive Medicare

How Long Do You Have To Be On Medicare If You Are Disabled

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

How Do Medicare Premiums Be Deducted From Social Security

Depending on your Social Security retirement benefit, your Medicare benefit may automatically be deducted. The premium amount will go directly to the credit card before the checks are delivered to them. It is usually applied to part B premiums and is available for other parts of a part C and a section d plan.

Benefits and Resources Housing Insurance Taxes and Financial Abuse Employment Health and Wellness Nutrition Chronic Conditions and General Health At-Home Health Caregiving About Us Who We Are Research and Reports Authors and Contributors Home Medicare Can You Have Medicare Premiums Deducted from Your Social Security Check? Can You Have Medicare Premiums Deducted from Your Social Security Check.

Recommended Reading: Is Medicare Available For Green Card Holders

What Are The Medicare Tax Rates

The Medicare tax rate is determined by the IRS and is subject to change. The Federal Insurance Contributions Act, or FICA, tax rate for earned income is 7.65% in 2022, which consists of the Social Security tax and the Medicare tax . The Medicare tax is one of the federal taxes withheld from your paycheck if youâre an employee or that you are responsible for paying yourself if you are self-employed.

If you are self-employed, youâll pay a higher tax rate, since youâll be responsible for paying both the employee portion and the share that is normally paid by your employer. Visit IRS.gov or contact Social Security for the current self-employment tax rate by calling 1-800-772-1213 , Monday through Friday, from 7AM to 7PM in all U.S. time zones.

How Much Do Part A Premiums Cost

If you paid Medicare taxes for under 30 quarters, the Part A premium is $499 in 2022. Those who paid Medicare taxes for 30 to 39 quarters will pay $274 per month in premiums. Please note that, if you have to pay monthly Medicare premiums, you cannot qualify for Social Security benefits. In that case, you will not have to worry about money being taken out for now.

You May Like: What Is The Difference Medicare Part A And B

When Do You Have To Pay For Medicare

If you dont qualify for premium-free Part A coverage, youll need to pay a monthly premium. Youll also have to pay a premium if you sign up for Part B, which is optional.

If you receive Social Security benefits, youll have these premiums automatically deducted from your checks. Medicare will bill you directly if you arent collecting Social Security.

If you sign up for Parts C and D, youll also need to pay premiums for those plans. If you receive Social Security benefits, you can request that the premiums be deducted from your checks, but this wont happen automatically. If you dont receive benefits, youll get a bill from Medicare for Part D and from the insurer for Part C.

Medicare Part B Premiums

For Part B coverage, youll pay a premium each year. Most people will pay the standard premium amount. In 2022, the standard premium is $170.10. However, if you make more than the preset income limits, youll pay more for your premium.

The added premium amount is known as an income-related monthly adjustment amount . The Social Security Administration determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago.

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income.

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. Youll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Recommended Reading: When Is Open Enrollment For Medicare