Why Do I Need To Buy A Private Health Plan

Private Medicare health plans like Medicare Advantage or Medicare Cost plans cover everything Original Medicare does, and usually include more coverage for services you might need. Plus, they can include extra perks and benefits.

Find out more in the article, 4 reasons to buy a private health plan.

How Do Medicare Part C Plans Work

Medicare Advantage plans all offer you care through a network of health care providers. Plans are divided into multiple types based on whether you can use providers outside of your network and how much you would have to pay for doing so. This is the same system that other private insurance plans use. Plans may not advertise very clearly what type they are, so make sure to check the plan details for more information.

The table below lays out the major features for each type of Medicare Advantage, and then we go into more detail on each one.

Recommended Reading: What Is The Best Medicare Advantage Plan In Arizona

What Does Part A Cost

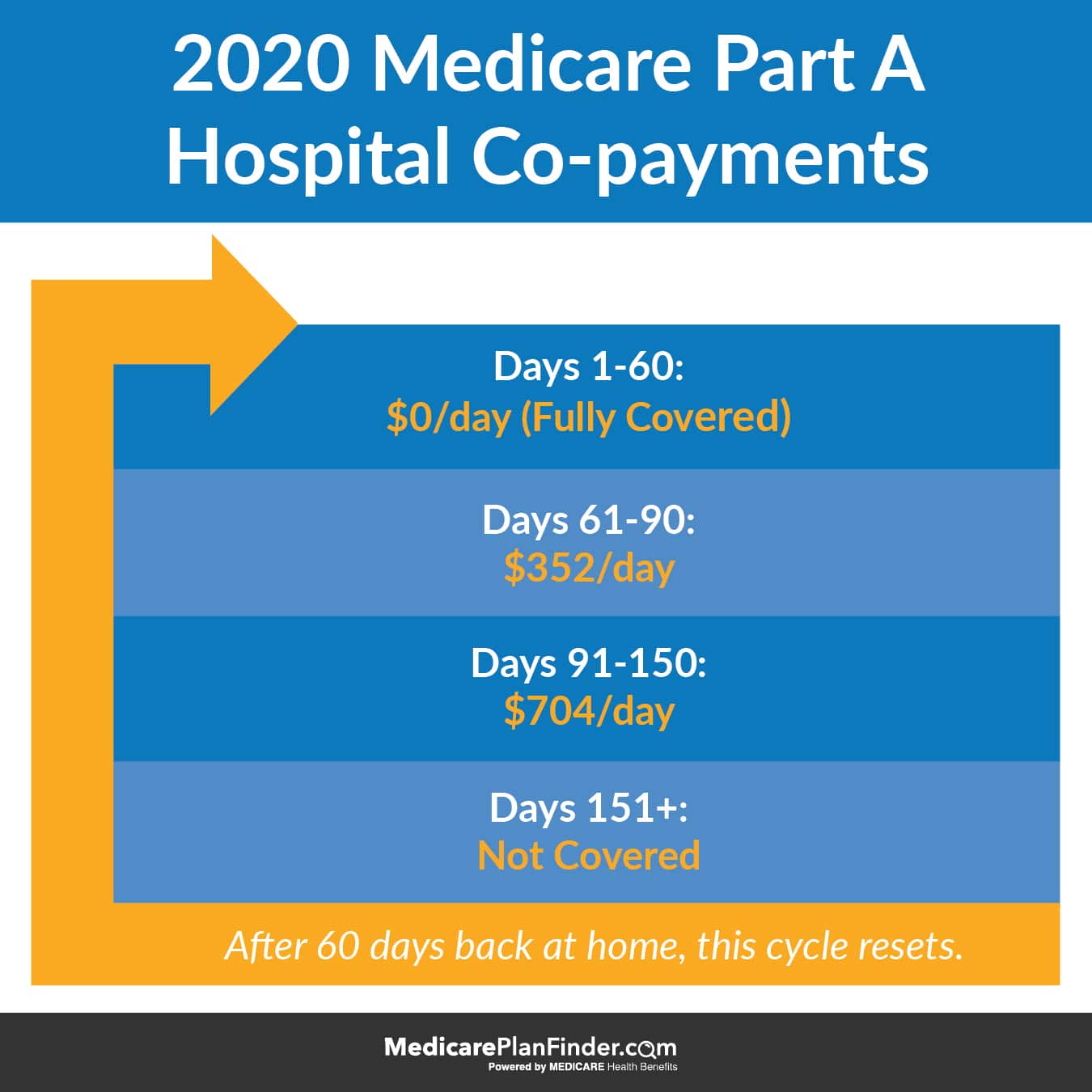

With Medicare Part A, you may have to pay copays and deductibles for hospital stays, but may not have to pay a monthly premium. Copays and deductibles apply to hospital benefit periods, which start when you enter a hospital or skilled nursing facility, and end 60 days after youve left the facility . Its important to note that:

- For each hospital benefit period, you pay a deductible.

- You pay a copay if youve stayed in a hospital for more than 60 days.

- Theres no deductible or copayment for home health care or hospice care.

For many people, Part A comes without a monthly premium. You may have no monthly premium if you paid a certain amount toward Medicare taxes while working. In this case, you are often automatically enrolled in premium-free Part A.

If you dont automatically get premium-free Part A, you may be able to buy it if you :

- Are age 65 or older and allowed to Part B to meet the citizenship and residency requirements.

- Are under age 65 and are disabled but no longer get premium-free Part A because you returned to work.

You May Like: Can You Have A Health Savings Account With Medicare

What Is Medicare Part A B C D

Asked by: Loma Grady

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs. Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006.

Sign Up: Within 8 Months After The Active Duty Service Member Retires

- Most people dont have to pay a premium for Part A . So, you might want to sign up for Part A when you turn 65, even if the active duty service member is still working.

- Youll pay a monthly premium for Part B , so you might want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Recommended Reading: Does Southeastern Spine Institute Accept Medicare

Who Is Eligible To Sign Up For Medicare Supplement Plan G

During Medigap open enrollment, you can purchase a Medigap policy for the first time. This is a 6-month term that begins the month you turn 65 and sign up for Medicare Part B.

The following are some other Medigap enrollment guidelines:

Because Medigap policies only cover one person, your spouse must purchase their coverage.

- Federal law does not require companies to sell Medigap coverage to those under age 65. It is possible that you may not be able to get the Medigap policy you desire if youre under 65 and qualified for Medicare.

- You cant have a Medigap and a Part C policy at the same time. Youll have to go back to the original Medicare if you want to buy a Medigap policy .

- Medigap insurance does not cover prescription medicines. Youll need to enroll in a Medicare Part D plan if you want prescription drug coverage.

Whether you have health concerns or not, Medigap insurance gives guaranteed renewal. Your insurance will not be canceled if you remain enrolled and pay your premiums.

When Can You Sign Up For Medicare Advantage

There are specific times during the year when you can sign up for a Medicare Advantage plan. These are HMO and PPO plans or Part D coverage plans that you can sign up for with a private health insurance carrier. In addition, you can only make changes to your coverage during certain parts of the year. Initial enrollment periods are as follows:

| If youre | ||

| Turning 65 for the first time | Enroll in a Medicare Advantage plan for the first time | During the 7-month period surrounding your 65th birthday |

| Under 65 and disabled | Enroll in a Medicare Advantage plan for the first time | Beginning 21 months after you start receiving SSI or Railroad Retirement benefits and ending the 28th month you get those benefits |

| Already enrolled in Medicare due to disability and you turn 65 | Enroll in a Medicare Advantage plan for the first time -OR- Switch from one MA plan to a different one -OR- Drop your Advantage plan entirely |

During the 7-month period surrounding your 65th birthday |

| Already enrolled in Medicare Part A but sign up for a Part B plan for the first time during the Part B general enrollment period | Enroll in a Medicare Advantage plan for the first time | From April 1 through June 30 |

The above table is for initial enrollment periods. There are other times when you can make changes to your Medicare Advantage plans or enroll in an MA plan from an existing Original Medicare plan. Alternate enrollment periods are as follows:

Recommended Reading: Who Can Get Medicare Before Age 65

Explore Our Plans And Policies

Medicare Advantage Policy Disclaimers

All Cigna products and services are provided exclusively by or through operating subsidiaries of Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All clinical products and services of the LivingWell Health Centers are either provided by or through clinicians contracted with HealthSpring Life & Health Insurance Company, Inc., HealthSpring of Florida, Inc., Bravo Health Mid-Atlantic, Inc., and Bravo Health Pennsylvania, Inc. or employees leased by HS Clinical Services, PC, Bravo Advanced Care Center, PC , Bravo Advanced Care Center, PC and not by Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All pictures are used for illustrative purposes only.

Cigna contracts with Medicare to offer Medicare Advantage HMO and PPO plans and Part D Prescription Drug Plans in select states, and with select State Medicaid programs. Enrollment in Cigna depends on contract renewal.

Medicare Supplement Policy Disclaimers

Medicare Supplement website content not approved for use in: Oregon and Texas.

AN OUTLINE OF COVERAGE IS AVAILABLE UPON REQUEST. We’ll provide an outline of coverage to all persons at the time the application is presented.

American Retirement Life Insurance Company, Cigna National Health Insurance Company and Loyal American Life Insurance Company do not issue policies in New Mexico.

Exclusions and Limitations:

What Does A Medicare Advantage Plan Cost

Depending on your Medicare Advantage plan, the costs you pay out-of-pocket can vary:

- You may pay a deductible, a certain amount you must meet before your plan begins to pay.

- There may be copays for doctor visitsthis is a flat fee usually due at the time of the visit.

- You may have to pay a share for lab services and medical equipment.

- You will pay a monthly plan premium if there is one.

- You will continue to pay the Original Medicare Part B monthly premium, as well.

- Additional coinsurance or copays if you see providers outside your plan network.

To help control your costs, make sure you understand the terms of your plan and the out-of-pocket costs you may be required to pay.

Recommended Reading: Does Medicare Cover Dupuytren’s Contracture

What Is Medicare Part F And Part G

The four parts of Medicare we describe above are the only Parts to Medicare. However, you may also be wondering about additional lettered plans, such as Plan F, Plan G, or Plan N. These plans are known as Medicare Supplement Plans, not Medicare Parts.

Medicare Supplement plans are identified as Plans, identified as lettered plans, A through N. If you have ever heard of a Part F or Part G, this was a mistaken reference to one of the most popular Medigap plans.

Medicare Supplement plans provide extra coverage to fill in the gaps Original Medicare leaves uncovered. If you plan on traveling in retirement or would rather not worry about the 20% of expenses uncovered by Medicare, a Medicare Supplement plan could be the right choice for you.

Medicare Supplement Plan F and Plan G are two of the most popular Medicare Supplement plans available to you. When you enroll in Medicare Supplement Plan F, all the costs left over by Original Medicare are completely covered. This means, you pay $0 out-of-pocket for your healthcare services. Similarly, Medicare Supplement Plan G covers all your costs after you meet the Medicare Part B annual deductible. After you meet this deductible, you are covered at 100%.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

What Is The Cost Of Medicare Supplement Plan G

Lets look at some of Plan Gs costs in more detail.

Premiums are paid once a month. Youll have to pay a specific amount monthly if you enroll in a Medigap plan. This is in addition to your monthly Medicare Part B premium.

Monthly rates will vary by the policy because private insurance firms sell Medigap policies. However, premiums can be imposed in a variety of ways by businesses. The following are the three main methods they use to determine premiums:

- The community pays for it. Regardless of age, everyone who has the policy pays the same monthly premium.

- They are issued a rating based on the issuers age. Then, monthly premiums are calculated according to your age at the time of purchase. Individuals who purchase insurance when they are younger will pay cheaper monthly premiums.

- Achieved-age rated Premiums are calculated based on your current age. As a result, as you age, your premiums will rise.

Deductibles

Plan G covers Medicare Part A deductible. However, the Part B deductible is not included.

Typically, Medigap insurance does not have its deductible. For Plan G, this could be different. A high-deductible plan is available in addition to the standard Plan G .

High-deductible Monthly rates for Plan G are frequently lower. However, youll have to pay a $2,370 deductible before your policy starts paying benefits. Theres also a yearly deductible for emergency services utilized while traveling abroad.

Copays and coinsurance are two types of copayments

Read Also: Does Medicare Cover Generic Viagra

Should I Get A Medicare Part C Plan

Enrollment in Medicare Part C plans has been growing, largely because Advantage plans offer more benefits than standard Medicare plans. Medicare Advantage plans usually arent the best option for low-income recipients because they can often qualify for other Medicare savings programs. Medicare Advantage also isnt generally necessary if youre still receiving employer-sponsored coverage.

Pros of Medicare Part C

-

Provides coverage for services Original Medicare does not, like vision or dental

-

Usually offers prescription drug coverage

-

Caps out-of-pocket expenses, unlike traditional Medicare

Cons of Medicare Part C

-

Likely have to pay two premiums, one for Medicare Part B and one for your Advantage Plan

-

Many types of individual plans, each with their own rules on the coverage and costs for using out-of-network providers

-

Your network of available health care providers is smaller than with Original Medicare plans

-

Not all in-network providers are necessarily accepting new patients

-

Cant be used in conjunction with employer-sponsored health care benefits that supplement Original Medicare

Senior Editor & Personal Finance Expert

Derek is a former senior editor and personal finance expert at Policygenius, where he specialized in financial data, taxes, estate planning, and investing. Previously, he was a staff writer at SmartAsset.

Questions about this page? Email us at .

32 Old Slip, 30th Fl New York, NY 10005

Inpatient Or Outpatient Hospital Status Affects Your Costs

Your hospital statuswhether you’re an inpatient or an outpatientaffects how much you pay for hospital services . Your hospital status may also affect whether Medicare will cover care you get in a skilled nursing facility following your hospital stay.

- You’re an inpatient starting when you’re formally admitted to the hospital with a doctor’s order. The day before you’re discharged is your last inpatient day.

- You’re an outpatient if you’re getting emergency department services, observation services, outpatient surgery, lab tests, or X-rays, or any other hospital services, and the doctor hasn’t written an order to admit you to a hospital as an inpatient. In these cases, you’re an outpatient even if you spend the night in the hospital.

| Note |

|---|

|

Observation services are hospital outpatient services you get while your doctor decides whether to admit you as an inpatient or discharge you. You can get observation services in the emergency department or another area of the hospital. |

The decision for inpatient hospital admission is a complex medical decision based on your doctors judgment and your need for medically necessary hospital care. An inpatient admission is generally appropriate when youre expected to need 2 or more midnights of medically necessary hospital care. But, your doctor must order such admission and the hospital must formally admit you in order for you to become an inpatient.

Read Also: What Is An Advantage Plan With Medicare

What Is Medicare Part A

Medicare Part A helps cover your inpatient care in hospitals, critical access hospitals, and skilled nursing facilities . It also helps cover hospice care and some home health care. You must meet certain conditions to get these benefits.Cost: Most people don’t have to pay a monthly payment, called a premium, for Part A. This is because they or a spouse paid Medicare taxes while they were working. If you didn’t pay Medicare taxes while you worked and you are age 65 or older, you may be able to buy Part A.

If you aren’t sure if you have Part A, look on your red, white, and blue Medicare card. If you have Part A, “Hospital ” is printed on your card. You can call Social Security at 1-800-772-1213, or visit your local Social Security office for more information about buying Part A. If you get benefits from the Railroad Retirement Board , call your local RRB office or 1-800-808-0772.

Eligibility: To learn if you are eligible for Medicare, use the Medicare Eligibility Tool.

What Does Medicare Part A Cover

With some exceptions, Medicare Part A covers the following services:

- Inpatient hospital care. This covers any tests or treatments you need when youve been admitted to the hospital.

- Limited home healthcare. If you need care from a home health aide after youve been released from an inpatient hospital stay, Medicare will cover medically necessary care while you recover.

- Hospice care. Once youve made the choice to seek hospice care instead of treatment for a terminal illness, Medicare will cover most of your healthcare costs.

- Short-term skilled nursing facility stays. If you need skilled nursing facility care, Medicare will cover your stay and services for a certain amount of time.

Inpatient care in a hospital includes services like meals, nursing services, physical therapy, and medications that a doctor says are important for care.

Medicare Part A usually only covers emergency room visit costs if a doctor admits you to the hospital. If a doctor doesnt admit you and you return home, Medicare Part B or your private insurance may pay for the costs.

Also Check: What Are Medicare Requirements For Bariatric Surgery

A Late Enrollment Penalty

You may have to pay a late enrollment penalty, depending on when you enroll. This can make the cost of your monthly premium higher for those who were not eligible for premium-free Part A and did not enroll in Part A as soon as they were eligible to purchase it. The penalty cost is equal to 10% of your Part A premium and is paid for two years for every one year you were eligible but failed to sign up.

When Are The Medicare Part A Enrollment Deadlines

For the most part, signing up for Medicare Part A depends on when you turn age 65.

You have a 7-month time period during which you can enroll. You can enroll as early as 3 months before your birth month, during your birth month, and up to 3 months after your 65th birthday.

If you dont enroll during this time period, you could face financial penalties that result in you having to pay more for your healthcare coverage. This also delays how fast your Medicare benefits begin.

You can sign up for Medicare Part A during the general enrollment period from January 1 to March 31, but you may face penalty fees.

Read Also: Are Medicare Premiums Based On Income

How Do I Sign Up For Medicare Part A

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board . You can sign up in a few different ways:

- Online: Visit the Social Security website to apply for Medicare Part A and/or Part B.

- : Call Social Security at 1-800-772-1213 . Representatives are available Monday through Friday, from 7AM to 7PM.

- In-person: Visit your local Social Security office to apply.

- If you worked for a railroad, contact the RRB to apply at 1-877-772-5772. . You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative.

You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so. If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

If you dont sign up during your Initial Enrollment Period, you may be able to sign up during the General Enrollment Period that takes place every year from January 1 to March 31 your coverage would start on July 1.