Does Medicare Cover Opioid Pain

There also may be other pain treatment options available that Medicare doesnt cover. Tell your doctor if you have a history of depression, substance abuse, childhood trauma or other health and/or personal issues that could make opioid use more dangerous for you. Never take more opioids than prescribed.

How Are Medigap Policies Standardized

Medigap policies are standardized, meaning these Medicare supplement policies must follow both state and federal laws. These laws are in place to protect beneficiaries. For example, insurance providers must clearly identify Medigap as Medicare Supplement Insurance.

All Medigap policies offer the same basic benefits. Some policies offer additional benefits, too. Do note, Medigap policies are standardized in a different way for those who live in Massachusetts, Minnesota, or Wisconsin.

Note: Learn more about Medigap at this resource.

When Is The Best Time To Enroll In A Medicare Supplement

To be eligible for a Medicare Supplement plan, you must enroll in Original Medicare. To qualify for Original Medicare, you must be a U.S. citizen or legal resident for at least five years and any of the following:

- Age 65 or above

- Collect Social Security Disability Income benefits for at least two years

- Diagnosed with ESRD or ALS

After enrolling in Original Medicare, the best time to sign up for a Medicare Supplement plan is during your six-month Medicare Supplement Open Enrollment Period. This enrollment period begins on the first day of the month your Medicare Part B goes into effect.

When you enroll in a Medicare Supplement plan during this time, you have guaranteed issue rights. This means pre-existing conditions cannot affect your admittance to the plan. Carriers cannot decline your coverage based on your health history. You may still enroll in a Medicare Supplement plan outside the Medicare Supplement Open Enrollment Period window, but you may be subject to health questions.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read Also: Does Medicare Cover Assisted Living In Illinois

What Is A Medicare Supplemental Plan J

Medigap plans are sold by private insurance companies, and they work together with your original Medicare Parts A and B to give you additional coverage that you wouldnt get with just your traditional coverage. There are ten different supplemental plans that you can choose from, all of them are going to have different coverages and gaps that they fill.

Some plans are going to be more basic than others. A Medigap Plan A is going to be one of the most basic, and its going to leave more gaps in coverage than other plans, like supplemental Plan F, which is the most comprehensive policy.

Plan J was one of the most popular options for Medigap coverage because of the additional insurance protection that it provided to enrollees. If you have a Plan J still, then you have the most coverage that you can buy. In fact, the law no longer allows you to get some of the coverage.

With your Plan J, you will get the basic coverage categories, like Part A coinsurance and hospital costs for an additional 365 days after your original Medicare coverage has expired. If youve ever stayed the night in a hospital for whatever reason, you know that it can be an expensive stay. With traditional Medicare, you will get some hospital fee coverage, but after that coverage ends, youll be responsible for all of those bills out-of-pocket. With a Medicare Plan J , you will get additional coverage that can protect your savings if youre ever in the hospital for several weeks.

How Do Medicare Supplement Plans Work

Medicare Supplement plans achieve one goal: lowering out-of-pocket costs for Medicare beneficiaries. Once you enroll in a Medicare Supplement plan, you can better predict your medical expenses for the year.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

This predictability helps you avoid unexpected out-of-pocket costs by eliminating them. In addition to predictable costs, you receive several benefits when you enroll in a Medicare Supplement plan.

These benefits include:

- No network restrictions you can see any doctor or visit any hospital that accepts Original Medicare

- No referrals are required when you see a specialist

- Coverage is the same in all states

- 12 Unique plan options available to fit your needs/budget

- Guaranteed renewable plans your carrier cannot drop you for any reason other than not paying your premium

If you are looking for a plan that prioritizes convenience and ease, a Medicare Supplement plan may be right for you.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read Also: What Is Extra Help With Medicare

What Is Plan J

Medicare Supplement Plan J is a policy that helps pay out-of-pocket expenses. Medicare has discontinued this plan for new enrollees. Medicare supplement insurance plans, also known as Medigap, help pay for the costs that people with original Medicare incur, such as coinsurance, deductibles, and copayments.

What Is Medigap Plan J

Medigap Plan J was one of several Medicare supplement plan options available to those eligible for Medicare. However, due to the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, this plan can no longer be purchased as of June 2010. If you bought this plan prior to this time, you may keep it for as long as the insurance company continues offering it.

If you became eligible for Medicare after June 2010, there are a few current options that are similar to Plan J. Because Plan J was a very comprehensive plan, the two most similar plans offered today include Plan G and Plan N.

For people who kept Medigap Plan J after it was no longer offered to new enrollees, the benefits include:

- Part A coinsurance and hospital stays up to 365 days after Medicare benefits are used up

- Part A deductible

- prescription drug benefits

With changes to Medicare over the years, some of this coverage is now redundant. Hospice and preventive care are now covered by Part A and Part B, respectively.

Although Medigap Plan J had a prescription drug benefit that was unique at the time, there are now other options available, including:

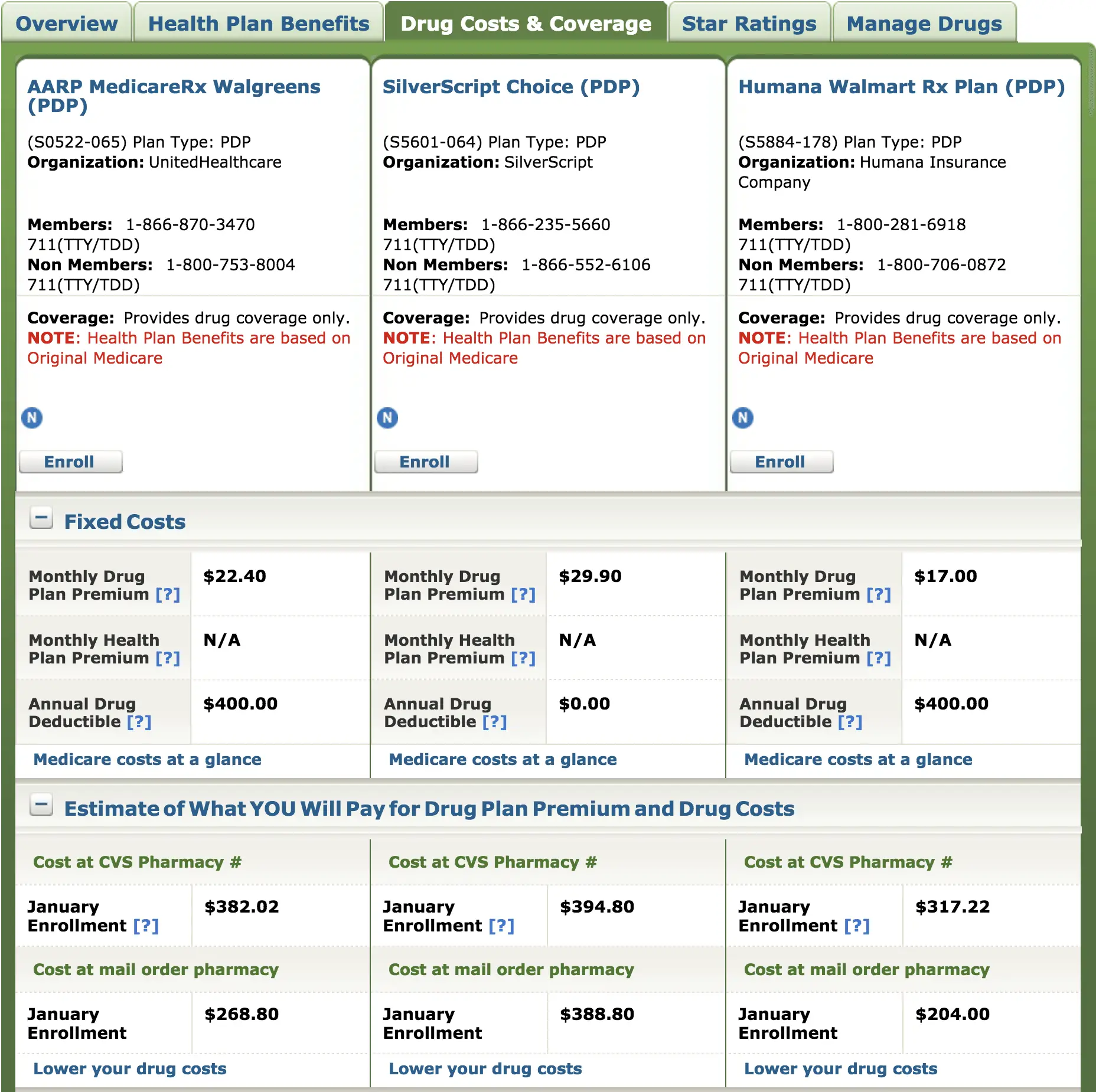

Both Medicare Part D and Medicare Advantage plans are offered by Medicare-approved private insurance companies. Review your options before making a decision on Medicare prescription coverage, because not only does coverage vary between plans, but the price does as well, including:

- monthly premiums

- yearly deductibles

- copayments/coinsurance

Read Also: Does Medicare Pay For A Portable Oxygen Concentrator

Service You Can Trust

Our agents/producers travel to your home or business. Our goal is to provide excellent service to every policyholder and make your life easier when it comes to your claims.

In 2018, Bankers Life paid Medicare Supplement insurance claims to over 300,000 policyholders, totaling $464 million.

Bankers Life is accredited by the Better Business Bureau with an A rating as of April 2017, in addition to currently holding an A rating by A.M. Best Company for our financial strength.

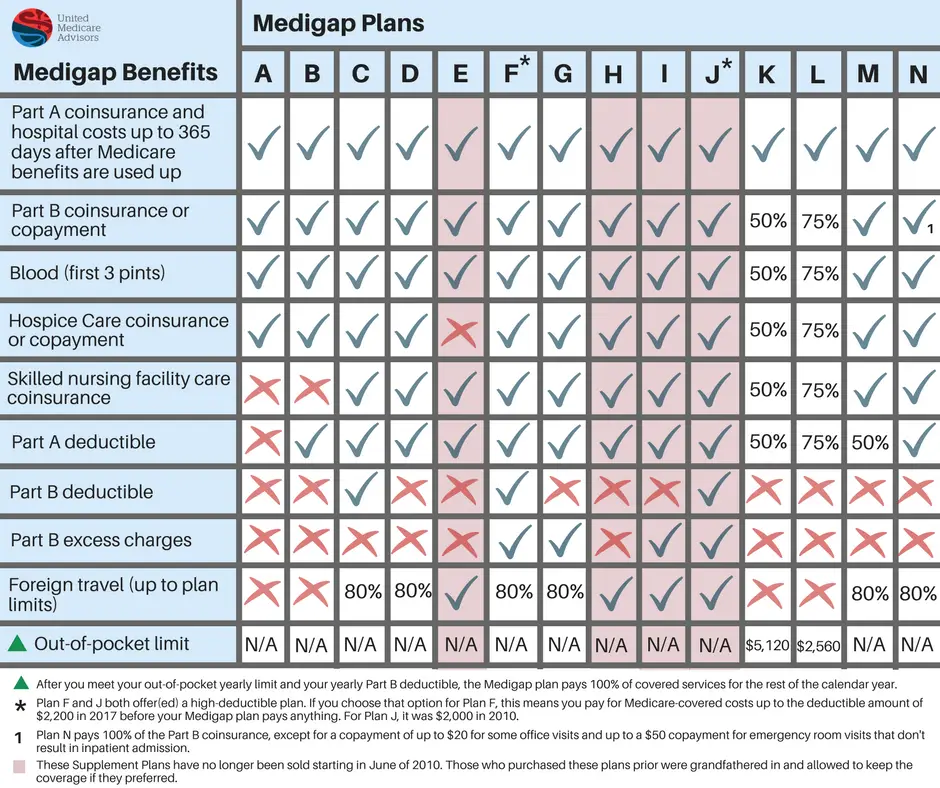

Medicare Supplement Comparison Chart 2022

The chart above outlines the ten lettered and two high-deductible Medicare Supplement plans available to Medicare beneficiaries. These plans are standardized in 47 of 50 states and Washington, D.C. This means that coverage does not differ from one state to another, and all carriers must follow the same guidelines.

The three states that offer different Medicare Supplement plan types are Minnesota, Massachusetts, and Wisconsin. Each of these states has its own Medicare Supplement plans that closely follow the rules of the top standardized Medicare Supplement plans.

You can compare Medicare Supplement plans online, but our licensed Medicare agents can help you understand the differences between the various Medicare Supplement plans available to you. Additionally, we can give you accurate premium quotes for the plans from the best carriers available in your area.

Don’t Miss: What Is Open Enrollment For Medicare Supplement Coverage

Why Was Was Medigap Plan J Removed

When Congress passed the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, the structure of Medicare was forever altered. Among other things, this act signaled the beginning of Medicare Part D . Because Plan J included coverage for prescription drugs, the advent of Medicare Part D made the Plan outdated.

How Can I View Rates Or Apply For Medicare Supplement Plan F

You can view rates from top-ranked companies for MedicareSupplement Plan F with our onlinetool. When youve chosen the carrier that you prefer, you can submit yourapplication online, all from the comfort of your home. Comparing rates in oneeasy place is convenient, and can give you the peace of mind that youre notpaying more than you need to for your insurance.

Medicare Supplement Plan F and Plan J both offer strongcoverage, but if you have Plan J you may be overpaying. We understand thatcomparing plans and switching coverage can be confusing, so were here to help.If you need some guidance with your Medicare Supplement plan or have otherMedicare questions, you can reach us at .

Nothing on this website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

You May Like: Does Medicare Cover Inversion Tables

How Much Does Medigap Plan J Cost

In 2021, the annual deductible to pay for Medigap Plan J is $2,370. If your plan covers prescription drugs, it also has a separate prescription drug deductible of $250 to cover each year.

Your Medigap policy also has a monthly premium. The exact amount can vary by individual policy. Insurance companies can set monthly premiums for their policies in a few different ways, so its important to know which type you have:

- Community rated. Everyone that buys the policy pays the same monthly premium regardless of age.

- Issue-age rated. Monthly premiums are tied to the age when you first purchased the policy, with younger buyers having lower premiums. Premiums dont increase as you get older.

- Attained-age rated. Monthly premiums are based on your current age. That means your premium will go up as you get older.

Contact your plan provider directly about any specific questions you have about your costs or how your plan is structured.

Should I Change From Medicare Plan J

The Centers for Medicare & Medicaid Services eliminated Medigap Plan J as an option for individuals on Medicare on June 1, 2010. Meaning there havent been any new enrollees since then. From the insurance companys perspective, there are no new revenue sources for that plan.

Additionally, those on Plan J are aging and will need medical services more frequently. At the same time, expenses to operate Medigap Plan J are also increasing. For it to remain profitable, prices must increase as well.

Many Medicare beneficiaries have switched to one of the other top Medicare Supplement plans. With the majority enrolling in Plan F and Plan G.

You May Like: What Is The F Plan For Medicare

Open Enrollment: Your Time To Join Switch Or Drop A Plan

There is an open enrollment period every year when you can join, switch, or drop a Medicare plan. From October 15 through December 7, 2022, Medicare beneficiaries can review how they receive their Medicare coverage for 2023, says Judith A. Stein, executive director at the Center for Medicare Advocacy in Willimantic, Connecticut.

According to Medicare.gov, you can do any of the following during open enrollment:

- Change from Original Medicare to a Medicare Advantage Plan

- Change from a Medicare Advantage Plan back to Original Medicare

- Switch from one Medicare Advantage Plan to another Medicare Advantage Plan

- Switch from a Medicare Advantage Plan that doesnt offer drug coverage to a Medicare Advantage Plan that offers drug coverage

- Switch from a Medicare Advantage Plan that offers drug coverage to a Medicare Advantage Plan that doesnt offer drug coverage

- Join a Medicare drug plan

- Switch from one Medicare drug plan to another Medicare drug plan

- Drop your Medicare drug coverage completely

Whether you are in Original Medicare with a Part D prescription drug plan, or enrolled in a private Medicare Advantage plan, all beneficiaries should make sure their current plan will meet their needs in the coming year.

What Are The Most Popular Medicare Supplement Plans

Not all Medicare Supplement plans share the same benefits. So, some plans tend to attract more enrollees than others. Due to their comprehensive coverage, Medicare Supplement Plan F, Plan G, and Plan N are the most popular Medicare Supplement plans nationwide.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If you refer to the Medicare Supplement comparison chart above, you will notice that these three plans offer the most comprehensive coverage of all Medigap plans.

Depending on your budget and healthcare needs, one of these three plans may work best for you. However, not all Medicare beneficiaries are eligible for all plans. Those who received Medicare after January 1, 2020, are not eligible for Medicare Supplement Plan F. So, if you are new to Medicare, your most comprehensive option is Medicare Supplement Plan G.

Don’t Miss: Does The Cleveland Clinic Accept Medicare

Keeping Medigap Plan J Vs Switching To Plan F

Medicare beneficiaries who enrolled in Medicare Supplement Insurance Plan J prior to its discontinuation may remain enrolled in the plan. However, it would be wise for any enrollees still receiving Medigap Plan J benefits to shop around and compare their premiums with those of a Plan F policy.

Because new enrollees are no longer accepted into Plan J, there are only older beneficiaries participating in the plan. As these beneficiaries continue to age, the insurance companies may have to pay out more claims, which can lead to an increase in rates. On the other hand, Plan F has newer Medicare beneficiaries that are not requiring as many claims, and thus lower rates may be maintained for a period.

The only real difference in the two Medigap plans today is a slight variation in foreign travel emergency coverage. Any Medigap Plan J enrollees who do not plan on doing any further foreign travel could potentially benefit from seeking out and comparing free Medigap quotes for Plan F and consider switching Medigap plans.

Refer to the chart below for a side-by-side comparison of all 10 standardized Medigap plans.

| 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Comparing Medigap Plan J Coverage To Plan F

Medigap Plan J benefits were popular among Medicare beneficiaries because of the comprehensive coverage of Medicares out-of-pocket costs. The option for a wide range of health care cost coverage still exists in the form of Medigap Plan F.

IMPORTANT: Plan F is not available to beneficiaries who became eligible for Medicare on or after January 1, 2020.

If you are not eligible for Plan F, you may consider Medigap Plan G.

Both Medicare Supplement Insurance Plan J and Plan F each provide coverage for:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance and copayments

- First three pints of blood

- Medicare Part A hospice care coinsurance and copayments

- Skilled nursing facility care coinsurance

- Medicare Part A deductible

- Medicare Part B deductible

- Medicare Part B excess charges

Plan J and Plan F each provide coverage for foreign travel emergency care as well. While Plan F allots for coverage of 80% of costs, Plan J provides 100% coverage.

Medicare Supplement Insurance Plan J coverage also provides two additional benefits that are not found in Plan F:

- At-home recovery care

- Preventive care

Medicare has since expanded its coverage of at-home recovery and preventive care, making these differences no longer necessary.

Recommended Reading: What Is A Medicare Supplement Insurance Plan

Is Medicare Supplement Plan J Still Available

Medicare Supplement Plan J is no longer available for a person to enroll in or private insurers to offer. As of June 1, 2010, the implementation of rules originating from the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 prevented new sales of Medigap Plan J due to the inclusion of additional benefits in original Medicare.

What Does Medicare Supplement Insurance Cover

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

Recommended Reading: Is Nursing Home Covered By Medicare

How Much Does Medicare Supplement Plan J Cost

The annual Medicare Supplement insurance premiums were $60.07 per month. The costs of MediGap are usually determined by factors including age and gender health care and the amount the plan costs. This average price list also covers options in Medigap Plan J that are less expensive than those listed, as well as some plans that carry comparatively high premium costs. It will not be sold in any new enrollment year.