Overview Of Annual Medicare Spending

Home / FAQs / General Medicare / Overview of Annual Medicare Spending

Every year, the Board of Trustees for Medicare and Social Security releases their annual report. This important document outlines Medicares spending trends, future projections, the current financial status of the program, and more.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Specifically, the Trustees Report provides insight into Medicares Hospital Insurance trust fund and the Supplementary Medical Insurance trust fund. The former funds Medicare Part A and the latter is funding for Medicare Parts B and D. Medicare Advantage receives money from both the HI and SMI trust funds.

Weve reviewed the 267-page report, so you dont have to. We have the highlights summarizing the past year of Medicare, the effects of the COVID-19 pandemic, and the uncertain future of funding.

What Is The Future Of Medicare Spending Per Beneficiary

As the next group of Baby Boomers reach Medicare eligibility, Medicare Trustees report that the number of beneficiaries is growing. Consequently, this will lead to rising costs per beneficiary.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

The average annual income for half of all Medicare beneficiaries is $29,650 or less. With rising health-related costs lawmakers must improve the program to make sure its affordable.

Background On Payments To Medicare Advantage Plans

Medicare beneficiaries have the option to receive their Medicare benefits through either the traditional Medicare program or by enrolling in a private health plan, such as an HMO or PPO, that contracts with Medicare, called Medicare Advantage. Medicare pays Medicare Advantage plans a set amount for each enrollee. The payment is determined through an annual process in which plans submit âbidsâ for how much they estimate it will cost to provide benefits covered under Medicare Parts A and B for an average beneficiary. The bids submitted by each plan are compared to a benchmark, which is an amount based on a set percentage of the projected average spending for beneficiaries in traditional Medicare in the same county. The benchmarks range from 95 percent in high spending counties to 115 percent in low spending counties. The benchmarks are subject to caps, meaning they cannot exceed the benchmarks that were in place before the Affordable Care Act. In addition, the benchmarks are increased by 5 percent for plans that receive at least 4 out of 5 stars under the quality bonus program, and 10 percent in certain âdouble bonusâ counties.

Also Check: Where Do I Send My Medicare Payment

Study Design And Statistical Analysis

Data for continuous outcome variables were transformed to categorical ordered quintiles to reduce the influence of outliers and provide a homogeneous parameter interpretation across outcomes, aligning outcome scales to that of the patient experience HCAHPS star ratings . Imputation of missing MSPB was considered, but small differences in resulting sample sizes with respect to the complete case analyses did not justify the approach.

Five domain models were defined assessing the association of MSPB with six healthcare-associated infections , six 30-day mortality rates , 30-day readmission rate , patient safety index , and patient experience HCAHPS star rating . Only hospitals with complete within-domain outcome metrics were used to avoid outcome imputation and define homogeneous sets of facilities with all available domain-based outcome metrics. Additionally, missing outcomes are not due to lack of reporting but, more importantly, because those measures are not applicable for those facilities .

A multiresponse multinomial ordered probit model was used for the multi-outcome domains, and univariate versions were used for the single-outcome domains. Since the primary analysis consists of assessing the statistical significance of MSPB with respect to each of the measurable outcomes across models/domains, a Bonferroni multiple testing correction was applied to preserve the target family-wise error rate of = 0.05.

What Is The Future Of Government Spending On Medicare

Additionally, Democratic lawmakers are seeking to lower prescription drug prices to help fund the expansion. The Medicare Payment Advisory Commission , which notifies Congress on Medicare policies and changes, suggests adjusting how Medicare Advantage payments are calculated. Furthermore, lawmakers should consider raising revenues and reducing costs to save the Medicare HI trust fund from depleting in by 2026, according to the Committee for a Responsible Federal Budget.

An analysis by the Kaiser Family Foundation of information from the Centers for Medicare & Medicaid Services and MedPAC estimates that just a 2% reduction in Medicare Advantage spending per enrollee, it would save $82 billion throughout the remainder of the decade.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If youd like additional information, read the full Medicare Trustees Report.

- Was this article helpful ?

Also Check: How Do I Apply For Medicare Part B

Quick Reference: Methodology Steps

There are two overarching processes in calculating revised MSPB clinician measure scores: episode construction and measure calculation . This section provides a brief summary of these processes, and Section 4.0 describes them in detail.

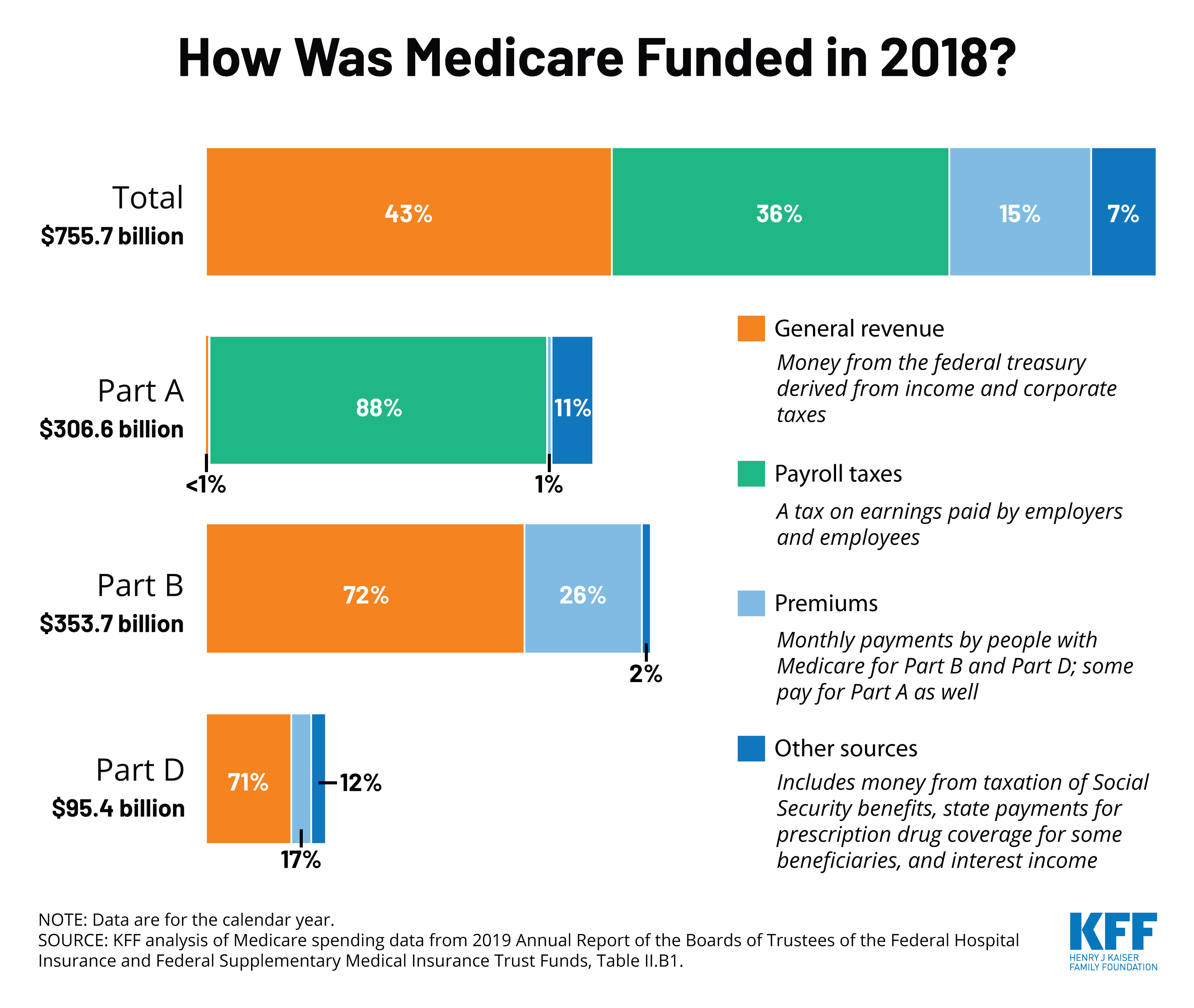

How Is Medicare Financed

Medicare is funded primarily from general revenues , payroll taxes , and beneficiary premiums .

Figure 7: Sources of Medicare Revenue, 2018

- Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees . Higher-income taxpayers pay a higher payroll tax on earnings .

- Part B is financed through general revenues , beneficiary premiums , and interest and other sources . Beneficiaries with annual incomes over $85,000/individual or $170,000/couple pay a higher, income-related Part B premium reflecting a larger share of total Part B spending, ranging from 35 percent to 85 percent.

- Part D is financed by general revenues , beneficiary premiums , and state payments for beneficiaries dually eligible for Medicare and Medicaid . Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

- The Medicare Advantage program is not separately financed. Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan about half of Medicare Advantage enrollees pay no additional premium.

Don’t Miss: Does Medicare Cover Full Body Scans

Medicare Spending Per Beneficiary : Dexur Methodology Calculations And Importance

Want to know more about Dexur’s Capabilities? Get In Touch

& nbspAug. 25, 2020

Importance of MSPB and other VBP Measures

Dexur analyzes Medicare Claims data to evaluate MSPB cost per episode for hospitals. MSPB Hospital measure assesses the cost to Medicare for services performed by hospitals and other healthcare providers during an episode of care , which is composed of the periods immediately prior to, during, and following a patients hospital stay. CMS stresses the importance of measuring the cost of care explicitly to recognize hospitals that are involved in the provision of high-quality care at a lower cost, in conjunction with other quality measures.

The Hospital VBP Program is designed to improve the quality, efficiency, and safety of care that patients receive during acute care inpatient stays, as well as to improve their experience of care during hospital stays. CMS evaluates hospital performance on an approved set of measures and dimensions grouped into four specific quality domains: clinical outcomes, efficiency and cost reduction, safety, and person and community engagement. Domains are assigned equal weights of the Total Performance Score.

MSPB: Dexur Methodology

In order to calculate the Medicare spending per beneficiary for each hospital, we determined the following:

Appendix B Illustrations Of Attribution For Medical And Surgical Ms

This appendix provides some further details and examples of attribution for episodes with medical and surgical MS-DRGs.Medical MS-DRG Episode AttributionAn episode with a medical MS-DRG is attributed to a:

- TIN if that TIN billed at least 30 percent of the E& M claims billed during the inpatient stay, and to a

- TIN-NPI if a clinician within an attributed TIN billed at least one E& M claim that was used to determine the episodes attribution to the TIN.

In the example shown above, the stacked, colored boxes on the left represent nine E& M claims billed by eight different clinicians across four TINs during the index admission for one medical MS-DRG episode. Clinicians 1 through 7 billed one E& M claim, and Clinician 8 billed two E& M claims under TIN D. The next set of boxes to the right of the colored boxes shows the percentage of total E& Ms for that index admission billed by each of the four TINs. Moving right, the next set of boxes lists the clinicians within each of the four TINs who had billed at least one E& M during the index admission. Finally, the last set of boxes shows a summary of how this affects attribution.Only TIN D billed at least 30 percent of the E& M codes during the index admission. This means:

- At the TIN level, only TIN D is attributed this episode.

- TINs A, B, and C did not meet the 30 percent threshold, so they are not attributed this episode.

Read Also: Does Medicare Cover Eye Surgery

Payments To Medicare Advantage

Medicare Advantage plans have seen a substantial shift in payments compared to previous Medicare Advantage plans. Currently, 43% of Medicare beneficiaries have an Advantage plan that number is expected to increase again, from 1.6% to 2.4% by 2030.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Growth projections are lower compared to last year, due in part to high numbers of people switching from Part D prescription drug plans to Medicare Advantage Prescription Drug Plans.

How Much Does The Average Medicare Beneficiary Pay Out Of Pocket For Medical Expenses

Q: How much does the average Medicare beneficiary pay out of pocket for medical coverage and expenses?

A: According to a Kaiser Family Foundation analysis of Medicare Current Beneficiary Survey , the average Medicare beneficiary paid $5,460 out-of-pocket for their care in 2016, including premiums as well as out-of-pocket costs when health care was needed.

Spending was highest among Medicare beneficiaries who had no supplemental coverage , and was somewhat lower for those who had Medigap coverage . Beneficiaries with Medicare and Medicaid spent the least out-of-pocket, paying only $2,665 in 2016.

Read Also: How Old Do You Need To Be To Collect Medicare

Insuranceopedia Explains Medicare Beneficiary

Medicare is a government health program for U.S. senior citizens who have paid their Medicare taxes while working.

There are four kinds of Medicare coverage that a Medicare beneficiary can avail themselves of:

- Medicare A: U.S. citizens are automatically eligible for this coverage when they turn 65. There is no premium for this plan and it covers most of the cost of hospitalization.

- Medicare B: To qualify for this plan, the beneficiary must pay a premium. It will pay for outpatient treatment, doctor’s services, and prescribed drugs.

- Medicare C: Medicare C plans are offered through private insurance companies that are approved by the Medicare program. Some Medicare C plans provide vision and dental care.

- Medicare D: Like Medicare C, this plan is offered through approved private insurance companies. It provides coverage for prescriptive drugs.

Related Question

How Does The Pandemic Affect Medicare Spending

In addition, Congress declared a public health emergency, leading to new policies and provisions that further increased Medicare spending. The following are some ways the report shows the impact COVID-19 had on Medicare:

- An increase in the use of telehealth services

- Increase in payments for COVID-19 related inpatient hospital admissions

- Waiver of a three-day requirement for patients receiving skilled nursing facility services

- Drop in spending for non-COVID treatment care

Read Also: Does Medicare Cover Parkinson’s Disease

What Does Medicare Beneficiary Mean

A Medicare beneficiary is someone aged 65 years or older who is entitled to health services under a federal health insurance plan.

Although Medicare beneficiaries are typically seniors, those who are younger than 65 years of age can still qualify for Medicare benefits if they meet certain qualifications, such as being a recipient of Social Security benefits or having a qualifying disability.

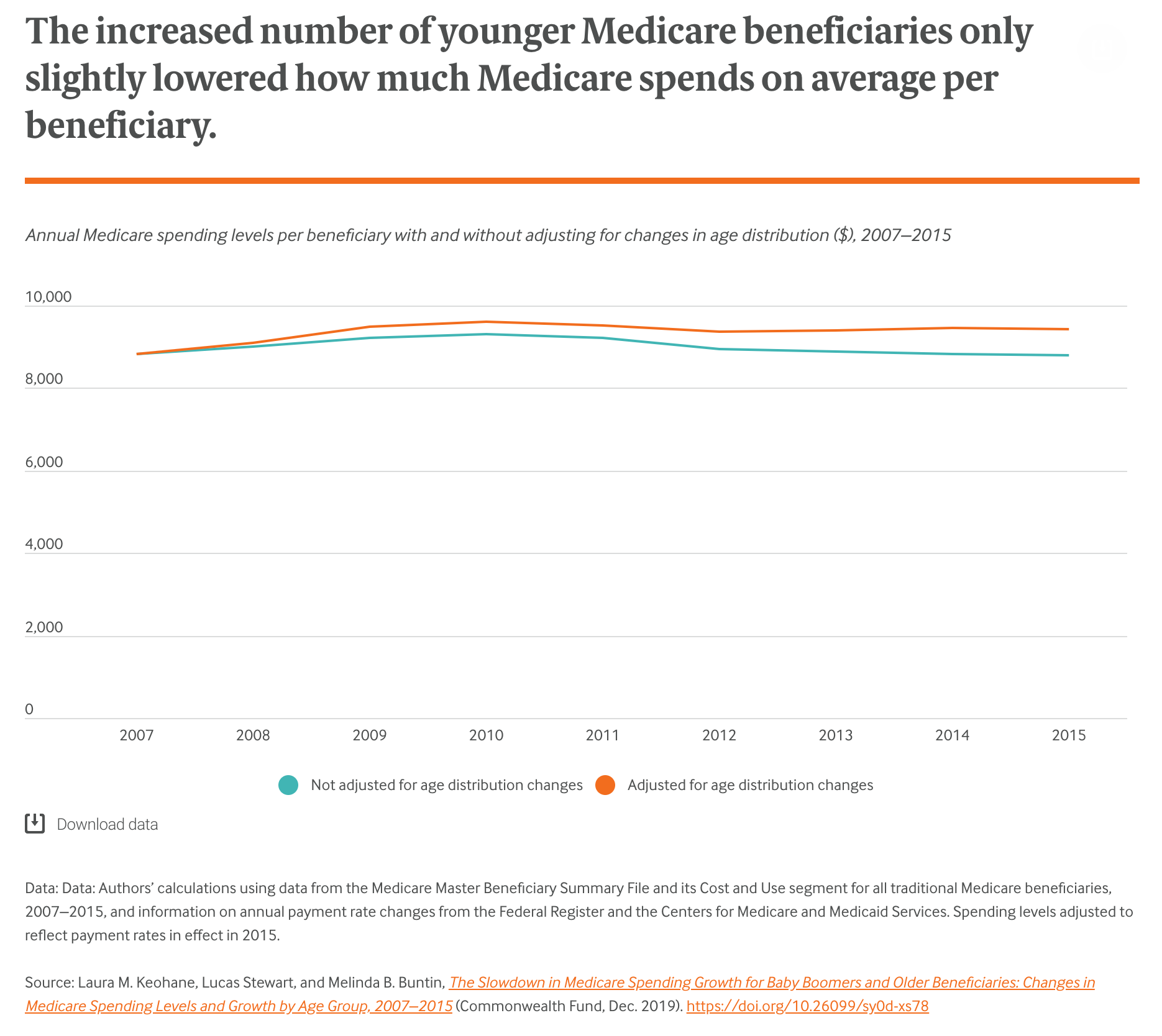

How Have Medicares Spending And Health Costs For Beneficiaries Changed In Recent Years

Total enrollee spending on Medicare has increased since 2010 as premiums, deductibles, and coinsurance have generally increased . From 2010 through 2017, Medicare Parts A and B had the lowest per-beneficiary spending growth in the programs history, primarily due to low provider reimbursement increases and reduced spending on Medicare Advantage plans. Medicares total per-enrollee spending rose from $11,902 in 2010 to $14,151 in 2019. This included spending on Part D, which began covering people in 2006 . These amounts come from p. 188 of the Medicare Trustees Report for 2020.

But there isnt always a clear connection between what Medicare spends and what enrollees pay themselves. In addition to cost sharing , beneficiaries have to pay out-of-pocket for expenses Medicare doesnt cover, such as long-term care and dental services. According to the KFF analysis, the amount Medicare beneficiaries paid for covered and non-covered care decreased slightly from 2013 and 2016, dropping from $5,503 to $5,460.

A significant portion of spending for all Medicare beneficiaries was on long-term care, with people living in the community spending only $4,519. Around 5 percent of Original Medicare beneficiaries were institutionalized in 2016, and had out-of-pocket spending costs that averaged more than $23,000.

Recommended Reading: Does Medicare Cover Dermatologist Check Ups

Projections For Medicare Spending

Trustees estimate that spending for Medicare Part A could climb from 1.7% to 2.2% by 2045. On the other hand, Trustees predict that Part B and Part D will grow at an even faster rate. According to the report, over the next seven years, spending for Part B will grow from 2.0% to 3.6%.

Consequently, Part Ds spending could rise from 0.5% to 0.9% Overall, Trustees attribute the cost growth to the rising enrollment numbers and cost of Medicare Advantage.

Overview Of Medicare Spending

Medicare is currently the nations second-largest social insurance program. Last year, Medicare insured 62.6 million Americans, including 54.1 million seniors and 8.5 million disabled beneficiaries under 65. Annual expenditures totaled $926 billion.

According to the Trustees Report, the Hospital Insurance trust fund expenditures surpassed $60.4 billion as a result of accelerated and advance payments.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

You May Like: What Year Did Medicare Advantage Start

Assessing Medicares Financial Condition

Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance trust fund.

Solvency of the Medicare Hospital Insurance Trust Fund

The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases. When spending exceeds income and the assets are fully depleted, Medicare will not have sufficient funds to pay all Part A benefits.

Figure 8: Figure 8: Solvency Projections of the Medicare Part A Trust Fund, 2005-2019

In the 2018 and 2019 Medicare Trustees reports, the actuaries attributed the earlier depletion date to several factors, including legislative changes enacted since the 2017 report that will reduce revenues to the Part A trust fund and increase Part A spending:

Quality Definitions And Methodology

- MSPB. Medicare Spending per Beneficiary

-

The Spending per Hospital Patient with Medicare measure shows whether Medicare spends more, less, or about the same per Medicare patient treated in a specific hospital, compared to how much Medicare spends per patient nationally. This measure includes any Medicare Part A and Part B payments made for services provided to a patient during the 3 days prior to the hospital stay, during the stay, and during the 30 days after discharge from the hospital. This measure is from the current reporting period- Opens in a new window. Learn more about Spending per Hospital Patient with Medicare.- Opens in a new window

This result is a ratio calculated by dividing the amount Medicare spends per patient for an episode of care initiated at this hospital by the median amount Medicare spent per patient nationally.

- A result of 1 means that Medicare spends ABOUT THE SAME amount per patient for an episode of care initiated at this hospital as it does per hospital patient nationally.

- A result that is more than 1 means that Medicare spends MORE per patient for an episode of care initiated at this hospital than it does per hospital patient nationally.

- A result that is less than 1 means that Medicare spends LESS per patient for an episode of care initiated at this hospital than it does per hospital patient nationally.

Lower numbers are better.

Read Also: How To Calculate Medicare Wages