How Much Does Medicare Part B Cost In 2021

The standard Part B premium in 2021 is $170.10 per month.

Part B premiums are based on your reported modified adjusted gross income from two years prior if you’re a higher income earner. So your 2022 Part B premiums may be based on your reported income from 2020.

- Individuals with a reported 2020 income of less than $91,000 per year and couples with a combined income of less than $182,000 per year pay the standard Part B premium of $170.10 per month in 2022.

- Anyone with incomes above those thresholds pay more for their Part B coverage based on the Income-Related Monthly Adjusted Amount, or Medicare IRMAA.

The table below breaks down 2022 Medicare Part B premiums according to income.

Medicare Part B IRMAAThe premiums for Part A and Part B can potentially increase every year.

Part B also includes a deductible, which is $233 per year in 2022.

After you meet your Part B deductible, you typically pay 20 percent of the Medicare-approved amount for most covered services. This is called the Part B coinsurance or copayment.

How Much Does Medicare Part B Cost

When you enroll in this part of Medicare, you are responsible for its costs such as premium. In 2022, the standard Medicare Part B premium is $170.10 each month.

However, those in a higher income bracket will pay a higher monthly premium.This higher monthly premium is due to the Income Related Monthly Adjustment Amount . IRMAA is calculated by looking at your annual income and using a sliding scale to determine your premium.

Get A Free Quote

| $587.30 | Plan Premium + $77.90 |

For most beneficiaries, the premium is automatically deducted from their monthly Social Security benefits check. If you do not receive Social Security benefits, you will get a quarterly bill from Medicare.

Medicare offers an online payment option called Easy Pay, which you can access with a MyMedicare account. Additionally, you may pay your quarterly premium by mail instead.

Alongside the premium, your Medicare Part B coverage includes an annual deductible and 20% coinsurance, for which you are responsible for paying out-of-pocket. In 2022, the Medicare Part B deductible is $233.

Once you meet the annual deductible, Medicare will cover 80% of your Medicare Part B expenses. If you are looking for how you can lower your Medicare Part B costs, Medicare Supplement plans can close this coverage gap. Medicare Supplement plans help reduce other out-of-pocket costs and is accepted anywhere Original Medicare is accepted.

Get A Free Quote

Find the most affordable Medicare Plan in your area

What Does Medicare Part B Cover

Medicare Part B covers outpatient medical services:

- Ambulance services, including the ride and any medical care administered

- Doctors office visits

- Cancer screenings

- HIV and STD screenings and counseling

Preventive care is care intended to prevent disease, rather than treat disease after it has occurred.

Medicare Part B pays 80% of costs for covered services, leaving beneficiaries to pay the remaining 20% of Part B expenses out of pocket.

Read Also: Is Medicare Free At Age 65

Are There Alternatives To Medicare Part A And B

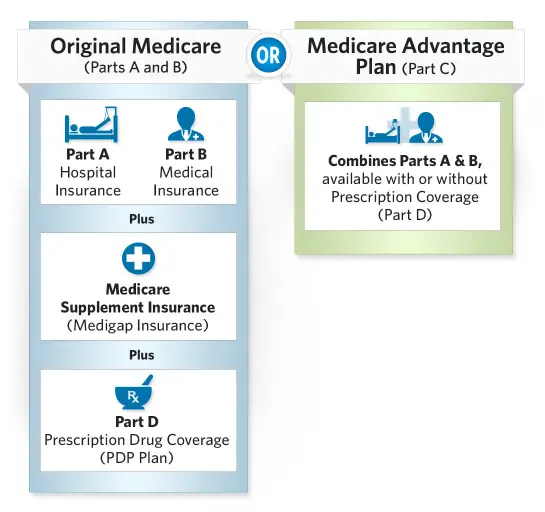

Yes. If you are still working, you could stay on your employers insurance plan. However, be aware that you may pay a penalty if you later enroll in Medicare outside of your enrollment period. Or, if you want Medicare benefits but need more flexibility than Parts A and B provide, you could opt for the next letter of the alphabet: Medicare Part C, known as Medicare Advantage.

Medicare Part C plans are offered by private insurance companies in accordance with federal guidelines. Beneficiaries that purchase Medicare Advantage are still enrolled in Medicare Parts A and B.

How Are Part A And Part B Defined

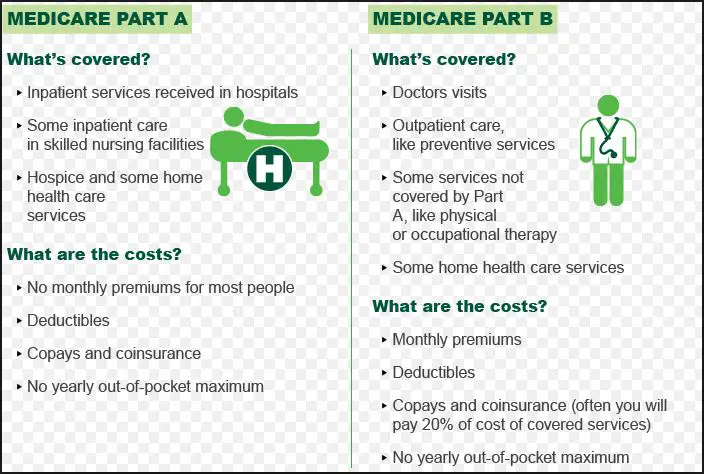

The Centers for Medicare and Medicaid Services provides a Medicare Part A definition as follows Medicare Part A includes coverage for inpatient care in hospitals, including critical access hospitals and skilled nursing facilities . Part A also covers surgery, a semi-private room and meals during a hospital stay, and some home health care.

In addition, part A also covers hospice care for terminally-ill patients.

Under special cases, Part A covers confinement in the following hospitals:

- Acute care

- Emergency room services

- Ambulance services

The lists provided above are not exhaustive. They give you a general idea of the differences in coverage between Medicare Part A and Part B.

Before we go any further, we should mention that prescription drugs and other benefits such as dental, vision, and hearing are not covered by Medicare Parts A and B. You can get coverage for these other benefits through Part C plans and drug coverage through Part D plans.

Recommended Reading: Does Medicare Cover Cpap Cleaner

What Is Covered By Medicare Part B

Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive.

The medically necessary coverage encompasses a variety of tests, procedures, and care options. A medical service or supply must be a requirement for treating or diagnosing a medical condition for Medicare to consider them medically necessary. Each situation is different, so a medical supply or service that is medically necessary for one person may not be for another.

It is easy to keep up with your general health needs through Medicares outpatient insurance by utilizing annual wellness visits.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Medicare Part B covers the following preventive care services:

- Vaccines

- Mental Health Counseling

You can receive many preventive services and more at your annual wellness visit.

Alongside preventive care services, Medicare Part B covers certain outpatient services you receive in the hospital. These include:

- Surgeries

- Chemotherapy

- Dialysis

If you are administered drugs while at the hospital, Medicare Part B will also provide coverage for these services.

Get A Free Quote

Find the most affordable Medicare Plan in your area

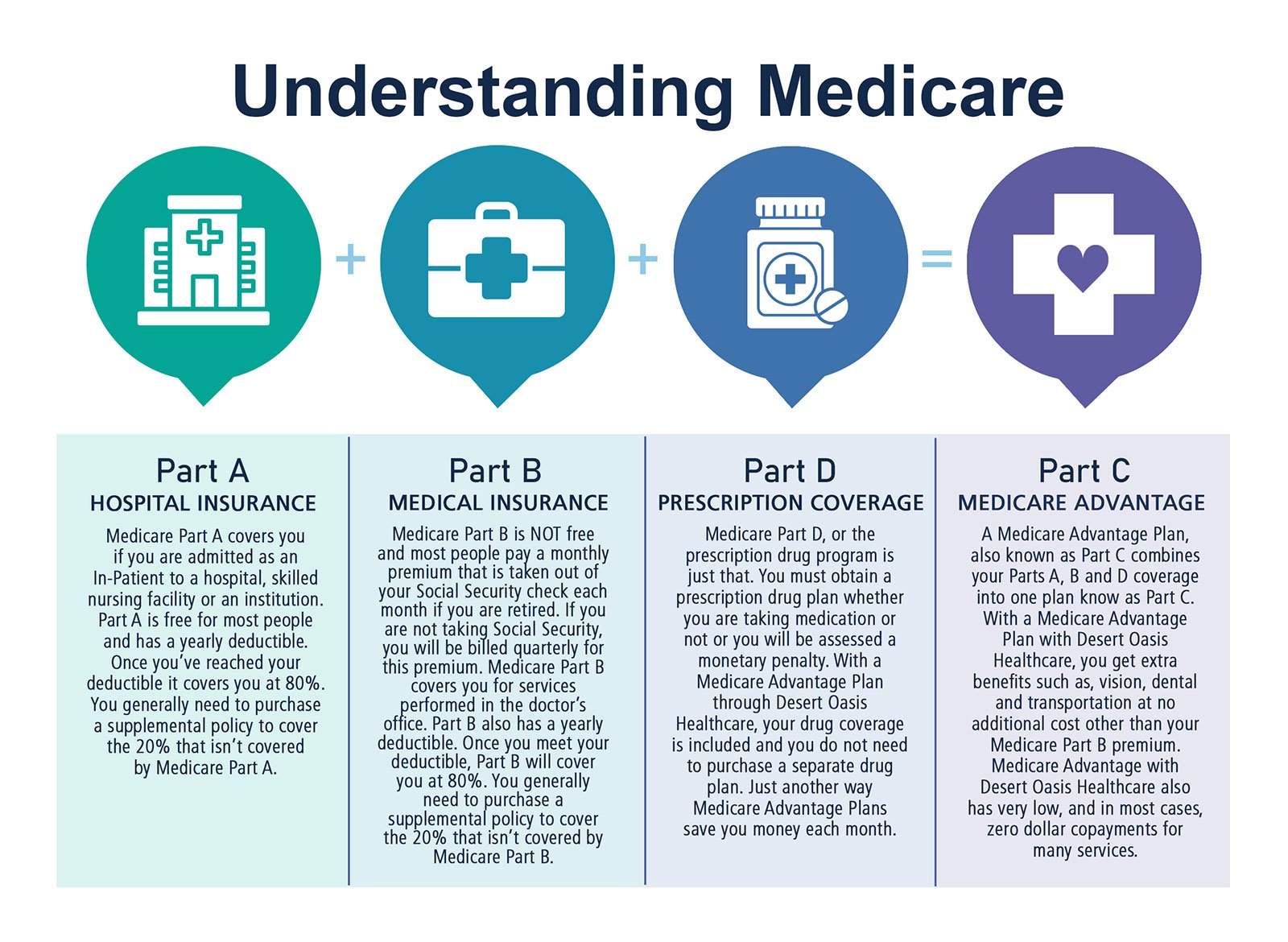

D: Prescription Drug Coverage

Medicare Part D plans are sold by private insurance companies to help cover prescription drugs for those enrolled in Original Medicare.

Remember, Original Medicare does not provide coverage for prescription drugs.

In addition to the Part D plan premiums, you may have to pay some Part D costs out-of-pocket, including an annual deductible and copayments or coinsurance.

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

Don’t Miss: What Does Part A Of Medicare Pay For

Delaying Enrollment In Medicare When You’re Eligible For It Could Result In A Penalty That Will Remain In Effect For The Rest Of Your Life

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month.

While Medicare Part A which covers hospital care is free for most enrollees, Part B which covers doctor visits, diagnostics, and preventive care charges participants a premium. Those premiums are a burden for many seniors, but heres how you can pay less for them.

What Is Medicare Part C Used For

Medicare Part C covers the inpatient care typically covered by Medicare Part A. If you are a Medicare Part C subscriber and are admitted to the hospital, your Medicare Advantage plan must cover a semi-private room, general nursing care, meals, hospital supplies, and medications administered as part of inpatient care.

Read Also: Can I Keep Medicare If I Get A Job

What Does Medicare Part D Cover

Part D covers prescription drugs. Only private insurance plans offer it. Its usually included in a Medicare Advantage plan or you can get a separate Part D plan.

Though Medicare Part B does cover certain vaccines and medications , Part D provides a much wider range of coverage of vaccines and outpatient prescription drugs.

Read more about the differences in Part B and Part D coverage in the article, Does Medicare cover all of my vaccines?

Medicare Part B: Medical Insurance

Examples of services that Medicare Part B helps cover include:

-

Doctors office visits

-

Ambulance services

-

Durable medical equipment

The standard premium amount for Medicare Part B is 2022 is $170.10 per month .

In addition to your monthly premium, you pay $233 per year for your Part B deductible in 2022.

Once your deductible is met, you usually pay a coinsuranceof 20% of the Medicare-approved amount for medically necessary care and services.

Don’t Miss: Does Medicare Pay For Shingles Shot 2020

Who Is Eligible For Medicare Part A And Part B

In order to be eligible for Medicare Part A and/or Part B, you must meet each of the following eligibility requirements:

- You are at least 65 years old OR have a qualifying disability

- You are a U.S. citizen OR a permanent legal resident of at least five consecutive years

- You are eligible for retirement benefits from either the Social Security Administration or the Railroad Retirement Board, OR you have been receiving disability benefits from either one for at least two years

As mentioned above, Medicare Part B is optional.

Do You Need Medicare Part B

The short answer is yes, especially if youll need the covered services mentioned above. However, if you have health insurance through a current job or are on your spouses active plan, you can delay your Medicare Part B enrollment without penalty. Once the spouse with employer coverage stops working whether its you or your partner you have eight months to sign up for Part B. Also, you need to be enrolled in Medicare Part B if you want to sign up for a Medicare Advantage plan.

Read Also: Does Medicare Supplemental Insurance Cover Pre Existing Conditions

Defer Income To Avoid A Premium Surcharge

The standard premium for Medicare Part B is $170.10 per month in 2022 but that assumes youre not a higher earner. Those with higher income levels are subject to higher premium costs. For 2022 heres what youre looking at:

| 2022 Medicare Part B premium costs by income level | ||

|---|---|---|

| Income level: individual tax filer | Income level: joint tax filer | Total monthly premium |

| $750,000 and above | $578.30 |

If youre able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns. For example, your 2020 tax return will determine whether you pay a surcharge in 2022 .

How Do I Sign Up For Medicare Part A And Part B

Some people are automatically enrolled in Medicare Part A and Part B. You are typically automatically enrolled if youre already receiving Social Security or Railroad Retirement Board retirement benefits when you turn 65.

If youre under 65 and eligible for Medicare due to a disability, youll be automatically enrolled the 25th month youve been receiving Social Security disability benefits.

- If youare eligible for premium-free Part A, you will receive your red, white and blue Medicare card and welcome packet in the mail approximately three months before your 65th birthday. You will also typically be automatically enrolled in both Part A and Part B, with your coverage beginning on the first day of your birthday month. Although you may be automatically enrolled in Part B, you may opt out of coverage before your first monthly premium comes due.

- If youarent automatically enrolled, you must take steps to manually enroll in both Part A and B. When you first become eligible for Medicare, you will be granted an Initial Enrollment Period . This 7-month period begins three months before you turn 65, includes the month of your birthday and continues on for three more months. You may apply for Medicare Part A and B during this time.

- You may also be able to sign up during a Special Enrollment Period if you qualify based on certain specific circumstances.

Don’t Miss: When Do You Get Medicare When On Disability

What Is Medicare Part A

Medicare Part A is sometimes referred to as hospital insurance. As the name implies, this is the Medicare plan that covers hospital stays and inpatient treatment. For treatment to be covered by Medicare Part A, it must be deemed medically necessary. This means a doctor has agreed that the treatment is required to prevent or treat a condition or illness.

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Recommended Reading: Is Medicare Free For Disabled

What Is The Difference Between Original Medicare And Medicare Advantage

Definitions:

- Premium: The monthly fee you pay to have Medicare or your health plan.

- Deductible: What you must pay before Medicare or your health plan starts paying for your care.

- Copayment/coinsurance: Your share of the cost you pay for each service.

- Part A: Medicare hospital insurance for inpatient care.

- Part B: Medicare medical insurance for outpatient care.

- Part D: Medicare drug coverage.

- Medigap: Supplemental insurance that helps pay your out-of-pocket cost in Original Medicare.

Pay Your Premiums Directly From Your Social Security Benefits

Seniors who are enrolled in Medicare and Social Security simultaneously have their Part B premiums deducted directly from their Social Security benefits. Doing so isnt just a convenience, though in some cases, it can save you from rising premium costs thanks to Medicares hold-harmless provision.

This provision protects you from losing out on Social Security income when Part B premium increases surpass the cost-of-living adjustments that are applied to benefits each year. This means that if Part B increases by $30 a month in a given year, but your COLA only raises your monthly benefits by $24, you save yourself the extra $6 by not having to pay it.

In recent years, the COLA has been more than adequate to cover the full cost of the standard Part B increases, so the hold harmless provision hasnt been applicable. But its always there, just in case the Part B premium increase is more than a beneficiarys COLA for a given year.

Recommended Reading: Is Shingles Shot Covered By Medicare Part D

What Are The Different Parts Of Medicare

The Medicare program has four parts:Part A : Hospital insurance helps pay for inpatient care in a hospital or skilled nursing facility , some home health care and hospice care.The other three parts of Medicare require premium payments, and if you dont enroll when youre first eligible, you may have to pay a late enrollment penalty for as long as you have coverage. Also, you may have to wait to enroll, which will delay coverage.Part B : Medical insurance helps pay for doctors services and many other medical services and supplies that hospital insurance does not cover.Part C : If you have Medicare Parts A and B, you can join a Medicare Advantage plan. Medicare Advantage plans are offered by private companies and approved by Medicare. These plans generally help you pay the medical costs not covered by Medicare Part A and B.Part D : Prescription drug coverage helps pay for medications doctors prescribe for treatment.More Information

What Is Medicare Part B And What Does It Cover

Medicare Part B is medical insurance.

Part B covers outpatient care, which can include:

- Doctors appointments

- Hepatitis B shots

- Pneumococcal shots

You should talk to your doctor or health care provider to find out more about how Medicare may or may not cover your tests, screenings or health care services and devices.

Don’t Miss: When Am I Eligible For Medicare Benefits

General Overview Of Medicare Parts

There are four parts for Medicare coverage. They are:

- Part A covers costs associated with a hospital or in-patient stay

- Part B covers the cost of seeing a doctor for outpatient care, such as annual physicals

- Part C provides alternate benefits not covered by federal Medicare

- Part D pays for prescription medications

Medicare Part A and Part B are provided by the federal government, while Part C, also known as a Medicare Advantage Plan, is provided by private insurance companies. Medicare insurance agents can help you find and compare these alternative plans.

What Is The Difference Between Part A And Part B

What is the difference between Part A and Part B? Summary: When you are eligible for Medicare, it is usually Parts A and B of Medicare that you register for the first time. Parts A and B of the Medicare plan are the original Medicare plan. Part A of Medicare usually helps pay your expenses as an in-patient patient. Part B of Medicare can help pay for medical visits, preventive services, laboratory tests, medical equipment and supplies, and more.

Read Also: What Is Medicare Advantage Coverage

What Is The Difference Between Medicaid And Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare.

Heres how Medicaid works for people who are age 65 and older:

Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article, Can I get help paying my Medicare costs?

Why Do I Need To Buy A Private Health Plan

Private Medicare health plans like Medicare Advantage or Medicare Cost plans cover everything Original Medicare does, and usually include more coverage for services you might need. Plus, they can include extra perks and benefits.

Find out more in the article, 4 reasons to buy a private health plan.

Recommended Reading: What Is A Ppo Medicare Plan