Signing Up For Medicare

Follow the steps below if you need to actively enroll in Medicare.

If you decide to enroll in Medicare during your Initial Enrollment Period, you can sign up for Parts A and/or B by:

- Visiting your local Social Security office

- Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare

- Or, by applying online at www.ssa.gov

If you are eligible for Railroad Retirement benefits, enroll in Medicare by calling the Railroad Retirement Board or contacting your local RRB field office.

Keep proof of when you tried to enroll in Medicare, to protect yourself from incurring a Part B premium penalty if your application is lost.

- Take down the names of any representatives you speak to, along with the time and date of the conversation.

- If you enroll through the mail, use certified mail and request a return receipt.

- If you enroll at your local Social Security office, ask for a written receipt.

- If you apply online, print out and save your confirmation page.

Related Answers

Medicare Enrollment Can Be Impacted By Social Security Benefits

Depending on your situation, you with either need to enroll in Medicare at age 65 or you may be able to delay. If you continue to work past age 65 and have creditable employer coverage , you can likely delay enrolling in Medicare until you lose that employer coverage. In most cases, people turning 65 will need to get Medicare during their 7-month Initial Enrollment Period to avoid financial penalties for enrolling late. Your IEP begins 3 months before the month of your 65th birthday and ends 3 months after.

Social Security benefits fit in the Medicare enrollment journey in one special way. If you are receiving either Social Security benefits for retirement or for disability, or Railroad Retirement Board benefits, you will be automatically enrolled in Medicare Part A and Part B when you first become eligible.

Do I Qualify For A Medicare Special Enrollment Period

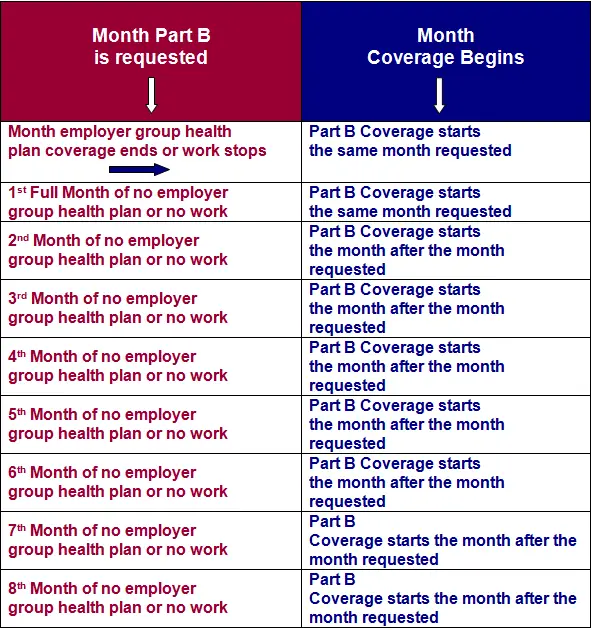

Perhaps, if you or your spouse is still working and you have health insurance from that employer. The special enrollment period allows you to sign up for Medicare Part B throughout the time you have coverage from your or your spouses employer and for up to eight months after the job or insurance ends, whichever occurs first.

If you enroll at any point during this time, your Medicare coverage will begin the first day of the following month. And you will not be liable for late penalties, no matter how old you are when you finally sign up.

Your decision also depends on the size of your employer and whether the employers plan is first in line to pay your medical bills or second.

Larger companies. If you or your spouse work for a company with 20 or more employees, you can delay signing up for Medicare until the employment ends or the coverage stops, whichever happens first. These large employers must offer you and your spouse the same benefits they offer younger employees and their spouses, which means that the employers coverage can continue to be your primary coverage and pay your medical bills first.

Many people enroll in Medicare Part A at 65 even though they have employer coverage, because its free if they or their spouse has paid 40 or more quarters of Medicare taxes. But they often delay signing up for Part B while theyre still working so they dont have to pay premiums for both Medicare and the employer coverage.

Keep in mind

Don’t Miss: Can You Use Medicare Out Of State

Medicare Advantage Open Enrollment Period

The period runs between January 1st and March 30 each year. It allows Medicare Advantage plan participants to choose a Medicare Advantage plan at an unscheduled time. You can enroll in prescription medications for Medicare too. In either situation your new coverage starts on the 1st Monday of the month immediately following the change. TIP : If your current Medicare plan is not active, then it is possible to get a Medicare Supplement.

Part A premiums, deductible and coinsurance are all increasing for 2023. Read More Four reasons to change your Medicare Advantage coverage If you’re enrolled in a Medicare Advantage plan and you’re not happy with it, you can switch plans during Medicare’s annual open enrollment period. Here are four reasons why you might change coverage.

D Late Enrollment Penalty

The Part D late enrollment penalty is similar to the Part B late enrollment penalty, in that you have to keep paying it for as long as you have Part D coverage. But its calculated a little differently. For each month that you were eligible but didnt enroll , youll pay an extra 1% of the national base beneficiary amount.

In 2020, the national base beneficiary amount is $32.74/month. Medicare Part D premiums vary significantly from one plan to another, but the penalty amount isnt based on a percentage of your specific planits based instead on a percentage of the national base beneficiary amount. Just as with other parts of Medicare, Part D premiums change from one year to the next, and the national base beneficiary amount generally increases over time.

So a person who delayed Medicare Part D enrollment by 27 months would be paying an extra $8.84/month , on top of their Part D plans monthly premium in 2020. A person who had delayed their Part D enrollment by 52 months would be paying an extra $17.02/month. As time goes by, that amount could increase if the national base beneficiary amount increases . People subject to the Part D late enrollment penalty can pick from among several plans, with varying premiums. But the Part D penalty will continue to be added to their premiums for as long as they have Part D coverage.

Also Check: Does Humana Medicare Cover Incontinence Supplies

Also Check: Will Medicare Pay For A Roho Cushion

What Are My Insurance Options If I Cannot Get Medicare At Age 62

If you dont qualify for Medicare, you may be able to get health insurance coverage through other options:

- Employer-provided insurance

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

How Do You Enroll In Medicare Supplement Medicare Advantage And Medicare Prescription Plans

Medigap, Medicare Part C, and Medicare Prescription Drug plans are administered by private insurance companies approved and regulated by Medicare. The company you choose or a licensed agent can help with your enrollment. During your time working, you pay medicare taxes through your employer. Medicare taxes allow this health insurance coverage to be available.

As for finding plans, you can view options on Medicare.gov, where there is also a premium calculator and you can learn more about part coverage. An explanation of each:

Recommended Reading: What Is The Monthly Premium For Medicare Part B

When Should You Sign Up For Medicare If You Are Still Working

You can sign up for Medicare Part A at age 65 even if youâre still working and have insurance through your employer. You are allowed to delay signing up for Medicare Part B until you leave work. There is a special enrollment period, which lasts eight months, when you can sign up for Part B. Miss the special enrollment period, though, and youâll have to pay a 10% penalty for each year you could have signed up but didnât.

You May Like: Does Medicare Cover Freestyle Libre Sensors

Automatic Enrollment Into Medicare For Those Diagnosed With Als Or Esrd

If you are diagnosed with amyotrophic lateral sclerosis, you will automatically enroll in Medicare Part A and Part B starting the month disability benefits begin. You will not need to wait the 24-month waiting period.

Similarly, if you have an end-stage renal disease diagnosis, you do not need to receive SSDI benefits to qualify for Original Medicare. If you have ESRD, you can enroll in Medicare at any time.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read Also: Can I Cancel My Medicare Part D Plan Anytime

What Age Can You Get Social Security

The minimum age to get Social Security benefits is 62. You can apply when you turn 61 years and 9 months of age. If you are turning 62 and you need the income from Social Security to support yourself, then you can start claiming your benefits now. Nevertheless, if you have enough income from other sources to keep you going until you are older, then it is suggested that you delay increasing the size of your monthly benefit.

Medicare Open Enrollment Period Dates

Currently available, you may be eligible to apply to the five-star plan anytime between December 8 and December 9, 2023. Often known as “five stars” Special enrollments. Compare plans Star ratings online and talk to an insured agent to change plans to five star Medicare Advantage Plans if you qualify by calling 577-8574. TY users: 711. Our Customer Service is always on site all the time!

Read Also: What Are Medicare Requirements For Bariatric Surgery

Younger Enrollees Would Primarily Enroll In Part A

Lowering the age of eligibility for Medicare would also shift enrollment across the various components of the program. For example, 82 percent of 65- to 69-year-olds enrolled in both Part A and Part B in 2019. By contrast, CBO estimates that in 2031 only 53 percent of 60- to 64-year-olds would enroll in both programs. That is because 60- to 64-year-olds would be more likely to enroll exclusively in Part A while also maintaining employer-provided coverage or another form of health insurance. That greater emphasis on Part A which is funded by payroll taxes and has a trust fund that is set to become depleted in 2028 could accelerate Medicares financial difficulties.

Medicare Prescription Drug Coverage

Enroll in a Medicare prescription drug plan . Jump from one Medicare drug plan to a different Medicare drug plan. Quit your Medicare prescription drug coverage. If you return to Original Medicare during this annual enrollment period and you want Medicare Supplement Insurance, also known as Medigap , you may pay more than you expected for a supplement policy, or you may be denied coverage.

There are 2 separate enrollment periods each year: Open Enrollment Period for Medicare Advantage and Medicare drug coverage. What can I do? Change from Original Medicare to a Medicare Advantage Plan. Change from a Medicare Advantage Plan back to Original Medicare. Switch from one Medicare Advantage Plan to another Medicare Advantage Plan.

Recommended Reading: Does Medicare Pay For Prep

If My Spouse Is 65 And Im 62 How Will That Affect My Spouses Medicare Costs

Your spouseâs costs will depend on the type of Medicare plan they choose â Original Medicare from the government or Medicare Advantage from a private insurer. And it will depend on the number of years youâve both worked.

Hereâs the lowdown: At the age of 65, your spouse will qualify for traditional Medicare, also called Original Medicare. That includes Medicare Part A, which covers hospital costs, and Medicare Part B, which covers doctor visits, among other things. If they need additional benefits, like coverage for prescription drugs, vision, hearing, or dental care, they must buy either additional Medicare Supplement plans or enroll in a Medicare Advantage plan that bundles those benefits in one policy.

Chances are that your spouse will have to pay a monthly premium for Part B . But they probably wonât have to pay for Part A. The reason: If your spouse has worked for at least 10 years , theyâve paid taxes to Medicare, so they wonât have to pay a premium for Part A.

And if your spouse hasnât worked for at least 10 years? They can still qualify for premium-free Part A if youâve worked for that amount of time and have paid taxes to Medicare.

If, on the other hand, neither you nor your spouse has worked for at least 10 years, you both may need to pay a premium for Part A. That cost can be as much as $499 a month. Part B is at least $170.10.

How Do I Get Full Medicare Benefits

Youâre entitled to full Medicare Part A and Part B benefits as soon as youâre eligible for Medicare.

If youâre interested in benefits beyond Original Medicare, you may want to consider:

- Medicare Advantage: Also known as Medicare Part C, these plans give you another way to get your Medicare Part A and Part B coverage. Plus, they often include extra benefits, like prescription drug coverage.

- Medicare Supplement Insurance: This private insurance plan works alongside your Medicare Part A and Part B coverage. Itâs also called Medigap.

- Medicare Part D: This stand-alone prescription drug plan helps you cover the cost of prescription medications.

Finding the Medicare plan thatâs right for your needs doesnât have to be overwhelming â eHealth is here to help. Get started now.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Don’t Miss: Which Part Of Medicare Is Free

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

You May Like: Is Entyvio Covered By Medicare Part B

How To Enroll In Medicare

Enrolling in Medicare is an easy two-step process. However, it may take more than one month for the entire application process to be completed. For best results, we recommend applying for Medicare three months before your 65th birthday.

Step 1 Sign up for Medicare.

Apply for Medicare three months before your 65th birthday so there is no delay in Medicare coverage.

To enroll in Medicare, visit your local Social Security Administration office or call Social Security toll-free at 8007721213. If you are enrolling in both Medicare Parts A & B, you can also complete your Medicare application online at www.ssa.gov.

If you visit your local office, find out which documents to bring with you to your appointment.

Step 2 Send proof of Medicare Enrollment to STRS Ohio.

Once you enroll in Medicare, you must provide proof of Medicare enrollment to STRS Ohio by submitting your Medicare information through your Online Personal Account. To submit your information:

- Log in to your Online Personal Account.

If you do not have an Online Personal Account, visit the Account Setup page to create your account. Then follow the instructions above to submit your Medicare information.

Note: Please check all information on your Medicare card for accuracy. If it is incorrect, contact Medicare to request a new card with the correct information.

Read Also: What Is The Best Medicare Advantage Plans In South Carolina

Fall Medicare Open Enrollment Period

If you didn’t enroll for Medicare Advantage plans during the first enrollment phase, you can join the Medicare Advantage plan during Medicare’s Spring 2018 open enrollment period. Medicare Open Enrollment period in 2019 will be dubbed an Medicare Annual Election Period. It takes place from 15 October to the 6th of December each year. The Medicare Open Enrollment period for the Medicare Advantage or Medicare prescription drug program in Fall 2019 goes into effect January 2023.

What Happens If I Miss My Initial Enrollment Window For Medicare

If you miss your Medicare Initial Enrollment Period for any reason, you may still enroll in Original Medicare during the General Enrollment Period. Remember, if you sign up during the annual General Enrollment Period, your Medicare will not start until July 1.

Therefore, you may have a coverage gap. If you do not maintain creditable coverage meaning at least as good as Medicare until this start date, you may be responsible for paying the Medicare Part B penalty.

Also Check: Are Dental Implants Covered By Medicare