Bluecross Blueshield : Largest Network Of Pharmacies

Medicare stars: 3.9 out of 5

Avg. monthly cost: $69

Avg. Part D drug deductible: $241

NAIC Complaint Index: Variable based on subsidiary

Prescription drug plans from BlueCross BlueShield , and its subsidiary Anthem, have strong average ratings with 3.9 stars. However, the monthly costs are the highest of all of the best-rated providers we profile here.

Despite the cost, plans from BCBS and its subsidiaries have several advantages.

Standard coverage options are robust, and many plans provide features such as additional cost-sharing during the coverage gap and low or $0 copays for generic drugs. There’s a very large network that includes most of the pharmacies in the country, and about half of the pharmacies are considered preferred, giving you wide access to discounted rates. The company also offers medication home delivery for those who regularly take medications.

Keep in mind that the major insurance company has many subsidiaries. The Part D plans that are available in your area may have better or worse ratings based on how your local BCBS subsidiary is managed. For example, BCBS of Massachusetts has an average of 4.25 for its prescription drug plans while BCBS of South Carolina has 3.25 stars.

Is Medicare Part D Mandatory

Medicare Part D prescription drug plans are not mandatory.

Medicare Part D will have a premium that goes along with it, but even if you have cheap prescriptions or no medications at all, it can be a good idea to sign up during your enrollment period so that you donât face a penalty.

Even if you donât need a drug plan, we recommend buying the lowest premium option . That way, you have some sort of drug coverage if need be, and you avoid the penalty.

If you donât like the idea of adding Medicare Part D to your original Medicare plan, you do have the option of an MAPD plan, which is a Medicare Advantage plan that includes Medicare Part D coverage.

A Medicare Advantage plan â also referred to as Medicare Part C â is private insurance, which follows the rules of traditional Medicare for those who are eligible for Medicare.

MAPDs offer the coverage of Medicare Part A, B, and D bundled into one.

A variety of companies offer MAPD plans, including:

How To Enroll In Medicare Part D

First, you need to enroll in Original Medicare . If you arenât automatically signed up â meaning youâre 65 but not yet receiving federal retirement benefits â you can enroll in Medicare by visiting your local Social Security office, calling 1-800-772-1213, or completing an online application at the Social Security Administration website.

Then you can find Medicare Part D plans in your area through the Medicare website. When you choose a plan, the site will direct you to the insurerâs website because you have to purchase plans directly from insurers.

However, you can only get a Medicare Part D plan during certain times of the year. New Medicare beneficiaries have a seven-month period that starts three months before their 65th birthday. This is your initial enrollment period. Outside of that, there are three other times you can enroll:

-

Medicare open enrollment runs from October 15 to December 7 each year. Itâs also called the annual election period .

-

Special enrollment occurs after a major life event, like a move or loss of coverage. Itâs also known as a special election period .

-

If you have Medicare Advantage , the Medicare Advantage disenrollment period allows you to drop Medicare Advantage, and revert to Original Medicare. Then you can enroll in a Medicare Part D plan. The MADP is January 1 to February 14.

You May Like: What Are The Four Different Parts Of Medicare

Recommended Reading: Can You Get Medicare Early

Con: High Cost To Government And Taxpayers

Running the Medicare program costs money and lots of it. According to Kaiser Family Foundation stats , in 2018 Medicare spending totaled close to 15% of the overall federal budget, and thats expected to rise to 18% over the next decade.

Thats a staggering amount that takes money away from other important services such as education, mental health, and social justice. When you consider that 36% of Medicare funds come from payroll taxes, the cost to both you and the government is extensive.

Premiums May Be Different For You Based On Your Income

Some people with very low incomes can qualify for assistance with Parts B and D. If you qualify for Medicaid or the Part D Low Income Subsidy, you may pay less for the drug plan than the premium listed in the plans summary of benefits. Learn more about help with Medicare Part D cost help here.

On the flip side , if you have higher than average income, the plan premium listed by the insurance company may not be ALL that you spend. If you enrolled late in your plan, youll have late penalties to pay. Your agent will only know this if you share that with him or her.

Likewise, people with higher incomes also pay more for Part D. Medicare tracks your income via your tax returns submitted to the IRS, so when your agent quotes you a Part D premium, that is your base premium for the plan. Only you know if your annual income over the last two years has exceeded the threshold. If your income is higher and you enroll in a Part D plan, expect a notice from Social Security informing you of an Income Related Monthly Adjustment Amount that they will add on top of your existing premium.

Tip: Review the Part B and D premium charts on our Medicare Part D Cost page to estimate your IRMAA.

Don’t Miss: Does Social Security Disability Include Medicare

What Are Medicare Supplement Plans

Under Original Medicare, which includes Medicare Part A and Medicare Part B, you get coverage from the federal government for hospital and medical expenses. However, you still have out-of-pocket costs that arent covered by Medicare.

For example, your Medicare Part B deductible is $203 for 2021. After you meet your deductible for the year, you typically pay 20% of the Medicare-approved amount for doctor services, outpatient therapy, and durable medical equipment. Medicare Supplement plans would help cover the 20% youre responsible for paying.

Medicare Supplement plans, or Medigap policies, are insurance plans sold by private insurance companies. You pay the insurance company a monthly premium for your Medigap plan, in addition to the Part B premium you pay to Medicare.

Some Medigap plans cover additional services that Original Medicare doesnt, such as coverage when you are traveling outside of the United States.

Insurance companies can refuse to sell Medigap policies to applicants with preexisting health conditions in specific circumstances. The good news is you may qualify for a guaranteed issue policy if you meet certain criteria. For example, you can qualify for one of the available guaranteed issue Medicare Supplement plans if your employer-sponsored health plan covers your costs after Medicare pays, and if the plan is ending.

What Drugs Are Covered By Medicare Part D

The list of covered drugs is determined by each insurance provider in what’s known as a drug formulary. All companies are required to cover at least two medications in each drug category, but the specific medications vary. The formulary will also determine each drug’s tier and how much you’ll pay. Tier 1 drugs are low-cost generics, and Tier 5 drugs are expensive or specialty medications.

You May Like: Must I Enroll In Medicare At Age 65

Cvs Health Unitedhealth And Humana Have The Most Stand

Figure 4: Distribution of Medicare Part D Stand-alone Drug Plan Enrollment by Firm, 2018-2019

In 2019, 9 out of 10 stand-alone drug plan enrollees are in plans sponsored by five firmsCVS Health, UnitedHealth, Humana, WellCare, and Cigna. Enrollment in PDPs sponsored by CVS Health, which has the most stand-alone drug plan enrollees in 2019, increased over time through acquisition of other plan sponsors, while UnitedHealth and Humana have had large market shares since the Part D program began . However, enrollment in PDPs sponsored by the three largest firms declined between 2018 and 2019, while WellCare and Cigna gained PDP enrollees in part due to merger activity: specifically, Cignas acquisition of Express Scripts and the divestiture of Aetnas PDP enrollment to WellCare pursuant to the acquisition of Aetna by CVS.

The decline in Humanas PDP enrollment between 2018 and 2019 was driven by a large drop in enrollment in the Humana Walmart Rx PDP, which may be attributable to a 37% increase in the average monthly premium for this PDP . This plan was among the lowest-premium PDPs in all regions in 2018, but that is no longer the case in 2019.

Con: It Disadvantages Older Enrollees

Those aged 85 years and over are spending around three times more on healthcare services than those aged 65-74, which means their out-of-pocket expenses are significantly higher. That in itself isnt unexpected, most of us know that the older we get the more health issues were likely to encounter, but enrollees shouldnt be penalized by an exorbitant rise in their medical expenses as they age.

For Medicare to be a truly equitable system, the increased health costs incurred in later life need to be taken into account and incorporated into the monthly premium for all enrollees.

Don’t Miss: Does Medicare Cover 100 Percent Of Hospital Bills

Is Humana A Good Provider Of Medicare Supplement Insurance Plans

Humana is a strong financial company with years of experience inside the Medicare industry. They provide a wide diversity of plans with competitive premiums throughout the United States.

One of the perks of Humanas Supplement plans is you have unlimited doctor choices. You are not locked into a particular network.

You will also receive other benefits of a Medicare supplement plan such as :

- Portable Coverage Medicare Supplements plans from Humana have coverage that will follow you anywhere in the U.S. , and they are accepted anywhere that also accepts Medicare.

- Guaranteed Renewable Once you have qualified for a Humana Medicare Supplement plan, your insurability is guaranteed, even if you become ill or injured in the future. One important tip is to purchase a plan during your original Medicare window when you turn 65. By purchasing a plan during this time, you are guaranteed coverage without special underwriting rules that normally would consider pre-existing conditions and overall medical history.

- 30-Day Free Look Period If, after purchasing a Humana Medicare Supplement, you decide that you do not want the coverage, you will have 30 days to receive a full premium refund.

Humana is a well-known stable company that has deep experience in the Medicare industry. Over the years, customers have given us positive feedback on their own use of Humanas plans.

We are confident providing Humana Supplemental plans to our customers.

Prefer to chat by phone? Give us a call at

Get Someone On Your Side With Part D

Please consider enrolling. Make sure to do so through an agency like ours that wont pass you off to Medicare to enroll. Well help you choose a Part D plan if you have your Medigap plan with us. Well support you on the back end of it too. Thats how much we value our Medigap policyholders.

Every year our agency explains Part D plans to thousands of new Medicare beneficiaries who are setting up their Medigap plans through our agency. Theres no need for you to go it alone. We can help you with the best way to insure yourself at the lowest possible cost. Give us a call today for help with all of your Medicare needs.

You May Like: Is Cobra Creditable Coverage For Medicare

Supplement Plans Also Known As Medigap

Medicare Supplement plans are commonly known as Medigap policies. These plans were created by the federal government to pick up expenses Original Medicare does not cover. These policies are tightly regulated by the government and coverages are identical for every private insurance company that administers and sells the plans.

Here are the basic plans that Humana offers across the country. It is important to remember that each company like Humana does not have the same plans in every state. There are even several outlier states that have their own structure of Medicare Supplement plans .

Humana offers Medicare Supplement policies for 11 of the 12 standardized plans A, B, C, D, F, G, K, L, and N.

Medicare Supplement Plans A & B

All Supplement Plans are built of the base of Plans A & B. These are basic plans that provide some out-of-pocket expenses but will not cover as much as the more comprehensive plans like F, G, & N.

Plan A will cover the Part A coinsurance and Part B copayments and preventative care coinsurance.

Plan B picks up the Medicare Part A hospital deductible.

Humana Medicare Supplement Plan F

Supplement Plan F has been Humanas most popular plan because of the comprehensive coverage it offers. It has gone through many changes due to government regulations. Today, it is only available to seniors who entered Medicare prior to 2020.

Plan F covers:

Humana Medicare Supplement Plan G

Recipients of Supplement Plan G will receive coverage for:

How To Find A Medicare Supplement Policy

Are Medicare Supplement plans worth it in 2021? Depending on your health care needs, a Medigap policy can be a worthwhile investment. If you decide to get a Medigap policy, the best time to enroll is during the six-month Open Enrollment Period.

If youre about to turn 65, your Medigap Open Enrollment period starts the first day of the month that you turn 65. During that time, you can purchase any Medigap policy sold in your state, even if you have health issues .

You can use Medicares Plan Finder tool to view available policies in your state, review your coverage options, and compare costs. Call a licensed Medicare professional at to determine your next steps and find the best plan for your healthcare needs.

Also Check: Is Humana Medicare The Same As Medicare

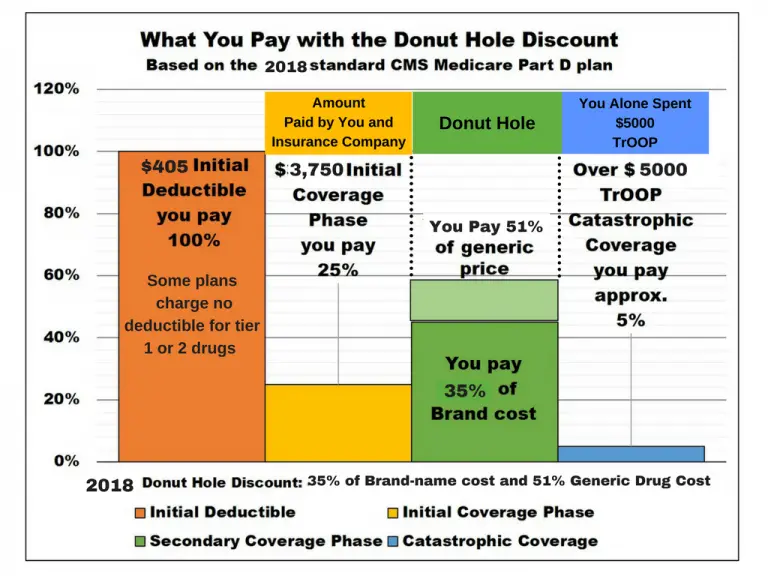

Medicare Tracks Your Part D Spending

Its important to note Medicare itself tracks your True Out of Pocket Costs for each year. This can protect you from paying certain costs twice. For example, say you have already satisfied the deductible on one plan. Then you later switch mid-year to a different Medicare Part D plan because you moved out of state. Your new plan will already see that you have paid the deductible for that year. The costs for the coverage gap and catastrophic coverage work the same way.

Part D drug plans also have changes from year to year. Your plans benefits, formulary, pharmacy network, provider network, premium, and/or co-payments/co-insurance may change on January 1st of each year. Medicare gives you an Annual Election Period during which you can change your plan if you desire to do so.

How To Find Out If A Medicare Supplement Is Worth It For You

It is better to have some protection when it comes to your healthcare than it is to have no protection. Enrolling in a plan will help give you peace of mind and financial security. Medicare Supplement plans are worth it doctor freedom, low out of pocket costs, and when Medicare pays the claim, your supplemental Medicare plan will pay the rest.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Our team of experts is ready to answer your questions are share the best Medicare Supplement plans in your area. Call us today to find out if Medicare Supplements are worth it for you!

You can also fill out a compare rates form to see your rates now.

- Was this article helpful ?

Recommended Reading: Does Medicare Cover The Shingrix Shot

Is Supplemental Medicare Insurance A Waste Of Money

Home / FAQs / Medigap Plans / Is Supplemental Medicare Insurance a Waste of Money?

If youre on Medicare, you might be wondering if Medicare Supplement plans are worth it. Consider that Medicare only covers a portion of your medical costs, leaving you to pay the remaining balance. Add deductibles as well as copays, and suddenly Medigap premiums make sense.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Were here to help answer frequently asked questions about supplemental insurance. Youll walk away knowing whether its worth looking into Medigap, as well as other supplemental insurance.

In 2019 Roughly 3 In 10 Part D Enrollees Receive Low

Figure 9: Medicare Part D Low-Income Subsidy Enrollment, by Plan Type, 2006-2019

In 2019, nearly 13 million Part D enrolleesroughly 3 in 10receive premium and cost-sharing assistance through the Part D Low-Income Subsidy program. These additional financial subsidies, also called Extra Help, pay Part D premiums for eligible beneficiaries, as long as they enroll in stand-alone PDPs designated as premium-free benchmark plans, and reduce cost sharing. Reflecting overall trends in Part D enrollment, the share of LIS enrollees in stand-alone PDPs has declined over time, from 87 percent in 2006 to 57 percent in 2019, while the share in MA-PDs has increased, from 13 percent in 2006 to 39 percent in 2019.

Overall, the share of Part D enrollees receiving low-income subsidies has declined over time, from 42 percent of Part D enrollees in 2006 to 28 percent in 2019. The rate of growth in LIS enrollment has not kept pace with the rate of growth in Part D enrollment overall or in total Medicare enrollment .

Recommended Reading: Will Medicare Cover Lasik Surgery

What Does Part D Cover

When considering Medicare Part D cost its important to first understand what is included with your Part D coverage. All Part D plans cover most generic and brand-name self-administered prescription drugs. Each Medicare Part D plan must cover all or substantially all drugs in the following six categories:

- Antidepressants

- Immunosuppressants

- Anticancer

Each plan can differ on the specific drugs covered in each category and can change their list of drugs or formulary each year. Some plans may cover a wide range of generic drugs while others may carry mostly brand name prescriptions. Part D plans must also cover all vaccines that are not covered by Medicare Part B.