Do You Need Medicare Supplement Insurance

If youre experiencing a gap in coverage from Medicare, then you may need to choose supplemental coverage. Explore your options when it comes to finding out what coverage youre lacking and if things like prescriptions, doctor visits, vision, and dental care are covered or if you need help paying for them. If youre not fully covered, then consider purchasing supplemental insurance.

Best For Under : Cigna

Cigna

-

Not everyone will qualify for subsidized premiums.

-

Does not offer plans in all states

-

International coverage must be purchased separately.

Cigna is one of the largest insurance companies on the Health Insurance Marketplace, with more than $32 billion in premiums written in 2020. When comparing the Health Insurance Marketplace plans, Cigna stands out from its competitors with its extra perks and benefits.

Cigna members get $0 virtual care, where you can connect with a doctor via phone or video chat with no additional out-of-pocket cost. Regardless of what type of provider you choose, you dont need referrals to see a specialist, but your primary care physician can recommend a specialist to you that is within the network to help you save money.

If youre diabetic, youll pay no more than $25 out-of-pocket for a 30-day supply of covered insulin, and Cignas diabetes care plans offer additional benefits with $0 out-of-pocket costs. It also offers separate international coverage. If you frequently travel outside of the country, you can purchase international insurance to make sure youre covered.

Cigna also has a financial assistance program. Information about financial assistance options available to their customers also is available from Cigna. However, not everyone will qualify for subsidized premiums, so you may be responsible for the full cost yourself.

Best For Bonuses: Aarp

AARP Medicare Advantage plans include extra benefits, from dental, vision, and hearing, to over-the-counter benefits and fitness programs. AARP offers lots of additional support to help members stay healthy or manage health conditions.

-

Plenty of added bonuses, like annual ear/eye exams and $0 copay dental work

-

Low copays and prescription drug copays

-

Automatic deduction from Social Security benefits available

-

No mobile app for payments

-

Higher out-of-pocket maximums

Nearly all of the Medicare Advantage plans offered by AARP come with plenty of extras, such as dental exams, vision and eyewear coverage, and foot coverage. There is also Renew Active, a Medicare fitness program with a gym membership, and an online brain health program.

AARP offers low copays for specialist visits, like oncologists or cardiologists, provided theyâre in-network, and a variety of Medicare Advantage plans . It also has an incredible amount of detailed educational information about Medicare and Medicare Advantage plans on its website, including the option to receive a free Medicare guide via email. However, the out-of-pocket maximums can be a bit on the high side, usually several thousand dollars.

Don’t Miss: Does Medicare Cover Outside Usa

Know The Timeline And Important Deadlines

The annual open enrollment period from October 15 to December 7 is the one time that most people can make changes to their Medicare coverage. But you dont need to wait for October to roll around before you start investigating plan options. “Get started early, says Murdoch. It’s always better to have enough time to do the research you need.”

During open enrollment, you can:

-

Join a new Medicare Advantage plan

-

Switch from original Medicare to a Medicare Advantage plan

-

Switch from a Medicare Advantage plan to original Medicare

-

Switch Part D plans

You can make as many changes as you want. The plans you end up with will take effect January 1. If you’re newly eligible for Medicare, keep in mind that your initial enrollment period starts 3 months before the month you turn 65 and lasts 3 months afterward. It’s best to start your health plan search well before your 65th birthday so you can enroll promptly and start the benefits as soon as possible. That will help you avoid a gap in coverage.

Also, if youre buying Medicare supplement insurance for the first time, be sure to do it within your first 6 months of eligibility. During that period, you can buy Medigap without having to go through medical underwriting.

Will I Have A Choice Of Doctors And Hospitals

Many doctors and hospitals do accept Original Medicare. But your choices may be limited. Wouldnt you rather have comprehensive, affordable coverage that offers convenient, quality care from a large, local network?

With Advantage MD, you get access to more than 10,000 trusted Johns Hopkins providers in your community and throughout Maryland. Its the smart, worry-free Medicare plan backed by more than 120 years of experience from the experts in care.

Don’t Miss: Does Aarp Medicare Complete Cover Dental

Medigap Plan K And Plan L Have Annual Out

Plan K and Plan L each have an annual out-of-pocket spending limit.

Once you reach this limit within a calendar year, the plan will pay 100 percent of the costs for your covered Medicare services for the remainder of the year.

The Plan K out-of-pocket maximum is $6,620 in 2022. The 2022 Plan L out-of-pocket spending limit is $3,310.

Types Of Medicare Advantage Plans

There are four common types of Medicare Advantage plans to compare when making your selection.

Health Maintenance Organization

- Must receive your care from providers in your plans network except in the case of emergency care or out-of-area dialysis

- Requires choosing a primary care provider

- Typically covers prescription drugs

- Requires specialty referrals

Preferred Provider Organization

- Allows you to choose your service provider, but will cost more if you choose out of network

- Typically covers prescription drugs

- Doesnt require you to select a primary care provider

- Usually doesnt require a specialty referral

Private Fee-for-Service

- Allows you to choose any provider who agrees to accept PFFS plans

- Typically covers prescription drugs

- Doesnt require you to select a primary care provider

Special Needs Plans

- Benefits, drug coverage and provider choices are tailored to best meet the needs of the groups served by the plan.

- Membership is limited to people with specific chronic diseases or conditions that are disabling, those who require institutional or nursing home care and people who have both Medicare and Medicaid coverage.

You May Like: When Can A Disabled Patient Enroll In Medicare Part D

How We Chose The Best Medigap Providers

Since Medigap policies are federally regulated, the actual coverage you receive will be identical from company to company. For example, a Medigap Plan C from Cigna will offer the same benefits as Aetnas Plan C. The companies listed below, however, provide some additional services that help them rise above hundreds of other Medigap providers.

Heres what we looked for:

- Nationwide availability: Few insurers offer Medigap policies in every state, but we looked for insurers that offered coverage in 40 or more states. Some of these providers even allow you to keep your policy upon relocating to another state.

- Transparent pricing: From free online quotes to guarantees that your premiums wont rise with age, we looked for providers that make it very clear what youre paying for.

- Extra perks: Our favorite Medigap providers offer extra benefits for policyholders, such as household discounts, fitness programs, and savings on healthcare services.

- Financial stability: Using data from AM Best, we made sure each of these providers rated highly in financial health and reliability.

- In-person agents: In an increasingly digital world, we value when a company has in-person agents available to walk you through the details of your insurance policy.

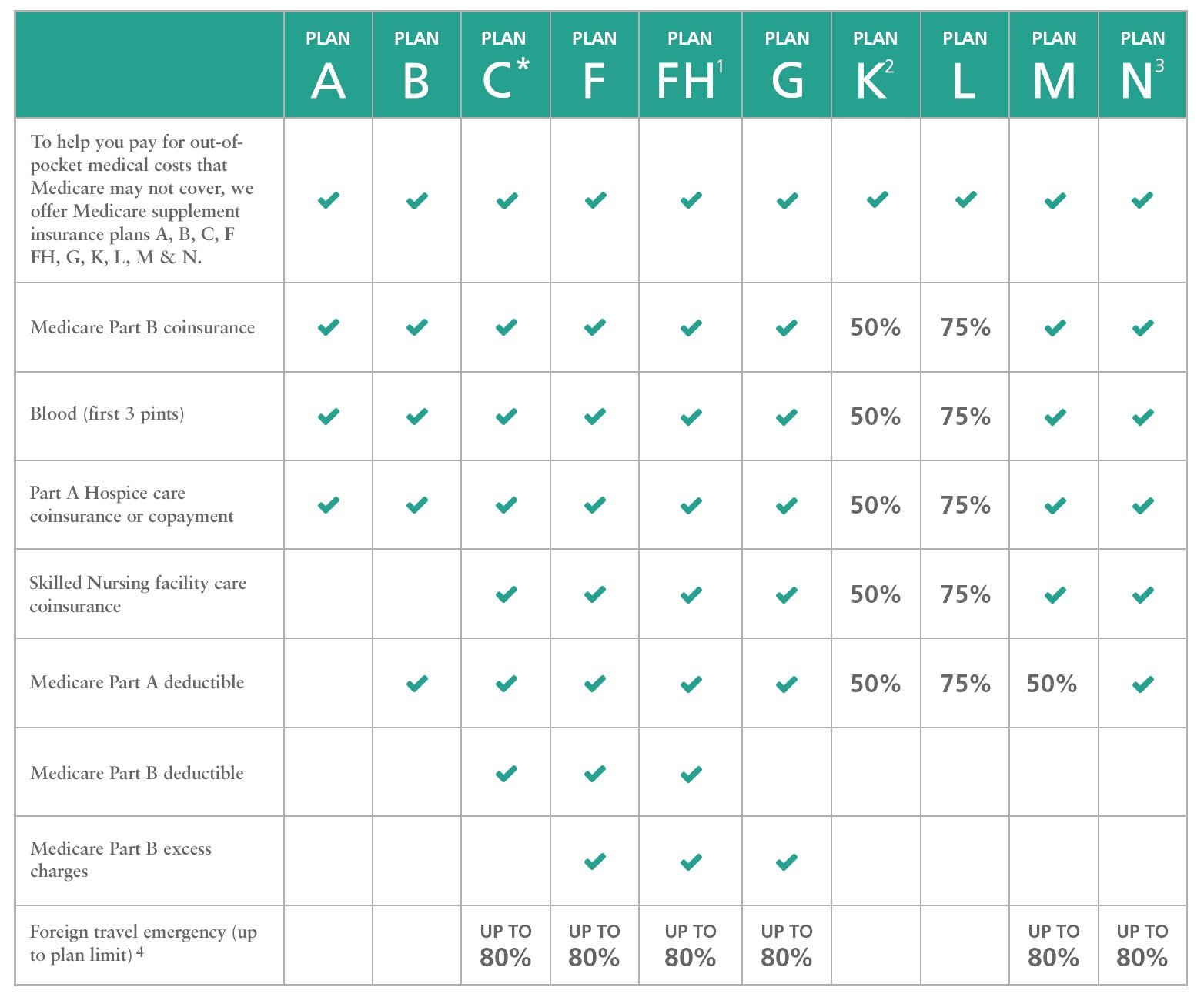

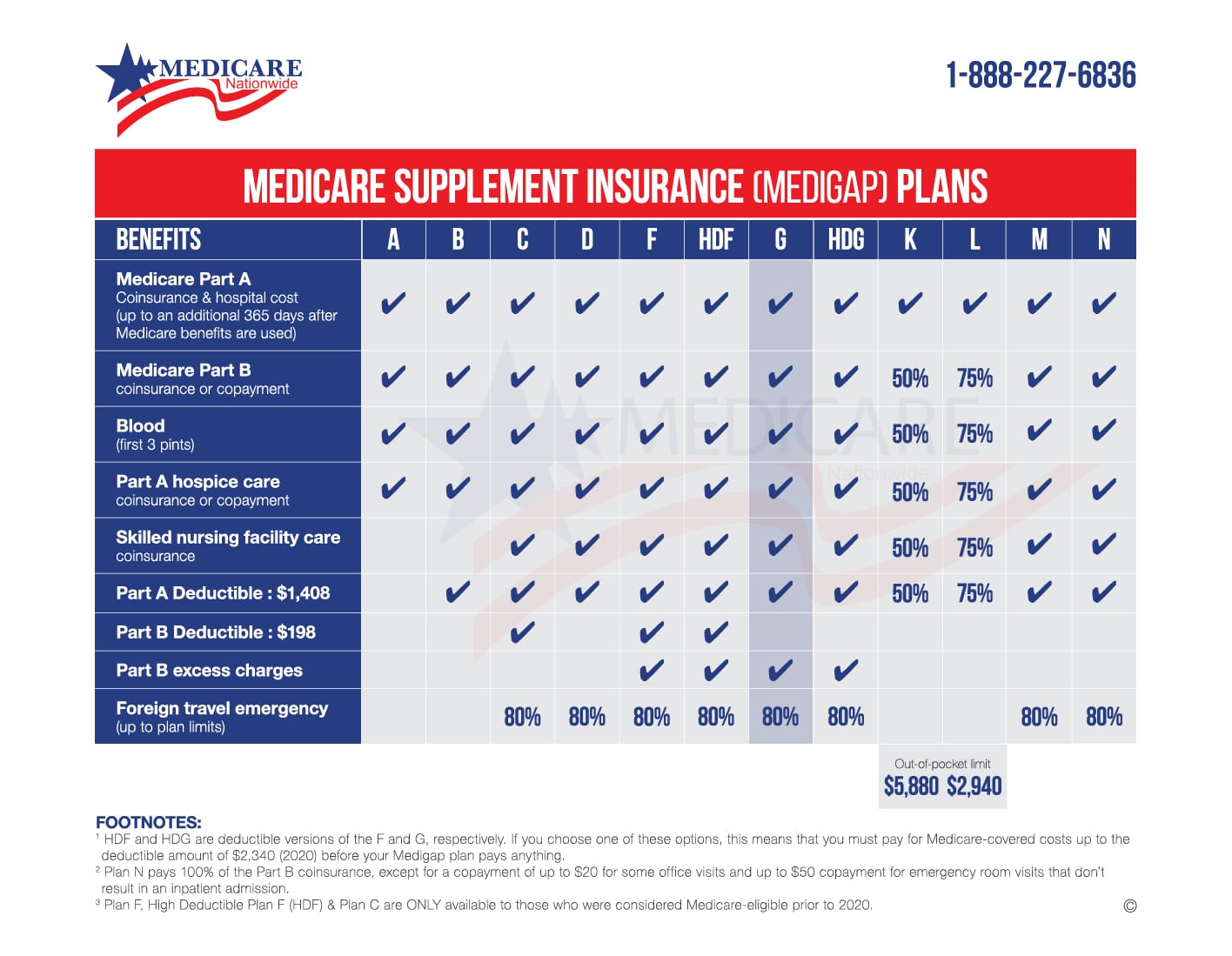

What Do Medicare Supplement Plans Cover

All 10 Medicare Supplement plans offer the following core set of benefits:

- 100 percent of Your Part A Coinsurance There is also an additional 365 days of coverage after your Part A benefits are exhausted.

- Part B Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Your First Three Pints of Blood Each Year Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Part A Hospice Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

Some plans build on these baseline benefits and cover other out-of-pocket costs, such as your Part A and Part B deductibles, Part A skilled nursing facility coinsurance, and Part B excess charges. A few plans even offer a foreign travel emergency benefit that helps cover medical costs if you need care while traveling outside the United States.

Read Also: Who Can Get Medicare Before Age 65

How Do You Decide

âMake sure you have enough coverage to limit your financial liability in case of catastrophic injuries or disease,â Nance says. âWhile the plans that have better benefits often cost more, they will usually save you in the long run in terms of out-of-pocket fees.â Nance further recommends speaking to family and friends to compare experiences.

Compare The Difference In Cost Among Medicare Advantage Plans

If you donât want to make an account or are just looking for estimates, you can select âContinue without logging in.â Keep in mind that some companies require more personal information than others before theyâll give you an estimate.

Different companies can offer different prices for two people on the same plan, depending on age and gender, so itâs worth doing some research about what your specific costs may be.

You May Like: Can A Doctor Refuse A Medicare Supplement

When And How To Enroll In Medicare

As we mentioned above, people who want to enroll in Medicare must be at least 65 years old if they are under 65, they must either have a covered disability or suffer from end-stage renal disease. Here well discuss these requirements in full.

If Youre Age 65 or Older

As you near your 65th birthday, you must start thinking about Medicare.

If you receive benefits from the Social Security Administration or the Railroad Retirement Board , you will be automatically enrolled in Parts A and B.

If you dont receive these benefits yet, youll have to enroll yourself. Youll have three months before your birthday month, the month of your birthday, and three months after your birthday month to submit the paperwork. This total of seven months is called the Initial Enrollment Period.

If youre 65 but youre covered by your or your spouses employers group health plan, you dont have to enroll in Medicare immediately. You can choose to enroll at any point during your coverage or you can enroll within eight months of the employment termination date.

For example, if youre still working, youre enrolled in your workplace group plan, and you turn 65, you can choose to enroll while you still have coverage but youre not obligated to. Once your job ends, because you retire or youre terminated, you have eight months to enroll in Part A and Part B from the date the employment or the coverage ends. This is called a Special Enrollment Period or SEP.

If Youre Under 65 With a Disability

The Best Medicare Advantage Provider For Plans Without Drug Coverage

Prescription drug coverage is optional for Medicare members and is not included in Original Medicare. Though many Medicare Advantage plans include prescription drug coverage, you can choose a Medicare Advantage plan without drug benefits.

The upside of a Medicare Advantage plan without drug coverage is that you can save money if you dont need any prescription medications. But if you develop a need for a prescription down the road, you could wind up paying a lot more for that medicine because youll have to pay out-of-pocket.

If you dont sign up for drug coverage in your initial enrollment period with Medicare, youll pay a penalty if you eventually sign up for it later. The size of the penalty depends on how long you went without drug coverage.

If you decide to sign up for a separate prescription drug plan, keep in mind that you cannot get stand-alone drug coverage and stay on Medicare Advantage.

MoneyGeek analyzed Medicare Advantage plans without prescription drug coverage and ranked UnitedHealthcare as number one in this category.

United Healthcare

UnitedHealthcare averages 4.3 stars out of 5.0 in Medicare Star Ratings for its plans without drug coverage. Most of UHC plans without prescriptions have $0 premiums, and all or virtually all offer vision, hearing and dental benefits.

Don’t Miss: Does Aarp Medicare Advantage Cover Eyeglasses

Medicare Advantage Vs Medicare Supplement Insurance Plans

Are you trying to decide between Medicare Advantage vs. Medicare Supplement insurance? Heres a rundown of the two types of coverage.

While Original Medicare covers many health-care expenses, it doesnt cover everything. Even with covered health-cares services, beneficiaries are still responsible for a number of copayments and deductibles, which can easily add up. In addition, Medicare Part A and Part B also dont cover certain benefits, such as routine vision and dental, prescription drugs, or overseas emergency health coverage. If all you have is Original Medicare, youll need to pay for these costs out-of-pocket.

As a result, many people with Medicare enroll in two types of plans to cover these gaps in coverage. There are two options commonly used to replace or supplement Original Medicare. One option, called Medicare Advantage plans, are an alternative way to get Original Medicare. The other option, Medicare Supplement insurance plans work alongside your Original Medicare coverage. These plans have significant differences when it comes to costs, benefits, and how they work. Its important to understand these differences as you review your Medicare coverage options.

Key Points In Making Your Decision

There are many choices for health coverage in the Medicare system. You are eligible for Medicare Part A and Part B when you turn 65. If you are already receiving Social Security benefits, you will automatically be enrolled in Medicare. Otherwise, you can sign up during the 3 months before your 65th birthday, your birthday month, and the following 3 months. If you were automatically enrolled, you can opt out of Part B if you don’t want to keep it, but there are financial consequences for doing so. Consider the following when making your decision:

- If you are covered by other health insurance now, such as health benefits offered through your job, there is no penalty if you defer Part B until you or your spouse retires and loses work-based coverage.

- If you are not covered by other insurance, and you do not sign up for Part B , you will pay a penalty for signing up late, which will increase your costs for life.

- If you have Part B, you can buy extra insurance to cover health care costs that the traditional Medicare plan does not cover. Either a Medigap plan or a Medicare Advantage plan can help fill in the gaps in coverage.

Also Check: How To Apply For Medicare In Illinois

The Cost Of Medicare Supplement Plans In Mississippi

The cost of Medicare Supplemental Insurance varies by the plan and the insurance company you choose. Aetna is the cheapest Medigap insurance company in Mississippi for Plans A, B, G and N. However, Blue Cross Blue Shield of Mississippi is the cheapest for Plans C and D, Cigna for Plan F and UnitedHealthcare for Plans K and L.

When it comes to insurance quotes, insurance companies typically assess them in one of three ways:

- Attained-Age: This is the most often used pricing method in the state. Your current age will decide your premium, and it will rise as you become older using this process.

- Issue-Age: The cost of your insurance is determined by your age when you first became eligible for Medicare. Using this method, your premiums will not increase as you age.

- Community-Rated: As per this method, except for Plan D and Plan M, all policyholders in a specific plan type pay the same monthly price.

Average Cost of Medicare Supplement in Mississippi

Sort by Plan Letter:

- $147

Do Plans Offer Benefits Beyond Original Medicare Like Prescription Drug Coverage

Unlike Original Medicare, which only covers part of the costs of hospitalization and medical services, affordable options like a Medicare Advantage plan do a much better job of protecting your health and savings.

With Advantage MD, youll get all the benefits youre entitled to from Original Medicare and coverage for just about anything else you need prescription drugs , preventive dental and vision care, a hearing aid, urgent and emergency services, even foot care.

Recommended Reading: Who Does Not Have To Pay For Medicare Part B

Tip : Drug Formularies Are Your Friends

Medicare plans have a list of covered drugs called a formulary. Each plan creates its own formulary and can change it from year to year. Check each formulary when shopping and reject any plan that doesnt list the prescription drugs you take.

Once you find a few plans that offer the medications you need, then compare costs and other factors for the remaining plans youre interested in. Most plans have pharmacy networks that offer plan pricing to members, so youll want to find one that includes the pharmacy you like to use as well.

You can get prescription drug coverage through a standalone Medicare Part D plan or as part of a Medicare Advantage plan.

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

For instance, Plan G is good for people who want very few medical bills and are willing to pay about $190 each month. This can give you peace of mind so that you won’t be surprised by unexpected medical costs. However, if you expect your out-of-pocket medical costs to be less than the plan’s annual cost of about $2,280, then a cheaper Supplement plan may be more cost-effective.

Note that because of a recent legislation change, Plans C and F are not available for new enrollees. Below you can find a chart of the level of coverage and 2022 monthly premium ranges for all of the Medicare Supplement plans. The Medigap plan names are along the top, and on the left are the coverage categories.

| Plan A |

|---|

Don’t Miss: Is A Psa Test Covered By Medicare