Get Help From A Medicare Specialist

Medigap plans are nuanced when it comes to pricing. For example, not everyone understands that there is only one Medigap Enrollment Period in your lifetime, not an annual one like other Medicare plans. Signing up late can cause your rates to go up based on preexisting conditions. Your local State Health Insurance Assistance Program or State Insurance Department can help you with issues like this. You can also ask your broker for details.

Quick Answer: Does Aarp Have Dental And Vision Insurance

Posted: Does AARP pay for gym membership? AARP Member Discounts are available to seniors on restaurants, travel deals, health care, prescription drugs, dental, vision, hearing aids, rental, cruise, hotel, tours, fitness equipment & gym memberships, cell phones, home security service, roadside assistance, insurance, legal aid and much more.

MembershipEquipmentInsurance View More

Best Discounts For People New To Medicare: Aarp By Unitedhealthcare

AARP by UnitedHealthcare

-

Rates do not increase based on age

-

Also offers Part D drug plans

-

No High-Deductible Plan F

-

Requires dues for AARP membership

UnitedHealth Group was founded in 1977, and its insurance arm, UnitedHealthcare, has been in partnership with AARP since 1997. Combining quality healthcare offerings with one of America’s largest advocacy groups for people over 50, AARP by UnitedHealthcare Medicare Supplement Plans are highly ranked. It offers Plan F, but not High-Deductible Plan F, in all states except for Massachusetts, Minnesota, and Wisconsin.

Enrollment in Medicare Supplement Plan F requires AARP membership, which is $16 unless signing up for automatic renewal, making it $12. Membership comes with added perks, including financial planning services, shopping discounts, and more. Once you are a member, you can reach out to UnitedHealthcare to sign up for Plan F and, if you’re interested, one of the company’s highly-rated Medicare Part D plans for prescription drug coverage.

Reach out to a representative seven days a week, or chat with an agent online at its website. The site is easy to use and provides a wealth of information about Medicare and Medicare Supplement Plans. The company did not provide a quote to us over the phone because we were not applying for a plan.

UnitedHealthcare offers several discounts, so be sure to ask for available discounts when you sign up to save even more on Plan F.

Don’t Miss: Does Medicare Cover Home Sleep Apnea Test

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

What Does Aarp Medicare Supplement Plan I Cover

AARPMedicare SupplementMedicare SupplementcoverMedicareMedicarecoverpay for

. Also know, what does AARP Medicare Supplement cover?

It pays 50 percent of mental health services and 100% of some preventive services. Medigap plans cover all or part of your share of these services 20 percent of the Medicare-approved amount for doctor services and 50 percent for mental health services.

Beside above, does AARP offer Medicare supplement insurance? AARP®Medicare Supplement Insurance Plans insured by UnitedHealthcare. Medicare Supplement Insurance Plans help cover some of your out-of-pocket expenses that Medicare doesn’t pay. That’s where an AARP®Medicare Supplement Insurance Plan, insured by UnitedHealthcare Insurance Company®, may help.

Similarly one may ask, is AARP supplemental insurance any good?

The bottom line, says Burns, is that the AARP/UnitedHealthcare Medigap planscan be a good deal, and they’re more likely to be a good deal for older people who have health conditions. In states where most insurers use attained-age rating, AARP becomes price competitive by offering a loyalty discount: Members who

What is the monthly premium for AARP Medicare Supplement?

a $458

Read Also: What Insurance Companies Offer Medicare Supplement Plans

Medicare Select Policies Add Network Requirements

AARP and UnitedHealthcare offer Medicare Select policies in some locations. These plans cover the same Medicare services as any Medigap plan of the same type, but it requires beneficiaries to get inpatient services from in-network hospitals and health care providers.

In exchange for the network restrictions, Select plans offer lower premiums than their non-Select counterparts.

If you have a Medicare Select plan and get services from an out-of-network hospital, you become responsible for the Medicare Part A deductible, which is $1,556 in 2022. Exceptions are available for emergency services, services not available from an in-network hospital and when youre more than 100 miles from home.

Select plans arent available in all areas or for all Medigap plan types. Enter your ZIP code on UnitedHealthcares website to check whats available to you and to compare prices for Select and non-Select plans.

How Insurance Companies Set Medicare Supplement Insurance Plan Costs & Premiums

Insurance companies can decide the premium costs for the Medicare Supplement insurance plans they offer. They can use any of three ways to set premium costs. Which method insurance companies use to arrive at their premiums can affect your costs in the short term or the long term.

Here is how the rating systems work.

eHealths research team looked at average Medicare Supplement insurance premiums across different age groups . Older beneficiaries had higher average premiums.

Read Also: Does Medicare Pay For A Caregiver In The Home

What Are My Costs For Original Medicare

With Medicare Part A, most people don’t pay a premium, though you may if you or your spouse worked and paid Medicare taxes for less than 10 years. Medicare Part B has a monthly premium you pay directly to Medicare, and the amount you pay can vary based on your income level. Other costs you may pay with Medicare Part A and Part B include deductibles, coinsurance and copays.

What Are The Most Popular Medicare Supplement Plans

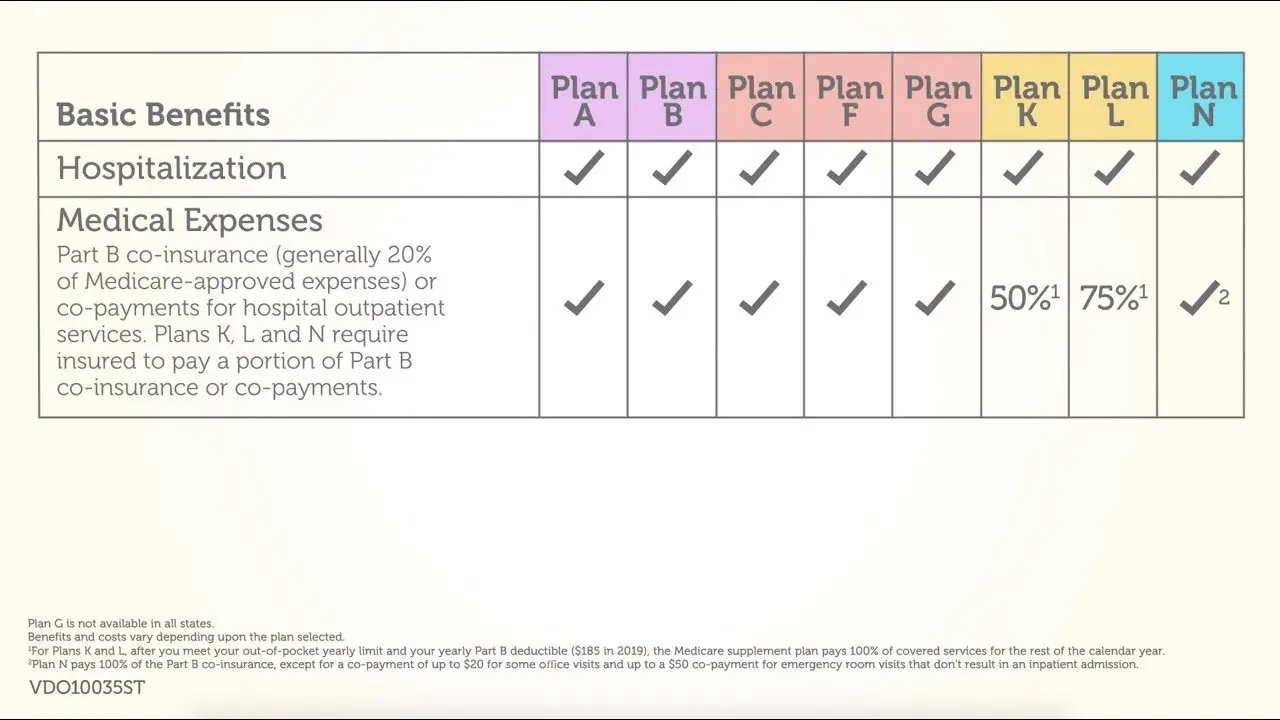

The most popular supplement plans are F, G and N. As you can see in the accompanying chart, these are the plans that appear to provide the richest benefits. Here are some things to consider when evaluating them.

What Should You Know About Popular Plan F?

Plan F is no longer available to anyone who wasnt previously enrolled in Part B prior to January 1, 2020. But if you already have it, you can keep it.

Plan F has long been the most popular plan. While it is more expensive than the others, it also covers the most if you get sick. It can be very convenient because you can go to the doctor without worrying that youll have to pay copayments or other bills.

The price of Plan F varies. For a 65-year-old woman who doesnt smoke, the price ranges from $305 to $514 in New York City and $117 to $461 in Dallas.5

More than Price

While price is always a big consideration when purchasing insurance, being a customer of companies that are reliable is worth a lot.

What Should You Know About Practical Plan G?

Plan G offers everything that Plan F offers, except the Part B deductible, which in 2022 is $233.6 That is about $17 a month, a useful figure to know when you calculate which plan will give you the most value for your money.

The Plan G monthly premiums range from $476 in New York City to $99 in Dallas for a 65-year-old woman who doesnt smoke.7

What Should You Know About Economical Plan N?

- Part B deductible.

- Part B excess charges.

Don’t Miss: Is Eye Care Covered Under Medicare

How Much Should I Expect To Pay For Medicare Plan F

The following summary reviews Plan F costs across four regions of the United States. Based on cost summaries from Medicares Medigap Find a Plan database, Part F ranges from $97 to $990 per month.

- East Coast : $242$414

- Midwest : $115$946

- South : $97$903

- West Coast : $144$990

Keep in mind this is only a sampling of data. Costs could be higher or lower where you live, depending on your age, gender, and when you first sign up for Medigap.

What Is Plan F 2020 High Deductible

High Deductible Plan F overview High Deductible Plan F includes the comprehensive benefits of regular Plan F, but you manage your health care costs until youve reached the calendar year deductible amount. After that, the plan functions like regular Plan F. Having a high deductible can reduce your monthly premiums.

Recommended Reading: Does Medicare Cover Depends For Incontinence

Aarp Medicare Supplement Plans Reviews And Ratings

AARP Medicare Supplement plans offer a good value according to customers. Plans typically offer affordable coverage with broad limits. Members appreciate the organizations responsive customer service team, which received excellent ratings in the Gongos 2019 Medicare Supplement Insurance Plan Satisfaction Posted Questionnaire.

Trusted ratings and reviews can help you understand how an insurers plans stack up against the competition. See how A.M. Best, the Better Business Bureau , and more rate AARP Medicare Supplement plans.

| A.M. Best financial strength rating: A | A.M. Best is a credit rating agency that specializes in the insurance industry. An A rating in this category indicates that A.M. Best believes AARP Medicare Supplement Insurance company has an excellent ability to meet its ongoing insurance obligations. |

| BBB rating: A+ | AARP has an A+ rating from the BBB with 51 complaints handled in the last 12 months and 215 complaints closed over the past three years. |

| Consumer Affairs rating: 3.9 | According to Consumer Affairs, AARP Health Insurance has a rating of 3.9 out of 5 stars based on 101 customer reviews. Customers appreciate the easy enrollment process despite occasional billing issues and say the plans are a good value. |

Whats In A Medicare Supplement Plan

To ensure that members are fully covered such that there are no exclusions, Medicare has designed Supplement plans. Under the Original Medicare plan, so many omissions are made. This means that you still dig deeper into your pocket to cater to those other extra expenses. Among the additional costs not covered may include coinsurance, copayments, deductibles, among others. By signing for a Supplement plan of your choice, you cover yourself from these costs. Indeed Supplement plans are essential in filling the gaps left by basic Medicare plan and hence time, and again you will hear people refer to Supplement as Medigap plans.

Supplement plans essentially take care of all the remaining Medicare cost subject to your choice of plan. Some costs in Medicare Part A copayment, Medicare Part B copayment, Medicare Part B coinsurance for hospice care are usually exempted from the basic Medicare cover. To add to this list of exemptions, also Medicare Part A deductible, Medicare Part B deductible and excess charges, coinsurance for nursing care are not fully covered. Other very important benefits which you enjoy with Supplement plan and not covered by basic Medicare are three pints of blood and foreign travel exchange. It is important to note that we are all subject to medical emergencies. Supplement plan takes up to 80% of these emergency cost any time you fall ill outside the United States and call for an emergency. The cover offers a lifetime coverage of $50,000 for this purpose.

You May Like: Will Medicare Cover Life Alert

Costs You May Pay With Medicare

Medicare Part B and most Medicare Part C, Part D and Medigap plans charge monthly premiums. In some cases, you may also have to pay a premium for Part A. A premium is a fixed amount you pay for coverage to either Medicare or a private insurance company, or both.

Youll also pay a share of the cost for your care, while your Medicare or Medigap coverage will pay the rest. There are three methods of cost sharing:

- DeductibleA set amount you pay out of pocket for covered services before Medicare or your plan begins to pay.

- CopayA fixed amount you pay at the time you receive a covered service or benefit. For example, you might pay $20 when you visit the doctor or $12 when you fill a prescription.

- CoinsuranceThe amount you may be required to pay as your share for the cost of a covered service. For example, Medicare Part B pays about 80% of the cost of a covered medical service and you would pay the rest.

Aarp Medicare Supplement Plan Options

There are 10 universal Medigap policies known as plans A, B, C, D, F, G, K, L, M, and N, including standardized benefits and copay reductions. Plans C and F are only available to existing Medicare enrollees who became eligible for Medicare before 2020. New beneficiaries can sign up for a Medigap plan without restrictions during their seven-month Initial Enrollment Period. Otherwise, insurers can base eligibility on your medical history. AARP Health Insurance offers six to eight Medicare Supplement plans in most geographic areas.

Regardless of which plan you choose, youre responsible for paying your $203 Part B deductible in 2021 for medical services and diagnostics. Medigap policies can reduce or eliminate your Part A hospital deductible, which can save you up to $1,484 per benefit period. Some plans may pick up excess charges beyond Medicare-approved amounts, and they can limit your out-of-pocket expenses.

Learn more about some of the AARP Medicare Supplement plans that may be available in your area:

| Plan name |

*Based on pricing in Denver

Rates are based on medical eligibility

Excess charges dont count toward your out-of-pocket maximum

You May Like: When Does Your Medicare Start

How Do I Apply For Medicare Supplement Plan G

You may enroll in a Medicare Supplement Insurance plan at any time by contacting a licensed insurance agent. However, the best time to do so is during your Medigap Open Enrollment Period. This period begins the month you are 65 years old and enrolled in both Medicare Part A and Part B. Your Medigap Open Enrollment Period lasts for six months.

During this enrollment period, you have what are called guaranteed issue rights. When you have guaranteed issue rights, insurance companies are not allowed to use medical underwriting to determine your plan rates or to deny you coverage. But if you apply for a plan during a time when you dont have guaranteed issue rights, a carrier may use medical underwriting to charge you a higher rate or deny you coverage based on your health.

Medigap prices may vary among insurance carriers in the same area, so contact a licensed insurance agent for help comparing all of your plan options.

Does Medicare Pay For Gym Membership

Posted: You pay 100% for non-covered services, including gym memberships and fitness programs. Gym memberships or fitness programs may be part of the extra coverage offered by Medicare Advantage Plans, other Medicare health plans, or Medicare Supplement Insurance plans. Does AARP pay for gym membership?

MembershipInsuranceSupplement View More

Recommended Reading: How Much Does Medicare Part B Cost For A Couple

Medicare Supplement Plan N Rate Increase History

Among the factors that affect your monthly premium rates is the pricing method that your carrier uses. In the last five years, premium rates for Plan N have increased between 2% and 4%. These increases are lower when compared to Plan F and comparable when compared to Plan G.

As Plan N benefits are the same from carrier to carrier, its important to discuss with your agent rate history increase for the company you are considering enrolling with. Additionally, research carrier reviews for Plan N.

Explore Your Medicare Supplement Options With Healthmarkets

The Medicare Plan F vs. Plan G decision doesnt have to be complicated. HealthMarkets can help you get the right Medicare Supplement plan for your needs. Best of all, this service comes at no cost to you. Compare plans online today or call to speak with a licensed insurance agent.

48182-HM-1121

* The cost of Plan G premiums will vary by state, age, sex, and tobacco use.

1.How to compare Medigap policies. Medicare.gov. Retrieved from https://www.medicare.gov/supplements-other-insurance/how-to-compare-medigap-policies. Accessed on November 10, 2021. | 2.Medicare costs at a glance. Medicare.gov. Retrieved from https://www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance. Accessed on November 10, 2021. | 3.Supplement Insurance plans in Florida. Medicare.gov. Retrieved from https://www.medicare.gov/medigap-supplemental-insurance-plans/#/m/plans?fips=12083& zip=32162& year=2022& lang=en. Accessed on November 10, 2021.

Also Check: What Is A Medicare Health Plan

Top Rated Assisted Living Communities By City

AARP by UnitedHealthcare insurance policies are a collaboration between a senior advocacy group and an insurance company. Those interested in these policies may like to know a little about both of the organizations behind the policies. AARP, the advocacy group, was founded by Ethel Percy Andrus in 1958 and is now led by CEO Jo Ann Jenkins. Over 38 million seniors are members of AARP, enjoying the educational materials, discounts, and other benefits that the group provides. UnitedHealthcare , the insurance company, began in 1977 in Minnetonka, Minnesota. It has since become the largest health insurance company in America. Ranking 7th on the Fortune 500 list, this company is well known for the health coverage that it offers in all 50 states as well as around the world.

The partnership of AARP and UnitedHealthcare can be difficult to understand, but it has existed since 1997- over 20 years. Essentially, AARP recognizes that different seniors have different insurance needs, so it does not necessarily endorse the use of UnitedHealthcare products for all of its members. However, AARP acknowledges UnitedHealthcare as a trusted healthcare partner and resource. The AARP name is attached to numerous Medicare-related forms of UnitedHealthcare insurance, including Medicare Supplement insurance. UnitedHealthcare pays AARP for the use of the AARP name, and seniors must be members of AARP if they want to purchase these insurance policies.