Does Medicare Ever Make Exceptions On What It Covers

If you need a service or item that Medicare does not cover or if Medicare denies a claim you think it should not have you may have options. Discuss with your doctor whether Medicare covers the specific services you receive. When you receive your Medicare Summary Notice , review any charges and how much Medicare covers them. If Medicare denies a claim, your MSN will provide instructions on how to file an appeal, and the appeals due date.

What Does Part A Cost

With Medicare Part A, you may have to pay copays and deductibles for hospital stays, but may not have to pay a monthly premium. Copays and deductibles apply to hospital benefit periods, which start when you enter a hospital or skilled nursing facility, and end 60 days after youve left the facility . Its important to note that:

- For each hospital benefit period, you pay a deductible.

- You pay a copay if youve stayed in a hospital for more than 60 days.

- Theres no deductible or copayment for home health care or hospice care.

For many people, Part A comes without a monthly premium. You may have no monthly premium if you paid a certain amount toward Medicare taxes while working. In this case, you are often automatically enrolled in premium-free Part A.

If you dont automatically get premium-free Part A, you may be able to buy it if you :

- Are age 65 or older and allowed to Part B to meet the citizenship and residency requirements.

- Are under age 65 and are disabled but no longer get premium-free Part A because you returned to work.

Please Answer A Few Questions To Help Us Determine Your Eligibility

Thecategories of medical treatment and services listed below are not covered byMedicare. However, the non-covered services listed below do not necessarilyapply to HMO or other Medicare Advantage plan coverage. Many Medicare Advantageplans include some coverage for these medical services even though Medicareitself does not cover them.

You May Like: Does Medicare Cover 24 Hour Care

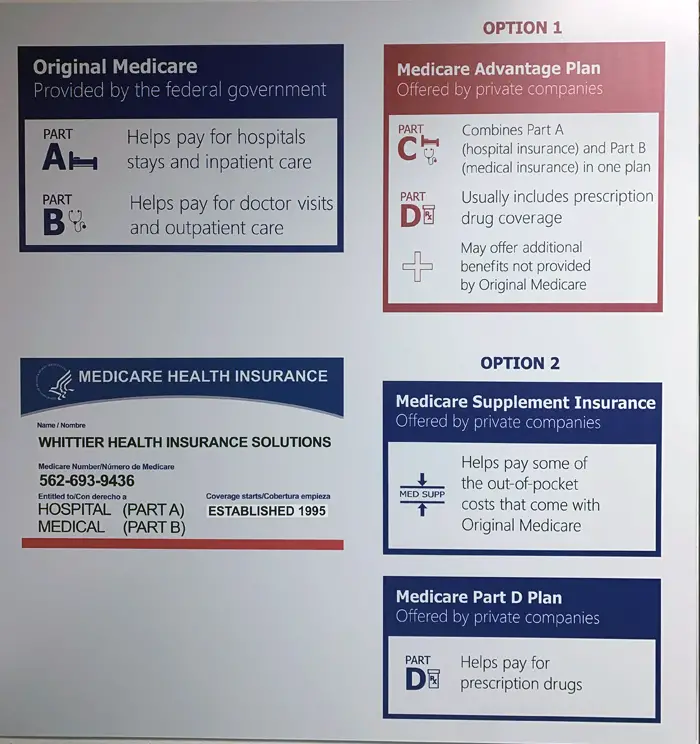

Whats The Difference Between Medicare Part A And Medicare Part B

Part A is the hospital services part of Medicare. This benefit covers inpatient care, hospital stays, skilled nursing facility care, hospice care, and medically needed home health care services.

Part B is the medical services part of Medicare. It covers many of the medically necessary services not covered in Part A, such as outpatient and preventive services. This involves things like x-rays, bloodwork, doctors visits, and outpatient care. It will also cover other medical items such as diabetic test strips, nebulizers, and wheelchairs.

Does Medicare Cover Cataracts

Cataracts cloud the lens of the eye, making it difficult to see. Surgery is generally needed to correct the condition, and under original Medicare, you have two choices in this regard.

First, you can receive a basic lens replacement, paid in full by Medicare up to $2,000. Or, you can apply that amount to a replacement lens that not only addresses the cataract, but also corrects for near or farsightedness, and then pay the difference. Additionally, Medicare will pay for a pair of corrective eyeglasses or contacts that are necessary following cataract surgery.

As is the case with other medical procedures, with cataract treatment, youll still be responsible for your Part B deductible and 20 percent coinsurance. If you have a Medigap plan, it can pick up some or all of these out-of-pocket costs. And if youre on Medicare Advantage, your out-of-pocket costs may be lower, depending on what plan you have.

Read Also: Which Medicare Plan Covers Hearing Aids

Medicare Part B Coverage

Medicare Part B covers two kinds of services: medically necessary outpatient care and preventive services

Medically necessary outpatient care

Medicare Part B covers a variety of outpatient care and services when theyre medically necessary. According to the Centers for Medicare & Medicaid Services, medically necessary services are services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

After youve paid your Medicare Part B deductible for the year, Part B generally pays for 80% of covered medically necessary services. Youre responsible for a 20% Part B coinsurance for most covered services.

Here are some examples of medically necessary services covered by Medicare Part B:

Medicare preventive services

Medicare Part B also covers preventive care and services including certain disease and cancer screenings, tests, shots and counseling.

While most medically necessary services require a 20% Part B coinsurance, you dont pay anything for most preventive services.

Here are a few examples of preventive services for which youll pay nothing under Medicare Part B

Certain preventive services are limited to certain sexes and/or have conditions on how often Medicare covers them. To pay nothing for some services, you need to get them from a health care provider who accepts Medicare assignment. You can find specific details for how individual services are covered at medicare.gov/coverage.

Does Medicare Part B Cover Chemotherapy Drugs

Medicare Part B covers several chemotherapy drugs that are administered through the vein in an outpatient setting.

Part B coverage includes certain oral and intravenous drugs along with anti-nausea drugs to offset the symptoms of chemotherapy. In fact, chemotherapy and other cancer-treating drugs account for the majority of units of Medicare-covered drugs that are thrown away or otherwise discarded by health care providers.

Chemotherapy drugs can be expensive, which is why Part B may not cover all of them. Further coverage for chemotherapy drugs can be found in Medicare Part D or Medicare Advantage plans that include prescription drug coverage.

Recommended Reading: Are Synvisc Injections Covered By Medicare

Is Medicare Part A Free

Typically, most people dont pay for Part A if they have paid Medicare taxes for a certain amount of time while working. However, if you dont qualify for premium-free Part A, it can be purchased for a monthly premium. This amount may vary each year and is based on how long you or your spouse worked and paid Medicare taxes.

What Is Not Covered Under Medicare Preventive Care Benefits

Aside from simply treating illnesses and injuries you already have, Medicare offers a robust system of preventive services aimed at improving your health outcomes over time. With screenings and other proactive services, Medicare beneficiaries can find health issues early before becoming more serious and costly.

One service many Medicare beneficiaries expect to find, but dont, is their annual physical. Under current Medicare guidelines, the traditional annual check-up is not covered. But that doesnt mean your health isnt monitored every year.

Within 12 months of enrolling in Medicare Part B, youll have a Welcome to Medicare preventive visit with a doctor. Your doctor will check your height, weight, blood pressure and other measurements during this appointment. Youll also receive a vision test and discuss your medical history. All Medicare beneficiaries are allowed one Welcome to Medicare preventive visit.

Then one time per year, youll have an Annual Wellness Visit. Like with an annual physical, your doctor will check for issues and determine if any further preventive services are needed to keep you as healthy as possible. While not technically a physical, youll receive a similar level of managed care.

What extra benefits and savings do you qualify for?

You May Like: How To Qualify For Medicare In Florida

Original Medicare And Non

Medicare Part B only covers non-emergency ambulance services to the nearest medical facility that is able to provide you with appropriate care if you have a written order from your doctor saying that it is medically necessary.

If you go to a facility that is farther away, Medicares coverage will be based on the charge to the closest facility, and you must pay the difference.

If the ambulance company thinks that Medicare might not cover your non-emergency ambulance service, they should provide you with an Advance Beneficiary Notice of Noncoverage.

Recommended Reading: How To Change Primary Doctor On Medicare

Medical Coverage Outside The United States

Original Medicare generally does not cover treatment outside the United States, except under very limited circumstances, such as on a cruise ship within six hours of a U.S. port.

However, some Medicare supplement insurance policies also known as Medigap cover overseas health care costs.

Medigap plans C, D, F, G, M, and N provide foreign travel emergency health care coverage outside the United States.

These Medigap Plans Will Cover

- Foreign travel emergency care if it begins during the first 60 days of your trip

- Eighty percent of billed charges for certain medically necessary emergency care after a $250 yearly deductible is met

A lifetime coverage limit of $50,000 applies.

In 2020, the average premium for a Medigap policy was roughly $150 per month, or $1,800 per year, according to full-service insurance organization Senior Market Sales.

You May Like: Does Medicare Cover Cell Phones

Does Medicare Cover Nursing Homes And Long

Original Medicare generally doesnt cover the cost of a nursing home, assisted living or long-term care facility. Medicare Part A does cover care provided in a skilled nursing facility .

If you qualify for it, Medicaid, which is administered by states under federal guidelines, may cover nursing home care. You may need to exhaust your personal resources on medical care before you are eligible.

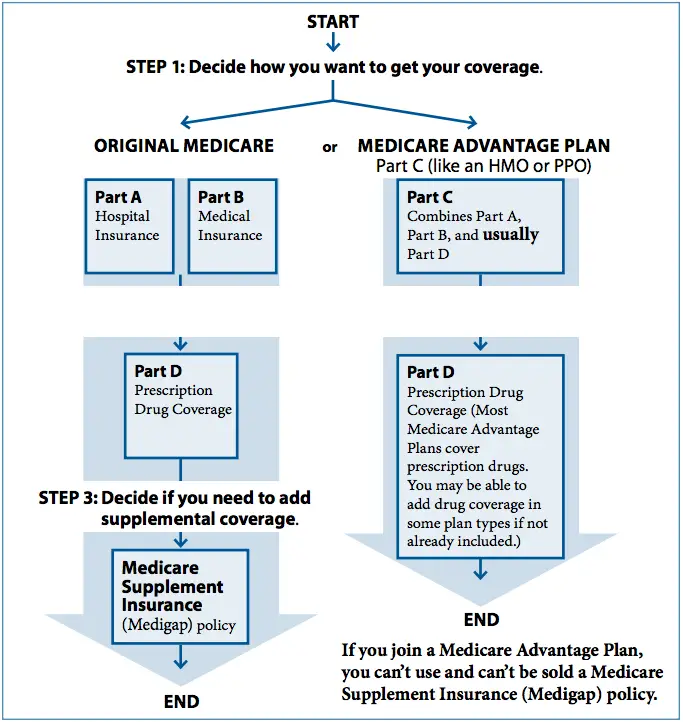

Benefit Gaps And Supplemental Coverage

Medicare provides protection against the costs of many health care services, but traditional Medicare has relatively high deductibles and cost-sharing requirements and places no limit on beneficiariesâ out-of-pocket spending for services covered under Parts A and B. Moreover, traditional Medicare does not pay for some services that are important for older people and people with disabilities, including long-term services and supports, dental services, eyeglasses, and hearing aids. In light of Medicareâs benefit gaps, cost-sharing requirements, and lack of an annual out-of-pocket spending limit, most beneficiaries covered under traditional Medicare have some type of supplemental coverage that helps to cover beneficiariesâ costs and fill the benefit gaps .

Figure 4: Distribution of Types of Supplemental Coverage Among Beneficiaries in Traditional Medicare in 2016

Medicare Advantage

In 2018, one-third of all beneficiaries were enrolled in Medicare Advantage plans rather than traditional Medicare, some of whom also have coverage from a former employer/union or Medicaid. Medicare Advantage plans are required to limit beneficiariesâ out-of-pocket spending for in-network services covered under Medicare Parts A and B to no more than $6,700, and may also cover supplemental benefits not covered by Medicare, such as eyeglasses, dental services, and hearing aids.

Recommended Reading: Is Medicare A Social Security Benefit

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

What Does Part B Cost

With Medicare Part B, you pay a standard monthly premium thats based on your income. In some cases, your monthly premium may be higher if you didnt sign up for Part B when you became eligible.

You may also need to meet an annual deductible before Medicare kicks in and starts paying. Once youve met your deductible, you will pay a 20 percent copay for approved Medicare Part B services.

You can always buy a Medicare Supplement Plan that pays your Part B deductible, as well as other out-of-pocket costs such as copays and coinsurance.

Read Also: What Is Medicare Hospital Insurance

Do You Have To Pay For Medicare Part B

Medicare Part B comes with some costs on your end. Thereâs a monthly premium, and there may be deductibles, coinsurance and/or copayments. Letâs get into these one at a time.

The Medicare Part B monthly premium may change from year to year, and the amount can vary depending on your situation. For many people, the premium is automatically deducted from their Social Security benefits.

How much Medicare is deducted from your Social Security can vary, depending upon income, with higher earning beneficiaries paying premiums that account from 35 to 80 percent of the cost of coverage.

The standard monthly Part B premium: $170.10 in 2022.

If in fact you do end up paying the higher end of premiums, a sliding scale is used to calculate adjustments based on the beneficiaries modified adjusted gross income .

If you are receiving Social Security, Railroad Retirement Board, or federal retirement benefits, your Part B premium will be deducted directly from your monthly benefit. If not, you will be sent a bill.

Medicare Part A And Part B Leave Some Pretty Significant Gaps In Your Health

Medicare Part A and Part B, also known as Original Medicare or Traditional Medicare, cover a large portion of your medical expenses after you turn age 65. Part A helps pay for inpatient hospital stays, stays in skilled nursing facilities, surgery, hospice care and even some home health care. Part B helps pay for doctors’ visits, outpatient care, some preventive services, and some medical equipment and supplies. Most folks can start signing up for Medicare three months before the month they turn 65.

It’s important to understand that Medicare Part A and Part B leave some pretty significant gaps in your health-care coverage. This is why increasing numbers of Medicare beneficiaries choose to go with Medicare Advantage, which purports to fill some of those gaps.

A private plan through Medicare Advantage can offer more benefits and lower premiums. But a recent report from the Office of Inspector General found that some beneficiaries of Medicare Advantage are denied necessary care.

Here’s a closer look at what isn’t covered by traditional Medicare, plus information about supplemental insurance policies, Medicare Advantage and strategies that can help cover the additional costs, so you don’t end up with unexpected medical bills in retirement.

You can also get a long-term care rider on an annuity, which could help defray the cost of long-term care.

Also Check: Are Blood Glucose Test Strips Covered By Medicare

Do You Need Medicare Part B

The short answer is yes, especially if youll need the covered services mentioned above. However, if you have health insurance through a current job or are on your spouses active plan, you can delay your Medicare Part B enrollment without penalty. Once the spouse with employer coverage stops working whether its you or your partner you have eight months to sign up for Part B. Also, you need to be enrolled in Medicare Part B if you want to sign up for a Medicare Advantage plan.

Does Medicare Cover Home Health

Medicare does help cover some

To be eligible, you must be under the care of a doctor and treated under a plan of care that is monitored and reviewed by your doctor. Also, your doctor will need to certify that you need certain eligible in-home services.

Medicare will not pay for 24-hour in-home care or meals delivered to you at home. It also doesnt cover help for whats called activities of daily living, like bathing, getting dressed, using the toilet, eating or moving from place to place within your home.9

Also Check: Will Medicare Help Pay For A Walk In Shower

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youâre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youâre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a âguaranteed-issue rightâ to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition**. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.

What Is The Difference Between Medicaid And Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare.

Heres how Medicaid works for people who are age 65 and older:

Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article, Can I get help paying my Medicare costs?

Don’t Miss: How To Qualify For Medicare In California

Understanding Coverage Gaps In Original Medicare

Many retirees think Medicare covers most health care expenses.

In reality, Medicare Part A and Part B otherwise known as Original Medicare has several coverage gaps.

In general, Original Medicare does not cover:

- Prescription drugs

Original Medicare does not cover most prescription drugs.

However, You Can Get Drug Coverage One of Two Ways

You can use the Medicare Plan Finder to compare Part D or Medicare Advantage plans in your area.

Medicare Part B may cover some outpatient drugs under limited circumstances.

For example, certain injectable osteoporosis drugs and oral drugs for end-stage renal disease are covered.

In general, drugs covered under Medicare Part B are usually received at a doctors office or hospital outpatient setting.

In these situations, youll owe 20 percent of the Medicare-approved amount for covered Part B drugs administered in a doctors office or pharmacy, and the Part B deductible applies.