Tricare Champva & Va Benefits With Medicare

If you have TRICARE or CHAMPVA coverage, you will need to see if you qualify for premium-free Part A. If you are eligible, you will be required to enroll in both Part A and Part B to keep TRICARE or CHAMPVA coverage. If you are not eligible, enrollment is optional, but you could face late enrollment penalties. Its best to talk with your TRICARE and CHAMPVA benefits administrator to learn more.

VA benefits alone will not qualify you to delay Medicare without penalty, so if you have VA health coverage and are still working past 65, you will need to enroll in Medicare during your Initial Enrollment Period.

What Does Part B Cover

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

Can I Drop Other Coverage To Enroll In Part B

Once youre eligible for Part B, youre eligible.

If one of the exceptions applies that qualifies you for a Special Enrollment Period, you can drop other coverage and enroll in Part B at any time, assuming you have enrolled for Part A.

You may be automatically enrolled in Medicare Part A.

Your retiree health plan may require you to enroll in Medicare. Whether or not this is the case, many health plans coordinate benefits with Medicare.

Medicare is the usually the primary payer. You may find that adding part B coverage can help lower your overall out-of-pocket health care expenses. In any case, having other coverage doesnt typically block you from enrolling in Part B if you are eligible.

You should consult your human resources office or benefits administrator to see how your employee or retiree plan coordinates with Medicare.

Don’t Miss: What Age Can You Start To Collect Medicare

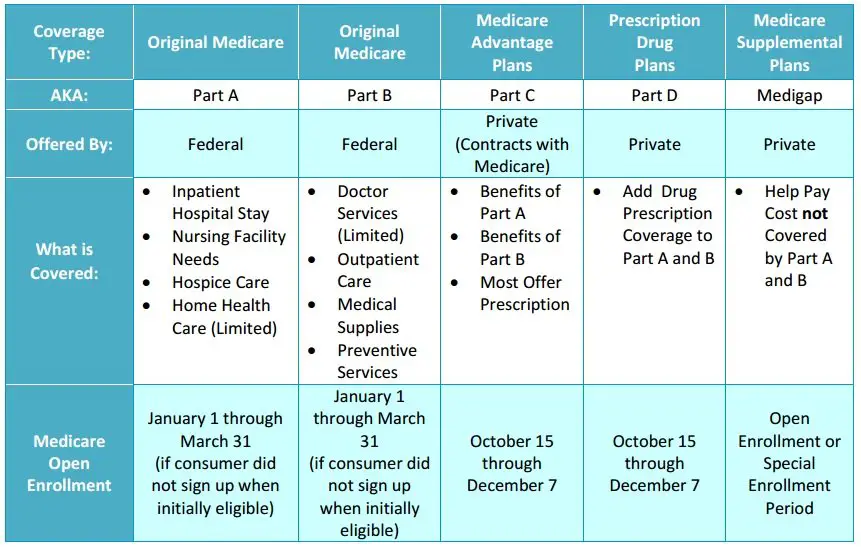

What Are The Different Types Of Medicare

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments. Part C, also known as Medicare Advantage, seeks to cover any coverage gaps. Part D covers prescription drug benefits.

Who Is Eligible For Medicare Part C

Now, lets look at Medicare eligibility for Part C, or Medicare Advantage. Youre eligible to enroll if you already have both Part A and Part B.* Coverage is provided through Medicare-approved private insurance companies. Every plan has a service area that you must live in to receive benefits.

*You typically arent eligible for Medicare Advantage if you have ESRD . However, some insurers offer Special Needs Plans that cover ESRD. That will change in 2021 when enrollment restrictions are lifted for enrollees with ESRD.

Also Check: Can I Buy Into Medicare

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Who Must Sign Up

Remember that not everyone who is eligible for original Medicare will be automatically enrolled. Some will need to sign up through the SSA office:

- Those who are turning 65 years old and are not currently getting retirement benefits from the SSA or RRB can sign up beginning 3 months before they turn age 65.

- People with ESRD can sign up at any time when your coverage will begin may vary.

You May Like: How Does Medicare Work If You Have Other Insurance

B With A Medicare Supplement

A Medicare Supplement or Advantage plan can help by setting an annual stop-loss amount for medical expenses. Upon spending the annual maximum dollar amount, the plan pays 100% of out-of-pocket medical expenses until the year ends.

Medigap or Medicare Supplement are private insurance plans authorized by the federal government with state government oversight.

As insurance companies, states must authorize and review their activities to continue offering Medigap plans.

A Medicare Supplement, or Medigap policy, can secure an individuals budget in the event of unexpected medical expenses.

Medicare Supplement policies can pay the 20% gap between Part B coverage and the consumers responsibility. Medicare Supplement policies labels plans ranging from letters A through N.

Identified by a letter, each Medicare Supplement plan covers standardized portions of services. Some even cover medical expenses when traveling to a foreign county, with some states offering fewer options.

This means that when shopping by comparison, the only difference between Medicare Supplement policies of the same letter is the premium price charged by the insurance carrier who offers it.

Costs For Medicare Part B

Part B has an annual deductible amount which users must pay before Medicare will pay its share of costs.

In 2021, the Part B deductible is $203. After members pay this amount out-of-pocket, Medicare pays 80% and the beneficiary pays the leftover 20% for the remainder of the year. When the new year comes, the Part B deductible resets.

Even 20 percent of the leftover balance for medical services can build up quickly, especially if patients need more services than planned or expected.

Medicare sets no maximum out-of-pocket limit for the year. For beneficiaries, this means Original Medicare will never cover 100% of medical expenses.

To some, the 20 percent coinsurance payments create barriers to affording the care they need.

Also Check: What Does Medicare Supplement Cost

When To Enroll In Part B

The Initial Enrollment Period runs for seven months, lasting from three months before the 65th birthday month, through the birthday month itself, and three months afterward.

Initial enrollment presents the best time to make enrollment choices because of the greater number of options and the avoidance of late penalties.

- Open enrollment runs from October 15 through December 7 each year. Applicants can get Original Medicare, a Medicare Supplement, Medicare Advantage, or Part D prescription drug coverage.

- General Enrollment runs from January 1 through March 31 of each year. This period can be used to join Part A and/or B, with coverage starting July 1. Otherwise, this time allows persons with a Medicare Advantage plan, to change to another plan, drop it to join Part D, or revert back to Original Medicare.

- Special Enrollments follow qualifying life events related to a change in life status such as moving to a new area, gaining or losing state Medicaid benefits, natural disasters, or losing employer-based health insurance coverage.

How Much Does Medicare Part B Cost

Medicare Part B comes with some costs on your end. Thereâs a monthly premium, and there may be deductibles, coinsurance and/or copayments. Letâs get into these one at a time.

The Medicare Part B monthly premium may change from year to year, and the amount can vary depending on your situation. For many people, the premium is automatically deducted from their Social Security benefits.

The standard monthly Part B premium: $170.10 in 2022.

If your income exceeds a certain amount, your premium could be higher than the standard premium, as there are different premiums for different income levels.

If you are receiving Social Security, Railroad Retirement Board, or federal retirement benefits, your Part B premium will be deducted directly from your monthly benefit. If not, you will be sent a bill every three months.

The chart below shows the Medicare Part B monthly premium amounts, based on your reported income from two years ago . These amounts may change each year. A late enrollment penalty may be applicable if you did not sign up for Medicare Part B when you were first eligible. Your monthly premium may be 10% higher for each 12-month period that you were eligible, but didnât enroll in Part B.

| Medicare Part B monthly premium in 2022 | |

| You pay | |

| $578.30 | $750,000 or more |

Don’t Miss: Do You Need Medicare If You Are Still Working

Does Part B Cover Prescription Drugs

Short answer: No, Part B doesnt typically cover prescription drugs.

Longer answer: Part B may cover some drugs in a specific situations, typically only those that are administered by a doctor in their offices or in a clinic.

To get Medicare coverage for most retail prescription drugs, you need a Medicare Part D prescription drug plan or a Medicare Advantage plan that includes prescription drug coverage.

What Is Retroactive Reimbursement Of Medicare Premium

If you filled any covered prescriptions since < Retroactive Effective Date> , Medicare’s Limited Income Newly Eligible Transition Program will pay you back for what you spent out of pocket for these prescriptions, minus any copayments that apply (up to $3.70 for a generic drug and up to $9.20 for a brand-name drug …

Read Also: Does Medicare Take Care Of Dental

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

Sign Up: Within 8 Months After The Active Duty Service Member Retires

- Most people dont have to pay a premium for Part A . So, you might want to sign up for Part A when you turn 65, even if the active duty service member is still working.

- Youll pay a monthly premium for Part B , so you might want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Also Check: Does Medicare Cover New Patient Visit

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

You May Like: Do Medicare Advantage Plans Include Part B

Sign Up: Within 8 Months After You Or Your Spouse Stopped Working

Your current coverage might not pay for health services if you dont have both Part A and Part B .

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

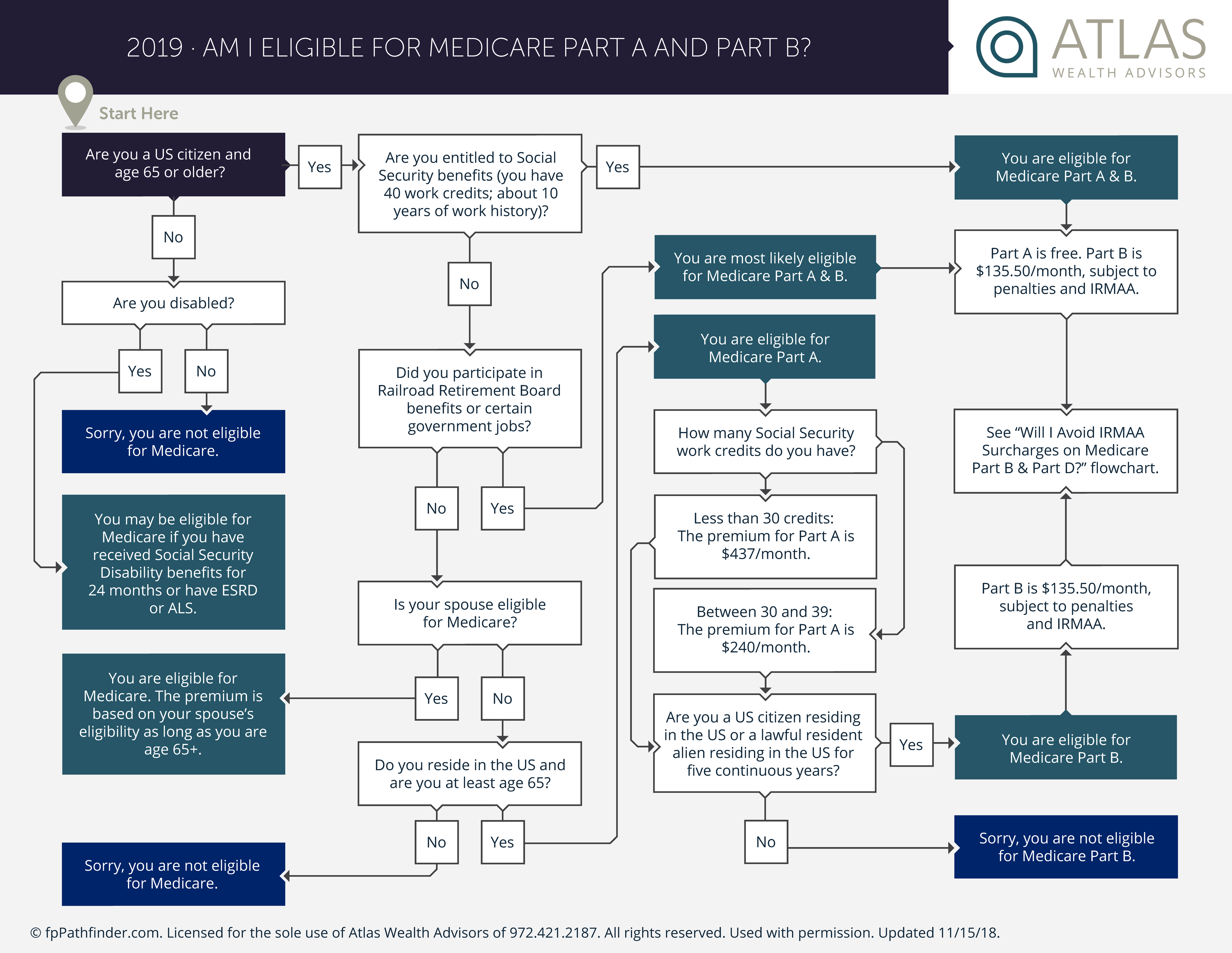

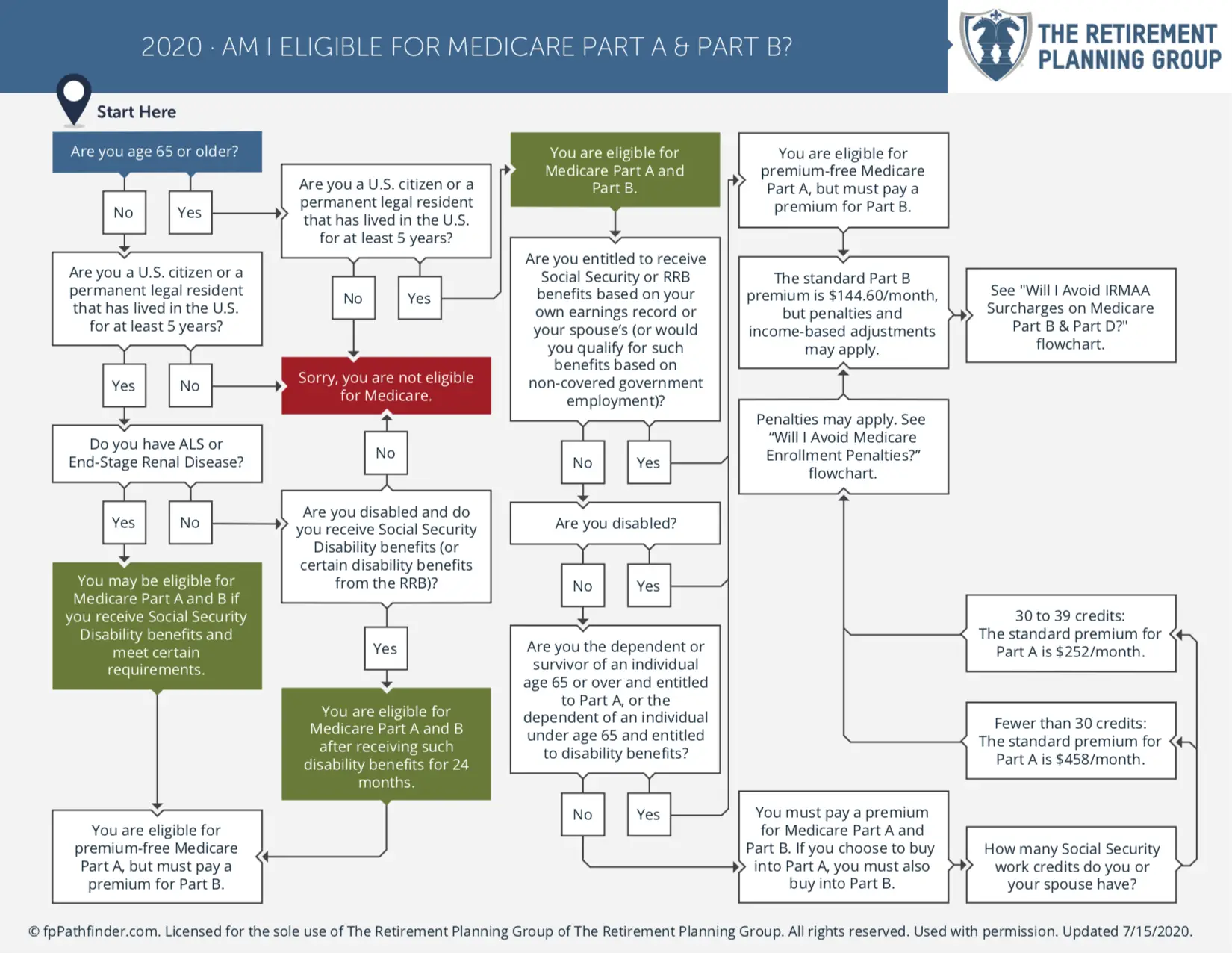

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

You May Like: How To Get Prescription Coverage With Medicare

Medicare Advantage Plan Eligibility For 2022

Heres what you need to know about eligibility for Parts C and D:

| If you | |

| Qualify for Medicare because youre turning 65 | Sign up for Medicare Advantage or Part D during your 7-month initial enrollment period |

| Qualify for Medicare because of a disability but arent 65 | Sign up for Medicare Advantage or Part D during the 7-month period that starts 3 months before your 25th month of disability payments, includes that 25th month, and ends 3 months after the 25th month of disability payments |

| Qualify for Medicare because of a disability and youre 65 | Sign up for Medicare Advantage or Part D during the 7-month period that starts 3 months before the month you turn 65, includes your birthday month, and ends 3 months after your birthday month |

| Dont have Medicare Part A, and you enrolled in Part B during general enrollment | Sign up for Medicare Part D only, from April 1 to June 30 |

| Have Medicare Part A, and you enrolled in Part B during general enrollment | Sign up for Medicare Advantage only, from April 1 to June 30 |

You can also switch to Medicare Advantage or join a Part D drug plan during the Medicare annual open enrollment period, which runs from October 15 through December 7 each year. And if you already have an Advantage plan, you can use the Medicare Advantage Open Enrollment Period to make a one-time change to your coverage.

- A Part D drug plan

- A Medicare Advantage plan with drug coverage

- Another Medicare health plan that covers prescription drugs

- A plan from an employer or union

Does Medicare Cover Prescription Drugs

Medicare prescription drug coverage is available to everyone with Medicare. Private companies provide this coverage. You choose the Medicare drug plan and pay a monthly premium. Each plan can vary in cost and specific drugs covered. If you decide not to join a Medicare drug plan when youre first eligible, and you dont have other creditable prescription drug coverage, or you dont get Extra Help, youll likely pay a late enrollment penalty. You may have to pay this penalty for as long as you have Medicare drug coverage.

Recommended Reading: Does Medicare Pay For Shingles Shot 2020

Can You Enroll In Medicare Before You Turn 65

You may be eligible for Medicare before age 65 if:

- Youve received Social Security Disability Insurance for at least 24 months

- Youll get Medicare Part A and Part B automatically starting the first day of your 25th disability month. You should get your Medicare card in the mail three months before this date.

- You have Amyotrophic Lateral Sclerosis , or Lou Gehrigs disease

- Youll get Part A and Part B automatically in the month your SSDI benefits begin.

Note: Part B isnt automatic if you live in Puerto Rico.4 Youll have to contact Social Security to enroll.

- You have permanent kidney failure, or end-stage renal disease

- Youll need to sign up for Medicare yourself. Your coverage usually starts the first day of the fourth month of dialysis treatment or in the month youre admitted to a Medicare-certified hospital for a kidney transplant.5

A Word of Advice

If you dont have any other type of health insurance, you should enroll in Medicare Parts A and B when you turn 65.