Do I Have To Enroll In Medicare At 65

If you have chosen to continue working and postpone receiving Social Security payments, you might wonder if you can postpone receiving Medicare.

In this case, you may want to ask Medicare to postpone your Part B Medicare. You cannot receive Social Security benefits after 65 without Medicare Part A coverage. Dont worry, Medicare Part A doesnt cost most people anything, so this shouldnt be an issue.

If you delay Medicare Part B and Part D because you are still working and therefore covered by your employer, you can add those parts later when you retire.

If you work for an employer with less than 20 employees, Medicare will be the primary insurance, so you should choose to keep both Parts A and B and your employer will be a secondary insurance provider.

Does Medicare Backdate Credentialing

There are certain situations where you can sign up for Medicare Part B without having to pay a late penalty, even if your sign up occurs during a Special Enrollment Period. These situations include:

- You are still employed and under your employerâs coverage. You can sign up for Part A and Part B any time as long as you have a group health plan coverage OR you/your spouse is working for the employer that provides the coverage

- You have 8 months to sign up after you/your spouse stops working or if you lose group health plan coverage

- Your 8-month Special Enrollment Period starts when you stop working even if you have COBRA or non-Medicare coverage

- Volunteers who are serving in a foreign country â Contact Social Security for details

- Some individuals with TRICARE â Contact TRICARE for details.

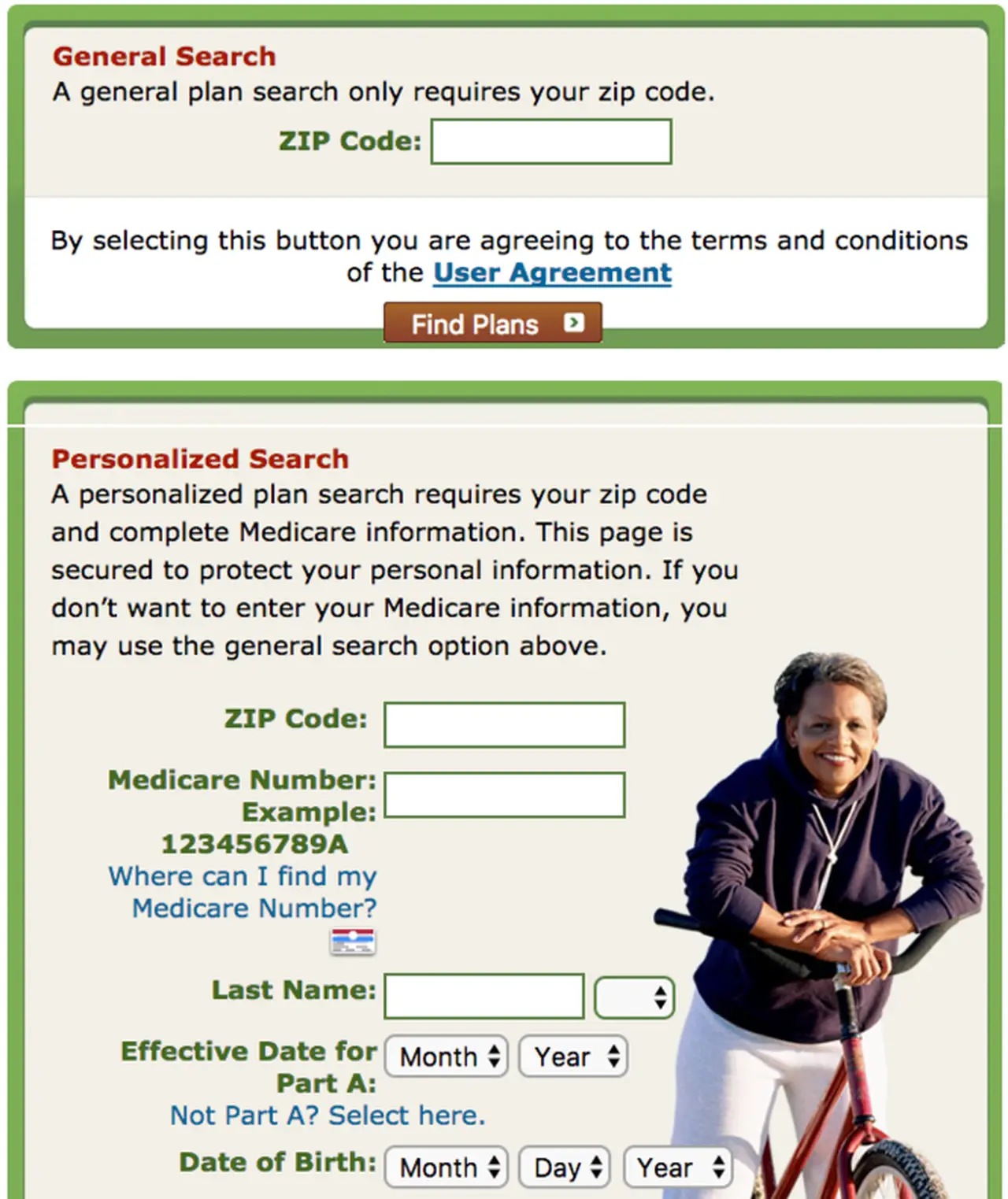

How To Get Started With Medicare

The first thing to do to get started with Medicare is to enroll in Medicare Part A and Part B. Once you have your Medicare Part B effective date, you can choose your supplemental coverage.At MedicareFAQ, we help you understand your options and find the coverage that is right for you. The best part is that our services are 100% free. We help you find the best plans in your area and educate you on all things Medicare.To get started, fill out a rate comparison form, or give us a call at the number above. We can help you navigate Medicare and prepare for when Medicare starts.

Recommended Reading: Does Medicare Cover Bariatric Surgery

Does Medicare Start On Your Birthday

Original Medicare coverage does not start on your actual birthday. At the earliest, coverage begins on the first day of the month you turn 65. So, if your birthday is July 24, your coverage will begin July 1.

However, there is one exception to this rule. If you are born on the first of the month, your Medicare coverage will begin one month earlier. So, if you are born on September 1, your Initial Enrollment Period will be the same as those born in August.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Part Ddrug Coverage Has To Be Creditable

Part D covers prescription drugs. If your employer plan offers what Medicare calls “creditable” coverage, you may be able to delay enrolling in a Part D plan. If you don’t have this type of coverage and don’t enroll as soon as you’re eligible, there’s a late enrollment penalty if you go more than 63 days without prescription drug coverage.

Recommended Reading: How Much I Have To Pay For Medicare

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

How Many Test Kits Can I Get

Each household can request two boxes with two tests each in them, for a total of four COVID-19 tests. A household is generally defined as a group of people, related or unrelated, sharing a single housing unit. According to the Department of Health and Human Services, residential addresses with multiple unrelated families can order multiple tests.

In some cases, the USPS may not recognize an address as being multifamily, so you may have trouble ordering if someone else at your location already requested tests. If you’re facing that issue, you can file a service request or call 800-275-8777 to resolve the problem.

You May Like: How To Change Medicare Address Online

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Medicare Part B Special Circumstances

Some people dont need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special conditions. And some people choose not to enroll in Medicare Part B, because they dont want to pay for medical coverage they feel they dont need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage. In this section, well discuss a few reasons to hold off on Medicare Part B, as well as how Obamacare affects Medicare Part B coverage.

For starters, people who are still working when they qualify for Medicare may not need to get Part B coverage right away. If you have insurance through your employer, then you most likely already have medical coverage. However, you should still meet with your plan administrator to find out how your current insurance works with Medicare, because some policies change once youre eligible for Medicare. Other special situations include the following:

Once you stop working or lose your work-based coverage, you have an eight-month period to enroll in Medicare Part B. If you dont enroll during this time, you may have to pay the late enrollment penalty every month that you have Part B coverage sometimes indefinitely. Also, you may face a serious coverage gap if you wait to enroll.

You May Like: Can I Sign Up For Medicare Part B Online

What Is The Difference Between Medicare And Medicaid

Medicare is typically an age-based program that all Americans eventually qualify to use. Those with permanent disabilities and dialysis patients may also qualify for Medicare regardless of age. Medicaid is income-based, and individuals of any age may qualify if they fall below certain income levels.

Sign Up: Within 8 Months After The Active Duty Service Member Retires

- Most people dont have to pay a premium for Part A . So, you might want to sign up for Part A when you turn 65, even if the active duty service member is still working.

- Youll pay a monthly premium for Part B , so you might want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Also Check: Does Medicare Cover Counseling For Depression

Do You Have To Get Medicare If You Are Still Working

Whether you are working or not when you turn age 65, youll still be eligible for Medicare coverage. It is not mandatory to sign up for Medicare. In fact, you may prefer the healthcare coverage offered by your employer. However, if you defer or decline Medicare coverage, you could pay some form of penalty.

Well go over some of the things you might consider before deciding to enroll in Medicare while still being employed.

Things To Do Before Signing Up For Medicare

Recommended Reading: When Does Medicare Coverage Begin

Can You Have Medicare While Working

If you donât receive health coverage through work, itâs safe to say you should get Medicare coverage.

If youâre working when you enter your Initial Enrollment Period , you can enroll in Medicare. As long as you meet all the criteria needed to be eligible, it is your right to do so. You can also choose to delay your Medicare coverage, though you may be penalized later.

If you donât receive health coverage through work, itâs safe to say you should get Medicare coverage.

Canceling Part B Because You Were Automatically Enrolled

Some people are automatically enrolled in Part B if theyre receiving Social Security or Railroad Retirement Board benefits when they become eligible for Medicare. If thats you, theres a good chance your Medicare card will arrive in the mail even if you havent applied for benefits.

If you dont want this coverage and dont opt out, youll be responsible for Part B premiums, which may come straight out of your Social Security or RRB checks. But beware: if you opt out of Part B without having creditable coveragethat is, employer-sponsored health insurance from your current job thats as good or better than Medicareyou could face late-enrollment penalties down the line.

Recommended Reading: When Is The Earliest You Can Apply For Medicare

Coordinating Start Dates For Medicare Advantage Or Drug Coverage And Medicare

Same as above. Once you learn your Original Medicare effective date, youll want to apply for Medicare Advantage prior to that date, so that you have the coverage you desire.

- If you have delayed Part B, your start date will be different from above, as will your Medicare Advantage and Medigap effective dates

- If you are enrolled in Medicare Advantage and want to switch to Medigap,

- If you are enrolled in Medigap and Switch to Medicare Advantage,

- Dont forget to coordinate your Part D drug plan enrollment with your Original Medicare

Related Articles:

- Medicare Advantage Overview Medicare Advantage is fairly similar to Original Medicare. The main difference is that when it comes to MA, your coverage is now offered by private companies. These plans are required to offer at least what Medicare does, and usually cover quite a lot more.

- New to Medicare: Everything you need to know. Medicare is the United States federal health insurance program for Americans 65 and older, as well as people with certain disabilities or End Stage Renal Disease .

- Medicare Insurance Switching: Ultimate Guide With so many different plans, carriers, deductibles and what not, picking the wrong plan happens. A lot. Check out your options.

You May Like: How Do I Find Medicare Number

How Many Free Home Covid Tests Will Be Available

Each Medicare beneficiary can claim up to eight free over-the-counter home tests per month. This is in addition to the four free COVID tests available to every U.S. household at COVIDTest.gov.

Eight tests per month for Medicare beneficiaries matches what private insurers must cover for their customers. There is no limit on lab-conducted COVID tests ordered by a doctor.

Don’t Miss: How To Choose The Best Medicare Plan

When Can You Start Getting Medicare

A somewhat cynical old saying declares that only two things in life are guaranteed: death and taxes. But theres also something positive you can count on, and thats Medicare.

Medicare is a federal health insurance program that U.S. citizens and qualified legal residents are guaranteed access to once they reach eligibility.

There are a few ways to become eligible for Medicare. The most common one is your age. Lets assume you meet the citizenship qualification above and go explore more about becoming eligible for Medicare via age.

More Answers: Changing From The Marketplace To Medicare

- Can I get help paying for Medicare?

-

If you need help with your Part A and B costs, you can apply for a Medicare Savings Program.

-

You may also qualify for Extra Help to pay for your Medicare prescription drug coverage if you meet certain income and resource limits.

- What if Im eligible for Medicare, but my spouse isnt and wants to stay covered under our current Marketplace plan?

-

If someone gets Medicare but the rest of the people on the application want to keep their Marketplace coverage, you can end coverage for just some people on the Marketplace plan, like a spouse or dependents.

Don’t Miss: How To Pay For Medicare Without Social Security

How Many Of The Eligible Medicare Beneficiaries Does Uhg Serve

UnitedHealthcare Retiree Solutions: Provides employers with high-quality, affordable health care solutions for more than 1.8 million retirees Serving one in five Medicare beneficiaries, UnitedHealthcare Medicare & Retirement is the largest business dedicated to the health and well-being needs of seniors and other

When Does Medicare Start If You Sign Up During A Special Enrollment Period

If you have creditable coverage and delay either part of Original Medicare, you will qualify for a Special Enrollment Period. The most common scenarios are if you delay both parts or hold off on enrolling in Medicare Part B but pick up zero-premium Part A.

Special Enrollment Periods only happen when you have a qualifying life-changing or financial circumstance. This would include losing group coverage. If you qualify, you will have 63 days to enroll in Original Medicare coverage without having to pay the late enrollment penalty.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Remember, if you do not enroll in Original Medicare during your Special Enrollment Period, then you will need to wait until the General Enrollment Period to receive coverage. In this case, you may be responsible for the Medicare Part B late enrollment penalty.

Recommended Reading: Is Kaiser A Good Medicare Advantage Plan

Do I Qualify For A Medicare Special Enrollment Period

Perhaps, if you or your spouse is still working and you have health insurance from that employer. The special enrollment period allows you to sign up for Medicare Part B throughout the time you have coverage from your or your spouses employer and for up to eight months after the job or insurance ends, whichever occurs first.

If you enroll at any point during this time, your Medicare coverage will begin the first day of the following month. And you will not be liable for late penalties, no matter how old you are when you finally sign up.

Your decision also depends on the size of your employer and whether the employers plan is first in line to pay your medical bills or second.

Larger companies. If you or your spouse work for a company with 20 or more employees, you can delay signing up for Medicare until the employment ends or the coverage stops, whichever happens first. These large employers must offer you and your spouse the same benefits they offer younger employees and their spouses, which means that the employers coverage can continue to be your primary coverage and pay your medical bills first.

Many people enroll in Medicare Part A at 65 even though they have employer coverage, because its free if they or their spouse has paid 40 or more quarters of Medicare taxes. But they often delay signing up for Part B while theyre still working so they dont have to pay premiums for both Medicare and the employer coverage.

Keep in mind

Medicare Part Aan Easy Choice

Medicare Part A provides hospital insurance. It covers in-patient hospital stays, care in a skilled nursing facility, hospice care and some home care. Most people benefit by enrolling in Medicare Part A at age 65, whether or not they continue to work. There are no premiums, and enrolling now will help you avoid gaps in coverage down the road.

Also Check: How To Apply For Medicare Without Social Security