No Medicare Does Not Cover The Cost Of Long

When it comes to the costs associated with senior living options like an assisted living community, there are a lot of questions that family members ask themselves when finding a home for a loved one. Things may be on your mind like what are the costs associated with increased care needs, how much is the monthly room and board, and if luxuries are an additional charge.

Finding senior loved ones the best senior living community depends on knowing the answers to all of these questions and more. When thinking about ways to help finance assisted living, another common question is if Medicare, or senior health insurance available to everyone over 65, will help pay for the costs of assisted living.

What Medicare Covers

To make a long answer short, Medicare does not cover assisted living costs. Medicare, for the most part, does not pay for any type of long-term residential care, including nursing homes and assisted living communities, so if one of these is the best option for your loved one, you will need to find a different way to pay than through their Medicare plan.

Medicare will sometimes pay for a short-term stay in a skilled nursing facility or for some home health care options, but senior living communities like assisted living are not included in Medicare plans. This can pose a problem for many elders, especially as the senior population often needs some sort of residential care community as they continue to age.

Other Payment Options

Can I Get Financial Assistance For Assisted Living Facilities

You may qualify for help from your state if you need long-term assisted living assistance contact your states Medicaid office or State Health Insurance Assistance Program for information.

If you purchased a long-term care insurance policy, you may also qualify for benefits to cover assisted living facilities check your policy documents for more information.

Should You Consider Long Term Care Insurance Along With Medicare For Assisted Living

Long-term care insurance policies may help cover assisted living costs. For instance, you may receive a daily dollar amount for room and board until your lifetime maximum allowance is reached. Policies vary, but most require that you meet two criteria before your policy pays:

- Benefit triggers determine if you are eligible for benefits. These are typically based on your inability to perform activities of daily living or your compromised cognitive function.

- The elimination period is the time between when you are deemed eligible for benefits and when your policy pays. You must pay for costs during the elimination period, much like you have to pay a deductible on an insurance plan first.

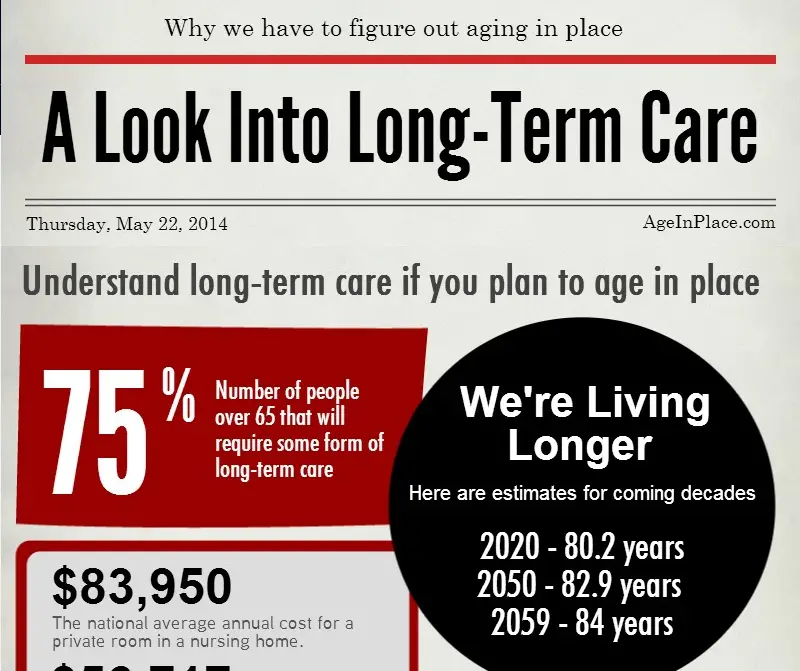

On average, if you are 65 years old, you have a 70% chance of needing some time of long-term care or support as you age. According to longtermcare.gov, 13% of people may need assisted living for up to a year.

You need to decide on long-term care insurance before you need it. You may not get an affordable policy if you wait until you are older and have health concerns.

The American Health Care Association and National Center for Assisted Living provide consumers with helpful information about assisted living and how to pay for it. If you want to make a plan for assisted living, consult your local Agency on Aging or speak with your insurance agent.

Recommended Reading: When Do I Have To Enroll In Medicare

How Often Does Medicare Pay For Hospital Bed Mattress

Medicare pays for all medical equipment, including hospital beds, under Part B, and Part B will pay 80% of the cost of the hospital bed for you. It is possible that a Medigap or Medicare Advantage plan will provide you with more coverage.

Although Medicare does cover some mattress costs, they are not always. For certain conditions, pressure-relieving mattresses can be covered by Medicare. Semi-electric beds, which are paid for by Medicare, are sometimes required by patients. It is common for an item to be purchased if it is specifically designed for your use. Medicare covers the cost of mattresses when they are provided in an outpatient setting. Copayments may be included in Part C plans, but they are not in Original Medicare. Medicare pays for out-of-pocket expenses that Medicare does not cover in order to cover the costs of Medigap plans.

If you are looking for additional assistance with these fees, these plans may be a good choice. You will be responsible for your Medicare deductible if you require a mattress. After that, you will be required to pay a coinsurance. If the equipment is what your doctor requires, your equipment may be covered by Medicare. You must also purchase from a Medicare-approved retailer in addition to the Medicare-approved retailer.

Will Medicaid Cover Assisted Living

Medicaid benefits for supported living. Medical assistance to change maintenance by state. This is because Medicaid is funded in part by the federal government and in part by the states. The federal government is setting guidelines on how each state should spend its Medicaid dollars.

What qualifies you for assisted living?

Eligibility depends on the persons level of care. People entering marriage institutions often need help with ADLs such as personal care, hygiene, mobility, cooking, medication management and more.

What happens if you run out of money in assisted living?

If you run out of money and your family cant intervene and cover the costs, your options will depend on your state and whether you live in a care home. Your ombudsman may be able to negotiate with the institution, provide financial assistance to pay for your care or find you a new home.

Read Also: Do I Have Medicare Part B

Medicare Coverage Is Available For Hospice And Qualified Long

If you have a terminal illness and are not expected to live more than six months and are no longer seeking a cure Medicare may also cover some or all of the costs associated with hospice care. Learn more about Medicare coverage for hospice care here.

If you meet certain conditions, Medicare may cover some long-term care services. Medicaid, the Department of Veterans Affairs, and other state programs may also offer coverage. Learn more about getting coverage for long-term care here.

Assisted Living Facility In Lakewood New Jersey

NPI list of 6 assisted living facility registered providers with a business address in Lakewood, NJ, all registered as organizations. A facility providing supportive services to individuals who can function independently in most areas of activity, but need assistance and/or monitoring to assure safety and well being.

| NPI |

|---|

Medicare Participation

What is PECOS?

PECOS is Medicares enrollment and revalidation system and it is the primary source of information about verified Medicare professionals eligible to order or refer healthcare services for Medicare patients.

Read Also: How To Sign Up For Medicare At Age 65 Online

Also Check: Does Medicare Cover Lasik Eye Surgery

How To Find Senior Assisted Living Near Me

The U.S. Department of Health & Human Services offers a state-by-state guide to assisted living resources. In many cases, the most comprehensive information about senior assisted living near me will come from your Area Agency on Aging.

Your healthcare provider or your plan may be able to help. If you believe a different provider or plan may be more beneficial to your situation, GoHealth can help you with coverage details and compare options.

Get real Medicare answers and guidance — no strings attached.

Is Assisted Living Covered By Medicare

Medicare is a health insurance program provided by the U.S. government for seniors age 65 and older and some younger people with disabilities. Although it doesnt pay for assisted living, it covers medical expenses for seniors. Medicare is divided into sections that cover different areas of health care:

- Medicare Part A/Hospital Insurance: Hospital stays, limited nursing home care, hospice care and some home health care costs

- Medicare Part B/Medical Insurance: Preventative care, doctors office visits, outpatient care and medical supplies

- Medicare Part D/Prescription Drug Coverage: Prescription drugs and vaccinations

Medicare Part A is funded by taxes on income, and most people over 65 get this insurance at no cost. If a senior or their spouse has worked for a certain amount of time and paid taxes, they should be eligible. This coverage may start automatically for seniors already receiving Social Security payments. However, those who are not enrolled need to go to the Medicare enrollment site and sign up to receive benefits.

Medicare Part B, the insurance for doctors office visits, must be chosen during enrollment to avoid paying an extra penalty for adding it later. After the initial enrollment, Medicare coverage choices can be changed at certain times of the year without a penalty.

Read Also: Does Medicare Cover Ambulance Transport

Does Medicare Cover Assisted Living In My State

While the answer to the question Does Medicare pay for assisted living? is no, Medicaid may help pay for assisted living, depending on your state and circumstance. If you are eligible for Medicare, it is also possible to qualify for Medicaid depending on your financial situation.

The American Council on Aging provides extensive information on how different states Medicaid program aligns with the needs of its long-term care population:

Does Medicare Cover Assisted Living For Dementia

Medicare doesnt cover the costs associated with assisted living for people with dementia. However, Medicare may help pay for other services related to dementia care, such as inpatient hospital care, physician fees, some medically necessary items and short-term skilling nursing care for up to 100 days, according to Medicare.org.

If you or a loved one is admitted to an Alzheimers special care unit specifically, Medicare may cover some of the costs associated with that care. Certain hospice care, whether rendered in the home, a nursing facility or an inpatient hospice facility, may also be covered for people with dementia.

People with dementia may be eligible to join the Medicare Advantage Value-Based Insurance Design Model as well. This program gives enrollees with chronic conditions additional benefits, reduced cost sharing and more flexible plans from Medicare Advantage providers.

Also Check: How Do You Apply For Extra Help With Medicare

Who May Receive Nursing Facility Services

NF services for are required to be provided by state Medicaid programs for individuals age 21 or older who need them. States may not limit access to the service, or make it subject to waiting lists, as they may for home and community based services. Therefore, in some cases NF services may be more immediately available than other long-term care options. NF residents and their families should investigate other long-term care options in order to transition back to the community as quickly as possible.

Need for nursing facility services is defined by states, all of whom have established NF level of care criteria. State level of care requirements must provide access to individuals who meet the coverage criteria defined in federal law and regulation. Individuals with serious mental illness or intellectual disability must also be evaluated by the states Preadmission Screening and Resident Review program to determine if NF admission is needed and appropriate.

Nursing facility services for individuals under age 21 is a separate Medicaid service, optional for states to provide. However, all states provide the service, and in practice there is no distinction between the services.

In some states individuals applying for NF residence may be eligible for Medicaid under higher eligibility limits used for residents of an institution. See your state Medicaid agency for more information.

Also Check: What Age Qualifies You For Medicare

Will Medicaid Pay For Assisted Living

Almost all national Medicaid programs cover the costs of assisting the eligible population. However, like Medicare, Medicaid does not pay for living in an assisted community. For qualified retirees, Medicaid pays for their assistance services: nursing care.

What qualifies you for assisted living?

Eligibility depends on the persons level of care. People entering marriage institutions often need help with ADLs such as personal care, hygiene, mobility, cooking, medication management and more.

Also Check: Is There A Copay With Medicare Part D

Does Medicaid Cover Assisted Living Costs

Medicaid is partly funded by the federal government and partly by the states. This means each state sets its own policies regarding how Medicaid funds can be applied to care in assisted living facilities. Many states include non-medical services under Medicaid programs, including personal care, homemaker assistance, medical equipment, and other services needed for senior care and housing.

Because custodial skilled nursing placement is costly, the Medicaid program sometimes provides vouchers that enable seniors to remain in assisted living facilities. For more information, here is a state-by-state summary of Medicaid personal care benefits.

Does Medicaid Pay For Assisted Living

Often confused with Medicare, Medicaid is a joint federal and state program that helps people with low income and limited assets cover health care costs, including long-term care. According to the U.S. Department of Health and Human Services , each state sets its own guidelines regarding eligibility and services, but they must meet federal requirements.

Most states offer Medicaid beneficiaries some degree of financial assistance with home and community based services , such as assisted living, either through a states regular Medicaid program, Medicaid waivers or both. However, Medicaid does not cover the cost of basic room and board the way it does for residents of nursing homes. If a seniors state does not offer a Medicaid program that helps cover assisted living costs, it likely offers other HCBS that can help delay or prevent their move to a long-term care facility.

Read:Medicaid and Assisted Living: Whats Covered and Whats Not

You May Like: What Is A Medicare Set Aside In Personal Injury

Does Medicare Or Medicaid Cover Assisted Living & Memory Care Facilities

As the cost of healthcare continues to rise, you may wonder how you or your loved one will keep up with their medical cost. On average, the cost of living in an assisted living community is just under $45,000 per year, per senior. Elderly people who need more intensive care, such as that provided in a nursing home can cost as much as $90,000 a year for each senior. Retirees and seniors who need specialized memory care facilities can expect their cost to fall in the middle of those two, at around $65,000 a year per senior.

Understanding the cost involved with assisted living is the best way to plan ahead for the future. When planning for long term care, it is also important to understand which services are covered or excluded by Medicaid and Medicare.

How Else Can I Pay For Companion Care Without Medicare Or Medicaid

There are many different ways to pay for companion care, but finding the best option for your needs requires a hard look at your finances â especially if you’re on a fixed income and living solely on your monthly Social Security payments.

After you’ve reviewed your savings and assets, consider which of these five popular options fit into your budget:

Don’t Miss: How To Check Medicare Deductible

How Much Does Medicare Pay For Assisted Living Facility

Medicare pays 100% of the cost of care for up to 20 days in a qualified care facility and about 80% of the cost for up to 80 additional days. Care should be taken after recovery from inpatient care. Medicare does not cover the cost of marriage.

Can Social Security pay for assisted living?

The short answer is yes, in most states, Social Security provides financial assistance to people living in assisting communities if they meet eligibility criteria.

What Is The Difference Between Medicare And Medicaid

With similar-sounding names, it’s no wonder that Medicare and Medicaid get confused sometimes! Both are funded by taxpayers what sets these two programs apart is who they provide health care coverage for.

Original Medicare is a federal health insurance program that provides health care coverage for Americans age 65 and older, as well as those who live with a disability.

Medicaid is a joint federal and state health insurance program that covers Americans with a limited income. Adults who are 65 or older and meet the limited-income requirements may be covered by both programs.

Recommended Reading: How Do You Get Dental Insurance On Medicare

What Is The Maximum Income To Qualify For Medi

Under the Covered California Income Guidelines and Salary Limits, if an individual earns less than $ 47,520 per year or if a family of four earns less than $ 97,200 per year, they qualify for government assistance based on their income.

What is the maximum qualifying income for Medi-Cali in California? Your household income must not exceed 138 percent of the federal poverty rate based on the size of your household. For example, if you live alone, your income cannot exceed $ 16,395 a year. If you live with your spouse or other adult, your income must not exceed $ 22,108 per year.

Getting Help With Long

In addition to Medicare Advantage and Medigap plans, there are a number of public and private programs to help pay for skilled nursing costs. A few examples include:

- PACE , a Medicare/Medicaid program that helps people meet healthcare needs within their community.

- Medicare savings programs, which offer help from your state to pay your Medicare premiums.

- Medicares Extra Help program, which can be used to offset medication costs.

- Medicaid, which may be used to help fund long-term care needs, if youre eligible.

A few last tips

- If you think you may need skilled nursing care after a hospital stay, talk to your doctor early.

- Make sure you are listed as an inpatient, not an observation patient, during your admission.

- Ask the doctor to document any information that would prove skilled nursing care is necessary for your illness or condition.

- Consider hiring a

Don’t Miss: Does Medicare Pay For Hearing Evaluation