Qualified Disabled And Working Individuals

The QDWI program helps a person pay Medicare Part A premiums. Medicaid limits enrollment to individuals who meet the following criteria:

- is aged years, is working, and has a disability

- returned to work and lost the premium-free Part A

- is not getting state medical assistance

- meets the resources and income limits

Paying For A Prescription Drug Plan

If you qualify for theQMB, SLMB or QI Medicare Savings Programs, then you also automatically qualify for a program called Extra Help designed to help with paying for your prescription drugs. Prescription drug coverage is provided through Medicare Part D, which is why Extra Help is also known as the Part D Low-Income Subsidy. Part D coverage generally comes with a premium, a deductible and a copayment or coinsurance. Learn more about Medicare Part D here.

But you dont have to be in a Medicare Savings Program to receive help paying for your prescriptions under Extra Help. If your annual income as an individual is up to $1,698 per month or $2,288 as a couple in 2022, you may be eligible. Asset limits in 2022 are up to $15,510 for an individual or $30,950 for a couple.

Depending on which Medicare Part D plan you choose, the program can reduce or eliminate your plans premium and deductible, and also lower the cost you pay for the prescription drugs covered under your plan.

What Is The Medicare Savings Program

Not all Medicare beneficiaries can afford to pay their premiums, copayments, and coinsurance. If you have a lower income, its possible that youll qualify for a Medicare Savings Program to help with your out-of-pocket expenses.

Are you asking, Do I qualify for a Medicare Savings Program? If so, this article will help. This page is designed to help you understand the Medicare Savings Program income limits and other requirements.

Read on to find out if you qualify.

Read Also: Does Medicare Pay For Lung Cancer Screening

What Services Does The Partnership Provide

- Medicare and Medicaid information and education

- Help with original Medicare eligibility, enrollment, benefits, complaints, rights and appeals

- Explain Medicare Supplemental insurance policy benefits and comparisons

- Explain Medicare Advantage and provide comparisons and help with enrollment and disenrollment

- Explain Medicare Prescription Drug coverage, help compare plans and search for other prescription help

- Information about long-term care insurance

The partnership also helps with the following programs. Benefit Counselors are specially trained to help you understand all the fine print to find and apply to a plan that works for you. They advocate for you with these programs and help you get the services you need.

Qualified Disabled Working Individual Program

The Qualified Disabled Working Individual Program is designed to help those with disabilities who are working and have lost their Social Security disability benefits and premium-free Medicare Part A because of their return to work.

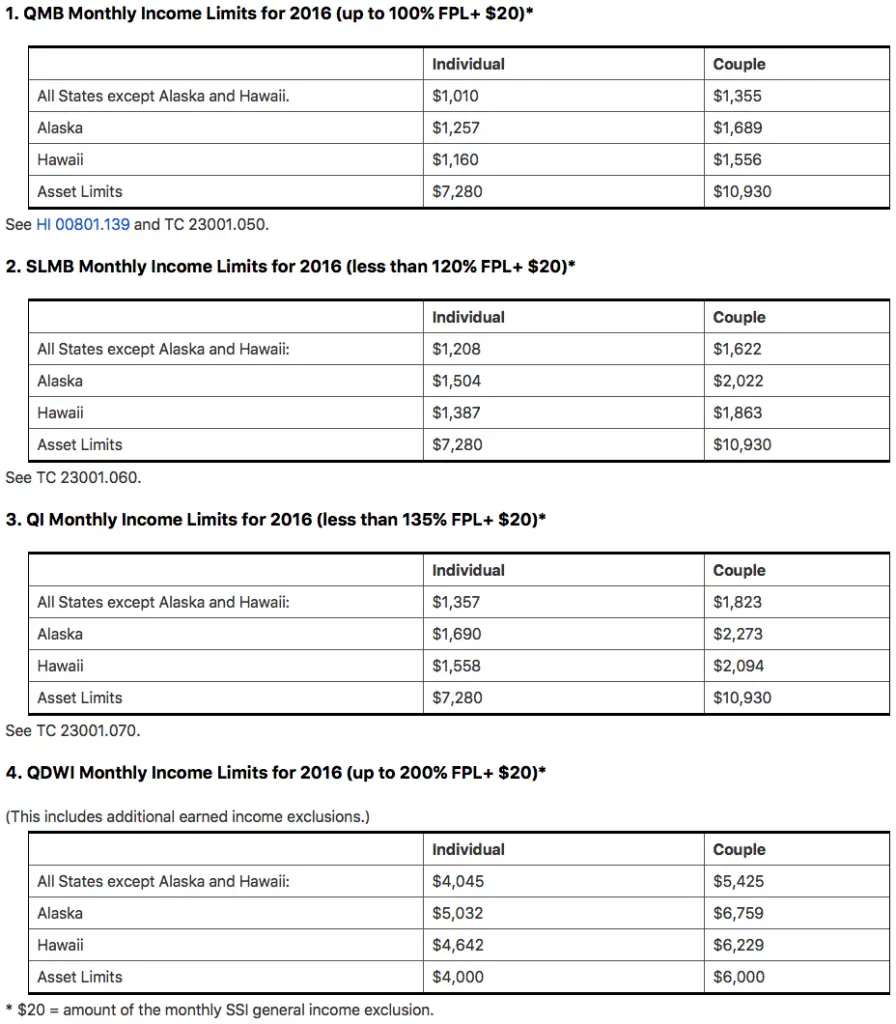

To qualify for the QDWI program, applicants must not make more than $4,615 a month for individuals or $6,189 for married couples. Resource limits are set at $4,000 for individuals and $6,000 for married couples.

If you live in Alaska or Hawaii, income limits for all four programs are slightly higher.

Don’t Miss: Is A Mammogram Covered By Medicare

Additional Barriers To Qualifying For An Msp

The application process for MSP programs is further complicated, Kayrish says, because a lot of states require information and proof about your assets. For instance, some states require that you provide a copy of the cash value of your life insurance policy. In some states, the full application is 15 to 22 pages long, she says.

And dont even think about lying. When someone applies for an MSP, they usually have to sign a form that says they must report any change in income/financial circumstances to the state Medicaid agency, writes Brandy Bauer, the director of NCOAs Medicare Improvements for Patients and Providers Act program, in an email.

If they do not and the state later finds out about a sudden windfall or change in income , you may not only be kicked off the benefit, but the state could pursue back payment, Bauer writes.

What Counts As An Asset

Medicare Savings Programs are only open to people who qualify based on income and asset requirements. So, what counts as an asset when it comes to qualifying?

- The house you live in

- One vehicle like a car, motor home or motorcycle

- Household items

- Burial funds up to $1,500 per person

There are four types of Medicare Savings Programs designed to help with paying costs for Original Medicare or Medicare Part B. They are distinguished by their income limits and what costs they help pay for. The programs include:

- Qualified Medicare Beneficiary Program

- This program helps to pay Part A and Part B premiums and copayments. It also helps to pay deductibles and coinsurance for both Part A and Part B.

- Asingle person can qualify for the program in 2022 with an income up to $1,153 per month.

- A couple can qualify with a combined income of $1,546 per month.

- The asset limits are $8,400 for an individual and $12,600 for a couple.

- Specified Low-Income Medicare Beneficiary Program

- This program helps to pay premiums for Part B.

- A single person can qualify in 2022 with an income up to $1,379 per month.

- A couple can qualify with a combined income of $1,851 per month.

- The asset limits are $8,400 for an individual and $12,600 for a couple.

It is important to note that income limits to qualify for these programs are slightly different in Alaska and Hawaii. To learn more about the income limits in those states, see details on the Social Security Administration website.

Recommended Reading: Can I Sign Up For Medicare Before Age 65

How To Get Medicare Help For Yourself Or Someone Else

Dont be discouraged by the complexity of applying for an MSP.

The National Council on Aging has a helpful website that explains eligibility requirements for all 50 states and the District of Columbia. It will get you started.

Centers for Medicare and Medicaid Services offers a step-by-step guide to applying. It acknowledges that this process isnt simple, but urges people to apply and not give up too quickly.

In addition, the State Health Insurance Assistance Program will walk you through the process. This free government-funded service is available in every state, plus Puerto Rico, Guam, the District of Columbia, and the U.S. Virgin Islands.

It may also make sense for financially strained Medicare participants to switch plans. Study whats available carefully and see if you can find a better option. There are two times you can do that:

- Open enrollment: You can join, switch or drop a plan annually from Oct. 15 to Dec. 7. New coverage starts Jan. 1.

- Medicare Advantage open enrollment period: If you already have a Medicare Advantage Plan, every year from Jan. 1 to March 31, you can switch to a different Medicare Advantage Plan or switch to Original Medicare once during this time.

% California Working Disabled

California offers qualifying residents the 250% California Working Disabled program. To qualify, you must be working, disabled and have income too high to qualify for free Medi-Cal. If eligible, you may be able to receive Medi-Cal coverage by paying a small monthly premium, ranging from $20-$250 per month for an individual or from $30-$375 for a couple.

How to Qualify

To qualify for CWD, you must:

- Meet the medical requirements of Social Securitys definition of disability

- Be working and earning income

- Have assets worth less than $130,000 for an individual or $195,000 for a couple

- Have countable income less than 250% of the federal poverty level . These income calculations are different from those for the Medicare Savings Programs . Disability income does not count toward the 250% CWD programs income limit, including:

Recommended Reading: Are Canes Covered By Medicare

Medicare Savings Program Vs Medicaid

The Medicare Savings Program is administered by each state, often through the Medicaid office. However, it is not the same as Medicaid.

Medicaid is specifically designed for low-income families and individuals and covers medical care with little to no out-of-pocket expenses. There is no monthly premium to be on Medicaid, you qualify based on your income and assets.

The Medicare Savings Program is designed to help Medicare beneficiaries, who are disabled or over 65, pay for their out-of-pocket costs with Medicare. This may include your Part B premium, your Part A premium , and other costs.

It is possible to be eligible for both Medicare and Medicaid at the same time. These folks are known as Dual Eligible, and generally qualify for a Medicare Savings Program automatically, along with Extra Help for prescription drugs.

Get Important News & Updates

Sign up for email and/or text notices of Medicaid and other FSSA news, reminders, and other important information. When registering your email, check the category on the drop-down list to receive notices of Medicaid updates check other areas of interest on the drop-down list to receive notices for other types of FSSA updates.

Read Also: How Old To Be Covered By Medicare

How To Apply For Medicare Savings Programs

If youre eligible for Medicare and your income and resources are at or below the limit for a Medicare savings program, you can apply by contacting the Medicaid office in your state.

You should receive an update on the status of your application within 45 days. If Medicaid denies your application, you may be able to file an appeal.

Here are some steps you can take to apply for a Medicare savings program:

- Familiarize yourself with the kinds of questions you may be asked when you apply. The form is available in multiple languages.

- Before you begin applying, gather supporting documents such as your Social Security and Medicare cards, proof of your address and citizenship, bank statements, IRA or 401k statements, tax returns, Social Security awards statements, and Medicare notices.

- To apply for the a program, youll need to contact your state Medicaid office. You can check online to find your states office locations, or call Medicare at 800-MEDICARE.

- Once you submit your application, you should receive a confirmation or denial within about 45 days. If youre denied, you can request an appeal. Enrollment in any of these programs must be renewed each year.

- Reach out to your State Health Insurance Assistance Program if you have any questions or need additional assistance.

Where Do I Get These Services

- If you have QMB, you can visit any doctor who accepts both Medicare and Health First Colorado coverage.

- Visit our Find a Doctor page to search for Health First Colorado providers. Remember to ask the provider if they accept both Medicare andHealth First Colorado.

- You can also visit the Medicare website to search for Medicare providers.

Recommended Reading: Do Any Medicare Supplement Plans Cover Hearing Aids

What Is A Medicare Savings Program

Medicare Savings Programs are federally funded programs administered by the states that can help pay Medicare premiums, copayments and deductibles for qualifying individuals.

There are four separate Medicare Savings Programs, each with different eligibility requirements. Keep in mind all these programs are administered by the states, and each state can have slightly different eligibility requirements. To ensure your loved ones eligibility, check with your specific state administrator.

Qualified Disabled Working Individual

The Qualified Disabled Working Individual program is available to people who had Social Security and Medicare benefits because of a disability, but lost them because they returned to work and their earnings exceeded the allowable limit. QDWI pays for the Medicare Part A premium, but it doesnt pay for Part B.

How to Qualify

To qualify for QDWI, your monthly income cannot exceed $4,615 if you are single or $6,188 if you are part of a couple in 2022.

Note: A $20 disregard is subtracted from your monthly income . When you apply for QDWI, your eligibility worker will automatically deduct $20 from your monthly income. For some people whose income is close to the limit, this $20 disregard allows them to qualify for the program.

In addition, as of July 1, 2022, your personal assets cannot exceed $130,000 for an individual and $195,000 for a couple. Certain items are not calculated in your personal asset limit, including but not limited to the value of:

- Household goods and personal belongings

- Prepaid burial plan and burial plot

Retroactive Social Security or Supplemental Security Income benefits are also excluded for 6 months after you receive them.

You May Like: Does Medicare Cover Walking Canes

Is Other Help Available To Pay For Medicare

Another program administered by the federal government is called Extra Help, and it lowers the cost of prescription drugs through Medicare Part D.

To qualify for Extra Help, your savings, investments and real estate must be worth less than $15,510 for individuals or $30,950 for married couples. Other assets not included in the calculation include:

Qmb Slmb And Qi Programs

Assistance with Meeting the Costs of Medicare Premiums and Deductibles

The Qualified Medicare Beneficiary program , Specified Low-Income Medicare Beneficiary program , and Qualified Individual program , help Medicare beneficiaries of modest means pay all or some of Medicares cost sharing amounts . To qualify an individual must be eligible for Medicare and must meet certain income guidelines which change annually. The income guidelines, which are based on the Federal Poverty Level, change April 1 each year and can be found here.

Please note that the eligibility criteria listed below are federal standards states may have more, but not less, generous standards .

The QMB Program Provides:

- Payment of Medicare Part A monthly premiums .

- Payment of Medicare Part B monthly premiums and annual deductible.

- Payment of co-insurance and deductible amounts for services covered under both Medicare Parts A and B.

Eligibility Criteria for QMB

Note: Individuals who are eligible for Medicare Part A but not enrolled, may conditionally enroll in Medicare Part A at any time during the year and then apply for QMB to cover the cost of the Medicare Part A premium which must otherwise be paid by voluntary enrollees .This process, called the Medicare Part A buy-in is complex. For more information on the Part A buy-in see:

If an individual is enrolled in the QMB program, purchasing additional Medigap coverage for Medicare premiums, deductibles, and/or co-payments is unnecessary.

Don’t Miss: Does Medicare Pay For Biopsy

Types Of Medicare Savings Programs

There are seven kinds of MSPs. Each type of MSP is tailored to different needs and circumstances.

- Qualified Medicare Beneficiary Programs pay most out-of-pocket costs for Medicare, protecting beneficiaries from cost-sharing. These programs offer full coverage of Part B premiums. Your Part A premium will also receive coverage if you havent worked 40 quarters. Deductibles, copays, and coinsurance receive coverage contingent on the state in which the beneficiary resides. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs.

- QMB Plus refers to those who receive full Medicaid benefits, as well as all the cost-sharing coverage QMB programs offer.

How To Qualify For The 4 Medicare Savings Programs

In many cases, to qualify for a Medicare Savings Program, you must have income and resources below a certain limit, as described below. These limits go up each year.

You may still qualify for these programs even if your income or resources are higher than the limits listed. Some states dont count certain types or specific amounts of income or resources when deciding who qualifies.

You May Like: What Does Medicare Cover For Home Health Services

Qualified Medicare Beneficiary Program

Helps pay for: Part A premiums Part B premiums, deductibles, coinsurance, and copayments .

Monthly income and resource limits for 2022:

| Your situation: |

|---|

* Limits slightly higher in Alaska and Hawaii

If you qualify for the QMB program:

- Medicare providers arent allowed to bill you for services and items Medicare covers, including deductibles, coinsurance, and copayments. What to do if you get a bill

- You may get a bill for a small Medicaid copayment, if one applies.

- You’ll also get Extra Help paying for your prescription drugs. Youll pay no more than $4 in 2022 for each drug covered by your Medicare drug plan.

Medicaid For The Elderly And People With Disabilities Handbook

- Chapter Q, Medicare Savings ProgramMenu button for Chapter Q, Medicare Savings Program”>

- Q-1000, Medicare Savings Programs OverviewMenu button for Q-1000, Medicare Savings Programs Overview”>

Revision 21-1 Effective March 1, 2021

This chapter describes the Medicare Savings Programs. The Medicare Savings Programs use Medicaid funds to help eligible persons pay for all or some of their out-of-pocket Medicare expenses, such as premiums, deductibles or coinsurance.

HHSC manages the Medicare Savings Programs, which consists of the following:

- Qualified Medicare Beneficiary Program

- Specified Low-Income Medicare Beneficiary Program

- Qualifying Individual Program

- Qualified Disabled and Working Individual Program

Countable resource limits for Medicare Savings Programs are updated annually based on the Consumer Price Index. QDWI requires a person to have countable resources equal to or less than twice the limits for the SSI program to be eligible based on resources. The treatment of income and resources is based on policy in Chapter E, General Income, and Chapter F, Resources. Application and redetermination policies for Medicare Savings Programs adhere to policy and procedure in Chapter B, Applications and Redeterminations. Transfer of assets, spousal impoverishment and co-payment policy and procedures are not used in the Medicare Savings Programs.

All Medicare Savings Programs require a person to meet non-financial eligibility requirements described in Chapter D, Non-Financial.

Don’t Miss: How To Apply For Medicare In Colorado