Medicare Part B Premium For 2022

In 2022, the standard Part B premium is $170.10 per month. Most people pay the standard premium amount. Its either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

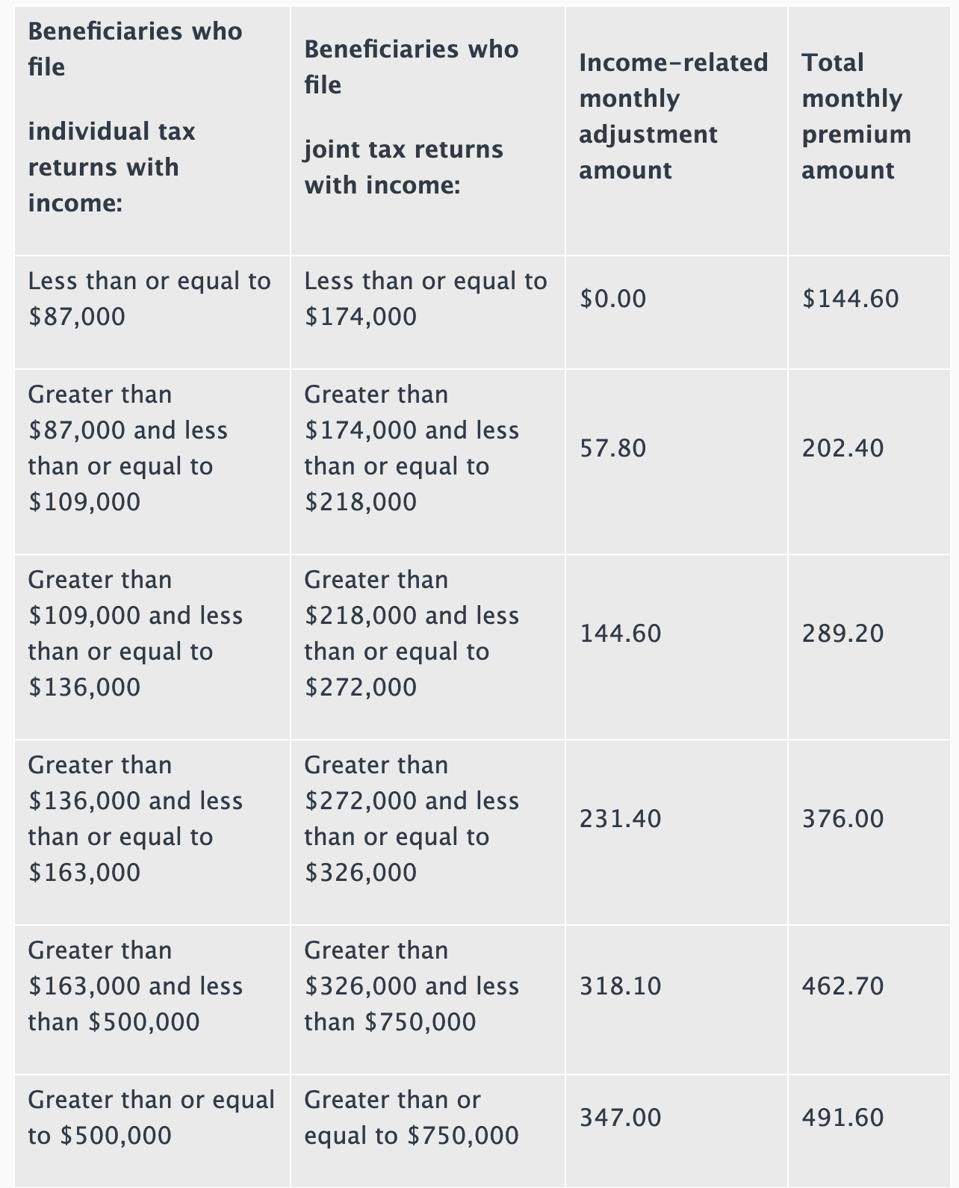

People with tax-reported incomes over $91,000 and $182,000 must pay an income-related monthly adjustment amount . The table below shows Part B premiums for 2022 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago.

Total monthly Part B premium by tax return| Filing individual tax returns | Total monthly Part B premium |

|---|---|

|

$91,000 or less |

|

|

$750,000 or more |

$578.30 |

Part B premiums for high-income beneficiaries who are married, lived with their spouse at any time during the taxable year, but who are filing separate are shown in the table below.1

Total Part B monthly premiums by tax return for married filing separately| Total monthly Part B premium |

|---|

|

$91,000 or less |

|

$578.30 |

How Do You Enroll In Original Medicare

To enroll in Original Medicare , you must be 65 and dont necessarily have to be retired. Initial enrollment period packages are sent to people 3 months before they turn 65 or during their 25th month of disability benefits.

If youve received Social Security disability benefits for 24 months, you are automatically enrolled in Part A and Part B.

Officials Say Substantial Social Security Cola Will More Than Offset The Monthly Hike

by Dena Bunis, AARP, Updated November 15, 2021

designer491 / Alamy Stock Photo

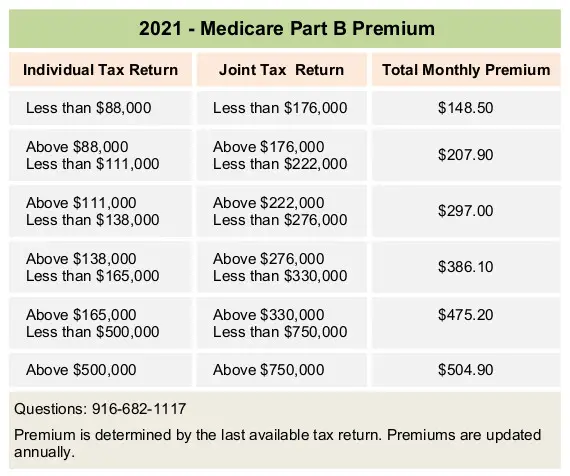

Medicare’s Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program’s history, the Centers for Medicare & Medicaid Services announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase:

CMS officials stressed that while the 14.5 percent Part B premium increase is a stiff one, the Social Security cost-of-living adjustment at 5.9 percent, the largest in 30 years – is estimated to average $92 per recipient. So even after the increase in the Medicare Part B premium, most Social Security recipients, whose Part B premiums are typically deducted from their Social Security benefits, will still see a net increase in their monthly check. The COLA goes into effect in January.

AARP Membership -Join AARP for just $9 per year when you sign up for a 5-year term

Join today and save 43% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Need Help With Medicare?

You May Like: Does Humana Medicare Cover Tdap Vaccine

How Much You’ll Save

The typical Part B savings will amount to $62.40 over the course of the year, or $5.20 a month, but seniors will receive another boost because Medicare is also lowering its Part B deductible.

Single Medicare enrollees who earn $97,000 or less are charged the standard premium, while couples who file jointly will pay the standard premium if they earn $194,000 or less.

Seniors who earn above that amount pay higher premiums. For example, a single taxpayer who earns more than $97,000 but up to $123,000 will pay $230.80 a month for Part B coverage in 2023, CMS said.

CMS said that the annual deductible for Part B will decline to $226 in 2023, down $7 from the 2022 deductible of $233.

That means seniors will be required to pay a lower out-of-pocket amount before Medicare coverage kicks in.

Overall, that will require $84 less in annual out-of-pocket spending from seniors.

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Read Also: How Much Does It Cost For Medicare Part C

B Premiums And Social Security

You cannot be expected to pay more for Medicare if there is not also a proportionate rise in Social Security benefits. The hold harmless provision of the Social Security Act protects recipients from paying higher Medicare Part B premiums if those premiums will cause their Social Security benefits to be lower than they were the year before.

Simply put, increases in Part B premiums cannot exceed the annual cost-of-living adjustment for Social Security.

In those cases, the Medicare Part B premium will be decreased to maintain the same Social Security benefit amount. However, keep in mind that the hold harmless provision does not apply to Medicare Part D. If the Medicare Part D Income-Related Monthly Adjustment Amount increases, a beneficiary may still see a decrease in their overall Social Security benefits.

Not everyone is eligible for the hold harmless provision. Only people in the lowest income category who have already been on Medicare Part B and have had their premiums directly deducted from their Social Security checks for at least two months in the past year are considered. Beneficiaries new to Medicare and people on Medicaid will be subjected to the current premium rate.

The Social Security cost-of-living adjustment for 2022 is 5.9%. This is estimated to be an additional $92 per month for the average recipient. This amount would be able to cover the rise in Medicare premiums in the new year.

For those who are dual eligible, Medicaid will pay their Medicare premiums.

When Are Medicare Premiums Due

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of billing timeline

For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

Also Check: Does Medicare Pay For Lung Cancer Screening

Medicare Part B Premiums To Decrease For The First Time In Over A Decade

The Biden administration on Tuesday announced that Medicare Part B premiums will decrease in 2023, marking the first time this cost has been lowered in more than a decade.

The Centers for Medicare & Medicaid Services announced that Medicare Part B premiums would be lowered by three percent, or $5.20, going from $170.10 a month to $164.90. The programs annual deductible will also fall by $7, from $233 to $226.

The last time Medicare Part B premiums fell was in 2012 when they went from $115.40 to $99.90 a month, a decrease of 13.4 percent.

In 2022, Medicare Part B premiums rose by 14.5 percent, one of the largest annual increases ever seen in the programs history. A major factor in this increase was the inclusion of Aduhelm, the first Alzheimers medication approved by the Food and Drug Administration in 20 years.

The drug was highly scrutinized due to questions regarding its efficacy in treating Alzheimers disease as well as its sky-high price. Aduhelm initially cost $56,000 before its manufacturer Biogen announced it was halving the price to $28,200.

Becerra said at the time that he had hoped to lower premiums during 2022, but found that there were legal and operational hurdles preventing this. With this announced decrease, the 2023 Medicare Part B premium will be 11 percent higher than the $148.50 monthly fee that was set in 2021.

Medicare Part B Coinsurance

Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

There is no limit on Part B coinsurance costs, which could add up if you have a lot of doctor visits or need other services.

With a Medicare Advantage plan, your costs will be different and may include copays for doctor visits or other services. However, your out-of-pocket costs are limited to the annual plan maximum. Once youve paid that amount, the plan pays 100 percent for Medicare-covered services through the end of the year.

If Medicare costs are a concern, you may want to take advantage of financial protection and other benefits offered by Medicare Advantage plans.

Footnote

Recommended Reading: How To Sign Up For Silver Sneakers With Medicare

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

For instance, Plan G is good for people who want very few medical bills and are willing to pay about $190 each month. This can give you peace of mind so that you wont be surprised by unexpected medical costs. However, if you expect your out-of-pocket medical costs to be less than the plans annual cost of about $2,280, then a cheaper Supplement plan may be more cost-effective.

Note that because of a recent legislation change, Plans C and F are not available for new enrollees. Below you can find a chart of the level of coverage and 2022 monthly premium ranges for all of the Medicare Supplement plans. The Medigap plan names are along the top, and on the left are the coverage categories.

| Plan A |

|---|

Read Also: How Many Medicare Credits Do I Have

Medicare Part A Premiums

Medicare calculates Part A premium costs by how long you or your spouse have paid Medicare taxes.

Here is an explanation of monthly premiums for Plan A in 2022:

If you or your spouse paid Medicare taxes for 10 years or more

$274/mo.

If you or your spouse paid Medicare taxes for more than 7.5 years but less than 10

If you paid Medicare taxes for fewer than 7.5 years

Medicare Part B Premium Discounts And Regulations

You can save some money on your monthly costs by electing to have your Part B premium payments deducted directly from your Social Security checks.

Youll have to pay the standard premium if you are enrolling in Medicare Part B for the first time. Other reasons you might have to pay the standard Part B premium amount include:

- You do not receive Social Security Benefits

- Medicaid pays your monthly Part B coverage

- You choose to be billed directly for your Part B premiums

In most cases, you will pay a late enrollment penalty if you do not sign up for Medicare Part B when you are first eligible. This penalty will be enforced for the rest of the time that you receive Part B coverage, and could increase by up to 10 percent for each 12-month period that you didnt enroll in Part B once you became eligible.

Recommended Reading: Do You Have To Pay A Premium For Medicare

Read Also: How To Add Medicare Part B

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.coms The Best States for Medicare report.

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christians passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

Relief After Big Premium Increase

A key driver of the 2022 hike was a projected jump in spending due to a costly new drug for Alzheimers disease, Aduhelm. However, since then, Aduhelms manufacturer has cut the price and CMS limited coverage of the drug. The agency said it would factor the lower-than-forecast spending into the 2023 premium.

Also, spending was lower than projected on other Part B items and services, which resulted in much larger reserves in the Part B trust fund, allowing the agency to limit future premium increases.

The annual deductible for Medicare Part B beneficiaries will be $226 next year, a decrease of $7 from 2022.

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment and certain other medical and health services not covered by Medicare Part A.

One of the benefits of the Inflation Reduction Act, which Congress passed in August, will also kick in next year for Medicare beneficiaries. Starting July 1, cost-sharing will be capped at $35 for a one-month supply of covered insulin. Also, people with Medicare who take insulin through a pump wont have to pay a deductible. This benefit will be available to people with pumps supplied through the durable medical equipment benefit under Part B.

For 2022, seniors received a 5.9% increase, the largest in decades, but it was quickly overrun by soaring price increases.

CNNs Allie Malloy and Maegan Vazquez contributed to this report.

Read Also: What Are The Four Different Parts Of Medicare

What Does Part A Cost

With Medicare Part A, you may have to pay copays and deductibles for hospital stays, but may not have to pay a monthly premium. Copays and deductibles apply to hospital benefit periods, which start when you enter a hospital or skilled nursing facility, and end 60 days after youve left the facility . Its important to note that:

- For each hospital benefit period, you pay a deductible.

- You pay a copay if youve stayed in a hospital for more than 60 days.

- Theres no deductible or copayment for home health care or hospice care.

For many people, Part A comes without a monthly premium. You may have no monthly premium if you paid a certain amount toward Medicare taxes while working. In this case, you are often automatically enrolled in premium-free Part A.

If you dont automatically get premium-free Part A, you may be able to buy it if you :

- Are age 65 or older and allowed to Part B to meet the citizenship and residency requirements.

- Are under age 65 and are disabled but no longer get premium-free Part A because you returned to work.

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Also Check: How To Get Free Medicare