Enrolling In A Medigap Plan

You have the right to buy a Medigap policy only at certain times.

- Starting the month you turn 65 and are enrolled in Part B, you have an open enrollment period to sign up for any Medigap plan available in your state.

- If you are 65 or older, you have a guaranteed issue right to enroll in certain Medigap polices within 63 days of losing certain types of coverage, such as a retiree health plan or a Medicare Advantage plan.

These are the federal open enrollment periods. Some states have much broader open enrollment periods. Check with your states department of insurance for more information about enrollment rules in your state.

Federal law does not require Medigap insurers to sell Medigap policies to Medicare beneficiaries under age 65 however, some states do require insurers to sell Medigap policies to beneficiaries under age 65. If you are under 65, check with your states department of insurance or State Health Insurance Assistance Program for more information.

What Age Does Medicare Start

For most, Original Medicare coverage starts when you turn 65. However, some delay enrollment to remain on an employer plan or become eligible before age 65 due to disability. Others may take zero-premium Medicare Part A at 65 and delay Part B until a future date due to creditable coverage.

Hence, there are several possibilities for when one starts Medicare. Therefore, knowing which route works best in your situation is vital.

In some cases, you may qualify for Medicare before age 65. If someone receives Social Security Disability Income benefits for at least 24 months, they are eligible for Medicare. Additionally, those with end-stage renal disease or amyotrophic lateral sclerosis are eligible for Medicare with no need to meet the 24-month benchmark.

No matter when or how you become eligible for Original Medicare, you must ensure you understand how the benefits work and when your coverage begins.

How Does It Work

Supplementary health and dental insurance policies are contracts between you and an insurance company. You agree to pay a yearly or monthly fee called a premium, and the company agrees to pay the benefits which are covered under your policy. Your policy will outline what is included and what is not.

Here are some common features of supplementary health and dental insurance:

- Most policies do not cover 100 per cent of your medical expenses. You may have to pay some of the medical expenses you and your dependants incur. This is known as the deductible. Each policy is structured differently and you might have family deductibles or per service deductibles .

- Some plans have a co-insurance feature in addition to the deductible. That means you have to pay a percentage, or co-insure, the medical expenses on top of your deductible. It could be 10 per cent of the eligible medical expense, or higher, and it may depend on the type of medical service required.

- You may also have dollar or percentage limits, or maximums placed on the amount of benefits that you can receive. Maximums can apply to specific health benefits like eyeglasses or massage therapy sessions in a specified period typically a year, or during your lifetime.

Dont Miss: Veteran Owned Business Tax Benefits

You May Like: Do I Really Need Medicare Part B

How To Determine Whether You Qualify For Ssdi

Before considering your healthcare options, the first step to getting on the right path is determining whether you qualify for disability benefits.

Most likely, you have already started trying to figure out if youre eligible.

What you may be finding is that theres a lot of information to parse through. Unfortunately, the listings of impairments was written for legal professionals and Social Security disability case workers. The listings often use complicated language to describe the requirements for eligible medical conditions.

For someone who isnt used to dealing with legal language and technical terms, verifying whether your disability is considered severe enough using the listings can quickly get overwhelming.

The easiest way to determine your eligibility is to get an online disability case evaluation from a legal professional. Once you determine whether youre eligible for SSDI or SSI, you will know whether you qualify for Medicare.

Remember, if you qualify for SSDI, you also qualify for Medicare.

At BenefitsClaim.com we offer a disability case evaluation for free. There are no up-front costs, retainers, or fees for the evaluation. It really is free. All you need to do is take our 1-minute survey and leave your contact information. Someone from our team will be in touch with you to help you get started.

Exclusions And Limitations Of Medi

There are some limitations and exclusions that go along with the Medi-Share program.

- Covered services must be approved and covered by Medicare.

- Services not approved by Medicare while out of the country, except for Urgent care

You May Like: Will Medicare Cover Lasik Surgery

What Is The Downside To Medigap Plans

There’s one disadvantage with Medigap plans: high monthly premiums. It is necessary to find various plans. There is a minimum requirement for prescription insurance .

For your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you’ll each have to buy separate policies. You can buy a Medigap policy from any insurance company that’s licensed in your state to sell one.

It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

Core Benefits For Medicare Supplement Policies

Lindsay MalzoneReviewed by: Rodolfo MarreroHomeFAQsMedigap

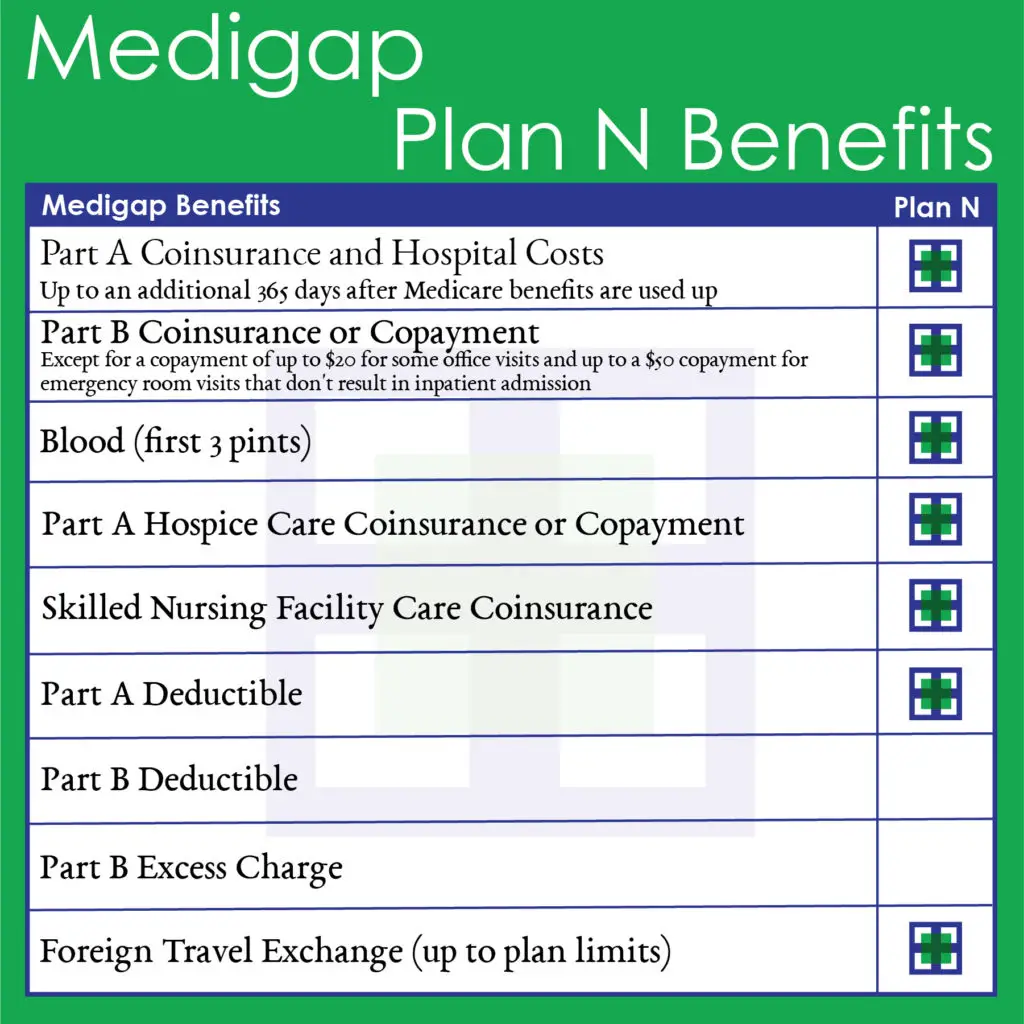

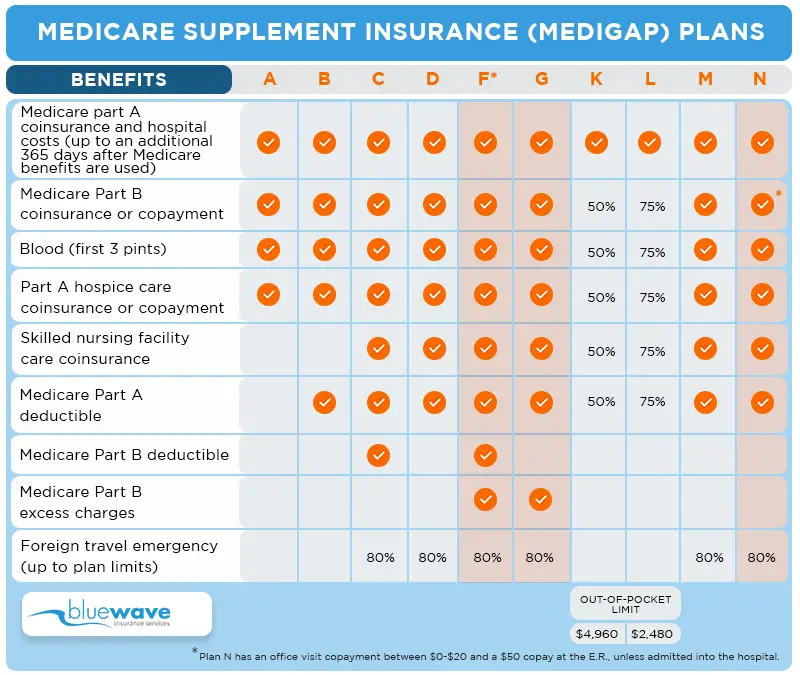

Medicare Supplement policies are standardized plans sold by private insurance companies the federal government requires companies to cover core benefits on all Medigap plans. So, no matter which option you choose, there are guaranteed benefits. Lets dive deep into the Medicare benefits you can expect to have coverage through Medigap insurance.

You May Like: Does Medicare Payment Come Out Of Social Security Check

What If You Still Work

Theres a limited period of time during which you can receive SSDI benefits and work, but you can continue to receive Medicare benefits even once disability payments have stopped. This is known as the extended period of Medicare coverage, and it allows you to keep your Medicare coverage for at least 93 months after you have completed your trial work period.

Trial Work Period

There are three timeframes to understand. The first, the trial work period, is a nine-month period during which you can test your ability to work and still receive full SSDI and Medicare benefits. The nine months dont have to be consecutive, and a qualifying month is one during which you earned at least $1,050 in 2023. The trial period continues until you have worked for nine months within a 60-month long period.

Extended Period of Eligibility

Once those nine months are up, you move into the next time framethe extended period of eligibility. For the next 36 months, you can still receive SSDI in any month you arent earning substantial gainful activity income. Plus, you receive a 3-month grace period the first time you earn SGA-level income, during which youre still paid SSDI benefits. The 2023 monthly SGA amount is $1,470 if you arent blind $2,460 if you are. Youll continue to receive Medicare benefits regardless of income.

Extended Period of Medicare Coverage

Recommended Reading: What Is Medicare Give Back Benefit

About Medicare Supplement Plans

Summary: Medicare Supplement Insurance plans help cover your out-of-pocket Medicare costs. There are 10 Medicare Supplement plans that may be available to you, each providing different level of benefits.

Find affordable Medicare plans in your area

Do you have Original Medicare for your Medicare coverage? You may want to know about the added protection available with Medicare Supplement plans. Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency.

Medicare Supplement plans help cover those out-of-pocket Medicare costs so its easier to budget for your health care. Heres what to know so you can make an informed decision.

You May Like: Does Medicare Cover In Home Care For Seniors

What Does Medicare Supplement Plan A Cover

Plan A of Medicare Supplement Insurance pays for all of the following: Coinsurance payments under Medicare Part A for inpatient hospital treatment for up to an extra 365 days after Medicare benefits have been exhausted. Copayments or coinsurance for Medicare Part B. A medical procedures initial three quarts of blood.

What Are The Benefits Of Medicare Supplement Plans

Medicare supplement plans help you reduce the need for healthcare expenses. According to Jacobson, cost-sharing has helped to make it easy for people to get care without worrying that they owe money every time they visit their doctor. It’s possible to go anywhere you wish. I’ve seen almost every doctor.. For instance in Arizona, you could fly to Minnesota and see the Mayo Clinic. Jacobson says the benefit is more important for those who are sick.

Read Also: What Is A Medicare Ppo Plan

How Do I Enroll In A Medicare Supplement Plan

Medicare Supplement Insurance plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare . These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health. Information about the Medicare supplement plans sold in North Carolina is available from SHIIP by calling us toll-free at 1-855-408-1212.

Use our free tool to find estimated premium rates.

Which Renewal Provision Must All Medicare Supplement Policies Contain Quizlet

What should a continuance provision include? Any reservation by the issuer of the right to adjust premiums, as well as any automatic renewal premium increases depending on the policyholders age, must be included in the continuation clause. The provisions must be labeled and appear on the policys first page.

Recommended Reading: Do You Get Medicare At 65

Which Companies Sell Medicare Supplement Insurance In Indiana

Companies must be approved by IDOI in order to sell Medicare Supplement policies. All of the companies listed below have been approved by the state. The plans are labeled with a letter, A through J. Not all companies sell all ten plans. Following each company name and phone number, we have listed the Medicare Supplement plans sold by that company based on the following categories:

- Medicare Supplements for Persons 65 and Older

- Medicare Supplements for Persons Under 65 and Disabled

- Medicare SELECT Insurance Companies

What Is The Average Cost Of Medicare Supplement Insurance

The monthly premium for the Medicare Supplement is estimated to be $150 or $200, depending on the country you reside in and the insurance company you are using. Just as Medicare is good for shopping – 65-year-of-age people will have the opportunity to save up to $840 per year on the Medicare Supplement Plan, or $648 per year for the plan N in a state where the lowest-cost is the most common. We continue to explore ways to improve the efficiency of private insurance programs and health coverage, she said.

Also Check: What Is Covered Under Medicare Part B

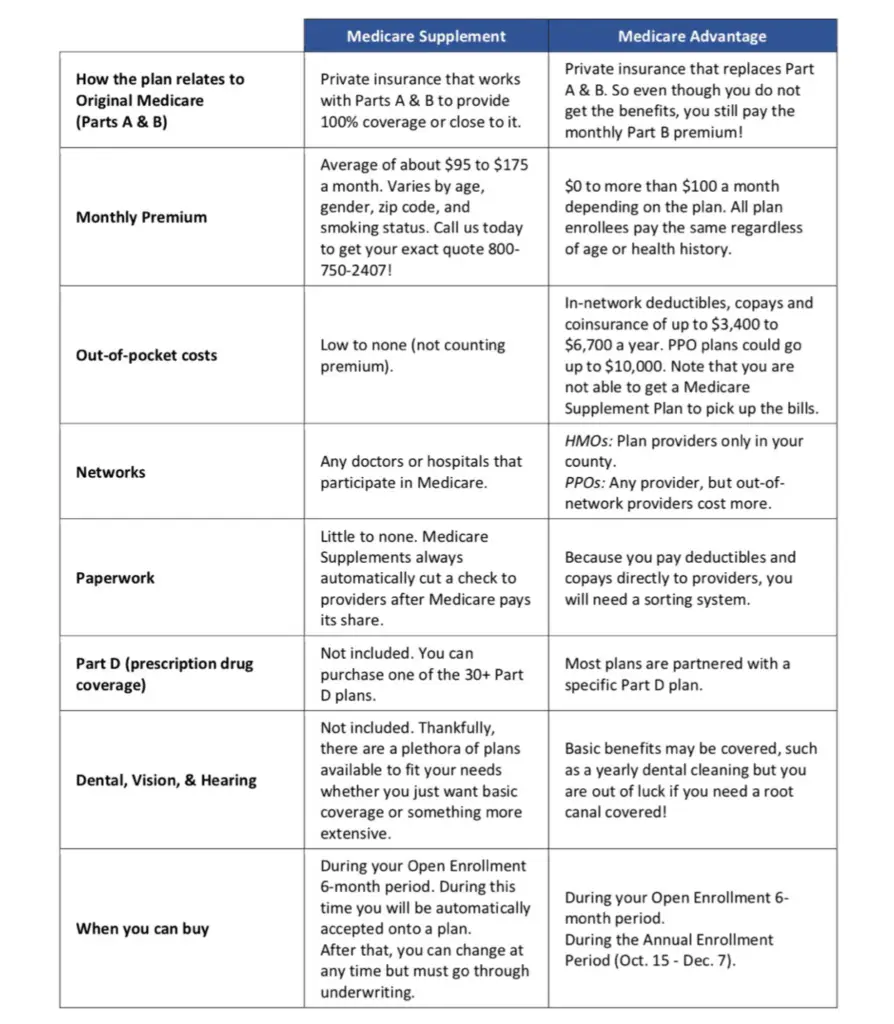

Medicare Advantage Vs Medigap

If it isn’t available, you can buy another Medigap policy. The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a Medicare Drug Plan Part D adds prescription drug coverage to: Original Medicare Some Medicare Cost Plans Some Medicare Private-Fee-for-Service Plans Medicare Medical Savings Account Plans These plans are offered by insuranceWhat’s the difference between Medicare Advantage and Medigap?

There are only two kinds of insurance, you must learn the basic structure of each. The biggest difference between Medigap and Medicare Advantage is that you have free access to doctors that offer Medicare while Medicare Advantage allows patients to receive care through their network of medical providers. Tell me the important part.

Dropping Your Entire Medigap Policy

You may want a completely different Medigap policy . Or, you might decide to switch to a Medicare Advantage Plan that offers prescription drug coverage.

If you decide to drop your entire Medigap policy, you need to be careful about the timing. When you join a new Medicare drug plan, you pay a late enrollment penalty if one of these applies:

- You drop your entire Medigap policy and the drug coverage wasn’t creditable prescription drug coverage

- You go 63 days or more in a row before your new Medicare drug coverage begins

Read Also: Which Cgm Is Covered By Medicare

Services Medicare Doesnt Cover

Though Medicare can be a huge help in covering home health care, it doesnt cover everything. Here are some of the services that arent included as part of these benefits:

- Around-the-clock care

- Personal care services if you dont also require skilled medical care or therapy

- Homemaking services if you dont also require skilled medical care or therapy.

Before your care starts, your Medicare-certified home health agency should present you with a breakdown of the charges and what Medicare will pay. This notice should also include how much youll be required to pay out of pocket.

You May Like: Extra Social Security Benefits For Vets

What Is Supplementary Health And Dental Insurance

If you live in Ontario, you are probably covered under the government-funded Ontario Health Insurance Plan . When you are approved for OHIP, youll get an Ontario health card which enables you to go to a doctor, clinic, hospital or emergency room, and receive medical attention, tests and surgeries at no cost to you.

But OHIP only partially covers or doesnt cover some medical services like prescription drugs and vision care, and it does not cover dental care. To pay for medical needs and dental care that OHIP doesnt cover, you may want to consider purchasing supplementary health insurance also known as extended health insurance, or private health insurance, and supplementary dental insurance.

You might have supplementary health and dental insurance through your employer, known as group insurance, or you may decide to buy your own policies, known as individual insurance. Supplementary health and dental insurance is a way to get the medical services you need, at an affordable price. To find out more about the different types of supplementary health and dental insurance, visit Types of Supplementary Health and Dental Insurance.

Also Check: Does Medicare Start The Month Of Your Birthday

Medicare Supplement Or Medicare Advantage

The Medicare Supplement is the most common plan, but not the most. Tell me the difference between these options.

Anthem Blue Cross Life and Health Insurance Company has contracted with the Centers for Medicare & Medicaid Services to offer the Medicare Prescription Drug Plans noted above or herein. Anthem is the state-licensed, risk-bearing entity offering these plans. Anthem has retained the services of its related companies and authorized.

What Is Social Security

Social Security is the most successful anti-poverty program in our countrys history, according to the SSA. President Franklin D. Roosevelt signed the Social Security Act into law in 1935 as a retirement program for workers. It was part of the historic New Deal, and the first lump-sum payments were made in 1937.

Payments for workers survivors were added by Congress in 1939 and regular monthly checks started in 1940. Disability benefits were added in 1956.

Todays workers pay Social Security taxes into the program, and the money is disbursed as monthly income to beneficiaries in a pay-as-you-go system, according to the National Academy of Social Insurance.

One in five Americans receives benefits, including more than 47 million retired workers and dependents, 10 million disabled workers and dependents, and 6 million survivors of deceased workers.

You May Like: Does Medicare Coverage Work Overseas

Your Medicare Supplement Options

If you are already on Medicare Supplement plans, you may be referred to Medicare Supplement. You can open enrollment for 6 months from when you reach age 62. During the open enrollment period of the Medicare Supplement, you cannot get any coverage for any prior medical condition. Not all states permit insurance for health coverage, and some states offer plans for those under age 65. Medicare Supplement insurance gives you access to all doctors who treat Medicare patients. Anthem’s Medicare Supplement plan covers Part B- 100% coinsurance.