How Much Do Part A Premiums Cost

If you paid Medicare taxes for under 30 quarters, the Part A premium is $499 in 2022. Those who paid Medicare taxes for 30 to 39 quarters will pay $274 per month in premiums. Please note that, if you have to pay monthly Medicare premiums, you cannot qualify for Social Security benefits. In that case, you will not have to worry about money being taken out for now.

Can I Get Other Medicare Monthly Premiums Withheld From Social Security

If you are signed up for both Social Security and Medicare Part B , the SSA will automatically deduct the Part B premium from your monthly benefit. You do not have to do anything to enroll in the automatic deduction.

If you are enrolled in Part B but not collecting Social Security, youll be billed quarterly by Medicare and must pay electronically or by mail.

What Is Deducted From Your Monthly Social Security Check

- Score4.2/5

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted.Read more

-

Are Medicare Premiums Deducted From Social Security?

Watch Youtube video

Don’t Miss: Does Medicare Cover Nursing Home Care

When Are Your Payment Days If You Filed For Benefits Beforemay 1 1997

Social Security payments are usually dated and delivered onthe third day of the month following the month for which the paymentis due. For example, payments for January are delivered on February3. If the third of the month is a Saturday, Sunday or Federal holiday,payments are dated and delivered on the first day preceding the thirdof the month which is not a Saturday, Sunday, or Federal holiday.For example, if the third is a Saturday or Sunday, payments are deliveredon the preceding Friday.

Groups Not Covered By The Hold

Several groups are not covered by the hold-harmless provision. The following groups may receive reduced Social Security benefit payments due to Medicare premium increases that are greater than the Social Security COLA:

- New enrollees to either Medicare or Social Security 63

- Medicare Part B enrollees who do not receive Social Security benefits

- High-income individuals who pay income-related Medicare Part B premiums

- Low-income beneficiaries who are in a Medicare Savings Program .

Medicare Part B enrollees who do not receive Social Security may include individuals who spent their careers in employment that was not covered by Social Security, including certain federal, state, and local government workers. This includes civilian federal employees who were hired before 1984 and are receiving Civil Service Retirement System benefits. Although CSRS benefits are increased annually by the same COLA applied to Social Security benefits, the benefits are not Social Security benefits and thus its beneficiaries are not protected under the hold-harmless provision.64

Also Check: Does Medicare Cover Eylea Injections

What Are The Differences Between Medicare And Social Security

When you retire or go on disability, you get a Social Security check. The Social Security Administration will determine Medicare eligibility and handle some of Medicares administrative work, like enrollment. While these programs serve different purposes, both programs are funded through payroll taxes, provide benefits to those eligible, and help people with certain disabilities. While they are different programs, the National Committee to preserve Social Security and Medicare helps to keep both programs protected.

Will You Get Part A Coverage Immediately With Social Security

Those under age 65 on disability will get benefits from Part A automatically and immediately if they have Amyotrophic Lateral Sclerosis. Otherwise, those on disability will begin Part A benefits after 24 months of collecting benefits. Those turning 65 that plan to obtain Social Security at 65 can have the effective dates for both coincide.

The situation is personal to each individual. So, if you want to work after age 65, you could delay benefits depending on the size of your employer.

You May Like: Is Trelegy Ellipta Covered By Medicare

Medicare Part D Premiums

Each year, the Medicare Part D base premium is set at 25.5% of the expected per capita costs for standard prescription drug coverage.49 Beneficiary premiums are based on average bids submitted by participating drug plans for basic benefits each year and are adjusted to reflect the difference between the standardized bid amount of the plan the beneficiary enrolls in and the nationwide average bid. The actual cost of coverage and premiums, however, varies by plan. Medicare Part D enrollees may pay premiums to their plans directly or may have premiums automatically deducted from their Social Security benefits.50

In 2018, the Medicare Part D base premium is $35.02.51 However, as noted, actual premiums vary by plan and the average Medicare Part D premium, weighted for enrollment, is $41.00.52

Is Social Security Getting A Fourth Stimulus Check

While it does not include a stimulus check for those on Social Security it does include some benefits for seniors. These include the expansion of Medicare to include hearing services, and provisions that will grant the government power to negotiate a limited about of drug prices with pharmaceutical companies each year.

Read Also: Does Medicare Cover Miracle Ear

How Much Is Deducted From Social Security For Medicare Part A

For most people, Medicare Part A hospital insurance is premium-free. This doesnt mean it is actually free, because you still have to pay your deductible, co-insurance, and other out-of-pocket costs. However, you will have no monthly premium fees if you qualify.

You are eligible to receive premium-free Part A coverage at age 65 if:

- You or your spouse paid Medicare taxes for ten years or longer

- You already receive Social Security retirement benefits or Railroad Retirement Board benefits

- You are eligible for these benefits but havent yet received them

- You or your spouse had Medicare-covered employment through the government

You can also get premium-free Part A if you are under 65. This will happen if you have received Social Security or Railroad Retirement Board disability benefits for over 24 months, or if you have end-stage renal disease and meet certain other qualifications.

Part A is paid for through income taxes that you pay for while you work. This is why the amount of years that you paid this tax is used to determine how much you pay in premiums.

Medicare Premiums Shrank Your Social Security Check

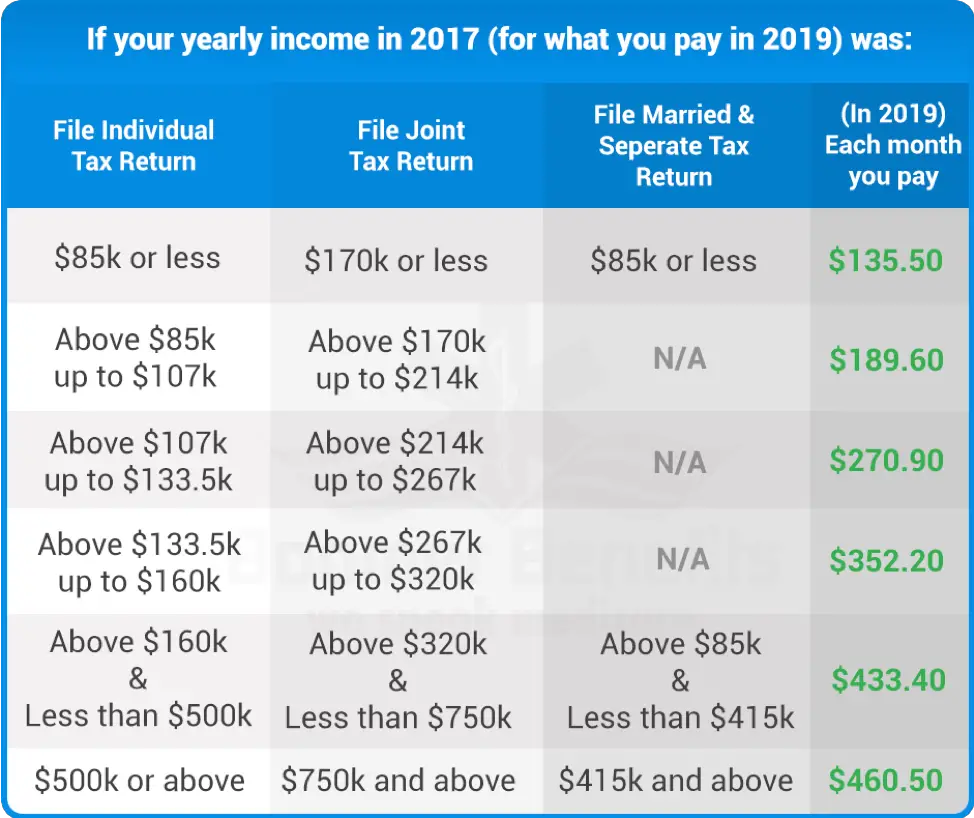

You are eligible to enroll in Medicare the year when you turn 65. If you sign up for Medicare Part B, your premiums are deducted from your Social Security benefits. The standard monthly premium for Medicare Part B enrollees is $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. However, its entirely possible that you could end up paying more if you fall into a higher tax bracket.

If you file an individual return and your income was higher than $88,000 but less than $111,000, then you paid $207.90 in 2021. If your income ranged from $111,000 to $138,000, then you paid $297. And if its more than $500,000, then the premium came to $504.90.

And in 2022, single filers with income greater than $91,000 and less than or equal to $114,000 pay $238.10 monthly. If their income is greater than $114,000 and less than or equal to $142,000, they pay $340.20. If it’s between $142,000 and $170,000, the premium is $442.30. For income between $170,000 and $500,000, the premium rises to $544.30. And if its more than $500,000, then the premium comes to $578.30.

If your income has recently dropped, you may appeal to the SSA for a lower premium. The IRS may be providing the SSA with older data that needs to be updated, says James B. Twining, CFP, founder, and CEO of Financial Plan Inc.

For certain high-income earners, Medicare premiums are equivalent to 35%, 50%, 65%, 80%, or even 85% of the total cost of coverage.

Don’t Miss: Does Medicare Pay For Medical Alert Bracelets

Why Medicare Deduction Is On Pay Check Stub

- Copy Link URLCopied!

Q: Can you explain Medicare deduction on my paycheck? I cant figure out what it is.F. C.

A: Many employers are separately itemizing payroll deductions for Social Security and Medicare, rather than lumping them together as a single Social Security deduction. Why? Because beginning this year, Medicare taxes will be assessed on earnings up to $125,000 per year, nearly twice the $53,400 subject to Social Security taxes.

Heres whats happening: Since 1967, when the Medicare program was established, a portion of our Social Security taxes has gone to pay for it every year. This year, of the 7.65% payroll tax employees and employers each contribute to Social Security, 6.2% is strictly for Social Security while the remaining 1.45% is for Medicare. It was easier just to lump the taxes together under the general heading of Social Security when the taxes were applied evenly to earnings.

However, beginning this year, the amount of earnings subject to the 1.45% Medicare tax is nearly twice as high as those subject to the 6.2% Social Security tax. Many companies have decided to show the two taxes individually because they are levied separately.

For some workers this distinction wont matter because they dont earn more than the $53,400 that is subject to both taxes. But for wage earners in higher income brackets, the Medicare tax will continue long after the Social Security tax is satisfied.

There Are Ways to Give Without Reporting It

People Enrolled In Both Social Security And Medicare Have Their Premiums Automatically Deducted From Their Monthly Check

If you receive Medicare health insurance benefits and Social Security retirement benefits at the same time, you can have your Medicare premiums automatically deducted from your Social Security check each month. This can save a lot of time and energy, as you wont have to worry about paying your premiums manually. This option is available for every part of Medicare, including private plans like Medicare Advantage and Medicare Part D.

This article explains everything you need to know to understand how much will be deducted from your Social Security benefits.

You May Like: Is Unitedhealthcare A Medicare Advantage Plan

Don’t Miss: How Is Medicare Part B Penalty Calculated

What Insurance Do You Get With Social Security Disability

In most cases, people receiving Social Security Disability Income are automatically enrolled in Original Medicare after serving a 24-month waiting period.

The CMS waives this waiting period for people with ALS or end-stage renal disease. People with these conditions receive Medicare coverage as soon as they collect SSDI.

How Does Automatic Enrolling In Medicare Work

Most people who collect Social Security benefits automatically receive Original Medicare coverage once they’re eligible.

If you receive benefits through the Railroad Retirement Board , youll receive the same Medicare coverage.

Youll become eligible for Medicare when one of the following events occur:

- You turn 65

- You have end-stage renal disease

- You have Lou Gehrig’s Disease, amyotrophic lateral sclerosis

- You have been on Social Security disability insurance for 24 months and have a qualifying condition. These include heart and lung issues, neurological disorders, cancer, kidney dysfunction and other severe health problems.

If you live in Puerto Rico and receive Social Security or RRB benefits, youll only become automatically enrolled in Medicare Part A. If you want Medicare Part B, youll need to apply for coverage.

Those receiving Social Security benefits who also qualify for both Medicare and Medicaid will also be awarded Medicare Part D prescription drug coverage automatically. If you don’t qualify for Medicare and Medicaid, you’ll need to compare Part D prescription drug plans or Medicare Advantage plans that include Part D coverage and enroll in a plan available where you live.

Read Also: How Do I Pay Medicare Premiums

Deductions Only Allowed From Final Paychecks

Except for the deductions listed above, any deductions from final paychecks may not take the employees final paycheck below the minimum wage.

The following deductions are allowed only when there is an oral or written agreement between the employee and employer and the incidents described occurred during the final pay period:

- For covering a cash shortage in the till if the business has established policies regarding cash acceptance, the employee has sole access to the till, and the employee counted the cash at the start and end of the shift.

- For covering the cost of a lost or damaged equipment if the equipment damage or loss can be shown to be caused by the employees dishonest or willful act.

- For acceptance of a bad check or credit card purchase if the business already has policies for check and credit card acceptance at the time of the incident.

- For worker theft if the employees actions are shown to be dishonest or willful and the employer files a police report.

It is the employers responsibility to prove the employees alleged actions and the existence of any policy, agreement, or procedure.

Employers should notify employees of all, policies, agreements, and procedures for final paycheck deductions. These policies should be made in writing and signed by employees.

Some American College Students

American college and university students who work part-time at their schools may also qualify for an exemption from Social Security tax. The job must be contingent on the students full-time enrollment at the college or university or half-time status if in the last semester or trimester.

“Students who are employed by a school, college, or university where the student is pursuing a course of study are exempt from paying FICA taxes as long as their relationship with the school, college, or university is student, meaning education is predominantly the relationship, not employment,” says Alina Parizianu, CFP®, MBA, who as of 2021 was a financial planning specialist for MMBPB Financial Services in New York.

Income beyond a certain level isn’t subject to Social Security tax, but Medicare tax applies to all income.

Also Check: Is It Mandatory To Have Medicare Part D

Do You Automatically Get Medicare With Social Security

Medicare and Social Security are two benefits programs managed by the United States government. Medicare currently has over 61 million beneficiaries.

Both federal initiatives are linked, meaning that many individuals receiving Social Security payments may automatically receive Medicare benefits once they qualify for Medicare based on age or disability.

In this article we review how people can receive Medicare health insurance coverage alongside their Social Security benefits.

What Is Part A Medicare

Premium-free Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called premium-free Part A. Most people get premium-free Part A.

Dont Miss: What Brand Of Diabetic Test Strips Does Medicare Cover

Don’t Miss: Will Medicare Pay For An Inversion Table

Why Did I Get Extra Money From Social Security

The extra payment compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments will be made. … Most Social Security beneficiaries and SSI recipients had a shortfall as a result of the CPI error.

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

Read Also: When Will I Get Medicare

Earn Ssa Work Credits In Some Countries

You may not have enough credits from your work in the United States to qualify for retirement benefits. But, you may be able to count your work credits from another country. The SSA has agreements with 24 countries. If you earned credits in one of those countries, they can help you qualify for U.S. benefits.

How Do I Know If I Will Have Money Taken Out Of My Social Security Check

If you receive Social Security retirement benefits, your Medicare benefits will be deducted automatically. This means that you do not have to do anything to make this happen it will be automatic when you enroll in Medicare.

If you sign up for Original Medicare during your Initial Enrollment Period and already receive Social Security retirement benefits, you should not expect to receive a bill for your premiums. Instead, your Social Security benefit will be smaller, since the money is taken from there.

If you want to find out for sure whether this applies to you, your best bet is to contact the Social Security Administration . They will look up your current status to determine whether payments will be taken out automatically.

Don’t Miss: How To Disenroll From A Medicare Advantage Plan

What Does Medicare Mean On My Paycheck

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act are to support both your Social Security and Medicare benefits programs. Your employer makes a matching contribution to the Medicare program.

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer. The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 and 2.90 percent regardless of the total amount you have earned. The benefit of placing funds into this program during your working career is the healthcare coverage you will receive at the time you become eligible for Medicare benefits.

Who Pays for Medicare?Every person who receives a paycheck is paying a Medicare tax. If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax. If you are self-employed, you are required to pay both the employee and employer tax for Medicare.

Related articles: