How Can I Be Eligible For Medicare Part D

Not everyone on Medicare is eligible for Medicare Part D coverage.To be eligible for Medicare Part D plan coverage, you must first meet specific requirements to enroll in a Medicare Part D plan. Medicare Part D eligibility requires you first to enroll in Original Medicare.

You may also find that you are dual eligible for Medicare and Medicaid. In this case, you can enroll in Medicare Part D.

Get A Free Quote

Find the most affordable Medicare Plan in your area

However, if you are enrolled in a Medicare Advantage plan that offers prescription drug coverage, you will be ineligible to enroll in a stand-alone Medicare Part D plan.

Tricare Is Creditable Coverage

TRICARE is creditable prescription drug coverageCoverage that pays at least as much as Medicares standard prescription drug coverage.. This means you wont pay extra if you decide to enroll in a Medicare prescription drug plan after your Initial Enrollment Period.

When you become eligible for Medicare Part D:

- Youll receive a letter in the mail.

- It will explain how your TRICARE prescription drug plan works with Medicare Part D.

- Please keep this letter for your records.

- You may need it to show that you dont have to pay extra if you decide to enroll in Medicare Part D.

-

Easy-to-understand information about each plan type

-

Opportunities for gap coverage for some prescription medications

-

Plans with a $0 copay and $0 deductible available

-

Premiums can be a bit pricey

-

Choice Plan deductibles for Tier 3 prescription drugs and above can have higher deductibles, ranging from $205 to $445

Aetna offers a straightforward breakdown of plans: SilverScript Smart Rx, SilverScript Choice and SilverScript Plus. The Smart Rx Plan is the lowest-priced of all plans, with the highest deductibles. The Choice Plan offers lower premiums but has moderately expensive deductible ranges. The Plus Plan offers a range of roughly double the cost of the Choice plan for monthly premiums, but with the promise of a $0 deductible for all levels of prescription medication .

Recent Articles And Updates

For older articles, please see our article archive.

References

The 2010 Medicare Part D $250 Donut Hole Rebate. Q1Group LLC, .

2020 Part D Income-Related Monthly Premium Adjustment. . .

2021 Medicare Part D Outlook. Q1Group LLC, .

2021 Part D Income-Related Monthly Premium Adjustment. . .

How Do Medicare Advantage Ppo Plans Work? Healthline Media, May 5, 2021, .

Analysis of Part D Beneficiary Access to Preferred Cost Sharing Pharmacies . . .

Announcement of Calendar Year 2021 Medicare Advantage Capitation Rates and Part C and Part D Payment Policies. . .

Assistance with Paying for Prescription Drugs. Center for Medicare Advocacy, November 30, 2015, .

How Medicare Part D Works. AARP, October 2016, .

Medicare Advantage Special Needs Plans . Healthline Media, May 3, 2021, .

Kirchhoff, Suzanne M. Medicare Coverage of End-Stage Renal Disease . . .

Also Check: Does Medicare Pay For Hospitalization

D Enrollment Is Concentrated In 3 National Firms Unitedhealth Humana And Cvs Which Have A Combined 56% Of Total Enrollment

The top three firms UnitedHealth, Humana, and CVS Health cover close to 6 in 10 of all beneficiaries enrolled in Part D in 2021 , while the top five firms including Centene and Cigna account for three-quarters of Part D enrollment . With the exception of Kaiser Permanente, which exclusively offers MA plans, the top Part D plan sponsors offer both stand-alone PDPs and MA-PDs. For most firms, Part D enrollment is more concentrated in one market than the other for example, CVS Health, Centene, and Cigna have greater enrollment in PDPs than MA-PDs .

Medicare Part C And Va Benefits

If you need additional services or coverage not offered to you through your VA benefits, you may consider a Medicare Advantage plan. Most Medicare Advantage plans offer additional coverage, like vision, hearing, dental, prescription drug coverage, and/or health and wellness programs. These services are usually offered through your VA benefits too, however, a Medicare Advantage plan might be a better choice depending on the facility locations and your travel needs. Learn more about Medicare Part C.

Also Check: How Much Is Medicare B

Don’t Miss: What Is A Medicare Discount Card

What To Do If Your Drug Isnt Covered

If you have trouble getting the medication that you want covered, you may be able to appeal. You and your doctor can submit a formal request for an exception to a drug coverage rule. For example, you could send a request to get coverage for a drug thats not in your formulary. You could also send a request to waive a step therapy requirement to use a lower-tier drug.6

Issues For The Future

The Medicare drug benefit has helped to reduce out-of-pocket drug spending for enrollees, which is especially important to those with modest incomes or very high drug costs. But in the face of rising drug prices, more plans charging coinsurance rather than flat copayments for covered brand-name drugs, and annual increases in the out-of-pocket spending threshold, many Part D enrollees are likely to face higher out-of-pocket costs for their medications.

Policymakers are currently debating several proposals to control drug spending by Medicare and beneficiaries. Several of these proposals address concerns about the lack of a hard cap on out-of-pocket spending for Part D enrollees, the significant increase in Medicare spending for enrollees with high drug costs, prices for many drugs rising faster than the rate of inflation, and the relatively weak financial incentives faced by Part D plan sponsors to control high drug costs. Such proposals include allowing Medicare to negotiate the price of drugs, restructuring the Part D benefit to add a hard cap on out-of-pocket drug spending, requiring manufacturers to pay a rebate to the federal government if their drug prices increase faster than inflation, and shifting more of the responsibility for catastrophic coverage costs to Part D plans and drug manufacturers.

Topics

You May Like: Do Medicare Advantage Plans Cover Cataract Surgery

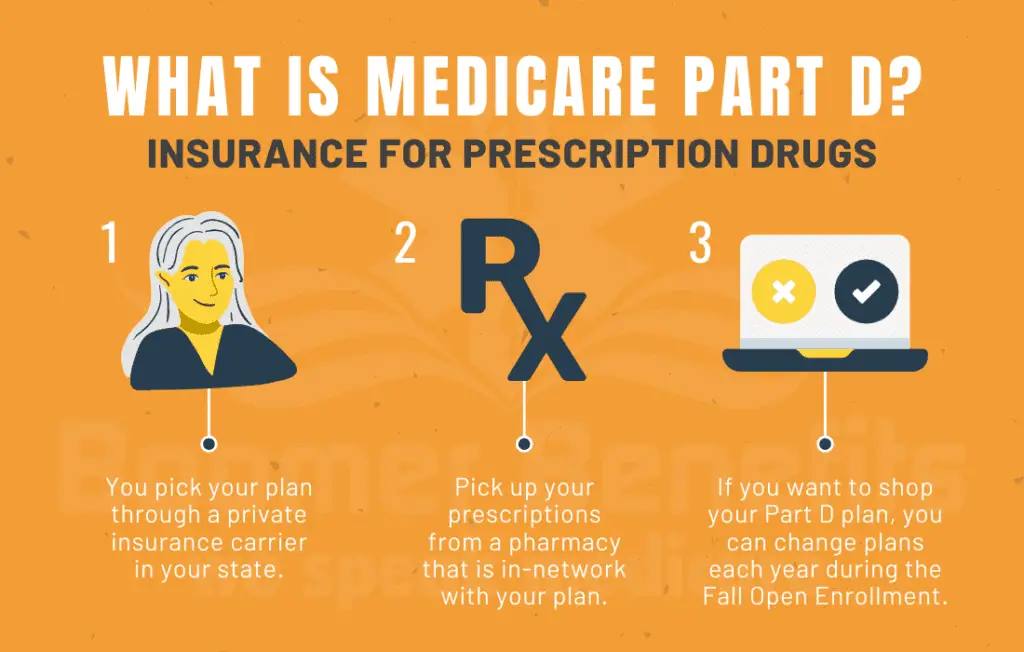

How Do Medicare Enrollees Get Medicare Part D Prescription Drug Coverage

All prescription drug coverage for Medicare beneficiaries is provided by private insurance companies, as Medicare A and B dont cover outpatient prescriptions. Most Medicare Advantage plans do include prescription drug coverage .

If youre enrolled in a Medicare Savings Account plan or Private Fee-for-Service plan that doesnt include Part D coverage, you have the option to enroll in a stand-alone Part D plan to supplement your coverage.

However, a stand-alone Medicare Part D plan cannot be used to supplement a Medicare Advantage plan that doesnt include prescription drug benefits. Medicare Advantage enrollees who want prescription drug benefits need to enroll in a Medicare Advantage plan that offers them.

What About Part C And Part D

Youll pay your Part C or Part D bill directly to the insurance company. Each company has their own preferred methods, and not all companies accept all payment types.

Generally, you should be able to:

- pay online with a debit or credit card

- set up automatic payments

- mail a check

- use your banks automatic bill pay feature

You might also be able to set up a direct deduction for your retirement or disability payments.

You can contact your plan provider to find out what payment options are available. They can also let you know if theres anything you should be aware of with each payment type, such as added fees or time delays.

Donât Miss: Is Coolief Covered By Medicare

Recommended Reading: When Is The Earliest You Can Apply For Medicare

How To Make Premium Payments

Your Part B Medicare premiums are billed directly through Medicare, while your Part C premiums are billed through the private insurance company associated with your Medicare Advantage plan. Heres how you pay Medicare and your private insurance company.

- Premium Payments to Medicare: If you receive Social Security, Office of Personnel Management, or Railroad Retirement Board benefits, Medicare will automatically deduct your Part B premiums from your benefits check. If you dont receive these benefits, you will receive a bill called Notice of Medicare Premium Payment Due. You can then pay by mailing a check, use your banks online billing to make payments every month, or sign-up for Medicares bill pay to have the premium come out of your bank account automatically.

- Part C Premium Payments to Private Insurance Companies: If your insurance company charges a premium for your Medicare Part C plan, you can set your payments to come from your Social Security benefits. But this is not an automatic action. You must submit a request to Social Security, and they have to approve your request before your Part C premium payments will be deducted. If you dont get Social Security, you can mail in a check or have your premium automatically drafted from your bank account.

Do I Have To Enroll Or Renew Medicare Part B Every Year

Medicare Part B will continue as long as you are paying your insurance premiums. For most people, these fees are subtracted for your Social Security payments. If you do not receive Social Security, Medicare sends a bill.

If you miss three payments in a row, you will receive a cancellation notice. If you do not pay what is due at that time, your plan will get cancelled, and you will have to wait until the next general enrollment period to get your Part B reinstated. Just be aware that you will likely have a penalty fee at that time.

Dont Miss: When Does My Medicare Coverage Start

Also Check: How Do I Get A Replacement Medicare Card Online

Medicare Part D Plan From A Trusted Agency

Home » Medicare » Medicare Part D

Original Medicare Parts A and B do not include coverage for prescription drugs. Medicare Part D was established in 2003 as part of the Medicare Prescription Drug Improvement and Modernization Act, or MMA. Medicare began to cover prescription drugs under Part D in 2006.

Understanding Medicare Part D

For more than 40 years, Medicare did not cover the cost of prescription drugs. Parts A and B still do not provide any coverage. Rather, those eligible for Medicare have two choices. They can buy a Medicare Advantage plan that includes coverage for prescription drugs or they can buy Medicare Part D. If you are enrolled in Medicare Part A and/or B, and you do not have prescription drug coverage from any other source, you should consider enrolling in Medicare Part D. However, if you choose not to enroll when youre first eligible and you do not have other creditable prescription drug coverage, you will be charged a penalty if you decide to enroll in Part D later.

How does Part D work?

There are various costs associated with Medicare Part D. Upon enrolling, you will pay a premium. This will be in addition to any premium you pay for Part B. Your premium will be higher if you are subject to the late enrollment penalty.

Medicare Part D deductible.

Medicare Part D coverage gap.

Catastrophic coverage.

How To Shop For Part D

I have set up a website to help clients learn more about Part D and shop for a plan. It includes a link to shop plan tools that will show which of the Part D plans I recommend will charge the least for your prescriptions. The website is PartDShopper.com Keep in mind, this site only shows the plans and companies I recommend. If you wish to see all plans available to you, you can use a similar tool on Medicare.gov.

Recommended Reading: Do All Medicare Plans Have A Deductible

How Does A Medicare Advantage Plan With Medicare Part D Included Cover My Prescription Drugs

The prescription drugs covered by your Medicare Advantage plan will be listed in the plans formulary, or list of covered medications. If a prescription drug you need is not covered by your Medicare Advantage plans formulary you can appeal that it be covered or switch plans during the Open Enrollment Period October 15-December 7 each year. Medicare Advantage plans generally put covered prescription drugs on tiers, which is a way to charge for different prescriptions. Tier 2 prescription drugs typically cost more than tier 1 prescriptions, and so forth.

For example, for a 30-day supply of your medication you may pay:

Tier 1 $10.00 copay

Tier 5 33% coinsurance

Tier 6 $10.00 copay

Do you want to find a Medicare Advantage plan in your area that includes Medicare Part D coverage for prescription drugs? Just enter your zip code on this page to begin searching.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Dont Miss: Are Resident Aliens Eligible For Medicare

How Does Medicare Part D Work With Other Insurance

If you already have prescription drug coverage through another plan, there will usually be some coordination of benefits between Medicare and your current drug coverage provider. Depending on your current coverage, Medicare will be either your primary or secondary payer for prescription drug coverage.

See Medicares to see coverage options that may apply to you.

Also Check: Does Medicare Cover Bariatric Surgery

How Much Does Part D Cost

Part D costs will vary by plan, provider and location. Costs may include premiums, deductibles, copayments and coinsurance. The amount you pay will also change based on how a plans drug formulary is organized. Part D and Medicare Advantage plans organize their drug lists in a tiered format. Generally, the lower the tier, the lower the cost of the drug. For example, a generic drug will usually live on a lower tier and cost less than a brand-name drug.

Finally, if you enroll in Part D late, you will also have to also pay a Part D premium penalty, which is 1% of the average Part D premium for each month you delay enrollment. This penalty is paid as long as you have Part D.

Easy Steps To Choosing The Medicare Part D Plan That Is Right For You

Even if you are currently in a Medicare Part D plan you should reevaluate it every year. Heres how:

Also Check: Will Medicare Cover Life Alert

What Does Medicare Part D Cover

Each Medicare Part D plan uses a list of approved drugs to decide whats covered and what isnt. This list is called a . Generally, drugs in a lower tier will cost less than drugs in a higher tier. Here is one example of a typical Medicare drug plans tier system :3

- Level or Tier 1: Preferred, low-cost generic drugs

- Level or Tier 2: Nonpreferred and low-cost generic drugs

- Level or Tier 3: Preferred brand-name and some higher-cost generic drugs

- Level or Tier 4: Nonpreferred brand-name drugs and some nonpreferred, highest-cost generic drugs

- Level or Tier 5: Highest-cost drugs including most specialty medications

An Increasing Share Of Beneficiaries Receiving Low

In 2021, nearly 13 million Part D enrollees, or just over 1 in 4, receive premium and cost-sharing assistance through the Part D Low-Income Subsidy program. These additional financial subsidies, also called Extra Help, pay Part D premiums for eligible beneficiaries, as long as they enroll in stand-alone PDPs designated as premium-free benchmark plans, and reduce cost sharing. For the first time since Part D started in 2006, more LIS enrollees are in MA-PDs than in PDPs . Reflecting overall trends in Part D enrollment, the share of LIS enrollees in stand-alone PDPs has declined over time, from 87% in 2006 to 47% in 2021, while the share in MA-PDs has increased, from 13% in 2006 to 53% in 2021 .

As part of increased enrollment in MA-PDs, more than one quarter of all LIS enrollees are now enrolled in Medicare Advantage Special Needs Plans , up from only 4% in 2006. SNPs limit enrollment to beneficiaries with certain characteristics, including those with certain chronic conditions , those who require an institutional level of care , and those who are dually enrolled in Medicare and Medicaid , which account for the majority of SNP enrollees.

Recommended Reading: Where Can I Go To Apply For Medicare

Am I Eligible For Part D

Medicare prescription drug coverage is an optional benefit offered to people who have Medicare. If youre enrolled in Original Medicare Part A and/or Part B, you can get Part D regardless of income. You dont need to have a physical exam and you cannot be denied for health reasons. Part D is also a part of some Medicare Advantage plans.

How To Get Extra Help

Depending on your income, you may qualify for Extra Help. Extra Help is a program that assists those with limited resources in paying for their Medicare prescription drug costs.

You may automatically qualify for Extra Help if you have Medicare and are enrolled in any of the following programs:14

- Full Medicaid coverage

- Assistance from your state Medicaid program for covering Part B premiums

- Supplemental Security Income benefits

any time.

You May Like: Is Medicare Accepted In Puerto Rico

Late Enrollment Penalty For Medicare Part D

A person may have to pay a late enrollment penalty if they do not sign up for Medicare Part D during an eligible enrollment period.

A person will pay a late enrollment penalty if they do not have creditable prescription drug coverage 63 days after their enrollment period.

Medicare will calculate the late enrollment penalty based on the length of time for which a person did not have prescription drug coverage. They work this out as follows:

The penalty applies on a lifelong basis. For this reason, it is most cost-effective to sign up during one of Medicares established enrollment windows.

A person can appeal the penalty decision if they feel that it is unfair.

People who receive Extra Help due to their income level are not subject to Medicare Part D penalties.