What Happens If Medicare Beneficiaries In Private Plans Need To Receive Care From Out

Plans that provide Medicare-covered benefits to Medicare beneficiaries, including stand-alone prescription drug plans and Medicare Advantage plans, typically have provider networks and limit the ability of enrollees to receive Medicare-covered services from out-of-network providers, or charge enrollees more when they receive services from out-of-network providers or pharmacies. In light of the declaration of a public health emergency in response to the coronavirus pandemic, certain special requirements with regard to out-of-network services are in place. During the period of the declared emergency, Medicare Advantage plans are required to cover services at out-of-network facilities that participate in Medicare, and charge enrollees who are affected by the emergency and who receive care at out-of-network facilities no more than they would face if they had received care at an in-network facility.

Part D plan sponsors are also required to ensure that their enrollees have adequate access to covered Part D drugs at out-of-network pharmacies when enrollees cannot reasonably be expected to use in-network pharmacies. Part D plans may also relax restrictions they may have in place with regard to various methods of delivery, such as mail or home delivery, to ensure access to needed medications for enrollees who may be unable to get to a retail pharmacy.

Will Medicare Cover Vaccines For Covid

Medicare Part B covers certain preventive vaccines , and these vaccines are not subject to Part B coinsurance and the deductible. Medicare Part B also covers vaccines related to medically necessary treatment. For traditional Medicare beneficiaries who need these medically necessary vaccines, the Part B deductible and 20 percent coinsurance would apply.

Based on a provision in the CARES Act, a vaccine that is approved by the FDA for COVID-19 will be covered by Medicare under Part B with no cost sharing for Medicare beneficiaries for the vaccine or its administration this applies to beneficiaries in both traditional Medicare and Medicare Advantage plans. Although the CARES Act specifically provided for Medicare coverage at no cost for COVID-19 vaccines licensed by the U.S. Food and Drug Administration , CMS has issued regulations requiring no-cost Medicare coverage of COVID-19 vaccines that are also authorized for use under an emergency use authorization but not yet licensed by the FDA.

In recognition of the fact that COVID-19 has taken a heavy toll on residents and staff of long-term care facilities, the Advisory Committee on Immunization Practices has recommended that health care workers and long-term care facility residents should be among the first to receive new COVID-19 vaccines after they are authorized for use. People 65 and older, which includes most Medicare beneficiaries, are expected to be among the other high-priority groups for vaccination.

What Is The Maximum Out

Original Medicare does not have an out-of-pocket limit. You’ll keep paying co-pays and co-insurance regardless of how many services you receive or how much you spend in a plan year. However, Medicare Advantage plans are required by law to have an out-of-pocket maximum. A study by the Kaiser Family Foundation found that the average out-of-pocket limit for Medicare Advantage recipients in 2021 was $5,091 for in-network services and $9,208 for combined in-network and out-of-network services.

Recommended Reading: Can You Have Medicare Before Age 65

What Is The Medicare Deductible For 2022

The annual Part B deductible has increased to $233 which is $30 more than last year. The standard Part B premium is increasing to $170.10 monthly, which is $21.60 more per month than before.

Part A is free for most people. The Part A deductible increases annually. In 2022, the deductible will be $1,556 for each benefit period. That makes the increase $72 more than last year. But, those who buy into Medicare could pay a full Part A premium of $499 each month. And, those who paid 30-39 quarters could pay $274 per month.

The inpatient hospital benefit period costs are rising slightly for 2022. For days 1-60 beneficiaries will continue to pay $0 each day. Days 61-90 now cost $389 per day. Finally, for days 91 and beyond, youll pay $778 coinsurance for each day. Now, skilled nursing facility copayments also saw an increase days 21-100 cost $194.50 per day.

What Does Medicare Supplement Plan G Cover

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible. However, the premiums for Plan G tend to be considerably less than that of Plan F. Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option.

Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F. This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

Also Check: How To Determine Medicare Part B Premium

Changing Your Medicare Advantage Plan

Can you change your Medicare Supplement insurance plan anytime? What if you arent happy with the Medicare Advantage plan you chose?

You can make changes to your plan during the Medicare Advantage Open Enrollment Period, which is from January 1 through March 31 of each year.

- Change from Original Medicare to a Medicare Advantage plan.

- Sign up for a Medicare prescription drug plan if youre covered by Original Medicare.

- Change from one Medicare prescription drug plan to another if youre on Original Medicare.

You can only make one change during the Medicare Advantage Open Enrollment Period. The changes you make will be effective on the first day of the month after the insurance company gets your change.

If you decide to drop your Medicare Advantage plan coverage and return to Original Medicare with a separate drug plan, you dont have to contact your Advantage plan company to disenroll. Youll automatically be disenrolled when you join a new Medicare Part D plan.

One exception: If you enrolled in your Medicare Advantage plan during your Initial Enrollment Period, you can switch to another Medicare Advantage plan or go back to Original Medicare within the first three months that you receive Medicare.

How Much Does Medicare Part B Cost

The out-of-pocket costs for Part B include a premium, deductible, and coinsurance. Part B will cover 80% of your medical expenses once youve met the annual deductible. You must pay the monthly premium for Part B. Most beneficiaries will pay the standard monthly premium. Those in a higher income bracket will pay more.

In 2022, the Part B premium is $170.10 a month. If you receive Social Security, Railroad Retirement Board, or Office of Personnel Management benefit payments, your Part B premium will be deducted from your monthly check. Part B has an annual deductible of $233. This deductible can slightly increase each year.

If you dont receive Social Security, you could get a monthly bill from Medicare. They have an online payment option called Easy Pay for those with a MyMedicare account.

Read Also: What Is The Cheapest Medicare Plan

How Much Does Medicare Cost

The cost of Medicare depends on how much you worked, when you sign up, and which types of coverage options you choose. If you paid Medicare taxes for 40 or more quarters, you’re eligible for premium-free Medicare Part A. You’ll pay a premium for Part A if you worked less than 40 quarters, and you’ll also pay a premium for additional coverage you want from Part B, Part C, or Part D, as well as penalties if you enroll in these after your initial enrollment period.

Watch A Video To Learn More About Medicare Costs

NOTE: Video does not contain audio

Video transcript

An animated white speech bubble appears over an animated character’s yellow and blue head.ON SCREEN TEXT: What are the costs you could pay with Medicare?

The speech bubble and character fall away. Blue text appears surrounded by animated dollar signs on a light blue background.

ON SCREEN TEXT: There are four kinds of costs you may pay with all Medicare plans.

The text and dollar signs fall away. Darker blue text appears surrounded by animated calendars on a light blue background.

ON SCREEN TEXT: 1 Premiums A fixed amount you pay to Medicare, a private insurance company, or both. Premiums are usually charged monthly and can change each year.

ON SCREEN TEXT: January June February April May

The text and calendars fall away. Darker blue text appears above an animated piggybank graphic on a light blue background.

ON SCREEN TEXT: 2 Deductibles A set amount you pay out of pocket for covered health services before your plan begins to pay.

The text and piggybank fall away. Darker blue text appears surrounded by animated green and white circles on a light blue background.

ON SCREEN TEXT: 3 Co-payments A fixed amount you pay when you receive a service covered by Medicare. Your plan pays the remaining amount.

The text and circles fall away. A white and green circle splits in two, the white half falling to the left and the green to the right. Darker blue text emerges in the center of the screen on a light blue background.

Read Also: How Do I Replace A Lost Medicare Card

Some Medicare Advantage Plans May Feature $0 Premiums

Your Medicare Part C plan premium is the cost you must pay typically monthly to belong to the plan.

In 2022, the average premium for a Medicare Part C plan is around $63 per month. This varied from plans with premiums as low as $38 per month in Maine and South Carolina to as high as over $100 per month in North and South Dakota, Massachusetts, Michigan and Rhode Island.1

Its important to note that many areas of the U.S. may feature $0 premium plans. In fact, over half of all beneficiaries of Medicare Advantage plans with prescription drug coverage pay no premium for their plan.2

Medicare Part B Deductible

The Medicare Part B deductible is far less than that of Part A. In 2022, Part B requires an annual deductible of $233. And unlike the Part A deductible, Part B’s deductible operates on an annual basis.

Just as with Part A, copayments and coinsurance responsibilities take effect once the Part B deductible has been satisfied.

Recommended Reading: Does Medicare Have Life Insurance

Who Is Eligible For Medicare Advantage

Anyone over 65 years of age who is enrolled in Medicare Part A and Part B may opt for a Medicare Advantage plan that serves their geographic area. If you are receiving Social Security Disability benefits, you will be enrolled automatically in Medicare when you become eligible, usually after you have been receiving SSDI benefits for two years.

An exception used to be people with end-stage renal disease , which requires regular dialysis or a kidney transplant. Starting in 2021, Medicare Advantage plans now offer coverage for ESRD.

Prior to 2021, you could only keep your Medicare Advantage plan if you were enrolled and developed ESRD. Another way was if you enrolled in a Special Needs Plan.

What If I Need Help Paying Medicare Costs

If you have limited income and assets, you may qualify for help with your Medicare costs, including those that you pay for care you receive. There are several programs that help pay Medicare costs. Many people who could qualify never sign up, so be sure to apply if you think you might qualify. Dont hesitate to apply. Income and resource limits vary by program.

Also Check: Where Do I File For Medicare

Does Everyone Have To Pay The Part B Deductible

Some Medicare enrollees arent directly responsible for the Part B deductible:

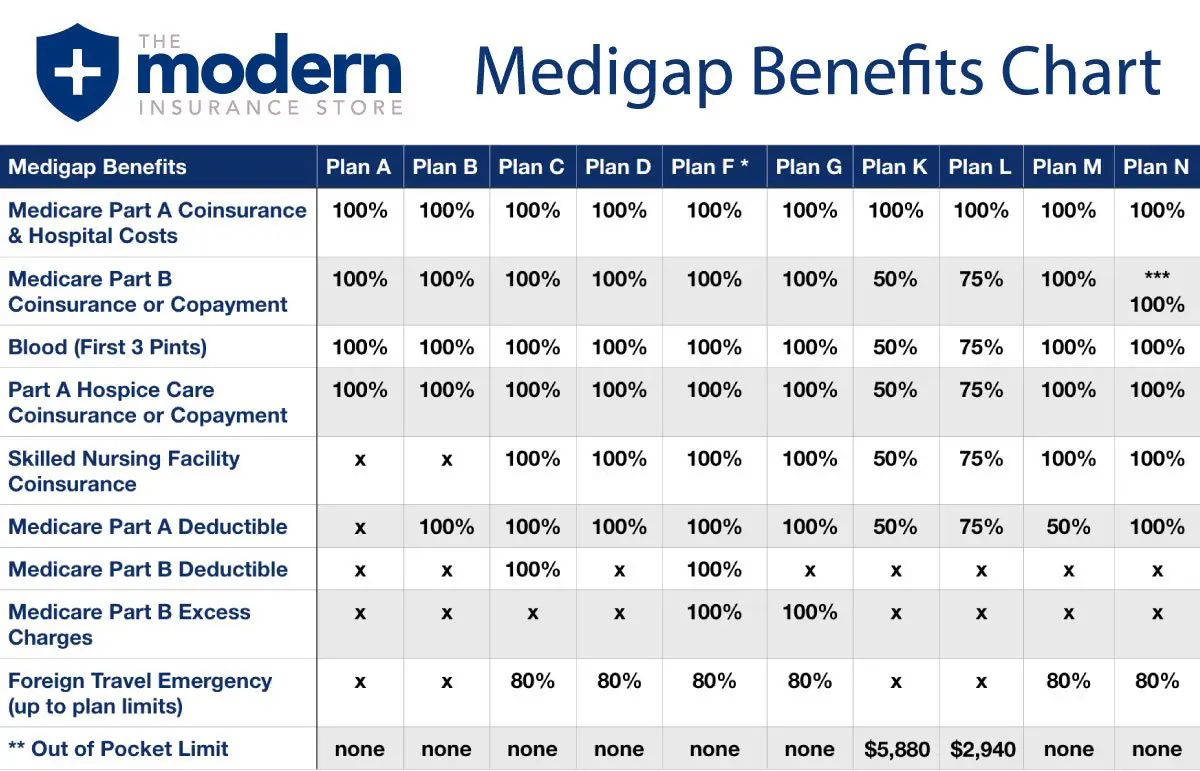

- Medigap plans C and F cover the deductible .

- Enrollees who have Medicaid or retiree health benefits from an employer generally dont have to pay the Part B deductible, as the other coverage picks up the tab.

- Some Medicare Advantage plans have no deductibles and low copays benefits into one plan for the enrollee, with cost-sharing that can differ greatly from the standard Original Medicare cost-sharing).

But according to a Kaiser Family Foundation analysis, about 19% of Original Medicare beneficiaries only have Medicare Parts A and B. They dont have Medigap coverage, retiree health benefits from a former employer, or Medicaid. These enrollees have to pay the full Part B deductible if and when they need services that are covered under Medicare Part B. For 2021, that deductible is $203.

After the enrollee pays the deductible, Medicare Part B generally covers 80% of the Medicare-approved amount for covered services, and the enrollee pays the other 20%. But again, supplemental coverage can pay some or all of this 20% cost, leaving the enrollee with far lower out-of-pocket costs than they would have under Part B by itself.

What Is The Medicare Part B Deductible For 2022

The Medicare Part B deductible is $233 per year in 2022.

Medicare Part B provides coverage for outpatient care such as doctors appointments, outpatient surgeries, procedures performed in outpatient facilities, rehabilitation care, preventive medicine, durable medical equipment and more.

Here’s an example of how the Medicare Part B deductible might work in 2022:

- You go to the doctor in January, and the allowed charge is $160. You would be responsible for paying that amount and would have $73 remaining before meeting your annual Part B deductible.

- In March, you go to the doctor again, and the allowed charge is $150. You would be responsible for paying the first $73, which would meet your deductible. There is still $77 remaining on the bill, for which you would be responsible for the Part B copayment or coinsurance, which is typically 20% of the allowed amount .

For the remainder of the year, you would be responsible for the copay on allowed charges billed to your Medicare Part B coverage.

The copay for most services under Medicare Part B is 20%. So, imagine you had $2,000 in covered medical charges in 2022 that were subject to Part B copay costs. You would be responsible for:

- The $233 deductible

- 20% of the remaining $1,767, which is $353.40

That’s a total out-of-pocket responsibility of $586.40

Some Medicare Supplement Insurance plans cover the Part B deductible or the Part A deductible.

Don’t Miss: Are Pre Existing Conditions Covered Under Medicare

Does Medicare Cover Testing For Covid

Yes, testing for COVID-19 is covered under Medicare Part B. Under rulesannounced on April 30, 2020, an order from a beneficiarys treating physician is no longer required for COVID-19 testing to be covered under Medicare, which will better enable beneficiaries to use community testing sites, such as drive-through testing at hospital off-site locations. Medicare Advantage plans are required to cover all Medicare Part A and Part B services, including COVID-19 testing. Medicare will also cover serology tests that can determine whether an individual has been infected with SARS-CoV-2, the virus that causes COVID-19, and developed antibodies to the virus.

Paying For Medicare Deductibles

Medicare Supplement Insurance provides full or partial coverage for the Medicare Part A and Part B deductibles. So instead of paying out of pocket to meet a deductible, you can simply pay a premium to belong to an appropriate Medigap plan and the Medigap insurance will cover the cost of that deductible.

Even better, Medigap plans cover more than just the cost of deductibles. Other out-of-pocket expenses such as copayments and coinsurance can also be covered by several Medigap plans.

To learn more about how trading a Medicare deductible for a Medigap premium may benefit you financially, speak with a licensed agent. Compare free quotes for Medicare Supplement Insurance plans online today.

To learn more about Medicare, read through some of the guides below.

Also Check: Does Medicare Cover Dexa Scan

Medicare Part C Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage. Medicare Advantage plans are required by law to cover everything found in Medicare Part A and Part B, and many Medicare Advantage plans may typically include benefits not covered by Original Medicare such as dental, vision, hearing, prescription drugs and more.

Medicare Advantage plans are sold by private insurance companies and dont have a standard deductible. There are thousands of different Medicare Advantage plans sold by dozens of insurance companies, and each carrier is free to set their own deductibles for each of their plans.

Medicare Advantage deductibles can range from $0 to several thousand dollars. Medicare Advantage plans that include prescription drug coverage will often have two separate deductibles, one for medical care and another for prescription drug costs.

Are There Any Special Rules For Medicare Coverage For Skilled Nursing Facility Or Nursing Home Residents Related To Covid

In response to the national emergency declaration related to the coronavirus pandemic, CMS is waiving the requirement for a 3-day prior hospitalization for coverage of a skilled nursing facility for those Medicare beneficiaries who need to be transferred as a result of the effect of a disaster or emergency. For beneficiaries who may have recently exhausted their SNF benefits, the waiver from CMS authorizes renewed SNF coverage without first having to start a new benefit period.

Nursing home residents who have Medicare coverage and who need inpatient hospital care, or other Part A, B, or D covered services related to testing and treatment of coronavirus disease, are entitled to those benefits in the same manner that community residents with Medicare are.

Medicare establishes quality and safety standards for nursing facilities with Medicare beds, and has issuedguidance to facilities to help curb the spread of coronavirus infections. In the early months of the COVID-19 pandemic, the guidance directed nursing homes to restrict visitation by all visitors and non-essential health care personnel , cancel communal dining and other group activities, actively screen residents and staff for symptoms of COVID-19, and use personal protective equipment .

Topics

Recommended Reading: How Much Is Medicare Deductible Per Year