Can I See An Online Doctor Without Insurance

You can still see an online doctor even if you dont have insurance. If you use a service such as the GoodRx Telehealth Marketplace, you can shop around to find an affordable virtual appointment for a wide range of health concerns.

Some doctors and specialists charge a flat fee for a virtual consultation or visit, while others may charge fees based on your diagnosis or required testing. You may have to pay upfront using a debit or credit card, or in some cases, you may be billed later. This typically depends on the telemedicine company youre using or the healthcare providers preferences.

When Can You Use Telehealth

Since COVID-19

Since March 6, 2020, Medicare has covered telehealth appointments for all Medicare beneficiaries for office, hospital visits and other services that typically take place in person.

Its still unclear exactly what telehealth benefits will be covered once the COVID-19 pandemic is over. CMS has proposed a permanent expansion of telehealth coverage to make it easier and more convenient for people receiving Medicare to access care, especially those living in rural areas.4

Before COVID-19

Prior to the coronavirus pandemic, Medicare only covered and paid for telehealth services for seniors in rural areas who left their home to have a virtual appointment at a nearby clinic, hospital or other medical facility.

Many appointments were with specialists that patients otherwise would not have been able to meet with in person due to distance.

Medicare limited the eligible facilities where seniors could have their appointments to:5

- speech language pathologists

- audiologists

While this public health emergency lasts, Medicare wont check that patients have an established relationship with practitioners theyre connecting with via telehealth, which was previously a requirement for a telehealth visit.8

Outpatient Care And Laboratory Testing

Medicare medical insurance covers outpatient hospital treatment, such as emergency room or clinic charges, X-rays, injections that are not self-administered, and laboratory work and diagnostic tests. Lab work and tests can be done at the hospital lab or at an independent laboratory facility, as long as that lab is approved by Medicare.

Beware: Medicare pays only a limited amount of outpatient hospital and clinic bills. Unlike most other kinds of services, Medicare places no limits on how much the hospital or clinic can charge for outpatient services over and above what Medicare pays.

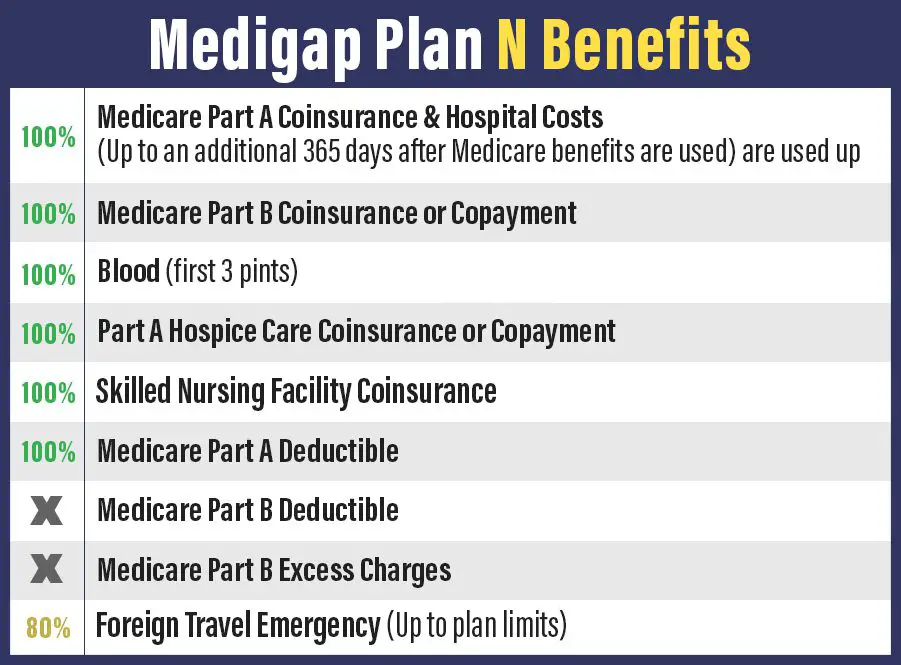

You May Like: What Does Medicare Supplement Plan N Cover

When Does Medicare Cover House Calls

Unfortunately, Medicare doesnt typically cover the type of house calls with which people are most familiar. Even in the age of Covid, its not as simple to make an appointment for a home visit from your primary care physician as it is to schedule a telehealth visit.

Ultimately, Medicare will pay for you to receive care at home if your circumstances qualify you for such. Again, youll need to make sure your provider accepts Medicare assignment or is within your Advantage plans network for your care to receive coverage. This rule of thumb applies regardless of whether the care will take place at your home.

Medicares guidelines for home health care dictate that the visit must be medically necessary. Thus, you must be under the care of a doctor for your condition and your doctor deems certain at-home care to be a necessity.

You must qualify as homebound, meaning you have difficulty leaving your home independently . Further, your practitioner must document a face-to-face meeting with you to verify your eligibility.

An eligible individual can receive physical, speech, or occupational therapy, or intermittent care from a skilled nursing professional at home. The practitioner providing the service must accept Medicare assignment or contract with your Advantage plan.

What Telehealth Benefits Are Covered By Medicare And How Much Do Beneficiaries Pay

Based on new waiver authority included in the Coronavirus Preparedness and Response Supplemental Appropriations Act the HHS Secretary has waived certain restrictions on Medicare coverage of telehealth services for traditional Medicare beneficiaries during the coronavirus public health emergency. The waiver, effective for services starting on March 6, 2020, allows beneficiaries in any geographic area to receive telehealth services allows beneficiaries to remain in their homes for telehealth visits reimbursed by Medicare allows telehealth visits to be delivered via smartphone with real-time audio/video interactive capabilities in lieu of other equipment and removes the requirement that providers of telehealth services have treated the beneficiary receiving these services in the last three years. A separate provision in the CARES Act allows federally qualified health centers and rural health clinics to provide telehealth services to Medicare beneficiaries during the COVID-19 emergency period.

Telehealth services are not limited to COVID-19 related services, and can include regular office visits, mental health counseling, and preventive health screenings. During the emergency period, Medicare will also cover some evaluation and management, behavioral health, and patient education services provided to patients via audio-only telephone.

You May Like: Does Medicare Pay For Someone To Sit With Elderly

Going Backward With Telehealth

While requiring in-person visits to establish the doctor-patient relationship was a part of many states telehealth medicare laws in years past, the trend has been moving towards allowing providers to see new clients via telehealth for the first visit. Enter COVID-19 and the emergency measures put in place to allow for greater coverage and access to healthcare. Many mental health providers closed their brick-and-mortar offices and have guided their new and existing clients to telehealth use to reduce the spread of the virus.

What Are The Costs Of A Doctor Visit

Like most Medicare doctor visits, youll pay some out-of-pocket costs for dermatologist appointments. Those expenses include your deductible and a 20% coinsurance payment if you only have Original Medicare.3 Some Medicare Supplement plans, also called Medigap, can help cover out-of-pocket costs for dermatology.

What If Your Doctor Doesnt Accept Medicare?

Ask your dermatologist if he or she accepts Medicare reimbursement as payment in full, often called accepting assignment. If not, you may pay an excess charge beyond your coinsurance up to an additional 15%.4A Medicare Supplement plan can help cover these costs.

A Medicare Advantage plan can have a deductible and will likely charge a copayment for the visits. You will likely need to see doctors in network and Medicare Advantage plans often require prior approval.

Also Check: What Does Medicare Extra Help Pay For

A Hindrance To Accurate Safe Assessment

This requirement in section 123 is at odds with providing a safe environment in which to establish a positive client-clinician relationship. Especially now during the pandemic, clients are presenting with anxiety related to contracting the virus. Sitting in a small office, provider and client sitting at least six feet apart for 50 minutes with masks on, makes little sense. An integral part of the initial assessment, clinicians depend on visual cues from client facial expressions that are largely hidden by a mask. Moreover, providers wearing masks will have a more difficult time conveying warmth and empathy so critical to establishing a connection in the first session. Many times clients are in emotional pain, crying and blowing their noses, adding to the potential for viral spread. Many providers offices are outfitted with comfortable fabric chairs that dont allow for thorough cleaning between clients, making the environment potentially riskier.

Which Parts Of Medicare Cover Doctors Visits

Medicare Part B covers doctors visits. So do Medicare Advantage plans, also known as Medicare Part C.

Medigap supplemental insurance covers some, but not all, doctors visits that arent covered by Part B or Part C. For example, Medigap will cover some costs associated with a chiropractor or podiatrist, but it wont cover acupuncture or dental appointments.

You May Like: What Medicare Supplement Plans Cover Hearing Aids

Do Medicare Supplement Plans Cover Transportation

Medicare Supplement Insurance plans are sold by private insurance companies to work alongside your Original Medicare coverage.

A Medigap plan won’t typically cover transportation, but a Medigap plan can help cover the out-of-pocket Medicare costs that you may face if Medicare covers your transportation.

For example, if your ambulance ride to the hospital is covered by Medicare Part B, some types of Medicare Supplement plans will cover your Part B deductible, and all Medigap plans provide at least some coverage for your Part B coinsurance costs.

Medicare Supplement plans and Medicare Advantage plans are very different things, and you cannot have a Medigap plan and a Medicare Advantage plan at the same time.

When Should I Go To Urgent Care

You should go to urgent care when you need medical attention quickly but the situation isnt life threatening. Some of the conditions that can be treated at an urgent care center include:

- insect or animal bites

- bleeding that cant be controlled

- suicidal thoughts

- serious wounds

Any condition that threatens your life or could cause you to lose a limb needs to be treated at the ER.

For example, if you fell and hit your head, you should pay attention to your symptoms to decide where to go. If youre slightly dizzy and have a dull headache, you should go to an urgent care center to get checked for a possible mild concussion. But if youre disoriented, confused, slurring your words, or having trouble with your vision, you should go to the ER.

Recommended Reading: Does Medicare Call To Verify Information

Medicare Supplement Insurance And Covid

Medigap, or Medicare Supplement Insurance, is a supplementary form of coverage that is used alongside Medicare Part A and Part B.

Medigap plans can help cover the cost of certain out-of-pocket Medicare costs like deductibles, copayments and coinsurance.

Medicare Supplement plans and Medicare Advantage plans are not the same thing. You cannot have both Medicare Supplement Insurance and a Medicare Advantage plan at the same time.

Lets consider another hypothetical example, this time using Jane to illustrate how Medigap plans can help cover Medicare costs. In this example, Jane has Original Medicare and Medigap Plan F, which covers more costs than any other type of standardized Medigap plan.

- Her Medigap plan also provides full coverage of the Part A deductible, which means she pays nothing for her hospital stay when she is admitted for inpatient care.

- Upon discharge, Jane must pay out of pocket for her prescription drugs.

Here is a breakdown of Janes total out-of-pocket spending:

- 100% of the cost of her over-the-counter drugs

- 100% of the cost of her prescription drugs

Because Jane incurred no charges for her doctor appointment, emergency room visit or hospital stay, her bout with COVID-19 cost her far less in out-of-pocket Medicare costs than John, Tom or Nancy paid.

It should be noted that Jane still is responsible for paying her monthly Medigap plan premium. Some Medicare Advantage plans, even most plans with prescription drug coverage, charge $0 monthly premiums.

How Does An Office Visit Copay Work

- Post comments:

Office visit copays work differently depending on the type of plan you have. An office visit copay works differently for a Medicare PPO plan than a Medicare HMO plan. And the Medicare Supplement Plan N copay is also different then the previous two plans.

Medicare Supplement Plan N Plan N has a copay of $20 per visit. Plan N also has an annual outpatient deductible of $198 which first needs to be paid before the copays commence. Once the copays start, you are responsible for the $20 copay for each Dr visit, lab, x-ray, outpatient surgery, physical therapy, etc. The Plan N hospital benefit is 100% coverage.

HMO Typically when you receive services from your HMO primary care physician or a specialist, whatever services or procedures and costs you receive during the visit, all are included in your Plan co-pay. For example you schedule a visit because your knee hurts from your day of hiking. The doctor who sees you discusses your knee issue, examines your knee, has you walk down the hall for an X-Ray, then gives you a cortisone shot. If your HMO plan has a $30 copay, that is all you would pay for this days visit.

Some PPOs offer plans with unlimited office visit co-pays, other plans have a limited number of co-pays per year, such as three or five, after they are used you simple pay the cost of the visit. And others offer no office visit co-pays.

Have questions or would like more details, please contact me anytime.

John Conner

You May Like: Does Medicare Pay For Physical Therapy After Knee Surgery

Urgent Care Vs The Er: How Do I Know Where To Go

Urgent care centers can save you from a trip to the ER, but they cant treat all conditions. Generally, urgent care is for situations that are not emergencies but cant wait until you get an appointment with your primary care doctor. The ER is for potentially life threatening situations and serious injuries.

Does Medicare Cover Telemedicine

Medicare coverage for telemedicine visits is relatively new. Traditionally Medicare has paid for such visits in a limited way. But the coronavirus, or COVID-19 pandemic, has changed all of that. Why? Many primary care physicians are using telemedicine appointments in lieu of traditional in-office visits to keep patients, doctors and their staffs safe during this time. This has been valuable to patients 65 and older who are considered to be at higher risk, especially if they have an underlying condition such as COPD , heart disease or diabetes.

Many seniors, likewise eager to reduce their risk, have begun to embrace telemedicine. From mid-March to mid-June alone nine million Medicare beneficiaries used some type of telemedicine service. Over three million received telehealth services by phone, and 26 percent received care at nursing homes. Approximately 60 percent have had virtual visits with a psychologist or psychiatrist.

Also Check: Who Pays For Part A Medicare

What Does Medicare Part B Cover

Medicare Part B covers doctor visits and most routine and emergency medical services. It also covers some preventive care, like flu shots.

What is covered by Medicare Part B

- Doctor visits, including when you are in the hospital

- An annual wellness visit and preventive services, like flu shots and mammograms

- Clinical laboratory services, like blood and urine tests

- X-rays, MRIs, CT scans, EKGs and some other diagnostic tests

- Some health programs, like smoking cessation, obesity counseling and cardiac rehab

- Physical therapy, occupational therapy and speech-language pathology services

- Diabetes screenings, diabetes education and certain diabetes supplies

- Mental health care

- You enroll for the first time in 2021.

- You aren’t receiving Social Security benefits.

- Your premiums are billed directly to you.

- You have Medicare and Medicaid, and Medicaid pays your premiums.

Your Part B premium may be less than the standard amount if you enrolled in Part B in 2020 or earlier and your premium payments are deducted from your Social Security check.

Your premium may be more than the standard amount based on your income. You will pay an incomerelated monthly adjustment amount if your reported income from 2019 was above $88,000 for individuals or $176,000 for couples. Visit Medicare.gov to learn more about IRMAA.

And while Medicare will share your Part B health care costs with you, there is something called “Medicare assignment” that’s important to understand.

Does Medicare Cover Podiatry For Diabetics

Medicare Part B may cover a foot exam every six months if you have nerve damage related to diabetes. If youve had a podiatry exam for a different foot problem anytime during the past six months, Medicare might not cover a foot exam.

Medicare might cover podiatry services more frequently in certain situations, such as:

- You had an amputation of all or part of your foot, and it was not because of an injury.

- Your foot or feet have changed in appearance, signaling that you might have a foot disease.

Also Check: Is Robotic Knee Replacement Covered By Medicare

Will Medicare Pay For A Yearly Physical Examination

En español | Medicare does not pay for the type of comprehensive exam that most people think of as a physical. But it does cover a one-time Welcome to Medicare checkup during your first year after enrolling in Part B and, later on, an annual wellness visit that is intended to keep track of your health.

Initial visit: The Welcome to Medicare visit with your doctor aims to establish the state of your health when you enter the program and provide a plan of future care. The doctor will:

- record your vital information

- review your personal and family health history

- check risk factors that could indicate future serious illnesses

- recommend tests and screenings that could catch medical issues early and provide a checklist of preventive services to help you stay healthy

- offer you the option of discussing end-of-life issues, including information on how to prepare an advance directive naming someone to make medical decisions on your behalf if you became too ill to make them yourself

- provide counseling and referrals as appropriate

Annual visit: During an annual wellness visit, the doctor measures your height, weight, body mass and blood pressure, and may listen to your heart through your clothes. The rest is a discussion of your own and your familys medical history, any physical or mental impairments, and risk factors for diseases such as diabetes and depression.

Both services are free of charge if the following conditions are met:

Medicare Doesn’t Cover Deductibles And Co

Medicare Part A covers hospital stays, and Part B covers doctors services and outpatient care. But youre responsible for deductibles and co-payments. In 2021, youll have to pay a Part A deductible of $1,484 before coverage kicks in, and youll also have to pay a portion of the cost of long hospital stays — $371 per day for days 61-90 in the hospital and $742 per day after that. Be aware: Over your lifetime, Medicare will only help pay for a total of 60 days beyond the 90-day limit, called lifetime reserve days, and thereafter youll pay the full hospital cost.

Part B typically covers 80% of doctors services, lab tests and x-rays, but youll have to pay 20% of the costs after a $203 deductible in 2021. A medigap policy or Medicare Advantage plan can fill in the gaps if you dont have the supplemental coverage from a retiree health insurance policy. Medigap policies are sold by private insurers and come in 10 standardized versions that pick up where Medicare leaves off. If you buy a medigap policy within six months of signing up for Medicare Part B, then insurers cant reject you or charge more because of preexisting conditions. See Choosing a Medigap Policy at Medicare.gov for more information. Medicare Advantage plans provide both medical and drug coverage through a private insurer, and they may also provide additional coverage, such as vision and dental care. You can switch Medicare Advantage plans every year during open enrollment season.

Recommended Reading: How To Get Motorized Wheelchair Through Medicare