Which Medicare Plan Is Better For You

For those who rely on prescription drugs, Medicare Advantage is the best plan. Original Medicare does not provide any coverage for prescription drugs whether you have Medigap or not. Although you can add Part D coverage to an Original Medicare plan, its typically a much higher cost to do this. About 82 percent of Medicare Advantage plans already include prescription drug coverage. In addition, Medicare Advantage plans make it so there is a cap on out-of-pocket spending. No matter what, you cant spend more money out-of-pocket after a certain limit. There is no out-of-pocket maximum for Medicare, which means that you can often pay more out-of-pocket.

Medicare Advantage plans also include a cap on out-of-pocket expenses. If you dont want to pay the 20 percent coinsurance with Original Medicare, then you should also pick Medicare Part C. Medicare Advantage plans are structured differently and typically cost less for the value that you receive. You may be able to see more doctors and also pay a less premium per month. You may also only be responsive for co-pays when you visit a doctor or hospital. Under some Medicare Advantage plans, extra services are available. If you are looking for assisted living facilities, nursing home care, vision and dental, its best to pick a Medicare Advantage plan that already has those features built in.

When Medicare Advantage Isnt Always Best

Making the Right Medicare Choice

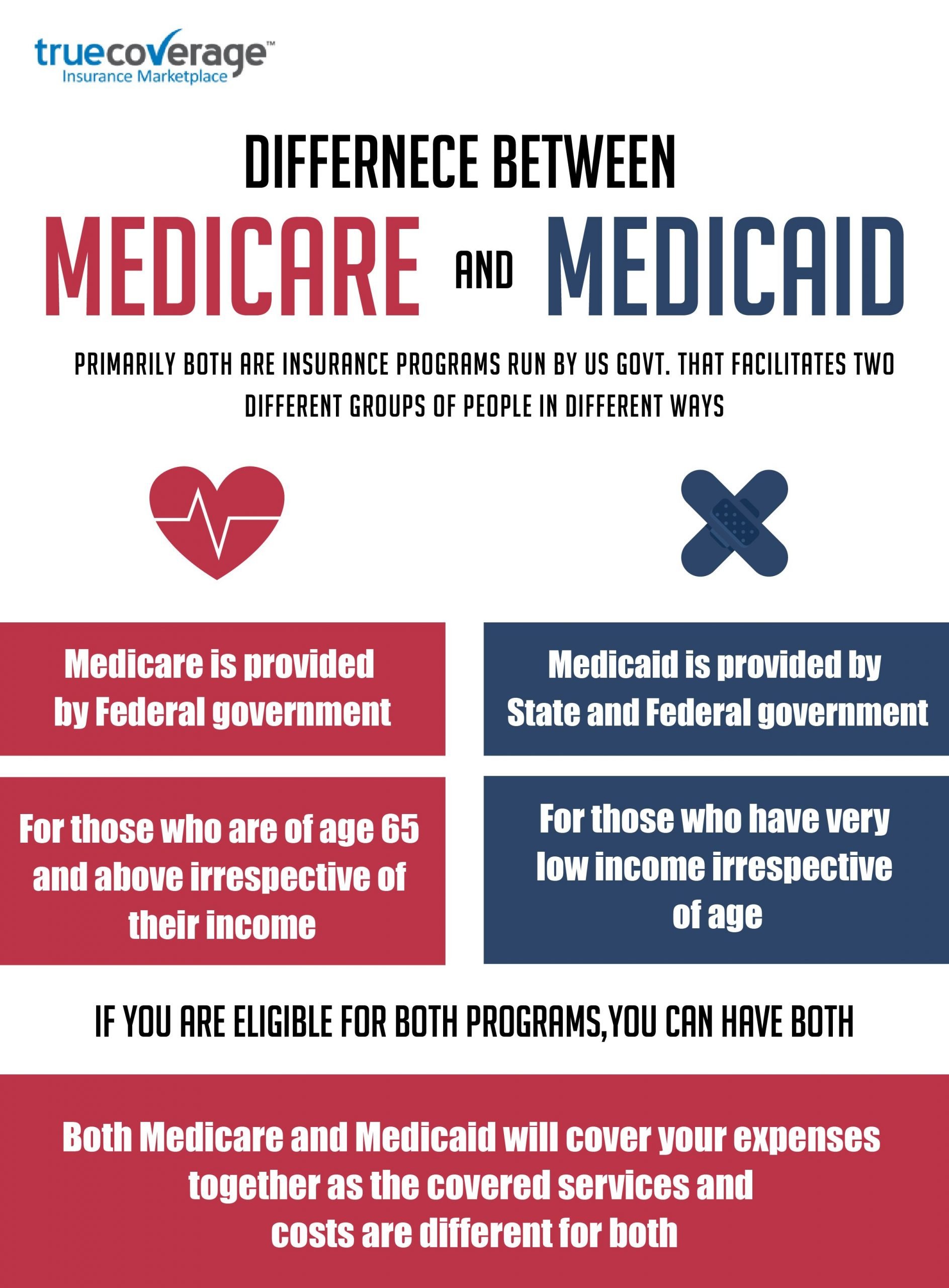

Medicare Vs Medicaid: Whats The Difference

Fact checkedReviewed by: Leron Moore, Medicare consultant –

Understand the differences between Medicare and Medicaid and find out if you can qualify for both.

What you should know

- 1Medicare and Medicaid are both government programs to help Americans afford health care.

- 2Medicaid is funded jointly by federal and state governments and is available if you meet your states income eligibility and other standards.

- 3Medicare is health care coverage available if youre at least 65 or have a qualifying disability.

- 4Its possible to be eligible for both Medicaid and Medicare at the same time.

Have you wondered about the difference between Medicare and Medicaid? Theyre very different programs. Although both are government-run health care programs, the similarities end there. Medicaid is available if you have low income, while Medicare eligibility kicks in when you turn 65 or have a qualifying disability.

If you meet income eligibility, Medicaid can be an essential resource for covering health care expenses that Medicare does not. But not everyone can qualify for Medicaid, so you can enroll in Medicare when you reach retirement age.

Both programs are designed to offset the costs of health care services. Medicaid offers additional coverages that Medicare does not. If youre dual-eligible, you can qualify for Medicaid and Medicare and get coverage from both.

Learn more about the differences between Medicaid and Medicare.

Types Of Medicare Managed Care Plans

Moreover, care plans are private health insurance companies that Medicare-approves. Plans offer care from a specific network of providers at a lower overall cost. Medicare divides managed care plans into different plan types. Classifying each by using acronyms such as HMO, PFFS, PPO, or HMO-POS. Some are more popular, others are more expensive, and not all are available in certain areas.

Premium rates, out-of-pocket expenses, deductibles, coinsurance, and copayment amounts, and restrictions vary. Costs will depend on plan type, where you live, and insurance carrier.

Contact the plan directly for out-of-network coverage options and questions about available benefits.

Don’t Miss: Does Medicare Pay For Blood Pressure Cuffs

Opting For Part A Only

Some people choose only to have Medicare Part A coverage so that they dont have to pay the monthly premiums for Medicare Parts B and D. If you still have insurance through a current employer , you can add the other parts later with no penalty.

However, if you decline Parts B and D and don’t have another insurance plan in place, you’ll face a late enrollment penalty when you add the other parts later.

In the past, Medicaid programs typically didn’t offer a lot of choice in terms of plan design. Today, most states utilize Medicaid managed care organizations . If there’s more than one MCO option in your area of the state, you will likely be given the option to select the one you prefer.

How The Programs Differ

Medicare is an insurance program while Medicaid is a social welfare program.

Medicare recipients get Medicare because they paid for it through payroll taxes while they were working, and through monthly premiums once theyre enrolled.

Medicaid recipients need never have paid taxes and most dont pay premiums for their Medicaid coverage .

Taxpayer funding provides Medicaid to eligible needy people in a manner similar to other social welfare programs like Temporary Assistance for Needy Families Women, Infants and Children and the Supplemental Nutrition Assistance Program.

Also Check: Does Medicare Cover Bladder Control Pads

Beneficiaries’ Access And Choice Of Plans

From 1997 to 2003, the widespread exit of MA plans reduced beneficiaries’ choices and weakened confidence in Part C. Moreover, with the exception of floor counties, the BBRA and the BIPA failed to reverse the declining participation of the plans and the enrollment of beneficiaries. By 2003, the number of what Medicare now called coordinated-care plan contracts had fallen 50 percent, to 151 from 309 in 1999 , although some of the drop was attributable to the health plans’ mergers and acquisitions. There still were few other plan types offered besides HMOs, and there continued to be a wide geographic variation in plans’ availability across markets, with 40 percent of beneficiaries still lacking access to a Medicare managed care plan .

How Can I Find Which Medicare Advantage Plans Are Available In My Area

Im available to help you understand your options. If you prefer, you can request information via email or schedule a phone call at your convenience by clicking one of the links below. To view some plans you may be eligible for, use the Compare Plans button below.

*Out-of-network/non-contracted providers are under no obligation to treat Preferred Provider Organization plan members, except in emergency situations. For a decision about whether we will cover an out-of-network service, we encourage you or your provider to ask us for a pre-service organization determination before you receive the service. Please call our customer service number or see your Evidence of Coverage for more information, including the cost-sharing that applies to out-of-network services.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Recommended Reading: Can I Get Medicare If I Live Outside The Us

Medicare Advantage Managed Care Plans: Beneficiary Protections

- The plan cannot charge more than a $50 copayment for visits to the emergency room.

- You or your doctor can appeal a denial of service and the appeal must be handled in a “timely” way. The plan must make an initial determination within 14 days. Reconsideration of a decision must be made within 30 days. Decisions regarding urgent care must be made within 72 hours.

- The plan must have a process for identifying and evaluating persons with complex or serious medical conditions. A treatment plan must be developed within 90 days of your enrollment.

- If your treatment plan includes specialists, you must have direct access to those specialists. You do not need a referral from your primary care physician.

Medicare Advantage Plans May Cost You Less

If you enroll in a Medicare Advantage plan, you continue to pay your Medicare Part B premium and you may pay an additional premium. The insurer determines the Medicare Advantage plans premium, which can vary from one Medicare Advantage plan to another. Some Medicare Advantage plans may have premiums as low as $0.

Your cost sharing may also be less under Medicare Advantage. For, example, if you visit a primary care physician under Medicare Advantage, you may pay a copayment of $10. However, if you visit a primary care physician under Original Medicare, you may have a coinsurance of 20%, which could be more than $10.

Also, a Medicare Advantage plan limits your maximum out-of-pocket expense. Once you have spent that maximum, you pay nothing for covered medical services for the remainder of the year. Original Medicare does not provide a maximum out-of-pocket cap, so your potential expenses are limitless.

Often a Medicare Advantage plan can be less expensive than comparable coverage you would receive if you stayed with Original Medicare. To get all the benefits of Medicare Advantage with Original Medicare, you would also need to enroll in a stand-alone Medicare Part D Prescription Drug Plan as well as a Medicare Supplement plan.

Also Check: Are Continuous Glucose Monitors Covered By Medicare

Who Runs Medicare And Medicaid

The federal government runs the Medicare program. Each state runs its own Medicaid program. Thats why Medicare is basically the same all over the country, but Medicaid programs differ from state to state.

The Centers for Medicare and Medicaid Services, part of the federal government, runs the Medicare program. It also oversees each states Medicaid program to make sure it meets minimum federal standards.

Although each state designs and runs its own Medicaid program, all Medicaid programs must meet standards set by the federal government in order to get federal funds .

In order to make significant adjustments to their Medicaid programs, states must seek permission from the federal government via a waiver process.

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

You May Like: Are Hearing Aids Covered By Medicare Part B

Legal Terms & Conditions

HealthPlanOne.com is a service mark of HealthPlanOne, LLC. All trademarks, service marks, trade names and logos displayed on this site are proprietary or licensed to HealthPlanOne, LLC, except for those of the insurance carriers, agent, brokers, industry organizations, associations, health care institutions, and other service companies, which are service marks or trademarks of their respective entities. The name, trademarks, service marks and logos of HealthPlanOne LLC and any of the insurance companies represented by HealthPlanOne LLC may not be used in any advertising or publicity, or otherwise for any commercial use by other insurance agent or brokers. Any such use is prohibited by federal trademark and copyright law. This site is a copyrighted publication of HealthPlanOne, LLC. No portion of this site or any news or information displayed on this site may be published, broadcast, duplicated, photocopied, faxed, downloaded, uploaded, distributed, transmitted or redistributed in any way for any purpose without HealthPlanOne, LLCs prior express written permission. The content presented on this site is that of HealthPlanOne, LLC and not necessarily that of the participating insurance carriers. However, certain content is presented by insurance carriers, agents, brokers, industry organizations, service providers and educational institutions, and that content is solely that of the respective entity providing the content.

What Does Medicare Plan F Cover

![Medicare vs. Medicaid [INFOGRAPHIC] Medicare vs. Medicaid [INFOGRAPHIC]](https://www.medicaretalk.net/wp-content/uploads/medicare-vs-medicaid-infographic.png)

Youll need to investigate the different Medigap plans to determine the right one for you. The comparison chart below will help.

Medicare Plan F provides the same healthcare coverage from state to state. In general, you can use it to cover the copayment for all medical costs and even the Medicare Part B deductible.

Another benefit covered by Plan F is Medicare Part B Excess ChargesA Medicare Part B excess charge is the difference between a health care providers actual charge and Medicares approved amount for payment….. These occur when your doctor or specialist does not accept the standard Medicare payment for a service. Medicare allows healthcare providers that do not accept Medicare assignmentAn agreement by your doctor to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance…. to charge up to 15 percent more. Without Plan F, you will pay these costs out-of-pocket.

Plan F also covers your big costs if you are admitted as an inpatient in the hospital or a skilled nursing facility. Your Medicare benefits cover these costs under Part A, but most people are taken by surprise when they see the per-benefit-period deductible. Plan F is one of these insurance plans that protect enrollees from these high out-of-pocket expenses.

Heres a side-by-side Medigap comparison chart:

You May Like: When Is Open Enrollment For Medicare

Care Management Appears Somewhat Better For Beneficiaries In Medicare Advantage Plans Than For Beneficiaries In Traditional Medicare

Self-management of conditions. Across both types of Medicare coverage, most people age 65 and older said they felt confident they could manage and control their own health conditions . A somewhat larger share of people with diabetes in Medicare Advantage plans than people with diabetes in traditional Medicare felt confident they could manage their health conditions.

Among people age 65 and older with a health condition, a somewhat larger, though not statistically significantly different, share of those in Medicare Advantage plans than those in traditional Medicare that said they had a treatment plan for their condition. A larger share of Medicare Advantage enrollees said that a health care professional had given them clear instructions about symptoms to monitor and had discussed their priorities in caring for the condition .

Self-care among people with diabetes. Among beneficiaries with diabetes, no significant difference was observed by type of Medicare coverage in the proportion reporting their blood sugar was under control .9 While a larger share of SNP enrollees with diabetes engaged in self-care behaviors than their counterparts in other Medicare Advantage plans or traditional Medicare, the differences did not meet the statistical test for significance .

What Is Excluded From Medicare Plan F

Plan F does not cover vision, dental, long-term carea variety of services that help people with their medical and non-medical needs over a period of time. Long-term care can be provided at home, in the community, or in various types of facilities, including…, hearing aids, or private nursing services. These benefits are common in Medicare Advantage plans, however, a Plan F policy cant cover them because they are not covered by Original Medicare. Additionally, Plan F does not cover prescription drug costs either. For this, you will need a Part D Plan.

However, there is one benefit that both Original Medicare and Medicare Advantage plan do not cover that a Medicare Supplement Plan F policy does cover, and thats international emergencies. With a Plan F policy, you are covered for up to 80 percent of a foreign travel emergency , which is very reassuring.

Recommended Reading: Will Medicare Pay For My Nebulizer

Original Medicare: A Quick Overview

The government health insurance program created in 1965 is called Original Medicare. Its made up of:

- Part A, which is hospital insurance and generally covers care at skilled nursing facilities and sometimes nursing homes

- Part B, which is medical insurance and generally covers preventive care, doctor visits, lab tests, durable medical equipment, and more.

Part A and Part B come with deductible amounts, coinsurance, and/or copayments for most services.

If youre automatically enrolled in Medicare, as many people are, youre usually enrolled in Part A and Part B. If youre already getting Social Security benefits when you turn 65 or qualify by disability, youre usually enrolled automatically.

Finding Part D Drug Insurance

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings .

If you dont take many prescription drugs, look for a plan with a low monthly premium. All plans must still cover most drugs used by people with Medicare. If, on the other hand, you have high prescription drug costs, check into plans that cover your drugs in the donut hole, the coverage gap period that kicks in after you and the plan have spent $4,430 on covered drugs in 2022.

Don’t Miss: How Long Do You Have To Sign Up For Medicare

How Is A Medicare Advantage Pffs Plan Different From A Managed Care Plan

Medicare Advantage PFFS plans operate a bit differently than managed care plans. Under a PFFS plan, the plan determines what it will pay for any particular medical service or medication, and what you will pay. You usually can see any doctor or hospital that accepts your plan terms and you are not required to choose a primary care physician or get referrals for specialist care, unlike some managed care plans.

However, unlike other Medicare plans, doctors and hospitals are not required to accept your plan, even if they participate with Medicare. If you are enrolled in a PFFS plan, be sure to ask your provider before your appointment if they accept your plan, even if youve seen them before. A provider can choose to accept or decline your plan at any time for any non-emergency medical service.

Other things to keep in mind about PFFS plans that might be different from managed care plans:

- Some plans may have a network of providers who will see you and accept your plan, even if youve never been a patient before.

- Providers must treat you if you need emergency care.

- You may or may not have Part D coverage for prescription drugs with your plan.

Plan Participation And Beneficiaries’ Choices

When deciding whether to enter a county’s Medicare managed care market, insurance companies like Blue Cross or Aetna consider the level of Medicare payment, the costs of building and maintaining a physicians’ network and operating a health plan in the county, beneficiaries’ demand for plans, and the competition for products and provider markets. When entering a market, insurance companies establish contracts with Medicare and within those contracts offer at least one, but often several, benefit packages, which are referred to as plans .

Insurance Companies’ Contracts with Medicare

Insurers like Blue Cross or Aetna hold Medicare Advantage contracts with CMS. For each type of product such as an HMO or a PPO, the insurer generally has one contract for an entire state or the part of the state that is the insurer’s service area. Each contract holder may, and typically does, offer several benefit packages under each contract. The benefit packages specify the services covered, the cost sharing, and the premium. In the figure, MA refers to a plan that does not cover drugs, and MA PD indicates plans that, as of 2006, do cover drugs. Private-Fee-for-Service plans are described in the text.

Total Number of Medicare Advantage Contracts

Note: Contracts include local Coordinated Care Plans , Private Fee-For-Service plans, and regional PPOs.

Medicare Beneficiaries’ Access to an MA Plan

Note:aIncludes HMO, local PPO, and regional PPO plans.

, .

Read Also: What Is The Window To Sign Up For Medicare