Retirement Savings By Age

Its suggested to start saving for retirement as early as you can, even in your 20s. Experts recommend the following benchmarks to help you track toward your savings progress:

|

$500,000 |

The earlier you start saving, the more youll be able to funnel away for the future. Here’s an example that illustrates this importance:

- Person A saves $100 per month starting at age 25. Assuming annual returns of 10%, this person would have a retirement balance of more than $640,000 by age 65.

- Person B saves $200 per month but doesn’t start until age 35. Assuming the same 10% returns, they will have saved closer to $440,000, or $200,000 less, by the time they turn 65.

In this example, youll notice it’s not all about the balance you’re contributing, but instead the age at which you start. It also shows that you don’t have to invest huge amounts to ensure returns. In the Person B example, they only contributed $72,000 of their own dollars but earned nearly $380,000 in returns.

However, note the average employee 401 contribution rate is only around 9% . Even if you havent started yet or feel behind, dont feel intimidated. There are things you can do to keep your retirement on track and ensure youre financially secure once you leave the workforce.

Can A 62 Year Old Get Medicaid

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children.

Learn more about the difference between Medicare and Medicaid.

Benefits Received Before 65

For those who do qualify for benefits before age 65, there are restrictions. People in these categories qualify for free Part A benefits. According to medicare.gov, this is what Part A covers:

- Inpatient care in a hospital

- Skilled nursing facility care

- Inpatient care in a skilled nursing facility

- Hospice care

- Home health care

Most people qualify to not pay a monthly premium for Part A. This is true for those who have worked and paid Medicare taxes for at least ten years.

You May Like: Does Medicare Cover Rooster Comb Injections

A Sample Of Silversneakers Fitness Classes

The SilverSneakers Medicare program offers over 70 types of fitness classes for all fitness levels, and each one is taught by a certified instructor. You can choose a class to help you meet a specific fitness goalfrom mobility to building muscle.

Here is a sample of what you might find:

SilverSneakers Classic

This is where it all started. With SilverSneakers Classic, the class adapts to your fitness level, using a chair for support if you need it and exercises can be modified to your ability as well. Overall, SilverSneakers Classic is a good way to help increase range of motion and muscle strength to make daily activities easier and improve overall well-being.

SilverSneakers Circuit

The SilverSneakers Circuit class is a choreographed routine set to music that incorporates movement with standing exercises that use rubber tubing and dumbbells. The class can be adapted to suit your fitness level, and chairs are available for support during the exercises.

SilverSneakers Cardiofit

A more rigorous workout than SilverSneakers Classic or Circuit, SilverSneakers Cardiofit is an aerobics-type class to build core strength, upper body strength, and cardio health. However, all of the exercises are low-impact.

SilverSneakers Yoga

Recommended Reading: Does Medicare Cover Transportation To Physical Therapy

The More Qcs The Better

During their working careers, most people have enough coverage under the Federal Insurance Contributions Act to qualify for Social Security and Medicare. There is a sliding scale for partial to full coverage based on the number of calendar quarters worked with insurance deductions taken from the pay.

The below-listed items describe the QCs and Pat A premiums at age 65:

- $0 premium One can get premium-free Part A if 40 QCs or more

- $252 monthly premium if applicant or spouse has 30 to 39 QCs

- $458 per month -if applicant or spouse worked less than 30 QCs

Don’t Miss: How Does Medicare Supplement Plan G Work

Do You Automatically Get A Medicare Card When You Turn 65

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If youre not getting disability benefits and Medicare when you turn 65, youll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Adding Part B Benefits

When qualifying for benefits at the age of 65, a person will get the benefits of Part A, along with Part B. Part A and Part B combined are known as Original Medicare. Weve covered Part A, now well look at the two areas covered with Part B. Again, these are defined by Medicare.gov.

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventative services: Health care to prevent illness or detect it at an early stage, when treatment is most likely to work best.

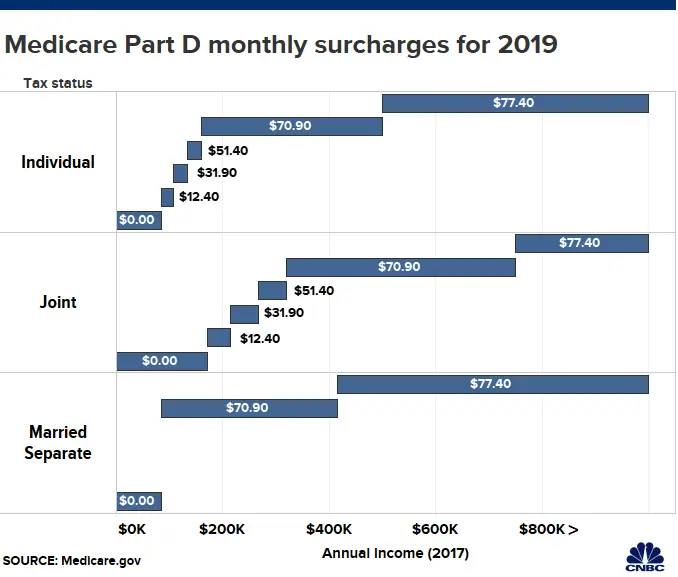

Unlike Part A, there is a Part B premium that most people will have to pay. However, the standard premium is minimal, currently $135.50. Those with an income below $85,000 will pay the standard Medicare premiums.

Don’t Miss: How Much Does Medicare A And B Cost Per Month

Medicare Misconceptions When Aging In

One big misconception is that every American automatically gets Medicare at age 65. Those who are collecting Social Security will automatically enroll in Part A and Part B. However, they will need to shop around for a Part D or Advantage plan to obtain prescription drug coverage.

If youre not yet collecting Social Security when your 65th birthday comes around, youll need to sign up for Medicare through the Social Security Administration. Its best to take advantage of your Initial Enrollment Period to do so.

While Medicare isnt mandatory, picking it up after lacking creditable coverage once youre eligible will cost you. Penalties also apply to prescription drug coverage. So, even if you dont currently take prescription medications, putting off your coverage can cost even more in the long run.

The amount of cost-sharing that comes with Medicare coverage is a shock to many new beneficiaries. Premiums, deductibles, and coinsurance can add up over a short time on Original Medicare.

A Medicare enrollee may learn how Medigap policies can reduce cost-sharing after their Medicare Supplement Open Enrollment window closes. Consequently, their selection of plan options may be smaller.

Also, many people are surprised to find out Medicare wont cover chronic needs or custodial care. Meaning, if you eventually need to live in a nursing home permanently, payment will be entirely out-of-pocket.

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Recommended Reading: Will Medicare Pay For A Patient Lift

How Reaching Age 62 Can Affect Your Spouses Medicare

While you may not be eligible to enroll in Medicare when you turn 62, your age can have an impact on your spouses benefits.

If you are in the workforce and your spouse is not, then you turning 62 can give them access to the premium-free Part A of Original Medicare.

You may also be eligible to receive Social Security benefits but dont have to start taking them. This is a requirement because if your spouse didnt work, they are essentially reliant upon your work history for their eligibility.

Part A premiums can also be significant in 2022, they can be as much as $499 a month.

To be eligible for the premium-free Part A when you turn 65 and can enroll in Medicare, you must have paid Medicare taxes for at least 10 years and be eligible for or receive benefits from Social Security or the Railroad Retirement Board.

You also could qualify for the premium-free Part A if you had Medicare-covered government employment.

At What Age Do I Qualify For Medicare

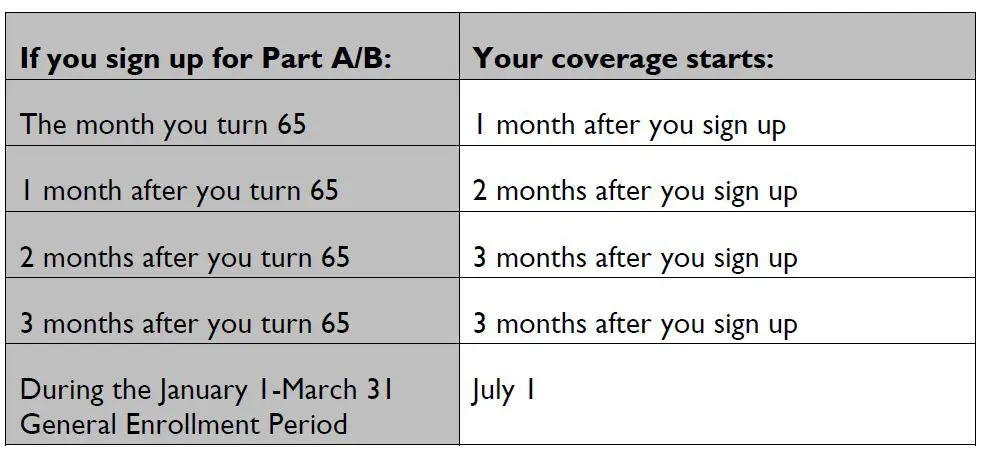

Medicare eligibility for seniors begins at age 65 . Your initial enrollment period for Medicare begins three months before the month of your 65th birthday, and ends three months after the month you turn 65.

If you miss your initial Medicare enrollment window, you can sign up during the general enrollment period of January 1 through March 31 of each year. But holding off too long could cost you. If you wait too long to sign up for Medicare Part B, youll face a 10 percent increase in your Part B premiums for every year-long period you were eligible to enroll but didnt. There are also financial implications associated with waiting too long to sign up for a Part D drug plan.

That said, if youre still working and have coverage under a group health plan during the seven-month period surrounding your 65th birthday, youll get a special enrollment period that begins when you separate from your employer or your group coverage ends. As such, you wont have to worry about the aforementioned penalties provided you sign up during your special enrollment period.

Read Also: When Is Someone Medicare Eligible

Also Check: How Can I Sign Up For Medicare Part B

Exceptions To Medicare Age Requirements

While you are typically not eligible for Medicare unless you are 65 and a U.S. citizen, there are some other ways that you can qualify.

If you have been receiving Social Security disability insurance for two years or more, you can be eligible for Medicare early.

You can also enroll if you have ALS or end-stage renal disease. In these circumstances, you are exempt from the requirement to have been on disability insurance for two years.

If you meet none of these requirements, you will have to wait until your standard eligibility period. According to AARP, your initial enrollment period will begin three months before the month of your 65th birthday.

Original Medicare is split into two parts, Part A and Part B. Unless you meet the above requirements, neither part is available to you early.

There is a third part, Part C, which is also known as Medicare Advantage. Private insurers provide Part C plans which offer expanded benefits and coverage like vision and dental.

Prepare for the Medicare Advantage Open Enrollment Period

What Age Can You Get Medicaid

Typically, Medicare is only available for people who are 65 years old or more, younger people with disabilities and people with End Stage Renal Disease can also qualify. Medicare has two parts, Part A and Part B . You are qualified for premium-free Part A if you are 65 years old or more and you or your spouse worked and paid Medicare taxes for at least 10 years.

Recommended Reading: Does Medicare Pay For Hearing Evaluation

New Proposal To Lower Medicare Age To 50 Could Be A Lifeline To Millions

A group of 21 Democratic senators have reintroduced legislation in Congress to lower the qualifying age for Medicare from 65 to 50.

When it comes to providing affordable health care for every American, there is more we must do right now to change the status quo, improve our health care system and lower costs, said Sen. Tammy Baldwin, a Democrat from Wisconsin and one of the cosponsors of the bill.

Baldwin added that this legislation would give millions of Americans an option to get the health care coverage they need at a price they can afford.

Heres what you need to know about the proposed reform and how to find affordable health coverage even if youre nowhere close to age 50.

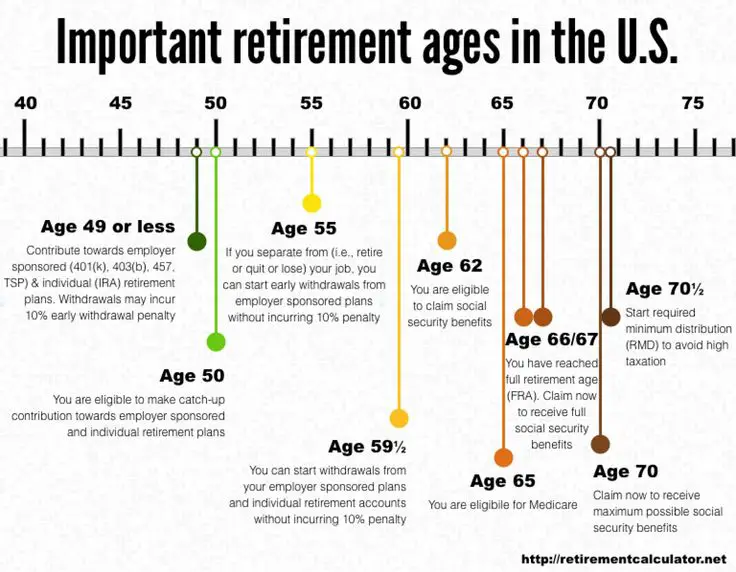

Can I Retire At 55 And Collect Social Security

So can you retire at 55 and collect Social Security? The answer, unfortunately, is no. The earliest age to begin drawing Social Security retirement benefits is 62. Once you turn 62, you could claim Social Security retirement benefits but your earnings from consulting work could affect how much you collect.

You May Like: Is Keystone 65 A Medicare Advantage Plan

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

What Is The Medicare Eligible Age

You may decide to retire at 62 because you can start collecting Social Security at that age and you feel ready to move on to a new stage in life. According to the Social Security Administration, you may start receiving retirement benefits as early as age 62. Your employer health benefits will likely end when you retire and you may wonder about your Medicare eligibility age.

Medicare is the government health care program for people age 65 and older and people younger than 65 with certain disabilities. Your Medicare eligible age is not correlated to when you retire and retiring early will not make you eligible for Medicare. Generally the only ways to be eligible for Medicare before age 65 is to:

- Have end-stage renal disease

- Have ALS

- Have a disability and have been receiving Social Security disability benefits for at least 24 months

If you retire at 62 and do not have a disability, you will generally have to wait three years for Medicare coverage. You can look on eHealth for an affordable individual or family health insurance plan as you wait to reach your Medicare eligible age.

There are certain advantages to waiting to retire beyond age 62 besides reaching the Medicare eligible age. If you retire early, your benefits are reduced a fraction of a percent for each month before your full retirement age, according to the Social Security Administration. The amount your benefit will be reduced depends on your year of birth.

Also Check: What Does Cigna Medicare Supplement Cover

More Resources For Medicare Beneficiaries

When approaching the age to qualify for Medicare benefits, visit the official Social Security Administration Medicare website to determine your eligibility and calculate your premium. In the meantime, read more about when and how to apply for Medicare and visit medicare.gov to prepare for when that time comes.

Whathappens When A Qualifying Spouse Is Younger

A person is eligible for Medicare Part A if they or their spouse have paid Medicare taxes for at least 40 quarters of work.

This might become more challenging when an older adult with a younger spouse did not work 40 quarters but their spouse did.

If a younger spouse worked for 40 quarters, they can qualify their partner for Medicare coverage once they reach 62 years of age and the older, nonworking spouse reaches 65 years of age.

If a person reaches 65 years of age, did not pay Medicare taxes for 40 quarters, and has a spouse under the age of 62 years, they may have to pay for their Medicare Part A benefits until their qualifying spouse reaches 62 years of age.

Don’t Miss: How Do I Enroll In Medicare Part A And B

Can I Draw My Deceased Husbands Social Security

If My Spouse Dies, Can I Collect Their Social Security Benefits? A surviving spouse can collect 100 percent of the late spouses benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

Health Care Options Between Early Retirement And Medicare

If you plan to retire early, youll need to figure out a plan to pay for health care before you reach Medicare eligibility age. There are a few different options.

If your spouse is still in the workforce, you might be eligible to be covered under their employers health plan if it includes spouses.

You also could opt for COBRA coverage, which allows you to essentially continue using your former employers coverage in some circumstances for a limited amount of time. This option can be expensive since you will have to pay the full premium.

This arrangement may not be sustainable depending on how early you retire since COBRA coverage typically only lasts for 18 to 36 months.

Depending on your financial situation, you may be eligible for Medicaid. Eligibility varies by state, but this is typically an option if you have very little money or income. You also could opt to purchase a private insurance plan.

Don’t Miss: What Is Aarp Medicare Supplement

Preparing As The Eligibility Age Nears

If a person already receives benefits from the Social Security Administration, the Administration will automatically enroll them in Medicare parts A and B.

The person will receive a âWelcome to Medicareâ packet 3 months before their 65th birthday, with instructions on how to sign up.

A person does not have to be retired to receive Medicare. If a person is not currently receiving Social Security benefits, they can apply for Medicare benefits as early as 3 months before their 65th birthday.

For example, if a person turns 65 years of age in April, they can apply for Medicare benefits in January of the same year.

Applying for Medicare benefits as early as possible may help the Social Security office process the paperwork in time for the personâs 65th birthday.

People who apply too late may face a premium 10% higher than that of those who apply on time. This premium would apply for double the time a person has been eligible but did not apply.

A person can apply for Medicare during their birth month or up to 3 months after their birth month without having to pay penalties for Medicare coverage.

However, their benefits will not begin until the Centers for Medicare and Medicaid Services process their request.