When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |

Medicare Eligibility At Age 65

- You are at least 65 years old

- You are a U.S. citizen or a legal resident for at least five years

In order to receive premium-free Part A of Medicare, you must meet both of the above requirements and qualify for full Social Security or Railroad Retirement Board benefits, which requires working and paying Social Security taxes for at least 10 full years .

Learn more about Medicare eligibility at and before age 65 by referring to this helpful chart and reading more information below.

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. Medicare Part A and Medicare Part B are available based on age or, in some cases, health conditions, including:

- Age 65 or older

- Disabled

- End-Stage Renal Disease

Individuals under 65 and already receiving Social Security or Railroad Retirement Board benefits for 24 months are eligible for Medicare. Still, most beneficiaries enroll at 65 when they become eligible for Medicare.

Recommended Reading: What Is The Annual Deductible For Medicare Part A

Get Started With Medicare

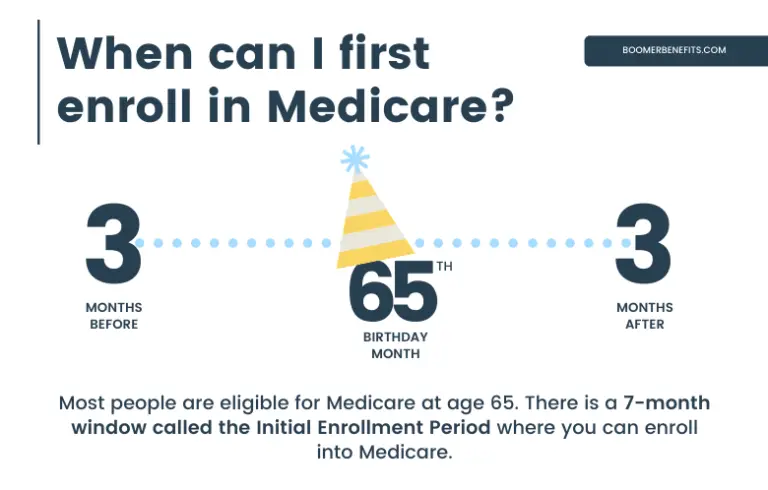

Medicare is health insurance for people 65 or older. Youre first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease , or ALS .

Follow these steps to learn about Medicare, how to sign up, and your coverage options. Learn about it at your own pace.

Waiting For Your Open Enrollment Period

Generally, your Medigap open enrollment period begins when you turn 65 and are enrolled in Medicare Part B. During your open enrollment period, you have a wider variety of Medigap plan options to choose from, and companies cant charge you a higher premium based on your medical history or current health status.

If you get Medicare Part B before you turn 65, your OEP automatically begins the month you turn 65. Some states have Medigap open enrollment periods for people under 65. If thats the case, youll still get a Medigap OEP when you turn 65, and you’ll be able to buy any policy sold in your state.

Before making a purchase, find out what rights you have under state law as someone who is younger than 65 and enrolled in Medicare due to a disability. Learn more by reviewing the Medicare and You handbook.

If you have questions about Medicare Supplement Insurance and want to speak to someone one-on-one, call a licensed agent today. Agents can help you find plans in your area and walk you through the process of buying a policy.

Don’t Miss: How Many Chiropractic Visits Does Medicare Allow

Medicare Part B And Group Coverage

Unlike premium-free Part A, Medicare Part B requires you to pay a monthly premium for your Part B benefits .

If youre still receiving health insurance benefits through your employer and are automatically enrolled in Medicare Part B, you may have the option to opt out of Part B until you retire or lose your group health insurance coverage.

Opting out of Part B will prevent you from having to pay monthly premiums for coverage you arent using. Once you retire, you should qualify for a Medicare Special Enrollment Period, which allows you to enroll in Part B later without facing a late enrollment penalty in most cases.

But You Don’t Have To Sign Up For Medicare

Just because you’re turning 65 this year doesn’t mean you’re giving up your job. And if you plan to keep working, you may continue to have access to a group health insurance policy through your employer.

If you’re happy with that coverage and want to keep it, you can delay your Medicare enrollment and avoid a late signup penalty. But if you’re not happy with that group plan, know that you’re allowed to work and get health coverage through Medicare at the same time.

Furthermore, if you’re keeping your group health coverage through your job, you may want to sign up for Medicare Part A regardless. Though you’ll pay a premium for Parts B and D, Part A is generally free for enrollees. Signing up could give you access to secondary insurance that may pick up the tab for hospital care your primary insurance doesn’t cover.

That said, once you enroll in Medicare, you won’t be eligible to contribute to a health savings account. And so if you’re currently taking advantage of that option, you may want to forgo that free Part A coverage if you’re keeping your group plan through work.

Don’t Miss: Who Is The Medicare Coverage Helpline

What You Should Know About Medicare And Retirement

Most people become eligible for Medicare at age 65, which is also the age at which many people retire. However, many American seniors are postponing retirement to continue working, and some are retiring early.

If youve retired or are approaching retirement age, you may have questions about how this will affect your Medicare coverage.

Below, we take a look at several scenarios to help you better understand your health insurance options whether you retire early, retire at 65, or continue working past the age of 65.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

You May Like: What Is My Medicare Group Number

Medicare While Working Past Age 65

Enrolling in Medicare is an important milestone in your life. To gain the maximum benefits from your health care, however, you have to sign up at the right time. If youre considering getting Medicare before you stop working, make sure you understand the impact this decision could have on your health care options as well as on your finances. Find out whether you should enroll in Medicare before retirement, and learn whether you will have other health care options if you keep working past the age of 65.

You Can Claim Social Security But You May Not Want To

The earliest age you can sign up for Social Security is 62, and so if you’re turning 65 this year, claiming benefits is definitely an option. But that doesn’t mean you should rush to file.

You won’t be eligible for your full monthly benefit based on your earnings history until you reach full retirement age. If you were born in 1957, full retirement age doesn’t kick in until 66 and 6 months. Filing for benefits at 65 will mean reducing them in the process for life.

Social Security: These 2022 updates could hurt your finances

Whether it pays to claim Social Security at age 65 will depend on different personal factors, like whether you’re still working full-time and what your retirement savings balance looks like. If your health is forcing you to cut down to part-time hours, then you may need your Social Security benefits to supplement your income.

On the other hand, if you’re still working full-time and aren’t thrilled with how much you’ve saved for retirement, you may want to sit tight and wait until full retirement age to claim Social Security. Scoring a higher monthly benefit could help compensate for having less money than you’d like in your IRA or 401.

As you get ready to celebrate your 65th birthday, be sure to keep these important details in mind. They could help lead you to wise financial decisions that serve you well throughout your senior years.

Social Security: The truth about 2022’s cost-of living raise

Recommended Reading: Is Blood Pressure Monitor Covered By Medicare

Social Security Disability And Medicare

A person may have a disability that restricts their ability to work. People with these disabilities may often qualify for Social Security or Railroad Retirement Board benefits.

Once a person has received these benefits for 24 months, they can start a Medicare plan, even though they are under 65 years of age.

A person with a disability may otherwise have difficulty getting health insurance, as a private insurer may charge them higher premiums due to pre-existing medical conditions.

As a result, Medicare provides a more cost-effective coverage option for people who have disabilities.

Examples of disabilities that may qualify a person for Social Security or RRB benefits include:

- back injuries and other musculoskeletal issues

- bleeding disorders

- heart conditions, including congestive heart failure

- mental health disorders, such as depression

- sensory issues, such as vision loss

- speech disorders

- severe respiratory illnesses, such as COPD

Medicare has specific criteria for children under the age of 18 years who wish to claim disability benefits or enroll in Medicare.

The SSA does not pay disability benefits to a young person until they reach 18 years of age. Therefore, a person with a disability does not qualify for Medicare until they are 20 years of age.

An exception to this rule applies to people who are 18 years of age and have ALS. They qualify for Medicare benefits once they reach this age.

Those with ESRD can qualify for Medicare if they meet the following criteria:

Why Are You Forced Into Medicare

If you or your spouse worked for at least 10 years in a job where Medicare taxes were withheld , you’ll become automatically eligible for Medicare once you turn 65.

Recent immigrants are not eligible for Medicare, but once they’ve been legal permanent residents for five years and are at least 65, they have the option to purchase Medicare coverageas opposed to getting Medicare Part A for freewhich is the same option available to long-term U.S. residents who, for one reason or another, don’t have a work history that gives them access to premium-free Medicare Part A . Note that immigrants who go on to work for at least 10 years in the US do then become eligible for premium-free Part A Medicare if they’re 65 or older, just like anyone else who has paid into the Medicare system for at least a decade.

Once you become eligible for premium-free Medicare Part A, you have to enroll in Medicare Part A or you forfeit your Social Security benefits. Most individuals are unwilling to forfeit their Social Security benefits, and thus accept the enrollment into Medicare. Note that you’re only required to accept Medicare Part Awhich is premium-free if you’re receiving Social Security benefitsin order to retain your Social Security benefits. You are allowed to reject Medicare Part Bwhich has a premiumif you choose to do so, although you could be subject to a late enrollment penalty if you choose to enroll in Part B at a later date. .

Recommended Reading: What Year Did Medicare Advantage Start

Medicare Eligibility For People Under 62

There are a few exceptions for Medicare age limits that can allow people younger than 65 and under age 62 to enroll in Medicare.

- If you have ALS , you are immediately eligible for Medicare regardless of your age as soon as your Social Security or Railroad Retirement Board disability benefits begin.

- You may also qualify for Medicare if you have kidney failure that requires dialysis or a kidney transplant, which is known as end-stage renal disease .

- You may also qualify for Medicare at age 62 or any age before 65 if you receive disability benefits from either Social Security or the Railroad Retirement Board for at least 24 months.

If you qualify for Medicare under the age of 65 because of a disability, you might also qualify for a Medicare Advantage Special Needs Plan.

Additional Information For Those With End

To get the full benefits available under Medicare to cover certain dialysis and kidney transplant services, youll need both Medicare Part A and Part B. .

Your Medicare coverage will generally end:

- 12 months after the month dialysis treatments stop, or

- 36 months after the month of a kidney transplant.

If your condition deteriorates and you require dialysis or a transplant before one of the above periods end, your Medicare benefits may be reinstated.

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency . Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

Recommended Reading: Does Medicare Pay For Cpap Machines And Supplies

Can I Buy Medicare Supplement Insurance If Im Disabled And Under Age 65

Federal law does not require states to sell Medicare Supplement insurance plans for the disabled under 65. Medigap insurers in some states can choose to deny you a policy before you turn 65, even if youre eligible for Medicare.

But in many states, insurance companies must sell Medigap plans to disabled beneficiaries under 65. Some states might not offer the full range of Medicare Supplement insurance plans that they offer to those over 65.

These are the states* where insurance companies have to sell at least one kind of Medicare Supplement insurance plan to those disabled under 65. Some may have restrictions. Please note that if youre under age 65 and have end-stage renal disease , you might not be able to get a Medigap insurance plan.

- Arkansas

- Vermont

- Wisconsin

*This list was current at the time of publication. Some insurance companies might offer Medigap insurance to those under 65 even where its not required.

Its best to check with your State Health Insurance Assistance Program to find out if your state offers Medigap insurance if youre under 65, and what the details and restrictions are. You can find out how to contact your states SHIP here.

Do You Have To Sign Up For Medicare At Age 65

- Are you required to sign up for Medicare when you turn 65? The answer is more than just a simple yes or no. Be sure to find out when you should sign up so that you dont face a late enrollment penalty or a lapse in coverage.

When you turn 65, you may have the opportunity to enroll in Medicare. But is it mandatory to sign up?

Technically, it is not mandatory to sign up for Medicare at 65 or at any age, for that matter. But its important to consider the situations in which you might decide not to enroll in Medicare at 65 so that you can make sure not to have any lapse in health insurance coverage or face a Medicate late enrollment penalty.

Also Check: Is It Mandatory To Take Medicare At 65

What You Need To Know About Medicare Before You Turn 65

For many, turning 65 is synonymous with Medicare and for good reason. This is the age when most people start to receive their Medicare benefits.

But how exactly do people receive their Medicare benefits? Do they need to sign up? Is enrollment automatic? To figure this out, lets take a closer look at Medicares eligibility rules.

Example : You Are Contributing To Your Group Health Insurance Plan

In almost all cases, you can save money by switching to Medicare with a Medigap plan if youâre the one contributing to your group health insurance plan.

Health insurance premiums are sky-high, with some plans costing upwards of $800 per month. Medicareâs monthly premium is nowhere close to that, and you can even add on a Medicare Supplement with no chance of reaching that kind of premium.

In sum, you can have much better coverage for a fraction of the cost if youâre paying for your group health insurance and are over 65.

If youâd like a Medicare specialist to help you one-on-one, schedule a free Medicare planner with one of our licensed agents.

Recommended Reading: Why Is My First Medicare Bill So High

How Do Sources Of Supplemental Coverage And Prescription Drug Coverage Differ For Medicare Beneficiaries Under Age 65 With Disabilities And Older Beneficiaries

Supplemental coverage

Most Medicare beneficiaries, including those under age 65 with disabilities, have public or private supplemental insurance to help cover Medicares cost-sharing requirements.9 A much larger share of beneficiaries under age 65 with disabilities than older beneficiaries rely on Medicaid to supplement Medicare because of their relatively low incomes .10 Medicaid helps with Medicare premiums and cost-sharing requirements, and covers services needed by many people with disabilities that are not covered by Medicare, particularly long-term services and supports.

Figure 3: Supplemental Coverage Among Medicare Beneficiaries Under Age 65 Compared to Those Age 65 or Older in 2012

Just over 1 in 5 beneficiaries under age 65 has no supplemental coverage, compared with 12% of those age 65 or older. Lack of supplemental coverage among Medicare beneficiaries is associated with higher rates of access problems, but rates of access problems are higher among younger beneficiaries with disabilities who lack supplemental coverage than among older beneficiaries, including not seeing a doctor for a health problem when they think they should and having trouble getting needed health care .12 Regardless of whether or not they have supplemental coverage, however, a larger share of younger beneficiaries with disabilities than older beneficiaries experience access and cost-related burdens .

Prescription drug coverage