B Premiums And Social Security

You cannot be expected to pay more for Medicare if there is not also a proportionate rise in Social Security benefits. The holds harmless provision of the Social Security Act protects recipients from paying higher Medicare Part B premiums if those premiums will cause their Social Security benefits to be lower than they were the year before.

Simply put, increases in Part B premiums cannot exceed the annual cost-of-living adjustment for Social Security.

In those cases, the Medicare Part B premium will be decreased to maintain the same Social Security benefit amount. However, keep in mind that the holds harmless provision does not apply to Medicare Part D. If the Medicare Part D Income-Related Monthly Adjustment Amount increases, a beneficiary may still see a decrease in their overall Social Security benefits.

Not everyone is eligible for the holds harmless provision. Only people in the lowest income category who have already been on Medicare Part B and have had their premiums directly deducted from their Social Security checks for at least two months in the past year are considered. Beneficiaries new to Medicare and people on Medicaid will be subjected to the current premium rate.

The Social Security cost-of-living adjustment for 2022 is 5.9%. This is estimated to be an additional $92 per month for the average recipient. This amount would be able to cover the rise in Medicare premiums in the new year.

For those who are dual eligible, Medicaid will pay their Medicare premiums.

Medicare If Youre Married

You and your spouses Medicare coverage might not start at the same time. Medicare is an individual plan . However, you may be eligible for Medicare based on your spouses work history even if you are not eligible on your own. You and your spouses Medicare coverage might not start at the same time. Since you each must enroll in Medicare separately, one of you may be able to sign up before the other one, depending on your age.

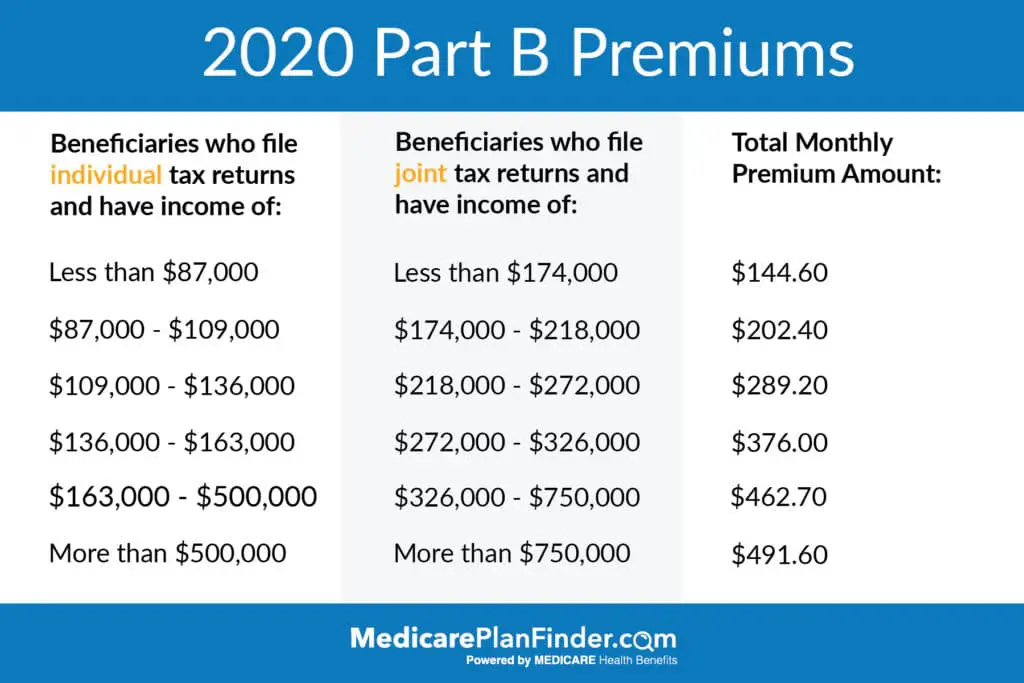

Your premiums may change because of your total income. There are no family plans or special rates for couples in Medicare. You will each pay the same premium amount that individuals pay. Heres what to know about costs:

What Is The Medicare Part B Premium

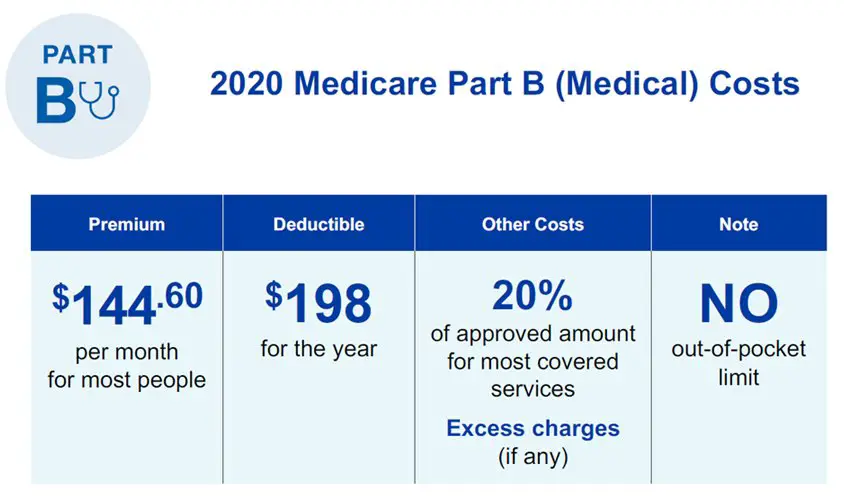

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

- Medicare Part A is hospital insurance. It is available primarily to U.S. citizens and permanent residents age 65 and older. Most pay no premium for it.

- Medicare Part B covers other medically necessary services and preventative care like doctor’s services, lab tests, and outpatient care. Most pay a flat monthly premium for it, which is adjusted annually.

There is also a Medicare Part D, which covers prescription costs. It is available from insurance companies that are approved to offer it.

You May Like: How Do I Find A Medicare Advocate

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

The Cares Act Of 2020

On March 27, 2020, President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the CARES Act. It expands Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19ârelated hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19ârelated services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Read Also: Which Cpap Machines Are Covered By Medicare

To 2016 Medicare Part B Premiums

Medicare Part B premiums went up in 2013 from the previous year, but then they stayed the same until the projected 2016 increase. The 2013 to 2015 premiums started at $104.90 per month and increased for single or married individuals who filed separately with MAGIs over $85,000 and married taxpayers who filed jointly with MAGIs over $170,000.

In 2016, the premium rate of $104.90 from the previous three years applied to about 70% of beneficiaries due to COLA. The other 30% paid a Medicare Part B premium that was not based on COLA. The premium was $121.80 in 2016, which was a 16% increase from the $104.90 paid in 2015.

Medicare Part D: Prescription Coverage

Medicare Part D is also offered through Medicare-approved private insurers. It covers the cost of prescription drugs. You can either opt-in through purchasing a Medicare drug plan or have it as part of your Medicare Advantage Plan. Medicare Drug plans can vary in cost and in the prescription drugs that they cover, but each plan meets a minimum standard of coverage.

Premiums

Part D premiums are in addition to Part A and B premiums, but they are covered as a part of Medicare Advantage plans. Although premium amounts can vary by the plan chosen, the average premium for Part D in 2021 is $33.06. Like with Part B, those with higher incomes will have higher premiums.

Deductible

Again, the deductible amount will vary by the plan you choose. Some plans are free, and the most expensive is $445.

Copays and Coinsurance

The amount of copayment varies from plan to plan and from drug to drug. Tier 1 and 2 drugs are relatively inexpensive, Tier 3 and 4 drugs are more expensive.

After meeting the deductible, you are responsible for your portion of the prescription coinsurance until the total amount paid by you and your insurer combined reaches $4,130 . After this amount, you only have to cover 25% of the prescription cost until you reach $6,550 total.

Don’t Miss: When Can I Change My Medicare Prescription Drug Plan

Medicare Part B Eligibility And Enrollment

Medicare Part B is available to U.S. citizens and legal residents who fall under one of the following criteria:

- Over the age of 65

- Under the age of 65 with a disability

- Have end-stage renal disease

- Have Lou Gehrig’s disease

If you contributed to Social Security while working and are getting benefits for at least four months prior to turning 65, you will be enrolled in Medicare Part A automatically. You’ll also be enrolled in Part B, but you can choose to decline it since you must pay a separate monthly fee for Part B insurance.

If you do not receive benefits from Social Security, then you’ll need to manually enroll in Medicare Part B. Enrollment begins three months before your 65th birthday and ends three months after the month you turn 65, for a total of seven months.

During this initial enrollment period, you can sign up for any part of Original Medicare. When you enroll before the month you turn 65, coverage begins on the first day of your birth month. If you sign up the month you turn 65 or in the final three months of your enrollment period, your Medicare policy will be effective on the first day of the following month.

If you delay enrolling in Medicare, you may have to wait for a general enrollment period to apply, which runs from Jan. 1 to March 31 each year. Your coverage would start on July 1 following the GEP.

Premium Surcharge Is Based On 2020 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2020 tax returns were filed in 2021, so those were the most current returns available when income-related premium adjustments are determined for 2022.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

You May Like: Does My Doctor Accept Medicare Advantage

Should I Enroll In Medicare Part B As Soon As I’m Eligible

If you’ve paid into Social Security, you typically are enrolled in Medicare Part B automatically at age 65. To help you decide whether you should keep â or enroll in â Part B, you should review your health insurance circumstances before you turn 65. This will help you determine if Medicare Part B makes sense for your situation. For example, if you’re covered by a qualified employer health plan, you can delay your Part B enrollment and remain on the employer plan without incurring a late enrollment penalty.

Before you decide to postpone Medicare Part B, you should confirm with your company’s benefits manager that the health plan is a qualified health insurance plan as defined by the IRS. You’ll also want to be sure and sign up for Part B promptly once your employer coverage ends to avoid potential late enrollment penalties at that time.

If you do enroll in Medicare Part B, you may want to consider a Medicare supplement policy to fill the coverage gaps.

Other Medicare Charges Also Rising

The annual Part B deductible will rise $30 next year to $233, up from this year’s $203.

For Medicare Part A, which covers hospitalization and some nursing home and home health care services, the inpatient deductible that patients must pay for each hospital admission will increase by $72 in 2022 to $1,556, up from $1,484 this year. Almost all Medicare beneficiaries pay no Part A premium. Only people who have not worked long enough to pay their share of Medicare taxes are liable for Part A premiums.

Open enrollment for Medicare began Oct. 15 and continues through Dec. 7. During this period, beneficiaries can review their coverage and decide whether to make changes.

Dena Bunis covers Medicare, health care, health policy and Congress. She also writes the Medicare Made Easy column for the AARP Bulletin. An award-winning journalist, Bunis spent decades working for metropolitan daily newspapers, including as Washington bureau chief for the Orange County Register and as a health policy and workplace writer for Newsday.

Editor’s note: This story has been updated to include additional information.

More on Medicare

Don’t Miss: Where Can I Go To Sign Up For Medicare

What Does Prolia Do

Throughout your life, your body breaks down existing bone and builds new bone in its place to keep your skeleton strong. Osteoclasts are the cells that drive the process. As you age, the bone-building process slows down while the work of osteoclasts continues at the same pace. This leads to a loss of bone density. Prolia is an injectable medication that works by disrupting the activation of osteoclasts to slow down bone loss.

How To Sign Up For Medicare Part B

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically be enrolled. Youll receive your Medicare card the month before your birthday. If youre not collecting Social Security benefits, youll need to enroll yourself. You can apply online, over the phone, or in-person.

All beneficiaries will have an Initial Enrollment Period for both Part A & Part B. This period begins three months before the month you turn 65th birthday and ends three months after. If you dont enroll during your Initial Enrollment Period and dont have , you could be subject to a penalty.

You wont pay the penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period. An example would be if you continued working past 65 and had creditable coverage through an employer group health insurance.

Also Check: How Do I Replace A Lost Medicare Card

Government May Scale Back Medicare Part B Premium Increase

- This year’s standard premium, which jumped to $170.10 from $148.50 in 2021, was partly based on the potential cost of covering Aduhelm, a drug to treat Alzheimer’s disease.

- The manufacturer has since cut the estimated per-patient annual treatment cost to $28,000, from $56,000.

- Medicare officials are expected this week to issue a preliminary determination of whether or to what extent the program will cover the drug.

There’s a chance that your Medicare Part B premiums for 2022 could be reduced.

Health and Human Services Secretary Xavier Becerra on Monday announced that he is instructing the Centers for Medicare & Medicaid Services to reassess this year’s standard premium, which jumped to $170.10 from $148.50 in 2021.

About half of the larger-than-expected increase was attributed to the potential cost of covering Aduhelm a drug that battles Alzheimer’s disease despite not knowing yet to what extent the program would cover it. Either way, the manufacturer has since cut in half its estimated per-patient price tag to $28,000 annually from $56,000 meaning Medicare’s cost estimate was based on now-dated information.

More from Personal Finance:

“With the 50% price drop of Aduhelm on Jan. 1, there is a compelling basis for CMS to reexamine the previous recommendation,” Becerra said.

A CMS spokesperson said the agency is “reviewing the secretary’s statement to determine next steps.”

There Is One Part Of Medicare That Is Freeyoure Not Wrong

When you turn 65, if you have worked at least 10 years, or 40 quarters, paying into Medicare taxes, you qualify for premium free Medicare Part A. If you do not qualify with your own working credits and are married to someone or have an ex-spouse who does, you may be able to obtain premium free Medicare Part A from their working credits. If you do not fall into any of those categories, you may be able to purchase Medicare Part A and pay a monthly premium. However, if you have worked at least 30 hours but not quite 40 hours, and paid into Medicare taxes during those working years, Social Security will prorate your premium. Contact Social Security for more details. For the remainder of this article we will be referring to costs for folks who qualify for premium free Medicare Part A.

You May Like: Are Medicare Advantage Premiums Deducted From Social Security

Do Medicare Supplements Have Deductibles

The term deductible is probably familiar to you in terms of your car insurance. Its the amount you pay before your insurance begins to pay. Some Medigap plans pay the Medicare Part A hospital deductible but make you pay the Medicare Part B medical deductible. Other plans dont cover either deductible.

There are two plans that have substantially lower monthly premiums than other plans. However, these low premiums come with a high deductible. With these plans, you pay a significant amount out of pocket before the Medigap plan pays anything. If you are healthy and have saved for the day when you may need to pay the deductible, one of these plans may work for you, but be sure to discuss it with your insurance agent first.

The plans are:

- High Deductible Medicare Plan FMedicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services.

- High Deductible Medicare Plan G

How Much Does Medicare Pay For Remicade

| Medicare Plan Name | |

|---|---|

| Express Scripts Medicare – Choice Lower price available | $6715 |

| Express Scripts Medicare – Value Lower price available | $6715 |

| Humana Enhanced Lower price available | $6715 |

. Similarly one may ask, does Medicare Part B pay for Remicade?

Medicare covers most physician-administered drugs like REMICADE® under Medicare Part B. There are comprehensive published Part B coverage policies specific to REMICADE®. However, some Medicare policies may limit coverage of REMICADE® to certain diagnoses, such as: Crohn’s disease.

how do people afford Remicade? Helping Patients Afford REMICADE®

Consequently, how Much Does Medicare pay for Remicade infusions?

A single dose of Remicade can cost from $1,300 to $2,500. The first step is determining insurance coverage for the infusion. Medicare does cover Remicade infusions. Most insurance companies require “pre-approval” for coverage.

Is Humira more expensive than Remicade?

Humira cost between $1,800 and $2,400 per month. Enbrel averages more than $4,000 per month. A single dose of Remicadecan cost anywhere from $1,250 to $2,500, depending on whether you need a shot every four weeks or eight weeks.

You May Like: Can I Submit A Claim Directly To Medicare

Find Cheap Medicare Plans In Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.