How Do I Qualify For Medicare Financial Assistance

Income limits change every year, so if you arenât sure about your qualification, donât count yourself out yet!

Each type of Medicare Savings Program has a different monthly income limit that varies based on marital status. Here are this yearâs limits to qualify for all the different programs*:

- QMB program: $1,094/month and $1,472/month

- SLMB program: $1,308/month and $1,762/month â

- QI program: $1,469/month and $1,980/month â

- QDWI program: $4,379/month and $5,892/month

*Income limits can be slightly higher in Alaska and Hawaii, so be sure to talk to a trusted agent to learn more about your specific qualifications.

Aside from income, there are also resource limits to qualify for Medicare Savings Programs. Countable resources include:

- Money in checking or savings accounts

- Stocks

However, the following resources are exempt:

- One home

- Up to $1,500 in set-aside burial expenses

- Furniture

- Any other household and personal items

All of these programs have personal qualifications, from age to disability status, so be sure to check with your agent or our team here at Medicare Allies to learn more about the best program for you.

Why Do I Have To Wait 2 Years For Medicare

Medicare was originally intended for those over 65, and when Medicare was expanded to include persons with disabilities, a very expensive expansion, the two-year waiting period was added as a cost-saving measure. About a third of disability recipients receive Medicaid coverage during the waiting period.

How Long Do People On Disability Have To Wait To Become Eligible For Medicare

Once you have collected SSDI payments for two years, you will become eligible for Medicare. You wont even have to sign upMedicare will automatically enroll you in Part A and Part B and mail your Medicare card to you shortly before your coverage begins.

Thankfully, your 24-month waiting period doesnt have to be all at once. For example, if you qualify for SSDI, lose eligibility, then re-qualify for SSDI, each month you collect checks counts toward the total 24-month waiting period.

Similarly, if you apply for SSDI and are denied disability benefits, you can appeal the decision. If you appeal and the decision is reversed, your 24-month waiting period will be backdated to when your disability benefits should have started. The result: your wait for Medicare will be shorter than two years.

Read Also: How Much Does Medicare Pay For Hospice

Medicare Eligibility For Medicare Advantage Before 65

After youre enrolled in Original Medicare, you may choose to remain with Original Medicare or consider enrollment in a Medicare Advantage plan offered by a private, Medicare-approved insurance company.

Medicare eligibility for Medicare Part C works a little differently. Youre eligible for Medicare Advantage plans if you have Part A and Part B and live in the service area of a Medicare Advantage plan. If you have End Stage Renal Disease , you usually cant enroll in a Medicare Advantage plan, but there may be some exceptions, such as a Medicare Advantage plan offered by the same insurance company as your employer-based health plan, or a Medicare Special Needs Plan .

When you enroll in a Medicare Advantage plan, youre still in the Medicare program and need to pay your monthly Medicare Part B premium and any premium the plan charges. The Medicare Advantage program offers an alternative way of receiving Original Medicare coverage but may offer additional benefits. For example, Original Medicare doesnt include prescription drug coverage or routine dental/vision care, but a Medicare Advantage plan may include these benefits and more. Benefits, availability and plan costs vary among plans.

New To Medicare?

Becoming eligible for Medicare can be daunting. But donât worry, weâre here to help you understand Medicare in 15 minutes or less.

You May Like: Does Medicare Pay For Inogen Oxygen Concentrator

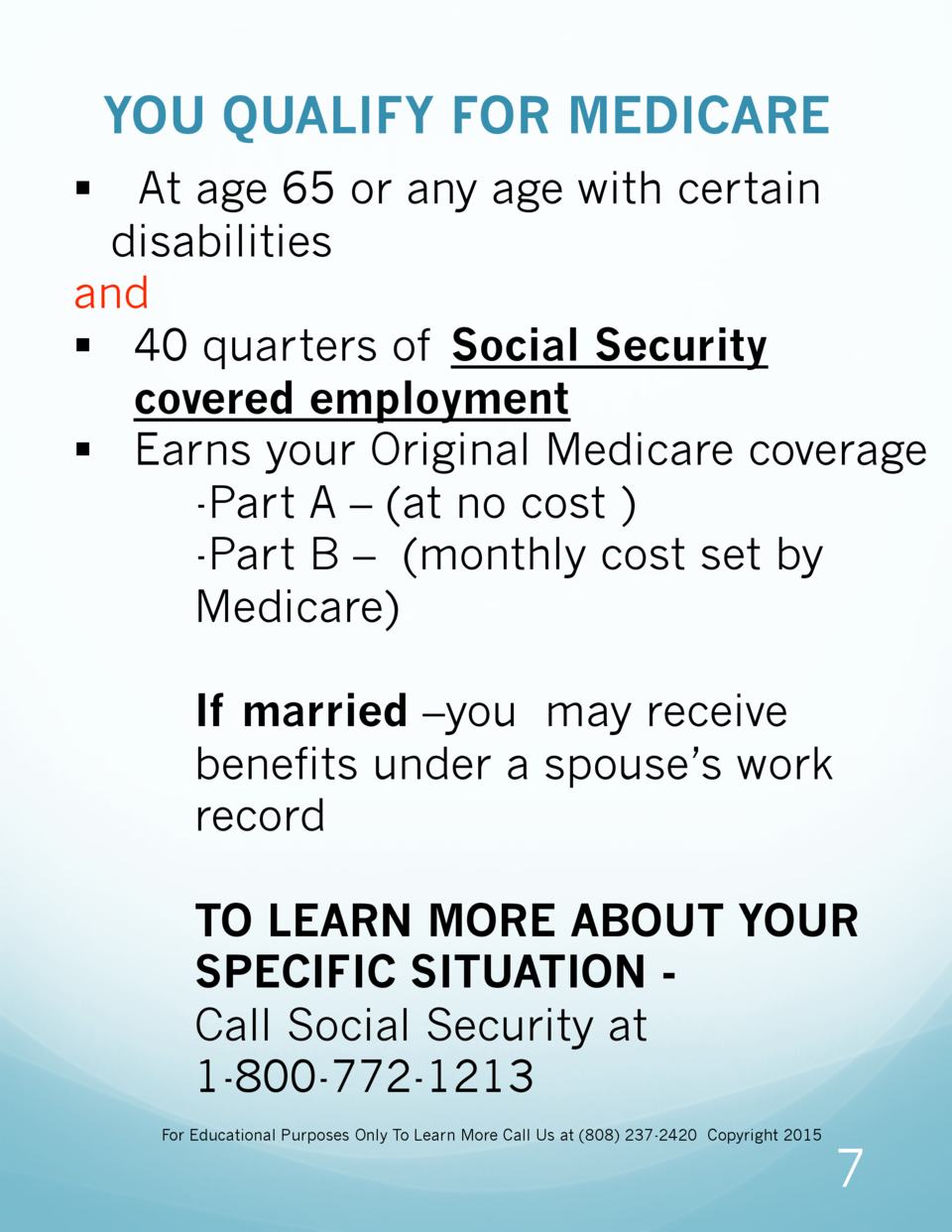

Medicare Eligibility At Age 65

- You are at least 65 years old

- You are a U.S. citizen or a legal resident for at least five years

In order to receive premium-free Part A of Medicare, you must meet both of the above requirements and qualify for full Social Security or Railroad Retirement Board benefits, which requires working and paying Social Security taxes for at least 10 full years .

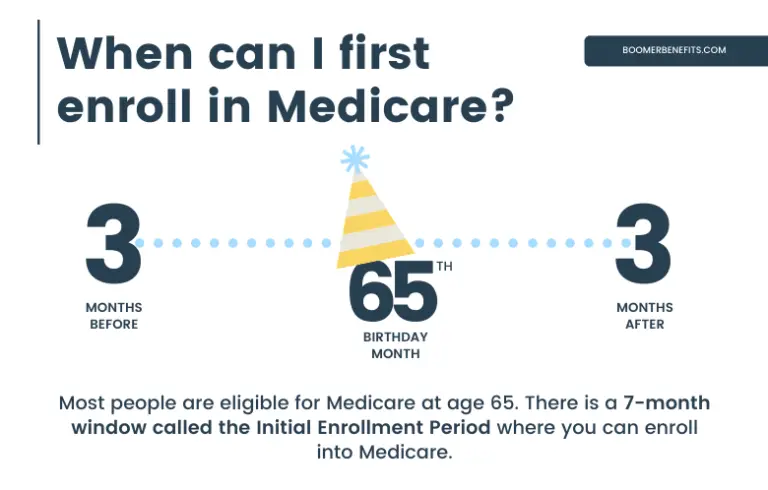

Learn more about Medicare eligibility at and before age 65 by referring to this helpful chart and reading more information below.

You May Like: How Do You Get Credentialed With Medicare

Medicare Other Insurance And How We Can Help

Did you know you can enroll in Medicare even if you have other kinds of insurance such as Medicaid, VA benefits, and employer-sponsored health insurance? That said, some of these types of insurance work better with Medicare than others. In some cases, they may affect your ability to enroll in Medicare.

To find out how to choose the right Medicare coverage and understand how it will interact with health insurance you may already have, call the number below. A licensed Medicare expert can answer your Medicare eligibility questionsand help you enroll.

Eligibility For Medicare Part A

Medicare Eligibility begins at age 65 for most people.

You are eligible for Medicare Part A at age 65 if you or your spouse has legally worked for at least 10 years in the U.S. During those years, you paid taxes toward your Part A hospital benefits. This is why most Americans pay no Part A premiums when they become eligible for Medicare. Part A mainly covers your hospital stays. If you have worked and paid taxes in the US then you will be issued Medicare Part A automatically. Even if you are employed with a company with over 20 employees it makes perfect sense to have this benefit.

If you have not worked and paid taxes the required 10 years, Part A may be available for you to purchase. You can call Social Security at 1-800-772-1213, or visit your local Social Security office for more information about buying Part A.

Find out about your Medicare Eligibility

Read Also: When Do Medicare Benefits Kick In

When I Turn 65 How Do I Get Medicare

Signing up for Medicare Visiting your local Social Security office. Calling Social Security at 800-772-1213. Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare. Or, by applying online at www.ssa.gov.

Medicare Eligibility: Key Takeaways

- Generally, youre eligible for Medicare Part A if youre 65 and have been a U.S. resident for at least five years.

- When youre notified youre eligible for Part A, youll be notified that youre eligible for Medicare Part B.

- You need to be eligible for both Medicare Part A and B in order to enroll in Medicare Advantage.

- To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both.

- If youre enrolled in both Medicare Part A and B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy.

For the vast majority of Americans who look forward to receiving Medicare health benefits, eligibility is as uncomplicated as celebrating your 65th birthday.

But your eligibility to receive Medicare coverage without having to pay a premium and your eligibility for other Medicare plans depends on such factors as your work history and your health status. Heres what you need to know:

You May Like: How To Qualify For Medicare And Medicaid

Healthmarkets Can Answer Your Medicare Eligibility Questions

If you are eligible for Medicare and are ready to shop for a plan, HealthMarkets can help. We make it easy to compare plans, get free Medicare quotes, and enroll. Answer a few short questions and to see what kind of Medicare plan might work best for your lifestyle, and which plans make the best fit. Get started now.

46253-HM-0920

What Happens If You Dont Sign Up For Medicare Part B At 65

If you wait until the month you turn 65 to enroll, your Part B coverage will be delayed. This could cause a gap in your coverage. In most cases, if you dont sign up for Medicare Part B when youre first eligible, youll have to pay a late enrollment penalty.

Don’t Miss: Does Medicare Cover Home Health Care After Surgery

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

You May Like: Can You Get Medicare If You Live Outside The Us

What If Youre Over 65

Dont worry: You can still sign up for Medicare if you didnt do so at age 65. But you may have to pay a 10% penalty on the monthly premiums for Part B for every 12-month period you didnt opt in for Medicare coverage after becoming eligible.

There is an exception, though: If you have group coverage through your employers plan or were covered through your spouses job and that coverage ends, you qualify for whats called a Special Enrollment Period . This is an 8-month period during which you can sign up for Part A and/or Part B to give you coverage starting when your or your spouses employers coverage ends.

Less commonly, if you didnt work long enough to qualify for premium-free Part A and you didnt sign up at age 65, you may have to pay a penalty for that coverage as well.6

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends whichever happens sooner.

Sign up during those eight months, and you wont have to worry about premium surcharges for being late. And the eight-month special enrollment period is also available if youre delaying Part B enrollment because youre covered under your spouses employer-sponsored plan, assuming their employer has at least 20 employees.

But note that in either case, it has to be a current employer. If youre covered under COBRA or a retiree plan, you wont avoid the Part B late enrollment penalty when you eventually enroll, and you wont have access to a special enrollment period to sign up for Part B youll have to wait for the general enrollment period instead.

Recommended Reading: Is Unitedhealthcare Dual Complete A Medicare Plan

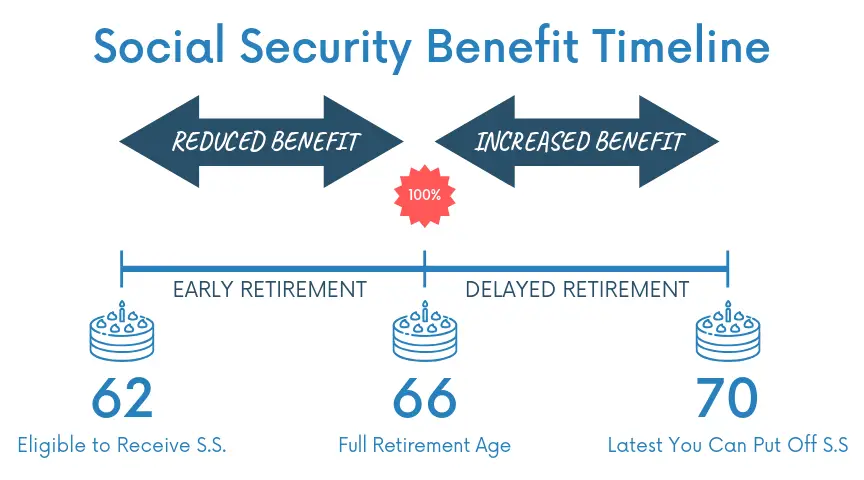

How Social Security Helps Pay For Medicare

In addition to automatically enrolling you in Medicare, if you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium will be automatically deducted from your monthly benefit payment.

If you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a Notice of Medicare Premium Payment Due . Bills can be paid for by check or money order, a credit or debit card, or through online bill pay services.

In conclusion, as youre starting to think about Medicare and retirement, do some research and make sure you understand how your Social Security benefits can or will play a role.

1

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2021, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

You May Like: How To Order Another Medicare Card

Medicare Eligibility If You Are Under 65

People younger than 65 may qualify for Medicare if they have certain costly medical conditions or disabilities.

If you are under 65, you qualify for full Medicare benefits if:

- You have been receiving Social Security disability benefits for at least 24 months. These do not need to be consecutive months.

- You have end-stage renal disease requiring dialysis or a kidney transplant. You qualify if you or your spouse has paid Social Security taxes for a specified period of time based on your age.

- You have amyotrophic lateral sclerosis, also known as Lou Gehrigs disease. You qualify for Medicare immediately upon diagnosis.

- You receive a disability pension from the Railroad Retirement Board and meet certain other criteria.

Eligibility For Medicare Part C

Medicare Part C is another name for the Medicare Advantage program which is issued by private insurance companies instead of Original Medicare. You can get them from an agent, broker, or the company directly. Usually, these plans have smaller networks than Medicare, but some of them include built-in Part D coverage.

To be eligible for Part C, you must first be enrolled in both Medicare Parts A and B. You must also live in the plans service area.

Many people think that if they enroll in a Medicare Advantage plan, they can drop their Part B and escape paying Part B premiums. This is NOT the case. You must have both A and B to even be eligible to enroll in either a Medicare Advantage plan or Medigap plan. You must continue to be enrolled in Parts A and B during the entire time that you are enrolled in a Medicare Advantage plan.

Recommended Reading: When Is Medicare Supplement Open Enrollment

Who’s Eligible For Medigap

If youre enrolled in both Medicare Part A and Part B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy. These plans are standardized, and are designed to cover some or all of the out-of-pocket costs that are incurred when you have a Medicare-covered claim .

You have a federal right to buy a Medigap plan during the six months beginning when youre at least 65 years old and have enrolled in Part B. This is known as your Medigap open enrollment period. After this time runs out, you will have only limited chances to purchase one down the road.

Some states allow people of any age or health status to purchase Medigap coverage at any time without medical underwriting, but most dont. In many states, Medigap plans may not be available for people who have Medicare before age 65. There are 33 states that require Medigap plans to be guaranteed issue in at least some circumstances when an applicant is under age 65, but the rules vary from one state to another you can click on a state on this map to see details about state-based Medigap rules.

If youre enrolling in Medicare due to your age, the primary factor that will affect your ability to purchase a Medigap policy regardless of your health will be whether you enroll during your Medigap Open Enrollment Period.

Can One Have Dual Eligibility For Both Medicare And Medicaid

Yes, Medicare and Medicaid are not mutually exclusive programs. Persons who are eligible for both are referred to as having Dual Eligibility, Dual Eligibles, or often simply Duals. Medicare is the first payer of covered benefits, while Medicaid is the secondary payer. Typically, Medicaid will pay for Medicare premiums and co-payments for dual eligibles. In fact, many states have special programs intended to make it easier for seniors to manage their dual eligibility status as it can be confusing to know where to turn for what services. This is generally in the form of managed care.

There are also programs called Medicare Saving Programs for low-income seniors that dont quite qualify for Medicaid.

Read Also: How Much Does Medicare Pay For Inpatient Psychiatric Care

Medicaid Part B Reimbursement Options

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.